Do you have a loan lending app or are you wondering about building one in 2025?

Well, here is a great opportunity for you to succeed in the industry. We understand that with the growing business, it is important to include the updated technology and trends for sustaining in the current diversified market.

Let’s discuss them in detail and help you to put them at your fingertips.

Loan Lending App Market Statistics

Before learning about the current trends in loan lending apps in 2025, let’s evaluate the Market.

Here are some of the loan lending market statistics to follow.

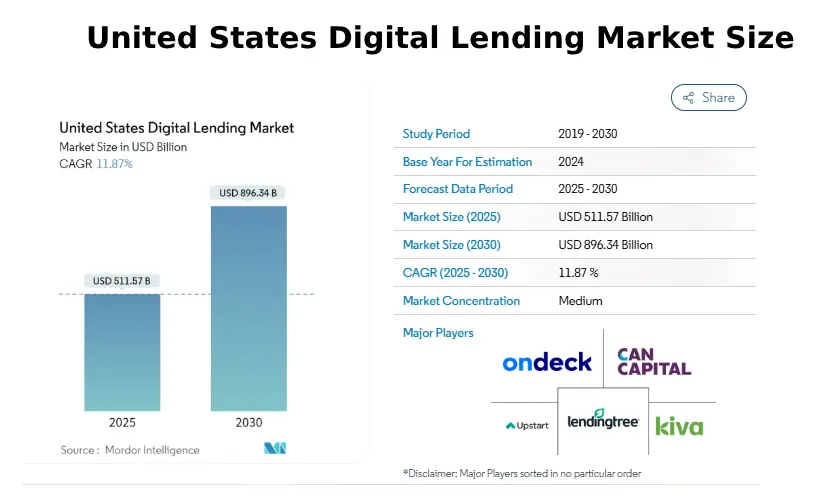

- The United States digital loan lending market size is estimated at 511.57 billion in the year 2025 and is further expected to reach at USD 896.34 billion by the year 2030. It is growing at a CAGR of 11.87%.

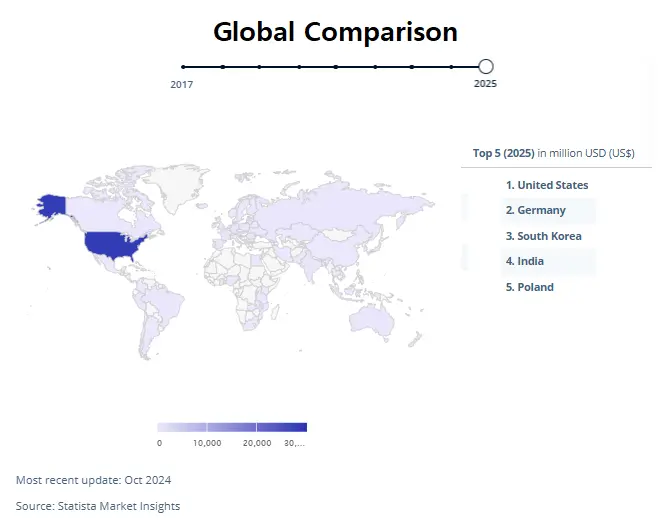

- When comparing globally, in the United States, the projected transaction value is expected at US$28,290 million in 2025.

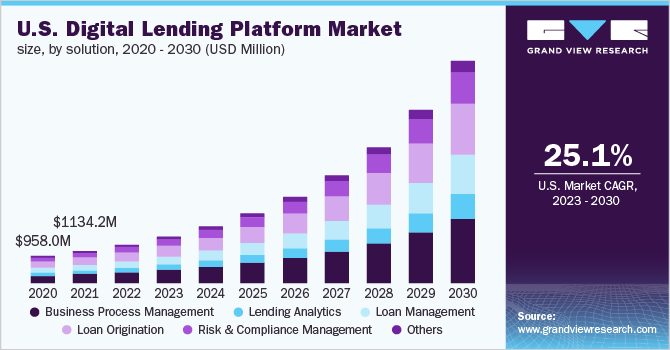

- The global digital lending platform market size is expected to grow at a CAGR of 26.5% from 2023 to 2030.

