Let’s talk about payment gateway integration.

Fintech is growing across the world in the form of online payment, digital banking, and contactless payment, just to name a few niches.

It is safe to say, people are hooked on using virtual currency and leaving their physical wallets in the past. And this is a good thing for everyone. But if businesses want to stay profitable and cater to changing user demand, they need to adapt.

That’s why payment gateway and payment gateway integration come in.

Being a top fintech technology, it enables businesses to accept payment digitally in a split second on their online platforms.

Want to achieve this in your platform?

Well, there’s a lot more to integration payment gateway than meets the eye.

So, let’s decode the sophisticated world of payment gateway integration, custom payment gateway development, challenges, and much more in this guide.

What is Payment Gateway Integration?

Let’s answer the big question first, what is payment gateway integration?

Starting with the basics, the term “payment gateway” refers to a front-end technology that allows businesses to accept payment from customers via digital wallets, debit cards, credit cards, or online banking methods.

Payment gateway applications range from physical stores receiving payment through physical cards to online stores which allow customers to pay via digital solutions.

Now, coming to “Payment gateway integration”, it is process of connecting your website or app to a payment gateway service. This allows customers to enter their payment information securely and process transactions electronically.

While this might seem like a new concept to some, it has been for a good while, being used in some of the top on-demand apps; plus any other app that handles payment processing.

Fintech Statistics show, Digital payments apps have become a dominant fintech product, claiming 25% of the market share.

As a consequence, payment gateway integration payment gateway integration in mobile app development has become a popular choice and feature.

Here are some of the most common app types that take advantage of payment gateway integration:

Popular Apps Using Payment Gateway

And so on.

All in all, payment gateway integration has become a popular tool not just in app development, but also in web development, as a lot of us have already seen.

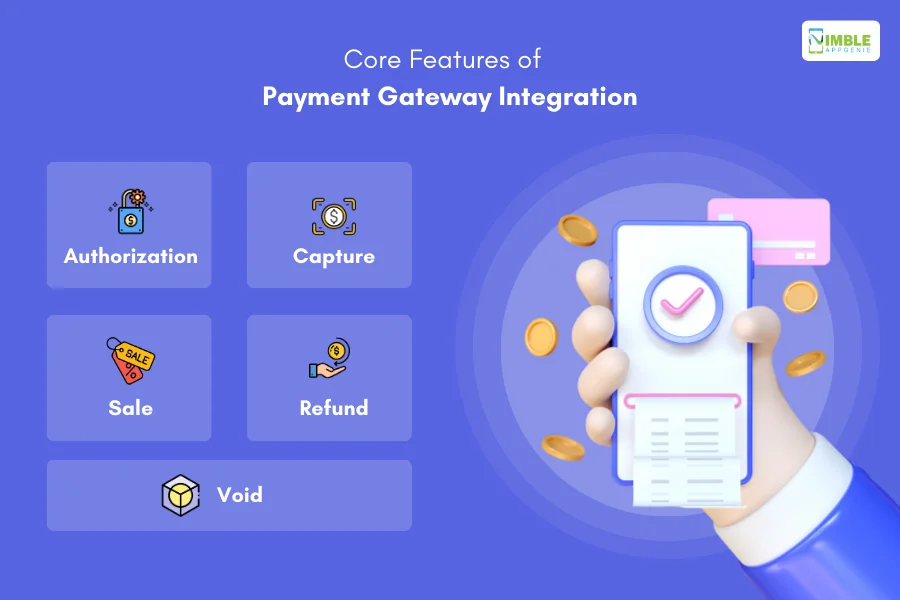

Core Features of Payment Gateway Integration

There are 5 core functions of payment gateway integration. And they open the door to numerous digital payment features.

Now, let’s discuss each of them below:

1. Authorization

The first core function is authorization.

As the name suggests, it refers to the part where the payment gateway verifies the customer’s payment information.

Integrated payment gateways will communicate with the concerned bank. This is done to check if there are required funds for the transaction.

Based on the result, the gateway system will come back with an authorization response, giving “approved” or “declined”.

2. Capture

Following capture, the second function is capture. This ensures businesses receive funds for the authorized payment.

This functionality allows the platform to confirm the payment and approve funds transfer, taking place following successful order fulfillment or service delivery.

3. Sale

More often than not, authorization and sale happen simultaneously, and this event is known as a “sale”

In simple words, this means a more streamlined and faster fund collection process.

4. Refund

As the name suggests, the refund function of the integrated payment gateway system returns the funds to the customer’s account.

This is activated in case of order cancellations, product returns, or other scenarios requiring a refund.

5. Void

Lastly, we have the void function.

It enables the platform to cancel authorized transactions prior to capturing.

So, why is it important? Well, the void function becomes very useful in case of abandoned carts, incorrect orders, or other times when the transaction shouldn’t be finalized.

Now that we are done with the meaning of payment gateway integration, popular apps that use it, and its core functions, it’s time to look at the payment gateway integration methods.

Types of Payment Gateway

There are different types of payment gateway integration.

Each of them has a different in their nature of working, giving us unique advantages as well as drawbacks.

Let’s look at these different payment gateway integration methods, below:

Type 1: Hosted Payment Gateway

Let’s start with the first one, which is, a hosted payment gateway.

This is the most common and user-friendly choice for payment gateway integration. In this system, the customers will be redirected to a secure payment page hosted by the gateway provider.

Here, they will enter the information and once the transaction is finished, they are redirected to the original platform.

