eWallet App Development Trends For 2024

It’s 2024 and eWallet apps are taking over the fintech market.

Now, there are hundreds of businesses, entrepreneurs, and existing eWallet businesses who want to become the market leader.

But the question is how?

eWallet market is an ever-changing landscape. And if you want to establish a foothold in this market, eWallet app trends are what will help you.

In this blog, we shall be discussing all you need to know about digital wallet trends, their use, top trends, and much more.

Therefore, with this being said, let’s get right into it, starting with:

Booming eWallet App Market, Statistical Insight

Have you ever wondered, why are businesses going crazy about eWallets? Well, fintech statistics hold the answer.

Let’s look at them below:

- By the end of 2024, half of the world’s population will be digital wallets.

- Jupiter Research also says, that due to this huge user base, transaction value across the world will cross $9 Trillion annually, with growth of 80%.

- The global market for mobile payment will be worth $14.78 trillion by 2027.

- In the US alone, the digital payment market is expected to reach $14.78 trillion by 2027.

- And by 2030, the mobile payment market in the US will reach $607.9 billion.

- In addition to this, Forbes’s study tells us that more than 50% of US citizens use eWallets more often than traditional methods like credit or debit cards.

These market statistics clearly show how much money there is in this fintech niche and how top digital wallet apps are making billions in profit.

However, to reach this level of success, there are various things that an eWallet company needs to do right, one of them being following trends.

Let’s discuss more on that in the next section.

Why are Trends Important in App Development?

In the world of mobile app development, “trends” is a common world.

But this isn’t one to be treading lightly, since trends can make and break industries, helping businesses generate billions and breaking down million-dollar companies.

That’s why, when you want to create an eWallet app that will amass millions of users and generate endless revenue, you can’t overlook Digital wallet app trends.

But why are these trends important for eWallet apps? Well, there are a range of reasons.

Some of these are:

- Embedding trends in eWallet apps helps businesses gain a competitive advantage

- Drives user engagement to help the platform grow

- By encompassing trends, digital wallets meet changing user expectation

- One of the benefits is staying market-relevant

- It’s a leading way to introduce advancement to the platform

These are some of the main reasons why eWallet future trends consideration is so important for both app development companies and eWallet service providers.

But what are the effects of the ever-changing trends of eWallet on existing apps and new solutions? Well, let’s discuss that below.

Effect of Trends of Existing Apps and New eWallet Apps

| Aspect | Existing eWallet Apps | New eWallet Apps |

| Increased Competition | Must focus on user experience, security, and brand loyalty to retain market share. | Need to stand out in a crowded market; continuous improvement is crucial. |

| Integration with Emerging Technologies | Embrace blockchain, AI, and biometrics for faster transactions, enhanced security, and personalized financial tools. | At the forefront of adopting cutting-edge technologies for a differentiated user experience. |

| Focus on Niche Markets | Leverage existing user base and brand recognition to cater to specific demographics or financial needs (e.g., gaming, cross-border payments). | Identify unique value propositions, such as superior functionality or targeted user groups. |

| Compliance with Evolving Regulations | Adapt policies and infrastructure to comply with data privacy laws and digital currency regulations. | Prioritize security and data privacy, implement robust measures, and maintain transparent policies to gain user trust. |

| Differentiation is Key | Differentiate through user experience, features, and brand loyalty. | Stand out by identifying unique value propositions and superior functionality. |

| Leveraging Emerging Technologies | Embrace AI-powered financial assistants and context-aware spending recommendations. | At the forefront of adopting cutting-edge technologies for a differentiated user experience. |

| Building Trust and Security | Maintain a focus on security measures, transparency, and data privacy policies. | Prioritize security and data privacy, implement robust measures, and maintain transparent policies to gain user trust. |

| Partnerships and Collaborations | Explore collaborations and partnerships to enhance reach and credibility. | Seek strategic partnerships with established players in the financial sector or other industries. |

With a basic overview and understanding of why eWallet app trends are important, it’s time to see what these trends are. And that’s exactly what we shall be discussing in the section coming up.

