UPI App Development has been a hot topic in the world of fintech recently. No, it’s just India, rather it is a keyword in some of the largest fintech markets.

But why?

The Indian market has been the home to fintech innovation like never before and UPI is one of the best examples it.

UPI is light fast technology for mobile payments. And trust us on this one, it is super-fast. Well, that’s the main reason why top companies from across the world are planning to invest in UPI app development.

On average UPI app development costs $25,000 to $150,000+ depending on factors like complexity, features, platform, size, development team, and much more.

That’s why when you go into this project, you want to know everything. And that’s exactly what we shall be discussing in this guide to create a UPI app. Covering everything from development process, market statistics, to development cost, monetization, and more.

Therefore, let’s get right into it:

The Growing Market For UPI Payment App: Industry Statistics

Before we get into whole UPI payment app development thing, let’s first look at the Fintech statistics to better understand the market.

- In June 2023, the number of UPI transactions in India reached 9.3 billion, up from 5.86 billion in June 2022. This represents a year-on-year growth of 60%.

- The value of UPI transactions in June 2023 was ₹14.75 trillion, up from ₹10.14 trillion in June 2022. This represents a year-on-year growth of 46%.

- UPI accounted for 52% of all digital payments in India in 2022-23.

And with this out of the way, let’s answer one of the big questions related to the same.

Is UPI Available Outside India?

One of the first questions that comes to mind of international investors and would-be entrepreneur is, “is UPI technology available outside India?”

This is a rather tricky question.

While UPI’s roots are in India, you can find its influence spreading globally.

As of recently, many countries are exploring the implementation of similar systems, inspired by UPI’s success.

The prospect of international transaction apps is becoming increasingly promising. This suggests a future where you can transfer money across borders using this innovative technology.

In layman’s terms, the majority of the first world countries are developing IT infrastructure to accommodate UPI-like mobile payment technologies.

Thus, paving way for a new age of UPI payment app development.

UPI Adoption Across The World

While UPI’s success story is undeniably rooted in India, its impact is starting to ripple outwards, attracting attention and adoption across the globe. Let’s delve into how different countries and big apps are embracing this innovative payment technology:

A] Countries Embracing the UPI Wave

eWallet app market statistics show us the huge wave of global adoption of UPI across the world.

- Singapore: As a close neighbor with strong economic ties, Singapore became the first country to integrate UPI for cross-border transactions in 2023. Users can now make seamless payments at select merchants and tourist sites using their Indian bank accounts, enabled with PayNow-UPI merger.

- UAE: Following suit, the United Arab Emirates has joined the UPI bandwagon, enabling Indian tourists and residents to make local payments using their familiar UPI apps.

- Bhutan: Bhutan, another close partner, has also adopted UPI, allowing both tourists and Bhutanese citizens with linked Indian bank accounts to experience cashless transactions.

- Europe’s Interest: France, through Lyra network, and BENELUX countries (Belgium, Netherlands, Luxembourg) through Worldline, have established partnerships to enable UPI usage, marking a significant entry into the European market.

- Global Expansion: Agreements with Saudi Arabia, Bahrain, Nepal, the UK, and Malaysia are underway, indicating a potential domino effect for worldwide UPI adoption.

B] Big Apps Joining the Movement

Some of the biggest fintech apps from across the world are adopting this technology, let’s see what these are:

- PhonePe: The leading Indian digital payments platform announced international UPI support in Singapore, UAE, Mauritius, Nepal, and Bhutan. Users can now pay in international currencies from their Indian bank accounts.

- Google Pay: While not officially offering UPI yet, Google has expressed interest in integrating it into its existing payment infrastructure, giving UPI a global reach through its user base.

- Worldline: This major payment service provider is partnering with NPCI (National Payments Corporation of India) to facilitate UPI acceptance among international merchants and acquirers.

- Visa and Mastercard: These global payment giants are exploring partnerships with NPCI to enable UPI acceptance within their networks, opening up UPI to millions of users worldwide.

Why the Global Buzz?

Several factors contribute to UPI’s growing appeal:

- Instant and Seamless: UPI offers real-time, 24/7 payment processing, making it faster and more convenient than traditional methods.

- Interoperable: It works across different banks and apps, promoting financial inclusion and simplifying transactions.