- Pros: Easy to set up and requires minimal technical expertise. Offers a secure checkout experience for customers.

- Cons: Limited customization options for the checkout page. Merchants have less control over the customer experience.

Type 2: API-Hosted Payment Gateway

Just like hosted gateways, customers enter their payment information on your platform.

However, the processing happens through an API provided by the gateway, offering more flexibility and customization.

This is one of the popular use cases of open banking APIs.

- Pros: Offers a seamless checkout experience without redirecting customers. Allows for greater control over the checkout page design and user experience.

- Cons: Requires more technical expertise for integration and maintenance. Merchants are responsible for PCI compliance and data security.

Type 3: Self-Hosted Payment Gateway

As the name suggests, self-hosted payment gateway integration doesn’t require customers to leave the platform.

Meaning, they can enter payment information directly onto the platform. The entire transaction is processed on your servers.

This offers the highest level of customization and control.

- Pros: Provides complete control over the checkout experience and branding.

- Cons: Requires significant technical expertise and resources to set up and maintain. Merchants bear full responsibility for PCI compliance and data security, which can be complex and expensive.

Type 4: Local Bank Integration Gateway

Lastly, we have the local bank integration gateway.

This option connects your website or app directly to local banks or payment networks in specific regions.

It allows customers to use familiar local payment methods.

- Pros: Enables acceptance of popular local payment methods, catering to specific regional preferences.

- Cons: Can be complex to set up and maintain, requiring integrations with multiple local providers. May not be suitable for businesses operating globally.

Now that we are done with different payment gateway integration types, you might be wondering, which one is the right for you.

Well, here’s how to find out.

How to Choose the Right Payment Gateway Integration Methods? Factors To Consider

It goes without saying it’s important to choose the ideal payment gateway integration for your next project.

But how do you choose the right one?

Well, while there’s no guide to it, here are a few factors that you can consider while doing it.

- Technical expertise: Hosted and API-hosted options are generally easier to integrate for businesses with limited technical resources.

- Customization needs: If you require a highly customized checkout experience, API-hosted or self-hosted options might be preferable.

- Security considerations: Merchants must ensure PCI compliance and data security regardless of the chosen integration method.

- Target audience: Consider the preferred payment methods of your customers, especially if you cater to specific regions.

These are some basic factors to consider, you can always go one step ahead, and consult a payment gateway integration service provider for greater insights.

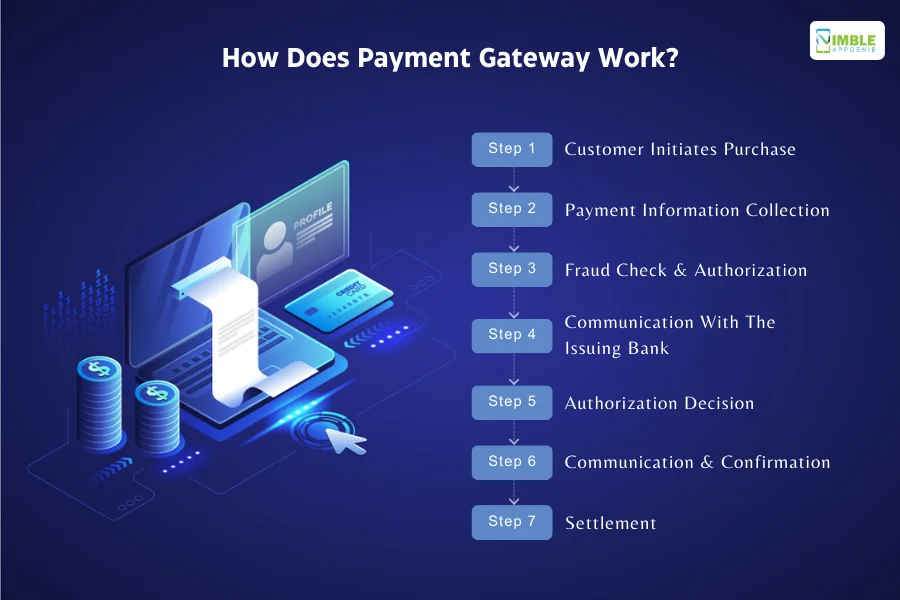

How Does Payment Gateway Work?

Let’s get a bit technical here, shall we?

It’s time to learn the workings of payment gateway.

A payment gateway acts as a secure intermediary between online stores, customers, and their financial institutions, facilitating smooth and secure online transactions.

Here’s a breakdown of how it works:

1. Customer initiates purchase

The payment processing flow starts with the customer deciding to buy something from the platform.

The core process remains the same whether we are talking about an eCommerce app or some NFT platform.

In any case, the user moves to the checkout page and enters their payment information, including card details or alternative payment method credentials.

2. Payment Information Collection

As soon as the customer enters their payment detail, the integrated payment gateway collects the info via encryption or tokenization.

This is done to keep the data secured when being processed through different channels.

3. Fraud check and authorization

Once the information is collected, the payment gateway will put it through a firewall that checks it for fraud.

If a green light is given, the payment information is sent to the merchant service provider i.e. the fintech company that handles payment processing for business.

4. Communication with the issuing bank

It’s important to establish secure communication with the bank and that’s what happens in this step.

Here, the acquirer forwards the information to the customer’s issuing bank (the bank that issued their credit or debit card).

In addition to this, the issuing bank verifies the customer’s account details and available funds and performs additional fraud checks.

