Are you planning to develop an eWallet app?

In recent years, fintech solutions like eWallet applications have become a household thing. Apps like Venmo, PayPal, and Google Pay have changed the way we handle money.

From a user’s perspective, one gets the ease of payment, the excitement of cashback and coupons, as well as security and convenience.

But when you look at digital wallet apps from a business perspective, you see Billions of Users, Endless Revenue, and a Market with so much potential.

In this blog, we shall address the audience who are looking at it from the latter perspective. Let’s discuss everything related to how to develop eWallet.

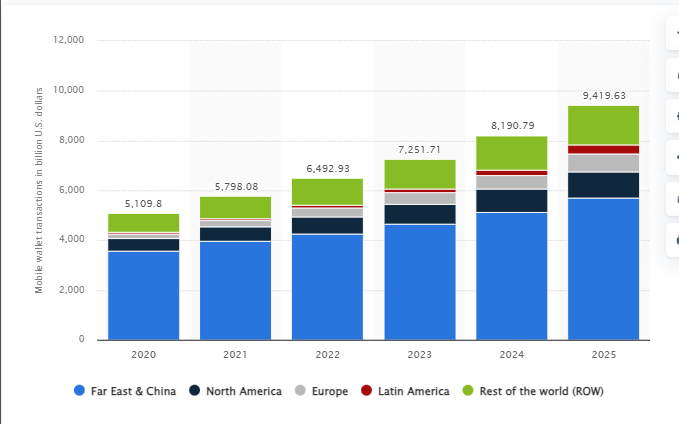

eWallet App Market Statistics

eWallet App Statistics show amazing numbers in the eWallet industry that just keep growing.

Revenue is rising, the numbers of users are going up every quarter, and eWallet applications are being used more and more.

To better understand this ragging market, let’s have a look at some eWallet app market statistics:

Digital Payment Market To Hit $10 Trillion in 2026, From $4 Trillion in 2023

With the rise of mobile payment technology, paying digitally for in-store or online shopping has become that much easier.

Back in 2020, the market for digital payment as a whole was worth around $4 trillion. Now, boosted by new technologies and developments, Statista claims the global market will reach $10 trillion by 2026

eWallet App Market Size Forecasted To Reach $567.2 Billion By 2032

Even though eWallet is a niche in the digital payment industry as a whole, it is growing like anything.

eWallet market size was around $85.6 Billion in 2022, fast forward to 2023, it reached 105.5 Billion. If the market follows the same trajectory, it will hit $567.2 Billion by 2032.

Marketresearchfuture, shows this growth with CAGR 23.40%.

By 2025, There Will Be Over 4 Billion eWallet App Users

Want to know why you should develop an eWallet app like PayPal? Well, this is a good one.

Around 2.8 Billion people were using the eWallet application back in the year 2020. If we are to believe Juniper Research, by 2025, the total number of mobile app users will reach 4 billion.

Use of Popular eWallet Apps like Apple Pay & Google Pay to Double by 2025

Apps like Apple Pay, Google Pay, & Samsung Pay are pretty popular in North America i.e. The United States of America, to be specific.

As per the data-driven forecast, the use of these apps will double between 2020 and 2025, showing the amazing growth rate of the market and demand for eWallet apps.

Digital Wallet Transaction Projected To Reach $16 Trillion by 2028

Digital wallet applications are being used like anything even today, but if you look at the latest research, we will see something amazing in the future.

As per Juniper Research, based on industrial data, the digital wallet will be responsible for transactions worth $16 Trillion by 2028.

What is eWallet App?

So, what are eWallet apps? You can look at it as a virtual version of your physical wallet but it’s better.

Known as digital wallets, mobile wallets, or payment apps, these mobile applications let users transfer funds (even internationally), manage bank accounts, carry virtual cards, pay bills, apply for financial products, and much more.

To add a face to it, some popular examples are, Apple Pay, Google Pay, and Samsung Pay.

Each digital wallet application is its unique offering, but depending on its general function and core working, they can be divided into a few solid categories.

Let’s discuss what these are, below:

Types of eWallet Apps

There are different types of digital wallets, varying based on their work and core functionalities. Now, if you want to create an eWallet app, it is important to understand what these types are.

Therefore, let’s look at the same below.

Type 1: Closed Wallets

First, we have the closed wallets.

These are “closed” as these types of wallets can only be used to make payments to a specific party.

For instance, a brand like McDonalds can create their own eWallet app. Users can pay via these apps at only McDonald’s outlets. A big example of this is Amazon Pay.

Who is this for?

This form of digital wallet app is recommended for brand retail stores and eCommerce platforms.

A good reason to invest in this form of digital wallet is that this will give the brand a huge boost in terms of reputation, reliability, and customer loyalty. Not to mention the increased revenue generation you get through it.

Type 2: Semi-Closed Wallets

One step further from closed wallets, we have the semi-closed ones.

As one might assume, Users can pay via a semi-closed wallet to pay at partnered merchants and locations. The trick here is that these wallets are restricted to these specific vendors and locations.

Zelle’s business model shows us how effectively you can use a semi-closed wallet to generate millions.

Who is this for?

This is a great business venture opportunity for fintech companies, financial institutes, eCommerce companies, or tech companies.

In fact, this is a good idea for Startups and Entrepreneurs.

Type 3: Open Wallets

Let’s talk about a more familiar form of eWallet application, the open wallet.

Being open-looped, these can be used anywhere and everywhere, the condition being the other party is also using the same platform or a compatible one.

Open wallets offer many amazing features in addition to all the functionality of previous types. It can be used to manage back accounts, ATM withdrawals, send money, and so on.

Apps like Revolut, Chime, MoneyLion, and so on.

Who is this for?

Wondering whether or not you should invest in open wallets? Well, if you want to start a fintech company and generate billions in revenue, go ahead with this idea.

Type 4: Crypto Wallet

Next up we have a crypto wallet. With this one, we broke the looped wallet as it’s working is totally different.

These types of digital wallets enable the user to buy, sell, transfer, and trade cryptocurrencies like Bitcoin, and Ethereum.

