Billions of users across the world are using the best loan lending apps to ease the financial burden.

Loans are a financial product that has been around since age immemorial. However, with recent innovations in fintech app development industry, everything has changed.

Unlike traditional loan lending, these soft loans are much more appealing to people as well as the service provider. This has allowed businesses to generate market-leading revenue in the industry with ease.

For ease, back in the year 2013, the loan lending industry was valued at 5 billion USD. Fast forward 2 years to 2015, it was valued at 64 Billion USD. And it is expected that the market will be valued at more than 1000 billion USD by the year 2025.

With millions of loan lending app users in the United States of America alone, these predictions will come true. This ever-growing nature of the loan lending industry is what helps the companies generate off-the-charts revenue and grow unscaled.

This has inspired and attracted the attention of startups as well as businesses from across the world. There are people who want to develop their own loan lending applications. Therefore, if you are one of these people who wants to develop their own loan lending apps, you have come to the right place. S

In this section of the blog, we shall be discussing all you need to know about creating market-leading loan lending solutions for your own business. So, with this being said, let’s get right into it:

What is Loan Lending App Development?

First things first, what is loan lending app development.

As the name suggests, this refers to the technical process which is used by mobile app developers to create loan lending applications.

As far as loan lending applications are concerned, these are mobile-based software which through which service providers or/and financial institutions provide soft loans to app users and receive the repayment through the mobile application itself.

These apps have become quite popular these days, especially following the covid-19 pandemic. Since a lot of the general public was struggling financially as many people had lost their job during covid, people resorted to loan lending apps.

For those asking why would one go for micro-loan rather than traditional ones is that the latter involves quite a complex, extensive, and tiring process. In fact, this is one of the largest selling points of loan lending apps as they allow users to get the loan without vesting a lot of time.

Moving on, there is a lot that goes into working of the best loan lending apps. Therefore, we shall be discussing just the same in the next section of the blog.

How Does Loan Lending Work

People often ask, how do loan lending apps works? Well, if this is something that you are wondering about, in this section we shall be discussing all you need to know about working on a loan lending application.

You see, the working of loan lender apps is quite simple actually. Contrary to popular belief, applying for these soft loans is much easier, simpler, faster, and more transparent than its traditional counterpart. This is one of the big reasons behind the success of the applications.

Nevertheless, the working process is, as mentioned below:

- Download and install: the first step of the process is downloading the application and letting it be installed on your mobile device. And once you are done with this, we will get to the next step.

- Sign Up: once you have downloaded the application, it is time to create your account. You can create an account through your mobile number, email id, and social media, among other ways.

- Verification: since the application’s nature deals with finances, you have to verify yourself. This can be done through online KYC or any other methods that are available.

- Explore Options: Loan lending applications often offer more than one methods that you can take benefit from, and you can explore to them to choose which one you want.

- Apply for loan: now that you have selected which option you want to go with, you can select the amount you want to loan, and apply for it.

- Get amount in your account: if the loan is approved you get the loan amount debited directly into your bank account.

- Flexible repayment: the loan lending application also allows the user to repay the loan through flexible methods i.e. over EMIs.

So, this is the working process of a loan lending application. And with this out of the way, let’s look at some of the features that you should be including in your loan lending application.

Features to Include in Loan Lending App

Features are an essential part of creating market-leading micro lending app. And if you are planning to do just that, you need to come up with unique and market catering features.

Here, we shall be looking at a few of the basic features that might be helpful to you.

These are, as mentioned below:

| User Panel | Service Provider Panel |

| Profile creation | Profile management |

| Verification | Verify user profile |

| Apply for a loan | Conduct KYC |

| Online Record Management | Revenue Management |

| Multiple Payment Gateway Integration | Approve or Deny Loan Application |

| Push Notification | Customer Support |

| AI & ML Technology Integration | Informative Dashboard |

These are some of the feature that you should be including in your loan lending app development project.

How Do Loan Apps Make Money?

Generating revenue is a big part of business, in fact, it is one of the prime objects. And for the people who are developing their own loan lending applications, they want to generate off-the-charts revenue while growing their business.

Unlike business, in a mobile app, you have to adopt monetization strategies. So, for those wondering how apps make money loan, these are, as mentioned below:

- Penalty on Late Payment

- Processing Fees

- Charges

These are, some of the methods through which, loan app business make money.

How to Build a Loan Lending App: Loan Lending App Development Process

As the name suggests, in this blog, we shall be learning how a loan lending app is developed. Because as it turns out, mobile app development is easier said than done, let alone complex fintech apps like loan lending.