5. Authorization decision

Now, with that said and done, it’s time for authorization. Based on the verification and fraud checks, the issuing bank either approves or declines the transaction.

6. Communication and confirmation

Following the authorization, the issuing bank’s decision is sent back through the acquirer and the payment gateway.

The customer and the merchant are notified about the authorization status (approved or declined).

7. Settlement (optional)

Lastly, we have this optional step.

If the transaction is approved, the funds are transferred from the customer’s account to the merchant’s account, typically within a few business days.

This process is known as settlement.

So, that’s how a seamless integration payment gateway works. With this out of the way, let’s look at some of the top payment gateway service providers.

Top Payment Gateway Service Provider

Speaking of choosing payment gateway integration, there are few options available in the market.

So, let’s look at some of the best payment gateway integration options along with the price. These are, as mentioned below:

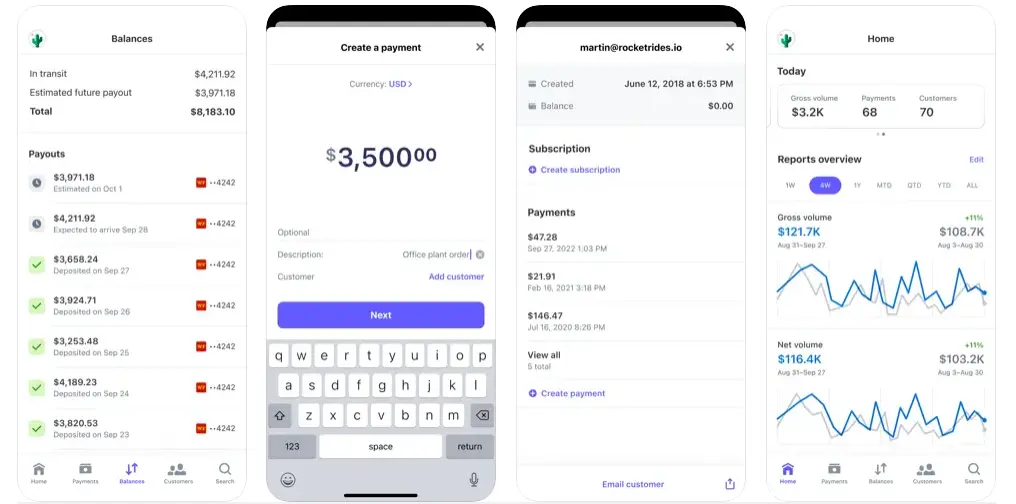

1. Stripe

Let’s start with the most popular payment gateway in the market, Stripe.

It is a popular choice across the world among startups and businesses alike. This is mainly due to its easy-to-use nature and the wide range of features it provides.

In addition to this, it also provides various payment methods covering: credit cards, debit cards, ACH payments, and alternative payment options.

To complete the package, it also comes with robust APIs and a range of tools for developers.

Charges:

Transaction fees: 2.9% + $0.30 per successful card charge. There are additional charges for other services like conversion.

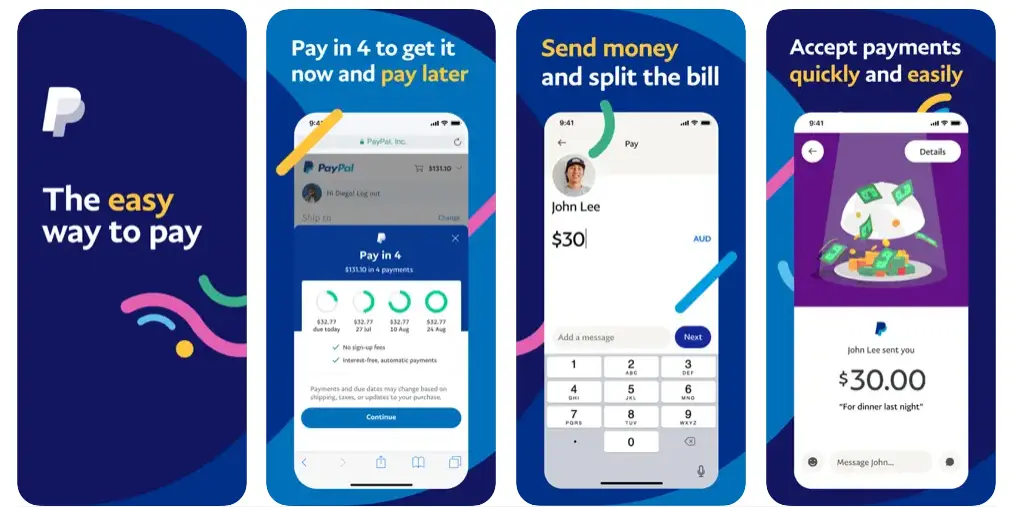

2. PayPal

While the market is filled with apps like PayPal, this OG also dominates the payment gateway world. It goes without saying, that PayPal is a widely recognized brand in the world of fintech.

Much like Stripe, PayPal offers a range of payment methods, including credit cards, debit cards, PayPal balances, and local payment options in specific regions.

As one might assume, it provides hosted checkout solutions and APIs for integration.

Charges:

Transaction fees vary depending on the transaction type and country. Typically around 2.9% + $0.30 per sale. Additional fees for currency conversion, chargebacks, and other services may apply.