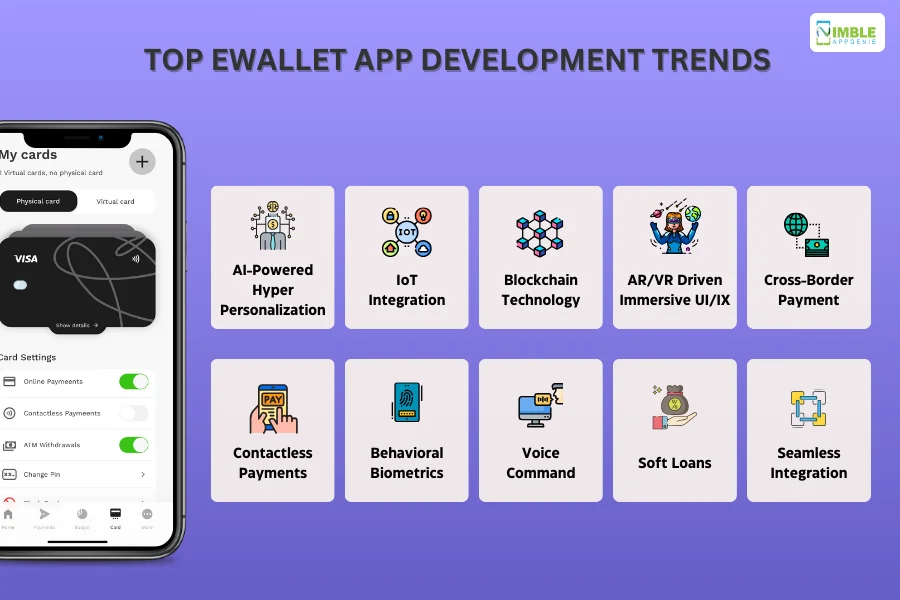

Top eWallet App Development Trends, 2024

eWallet is the most popular niche of fintech app development.

Now, whether you are an enterprise with a full-fledged or an entrepreneur with an eWallet app idea that will disrupt the market, digital wallet app development trends are important.

Let’s look at what these are, below:

1. AI-Powered Hyper-Personalization

AI solutions have been changing the market as one of the biggest industry 4.0 trends.

And it goes without saying that artificial intelligence has a big role in eWallets. However, it goes beyond using AI to automate mobile apps. You see, one of eWallet trends is all about user experience.

We are talking about hyper-personalization.

For those who don’t know, personalization refers to creating a custom experience for each user based on their data, preferences, and smart algorithms.

With this trend, it’s time to say goodbye to generic experiences. With hyper-personalization, the eWallet app will know users’ spending habits, predict their needs, and automatically adjust the budget or invest spare change. How cool is that?

Best part is, this isn’t a future speculation anymore! AI-powered financial bots are making this a reality, personalizing every interaction and streamlining financial management.

This is one of the many applications of AI in eWallet that has become a leading trend in eWallet.

2. Boost in IoT Integration

The second on our list of top trends in digital wallets is Internet of Things Integration.

A common scheme that you might notice is, that many of the industry 4.0 trends directly translate to eWallet niche’s trends.

Speaking of which, IoT is being leveraged in several forms of mobile solutions with the popular example being wearable app development.

While IoT is already being used in some forms of eWallet platforms, the usage is expected to grow future in the coming years. This will open doors to tap and pay everywhere, “without actually needing the phone”, made possible via application integration.

This enables smart wearables like Smartwatches. With the help of IoT, it takes contactless payment to the next level. In addition to this, it delivers other benefits like smart home integration and location-based offers.

Just imagine your eWallet app suggesting discounts at nearby stores based on your location or automatically topping up your metro card when you’re running low.

Or Your eWallet could soon be the one-stop shop for controlling your smart home devices for instance paying your bills, adjusting the thermostat, and unlocking your door, all from within your eWallet app

3. Blockchain Technology for Security & Transparency

Blockchain has been the name of the game for the past few years, especially due to its involvement in cryptocurrencies.

