It’s 2024 and digital wallets are dominating the market.

eWallet apps have completely replaced our traditional wallets, offering convenience at our fingertips. And in the process of delivering innovation, the eWallet market has grown to become one of the largest in the world.

Today, digital payment apps have integrated with the majority industry and our day-to-day lifestyle. This is how eWallet apps are generating multi-billions in revenue, attracting more than a billion customers.

Growing numbers have inspired a lot of businesses, fintech companies, and entrepreneurs to create an eWallet app of their own. This begs the question:

“What are the eWallet app features that you should include?”

If you are wondering the same thing, this blog is for you. Here, we shall be discussing all you need to know about eWallet app features to be included in your next solution. In addition to discussing the list of features of the eWallet app, we shall also discuss how you can choose the right ones.

So with this being said, let’s get right into it:

Growing eWallet App Market: Statistics

So you want to create an eWallet app?

There are lots of companies considering the same idea. But why? What makes eWallet app development such a lucrative business venture? Well, there are 100 reasons and 99 of them are the boom in the market.

So, to understand that better, let’s look at some market statistics surrounding the eWallet app before we dive deeper into eWallet app features:

- The global eWallet market size reached USD 105.5 billion in 2023 and is projected to reach USD 567.2 billion by 2032, exhibiting a CAGR of 23.40%.

- The mobile wallet market size was valued at USD 318.5 billion in 2022 and is predicted to register at a CAGR of 18.5% between 2023 and 2032.

- In 2020, there were approximately 2.8 billion mobile wallet users worldwide, and this number is expected to increase to over 4 billion by 2025.

Amazing, right?

With this out of the way, let’s move to the next section where we shall be looking at why features are important in the eWallet app’s success.

Importance of Features in eWallet App Success

Did you know 67% of consumers would abandon an app that was difficult to use?

In addition to this, 55% of consumers would switch to eWallets if a competitor offered a more convenient experience. Plus, 72% of consumers are more likely to use an eWallet app that offers strong security features.

With the rise of eWallet app development as a go-to business venture for fintech companies and entrepreneurs, the quality and importance of eWallet app features are overlooked.

Users are attracted to security, convenience, and smoother processes like bees are attracted to honey. And that’s exactly the reason why the feature of an eWallet app holds such an important place.

With the right features, you can hit home with your target audience. However, a bad feature set can also mean the demise of your digital wallet.

Apart from success, the feature set also affects the perception of the app, its maintainability, as well as overall eWallet app development cost. That’s why, it is important to choose the right feature for the eWallet application.

Now that we have cleared that, it’s time to move the discussion feature. Here, we shall be discussing the top features to have in your app during different phases.

Phase1: eWallet App Features for MVP Development

Let’s start with eWallet app feature for the MVP Development phase.

MVP refers to the minimum viable product, which is a barebones version of the application concept. This is the first phase because it is much cheaper and allows the business to test their fintech app ideas.

For the basic version of the eWallet application, here are some top features to include:

1. Seamless Onboarding

Since there are several compliances that you, as an eWallet service provider, will need to follow, it will be hectic for you to formulate a hassle-free onboarding process.

Moreover, you don’t want your users to abandon the app. Because they don’t have immediate access to their identity proof or financial details. Hence, it is necessary for you to create a user onboarding journey that is super easy.

2. KYC

Again, eWallet platforms and APIs involved are subjected to a lot of compliance. Now, to main a user part of the platform is to subject them to the same rules and regulations.

That’s why it’s important to integrate a KYC feature. KYC refers to “know your customer” where fintech companies cross-check the identity of customers to avoid fraud.

3. QR Based Contactless Payment

To facilitate ease of payment, your eWallet should allow users to scan QR codes to make payments.

With social distancing in place and personal hygiene becoming more and more necessary, allowing people to pay contactless will be a smart move.

4. Add Money Via Bank or Cards

The users will either receive money from some other user or will have to add money to their wallet. There can be two ways of adding money to the wallet – via bank or debit/credit cards.

Your mobile wallet MVP app should give users an option to save the methods used to add money to their wallets.

5. Instant Peer To Peer (P2P) Payment

It is the core of every eWallet. The reason why people prefer paying via eWallets is the capability to transfer money instantly. If you want to create an app like Cash, this is one of the most important features of the eWallet app to have.

