The fintech market is booming, and people have questions.

Which country is leading the world in fintech? What is the market size of fintech apps? How many fintech companies are there? The list goes on.

If you too are interested in the lucrative fintech app market and want to learn more, here’s where we shall be discussing all the fintech app statistics. Covering everything from fintech market size and top fintech apps to fintech startup statistics and much more.

2025 – An Era of Fintech Uses

By 2025, real-time payments are expected to become the standard for international transaction systems and will be driven by innovations in central bank digital currencies and by innovations in blockchain.

♦ Key Fintech Statistics: Take Away

- The global fintech app market is further expected to be worth $305 billion by the year 2025. This further represents a compound annual growth rate of 20%. Researchers have expected that the AI-enabled segment within the market to grow 21% within the next 5 years.

- Additionally, the digital asset market is further projected to have a revenue growth of 38% in the year 2025.

♦ Top Fintech Companies & Apps

The market capitalization of Visa has a market cap of $547 billion in the year 2024, with an average of 64% of consumers adopting fintech services globally, and in the United States, the average is 46%.

Additionally, the tech giants are better equipped to meet the consumer’s banking needs compared to traditional financial institutions.

Established FinTech Niche: eWallet, Mobile Wallet, Loan Lending Statistics

The market valuation of fintech apps was valued at $258.83 billion in 2025.

► eWallet Statistics

A recent study shows that the number of mobile wallet users globally could increase by 2.7 to 4.8 billion by the year 2025, which represents almost half of the world’s population.

► Loan-Lending Statistics

The loan-lending app growth in 2025 is projected to be an average of 5.9% increase, which prompts a surge in the mortgage origination volume from $1.68 trillion to $2.155 trillion.

► Mobile Banking Statistics

The estimated user base of mobile banking apps could reach 80 million by the year 2028.

With that out of the way, it’s time to look at fintech app statistics and gain important insight.

Key FinTech Statistics: Take Away

- As of 2023, the global fintech sector is valued at $179 billion, driven by 30,000 startups. In China, 90% of citizens embrace fintech banking, while globally, the financial sector is anticipated to reach $26.5 trillion by 2022, boasting a 6% CAGR.

- Visa leads the fintech landscape, commanding a valuation nearing half a trillion USD. Fintech unicorns, numbering 48, hold a market share surpassing $187 billion, constituting over 1% of the worldwide financial industry.

- A 2015 Goldman Sachs study suggests potential disruption of up to $4.7 trillion in traditional financial services revenue by fintech. Notably, 60% of credit unions and 49% of U.S. banks recognize the importance of fintech partnerships.

- Digital payments have emerged as the dominant fintech product, claiming 25% of the market share. The Nasdaq lists 463 fintech-related stocks, reflecting the sector’s significance in the global market.

- By Q2 2022, Asia will contribute 24% of global fintech deals, ranking second only to the U.S. in deal volume. More than 90% of fintech companies globally leverage artificial intelligence and machine learning.

- More than 60% Credit Unions and 49% of Banks have put their trust in our fintech partnerships

Top FinTech Apps & Companies with Their Statistics

The market is filled with top fintech apps that are generating billions in the market and top companies that are making even more.

Well, in this section of the fintech app data statistics, let’s look at the top apps and companies.

1. Chime

Chime is among the best banking apps in the market, let’s go through some Chime statistics to gain insight.

- Chime is projected to achieve a robust revenue of $3.16 billion in 2023.

- With a valuation of $25 billion in 2021, Chime stands as a significant player in the financial tech landscape.

- Boasting an estimated user base of 21.6 million in 2023, Chime continues to attract a large audience.

- Chime’s user demographic is female, constituting 61.24%, with males comprising 38.76%.

- The age group of 35-44 years represents the largest chunk of Chime’s users at 27.62%.

2. Robinhood

Who doesn’t want to create a platform like Robinhood? Well, let’s see how well it is doing with Robinhood statistics:

- Robinhood faced a valuation drop from $20 billion in 2021 to under $8 billion in 2022.