Crypto wallet sits somewhere between fintech and blockchain app development.

Who is this for?

Create a crypto wallet if you are a cryptocurrency-based company. This solution can really help your digital currency take off in the market, just like Ethereum did.

Type 5: Mobile Banking Apps

Let’s discuss mobile banking apps that we are all too familiar with.

These are mobile applications that are used to manage bank accounts, debit cards, credit cards, and other financial products. The Bank of America app is a popular mobile banking app.

Who is this for?

In the coming years, every financial institution and bank will create a mobile banking application. This is a response to growth in the fintech industry.

Now, if you fall into this category, you should go for it.

Type 6: Digital Wallet Super Apps

If you are familiar with the concept of Super App, you know what we are talking about.

This is an all-in-one digital wallet. Here the user gets the functionality of a banking app, cash advance, NFC mobile payment, and much more.

N26 and bolt-like apps are popular examples of eWallet super apps.

Who is this for?

There are no specific businesses that should go for this. Rather, super app development suggests platforms that handle a lot of similar niche companies.

Super apps combine everything into one, delivering the end-user superior value.

So, these are the popular forms of mobile wallet applications. And with this out of the way, let’s move to the next section, where we shall be discussing how eWallet applications work.

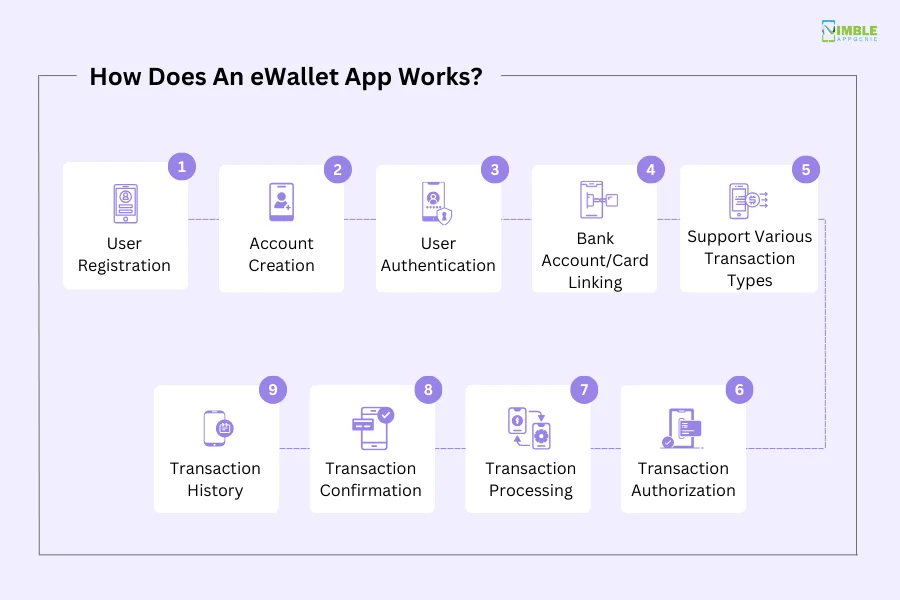

How Does an eWallet App Work?

So, how does a digital wallet work?

There is a lot that goes behind the working of the eWallet application. And this is an important thing to understand if you want to create your own eWallet app someday.

In this section, we shall be discussing each step in detail, let’s get right into it:

1. User Registration

After downloading the application from the App Store or Play Store, the user needs to register.

Registration is a crucial process, as this lays the foundation for cross-device & platform data synchronization.

Moving on, the user can register using their email ID, phone number, or even Google account/Apple ID. After entering this, the user needs to confirm their identity, usually through OTP verification.

2. Account Creation

User registration triggers account creation, but there’s more to it.

After the account is created the user needs to add other important information like social security number.

The account on the eWallet app is linked to the email ID and phone number. As a result, users can log in to any platform and access the same account.

3. User Authentication

eWallet app security matters a lot for obvious reasons. And to ensure it is at an individual level, user authentication is important.

Authentications like passwords, PINs, patterns, facial recognition, and fingerprints add to total security. To add another layer to it, dual-factor authentication is being introduced to the platform.

4. Bank Account/Card Linking

Digital wallet comes with in-app wallets that can be used to make instant peer-to-peer payments.

However, in order to add funds to the wallet, one must link a bank account or debit/credit card to the platform. Users can add one or more accounts and use them simultaneously.

The process of adding an account or card differs from platform to platform. But the general method is to put in your bank details or credit details and verify through OTP.

Moreover, eWallets enables bank account handling, giving users features like bank-to-bank transfer, check balance, and so on.

5. Support Various Transaction Types

With the setup done, users have access to a range of financial transaction types. This includes –

- Peer-to-peer transfer

- International or cross-border money transfer

- eCommerce payments

- BNPL access

- Bill payment

- Recharges

- Bank-to-bank transfer

Apart from this, some digital wallet also provides investment options, rounding it all up.

6. Transaction Authorization

Regardless of type, whenever a transaction is triggered from a digital wallet, an authorization is required. This takes us back to the 3rd step where we step up user authentication.

In layman’s terms, to make a transaction possible, the users have to provide a PIN, fingerprint, Facial scan, or password.

If two-step authentication is enabled, another additional step might be required from the service provider’s side.

7. Transaction Processing

After authentication, the transaction is processed.

In this step, lots of technicalities take place. For instance, communication between Open Banking APIs, the payment gateway, and the service provider.

The information transferred is encrypted to ensure its safety, and even tokenization might be used. The exact process may differ from platform to platform.

8. Transaction Confirmation

Once all sides agree on a secure transaction, a confirmation is sent back to the user’s ewallet application.

Even though it is a quite sophisticated process, it happens in mere seconds or even less time.

9. Transaction History

eWallet application comes with a feature called Transaction History.

Through this, one can check a detailed overview of all the fintech transactions made through the application, including payments sent and received.

Details include sender info, receiver info, time, amount, status, and so on.