- Cost-Effective: The low transaction fees associated with UPI make it attractive for both users and merchants.

- Secure: UPI leverages robust security protocols, ensuring safe and reliable transactions.

Is UPI Secure?

It goes without saying that when it comes to creating an UPI app, security is paramount. But when we are speaking of UPI technology, you can rest assured.

India’s UPI system is backed by robust encryption and authentication protocols. As a result, the transactions are shielded, ensuring both money and data remain safe.

In fact, it is one of the most secure fintech technologies that you can get your hands on in today’s time. This is what makes it such a great fit.

Understanding UPI System Technology

You will find that UPI operates on a real-time, interlinked platform, enabling seamless fund routing and merchant payments. Moreover, its architecture ensures swift transactions, allowing you to send and receive money in the blink of an eye.

In addition, you discover the power of real-time transactions, making your financial interactions smoother and faster than ever before.In fact, a great many readers are curious as to how UPI payment app technology works. So, let’s see:

- Open an UPI-enabled app and select the “Send Money” choice.

- Enter the recipient’s Virtual Payment Address (VPA) or mobile number.

- Select the bank account from which the money will be debited.

- Enter the amount to be transferred and add a note.

- Enter your UPI PIN to authenticate the transaction.

- UPI-enabled app forwards the transaction request to the Network Provider (NPSP).

- NPSP routes the request to the National Payments Corporation of India (NPCI).

- NPCI validates the transaction and forwards it to the remitter’s bank.

- The remitter’s bank verifies the transaction and debits the remitter’s account.

- NPCI forwards the debit confirmation to the beneficiary’s bank.

- The beneficiary’s bank credits the beneficiary’s account.

- NPCI sends a transaction success notification to the remitter’s UPI-enabled app.

With this out of the way, it’s time to look at the UPI payment app development in the next section of the blog.

UPI Payment App: The Power of Lightfast Payments

So, what do you get with UPI payment app development?

Well, for starters, imagine a world where you can transfer money at the speed of light. UPI payment apps make this a reality.

You witness how these apps harness the power of UPI technology, enabling you to make instantaneous payments, eliminating the hassles of traditional banking methods.

Whether you’re splitting a bill with friends or paying for groceries, UPI apps make transactions effortless, placing the power of money transfer right at your fingertips.

Technically, a UPI app is an eWallet app that can accommodate UPI transactions. As we learned through the working process, it is an easy task. This is one of the reasons many people want to hire app developers to create their own UPI payment apps.

Speaking of UPI payment apps, it’s best to learn from the best. So, let’s get right into it:

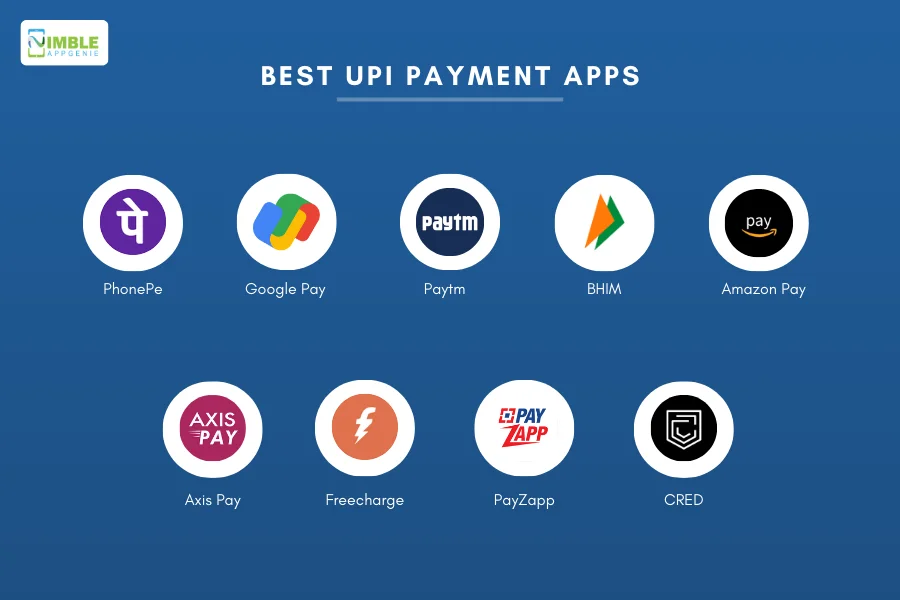

Best UPI Payment Apps Like

Want to know how to develop UPI app? Well, it’s best to learn from the best eWallet apps that use this technology. And that’s what we will be going through in this section of the blog:

- PhonePe: A popular choice with a user-friendly interface and a wide range of features, including bill payments, recharges, and shopping.

