Let’s Discuss your

IDEA!

Our team of developers offers custom loan software development services tailored to meet distinct financial models. From Peer-to-Peer (P2P) lending app development to loan origination software development, custom mortgage software development, and loan automation software, our solutions provide a flawless borrowing-lending experience.

Our p2p lending software development directly connects borrowers with investors, with no intermediaries. These platforms help with automated matching, secure payment gateways, and transparent transactions, offering higher returns for both lenders and borrowers.

The custom bank loan apps we build for financial institutions simplify loan applications, disbursements, and approvals through automation. When integrated with core banking systems, they diminish operational inefficiencies and smooth digital experiences.

Our loan lending app development company builds advanced loan comparison apps, using which users can evaluate and pick the best loan offers. These apps feature EMI calculators, intuitive dashboards, and real-time rate comparisons, improving financial transparency.

We design loan management software for compliance and scalability that supports lenders with risk alerts, real-time insights, and effortless handling of huge loan volumes, automating loan tracking, portfolio analysis, and repayment scheduling.

Our software developers have proficiency in building AI-powered digital lending platforms that automate the whole lending cycle. By integrating our platforms with KYC, payment APIs, and credit scoring, we enhance the borrower experience.

Leveraging the power of blockchain, we build a DeFi lending app that offers decentralized lending software. These apps allow smart contract-based transactions with no middleman while providing global accessibility for crypto-based lending and borrowing.

By building feature-packed crowdfunding platforms, our software developers securely connect fundraisers and investors. These platforms foster trust with rapid funding for innovative projects with integrated payment systems, KYC verification, and milestone tracking.

We provide custom mortgage software development services for tailored mortgage software development, energized with AI and automation that ease property loan processes. The lending platform software ensures a flawless borrower experience and reduced approval time.

Our loan lending software development services include credit scoring systems development utilizing AI and predictive analytics. These solutions analyze browser data to minimize risks, assess creditworthiness precisely, and enable swift decision-making for financial institutions and lenders.

Our expertise in personal loan app development enables us to develop user-friendly apps that facilitate users to apply, verify, and get loans quickly. With real-time tracking and automated workflows, such apps improve transparency for borrowers.

For small lenders, we provide microfinance app development solutions that efficiently manage microloans. Integrating these micro-lending solutions with repayment tracking, multi-tier management, and compliance tools, we promote financial inclusion and back underserved communities.

The enterprise-grade lending platforms we create are tailored for large financial institutions and banks. Strengthened with analytics dashboards, regulatory compliance, and modular architecture, these platforms provide complete regulation over the lending ecosystem.

Our custom loan lending app solutions speed up your fintech journey, designing digital lending solutions for rapid deployment that are ready-to-launch and help fintech startups and companies to enter the market faster while guaranteeing security, scalability, and comprehensive brand personalization.

Choose us for Klarna clone app development to launch your BNPL platform that offers smooth installment payments, secure transactions, and real-time credit checks to boost digital lending engagement and user convenience.

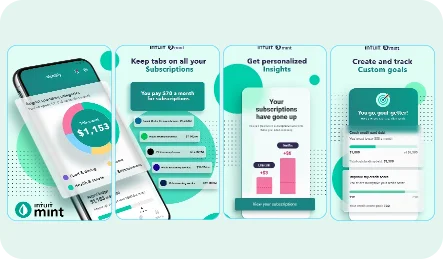

Build an intelligent personal finance management app like Mint, collaborating with us, that helps users with expense tracking, credit score monitoring, and budget management through AI-driven financial insights and intuitive dashboards.

Earnin like app solution, an instant cash advance app we created, facilitates users to securely manage their withdrawals, track earnings, and access their earnings before payday with no delays or hidden charges.

We develop an AfterPay clone app that rolls out as a flexible payment platform, splitting purchases into easy installments. When integrated with E-commerce platforms, it offers instant approvals and transparent repayment tracking.

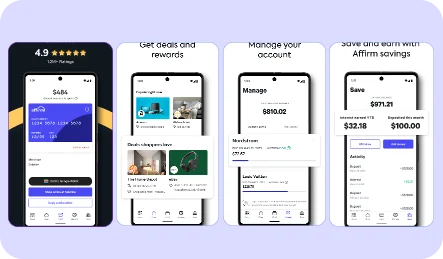

Create your lending solution like Affirm with clear interest rates and flexible payment plans that foster user trust via EMI options, instant credit approval, and secure digital payment processing.