So, this is how a mobile wallet works. And with this out of the way, let’s look at

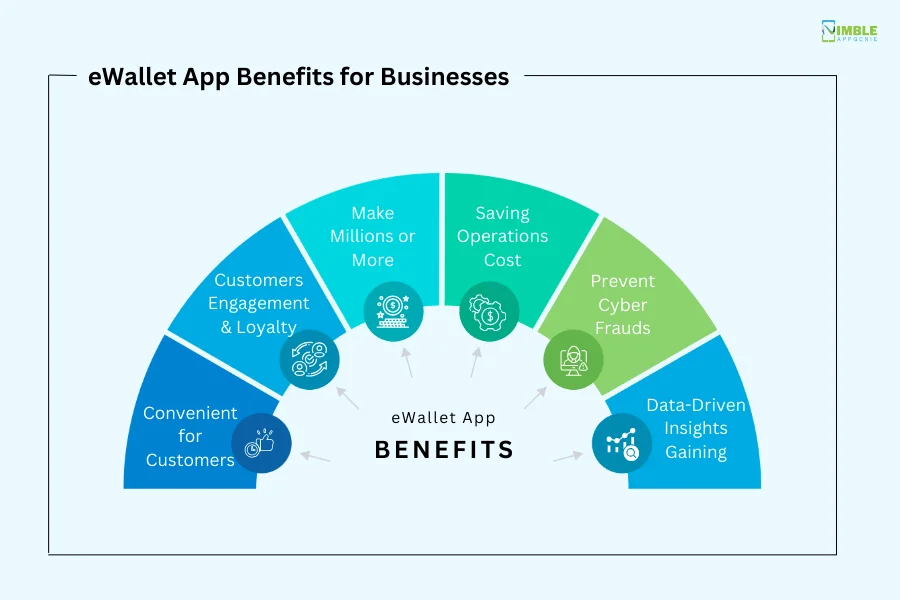

Why Create an eWallet App for Your Business?

Is eWallet app a worthy venture?

Choosing whether or not to invest in a project is a big decision, considering all that money, time, and effort that is put into it. So why should you invest in an eWallet solution?

Well, there are a range of reasons to go for businesses to invest in app development, especially for companies like B2C companies. Let’s discuss these reasons below:

Reason 1: Deliver “Convenience” to your customers

Customers are the center of the business world.

The majority of a company’s resources and time is spent improving its product or service, in a bid to deliver a better experience to its customers. And if your customers are happy, you generate a lot of revenue.

Now, to bring it to the context of creating a digital wallet, here’s why you should do it:

Fintech ecosystem and infrastructure are well-integrated with the world we live in. From online shopping to daily supply runs at local grocery stores, eWallets have replaced conventional payment modes.

eWallet app solutions dedicated to a business can greatly help their customers make payments easier, faster, and stay secure while doing so.

Depending on the nature of the business, the eWallet app offering can reap different benefits. But you can rest assured, as this will help you deliver a better experience.

Speaking of experience, this brings us to our next point.

Reason 2: Keep your customers engaged & drive loyalty

A big reason to work on user experience is to generate better customer engagement and drive loyalty. And that’s exactly what you can do if you make a digital wallet for your business.

Here’s how:

eWallet applications are known for their superior financial transaction capacities, which deliver a better user experience, which in turn leads to higher customer engagement.

Statistics show how engaging the eWallet application or just any mobile app can be when they are delivering “value” to the user. This is something the eWallet app if developed well, can do.

Coming to the loyalty part, digital wallet solutions can be used to introduce loyalty programs with coupons, deals, and promo codes. This has been a tried & tested method to drive loyalty among customers.

Reason 3: Make Millions or More

There are no businesses, that don’t want to increase their revenue. In fact, generating higher revenue is the core goal of any business venture.

So, how does eWallet fit in this picture? Well, there are two ways.

Develop an eWallet app as the main offering of your business.

You can build an app like Cash, as the primary offering of your business. This is among the amazing Fintech app ideas. As they can capture a dollar market with their unique value proposition.

In fact, this is what some of the top fintech companies have done and today, they are generating billions in revenue.

Creating a digital wallet app as a dedicated solution to receive payments

Here we have brands like Walmart, Amazon, McDonald’s, etc who have developed their own unique payment solutions. This helps with better customer loyalty, higher revenue generation, ease of payment, and much more.

Now, you aren’t limited to these two paths. In reality, there are a number of ways to create an eWallet system and generate revenue. But you get the gist of it.

Reason 4: All While Savings in Operations Cost

What if we told you that the eWallet app solution doesn’t only help with revenue generation, but also saves operational costs?

In Industry 4.0, automation has become a key trend as it’s slowly replacing boring and repeating tasks. Plus, these solutions help streamline business operations related to payment, enable better financial management, and reduce human error, all while without needing breaks or benefits.

What we mean to say, all of these benefits from the eWallet app combine to reduce business operations costs. At the same time, delivering higher efficiency.

Reason 5: A Firewall Against Rising Cyber Frauds

It is no secret that cyber fraud and online payment fraud have become a big issue.

Just last year, the market lost over $41 billion to these frauds. And more than 42% of this money was taken from North America.

But this doesn’t end here, as it will only get worse with time. Statistics show that this will increase from now to 2027 exceeding $343 billion.

Goes without saying, you don’t want your business to fall prey to these scams, right? Well, that’s one of the biggest reasons to create your own eWallet.

These apps ensure data visibility, letting businesses know where the money is going or coming from. Plus, everything is protected using the best technologies like encryption, tokenization, and biometric authentication.

With high-end mobile app security, your users don’t have to think twice before making a payment via digital wallet applications.

Reason 6: And Gain Data-Driven Insights

Lastly, we have an amazing reason to invest in this business venture.

Insights! Businesses run on insights, as they have become a base for decision-making, business development, offerings, and strategies.

Using data that is processed through the application, eWallet solution can generate in-depth reports that are beneficial to businesses for a number of reasons.

This is why you should create digital wallets. Now, if you’re considering this development project, it’s good to learn from the best in the market.

What are the Top eWallet Apps?

