First announced back in 2021, UPI – PayNow Linkage finally happened on February 21, 2023. And changes everything you know about P2P Payment.

UPI and PayNow are the two largest payment systems in the world, belonging to India and Singapore respectively.

To date, UPI has resulted in INR 12.11 trillion (or 147,041,557,600.00 United States Dollars)only transactions. On the other hand, PayNow of Singapore was responsible for 89.64 million transactions, in just the first half of 2021.

Singapore, the city-state is well-known as the financial capital of the world. And with the new collaboration between the Reserve Bank of India and the Monetary Authority of Singapore, we can expect a lot of opportunities in the fintech industry.

But what is it you should be expecting, what are these technologies exactly, and is there any chance of making a profit in this newfound partnership?

Well, we shall be answering all of these questions and discussing much more in this blog.

So, if you want to know more about UPI and PayNow, let’s get right into it:

UPI PayNow Linkage: New Age for P2P Payment

Singapore is the finance capital of the world with some of the world’s best financial institutes, start-ups, and companies in the entire world.

The city-state of Singapore is well known for its top-notch fintech infrastructure. In fact, the financial technologies of Singapore are something that has been inspirations to fintech developers and countries across the world.

On the other hand, India’s UPI, or Unified payment interface is one of the world’s best P2P payment systems.

So, when back in 2021 when the two countries decided to unify or link these technologies many businesses, start-ups, and investors started looking into it.

Moving on, the UPI – PayNow Linkage finally happened on February 21, 2023. There’s a lot to take away from this.

So, what does this mean? Well, their many benefits and takeaways from the merger. Here’s a detailed insight:

- India and Singapore have linked their digital payments systems, UPI and PayNow, for instant and low-cost fund transfers between the two nations.

- An Indian user can remit up to 1,000 Singapore dollars a day for now.

- The space for cross-border remittances is ripe for disruption, with high fees and a global average cost for sending money of around 6.5%.

- India plans to use its ongoing presidency of the G20 forum to make presentations to other nations about its digital infrastructure.

- The plan is to allow the transfer of funds from UPI to PayNow and vice-versa by using a virtual payment address

- Singapore has already connected PayNow with PromptPay of Thailand.

UPI And PayNow: All You Need To Know

Still, confused about what UPI and PayNow technologies are all about?

Well, let’s have a look at both of the P2P payment technologies in detail

What is UPI?

UPI stands for Unified Payments Interface.

It is a real-time payment system launched by the National Payments Corporation of India (NPCI) to facilitate inter-bank transactions.

In addition to this, UPI P2P Payment technology allows users to transfer money between bank accounts instantly using a mobile device.

UPI Payment Statistics

- UPI transactions in August 2021 reached 3.55 billion, with a total value of INR 6.39 trillion.

- The number of UPI transactions has been steadily increasing over the past few years.

What is PayNow?

PayNow is a real-time payment system launched by the Association of Banks in Singapore (ABS) in 2017.

Moreover, It enables customers of participating banks to send and receive money instantly using just their mobile number or National Registration Identity Card (NRIC) number.

PayNow Statistics

- PayNow transactions in July 2021 totaled SGD 2.2 billion, an increase of 5.5% compared to the previous month.

- PayNow is a real-time payment system launched by the Association of Banks in Singapore (ABS) in 2017. It enables customers of participating banks to send and receive money instantly using just their mobile number or National Registration Identity Card (NRIC) number.

So, are you wondering how is this technology actually going to work? Well, here are the answers.

How Will The Merge Work?

UPI and PayNow are two very different technologies with a common goal, P2P payment.

So, this begs the question, of how the merge actually works will and how it will enable a person-to-person payment.

We shall be answering this question in this section of the blog. And it is, as mentioned below:

As we already know, both of these technologies are used for person-to-person payment. But with a collaboration between the monetary authority of Singapore and the Reserve Bank of India, Cross border person 2 person payment has become possible.

UPI and PayNow Linkage will allow users to make cross-border P2P payments in seconds. There’s a little technology at play here, it’s known as VPA PayNow.

VPA stands for virtual payment address. With this, UPI and PayNow merger will create an effortless and swift cross-border payment.

It’s a big thing because – According to a World Bank report, the global average cost of sending remittances is 6 cents of the original amount.

But UPI and PayNow will make it easier and considerably cheaper.

So, what does this mean for the fintech industry of Singapore? Let’s have an overview.

Overview Of Fintech Industry In Singapore

Whether you speak of P2P payment or any other digital payment system, it goes without saying that, the Fintech industry in Singapore is one of the world’s best.

To better understand this, let’s discuss the market overview in detail.

Regulatory Framework for Fintech Technologies.

One of the key strengths of the fintech industry in Singapore is its strong regulatory framework.

The Monetary Authority of Singapore (MAS) has implemented a “regulatory sandbox” that allows fintech companies to test their products in a controlled environment.

Moreover, this has helped to encourage innovation and experimentation in the industry.

Skilled Workforce

When it comes to the development of an industry, a workforce, or rather a skilled workforce is very important.

Thus, this is another factor contributing to the growth of fintech in Singapore is the country’s highly skilled workforce.

For instance, Singapore has a large pool of talent in areas such as software engineering, app development, data analytics, and finance.

This has allowed fintech companies to develop cutting-edge technologies and solutions.

Investment Ecosystem

In addition, Singapore has a strong ecosystem of investors and venture capitalists that are interested in fintech.

This has led to a significant amount of investment in the industry, which has helped to fuel its growth. And if you want to develop a fintech app, this is the perfect market to do so.