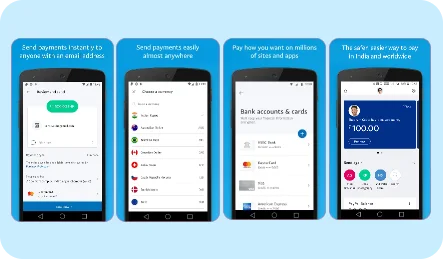

Build a secure lending platform like PayPal to empower merchant payments, credit services, and instant money transfers, while ensuring strong fraud prevention measures and PCI DSS compliance.

Explore our proven portfolio of loan lending apps crafted globally for fintech startups and enterprises. Be it P2P lending, micro-lending solutions, AI-based loan apps, or a white-label lending platform, we create custom software that ensures security and a matchless user experience.

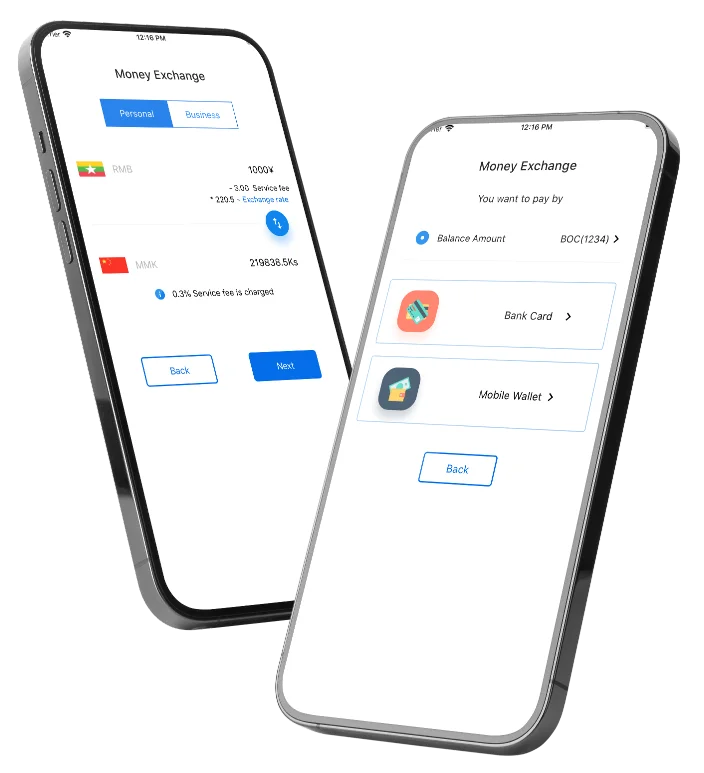

CUT, an e-wallet app available in China and Myanmar, supports RMB and MMK currencies and is accessible on iOS, Android, and web platforms. This free app streamlines transactions with QR code scanning for payments and personalized QR IDs for receiving money. Users can manage their finances easily with features like CUT Balance for tracking transactions and adding funds, and an exchange rate tool for efficient cross-border transactions.