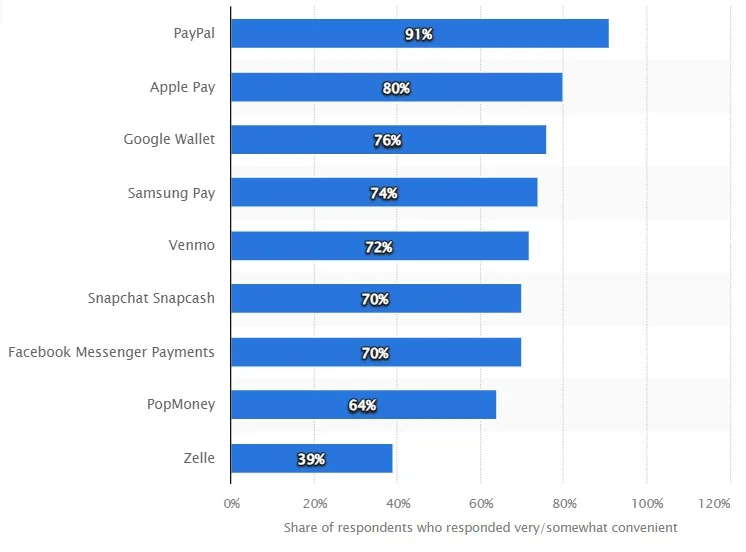

Source: Statista

To create your own eWallet and become the best in the market, you need to learn from the market leader. We are talking about top digital wallet apps that are driving innovation in the sector.

So, let’s look at these platforms:

1. Apple Pay

Who hasn’t heard of Apple Pay?

Coming from the tech giant, this is a mobile payment solution exclusive to Apple’s Ecosystem. The platform is well-fitted with amazing features.

In addition to sending money and making payments online, users can also hold their virtual cards and other important documents like boarding passes, tickets, etc.

2. Google Pay

Google Pay is a good example of open-looped eWallet applications.

It is simple, with a plain yet resourceful interface. Speaking of which, you can expect everything from Google Pay, what you see in an advanced digital wallet application.

3. PayPal

Well, well, if it isn’t the OG eWallet solution.

PayPal has been here the longest and deserves the title of the world’s best eWallet solution. However, this isn’t your typical digital wallet application.

Rather, the platform focuses more on international payment functionality. No wonder, everyone wants to make apps like PayPal.

4. Samsung Pay

![]()

Samsung Pay is an eWallet application that is limited to Samsung users.

This dedicated online payment solution has been handed crated for your day-to-day payment needs.

It is easy to use, comes with NFC functionality, and does well to integrate all the eWallet apps on your phone in one play for easy usage.

5. AliPay

Alipay is a popular digital payment application from Ant Group.

In other words, this is AliBaba’s own eWallet application. It comes with all the expected features including online payment, money transfer, recharge, and other mobile wallet features.

Being China’s favorite eWallet application, it is growing at an amazing rate.

6. Amazon Pay

If you know what closed–loop eWallet apps are, you know what Amazon Pay is.

Coming straight from the world’s largest eCommerce brand, payment solutions make it super easy to pay for your purchase with a BNPL option known as Amazon Pay Later.

Industries That Benefit From Digital Wallet Apps

In the 21st century, digital payment solutions have completely changed the way we handle money. However, this is not the result of app innovation alone.

Rather, today’s fintech scenario comes as a consequence of several level developments over many years.

Thus, today, we have an entire infrastructure built around online payments, enabling effortless payment via mobile wallets.

The point here is that due to these developments, there are several industries that enjoy the perks. For instance, the retail and eCommerce markets are the largest, responsible for 30% of eWallet usage.

In this section of the blog, we shall be looking at industries that benefit from digital payment solutions.

1) eCommerce & Mobile Commerce Industry

If you use eCommerce app like Noon or Amazon, you already know how useful eWallet functionality can be.

In fact, it was so high in demand that Amazon made their own eWallet application. After all, introducing digital payment to these platforms is super beneficial for users as well as businesses.

The former can make easier payments, making the decision to shop much quicker. On the other hand, the latter one, gets more revenue, while also gaining insight into the financial flow of the platform, among other things.

2) Ride Hailing Solutions like Uber

Best taxi apps like Uber, Lyft, Crub, etc are using eWallet solutions to generate billions.

It goes without saying that payment gateway integration in taxi apps can make it that much easier for the user to make payment and the company to handle it.

All in all, this is one of the major industries that has been reaping the fruit of fintech integration.

3) On-Demand App Industry

On-demand apps have become super popular in the market.

From food delivery apps like DoorDash to grocery delivery and on-demand laundry service apps, the list goes on.

In any case, any on-demand app can create an eWallet or integrate it into their app for added advantages.

For instance, easier payments, delivery people don’t have to deal with payments, better offers, and much more.

4) Travel industry

It is no secret that the travel industry is one of the world’s largest.

And there are no number of scams that tourists fall prey to in monetary matters. Well, travel apps for tourism are coming with digital payment functionality to deal with this problem.

Even if you don’t use the integrated solution and stick to your usual eWallet, it is still much safer for you, while also giving higher user engagement to travel platforms.

5) EdTech Industry

The growth of Edtech following the pandemic and the boost it got is remarkable.

Today, Edtech has become a common practice with every other person buying online courses. This is where eWallet and online payment apps come in.

6) Digital Healthcare

Lastly, we have digital healthcare examples.

Digital healthcare includes a range of solutions, from online appointment booking apps to telemedicine apps like Doctor On Demand.

The role of digital wallets here is to make payment for services easier and quicker.

So, these are some of the top industries that can benefit from eWallet integration and applications alike. With this out of the way, let’s answer a major “how to create an eWallet” question…

Features to Have in an eWallet App

eWallet app features play a great role in delivering value to the target user. And thus, make your eWallet application stand out from the rest.