Speaking of the market, let’s look at some of the more important statistics

Market Statistics

- According to a recent report published by the Monetary Authority of Singapore (MAS), the fintech industry in Singapore has been growing rapidly in recent years.

- In 2020, the total fintech funding in Singapore reached $1.2 billion, a significant increase from $0.4 billion in 2019.

- The number of fintech companies in Singapore has grown from 608 in 2019 to 1,000 in 2020. This is a clear indication of the thriving fintech ecosystem in Singapore.

- In terms of sub-sectors, payments, and remittances continued to dominate the fintech landscape in Singapore, accounting for 34% of the total fintech funding in 2020. This was followed by insurtech, which accounted for 17% of the total funding. Digital banks and blockchain/cryptocurrency also emerged as promising sub-sectors in 2020.

- Furthermore, the MAS has been actively promoting the adoption of fintech solutions in Singapore. In 2020, MAS launched the Singapore Green Finance Centre and the Global CBDC Challenge to encourage innovation in sustainable finance and central bank digital currencies (CBDCs) respectively.

With this out of the way, let’s look at the opportunity brought by the new cross-border person 2 person payment system in the section below.

New Opportunity in Fintech: P2P payment, Loan Lending Apps, & More.

Fintech is one of the world’s largest industry worth in trillions, generating revenue in billions. And with the merger, the monetary authority of Singapore has opened doors to new opportunities.

Let’s see what these are:

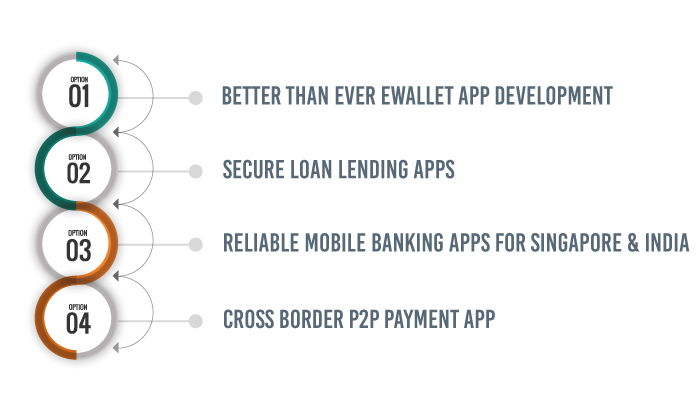

Better Than Ever eWallet App Development

eWallet app development is a popular concept.

Though there are some eWallet apps in the city-state, the new VPA PayNow, and UPI technology, you can create an eWallet app that is far better.

Moreover, it also supports QR code payments, sending money to accounts, and more.

Secure Loan Lending Apps

Loan lending apps like Klarna are what have shaped the industry.

But a big part of loan lending app creation is creating a secure platform. And with the technology that we have discussed in the blog, you can create a loan lending app that is absolutely secure.

Reliable Mobile Banking Apps For Singapore & India

Mobile banking app development has attracted hundreds of financial institutes from across the world to create their own solution.

With the likes of Bank of America’s leading industry, it’s easy to say that mobile banking apps are becoming a trend in the world of fintech.

Cross Border P2P Payment App

Cross-border payment is a P2P payment that is still to be conquered.

However, with the Monetary Authority of Singapore and its PayNow technology merging with another national payment system from India and Thailand, cross-border transactions will be made possible.

Using this opportunity many businesses are planning to make international transaction applications. Though there are already apps for that, what makes this one stand out is the low cost of the transaction.

Therefore, if you are planning to create a P2P payment app in Singapore, it’s highly recommended that you consider these new opportunities.

How You Can Make Most Of New UPI PayNow Linkage.

Do you want to take advantage of the new UPI PayNow linkage and make millions?

Well, statistics show that every year, transactions worth 1 Billion USD are done between Singapore and India.

But as we also read, the international or cross-border transaction doesn’t come cheap. Well, this is where the New P2P payment comes in.

The solution makes it easier to do international transactions opening doors to the cash flow of billions of dollars.

Moreover, there’s a big opportunity here too.

You can create a FinTech app as per the changing market needs.

Singapore has one of the best fintech infrastructures. And with your own fintech solution combined with the new technology, you can make millions in revenue.

So, contact a fintech app development company today to be part of this trend.

Conclusion

The UPI-PayNow merger is a significant collaboration between two of the world’s largest payment systems. This is set to disrupt the high fees associated with cross-border remittances and create new opportunities for the fintech industry in Singapore and India.

With the potential for other nations to adopt India’s digital infrastructure, the merger could pave the way for a more connected and efficient global financial system.

As we have seen, there are already new opportunities emerging in e-wallet app development, loan lending apps, mobile banking apps, and cross-border P2P payment.

Moreover, It will be interesting to see how these new technologies and solutions continue to evolve in the coming years.

FAQ

UPI-PayNow merger is the collaboration between India’s Unified Payment Interface (UPI) and Singapore’s PayNow, which allows for instant and low-cost fund transfers between the two nations.

The UPI-PayNow merger happened in February 21, 2023.

The benefits of the UPI-PayNow linkage include instant and low-cost fund transfers between India and Singapore, disruption of the high fees associated with cross-border remittances, and the potential for other nations to adopt India’s digital infrastructure.

The UPI-PayNow merger will allow for the transfer of funds from UPI to PayNow and vice-versa using a virtual payment address.

Singapore’s PayNow is a leading payment system in the Fintech industry, providing a secure, efficient, and convenient way for individuals and businesses to transfer funds.

India’s Unified Payment Interface (UPI) is a real-time payment system that allows for instant fund transfers between bank accounts through a mobile device.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.