- Google Pay: Another popular choice with a strong focus on security and privacy. It also offers a variety of rewards and cashback programs.

- Paytm: One of the earliest UPI apps on the market, Paytm offers a wide range of features, including mobile wallets, online shopping, and financial services.

- BHIM: The official UPI app from the National Payments Corporation of India (NPCI), BHIM is a simple and straightforward choice for making UPI payments.

- Amazon Pay: Amazon Pay offers a seamless integration with the Amazon shopping experience, making it easy to pay for purchases with UPI.

- Axis Pay: A reliable choice from Axis Bank, Axis Pay offers a variety of features, including bill payments, recharges, and discounts at select merchants.

- Freecharge: A versatile app with a wide range of features, including bill payments, recharges, shopping, and investment options.

- PayZapp: A popular choice for merchants, PayZapp offers a variety of features, including QR code payments, contactless payments, and rewards programs.

- CRED: A unique app that rewards users for paying their credit card bills on time. It offers a variety of features, including bill payments, recharges, and shopping.

Why Build an UPI App?

So, why should you go for UPI payment app development?

This is one of the most common questions that people ask when considering building an UPI app. Well, there are various reasons for this app development investment and we will be taking you through that.

These are, as mentioned below:

1. Tap into the Digital Payment Boom

In today’s world, the digital payment sector is booming. By developing a UPI app, you position your business at the forefront of this revolution.

This empowers your customers with convenient, contactless payment methods, which are becoming increasingly essential in our increasingly digital economy.

By offering UPI services, you stay ahead of the curve and meet the evolving needs of your customer base.

2. Enhance Customer Convenience

It goes without saying that like all other digital payment solutions, UPI apps give unparalleled convenience to users.

With the UPI app, your customers can make payments, transfer funds, pay bills, and many more amazing eWallet app features with a few taps on their smartphones.

This convenience factor is a significant driver of customer satisfaction, as it simplifies their daily financial transactions and makes their experience smooth and efficient.

3. Boost Customer Loyalty

User-friendly UPI apps enhance customer loyalty.

When your customers find it easy and hassle-free to transact with your business, they are more likely to remain loyal and continue using your services.

This fosters long-term relationships and strengthens the bond between your brand and its customers.

4. Increase Sales and Revenue

Our UPI app streamlines the payment process, enabling customers to make purchases swiftly.

The simplified payment process ensures that they can quickly complete transactions, which, in turn, leads to increased sales and revenue for your business.

Moreover, by accepting digital payments, you cater to a broader customer base, potentially attracting more sales.

All in all, you get numerous opportunities to apply fintech monetization strategies and generate healthy revenue via your app.

5. Streamline Business Operations

Automating payment processes through your UPI app increases efficiency in your business operations.

You can receive payments instantly, reducing the need for manual intervention. This not only saves time and resources but improves cash flow and business operations.

6. Global Expansion and Accessibility

While UPI was earlier only available in India, there has been technological adoption across the world. And soon, it won’t be confined to a specific region or country.

By offering your UPI app, you can expand your business globally, reaching customers across borders and opening up new avenues for growth and expansion.

This global reach can help your business tap into untapped markets and customer segments.

7. Enhanced Security Measures

Your UPI app ensures that your customers’ transactions are secure.

Advanced ewallet security features build trust among your customers, allowing them to use your app confidently, knowing that their transactions are protected.

This trust is crucial in today’s digital landscape, where security concerns are paramount.

8. Gaining Data Analytics and Insights

The UPI app provides valuable insights into customer behavior and transaction patterns.

By analyzing this data, you can tailor your products or services to align with your customers’ preferences.

These insights also enable you to make data-driven decisions that benefit your business strategy, ultimately leading to improved customer satisfaction and business growth.

9. Maintaining a Competitive Advantage

Offering a UPI app gives your business a competitive edge and becomes successful among people.