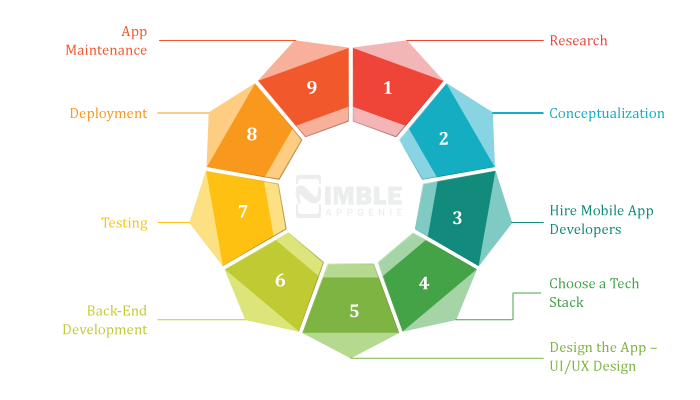

Thus, in this section of the blog, we shall be describing the various steps to build loan lending app. These are, as mentioned below:

1. Research

The first step of creating one of the best loan lending apps is conducting research.

It is here that you look at the market for opportunities while also analyzing the competition. All of this combines to create a base of information that will be quite valuable later down the line.

Once you are done with this, we can move to the next step which is…

2. Conceptualization

With all the required information at hand, you can muster up some ideas or concepts for the loan lending application.

This process is purely based on you and while an app Development Company can give you suggestions, this is something that you will have to do.

3. Hire Mobile App Developers

Now that you have an idea, it is time to hire dedicated developers for your project. Speaking of which, there are two ones you can go to here.

You see, mobile app development can be based on two platforms, i.e iOS, and Android.

Therefore, based on your project’s needs, you can either consult an iOS app development firm or android app development company.

However, if you are looking for a third option that gives you best of the both world, you can also opt-out for hybrid app development.

4. Choose a Tech Stack

Tech stack is one factor that can highly affect the development process as well as after-release performance of the application.

If you want to your loan lending application to be one of the best out there, it is highly recommended that you choose the one that best fits your business needs.

Now, this is how to create a banking app. And with this we have come to the end of your development process.

5. Design the App – UI/UX Design

With all preparations done, it is time to create the UI/UX Design.

The front-end design is one of the most important aspects as it can highly affect user engagement and user retention.

In order to maximize those two, you can create a design that is easy to navigate yet pleasant to look at. Once we are done with front-end, let’s move to the next step, which is back-end development.

6. Back-End Development

This is the step where the developers will be writing money lending app source code. This is one of the lengthiest and most crucial processes.

Therefore, it is highly recommended that you maintain good communication with the development side throughout this process. This will make sure everything is going as you want it to.

7. Testing

With the final version of the application created, it is time to test it.

Here, the application will be launched into a live environment, in this software it will be checked for bugs, errors, and other issues.

Once all of that is fixed, it is time to deploy it.

8. Deployment

Speaking of deployment, it is a process that highly depends on the platform you choose.

Therefore, if you choose native platform like iOS app development, the process will be highly different when compared to if you choose hybrid app development.

9. App Maintenance

App maintenance is something that goes for the lifetime of the application. And it plays a crucial role in deciding the success of loan lending applications.

Top 10 Best Loan Lending Apps

In this section of the blog, we shall be looking at top 10 best loan lending apps in the United States of America.

Reading about these apps will help you get some good ideas and inspiration for your own project. So, with that being said, let’s get right into it:

1. Dave

In the occasion which you actually need coins to avoid overdraft charges or to cowl a minor cost, Dave affords to $250 in coins progresses. The Dave app would not price hobby. All matters being equal, it has a $1 participation charge.

The degree urges customers to tip, but tipping is absolutely discretionary. Dave is one of the best mobile loan lending apps that can get you many advantages.

For example, credit score-constructing administrations, making plans gadgets and facts set of 2nd task probabilities you got extra pay.

2. Brigit

With Brigit, you could rise up to $250 without going via a credit score test. Cash advances is probably available in only 20 mins next to imparting a solicitation. Brigit has intended to appear over loose and Plus.

The loose association offers financial bits of information and recommendations but would not supply customers admittance to coins progresses. To make use of that element, you will want to join the Plus plan. Instead of charging hobby, Brigit expenses a degree month-to-month charge of $9.99 to make use of its Plus plan.

Individuals can make the most highlights like $1 million in wholesale fraud protection, making plans apparatuses account stability cautions, and credit score records get admission to.

3. MoneyLion

Through InstaCash, MoneyLion customers may have the choice to get a coins to strengthen for up to $250 without paying sales or month-to-month charges, and without going via a credit score test.

Moreover, MoneyLion as a market-leading instant loan lending app gives a scope of financial administrations you could oversee on the web. By becoming a member of MoneyLion, customers can place sources into virtual currency, get admission to programmed assignment debts, follow for a credit score-producer mortgage, and obtain test card rewards.

4. Even

With Even, certified representatives may have the choice to rise up to 1/2 of in their received wages early. The Even app includes making plans and gadgets which can help with peopling song their spending and get an angle on their entire financial picture.

Indeed, even likewise allows people to place forth up funding price range targets and to transport a degree in their assessments into reserve price range naturally. Bosses can pursue a discretionary hobby fit to help their workers’ reserve price range with development.