- The platform boasted 22.5 million verified users in 2021 and is expected to exceed 20 million in the coming years.

- With a significant user base increase, Robinhood reported $959 million in revenue in 2020.

- Robinhood was recently valued at $20 billion pre-IPO, reaching $40 billion in secondary share valuation.

- The average age of a Robinhood user is 31, with an average transaction size of around $500.

3. Coinbase

Coinbase is an absolute example of a potential cryptocurrency app development. Let’s see what Coinbase statistics show us:

- Coinbase Global Inc. reported 56 million verified users as of August 2023 and is aiming for 150 million by year-end.

- 6.1 million users do monthly transactions on Coinbase.

- The crypto exchange reached a valuation of $18 billion in 2022.

- Coinbase recorded a robust revenue of $3.1 billion in 2022, accompanied by a $2.6 billion annual loss.

- Coinbase, with over 3,400 employees, serves 9 million active users who transact monthly.

4. Acorns

As one of the best money-making apps out there, Acorns wins every fintech report. Let’s see what the Acorn statistics do.

- Acorns boasts over 6.5 million users, experiencing rapid growth from 49.8K in 2014.

- With assets under management (AUM) exceeding $6.3 billion, Acorns has become a major player in the Robo-advisor industry.

- The estimated average account size on Acorns reached $957 in Q1 2023, reflecting users’ growing investment portfolios.

- Despite a valuation dip to $1.9 billion in 2022, Acorns’ innovative features and user-friendly interface contribute to its fintech prominence.

- The projected 2023 revenue of $309 million showcases Acorns’ financial resilience, driven by subscription-based models and diverse revenue sources.

5. N26

N26 statistics below give us a great insight into the fintech startup statistics.

- N26 experienced a 30% year-on-year revenue increase, reaching €130 million in 2020.

- Over seven million individuals utilize N26’s services across 24 countries.

- The most recent valuation for N26 stands at $9 billion, supported by Third Point Ventures and Coatue Management.

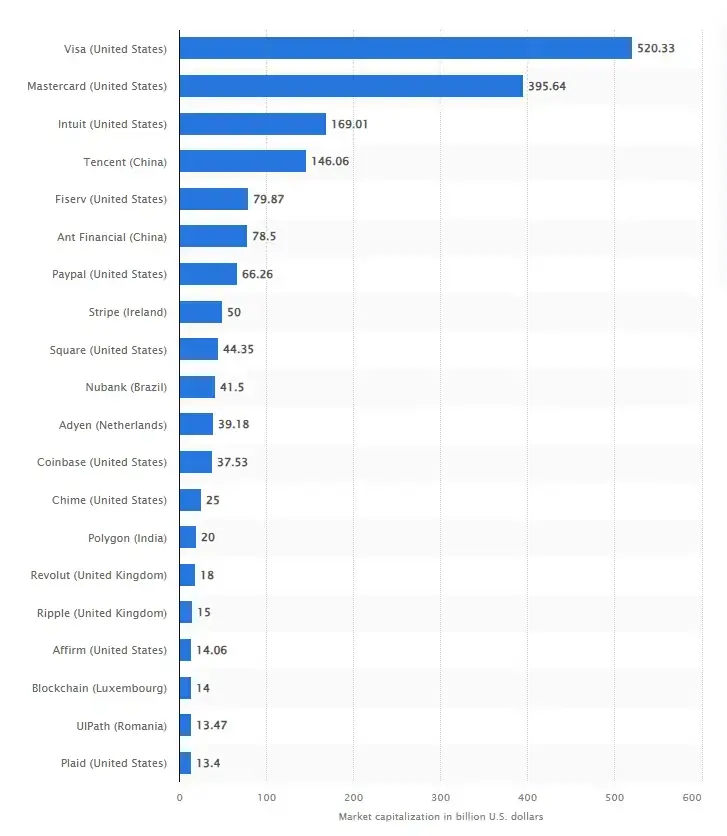

Market Capitalization of Fintech Companies

The market capitalization of Visa has a market cap of $547 billion in the year 2024, with an average of 64% of consumers adopting fintech services globally, and in the United States, the average is 46%.