6. Payment History – eWallet Passbook

Giving your EWallet users a place where they can see their recent payment history will add to the transparency between you and your users. Many times users lose track of their spending. The spending history is very useful in such scenarios too.

7. Customer Feedback

One of the goals of MVP development is to get user feedback and improve on that before you create the final version of the eWallet application. So, to find out whether the features of the digital wallet app MVP are working or not, it is important to include a panel to receive this feedback.

Now that we are done with the eWallet mobile app feature to include the MVP platform, let’s move to the second phase.

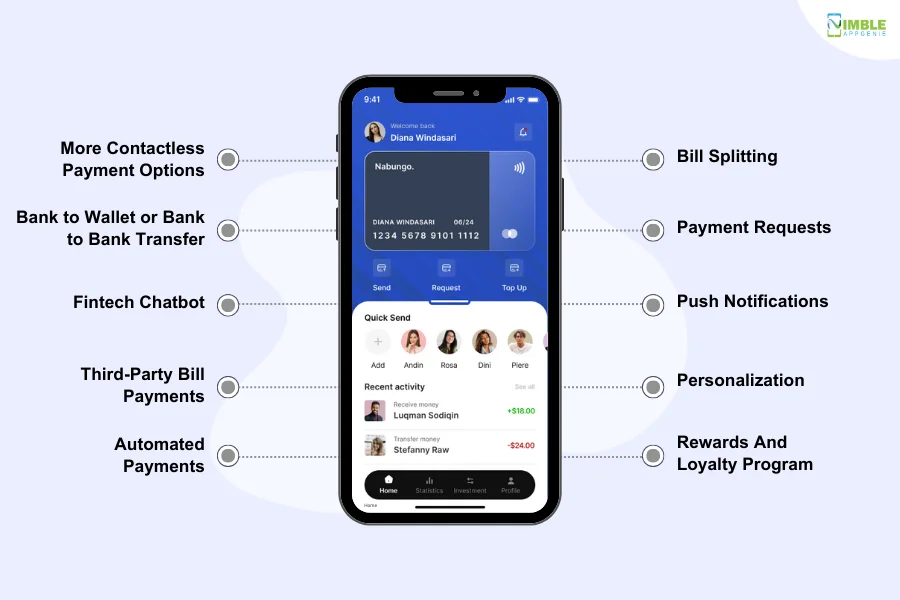

Phase 2: E-Wallet App Features for Initial Launch

If you want to create a platform that gives top eWallet apps a run for their money, it’s important to cover the right mobile wallet app features. And in the phase 2, we shall be discussing these features.

Let’s get right into it:

8. More Contactless Payment Options

Although you can incorporate this feature during the MVP stage, it isn’t feasible to incorporate NFC payments.

If you want your users to be able to pay directly via their debit cards without having to load money onto their eWallets, you can do what Samsung Pay did.

Samsung Pay allows users to pay at POS terminals via their NFC-enabled mobile phones.

9. Bank to Wallet or Bank to Bank Transfer

Not every user wants to load money into their digital wallets to make payments.

To provide them with an easy mode of payment, you should allow them to link their bank accounts to the eWallet app to make instant bank-to-bank or bank-to-wallet payments.

9. Fintech Chatbot

In 2024, when natural language processing and machine learning technologies are mature enough to provide support to users, why would you want to invest in human resources for customer support?

You can utilize AI-powered FinTech chatbots to make your customer support process efficient in terms of money and availability.

10. Third-Party Bill Payments

An EWallet isn’t supposed to be just a payment solution.

Rather it is a digital version of a traditional wallet thus, it should be capable of a lot of things. This is what brings us to one of the top features of mobile wallet apps, third-party bill payment.

Being a core feature of the basic eWallet app, it is what people are asking for these days, therefore, it’s a must-have.

11. Automated Payments

One of the big eWallet app challenges is, doing the same thing over and over again. Automated payments are here to solve the issue

Being among the top features of the mobile wallet app, it enables the user to pre-set the monthly payment. And that will be automatically dedicated to a bank account or credit card.

12. Bill Splitting

Although many mobile payment apps don’t have this feature in place, it is an opportunity for new eWallets to acquire the desired market share.

With this feature in place, the users would be able to add their peers to the bills. With the peers’ approval, the bill payment is split among all the participants.