Therefore, in this section of the Digital wallet app development guide, we shall be going through essential feature for eWallets:

| User Panel | Vendor Panel | Admin Panel |

| Registration and Login | Product/Service Management | User Management |

| Product/Service Browsing | Order Processing | Dashboard Overview |

| Shopping Cart/Order Management | Inventory Management | Content Management |

| Payment Gateway Integration | Analytics and Sales Reports | Permission Settings |

| Wishlist/Favorites | Payment and Invoicing | Analytics and Reporting |

| Order Tracking | Profile Customization | Transaction and Order Management |

| Reviews and Ratings | Customer Interaction | Customer Support Tools |

| Messaging/Support | Discounts/Promotions | System Configuration |

| Settings and Notifications | Shipping and Fulfillment. | Security and Compliance |

| Registration and Login | Settings and Permissions | Communication Tools |

| Product/Service Browsing | Product/Service Management | User Management |

Apart from the essential i.e. basic eWallet app features, there are some advanced ones that one should considering during app development process.

Advanced Features to Have in an eWallet App

Every digital wallet application has essential features.

Therefore, if you want your platform to stand out from the rest, you want to consider some advanced features as well.

In this section of the blog, we shall be going through the top advanced features.

1. Biometric Authentication

Authentication like PIN and Password are basic features of all fintech apps.

To take this a step further, you can include biometric authentication features in the platform. It enables access via facial scan, fingerprint scanner, or retina scanner.

The eWallet app here uses the built-in scanners and sensors of the app to make this possible.

2. Multi-Currency Support

Globalization has made the entire world a big family. Today, you might be buying groceries in the USA paying in dollars and tomorrow you might be in Dubai for a business trip.

That’s why including multi-currency support for digital wallet app development can be super beneficial.

As a feature, it can lead to international exposure and better user experience among travelers.

3. Budgeting Tools

This is a feature that you can find in the best fintech apps.

You see, budgeting has been a big issue in today’s generation. People are having a hard time keeping track of their spending and saving up money.

Digital mobile wallet applications fitted with budgeting tools can really push the edge when it productivity and user experience.

4. Wearable Integration

Wearable devices like the Apple Watch, Samsung Smart Watch, and products from other parties have made it among the masses.

These devices have made it easier to receive notifications and interact with smartphones without touching it.

Using IoT technology as well as wearable app development, you can create solutions that enable payment approval via the smartwatches themselves. How cool is that?

5. iBeacon and Bluetooth Integration

iBecaon is a Bluetooth-driven technology that was developed by Apple.

Integrating this into your eWallet application can reap several benefits. This includes:

- Proximity-Based Payments

- Personalized Offers and Notifications

- Location-Based Services

- Automatic Check-ins and Loyalty Programs

All in all, this is a technology that is used by major platforms to make the eWallet app user experience better and more fulfilling. Therefore, it’s something that you should consider as an advanced feature for your platform.

6. Virtual Card Management

One of the key features and selling points of the digital wallet mobile solution is virtual card management.

So, what is it? In layman’s terms, user can add their credit cards or debit cards to the app and never carry it on them physically.

For instance, NFC payment apps enable users to make payments via their cards from their phones. This is what makes it a great feature in your app.

7. E-commerce Integration

eCommerce is changing how we shop and it can be a great thing for many reasons.

For starters, Mobile Commerce is one of the largest industries in the world, generating billions. And by offering a solution here, eWallets can capture more revenue.

In addition to this, also considering providing BNPL functionality here.

So, these are some advanced features that you should consider including in your eWallet application. With this out of the way, it’s time to discuss how to develop eWallet in the section below.

How to Create an eWallet App?

So, how to create an eWallet mobile application?

It is both a technical and creative process. To help you better understand the same before your venture, let’s go through each step, discussing them in detail.

Therefore, these are, as mentioned below:

Step 1: Discovery Stage

The first step to develop a digital wallet application is the discovery phase.

In this part, you have to deal with all things research-related, as you can see below. Thus, let’s discuss each one of these in detail.

Market Research and User Persona

This is something that a lot of people get wrong.

App Market research is the gateway to becoming the next big name. The target audience base is super important considering the fact that your features, app market strategy, development prospects, and everything else are based around them.

For this reason, conducting in-depth research for the user base is very crucial.

Legal Compliances

Lastly, since we are dealing with finances, there is some legal compliance and licensing the business might need to deal with.

It goes without saying that Fintech is one of the world’s most regulated and supervised industries due to the importance of the data it handles.

Getting this done before you create an eWallet application is a must.

Finalize the features

Based on the user persona and your value proposition, the app feature will be finalized.

As we have already discussed in the blog earlier, the feature plays an important role in the success of any platform including digital wallet applications.

Therefore, choose the ones that best fit your user base and the app concept.

Choose an App Development Platform

Lastly, with everything else set and done, we need to decide development platform.

For those who are unfamiliar with the concept, here you need to decide whether you are creating an Android application or going for iOS app development.

If you are looking to target an audience from both platforms, you can consider a hybrid app.

Choosing the right platform is important as it affects the feature set, audience base, development cost, as well as design.

For instance, android app development is more expensive than the other two. However, it does introduce more custom features.

All in all, each platform has its own pros and cons.

When we are done with the discovery phase, it’s time to move to the designing part.

Step 2: App Designing

It’s time to deal with eWallet app design.

The idea here is to create a design that resonates with your target users, and is easy to use, while also being equally awe-inspiring and aesthetically pleasing.

To do this, here are some steps that you can follow:

Choose a design approach

The first thing you need to do is choose a design approach. This is much like choosing a software development methodology before creating software.

Once you are done with this, we will move to the next step…

Creating wireframes and prototypes

To turn the design’s concept into a real thing, we need to take it through app wireframing and prototyping.

There are several stages of mobile app wireframes that enable designers to add more weight, elements, and features at each step, bringing an idea to life.

On the other hand, prototype helps test these designs and get approval from clients.

Both of these have important roles to play.

User Experience

A big thing that requires attention during the UI/UX Designing process is User Experience.

When it comes to fintech apps like eWallet, UX plays an important role in driving user attraction and user retention. By designing a good experience, you can take your platform from 0 to 100 really quickly.

Here, you can take inspiration from top eWallet apps.

Step 3: App Development

Finally, it’s time to create a digital wallet application.

This is by far the most technical and time-consuming step. After all, all the source code is written here and developers give their all to bring your idea to reality.

