Best Recognizes the Best Our Esteemed Clients

Over the years, we have had the opportunity to develop apps for some of the best players in the market. The experience certainly helped us become familiar with industry needs.

Custom Insurance App

Solutions for Rapid Growth

The insurance industry has evolved massively. Gone are the days when a single agent used to handle different insurance needs. Today, there are dedicated solutions that can be built and deployed to support different insurance requirements of the users, all digital, all simplified!

CAR/AUTO INSURANCE APP

Simplify Car/Auto Insurance for your customers with an app that lets them file claims, check status, & upload files, all on their own, instantly!

Digital Banking for Smartphones

Encrypted Data for Secure Banking

AI-Powered Solutions for Automation

Big Data Analytics for Deeper Insights

HEALTH INSURANCE APP

Expand your services with health insurance app development that your users can turn to in times of distress and settle their treatment costs easily.

Secure loan and credit solutions

Crowdfunding & peer-to-peer platforms

Corporate Finance Management

Personal Finance Management

LIFE INSURANCE APP

One of the most popular insurance products is life insurance. If you too cater to the same market, building a life insurance app can be vital!

Intelligent Portfolio Management

AI Investment recommendations

Real-time Investment Tracking

ML Algorithms for Better Automation

PROPERTY INSURANCE APP

Our custom property insurance app development services allow you to reach the masses and spread better awareness about property insurance.

Seamless Integration

Active Fraud Detection

Secure Payment Gateways

Real-time Transaction Tracking

BUSINESS INSURANCE APP

Insuring businesses has caught on massively over the past few years. Capitalize on this rising trend with a customized business insurance app.

Automated Eligibility Checking

Instant Loan Approval Systems

Secure Transactions with Blockchain

Easy Preference Tracking with AI

WORKER’S INSURANCE APP

Our worker's compensation insurance app solutions allow a claimant to keep track of claims & open new avenues to explore as an insurance firm.

Personalized User Dashboard

Interactive App with Useful Features

Improved User Engagement

Enhanced User Retention

FIRE INSURANCE APP

Build a dedicated platform to support, manage, and resolve fire insurance claims and all the decisions around it easily for the claimant.

Personalized User Dashboard

Interactive App with Useful Features

Improved User Engagement

Enhanced User Retention

GENERAL LIABILITY INSURANCE

General liability insurance is paving the path for more user-oriented app solutions that allow clients to be more aware of general liabilities.

Personalized User Dashboard

Interactive App with Useful Features

Improved User Engagement

Enhanced User Retention

LOGISTICS INSURANCE APP

Catering to the majority of transportation and logistical businesses, a logistics insurance service provider can benefit significantly with an app.

Personalized User Dashboard

Interactive App with Useful Features

Improved User Engagement

Enhanced User Retention

Insurance App Development Services: What We Offer

Allowing you to make the most out of digital tools and insurtech available today, we at Nimble AppGenie can help you with a spectrum of highly efficient insurance-oriented solutions that can help you take your business digital and make it easier and efficient to manage.

Custom Insurance Solutions Development

There's no "One size fits all" approach in insurance solutions. Every business has different requirements and that's where our custom solutions come into play!

Insurance Quoting Software & Analysis Algorithms

We can help you build a dedicated insurance quoting software and analysis program for redefined accuracy and optimized profile analysis done quickly.

Insurance Document Management System

Maintaining the complete paper-trail for insurance policies, history, and claims can be difficult to manage without an insurance document management system.

Insurance System Integration & Modernization

With services like insurance system integration and modernization services, we help existing insurance apps do better by giving them the necessary upgrades.

Insurance Agency & CRM Solutions

To ensure that your insurance business is always on track, an insurance agency and CRM solution can be of great help for you. Connect today to build one!

Claims & Policy Management Software

If you plan to embed insurtech in the future, starting with a claims and policy management software is a good way to digitize the backend for operations.

Must-Have Features in Modern

insurance apps

Choosing the right insurance app features is crucial, as it is the functionalities that make or break an app. At Nimble AppGenie, we take pride in our research and understanding of the client requirements as it allows us to offer the best bunch of features that can optimize UI/UX.

Easy Policy Purchase

Claims Submission

Secure Document Upload

Payment Gateway Integration

Real Time Notifications

Customer Support Chat

Profile Management

Policy Renewal Alerts

Multi-Language Support

AI-Based Policy Recommendation Engine

Instant Premium Calculator

Health & Wellness Rewards Integration

Lead & Client Management

Policy Management

Claims Assistance Portal

Real-Time Notification

Commission Tracking

Document Sharing

Communication Tools

Reporting & Analytics

Task & Schedule Management

Agent Performance Metrics

Incentive & Bonus Management

Target & Goal Tracking

User & Agent Management

Policy & Product Configuration

Claims Oversight & Approval

Payment & Transaction

Advanced Reporting

Content & Document

Role-Based Access Control

System Settings & Customization

Audit Logs & Activity Tracking

Lead Assignment & Distribution Rules

Customer Feedback & Complaint Resolution

Fraud Detection & Risk Management

Insurance App Trends Our Developers Recommend

Maintaining top-notch security & scalability is a must in any application that involves personal data and monetary transactions. Our experts always pay attention to the latest market trends that can help in developing an iron-clad insurance app solution.