- The statistics present the value of peer-to-peer lending worldwide from 2012 to 2014, the market was valued at 3.5 billion U.S. dollars in 2013, which is growing concerning time.

These are some of the statistics that you should follow if you want to develop a loan lending app effectively.

Well, let’s discuss the current trends of loan lending apps in the following section.

Key Trends in Loan Lending Apps

To start a loan-lending business in 2025, it’s essential to follow the right trends. All the best loan lending apps knows well these trends, that helps them to lead the industry.

Here’s a list of key trends in loan lending apps.

1. Blockchain

Blockchain technology assists in automating the execution of loan agreements and helps to reduce operational costs by 15%-60%.

This offers transparent loan underwriting as well as ensures clear transactions.

The technology can be effective in streamlining the banking and lending services which further helps to reduce counterparty risk.

The implementation of blockchain technology enables faster and more cost-effective transactions by eliminating intermediaries.

Through the implementation of blockchain-based loans, there will be no need for a bank or any third party.

Smart contracts automate the execution of the loan and handle agreements via blockchain.

2. Direct Lending

The rise of direct lending is a great opportunity for you to enter the market at this scale. The implementation of automation has brought a revolution within the lending procedure by avoiding the traditional bottlenecks.

Direct loan lenders make use of current and updated technologies such as AI and ML for evaluating related applications faster.

With technological advancements, lenders are expecting automated solutions to enable a hyper-personalization lending experience.

With this element, the direct lenders get more freedom to make effective investment choices that allow them to manage their capital flexibly over competitive terms.

3. Personalized Lending

The loan-lending apps offer personalized services based on the issues of the users. With the diversified and unique needs of the users, the loan-lending app solutions differ.

Thus, with the personalized behavior of the loan-lending apps, the users can directly connect to the banks.

The use of AI-driven algorithms is effective for customizing the loan products as well as terms to individual borrowers.

Loan-lending app personalization is all about delivering the right loan with an effective offer to the right customer. This develops a win-win scenario for the customers and the lender.

4. AI-Powered and ML-Lending Platforms

The use of AI and ML within the lending process helps connect to the target users at ease. Artificial intelligence can help streamline the loan process, help detect fraud, along with evaluating the creditworthiness of the app.

These technologies provide the user’s suggestions based on their loan-lending issues, it mimics human intelligence along with decision-making for improving the process of how financial institutions can analyze, manage, invest, and protect the user’s money.

AI-powered lending platforms can be useful in leveraging machine learning algorithms to enhance processes.

It assists in the quick release of loans and is further helpful in determining the probability of a borrower defaulting on their loans.

5. Automation with No-Code Configuration

The implementation of automation along with no-code configuration tools assists the lending professionals in connecting with potential customers and adding custom lending solutions with agility.

By implementing automation and by introducing efficiencies, the users can transform the process for the lenders as well as for the borrowers.

Automation is effective in enhancing operational efficiencies by reducing human error, eliminating repetitive tasks, lowering costs, and enhancing customer satisfaction.

Thus, it is the loan-lending app’s current trend to implement effectively.

6. Cloud Computing

Cloud-based mobile applications assist the consumers or the end users in submitting loan applications as easily and quickly as possible.

Through loan lending apps, lenders can evaluate and access critical loan data by managing their portfolios over the Internet.

Additionally, the use of a cloud-computing platform is useful for promoting scalability and driving cost efficiency.

With the help of cloud computing, you can secure the data of the target users.

The cloud-based loan management system offers a reliable environment for users to connect with businesses.

Here you can manage sensitive financial data and information, successfully.