For that reason, it is highly recommended that you maintain a good communication channel with the development team.

Moving on, let’s look at the different things that you need to deal with in this step.

Tech Stack

The first thing you need to do is choose an eWallet app tech stack.

Technology stack refers to the set of technologies used for digital wallet application development. And there are a lot of options that you get here.

These are, as mentioned below:

| Layer | Technology |

| Frontend | React Native, Flutter, or Swift (for iOS) and Kotlin (for Android) |

| Backend | Node.js, Python (Django), Ruby on Rails |

| Database | MySQL, PostgreSQL, MongoDB |

| API Integration | RESTful APIs, GraphQL |

| Authentication | OAuth 2.0, JWT (JSON Web Tokens) |

| Payment Gateway | Stripe, PayPal, Braintree |

| Cloud Storage | Amazon S3, Google Cloud Storage |

| Security | SSL, Encryption, Two-factor authentication |

| Push Notifications | Firebase Cloud Messaging, Apple Push Notification Service |

| Monitoring | Sentry, New Relic |

| Deployment | Docker, Kubernetes |

| Version Control | Git |

| Development Environment | Visual Studio Code, Xcode, Android Studio |

Though these are the general options, there are a lot more top software development tools that you can use here.

Team Structure

Now that we are done with the tech stack, it’s time to hire mobile app developers.

However, it is not as simple as it sounds. If you are going for a big project like this one, you need an entire team.

Here, the team structure matters a lot. This gets us to the question, what is the ideal team structure for the eWallet app project?

Well, here’s an overview of it:

- Project Manager

- UI/UX Designers

- Mobile App Developers

- Frontend Developer

- Backend Developers

- QA/ Testers

- Fintech Security Experts

- Payment Gateway Specialist

- Database Admin

Now, there are various ways to assemble a team. You can choose between in-house and outsourcing.

However, in recent times, it has become a trend to find outsourcing development partner, as it makes the work a lot easier on the client side. Not to mention a lot cheaper as well.

Frontend Development

Though we are already done with the app designing process, it is time to integrate it with the eWallet application.

Here, technologies like CSS, react, JS, etc are used to make it possible. Front-end developers make the design responsive and connect it to the back end.

This makes eWallet app features come to life.

Backend Development

The real coding work is done here.

In eWallet app back-end development we deal with things like fintech APIs, database integration, and servers.

Though it might sound simple or straight, it takes the most time in the development process. The reason is that it is important to create a secure connection between different components.

Any leaks or errors here can compromise the entire platform.

Payment Gateway Integration

Now, to breathe life into the eWallet application, developers will integrate a payment gateway.

Like any other integration process in a digital wallet solution, payment gateway integration needs a lot of time.

In fact, it is this gateway that enables online payments, P2P payments, and so on. It is for this reason that you need to choose the right payment gateway.

Now that we are done with this, let’s move to the next step to create a digital wallet.

Step 4: App Testing

Mobile app testing is more important than anything else, especially when we are talking about how to build eWallet.

There are so many working components in these solutions that it has to be checked many times for any errors, bugs, or leaks.

Therefore, the QA and testing team will cross-check everything before sending it off to deployment.

Step 5: App Launching

Once the team gets the green light from the QA team, it’s time to deploy the app.

The app deployment process entirely depends on the development platform. This is to say, when you publish an iOS app on the App Store the process is a bit more complex and guidelines are strict.

On the other hand, when you submit an Android app to the Google Play Store, it’s a lot more flexible in guidelines and also easier.

Hybrid apps have to go through both of them. In any case, regardless of the platform, 2 weeks are required for the app to go live.

However, our work here is not done.

Step 6: Maintenance & Support

Even though we are done with the digital wallet application development, there’s work to be done.

Following the launch, it’s time to start app maintenance and support services. These help solve the recurring issue and prepare for sudden app issues.

This is more than just a step, rather a process on its own that will go on till the app is live in the market.

And with this, we are done with our guide on how to create a digital wallet app. And it’s time to answer the big question, how much does it cost to develop an eWallet application?

How Much Does it cost to develop an eWallet App?

The cost to build an eWallet app ranges between $15,000 and $70,000 based on factors like app platform, tech stack, feature set, complexity, and more.

A simple eWallet app with basic features and an average design would cost you between $15,000 and $30,000. On the other hand, a more complex one with advanced features will range between $30,000 and $70,000.

Finding accurate estimation is a big issue when we are talking about fintech app development cost. Therefore, if you are looking for a more accurate app development cost estimation, it is highly recommended that you consult eWallet App Development Company.

Major Challenges in Creating an eWallet app

Before we discuss how to secure the eWallet application, it’s a good idea to learn about the common eWallet app development challenges faced.

Therefore, let’s get right into it:

1. Fraud and Security

Even though eWallet applications and infrastructure are in an advanced state, it is still young in the grand scheme of things.

This gives us a lot of security issues, leading to billions lost in cyber fraud each year. And with time the number is slowly rising.

Solution: This can be resolved with multi-level security protocols, encryption, biometric authentication, and real-time monitoring, among other solutions.

2. Awareness and Adoption

So, one of the big issues is awareness and adoption.

There are still parts of our society that frown upon the entire eWallet and fintech scenario, not putting their trust in it.

Mainly, they don’t understand the usefulness of the eWallet application.

Solution: There is no technical solution for this but rather a social one. Platforms can release educational content, campaigns, and material to educate the masses about the benefits of their solutions.

3. Merchant Acceptance

Retail stores are places where eWallet applications and digital payment solutions are used the most.

However, smaller merchants and conservative ones still find it difficult to invest in merchant service providers. This sabotages a lot of the market and potential revenue they could be generating.

Solution: The service provider can offer incentives to merchants in a bit to lure them to use eWallet application integration in their systems.

4. Compliance with Legal Requirements and Standards

This is a problem that eWallet app companies themselves face in the market.

With different countries having their own unquiet compliance standards and legal requirements, there is a lot of overlaying that eWallet businesses have to deal with.

Therefore, if you want to create a digital wallet mobile app, this is an important thing to deal with.