5. PayActiv

PayActiv gives early tests to get admission in addition to making plans and funding price range gadgets. Clients can rise up to 1/2 of in their procured reimbursement earlier than payday, and also you choose in which to transport the coins.

You may have the coins moved to monetary stability, get coins at Walmart or flow your coins to AmazonCash. You can likewise deal with payments properly from the app. And this is what makes it one of the best examples of loan lending app development.

6. Earnin

Earnin is our choice for the fine via way of means of and massive app for obtaining coins because of its “Cash Out” preference, which can provide you with admittance for your assessments early.

Earnin ensures no sales expenses and no compulsory charges, and customers can develop up to $500 in their earnings according to payroll interval.

At the factor whilst you need coins rapidly, Earnin may be a sensible approach for staying far from overdraft charges or payday loans. Earnin likewise gives highlights to help people with safeguarding their facts from overdrafts.

Earnin sends alarms whilst your file adjusts are low, and you could therefore get admission to up to $100 of your income to stop overdrawing your facts.

7. SoFi

Here’s the reason: SoFi gives many loans, inclusive of character loans. Through SoFi, you could follow to get $5,000 to $ 100,000 with a character mortgage and you would possibly have the choice to use get the property whilst that very day.

In any case, keep in mind that the particular degree of time it takes for coins to seem to your file will depend on your bank. In fact, this has inspired a lot of people to use custom mobile app development to create one for their own business.

SoFi would not price begin charges or prepayment punishments for its very own loans. At the factor whilst you open a file with SoFi, you emerge as a component and are certified for its special advantages. Part blessings include financial education and vocation training.

8. CashApp

Anybody greater than 18 can pursue a CashApp account. When you join, you could get for your assessments so long as days beforehand of schedule. You can likewise get to lose ATM withdrawals so long as you don’t have much less than $ 300 of pay coming in each month.

As such, this is one of the best instant personal loan app on the list. Through CashApp, you could ship coins to partners or own circle of relatives or pay for administrations.

Besides, you could place sources into shares and Bitcoin with just $1. There is no charge for CashApp’s on-the-spot shop management or to transport coins to others. There are charges for ATM withdrawals and coin card updates.

Read the blog – Everything You Need Know About Buy Now, Pay Later App Development

9. Chime

For people who are not certified for Branch — or who want to make use of different monetary administrations, Chime is probably a precious preference. With Chime, you could get your test so long as days quicker via the direct shop.

Toll gives banking administrations like were given price cards, excessive go-back funding debts, and sans charge ATMs. With Chime monetary facts, there aren’t any month-to-month charges or least equilibrium charges.

Also, with its SpotMe management, Chime will disguise to $2 hundred on price card buys without overdraft charges. There aren’t any charges to join.

10. Branch

With the Branch app, certified representatives can rise up to half of their received wages early. There aren’t any credit score assessments, and there is no fee for the representative. Branch’s coins strengthen issue is virtually available to people used by taking hobby organizations.

Branch works with the groups to get employee participation facts and gauges of wages procured. As a representative, whilst you make use of the app to call for reserves, the coins are stored in your Branch superior wallet.

There’s no fee for you so long as you pick a popular shop. Be that because it may, assuming you actually need the coins in no time, you could choose the instant shop preference for a touch charge.

These are some of the best loan lending apps out there. If you are inspired by these, you can consult an on demand app development company that can help you with the same. Now, this might send me wondering how much all of this will cost. We shall be discussing this below:

How Much Does it Cost to Develop Loan Lending App?

The cost to build a loan lending app depends on a lot of different things. The reason is that each mobile app development project is unique in its own right.

For instance, if you are creating a peer-to-peer lending app, there are several factors involved that can affect the cost.

Some of these factors are, as mentioned below:

- Developer’s location

- Development time

- Team size

- Size of the app

- App complexity

- Tech stack

- App platform

These are some of the factors which can affect loan lending app development cost. Nevertheless, the average cost to develop one of the best loan lending apps can be anywhere between $15,000 and $30,000.

Conclusion

This is everything you need to know about creating a market-leading loan lending application. Now, if you want to do the same to help your business grow and generate millions in the market, it is highly recommended that you consult a globally renowned mobile app development company as they can help you with the same.

FAQ

Some of the best instant loan money apps are, as mentioned below:

- PayActiv

- Earnin

- Chime

- Branch

- Dave

- Brigit

- MoneyLion

The process to build a loan lending application is, as mentioned below:

- Come up with an idea

- Hire mobile app developers

- Choose tech stack

- Front end development

- Back end development

- Testing

- Deployment

- App maintenance

If you are looking for the best mobile app development company in USA, you have come to the right place. Nimble AppGenie is a market leading app development company which is renowned throughout the industry for quality work that is also highly economical.

Now, if you want to create a loan lending app for your business, we are here to help you.

The average cost to develop one of the best loan lending apps can be anywhere between $15,000 and $30,000. If you are looking for a more accurate estimate of the development cost, it is highly recommended that you consult a custom mobile app development company.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.