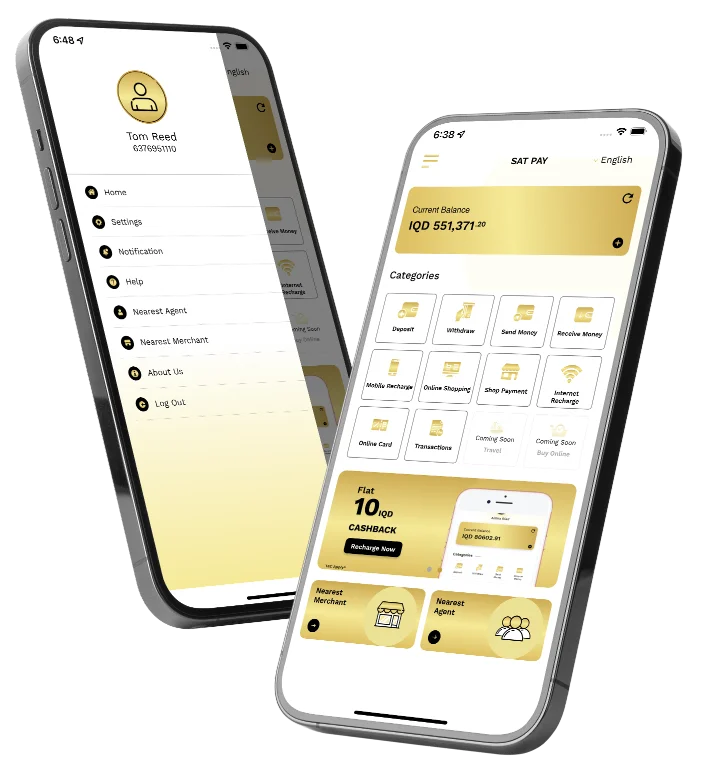

SatPay, a versatile eWallet platform, streamlines financial transactions by enabling users to effortlessly request, receive, and send payments. This user-friendly app and web service offer features like easy mobile recharge, where users can instantly top up their phones by selecting a plan. Additionally, SatPay supports seamless money transfers between users and provides a comprehensive transaction history for tracking all activities. Unique to SatPay is the online scratch card purchase option, adding flexibility for various uses like mobile recharges.

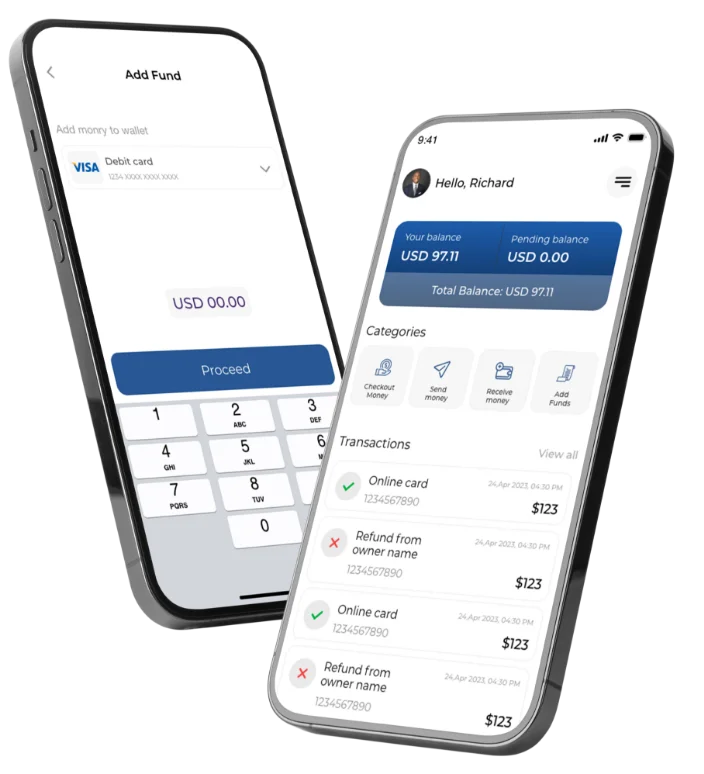

Pay by Check stands out as a leading multi-currency e-wallet app in the USA, accessible on the web, Android, and iOS. With a seamless onboarding process, users can quickly verify accounts. The app supports various funding methods, including ACH and EFT, allowing users to add multiple payment options. Unique features like inviting friends and customizable commission rates make it a versatile financial tool. The platform prioritizes security with amount limit management and robust verification processes.

SatBorsa is a unique currency exchange fintech platform available on both iOS and Android, with a primary focus on the Iraqi market where Android users dominate. Designed using Adobe XD, Java, Swift 4, PHP, and MySQL, the app delivers a seamless onboarding experience, requiring users to provide basic information for access to paid functions. It features a Market screen for live currency exchange rates, a Borsa feature to check rates across Iraqi cities, and multi-language support including Arabic, Kurdish, and English.

Loan lending business software boosts the borrowing and lending experience through convenience, transparency, and speed. They support financial institutions by automating processes, boosting customer satisfaction, and mitigating manual errors.

By integrating AI analytics, automation, and smooth UI/UX, and embracing user-focused lending features, our custom-built solutions increase security and customer engagement across distinct stages of the lending process.

This feature allows instant loan software via a simple digital form, tracks application progress in real time, and uploads required documents, with no need for visits to the physical branch.

Users can enjoy swift eligibility checks through automated algorithms that allow them to comprehend available offers, loan qualification, repayment terms, and interest rates, before loan application submission.

Using this software feature, borrowers can track approval stages, loan status, repayment schedules, and disbursement timelines in real-time, providing comprehensive clarity throughout their digital lending journey.