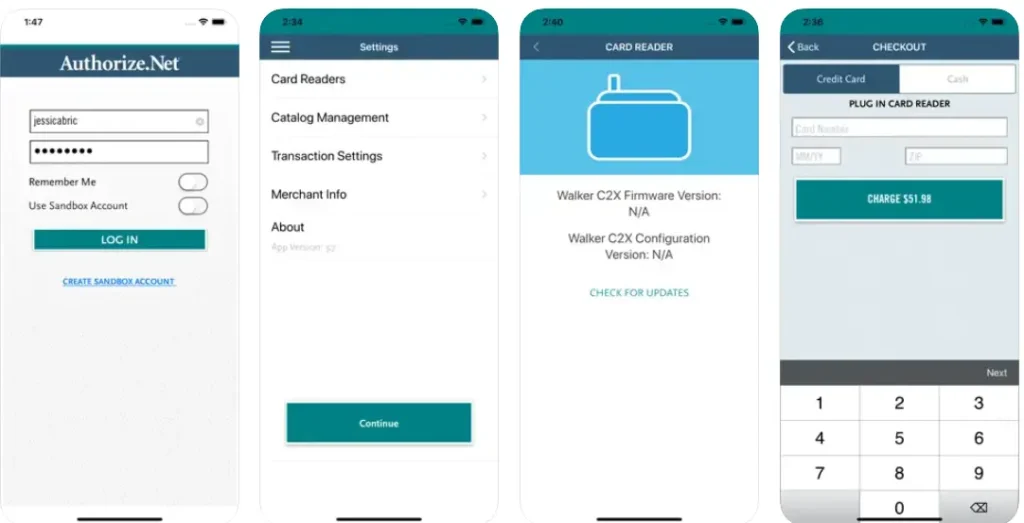

3. Authorize.Net

Let’s talk about another well-established payment gateway option, Authorize.Net.

As the name suggests, this service provider strongly focuses on security and fraud prevention area. Thus, a preferred choice for platforms looking for higher security.

It also provides all payment methods one might expect from a good payment gateway service provider, credit cards, debit cards, electronic checks, and recurring billing options.

Here too, you can get both API as well as other development tools.

Charges:

Here, the transaction fee actually depends on the account type and volume. It’s typically around 2.9% + $0.30 per transaction. Plus, there’s an additional fee for setup, PCI compliance, and other services that may apply.

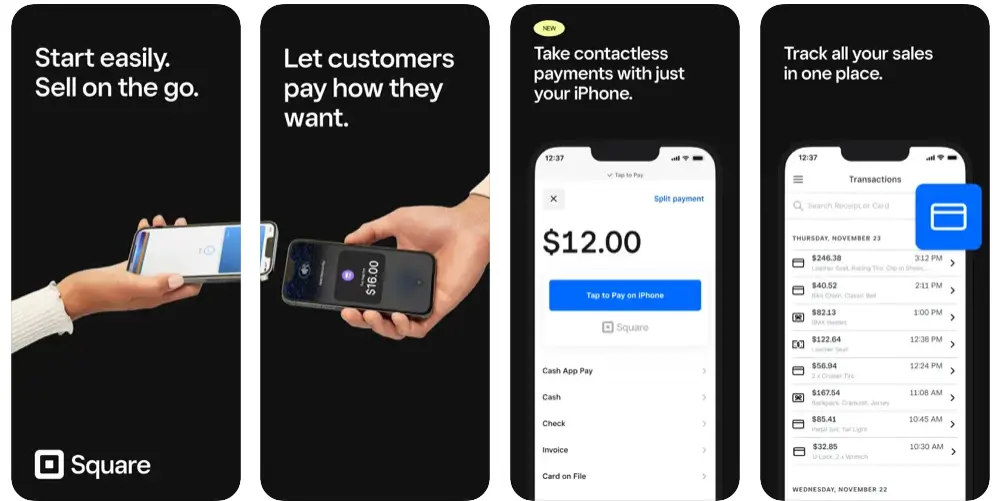

4. Square

If you don’t live under the rock, you have probably heard of the company named Square.

Well, apart from its popular payment app – cash, it also provides a Payment Gateway for brick-and-mortar businesses and others.

With this, a business can accept both online and offline payment, offering various payment methods.

Speaking of methods, Square itself provides point-of-sale hardware, mobile payment processing, and online checkout solutions.

Charges:

Transaction fee for square payment gateway is 2.6% + $0.10 per swipe for in-person transactions and 2.9% + $0.30 per online transaction. Plus, there’s an additional fee for hardware, specific features, and international transactions that may apply.

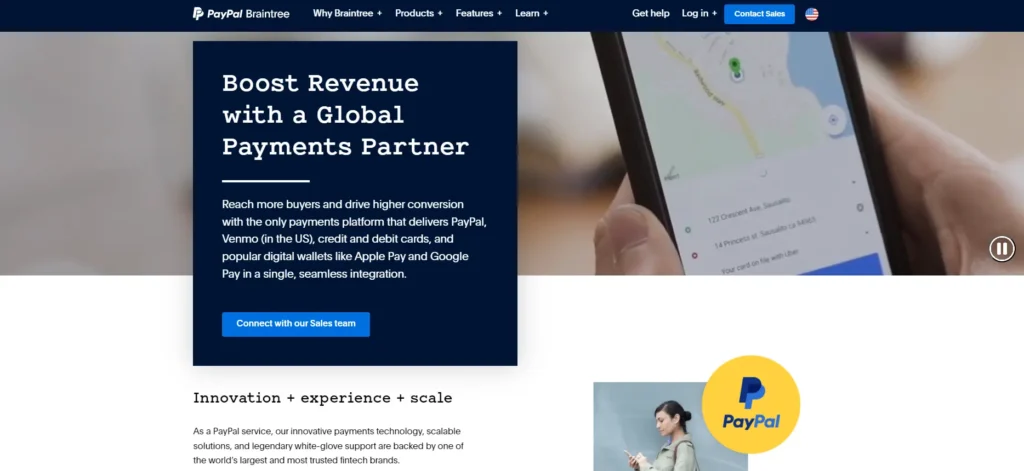

5. Braintree

Lastly, with the popular Braintree, a payment gateway service provider.

