AI in Digital Payments & eWallet: 9 Major Use Cases

With speculation building up since the better part of 20th century, Artificial Intelligence has finally become a megatrend, affecting industries left and right.

And fintech’s digital payment and eWallet app niche are no different either.

Artificial intelligence in digital payments has become the talk of the town recently with amazing applications and users as well as businesses left in awe.

If you are one of them, this blog is for you.

Here, we shall be going through all you need to know about AI and Digital payment, covering the basic overview of the concept, statistical insight, 10+ use cases, and much more.

So, buckle up, and let’s get right into it:

Understanding AI for Digital Payment

AI and Artificial Intelligence refers to the tech-driven stimulation of human-like intelligence and apply it in various processes to enable smarter results.

Or so they say.

So, how does AI work in the digital payment world?

Well, artificial intelligence in payments has been making a huge impact lately.

While we will discuss the various use cases of AI in digital payments and eWallet later down the line, you can understand it like this:

Artificial intelligence is integrated into existing systems to get better results and replicate human-like capacities, delivering far better results than traditional automation. This takes activities like personalization, security, and analysis to a whole next level.

So, it doesn’t come as a surprise when businesses want to develop an eWallet app and embed it with AI, opening the door to market success.

Chatbots powered by AI can handle up to 80% of basic customer service inquiries in the eWallet space, reducing operational costs and improving customer satisfaction.

Speaking of market success, let’s look at how AI in payments industry has been performing in the section below.

AI in Payment & Fintech: Statistics

While the use of AI in eWallets and digital payments is still evolving, several fintech statistics show the skyrocketing growth of technology.

Let’s have a look:

- The global AI market in the financial sector is expected to reach $1354.2 billion by 2030, up from $150.2 billion in 2023, indicating a significant projected growth rate.

- eWallet statistics show over 5 billion people will be using mobile wallets and digital payment solutions by 2027, showcasing the increasing demand for convenient and secure payment methods.

- A study by Juniper Research also suggests that AI-powered fraud prevention solutions in the payment industry will save businesses over $81 billion by 2027, highlighting the effectiveness of AI in combating fraudulent activities.

- A report by ACI Worldwide states that 63% of global consumers are interested in using AI-powered features in their eWallets, indicating a strong user preference for AI-driven functionalities.

9 Use Cases of AI in Digital Payments & eWallets

Now, let’s see how Gen AI in payments is changing the world of digital wallet apps forever.

Whether you are using traditional apps like PayPal or the modern NeoBanking platform, AI will affect it.

Here are the top AI use cases for payments:

1. Fraud Detection and Prevention That Save Billions

In recent years, cybercrimes have risen drastically. Global fraud losses in card-not-present transactions are estimated to reach $34.2 billion.

AI in payment & Fintech is helping us fight them back.

AI algorithms can analyze vast amounts of transaction data in real time to identify suspicious patterns and prevent fraudulent activities.

This includes analyzing factors like location, device, time, and purchase history.

Based on this, the algo tries to detect anomalies that might indicate unauthorized access or theft. It’s quite successful at that too!

Reducing false positives by up to 20%, saving institutions billions, and protecting user funds.

All in all, digital payment markets, especially mobile wallets, are leveraging AI to improve security. A much-welcomed change from users across the world and something that we are going to see much more of.

2. Less False Declines, More Revenue

One of the lesser-known but major problems in the payment world is false declines.

False declines can cause customer frustration and lost business, with estimates suggesting 1 in 50 transactions are wrongly declined.

This is where AI-driven payment solutions come in.

While AI helps in catching fraudulent transactions, it can also be fine-tuned to reduce the number of legitimate transactions being declined due to overly cautious security measures.

AI can distinguish between genuine and fraudulent transactions by learning user behavior and spending patterns.

Consequently, this leads to a smoother user experience.

AI-powered solutions for payments can decrease false decline rates by 30% (FICO), improving customer experience and revenue capture.