With this feature, users can accomplish their identity verification via integrated eKYC, document scanning, and face recognition tools, leading to a rapid onboarding experience by adhering to compliance.

A user-friendly EMI calculator in a loan lending software assists users in predicting interest amounts, total loan costs, and monthly payments, leading to sound borrowing decisions and better financial planning.

Our developers incorporate this feature to allow browsers to handle repayments through wallets, auto-debit, or bank transfers, get reminders, and check the complete repayment history, promising a flawless experience with timely dues.

Through this feature, admins can review loan applications, verify documents, approve or reject the requests, and handle loan workflows via an intuitive dashboard crafted for informed decision-making.

Leveraging the power of AI-driven scoring models, the admin panel of the loan lending software offers automated risk analysis, assisting administrators in assessing borrower profiles and diminishing default risks effectively.

Our software developers empower solutions with a user management feature that facilitates the admins to handle borrower information, track user activity, and update profiles, resulting in a regulated lending ecosystem.

Including this feature in loan lending platforms, admins can monitor overdue accounts, repayments, transaction history, and auto-debit performance, guaranteeing precise financial management across the whole lending lifecycle.

The dashboard of digital lending solutions with reporting and analytics provides deep insights, performance metrics, and charts to assist administrators in surveying conversion rates, delinquencies, loan trends, and financial health.

The admins of loan lending software can evaluate advanced fraud detection systems when equipped with fraud detection tools that stop high-risk users, monitor suspicious activity, and ensure compliant operations.

This feature automatically detects borrowers struggling and suggests revised EMIs, extended tenures, and optimized repayment plans, assisting lenders in diminishing defaults while providing easygoing restructuring options with reduced manual intervention.

The system proposes extremely personalized loan offers according to financial behavior, user intent signals, and spending habits, boosting conversions while ensuring borrowers get the most relevant lending products.

Pattern matching, fraud-flagging algorithms, and advanced OCR instantly validate documents, classify formats, detect anomalies, and ensure precise onboarding, diminishing processing delays, manual errors, and complete operational risk for next-gen lending platforms.

The software for lending business constantly monitors lending operations, automatically identifies violations, assists in maintaining regulatory compliance, and updates policy changes without any need for manual audits and ongoing administrative oversight.

The feature enables automated communication across email, SMS, in-app notification, and WhatsApp, ensuring borrowers get timely updates on dues, approvals, offers, and reminders, boosting satisfaction and mitigating missed payments significantly.

A real-time pricing engine alters interest rates according to borrower behavior, portfolio risk appetite, internal policies, and market conditions, allowing lenders to boost profitability while delivering responsive, fair, and competitive lending options to users.

We, a leading loan lending software development company, make the most out of avant-garde technologies to deliver scalable and future-proof lending platform software that enriches digital financial experiences.

We energize our solutions through blockchain integration to make transactions transparent, secure, and tamper-proof. Within decentralized lending ecosystems, our platforms fortify trust, diminish fraud, and enable smart contracts for automated repayments and loan approvals.

Utilizing the potential of AI and ML, we automate predictive risk assessment, credit scoring, and personalized loan recommendations that make decision-making more precise and enhance customer experience through cognitive automation.

Big data usage scrutinizes borrower behavior, anticipates lending market trends, and assesses creditworthiness to provide insights that allow lenders to make sound decisions and effectively optimize loan management approaches.

IoT integration supports asset tracking for secured loans, improves credit risk evaluation, and assists lenders in making data-backed lending decisions, accumulating real-time financial data from linked devices.

By adopting cloud technology, our loan lending software development company creates a cost-efficient lending infrastructure that empowers with rapid processing, secure integration, and smooth data access across digital lending platforms.

We implement advanced encryption, cybersecurity protocols, and multi-factor authentication to safeguard sensitive financial data that reinforces user trust, promising compliance and secure transactions with worldwide fintech data protection standards.

Get a custom loan lending app and fintech loan software development solutions tailored to your industry, meeting exceptional operational requirements, user experience, and compliance needs.

We build compliant lending platforms for NBFCs and banks that simplify approvals, streamline credit scoring, and offer effortless digital loan management.

Our software developers create microfinance software that streamlines small-loan management, borrower verification, and repayment tracking by promoting financial inclusion.

Create powerful mortgage and housing loan software by partnering with us that automates eligibility checks and document verification, speeding loan approvals, and elevating borrower satisfaction.

Develop embedded lending solutions for the e-commerce sector, hiring our leading loan lending software development company that drives customer retention and higher sales.