The platform is owned by PayPal and focuses more on mobile payments. Thus, making it a popular choice for eWallet app development.

It offers various payment methods, including credit cards, debit cards, PayPal, and alternative payment options.

Moreover, coming with developer-friendly tools, it provides robust APIs and SDKs for seamless integration with mobile apps and websites.

Charges:

Depending on the account type and volume, the transaction fee is typically around 2.9% + $0.30 per transaction. There’s an additional fee for setup, PCI compliance, and other services that may apply.

These are some of the popular payment gateways. But, wait, before we discuss how to integrate with the payment gateway, let’s first discuss the custom payment gateway.

Custom Payment Gateway: Should You Build It?

What if we told you, that instead of choosing from one of the top payment gateway service providers, you can also build your own payment gateway?

Yes, building a custom payment gateway is complex and resource-intensive but it comes with its own added benefits.

So, if you’re determined enough to pursue this path, here’s a general outline of the process involved:

Step 1: Planning and Requirements

When building a custom payment gateway, we start by defining the business’s needs.

That is, you need to clearly outline the functionalities you want your gateway to offer, your target audience, and transaction volume.

Plus, you also need to pay attention to fintech regulations when building a product like this. And once all of this is done, you need to…

Step 2: Partner with Development Team

Since we are talking about developing something, you need to hire dedicated developers fir for the task.

Now, in 2024, there are various ways to find developers starting from talking to local agencies to outsourcing to a fintech software development company.

In any case, once you are done with this, we move to the next step.

Step 3: Infrastructure Setup

With a development team by your side, it’s time to set up IT infrastructure.

Here’s what you need to do here:

- Choose a server:Select a reliable and secure server infrastructure to host your gateway application. Consider cloud-based solutions for scalability and redundancy.

- Database management: Design a secure database system to store transaction data, user information, and other crucial data.

- Payment processor integration: Partner with a reputable payment processor to handle the actual authorization and settlement of transactions.

Now that we are done with this, it’s finally time to develop and implement the custom payment gateway model.

Step 4: Development and Implementation

Finally putting the developers to work, we are developing and implementing the custom payment gateway system.

Here’s what you need to deal with:

- API development: Create APIs that enable merchants to integrate your gateway into their platforms for seamless payment processing.

- Payment flow implementation: Develop the logic for handling customer information, connecting to the payment processor, and managing various transaction states (authorization, settlement, etc.).

- Security measures: Implement robust security measures like encryption, tokenization, and intrusion detection systems to protect sensitive financial data.

Step 5: Testing and Deployment

With all said and done, we move it’s finally time for payment gateway integration testing and deployment.

The QA team will conduct rigorous testing to ensure your gateway functions flawlessly, handles various scenarios, and adheres to security standards.

Following this, you also need to undergo audits by relevant authorities to ensure compliance with financial regulations.

When this is done, we finally deploy your gateway and establish processes for ongoing maintenance, updates, and addressing potential security vulnerabilities.

Remember: Building a custom payment gateway is a challenging endeavor with significant risks and complexities. Carefully evaluate your needs, resources, and alternatives before embarking on this path. Consulting with fintech experts and experienced developers is highly recommended to ensure a successful and compliant implementation.

Custom Payment Gateway vs Ready-Made Payment Gateway

People often get confused between developing a custom payment gateway or choosing from the payment gateway service provider in the market.

Well, here’s how they compare.

| Features | Custom Payment Gateway | Ready-Made Payment Gateway |

| Control and Customization | High level of control over every aspect of the checkout process and branding. | Limited control: branding and layout typically follow the gateway’s design. |

| Security | Full responsibility for implementing and maintaining security measures. | Security is handled by the payment gateway provider, adhering to industry standards. |

| PCI Compliance | The sole responsibility for complying with PCI DSS and other relevant regulations. | Compliance is handled by the payment gateway provider, reducing your burden. |

| Development and Maintenance | Requires significant technical expertise and resources for development, testing, and ongoing maintenance. | No development or maintenance is required; updates and bug fixes are managed by the provider. |

| Cost | High upfront investment in development, infrastructure, and ongoing maintenance. | Typically lower costs with monthly fees or pre-transaction charges. |

| Integration Complexity | Complex integration process requiring API development and connection to payment processors. | Relatively simple integration using the provided SDKs and plugins. |

| Scalability | Scalable based on your own infrastructure and development efforts. | Scalability is potentially limited by the provider’s infrastructure. |

| Transaction Volume | Suitable for handling high transaction volumes with custom optimization. | may have limitations on transaction volume depending on the chosen provider’s plans. |

| Target Audience | Suitable for businesses with specific needs and unique requirements. | Suitable for most businesses seeking a quick and secure payment solution. |

Choosing the right option

If you are still confused about which one is for you, here’s some helpful insight.

A] Custom integration is ideal for:

- Businesses with unique payment processing needs and high transaction volumes.