In addition to providing customers with payment ease, this feature will also generate brand opportunities and new customers via word-of-mouth marketing.

13. Payment Requests

Although it doesn’t seem like a revolutionary feature to you, it is very essential when we talk about B2B payments.

Users should be able to request payments from other users via their email or phone number. You can make this feature more effective by implementing functionality to add/create bills along with the payment request.

In fact, it is also tested and proven by top apps like PayPal, so it’s good to go.

14. Push Notifications

Push Notifications have become very common. The reason I’m mentioning it here is to inform you that you should limit the number of notifications that you send to the users.

Overwhelming users with unnecessary notifications will trigger them to block notifications from your app.

15. Personalization

AI is trending. One of the best ways to use AI solutions in eWallet solutions is personalization.

We are talking about making the app more user-friendly using an AI engine that delivers recommendations, offers, and overall user experience.

Personalization highly adds to the UX app offers and thus, your brand name. This is why it’s a good digital wallet app feature that you should consider.

16. Rewards and Loyalty Program

It is proven that reward and loyalty programs in the eWallet application can greatly add to overall customer satisfaction. That’s why it is a must-have feature of eWallet apps.

To take it to the next step, you can also add cashback, promo codes, and many other rewarding elements like this.

All in all, whether you want to create a money transfer app or a traditional digital wallet, this is an essential feature.

With this, we are done with the essential eWallet application feature. Let’s move to the next section and discuss advanced features.

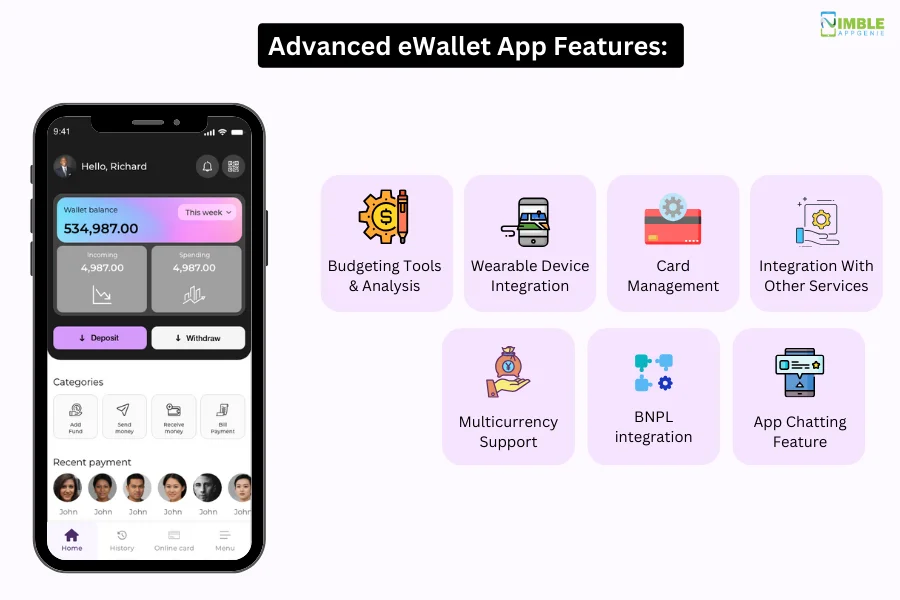

Phase 3: Advanced E Wallet Features for Service Expansion

Now that you have an eWallet app that is deployed in the market, we are entering the third phase, service expansion.

You can join in on the trends a go for super app development, driven by microservices. Alternatively, you can add some in-demand features to deliver more value to the end user.

Considering you are going with the latter one, let’s look at what are some top features to have in your eWallet app service expansion phase.

17. Budgeting Tools & Analysis

Everyone is looking for an easy way to manage their finances, and there is no place better than a payment or eWallet app to offer these services.

Your app will tend to have customer payment data, and if you provide users with insights into their spending, they’re more likely to prefer your app over other payment methods.

18. Wearable Device Integration

Although it isn’t a type of service expansion, a wearable device integration feature is a must at this stage of the EWallet app lifecycle.

The reason why I haven’t recommended it before is because it is a costly affair. You’ll have to develop separate applications for smart wearable devices, which isn’t feasible at the initial stages.

19. Card Management

As users will have a lot of payment options, they will need to manage their cards/ bank accounts within the digital wallet app.