3. Enhanced eWallet Security

Digital payment security is one of the biggest concerns of the industry.

Cybercrime is a constant threat, with the global cost reaching $6 trillion annually back in 2021 alone. eWallet apps are the biggest victim of this problem.

But things are changing.

Artificial intelligence in payment processing can be used to implement stronger biometric authentication methods like facial recognition, fingerprint scanning, and voice recognition.

Thus, adding an extra layer of security to digital wallet transactions.

Let us tell you that enterprises are crazy over this AI digital payment use case.

As a result, AI in the cybersecurity market is projected to reach $42.6 billion by 2026, highlighting its growing role in securing financial transactions.

4. Personalized Services = Happier Customers

Want to become successful among target users with your digital payment app? Well, personalization is key to user retention.

This might seem like a simple problem, but it’s something a lot of fintech solutions suffer with.

Artificial intelligence in payments can personalize the user experience by learning individual spending habits and preferences.

This can include recommending relevant financial products and services.

Consequently, it provides amazing budgeting and saving tips, and even offers personalized rewards programs.

That’s how AI can address this gap, increasing customer satisfaction and engagement.

5. Predictive Analytics for Better Decisions

Analytics is important, especially in an ever so nimble digital payment market.

Traditional methods may not effectively identify potential risks and opportunities. This is something of a big concern since data from analytics directly affects decisions in the digital payment market.

That’s where this use case of artificial intelligence for digital payments comes in.

AI and ML in payment solutions like eWallet startups can analyze user data to predict future spending patterns and needs.

This allows e-wallets to offer proactive features like automatic bill payments, low-balance notifications, and personalized financial planning tools.

Can’t take our word for it? Well, you don’t have to:

AI-powered customer segmentation and risk assessment can improve risk management by 20-30% (MIT Technology Review), leading to better financial decision-making.

6. Handing Over Interactions to Chatbots and Virtual Assistants

What happens when you combine two most amazing concepts, AI and Chatbots?

Well, AI chatbot development is a trend on-itself, spanning across various industries, and become a people’s favorite to the point that they prefer virtual assistants over human interaction.

And why not? After all, AI-powered chatbots and virtual assistants can provide 24/7 customer support, answer frequently asked questions, and resolve basic issues.

Plus, Chatbots can handle a significant portion of inquiries, handling 85% of customer interactions in 2023, improving efficiency and reducing costs.

In addition to the improved user experience, it also frees up human agents for more complex inquiries.

Don’t Be Left Behind: Get a Free Consultation on AI Integration for Your eWallet.

Claim Your Free Consultation

7. Make Customer The King With Unmatched User Experience

The customer is king.

And the King deserves to be treated like a king.

That’s something artificial intelligence in the payments industry has made possible.

AI can personalize the user interface and interact with digital wallets, making it more intuitive and user-friendly.

This can include features like voice commands, context-aware suggestions, and simplified navigation.

The impact has been huge! AI can personalize experiences, simplify financial management, and enhance user satisfaction, with 75% of customers open to using AI-powered tools,

8. Regulatory Compliance

It is no secret that dealing with fintech regulations and rules can be a big problem. It’s costly and super time-consuming.

AI-driven RegTech solutions for eWallet apps can change that.

AI can assist financial institutions in complying with complex regulations and anti-money laundering (AML) laws.

By analyzing user data and identifying suspicious activities, AI can help mitigate the risk of financial crimes and ensure regulatory compliance.

This is one of the big ways how AI is useful in payments at a greater level.

9. Open Banking Integration

Utilizing the vast amounts of data generated through open banking initiatives can be complex.

Now, to take full advantage of open banking components, businesses need to deal with this problem. Here’s how they do it:

AI allows third-party financial institutions to access customer data with their consent.

Thus, generative AI in payments can unlock the $1.3 trillion revenue potential within open banking, fostering innovation and financial inclusion.