AI Powered Underwriting

Deploying AI in insurance for underwriting and assessing potential risks is a great technology to have in your app.

Cloud Solutions for Scalability

Cloud services not only make the insurance app easy to access from everywhere but also make it scalable for future upgrades.

Usage-Based Insurance with IoT

UBI helps in collecting data through a network of IoT devices, allowing insurers to analyse individual habits for better analysis.

Blockchain & Smart Contracts

Smart Contracts on Blockchain are digital contracts usually stored on a decentralized Blockchain that are executed automatically.

ML Algorithms for Automation

Building an insurance app with machine learning algorithms can reduce the margin of error through automation.

Big Data Integration

Big Data allows your app to manage large volumes of data without putting too much strain on the app’s performance & services.

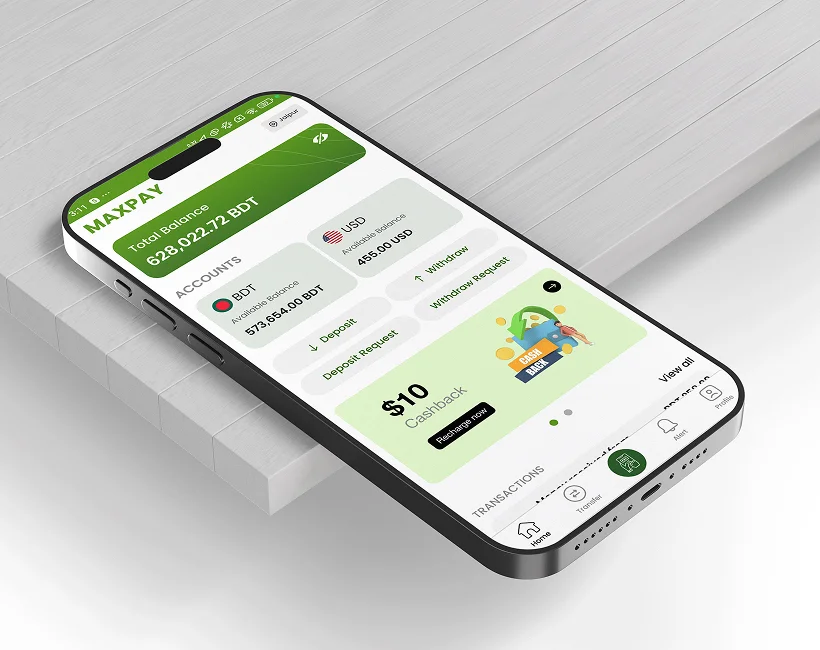

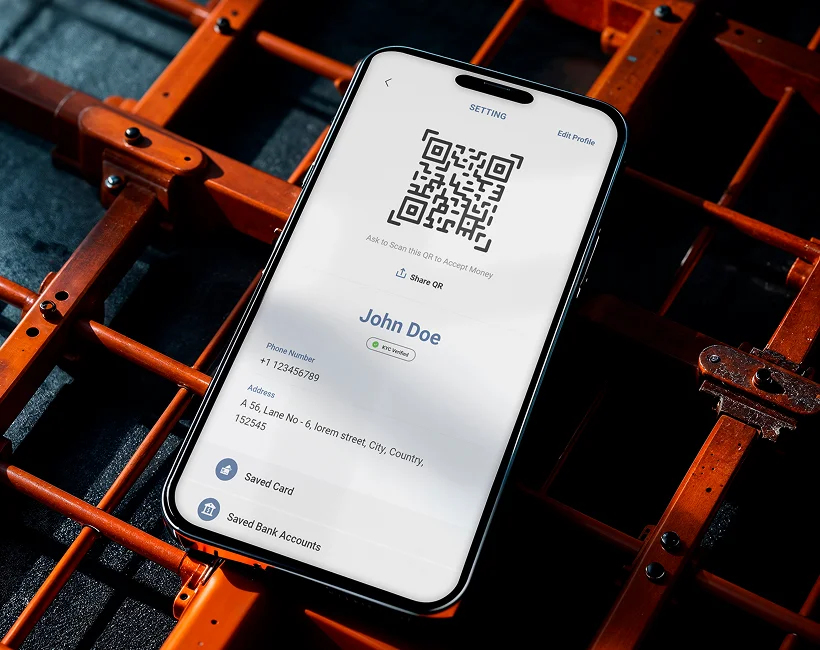

FinTech Solutions

that Speak for Our Excellence

Our portfolio is our biggest strength when it comes to showcasing our experience in insurance app development services. Over the years, we have built insurtech solutions that are future-proof and highly scalable.