Customers are more likely to choose businesses that give easy and secure digital payment options. By offering such a solution, you attract more customers and outperform competitors who may not have embraced this technology yet.

10. Participate in Government Initiatives

Developing a UPI app allows you to take part in government initiatives that encourage digital payments.

This alignment with government policies and regulations positions your business as a responsible and forward-thinking entity, which can enhance your reputation and credibility in the eyes of both customers and regulatory bodies.

UPI Payment App Development Process

Now you have a strong resolve to develop a UPO like system in the USA in the form of an app. So, let’s create a solution that can be named among the best UPI based payment apps.

Let’s get right into it, starting with the first step.

1. Understanding the Basics

How do you develop an eWallet app?

Well, whether it’s UPI or any other form of eWallet, we begin understanding the fundamentals.

In other words, our journey starts by learning the basic rules in the universe of Unified Payments Interface (UPI).

It’s essential to understand the intricacies of how digital transactions flow across this platform.

Delve into the mechanisms of encryption, the nuances of transaction protocols. The pivotal role that banking institutions play in facilitating this digital symphony of financial exchanges.

2. Market Research

Once done with the learning, we need to step into the shoes of a modern-day detective.

Your mission is to analyze your target audience and keep a keen eye on your competitors.

Investigate which features users gravitate towards in payment applications and identify the innovative functionalities that set some apps apart.

In other words, conduct mobile app market research.

This investigative process is crucial in shaping an application that resonates well with your intended user base.

3. Conceptualize the App

Now, let your imagination run wild and come up with an app idea for fintech solution.

Consider what unique offerings your application will bring to the table.

Will it merely facilitate transactions, or will it serve as a multi-functional tool that manages bills, orders food, and perhaps offers additional utility like weather forecasts?

Sketch out your vision, allowing your creative and innovative ideas to guide the formation of your app’s blueprint.

4. Choosing the Technology Stack

Dive into the technical side of development by choosing the right fintech app tech stack for your project.

This includes deciding on the programming languages, frameworks, and tools that will form the backbone of your app.

Think of this process as assembling a team of superheroes, where each technology brings a unique strength to your application’s functionality.

Speaking of which, an example of eWallet app tech stack for UPI technology is, as mentioned below:

| Component | Options | Considerations |

| Front-End Development | – Native Development (Java/Kotlin for Android, Swift for iOS) – Cross-Platform Development (React Native, Flutter) | – Native offers better performance and control, but requires separate codebases for Android and iOS.

– Cross-platform is faster to develop, but may have performance limitations. |

| Back-End Development | – Java/Spring Boot – Python/Django – Node.js/Express.js | – Choose a language/framework familiar to your development team.

– Consider scalability and security requirements. |

| Database | – MySQL – PostgreSQL – NoSQL (MongoDB) | – Relational databases (MySQL, PostgreSQL) for structured data and transactions.

– NoSQL (MongoDB) for flexibility and scalability. |

| UPI Integration | – NPCI UPI SDK | – Provides tools and libraries for interacting with the NPCI UPI infrastructure.

– Essential for all UPI transactions. |

| Payment Gateway Integration | – Razorpay – Paytm – Stripe | – Enables additional payment options beyond UPI.

– Choose a gateway based on features, fees, and target market. |

| Security | – SSL/TLS Encryption – Data encryption at rest and in transit – Multi-factor Authentication | – Essential for protecting user data and financial information.

– Comply with PCI DSS and other relevant regulations. |

| Additional Tools | – Push Notifications (Firebase Cloud Messaging, OneSignal) – Analytics (Google Analytics, Mixpanel) – Crashlytics (Firebase Crashlytics, Fabric) | – Enhance user experience and engagement. – Monitor app performance and identify issues. |

5. Design User Interface (UI) and User Experience (UX)

Focus on fintech app design An interface that is as intuitive as it is inviting.

The goal is to create an UPI application that could effortlessly be navigated by users of all ages, including those who are not tech-savvy.

Draft the layout of your app’s screens with clarity and simplicity in mind, ensuring that every element, from buttons to menus, enhances the user’s experience and interaction.

To create an UPI Wallet App design that capture customer, you must keep it simple and also easy to navigate.

For this, you can take inspiration from official android and iOS app design guides.