However, what I’m pointing out here is not just the card management. You should also issue debit/credit cards and allow users to manage them via your eWallet app.

20. Integration With Other Services

There are a lot of integration options when it comes to mobile wallets. For instance, on-demand apps of all types support and promote only payment.

In addition to ticket booking, you can incorporate any service that your user can avail via wallet money.

Be it concert airline tickets or movie tickets, providing users with the option to use wallet money will add to their faith in your digital currency.

21. Multicurrency Support

In the age of globalization, it is essential to provide multicurrency support.

With this, the users of the eWallet application can not only get currency exchanged online, but they can also use the eWallet platform in different categories while traveling.

After all, digital wallets are one of the most useful digital solutions that are used in every place. Therefore, do consider this feature.

22. BNPL Integration

In recent years, buy now pay later functionality has gathered some serious followings.

The market for this service has grown so big that, even Apply have introduced its own BNPL app, known as Apple Pay Later.

You can integrate the Buy Now Pay Later solution into your eWallet application feature list. This can be a great addition to other eWallet app monetization strategies.

23. App Chatting Feature

In recent years, whether it is social media apps like Instagram or other niches, adding the app chat or messaging feature has become a trend.

Working much like other top chatting apps do, it is a great functionality to have. This digital wallet app feature can really ram up engagement times.

With this out of the way, we are done with the top features for service expansion. It’s time to look at security features.

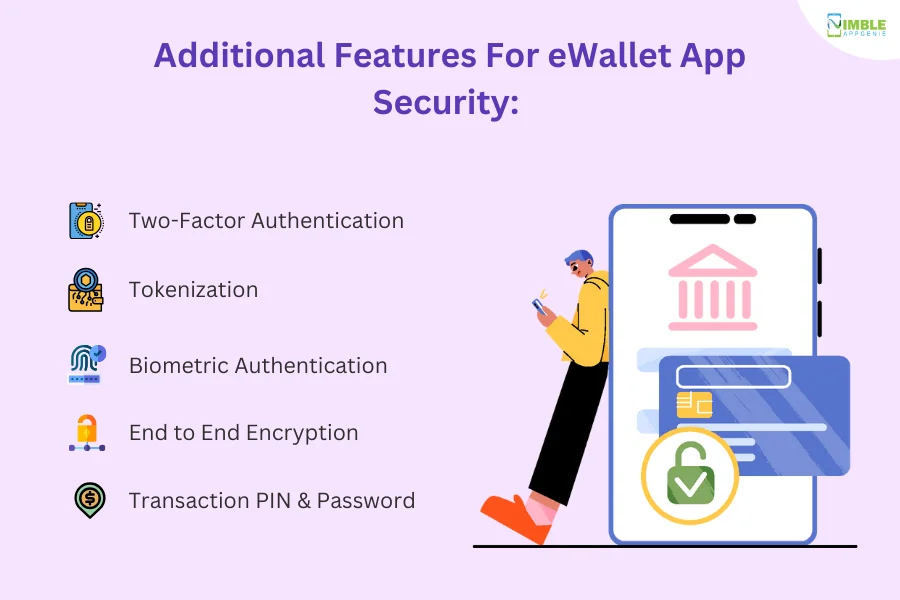

Additional Features For eWallet App Security

One common theme of top fintech apps is impregnable security.

After all, in today’s digitalized age, cyber security is a big issue. Features do play an important role in preventing fraud and ensuring a seamless user experience.

Take a look at some essential features that complement eWallet app security. They are:

24. Two-Factor Authentication

Do you know what is better than one layer of digital security? Well, it is 2 layers of security. This is the philosophy behind the factor authentication eWallet app feature.

What happens here is that in addition to the traditional letter of security, another triggered-based authentication is added.

More often than not, a one-time password or OTP is time-sensitive and unique. This is not only used in eWallet apps but also an essential feature in UPI app development.

25. Tokenization

So, what is tokenization?

Tokenization is a “blockchain” based technology that is often used to add an extra layer of security to digital solutions. What happens here is that a digital copy of important data like card information is made and it is stored on blockchain.

It can’t be stolen by the hacker or mangled in any way. This makes it impregnable. That’s the reason why every fintech company “99%” has invested in it.