- Who require complete control over branding and checkout experience.

- Businesses with the resources and expertise to manage complex development and security.

B] Ready-made solutions are ideal for:

- Businesses seeking a quick and easy setup with minimal technical expertise.

- Ones with moderate transaction volumes and standard payment processing needs.

- Businesses prioritize cost-effectiveness and reduced security burden.

How to Integrate Payment Gateway in Your App?

Now that we are done with understanding payment gateway integration meaning, how it works, different types, and much more, it’s finally time to answer the big question:

“How to Integrate Payment Gateway?”

The methods for websites and mobile apps differ a bit. So, let’s first see how you can integrate a payment gateway in the mobile app then we’ll move to the website.

Here’s how you can integrate a payment gateway in mobile app development:

1. Choose a Payment Gateway

Let’s start by choosing a payment gateway.

For this, you might need to do some research and compare different service providers. Here, you can consider their region of service, pricing, transaction fees, security measures, ease of integration, and customer support offered by the gateway

In any case, once you are done with this, we will move to the next step where we shall….

2. Set Up a Merchant Account

After selecting the payment gateway, it’s time to contact your chosen payment gateway provider and establish a merchant account.

This typically involves providing business information, undergoing verification checks, and agreeing to their terms and conditions.

3. Obtain API Credentials

Once your merchant account is set up, the gateway provider will provide you with the API credentials (keys, tokens, etc.) needed to integrate their API into your app.

And after this, it’s time to…

4. Integrate the Payment Gateway SDK

Most payment gateways offer Software Development Kits (SDKs) that simplify the payment gateway API integration process.

These SDKs provide libraries and tools specifically designed for your chosen development platform which are:

Then integrate the SDK into your app’s codebase following the gateway’s documentation and instructions.

5. Implement Payment Flow

Now, let’s develop and implement the logic within your app to handle the payment flow. Here’s what is included in this:

- Collect user payment information (card details, billing address, etc.)

- Encrypt sensitive data before transmission.

- Sending payment requests to the payment gateway using the API.

- Handling authorization responses (success or failure) and communicating them to the user.

- Processing successful transactions and displaying confirmation messages.

In any case, it’s finally time for payment gateway integration testing.

6. Testing and Deployment

As the general rule of thumb goes, it’s finally time to thoroughly test the payment integration in a sandbox environment provided by the gateway before deploying it to the live app.

This is done to ensure the payment flow functions smoothly. Once testing is complete, deploy the updated app with the integrated payment gateway.

Now that we are done with payment gateway integration in mobile applications, it’s time to go for payment gateway integration in the website.

How To Integrate Payment Gateway with Website?

It’s time to integrate a payment gateway into the website

This payment gateway integration project involves several steps, and the specific process can vary depending on the chosen gateway and the platform the website is built on.

In any case, here’s a general overview of the typical steps involved in the integration payment gateway in website development:

1. Choose a Payment Gateway

Much like payment gateway integration steps for mobile apps, for website integration, you need to choose a gateway to begin with.

Back it by researching and comparing different payment gateway providers based on factors like features, pricing, compatibility with your website platform, and region-specific requirements.

Once this is done, it’s time to set up a merchant account.

2. Set Up a Merchant Account

One of the core payment gateway integration requirements is access to the tools, for that, you need to create a merchant account.

All you need to do is contact your chosen payment gateway provider to establish a merchant account.

This typically involves providing business information, undergoing verification checks, and agreeing to their terms and conditions.

3. Obtain API Credentials

Once your merchant account is set up, the gateway provider will provide you with the API credentials (keys, tokens, etc.) needed to integrate their payment gateway integration API into your website.

4. Choose Integration Method

In this part of the payment gateway integration step-by-step process, we choose an integration method.

As we have already discussed, there are various payment gateway integration methods giving us two options when discussing websites.

They are:

- Hosted Payment Gateway: Customers enter their payment information on a secure page hosted by the gateway provider. After processing, they are redirected back to your website with confirmation.

- API-Hosted Payment Gateway: Customers enter their payment information directly on your website using an API provided by the gateway. The data is then securely transmitted to the gateway for processing.

Choose the method that best suits your needs, considering factors like security, customization, and technical expertise.

5. Implement Payment Integration

Finally, it’s time to integrate of payment gateway. Now, depending on the payment gateway integrator method you choose, there are two ways to do it.

- For Hosted Payment Gateway

Follow the provider’s instructions to generate payment buttons or links that connect to their secure payment page.

Then payment gateway integration providers have to embed these buttons or links strategically within your checkout process.

- For API-Hosted Payment Gateway:

Integrate the payment gateway’s SDK or library into your website’s codebase following their documentation and instructions.

After this, the payment gateway integration developer will develop the logic to collect user payment information, securely transmit it to the gateway API, and handle authorization responses.

6. Testing and Deployment

Thoroughly test the payment integration in a sandbox environment provided by the gateway before deploying it to your live website.

This is done to ensure the payment flow functions smoothly, handles various scenarios (errors, cancellations, etc.), and adheres to security best practices.

Once payment gateway integration testing is complete, deploy the updated website with the integrated payment gateway.

Now we are done with both of the

How To Integrate Multiple Payment Gateways?

A lot of people often ask:

“Is Multiple Payment Gateway Integration Possible?”

Well, it is. To make it easier for you, let’s discuss how to integrate two payment gateway in the same platform.

Why Integrate Multiple Payment Gateways In the Same Platform?