7. Faster Loan Processing

Faster loan processing is one of the advantages of cloud-based loan management systems effective for outlining and streamlining the user’s tasks.

The automated system integration within the loan-lending process assists the lenders to verify the borrower information including credit scores, income verification as well as property valuation.

Additionally, the combination of real-time data processing, with smooth integration of data, and automated workflow system management assists in managing the loan volumes successfully.

8. Open Banking and API-Led Financial Inclusion

Open banking is another important buzzword that is synonymous with the future of digital lending.

These trends are powered by APIs and open banking and allow third-party services to access the customer’s financial data with the consent of the users.

It has created a new trend, enabling lenders to create a more competitive and inclusive environment.

This trend will be helpful to bypass the traditional payment systems including credit cards, by implementing faster, cheaper, and more secure transactions.

Through APIs, you can facilitate a secure exchange of financial information among banks as well as authorized third-party providers.

9. Predictive Analysis

By leveraging data and machine learning algorithms, lenders may make more precise predictions related to borrowers’ creditworthiness.

It is one of the advanced forms of data analytics that attempts to answer the question “What might happen next?”

This type of analytics helps to predict future outcomes by utilizing historical data which is combined with statistical modelling.

This coincides with big data systems, where larger, broader pools of data enable increased data mining.

Here, you should use data, statistics, and updated technologies for planning future events and opportunities.

10. Security and Compliance

Another important and effective trend to adopt here is security and compliance. When it comes to security protocols, it is important to remain updated about the latest legal and safety measures.

Along with this, lenders need robust cyber security measures to protect the borrower’s data as well as to comply with the diverse and evolving regulations.

Here, it is important to implement robust technology parameters and strategies to protect the data of the users and retain their trust in loan-lending apps.

These were all the types of latest trends needed to be implemented successfully.

Now, the question is “What are the top benefits of loan lending app trends implementation?”

Let’s discuss the diversified benefits of loan lending app trends within the following section.

Benefits of Loan Lending App Trends in 2025

Where can you use these loan lending app trends and what are the major benefits of implementing them in the year 2025?

Well, let’s discuss them all here.

► Keeps You Updated

By implementing the loan lending app trends in the year 2025, you will remain updated about the latest technologies that will be helpful to sustain the competitive market.

Along with this, the latest market information will help you to connect with the target audience, efficiently.

► Helps to Break the Boundaries

With the implementation of the latest trends, your business will be able to break the boundaries of the market. The trends put forward new ideas along with opportunities.

This further assists the brands in communicating their values on a diversified scale.

► Decision-Making

The adoption of emerging trends is effective in laying the foundation to make informed as well as valuable decisions.

Relying on data-driven foundations, it assists businesses and investors to make strategic decisions that are helpful to project future outcomes.

► Helps to Scale-Up Operations

Your business can be helped in scaling up the operations quickly even without compromising quality and efficiency.

Along with this, you can improve the business value through expanding the market reach and providing growth in terms of reputation and revenue.

► Enhances Profitability

You can improve the complete profitability of your business by implementing the latest trends.

Thus, here you have an opportunity to connect with a diversified audience by updating your network successfully.

These are all the benefits you need to consider for adopting the loan lending app trends if you are in 2025.

How Nimble AppGenie Can Help You Leverage Loan Lending App Trends?

Still confused about how to implement the latest loan-lending trends?

Connect with Nimble AppGenie and let your business grow by implementing the latest trends. We are the best Loan Lending App Development Company, dedicated to helping you achieve your project aims.

Our team is ready to offer you a wide range of advice based on the current market and capital invested.

Conclusion

With the implementation of current valuable loan lending app trends in the year 2025, you can successfully connect with the audience.

You cannot be out of trend by following and implementing the latest technologies.

You can adapt to current technologies such as security and compliance, faster loan processing, cloud computing, automation, implementation of AI and ML, personalized lending, direct lending, and blockchain.

Connecting with an experienced team will be helpful here.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.