26. Biometric Authentication

Biometric authentication has been part of the mobile phone world for a long time. However, in recent times, it has been converted into one of the leading eWallet app features.

To enable a transaction, access the app, access the data, or do anything bank-account related in the app, one can use their biometric feature to gain a passage.

28. End to End Encryption

Encryption does magic when protecting important fintech data.

Whether you are using open banking APIs or any other form of safe communication, end-to-end encryption can give you an added layer of data security.

The reason is that once the data is encrypted, it can’t be read or decoded by anyone who does have the key, delivering unmatched security.

29. Transaction PIN & Password

One of the oldest tricks in the book of mobile app security is PIN and Password protection.

In simple words, here’s how it works: when the user wants to make a transaction, they can select the one they are sending it to and how much. Then to trigger the transaction, they have to enter a PIN or password.

This provides a personalized security solution.

So, these are the top ways to add to app security with some amazing features of the digital wallet app. Let’s move to the next section.

Panel Wise: eWallet App Features

Much like any other form of On-demand app development, mobile wallet apps can be divided into three panels.

In this section of the blog, we shall be discussing the top features of the digital wallet app, discussing the features of each panel in detail.

These are, as mentioned below:

| Features | Admin Panel | Merchant Panel | User Panel |

|

User Management | Add/Remove Users | View Customer Profiles | Register/Login |

| User Permissions | Manage Merchant Accounts | Profile Management | |

| KYC Verification | Settle Payments | View Balance | |

| User Activity Monitoring | Transaction History | Account Verification | |

| Account Lock/Unlock | Manage Sub Merchants | Payment Preferences | |

| User Access Logs | Settle Disputes | Transaction Limits | |

|

Transaction Management | View Transaction History | Transaction Reports | Send/Receive Money |

| Refund Transactions | Refund Processing | Transaction History | |

| Fraud Detection | Payment Gateway Integration | Transaction Notifications | |

| Dispute Resolution | Chargeback Handling | Payment Confirmation | |

| Transaction Monitoring | Subscription Management | Autopay and Recurring Payments | |

|

Wallet Management | Adjust User Balances | Check Wallet Balance | Add/Withdraw Funds |

| Set Wallet Limits | Load/Unload Wallet | Wallet Statements | |

| Freeze/Unfreeze Wallet | Payouts to Bank Accounts | Auto Reload | |

| Multi-Currency Support | Wallet Reconciliation | Transaction History | |

| Wallet Security Settings | Loyalty Program Integration | Wallet to Wallet Transfers | |

|

Security and Compliance | Two Factor Authentication | Compliance Checks | Secure Login |

| IP Whitelisting | Fraud Prevention | Biometric Authentication | |

| PCI DSS Compliance | Security Alerts | Device Authorization | |

| Data Encryption | Merchant KYC Verification | Account Recovery | |

| Security Audits | Anti-Money Laundering (AML) Checks | Tokenization | |

|

Notifications | Customizable Alerts | Transaction Notifications | Account Activity Notifications |

| Announcements | Promotional Notifications | Transaction Confirmation | |

| System Updates | Service Outage Alerts | Alert Preferences | |

|

Reporting and Analytics | Generate Reports | Sales Analytics | Transaction Analytics |

| User Activity Reports | Customer Insights | Spending Patterns | |

| Financial Statements | Transaction Trends | Budgeting and Expense Tracking | |

| Compliance Reports | Fees and Commission Reports | Reward Points Summary | |

|

Settings and Configuration | System Configuration | Payment Gateway Setup | Notification Preferences |

| User Roles and Permissions | Currency Configuration | Language Preferences | |

| Email and SMS Templates | Subscription Plans | Privacy Settings | |

| API Access and Integration | Customizable Receipts | Currency Conversion Preferences | |

|

Customer Support | Ticketing System | Customer Query Resolution | Help Center/FAQs |

| Live Chat Support | Merchant Assistance | Contact Support | |

| Knowledge Base | Technical Support | Report a Problem | |

| User Feedback and Surveys | Merchant Feedback | Support Ticket Status |

How to Choose a Feature Set for the eWallet App Solution?

If you want to make your eWallet app successful among people, hear us out:

Making an app feature right isn’t enough, to capture customers and generate revenue, one needs to choose the right feature set.