However, the scope of blockchain development expands far beyond just cryptocurrencies. Look at it like this, even in crypto, the use of blockchain was to ensure decentralization and security.

For that reason, this has become an increasing trend of digital wallets, helping companies take eWallet app security and transparency to the next level.

This digital ledger technology offers a decentralized and tamper-proof way to store and manage financial data. This means enhanced security, greater transparency, and reduced reliance on traditional financial institutions.

In addition to this, blockchain is also opening doors for crypto wallet app development or what we call decentralized apps (DApps). This gives us features like peer-to-peer lending, micro-investments, and even on-chain identity management.

4. AR/VR Driven Immersive UI/IX

In recent years, the concept of Metaverse has become a trend driven by Augmented Reality and Virtual Reality technology. And it is also an increasing trend of eWallet.

But this begs the question, how can AR/VR be used in eWallet apps?

Well, here’s how, using VR/AR eWallet companies are reimagining money management. Not to forget, it this the eWallet app design to the next level.

The main application of these Metaverse technologies is in budgeting apps.

Via this, gamified budgeting apps and interactive financial planning tools can be more fun to use. In addition to this, these technologies can also be applied to financial literacy apps i.e. Edtech apps for the finance industry.

With the integration of AR development and VR development, platforms can deliver immersive experiences and make managing finances engaging.

5. Cross-Border Payment Solutions

Let us introduce you to one of the top trends in eWallet for 2024, the cross-border payment.

While some Cross-border apps like Wise are already around, we are going to see many more advanced eWallets apps capable of international payment in the coming years.

This is one of the most anticipated future trends of eWallet and also much much-needed one with globalization at full force.

Driven by modern eWallet regulations and technologies, international money transfers are no longer slow and expensive.

With the latest payment solutions, you can send and receive money across borders instantly and with minimal fees. And this has already started taking effect.

One example of the same is the UPI and PayNow merger.

6. Generalization of Contactless Payments

Contactless payment has been a common thing.

So, why is it one of the next trends for eWallet? Well, while tap-and-go payment is a common thing in developed areas, the majority of the world doesn’t have the IT infrastructure to accommodate that.

Starting in 2024, development across the world has started and Contactless payment technologies like NFC payment and QR code have become widely accepted.

Another factor that adds to the growing widespread acceptance of tap-and-go payment is the overall increased app security as seen in top NFC payment apps.

7. Behavioral Biometrics

This is one of the futuristic mobile payment trends that we all have been waiting for.

So, the majority of us have already used and are quite familiar with Biometric authentication technology in the eWallet application.

Behavioral biometrics takes it next level.

Here’s how it works, artificial intelligence technology smart algorithms are built that learn user’s behavior over time. A fact that must be made clear is that much like physical biometrics, people also have unique behaviours.

Therefore, whenever there’s a behavioral anomaly i.e. unusual behavior, the eWallet app won’t allow them to login to the app or make a transaction. This technology has the potential to take app security to the next level.

Right now, this is highly experimental technology but we are soon to see its use as one of the innovative trends in digital wallet app development.

8. Voice Command Driven eWallet Experience

This is one of the Digital wallet trends that people least expected, but here we are.

Voice-based commands for eWallet apps have become a thing. And truth be told, it was inevitable considering how people preferred voice search over conventional means on their smartphones for years.

Though it seems like a rather simple digital payment trend, it isn’t. Integration with smart home devices can open doors to many more possibilities, pushing the limits of mobile commerce and adding several prized eWallet app features to the list.

This has been driving a trend in the eCommerce industry itself, much like Live Commerce.

In the next few years, we can see widespread applications of this eWallet trend, as it comes with the power to change how we interact with digital payment apps.

9. Soft Loans – BNPL and Cash Advances

Statistics from Consumer Protection Financial Bureau show that, from 2019 to 2021 BNPL loans from five primary lenders grew more than 970%.

Fast forward to today, the market for these solutions is larger than ever. With this, even tech giants like Apple have dedicated to introducing their own version of services.

This is what makes BNPL app development itself a digital wallet app trend.

Another similar concept that has come to market and disrupted it is cash advances.