6. Security Implementation

It goes without saying that when we are talking about a fintech solution like UPI app, security is paramount.

To do this, you need to adopt a vigilant approach to safeguarding user data, employing encryption methods to ensure that sensitive information is transmitted and accessed only by authorized parties.

Also consider incorporating multi-factor authentication to add an extra layer of security, protecting your users against potential threats.

7. Integration with Banks

Forge strong partnerships with banking institutions to ensure smooth interoperability between their services and your application.

Understanding the technical and regulatory requirements of banks is crucial for seamless money transfer processes, making transactions as simple and enjoyable as sharing moments with loved ones.

One of the best ways to do this is via Open Banking APIs and other fintech APIs.

8. NFC/QR Code Integration

If you know anything about UPI apps, you know that they thrive on contactless payment technology, securing top place in list of Contactless payment apps.

For that you can utilize QR codes or NFC payment technology as an efficient and user-friendly means for executing transactions.

By integrating these payment capabilities, you enable users to make payments swiftly and effortlessly, enhancing the overall user experience and streamlining the payment process.

9. Testing

With all said and done, it’s time to go for Fintech app testing.

Adopt a thorough testing mindset, scrutinizing your application for any potential flaws or bugs.

Test the app under various scenarios to ensure its reliability and robustness, addressing any issues that arise to ensure the application is ready for real-world use.

10. Compliance and Regulations

Since we are building a fintech app, you need to keep an eye out for compliance.

That’s why once all is done, we need to navigate the complex landscape of financial regulations, ensuring your application adheres to all relevant laws and guidelines.

This meticulous attention to compliance not only safeguards your operation but also builds trust with your users and stakeholders.

11. Launch

Drumroll, please.

It’s time to celebrate the culmination of your hard work and dedication by launching your application.

Now, there are do ways to do it:

Or both, if you are going for hybrid development.

In any case, once submitted it takes at most 2 weeks for app to get approved or denied.

Once all of this is done, you can start with a mobile app marketing plan to spread the word, leveraging social media, blogs, and video content to announce the arrival of your innovative payment solution to the world.

We are done with UPI payment app development and launch. Now, let’s look at some of the top features that you should include in your blog in the section below.

Essential Features for UPI App Development

Whether you talk of security or user satisfaction, UPI app features play a big role. That’s also the reason why it’s difficult to find the right fit for features.

That’s why in this section of the blog, we will be looking at some of the best features that every UPI payment app development solution should consider.

| Features | User Panel | Vendor Panel | Admin Panel |

|---|---|---|---|

| Registration & Login | Secure registration with phone number and UPI PIN | Registration with business details and bank account verification | User management (create, edit, delete) |

| Profile Management | View and edit profile information | View and edit business information | Manage vendor profiles (approve, suspend, block) |

| Product/Service Listing (applicable to vendor) | Add, edit, and manage product/service details (name, description, price, images) | View and manage product/service listings | Manage product categories |

| UPI Payment | Initiate payments to vendors using UPI ID, QR code, or VPA | Receive payments from users through UPI | View transaction history and manage settlements |

| Order Management (applicable to user and vendor) | View order history and track order status | View and manage orders (approve, reject, process) | Manage order disputes and refunds |

| Wallet Management | View wallet balance and transaction history | Manage payouts and settlements | Manage platform wallet and transaction fees |

| Promotions & Offers (applicable to user and vendor)** | View available promotions and apply them at checkout | Create and manage promotional offers (discounts, coupons) | Manage platform-wide promotions and loyalty programs |

| Feedback & Reviews | Rate and review vendors | View and respond to user reviews | Manage reviews and remove inappropriate content |

| Help & Support | Access FAQs, contact support | Access to dedicated vendor support | Manage knowledge base and support tickets |

| Security | Two-factor authentication (2FA) | Secure data storage and encryption | User verification and fraud prevention |

| Push Notifications | Receive order updates and promotional alerts | Receive order notifications and platform updates | Send announcements and manage user communication |

Advanced Features

It’s time to look at the Fintech app advanced features to include in UPI application. These are, as mentioned below:

User Panel:

- UPI AutoPay: Set up recurring payments for subscriptions or bills.

- Voice-based payments: Start payments using voice commands for hands-free experience.