View Details

View Details

Pay by wallet

Mobile Payment Platform

View Details

View Details

Maxpay

Multi-currency Wallet Platform

View Details

View Details

PAYBYCHECK

Multi-Currency E-wallet App Platform

View Details

View Details

CUT

E-wallet App Platform

BEST RATED INSURANCE

App Development Services on Clutch

Looking for insurance app development services that are recommended by the best? We are rated highly on multiple public platforms, including Clutch, the most popular marketplace for finding development services.

5.0

“Their project management was excellent”

CEO & Co-Founder, Bunk

5.0

“Their attention to detail and the client’s needs are first class”

Founder, StepbyStepfitness

5.0

“Every step of the project, I was comfortable that they had everything under control”

CEO, Wade Property

5.0

“They were always looking to maximize the benefit I could get from the web app..... ”

CEO, E-Commerce Company

Our Process for Robust Insurance App Development

Building an insurance app that meets the market standards can only be done when you follow the right approach. Our experts have devised an in-house development strategy that allows us to deliver efficient insurance app solutions every time.

Requirement Breakdown

As an experienced insurance app development company, we start our process by breaking down the requirements of our clients. We believe that every client has a different need and vision of building the app, and it is crucial to understand that intention before starting the development process.

Defining the Functionalities

After understanding the requirements, it’s time to define the functionalities that will shape the insurance application. Different solutions have different functions to offer. Hence, defining the functionalities allows you to narrow down the app’s use cases, making it fit for a particular sector of the market.

Choosing the Right Tech Stack

When you are aware of the functionalities, you can easily pick the tech that can help you execute them properly. It’s like cooking, you first identify the dish, then you identify its flavors, and accordingly, you pick the ingredients. We always choose tech that not only gets the job done, but is also scalable and future-proof!

Design & Develop the App

With all the right technologies and a clear vision of what your app should look like, it is time to give it shape by designing and developing the insurance app solution. The first leg is the front-end, where all the UI/UX decisions are made. Once the look and feel is finalized, the functionalities are built and developed by the experts.

Quality Check & Deployment

The development step is the longest one in the process; it is always incomplete without quality checks. Our expert quality analysts test the final developed build just to ensure that the application is not slowing down or has unnecessary glitches. When everything is checked thoroughly, the app is deployed for release.

Frequently Asked Question?

FAQ!

Get your answers to some of the most common queries around Insurance App Development.

It can take anywhere between 3-15 months depending on the requirements and complexity of the application. It can further go beyond 15 months if you have some additional demands that require customization. Generally, a full-fledged app is ready between 9-12 months.

Cost To develop an insurance app, you require anywhere between $25,000 - $250,000. The lowest amount can help you build an MVP to get an idea about how your insurance app will look and work. The budget can go further than 250,000, depending on the additional technologies and functionalities you offer.

At Nimble AppGenie, we are highly transparent about our privacy policies and work ethics. If you bring a customized idea to us that is unique to the industry, and you wish to sign an NDA, we are more than happy to do the same.

The tech stack for insurance apps requires a combination of different technologies such as a cloud platform, a database, some security measures, and frontend and backend tech. You can also integrate advanced technologies such as AI, Blockchain, IoT, etc.

Yes, at Nimble AppGenie we have a vast team of developers and analysts who are experienced in both iOS and Android app development, helping you build an insurance app that reaches the masses easily.

Well, we have a dedicated team for app maintenance and support services that help you resolve initial issues and ensure that there are no performance errors on your latest application.

An insurance app must-have significant security measures such as password protection, encryption, biometric (if available on device), and data protection mechanism as it has a lot of sensitive information included in the app.

Yes, our mobile app developers are fully equipped to identify the exact needs of the client and can accordingly build customized insurance applications.

Success stories

CLIENT TESTIMONIALS

Nimble AppGenie is committed to delivering results that satisfy our client’s needs and their business objectives. Here are testimonials from our clients about their experiences of working with us.

“Nimble AppGenie delivered a standout website that has attracted significant traffic. Their collaborative and organized approach made the development process smooth. Their expertise shines in the end product, making them the go-to web development company in London.

We hired Nimble AppGenie for web development services related to our edtech platform, Glu Learning. They integrated well with our team to solve all the problems and deliver remarkable solutions. Their team have great command of both client side and server side technology. We highly appreciate and recommend their services.

"Our journey with Nimble AppGenie is defined by their consistent availability, reliability, and efficiency. As we look towards expansion, I'm confident our partnership will grow even stronger. And we are eagerly anticipating the next chapter with them.

Dr. Christian Herbert Ayiku

(CEO of DafriBank, South Africa)

BLOGS

Our Latest Blogs

Read the latest blogs for the top industrial insights of development processes, tech guides, and the latest trends to stay updated & learn more.

Loading...