- Increased Payment Options: Cater to a wider audience by providing various payment methods preferred by different customers in different regions.

- Improved Conversion Rates: Allow customers to choose their preferred payment method, potentially leading to higher checkout completion rates.

- Redundancy and Failover: Mitigate risks associated with gateway outages or disruptions by having alternative options available.

Here’s the process of payment gateway integration:

1) Choose Payment Gateways

Much like any integration, the first thing you need to do is Select integrate payment gateway systems that complement each other.

Here, you need to consider factors like transaction fees, supported regions and currencies, security measures, and ease of integration.

2) Integration Methods

Now, since we are talking about steps to multiple payment gateway integration, there are actually two methods to it.

These are:

- Individual Integration: Integrate each gateway separately using their respective APIs and SDKs. This requires managing multiple integrations and potentially duplicating functionalities.

- Payment Orchestration Platform: Utilize a platform that acts as a single point of integration for multiple gateways. This simplifies the process, centralizes routing and management, and often offers additional features like transaction routing and fraud prevention.

This is by far one of the most important steps to integrate a payment gateway.

3) Implement Payment Routing

If you want to learn how to integrate 2 payment gateways, you need to decide on a strategy for routing transactions to different gateways.

This could involve:

- Manual selection: Allow users to choose their preferred gateway at checkout.

- Automatic routing: Based on factors like customer location, currency, or transaction amount.

4) Develop Integration Logic

With all said and done, it’s time to implement the chosen routing logic and handle communication with each gateway’s API.

Here, we need to ensure a seamless user experience regardless of the chosen gateway, handling error scenarios and providing clear feedback.

5) Testing and Deployment

Now that we are done with multiple payment gateway integrations, it’s time to thoroughly test the integration of each gateway and the overall payment flow in a sandbox environment.

Here are some of the important payment gateway integration test cases: verify successful transactions, routing logic, and error handling across different scenarios.

And finally, deploy the updated website or app with the integrated payment gateways.

Common Problems With Payment Gateway Integrations

It goes without saying, that even if you work with the website payment gateway integration service, there are going to be some challenges and problems.

To help you prepare for these pitfalls, we are going to look at some common problems with payment gateway integration and their solutions.

Therefore, with this being said, let’s get started:

Challenge 1: Technical Integration Issues

One of the most common issues payment gateway integration providers run into is technical integration-related issues.

What it means is, that the platform might experience errors during integration due to incorrect API implementation, missing credentials, or compatibility issues with your platform.

So, how do we solve this? Here’s how:

Solution:

- Double-check your code: Ensure it adheres to the payment gateway’s documentation and uses the correct API calls and parameters.

- Verify credentials: Confirm that you’re using the appropriate API keys and tokens provided by the gateway.

- Test thoroughly: Utilize the gateway’s sandbox environment to identify and resolve integration errors before deploying to production.

- Seek support: Contact the payment gateway’s developer support team for assistance with troubleshooting specific issues.

Challenge 2: Payment Declines

Payment decline is one of the most common payment gateway integration-related issues.

What happens here is that transactions are frequently declined due to various reasons like insufficient funds, invalid card information, or fraud prevention measures.

Here’s how to resolve this payment gateway issue:

Solution:

- Implement robust validation: Ensure users enter accurate and complete payment information during checkout.

- Partner with a reliable fraud prevention service: This can help identify and block suspicious transactions while minimizing false positives.

- Offer alternative payment methods: Provide options like digital wallets or local payment methods to cater to customers facing card-related issues.

- Analyze declined transactions: Review decline codes and reasons provided by the gateway to identify patterns and potential improvements.

Challenge 3: Security Concerns

Let’s look at some payment gateway security issues related to integration.

These are, data breaches or vulnerabilities in your integration exposing sensitive customer information. Now, these are super common and here’s how you deal with it:

Solution:

- Prioritize security: Implement robust security measures like data encryption, tokenization, and secure communication protocols (HTTPS).

- Maintain PCI compliance: Adhere to Payment Card Industry Data Security Standards (PCI DSS) to ensure secure handling of cardholder data.

- Regularly update software: Keep your website, app, and payment gateway integrations updated with the latest security patches.

- Conduct security audits: Schedule regular penetration testing and security audits to identify and address potential vulnerabilities.

Challenge 4: Complex Integration and Maintenance

When we are moving towards more complex platforms, it can be challenging on its own.

In layman’s terms, managing multiple payment gateway integrations can be time-consuming and require ongoing maintenance.

While this is a big issue, here’s how you can deal with this.

Solution:

- Consider payment orchestration platforms: These platforms centralize integration and management of multiple gateways, simplifying the process.

- Automate tasks: Look for solutions that offer automated updates, error notifications, and reporting functionalities.

- Document your integration: Maintain clear documentation of your integration process and configurations for future reference and troubleshooting.

Challenge 5: Lack of User-Friendly Checkout Experience

Lastly, we have a complex checkout experience.

You see, one of the main goals of payment gateway integration is to make the process easier and seamless for the end customer.

However, whenever it becomes too confusing or a cumbersome checkout process, it can lead to cart abandonment and lost sales.

Solution

- Simplify the checkout flow: Minimize the number of steps required to complete a transaction.

- Offer clear instructions and error messages: Guide users through the process and provide informative feedback in case of errors.

- Optimize for mobile devices: Ensure a smooth checkout experience on all devices, including smartphones and tablets.

- A/B test payment gateway integration designs: Test variations of your checkout page to identify what works best for your users.