Solution: To solve this, you should invest in regtech and legal experts. This can take you a long way as a business.

5. Device Compatibility

The mobile phone market is fragmented.

There is a small fraction of people who upgrade their smartphone every year. However, the majority of people are still using outdated OS and hardware.

This creates an issue as the new eWallet app is focused on the latest standards.

Solution: you can ask developers to use versatile frameworks for development. It is also advised to create a responsive design that can fit different device screens.

Digital Payment Technologies For eWallet App Development

The market for eWallet apps is growing at an amazing rate.

And this doesn’t just mean a lot of revenue. Rather, skyrocketing growth also inspires technological advancements and takes eWallet solutions to the next level.

This is to say, we are beyond sending payment online mode, these apps are on their way to entirely replacing credit and debit cards. Let’s see how these technologies work:

NFC

With the top NFC payment apps taking over the market, this is one technology that has caught everyone’s attention.

NFC stands for near-field communication.

As the name suggests, it enables two devices to communicate with each other via encrypted data when they are in close proximity.

Needless to say, it makes a good channel for contactless payments.

iBeacon

As we have discussed before, iBeacon technology is an advanced technology developed by Apple that uses Bluetooth low-energy to communicate with other devices.

This enables location-based services for eWallet applications.

Over the years, this has become a common technology used in digital wallets. Therefore, consider including it in your solutions.

QR Codes

Well, well, this was going to appear on this list, sooner or later.

eWallet QR codes are probably the most common and popular way of contactless payment. The term QR refers to a quick response.

For those who can’t put a face to this concept, they look something like this:

These are simple to use as all you need to do is scan them and it will make the payment possible.

UPI

Let’s talk about one of the most advanced online payment infrastructures in the world, coming from India.

UPI stands for Unified Payment Interface.

To be specific, it is a real-time payment system that allows instants between bank accounts using eWallet or a mobile banking application.

There are various ways a UPI transaction can be triggered including UPI ID, phone number, QR code, and so on.

All in all, the mere speed and security this technology offers have inspired a lot of investment in UPI app development.

MST (Magnetic Secure Transmission)

Lastly, we have the MST or magnetic secure transmission.

One of the most common examples of MST utilization is seen in the Samsung Pay application. It is similar to what cards are used in the form of a black strip on the backside.

Meaning, that it can only work on payment machines that accept debit or credit cards, making phone payment possible.

So, these are the top digital wallet payment technologies. With this out of the way, let’s focus on the security part of digital wallet solutions.

Security Compliance for eWallet App

When it comes to fintech apps of any sort, ensuring impregnable security becomes super important. The same is the case for eWallet applications.

The widespread use of the eWallet application and the development of infrastructure around it has led to the creation of multiple security compliances.

Therefore, let’s look at methods to ensure eWallet security.

1. Data Privacy Regulations

We are living in the 21st century, where everything exists in the form of data, from your life events to financial details. So, it is no surprise that people don’t want their data mangled.

This is why it is important to comply with data privacy regulations. This includes the likes of GDPR compliance (General Data Protection Regulation) and CCPA (California Consumer Privacy Act).

Depending on your market, there can be different regulations you need to follow, but for the majority of America and Europe, these two will do.

2. Multi-Factor Authentication

With the recent rise in financial fraud, many of the top authorities have mandated multi-factor authentication.

So, the first layer is the PIN or Password that you have created. Now to add an extra layer, a digital wallet might have internal or extra layers that require another PIN or OTP to enable transactions.

This is a general idea, we can also cover biometric authentication if required for multi-factors.

3. Secure Data Transmission

One of the biggest security issues in eWallet applications is communication familiarity.

This can happen when either side has compromised security or the connection isn’t secure. This is why secure data transmission is important.

For this, one can use encryption protocols like TLS or SSL.

4. Secure Data Storage

Data storage has to be the single largest security concern in fintech apps. After all, this is the first area of target for hackers and fraudsters.

To secure it, a good method is using cloud storage.

In addition to the extra security, it also enables cross-device data synchronization which is a highly valued feature in eWallet applications.

5. Compliance with Payment Card Industry Data Security Standards (PCI-DSS)

This is an important compliance standard for every platform that deals with credit card information, which eWallet applications do.

PCI DSS compliance helps eWallet applications secure their network, protect cardholder data, and implement security measures. In addition to this, it also mandates regular monitoring, network testing, and information security policy maintenance.

To learn more, you should definitely read this: How to develop a PCI DSS-compliant fintech mobile app?

6. P2P Encryption

P2P encryption refers to the application of end-to-end encryption in peer-to-peer transactions.

As all encryption does, this technology makes sure data transmission is secure. It does it by encoding data before sending it to the other party, and it is decoded once it is there.

This means that if any unauthorized party tries to mess with the data mid-path, they can’t access it.

7. Tokenization

Lastly, we have a rather new technology known as Tokenization.

It refers to the process of creating a digital version of financial assets on the blockchain. In fintech, it deals with credit cards, debit cards, and banking information.

It is a super secure technology that has seen wide application not just in eWallet but also in mobile banking app development.

eWallet App Monetization Strategies

Now, with all said and done, let’s see how fintech apps make money.

In order to do this, you have to incorporate, App monetization strategies. These are methods that enable the platform to generate revenue via various different paths.

Let’s look at some common ones, below:

- Cash Advances: This might not be the conventional eWallet monetization method that you see, but recently a lot of eWallet solutions have doubled as cash advance apps. This can help your business generate millions in revenue.

- Big Data: It goes without saying that fintech apps generate a lot of revenue. This data can be converted to be monetized as there’s a lot of demand for this form of package.

- Transaction Free: Since we are dealing with a lot of transactions, we charge a small percentage or fixed fee for every transaction. This is the most common app monetization method for eWallets.

- Partnership Commission: You can partner with top eCommerce platforms and retail chains offering discounts to users in exchange for part of the revenue. This is yet another great strategy.

- Advertisement: Platforms that are used by millions of users are a great place for advertisement. Because a lot of companies are willing to do big sums for mobile app ads.