There are millions of people across the United States of America who use cash advance apps to avoid over-draft with small payday loans.

The best part is, that you don’t need to invest in app development dedicatedly for them. Rather, integrating them in your eWallet app is one of the best ways to take advantage of these Digital wallet future trends

10. Seamless Integration with Other Services

If you want to monetize the eWallet app, you’ll love this trend. We are talking about, integration with other services.

If you are familiar with microservices in app development, you’ll understand the potential this trend of digital wallets holds.

The reason is, that there are n Number of industries that benefit from eWallet functionality. One of the prime examples of this is taxi apps like Uber which leverage payment gateway integration.

However, it isn’t limited to this, on-demand apps, healthcare apps, pet grooming, and 10s of other industries benefit from the convenience and fast payment digital wallet offers. This is what makes it one of the most important eWallet app development trends today.

Coming back to the app monetization part, it lets eWallet businesses partner with others from where they can earn more in direct sales, transaction fees, as well as partnerships.

These are some of the top trends in digital wallets that you have to look out for in 2024 and the future. With this out of the way, let’s look at some tips to deliver eWallet apps.

Tips to Build a Future-Ready eWallet App

Whether you want to Create a money transfer app or good ol’ apps like PayPal, here are some tips you can follow to make your app future-ready:

- Incorporate trends in eWallet app development to gain a competitive advantage and deliver an unmatched user experience.

- Listen to user feedback, with the help of MVP app development for new apps and community for established platforms to find improvement points.

- Aim to deliver constant innovation to the end user if you want to stay a market leader.

- Don’t forget to invest in post-deployment maintenance and support services for the eWallet platform.

- Strive to offer unmatched app security to the end user, a much-valued quality in the fintech industry.

These are some of the tips you can follow to make your app successful among people and become the next market leader taking advantage of Trends in eWallet app development.

Develop Future-Proof eWallet Apps with Nimble AppGenie

Are you planning to develop a future-ready eWallet app or upgrade your existing solution with the latest trend?

Nimble AppGenie, a renowned eWallet app development company, is here to help you. So, what makes it the right fit for your next project?

For started, we have worked on more than 700 projects across different industries, including these digital payment masterpieces:

- Pay By Check– Ewallet Mobile App

- SatPay– Ewallet Platform

- CUT–E-Wallet Mobile App

- SatBorsa– A Currency Exchange Fintech App

Amazing right? You know, what’s even more amazing?

You can hire mobile app developers at Nimble AppGenie within 24 hours of the request. Contact us now and we will assign a team of handpicked developers and designers to your project in no time.

Conclusion

eWallet solutions are all the raging with top fintech companies investing millions in the platforms, earning billions out of it. If you want to beat these top apps in their game, you have to leverage future trends of digital wallets.

In this blog, we discussed all you need to know about using eWallet app trends in your next project and how they are going to change the world. Now, it’s time to build your own solution with a top on-demand app development company.

FAQs

Digital wallets are gaining popularity due to the convenience they offer. You see, the users appreciate the ease of making transactions and managing finances within a single application. Plus Digital wallets often incorporate advanced security measures, such as encryption and biometrics, providing a secure way to handle transactions enabling seamless security.

The growing popularity of e-wallets in society can be attributed to several key factors. Firstly, the widespread use and reliance on smartphones have made digital transactions more accessible to a broader population. Additionally, e-wallets offer unparalleled convenience by consolidating various financial and non-financial services into a single, user-friendly platform.Top of Form

Digital payments are growing due to:

- Efficiency: Digital transactions are faster and more efficient than traditional methods.

- Contactless Payments: Widespread acceptance and adoption of contactless payment methods.

- Advanced Technologies: Integration of technologies like blockchain, AI, and IoT for security and enhanced functionalities.

Current trends in eWallet app development include:

- Integration with Various Services

- Soft Loans

- Voice Command Interfaces

- Behavioral Biometrics

- Contactless Payments

- Cross-Border Payment Solutions

- AR/VR-Driven UI/IX

- Blockchain Technology

- IoT Integration

- AI-Powered Hyper-Personalization

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.