- Split payments: Share bills and expenses with friends easily.

- P2P investment: Invest in mutual funds or stocks through the app using UPI.

- Bill reminders and automated payments: Set automated reminders and payments for important bills.

- In-app gamification: Integrate gamification elements like reward points or badges to incentivize transactions and engagement.

Vendor Panel:

- UPI Lite integration: Enable offline and contactless payments through NFC technology.

- Inventory management: Track inventory levels and receive automatic reorder alerts.

- Dynamic pricing: Set dynamic pricing based on demand, location, or other factors.

- Loyalty program management: Create and manage custom loyalty programs to reward repeat customers.

- Marketing tools: Access targeted marketing tools to reach specific customer segments.

- Analytics dashboard: Gain insights into customer behavior and sales performance.

Admin Panel:

- Fraud detection and prevention: Carry out advanced fraud detection algorithms and real-time monitoring.

- Dispute resolution tools: Streamline the dispute resolution process for users and vendors.

- User segmentation and targeted communication: Send targeted notifications and promotions based on user demographics and behavior.

- Regulatory compliance tools: Ensure compliance with relevant financial regulations and data privacy laws.

- API integration: Enable integration with other business applications and services.

- AI-powered recommendations: Leverage AI to personalize recommendations for users and vendors.

Additionally:

- Blockchain integration: Explore the potential of blockchain technology for secure and transparent transactions.

- Open banking integration: Provide seamless access to financial data and services from multiple banks.

- Chatbots for customer support: Implement chatbots for faster and more efficient customer support.

Cost to Develop an UPI Payment App

We have discussed all that you need to know about UPI app development, save for one thing – “How much does it cost to develop an UPI payment app?” Well, the cost of UPI payment app development depends on various factors.

On average, a basic UPI app with essential features can cost anywhere from $25,000 to $50,000. Feature-rich app with advanced functionalities and a polished user interface, the cost can range from $50,000 to $150,000 or more.

Moving on, to get an correct cost estimation, we recommend that you consult a fintech app development company. Based on your project specifications, they will be able to give a much better cost estimation.

Conclusion

UPI payment app development is gaining global attention due to its rapid growth and secure, real-time transactions.

While rooted in India, UPI’s influence is spreading worldwide, with many countries exploring similar systems. And, UPI offers robust encryption and authentication, ensuring transaction security.

Moreover, UPI app development provides advantages like tapping into the digital payment boom, enhancing convenience, boosting loyalty, and increasing revenue.

The development process involves understanding basics, market research, conceptualization, technology stack selection, UI/UX design, security implementation, bank integration, testing, compliance, and launch. In addition to this, the key features include fund transfer, bill payments, authentication, QR or NFC integration, and transaction tracking.

Costs vary based on complexity. Basic apps may cost $25,000 to $50,000, while feature-rich ones can range from $50,000 to $150,000 or more.

FAQs

UPI (Unified Payments Interface) is a real-time payment system in India. It allows developers to create seamless, instant payment experiences within apps. Understanding UPI is crucial for developers aiming to build user-friendly and secure payment applications.

For UPI Payment App Development, you need a registered business, compliance with NPCI guidelines, a UPI-enabled bank account, a secure server, and adherence to security standards like PCI DSS. Additionally, you require robust encryption, API integration, and a user-friendly interface for a seamless experience.

Security is paramount in UPI app development. Implement end-to-end encryption, secure API connections, two-factor authentication, and regular security audits. Adhering to PCI DSS standards and keeping your app updated with the latest security patches also ensures a safe transaction environment.

Challenges include complex API integration, security concerns, and compliance issues. Overcome these by collaborating with experienced developers, ensuring constant communication with regulatory bodies, staying updated with UPI guidelines, and rigorously testing your app’s security features before launch.

Focus on an intuitive UI/UX design, smooth navigation, minimalistic interface, and responsive customer support. Implementing features like QR code scanning, instant fund transfer, transaction history, and personalized notifications enhance user engagement and make your UPI app more user-friendly.

Yes, complying with RBI and NPCI regulations is mandatory. Obtain necessary licenses, adhere to data protection laws, and ensure your app meets all legal requirements. Consulting legal experts and staying updated with the latest guidelines will help you navigate the legal aspects effectively.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.