We design healthcare loan apps integrating payment gateways to make medical treatments more affordable and accessible for providers and patients.

Build education loan software that streamlines eligibility checks, repayment tracking, and student loan applications that help students access financial support easily.

Auto loan apps for lenders and dealerships manage EMI scheduling, approvals, and financing effectively, simplifying the car purchase and lending experience.

We deliver secure lending platform software for small and medium enterprises that ease credit management, business loans, and invoice financing to boost growth.

We create loan lending software utilizing the strength of a future-ready tech stack, including top frameworks, advanced analytics tools, and cloud infrastructure. Thus, we guarantee smooth integration, long-term reliability, and high performance for your lending space.

Following an efficient, transparent, and strategic software development process, we build equipped loan lending apps and solutions with reduced risks, paced delivery, and a unique user experience.

We define features, compliance requirements, goals, and a technical project blueprint.

Our team designs user-friendly interfaces promising flawless lending software experiences.

We build key functionalities with scalable backend systems and secure APIs.

Developers ensure software and app security, reliability, and complete regulatory compliance through audits.

We launch the software and offer constant updates, improvements, and monitoring.

Outshining as a trusted loan lending software development company, we build fully-featured digital lending software leveraging our extensive proficiency and a powerful focus on compliance, user experience, and innovation. Hire lending software developers who follow a tailored approach to create high-performing platforms aligned with your specific business objectives.

Our team of experts has 8+ years of experience in building secure lending platforms for fintech startups, banks, and enterprise lenders, ensuring an effortless user experience personalized to varied models.

By following rigid data protection and global security standards, like PCI DSS and GDPR, we protect sensitive financial data and ensure each loan lending software we develop fulfills regulatory and niche needs.

Our team implements advanced AI and machine learning algorithms to deliver precise credit assessments, mitigate lending risks, and enable rapid, data-driven decision-making for lenders and borrowers across distinct lending products.

Be it custom-built or ready-to-launch, white-label lending platforms, our developers provide flexible solutions tailored to each business model, assisting clients in speeding up time to market with the best performance and quality.

We opt for an agile methodology that accelerates development cycles and allows consistent iteration. Our adroit software developers deliver user-friendly interfaces with smooth functionality and powerful features through collaborative project workflows.

Our development specialists ensure your lending platform stays stable and competitive, providing ongoing updates, bug fixes, feature enhancements, and monitoring that support enduring growth and dynamic market needs.

Here are answers to some of your top questions about loan lending application development, from an expert team of problem solvers at a renowned loan lending app development company.

Nimble AppGenie offers comprehensive loan lending app development services, including P2P lending apps, bank loan apps, loan comparison, management apps, digital lending platforms, and more, tailored to meet the unique needs of your financial business.

It simplifies workflows, mitigates manual tasks, improves precision, and speeds up loan approvals for users with automated credit scoring and compliance tools.

Yes, Nimble AppGenie builds fully custom lending software tailored to your lending model, compliance requirements, workflows, and business objectives.

Absolutely, we have a team of software developers who create white-label platforms that come ready-made with customizable features, branding, and integrations.

Yes, we implement advanced encryption, secure APIs, access control, and industry-compliant security frameworks.

Yes, it supports business, personal, mortgage, BNPL, microfinance, P2P, and custom loan products.

Yes, we integrate global and regional KYC, AML, and credit bureau APIs for seamless onboarding and risk evaluation.

A loan lending software development takes around 10 to 24 weeks, and the time may fluctuate depending on various factors like complexity and more.

Yes, our architecture is created to scale seamlessly with the increasing user volume, loan disbursements, and operations.

Yes, we offer consistent monitoring, bug fixes, feature upgrades, and long-term maintenance.

Nimble AppGenie is committed to delivering results that satisfy our client’s needs and their business objectives. Here are testimonials from our clients about their experiences of working with us.

We hired Nimble AppGenie for web development services related to our edtech platform, Glu Learning. They integrated well with our team to solve all the problems and deliver remarkable solutions. Their team have great command of both client side and server side technology. We highly appreciate and recommend their services.

"Our journey with Nimble AppGenie is defined by their consistent availability, reliability, and efficiency. As we look towards expansion, I'm confident our partnership will grow even stronger. And we are eagerly anticipating the next chapter with them.

Read our blogs about the latest industry trends and much more inthe mobile app development industry.