This enables businesses to develop innovative fintech applications that are tailored to individual needs, often seen in the form of eWallet apps and payment apps.

Over 60% of global consumers are now using mobile wallets or other contactless payment methods.

Case Study: How eWallet Apps Are Using AI

The market is filled with popular eWallet apps that are leveraging AI in payment systems.

Let’s have a look at some examples of artificial intelligence payment implementations.

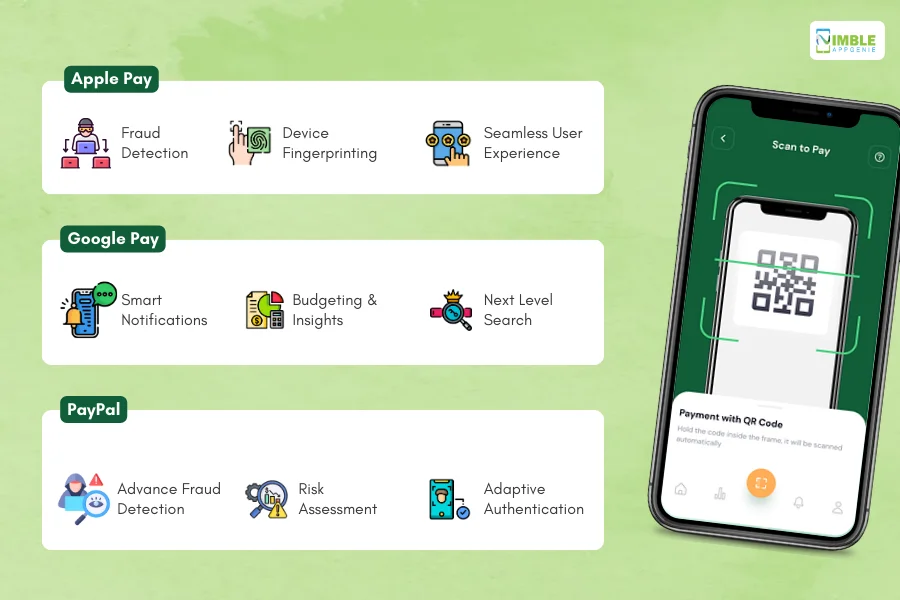

1. Apple Pay

Let’s start with one of the most popular digital wallets, Apple Pay.

Exclusive to the iOS platform, this payment app has been a flag bearer of innovation in the industry. Going with the trend, it also takes imitatively applying AI machine learning to payments.

Focus: Security and User Experience

AI Use Cases

- Fraud Detection: Utilizes machine learning to analyze transaction data in real time, identifying suspicious patterns and preventing unauthorized access.

- Device Fingerprinting: Analyzes various device characteristics to create a unique “fingerprint” and identify potential fraud attempts through unfamiliar devices.

- Seamless User Experience: Utilizes AI to personalize the payment experience, remembering frequently used recipients and suggesting payment methods based on context (e.g., splitting bills with friends).

2. Google Pay

Coming to Apple Pay’s biggest competitor, we have Google Pay.

As a product of the same company that runs Google and Android OS, this digital payment app has benchmarked its fair share of industry-breaking innovation in a more calm manner.

And here’s how it takes on the use of AI in payment applications:

Focus: Convenience and Personalization

AI Use Cases

- Smart Notifications: AI analyzes spending habits and suggests relevant bill payments or reminders to recharge low-balance accounts via push notification.

- Budgeting and Insights: Utilizes AI to categorize transactions, track spending patterns, and offer personalized budgeting insights and recommendations.

- Next-Level Search: AI powers the search function within the app, allowing users to find past transactions and specific spending categories quickly and easily.

3. PayPal

PayPal is an OG in the digital payment market, inspiring a lot of people to build their own app like PayPal.

But you can’t rule that market for that long without riding the wave of trends and innovation. This platform does exactly that.