Here are some of the factors to consider when choosing the eWallet application feature set:

| Features | Description |

| Relevance and usefulness |

|

| Impact on performance |

|

| Ease of implementation |

|

| User adoption |

|

| Future-proofing |

|

| Legal and regulatory compliance |

|

| Cost and resources |

|

Come up With a Unique eWallet App Feature: Here’s How

The idea of adding a unique feature to your own eWallet app is really amazing.

But how do you find that unique value and convert it into a working functionality? While there isn’t a set method to do this, here are some points to consider:

- The first thing to do is, identify user pain points. And based on that, conduct mobile app research. This is done to understand user needs and preferences.

- Develop features that solve real problems and provide value to users.

- Use eWallet app trends like AI, blockchain, and biometrics to deliver enhanced security and personalized experiences.

- As a service provider, one must always prioritize financial wellness. This can be achieved by providing budgeting tools, investment options, and financial education resources.

- One good thing to do is, research existing eWallet apps, stay up-to-date with fintech trends, conduct user testing, and build a strong team with expertise in mobile development, finance, and security.

Examples of Unique eWallet App Features:

| Personal Finance Assistant | Real-time Rewards Integration | Micro-Investment Opportunities | AI-powered Fraud Detection | Personalized Budgeting Templates |

| Group Payment Management | Bill Negotiation | Smart Bill Reminders | Secure Crypto Integration | Social Payment Sharing |

Partner with Nimble AppGenie, Renowned eWallet App Development Company

Are you looking for an eWallet app development partner?

Nimble AppGenie is a market-leading fintech app development company. With hands-on experience of over 700 projects and 95% client satisfaction, we have been named among the top eWallet app development companies by platforms like Clutch. com, GoodFirms, and DesignRush. SatPay, and Pay By Check are some of the most innovative and renowned fintech projects that have been developed by experienced mobile app developers at Nimble AppGenie.

If you have an idea, Contact Us Today and we shall assign you a team within 24 hours.

Conclusion

eWallet app development is on the rise. If you are planning to create your own digital wallet, it’s important to make it stand out from the rest. Otherwise, there’s no chance of business success. One of the ways to do so offering users unique value. This is the part where eWallet app features play a big role.

In this blog, we discussed everything you need to know about eWallet app development’s different phases and the right features to include. In addition to this, we also discussed how to choose the right features for a mobile wallet and how to come up with unique ones of your own. With this said, it’s time to conclude the blog.

FAQ

eWallet apps are secure mobile applications that store your financial information (debit/credit cards, bank accounts) and allow you to make payments, transfer money, and manage your finances easily. Think of it as your physical wallet in digital form, accessible 24/7 from your smartphone.

eWallet apps offer several benefits over traditional payment methods:

- Convenience

- Security

- Rewards

- Budgeting

- Contactless payments

Some of the important features to include in every eWallet app are, as mentioned below:

- Seamless Onboarding

- KYC

- QR-Based Contactless Payment

- Add Money Via Bank or Cards

- Instant Peer To Peer (P2P) Payment

- Payment History – eWallet Passbook

- Customer Feedback

To create an eWallet app with amazing features, here are some things to consider.

- Identify user pain points

- Develop valuable features

- Leverage technology

- Prioritize financial wellness

- Stay informed and collaborate

The technologies used to develop an eWallet app include:

- Programming languages such as Java, Swift, or Kotlin

- Mobile app development frameworks such as React Native and Flutter

- Payment gateway APIs such as PayPal and Stripe

- Cloud storage services such as Amazon Web Services or Microsoft Azure

The benefits of developing an eWallet app include:

- Increased convenience for users

- Reduced reliance on physical cash

- Improved security features

- Integration with other financial services

- Potential for revenue generation through transaction fees or partnerships with third-party services

The challenges of developing an eWallet app include:

- Ensuring the security of user data and transactions

- Meeting regulatory compliance requirements

- Integrating with multiple payment gateways and banks

- Provide seamless user experience across multiple devices and platforms

Yes, an eWallet app can be customized to meet the specific needs of a business or industry. For example, an eWallet app for a retail company may include features such as loyalty rewards and discounts, while an eWallet app for a healthcare provider may include features such as insurance claims processing and appointment scheduling.

Some examples of successful mobile wallet apps include:

- PayPal

- Venmo

- Google Pay

- Apple Pay

- Alipay

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.