- Freemium Model: Lastly, we have the popular freemium model. Here, the business offers a free app that has all the basic functionality. However, to access advanced features, users need to pay a subscription fee. We also know them as subscription-based apps.

These are the common digital wallet monetization methods. And with this out of the way, let’s look at some eWallet app best practices.

Tips to Create a Successful eWallet App

The goal of creating a digital wallet app is to generate money, make a name for business, and secure a good place in the market.

So, how do you do this?

Well, there are some things that require special attention if you want to create a successful eWallet app.

1. Create a Unique Value Proposition

What is my eWallet app idea offering to users?

This is the first question you must ask yourself as a business owner and someone considering building a digital

Now, you can be an eCommerce company or a retail chain that wants to introduce a wallet app for easier payment and driving a loyalty program. Or you can be a startup that wants to create an innovative app like Moneylion or Robinhood.

In either case, you need to deliver something unique, if you want to make the app successful among people.

2. Learn From Other’s Mistakes

There are millions of eWallet apps floating around in the market.

And to the ballpark, they have already made all the mistakes and mess-ups that you are to make. Therefore, a good strategy is to analyze them, look at their client feedback, and not do what they are doing wrong.

As a general rule of thumb, while we are learning from good options of top eWallet apps, we also learn from the downsides of the worst ones.

3. Adapt To Change, Incorporate Trends

The eWallet market is like the sea and if you want to scale it, you need to adapt to the changing tide, that comes in the form of trends.

For instance, some of the latest eWallet app trends at the time of writing this blog are:

- Contactless payments via NFC

- Digital gift cards

- Mobile loyalty programs

- Biometric Authentication

- Tokenization

- More Focus on Cyber Security

- In-app payments

- Buy Now: Pay Later Apps like AfterPay

By integrating these trends into your platform, you can become the next big thing in the market.

4. Listen To Users

We can’t stress things enough, always focus on what your users want.

There are various ways to get user feedback. Based on this, you can design your new features, change designs, remove extra functions, and introduce new concepts, leading to better user retention.

Following this tip, you can create an app like PayPal, Venmo, or Zelle in no time.

5. There’s Nothing Like A Good Marketing Campaign

It goes without saying that there is nothing that comes with a good app marketing campaign.

There are a lot of things that go down in-app marketing, from app-store optimization to creating a website for SEO.

However, by maintaining a brand, showing users what you got, and staying true to the message, success will come sooner or later.

There are various ways to market an app successful, most of all you can learn from your competitors and do it better.

These are some useful tips that you can follow if you want to create a successful solution.

How Nimble AppGenie can be a perfect partner for you to create eWallet App?

If you want to create an eWallet app with the potential to compete against big names like PayPal and Venmo, you need a good idea, passion, and developers who believe in your dream.

That’s why Nimble AppGenie comes in.

As a market-leading Mobile App Development Company, we are honoured by top platforms like Clutch. co, GoodFirms, TopDevelopers, and many more.

Our team of developers has experience working on top eWallet platforms that go on to rule the market.

This includes the largest digital bank in Africa that enables users to trade cryptocurrencies while delivering all the advantages you expect from a digital wallet.

In addition to this, Nimble AppGenie also rolled out CUT. An eWallet application that has been disrupting the market in China and Myanmar with its amazing features like multicurrency support, currency exchange, in-app wallet, QR code, and much more.

Our work speaks for itself. And so do our clients who are making millions with their future-ready eWallet solutions.

If you are looking for a fintech app development company that can give your amazing ideas a digital life, we have the technology, work ethic, and passion to do it.

Contact our team today and let’s create the next big thing.

Conclusion

eWallet apps have become a part of people’s day-to-day life. Though the masses seem satisfied with current platforms like PayPal, Venmo, or Cash App, there’s always room for improvement and market to be captured.

Time and time again, we have seen digital wallets disrupting the market with their unique value proposition and use of the latest technologies. For BNPL and Cash Advances, all are rooted in eWallet solutions.

Now, if you have a unique idea for a digital wallet that you think can take over the market, it’s the right time to partner with eWallet app developers and bring it to life. Done right, you can generate millions (or even billions) while creating a lasting brand.

FAQ

eWallet apps, also known as digital wallets, mobile wallets, or payment apps, these mobile applications let users transfer funds (even internationally), manage bank accounts, carry virtual cards, pay bills, apply for financial products, and much more.

The steps to how a digital wallet works are, as mentioned below:

- User registration and account creation

- User Authentication

- Bank Account/Card Linking

- Support Various Transaction Types

- Transaction Authorization & Processing

- Transaction Confirmation

- Transaction History

For a business, digital wallet applications offer many benefits. Some of these are:

- Increased sales

- Better customer loyalty

- Ease of introducing marketing campaigns

- Insight into finances

- Reduce operations costs

To create an eWallet app that stands out from the rest, here are some tips that you can follow:

- Learn from the best e Wallet apps in the market

- Always embed trends in new features

- Keep the app secure

- Create unique value among users

The average time taken to build a digital wallet app is anywhere between 2 weeks to 12 weeks. The development time for apps with complex design and advanced features is higher while simpler apps are both cheaper and quicker to create.

To integrate a digital wallet app with other payment systems, utilize APIs provided by the payment system to establish connections. Ensure the digital wallet app supports various payment methods and currencies. Implement secure data encryption and comply with industry standards for seamless transactions between the digital wallet and external payment systems.

To market a digital wallet app effectively, you can use the following methods:

- Define your target audience

- Conduct market research

- Develop a unique value proposition

- Define your success criteria

- Register your domain & create a landing page

- Using social media

- Reach out to influencers

Cost to build digital wallet ranges between $15,000 and $70,000 based on factors like app platform, tech stack, feature set, complexity, and more.

Here are the steps to follow to create an eWallet application:

- Come up with idea

- Market research

- Finalize feature

- Choose platform and tech stack

- App design

- App development process

- App testing

- Deployment

There are various eWallet app monetization strategies that you can use. Some of these are, as mentioned below:

- Big Data

- Transaction Free

- Partnership Commission

- Advertisement

- Freemium Model

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.