Let’s see how:

Focus: Risk Management and Security

AI Use Cases

- Advanced Fraud Detection: Employs AI to analyze vast amounts of transaction data across the entire PayPal network, identifying and preventing sophisticated fraud attempts in real time.

- Risk Assessment: Utilizes AI to assess the risks associated with individual users and transactions, enabling informed decisions about creditworthiness and potential fraud risks.

- Adaptive Authentication: AI personalizes the authentication process based on user behavior and transaction risk, ensuring security while minimizing friction for legitimate transactions.

AI-powered fraud detection systems can analyze transactions in milliseconds, preventing an estimated $8 billion in losses annually.

Nimble AppGenie, Your Partner in AI-powered eWallet App Development

Want to leverage the power of AI in your eWallet app?

Nimble AppGenie is here to help you!

As a market-leading eWallet app development company, we have hands-on experience with over 700 projects. Our efforts are recognized by top platforms like DesignRush, GoodFirms, and Clutch.co.

And even more importantly, our clients. Give us a whopping 95% client satisfaction rate.

In our years in the digital payment market, we have developed some of the most remarkable solutions covering:

- Pay By Check– Ewallet Mobile App

- SatPay– Ewallet Platform

- CUT–E-Wallet Mobile App

- SatBorsa– A Currency Exchange Fintech App

So, if you have an idea, we can convert it into a digital product that will disrupt the market.

With just a click, hire mobile app developers and start your dream project.

Bottom Line: Is AI the Next Big Trend?

eWallet trends come and go, but there are a few that stay and change the industry forever.

AI for digital payments is one such trend.

With the amazing capacity of Artificial intelligence models and how top digital payment companies are applying it, it’s only a matter of time before we see even better use cases.

From enhancing security and streamlining processes to personalizing user experiences and optimizing decision-making, AI is paving the way for a more efficient, secure, and user-friendly payment ecosystem.

As AI continues to evolve, its influence on eWallets and the broader digital payment industry is only expected to grow, shaping the future of financial transactions.

FAQs

AI plays a crucial role in enhancing the security, efficiency, and user experience of digital payment systems. It enables fraud detection and prevention, reduces false declines, enhances security through biometric authentication, and offers personalized services and predictive analytics.

- The global AI market in the financial sector is projected to reach $1354.2 billion by 2030, indicating significant growth.

- Over 5 billion people are expected to use mobile wallets and digital payment solutions by 2027.

- AI-powered fraud prevention solutions could save businesses over $81 billion by 2027.

- 63% of global consumers express interest in AI-powered features in their eWallets.

Some key use cases include fraud detection and prevention, reduced false declines, enhanced security through biometric authentication, personalized services, predictive analytics, AI-powered customer support, streamlined payment processing, risk management, improved user experience, regulatory compliance, and integration with open banking initiatives.

The future of eWallets is closely tied to AI advancements, with AI expected to drive innovation in security, personalization, efficiency, and compliance. As the demand for convenient and secure digital payment solutions continues to rise, AI is poised to play a central role in shaping the next generation of eWallet technologies.

AI enables advanced fraud detection and prevention by analyzing transaction data in real-time, identifying suspicious patterns, and mitigating potential risks. Additionally, AI-powered biometric authentication methods, such as facial recognition and fingerprint scanning, add an extra layer of security to eWallet transactions, ensuring secure and reliable digital payments.

Yes, AI analyzes user behavior and preferences to offer tailored recommendations and promotions within eWallet apps. This personalization enhances user satisfaction and encourages engagement with the platform.

AI algorithms continuously monitor transactions, identifying patterns indicative of fraudulent activities in real-time. This proactive approach helps in mitigating risks associated with fraudulent transactions, safeguarding users’ funds and financial information.

AI in payment systems like eWallet automates routine tasks like transaction categorization, reconciliation, and customer support, improving efficiency and reducing operational costs. Moreover, it enables predictive analytics for demand forecasting, ensuring seamless transaction processing.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.