These are some of the major payment gateway integration challenges. Now that we are done with all of this, it’s finally time to look at the cost part.

Payment Gateway Integration Cost

So, how much does it cost to integrate a payment gateway in an app or website?

While the average payment gateway integration cost ranges from $5,000 to $50,000, it can vary significantly depending on several factors, making it difficult to provide a definitive answer.

However, here’s a breakdown of the typical cost components and factors that influence them:

- Setup fees: Some payment gateways charge one-time setup fees for establishing a merchant account and activating their services.

- Monthly fees: Many gateways have monthly subscription charges that provide access to their platform and basic functionalities.

- Transaction fees: These are pre-transaction charges applied to each successful payment processed through the gateway. Fees typically range from 2% to 3.5% of the transaction amount, with additional charges for specific payment methods or features.

- Development costs: Integrating the payment gateway into your website or app might require development work. The cost depends on the complexity of the integration, the chosen platform, and whether you do it yourself or hire developers.

- Additional fees: Some gateways might charge additional fees for features like chargebacks, refunds, currency conversion, or PCI compliance assistance.

Plus, there are several factors that come into play, for instance, the payment gateway chosen, Transaction volume, Integration complexity, and development expertise. payment methods offered, Region and currency, and so on.

If you are looking for an accurate payment gateway integration price, it’s highly recommended that you consult a payment gateway integration service provider.

Nimble AppGenie, A Fintech Development Company Here To Help You

Do you want to integrate a payment gateway into your app or website securely, or want to develop a custom payment gateway?

Dealing with all things payment gateway-related can be super complex.

So why not leave it to the best fintech software development company around? Nimble AppGenie as a market leader in the fintech niche is here to help you.

With over 7 years of experience in developing fintech systems that disrupt the market, we know how to solve your problem.

If you have a payment gateway integration project that you need help with, our payment gateway integration developers are here to help and contact us today.

Conclusion

Payment gateway integration has become an essential component across different niches of mobile apps and web solutions.

The credit for this goes to the growing need for fintech infrastructure and the increasing popularity of digital payments. Now, if you want to be part of a future where money is digital, it’s the right time to make your solution digital payment-friendly.

Whether you choose to integrate existing payment gateway from some of the top fintech companies or develop your own unique one tailored to your business needs, you need a good tech partner.

FAQs

Payment gateway integration is the process of connecting your website or app to a payment gateway service. This allows customers to enter their payment information securely and process transactions electronically.

There are four main types of payment gateway integration:

- Hosted Payment Gateway: Customers are redirected to a secure page hosted by the gateway provider to enter their payment information.

- API-Hosted Payment Gateway: Customers enter their payment information directly on your website, but the processing happens through an API provided by the gateway.

- Self-Hosted Payment Gateway: Customers enter their payment information on your website, and the entire transaction is processed on your servers.

- Local Bank Integration Gateway: Connects your platform directly to local banks or payment networks in specific regions.

The right method depends on your technical expertise, customization needs, security considerations, and target audience.

- Hosted and API-hosted options are easier to integrate for businesses with limited technical resources.

- API-hosted or self-hosted options offer more control over the checkout experience.

- Merchants must ensure PCI compliance and data security regardless of the chosen method.

- Consider the preferred payment methods of your customers, especially if you cater to specific regions.

- Authorization: Verifies customer payment information and checks for sufficient funds.

- Capture: Collects authorized funds from the customer’s account.

- Sale: Combines authorization and capture into a single step for immediate fund collection.

- Refund: Returns funds to the customer in case of cancellations, returns, etc.

- Void: Cancels an authorized transaction before it’s captured.

Here’s how it works:

- Customer initiates purchase and enters payment information.

- Payment gateway securely collects and encrypts the information.

- Gateway performs fraud checks and transmits information to the merchant’s acquirer.

- Acquirer communicates with the issuing bank for verification and authorization.

- Customer receives notification of approval or decline.

- If approved, funds are transferred from the customer’s account to the merchant (typically within a few days).

Some of the top payment gateway service provider are, as mentioned below:

- Stripe

- PayPal

- Net

- Square

- Braintree

Building a custom gateway is complex, resource-intensive, and best suited for established businesses with significant expertise and resources. It requires navigating regulations, ensuring robust security, and maintaining ongoing compliance.

Here’s how you can integrate payment gateway in mobile app:

- Choose a payment gateway and set up a merchant account.

- Obtain API credentials.

- Integrate the payment gateway SDK following the provider’s instructions.

- Implement the payment flow within your app.

- Thoroughly test and deploy the app with the integrated gateway.

The process is similar to app integration, but you can choose between hosted and API-hosted methods:

- Hosted: Embed payment buttons or links that redirect customers to the gateway’s secure page.

- API-Hosted: Integrate the gateway’s SDK and develop logic to collect, transmit, and handle payment information.

Integrating multiple gateways offers wider payment options and redundancy but adds complexity. You can choose:

- Individual integration: Manage separate integrations for each gateway.

- Payment orchestration platform: Centralize integration and management through a single platform.

Here’s are some of the common payment gateway integration issues:

- Technical integration issues

- Payment declines

- Security concerns

- Complex integration and maintenance

- Lack of user-friendly checkout experience

While average cost ranges from $5,000 to $50,000, it depends highly on the:

- Setup fees, monthly fees, transaction fees

- Development costs

- Additional fees

- Factors like transaction volume, payment methods offered, region, and currency

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.