A survey of the respondents by Forbes represented that a significant majority (74.4%), is likely to use financial products offered by prominent tech figures.

Additionally, tech giants are better equipped to meet consumers’ banking needs than traditional financial institutions.

- Visa stands as the fintech giant, reigning supreme with an impressive market cap of $500 billion.

- Following is Mastercard, securing the second spot with a large valuation of $389 billion.

- Over 25 fintech companies have achieved the coveted “Decacorn” status, surpassing the $10 billion valuation mark.

- The United States dominates the fintech landscape, housing half of the top 20 companies by market cap.

- Of the top 20, nine fintech powerhouses hail from the United States, showcasing the country’s fintech prowess.

- China, with only two companies in the top 20, claims the third and fifth positions based on market cap.

- The United Kingdom hosts two fintech companies within the elite top 20.

- Other countries making their mark include Ireland, Brazil, the Netherlands, India, Israel, Singapore, and Luxembourg, each contributing one fintech company to the prestigious list.

FinTech Market Size

Fintech statistics paint a vivid picture of the ever-growing fintech market size. Let’s look at some growth statistics showing why everyone wants to invest in this market.

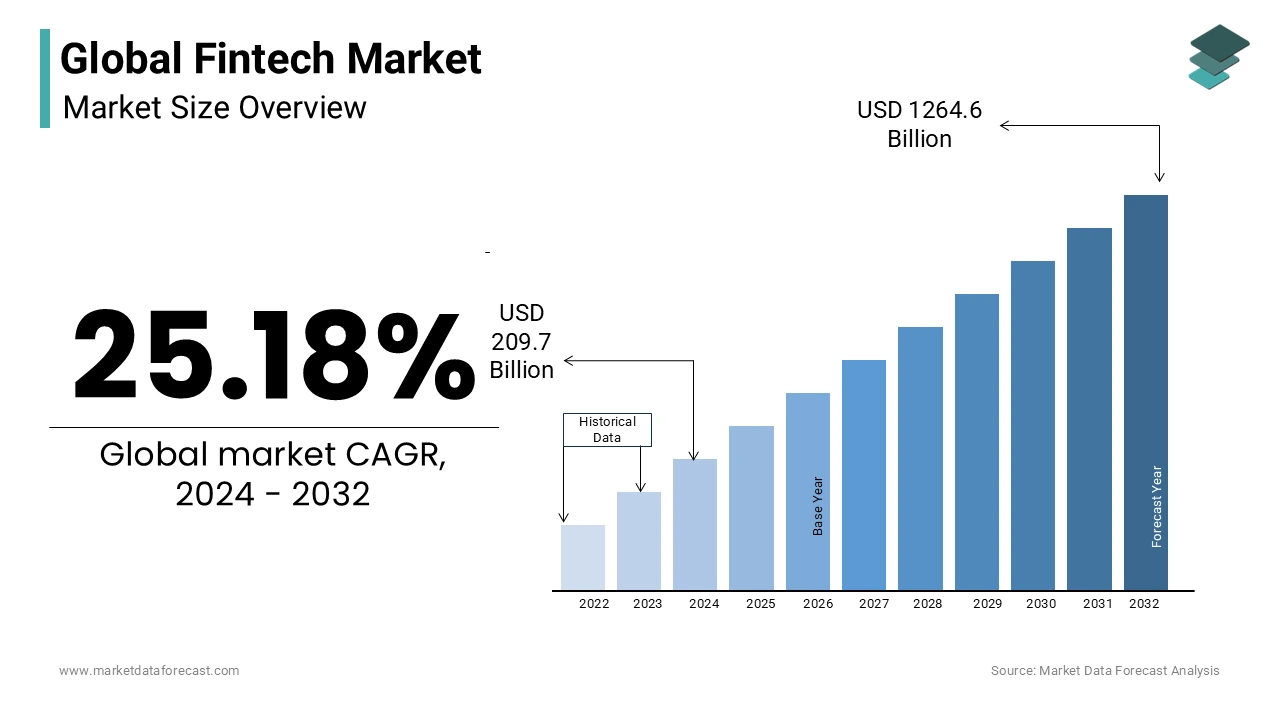

♦ What is the market size of fintech apps? FinTech’s Path to $492 Billion by 2028

Projections reveal an impressive growth trajectory for the fintech industry, with expectations to reach a remarkable fintech market size of $492 billion by 2028, driven by a robust CAGR of 16.8%.

This outlook reflects not only sustained fintech growth but also the industry’s crucial role in defining the future of global financial services.

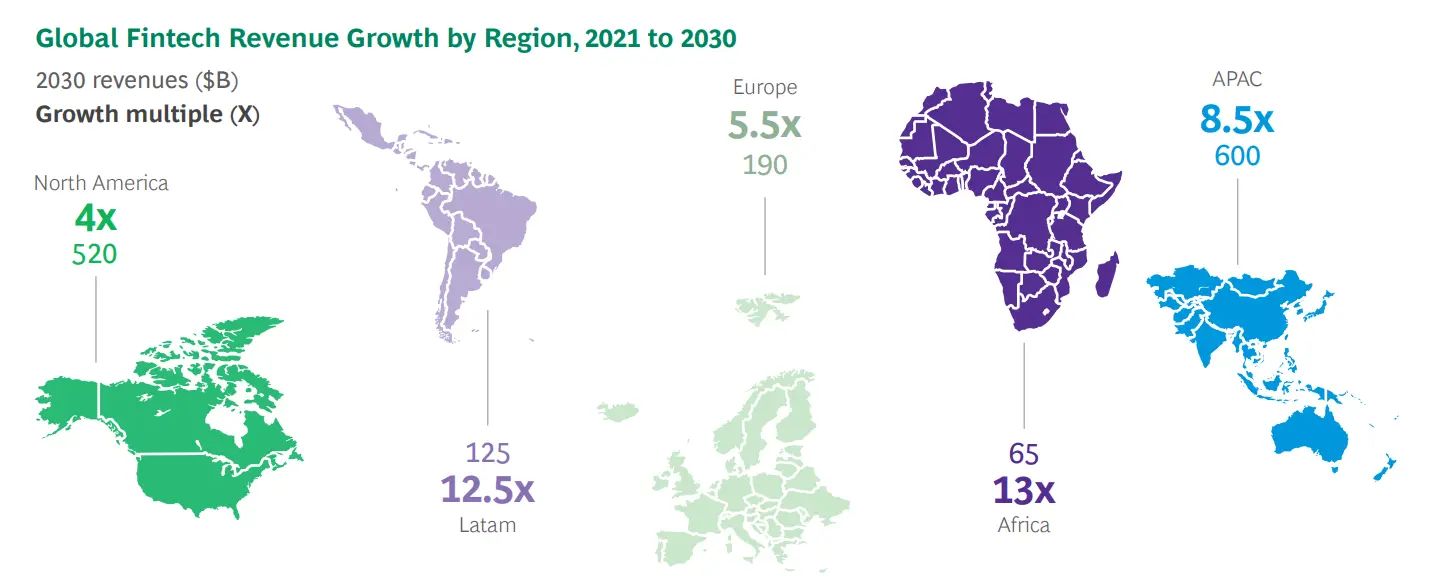

♦ Global FinTech Revenue Surges, Doubles

The global fintech industry has experienced remarkable expansion, witnessing a substantial increase of over 100% from around $90.5 billion in 2017.

Fintech statistics highlight the industry’s transformative journey and its substantial contribution to the broader financial landscape.

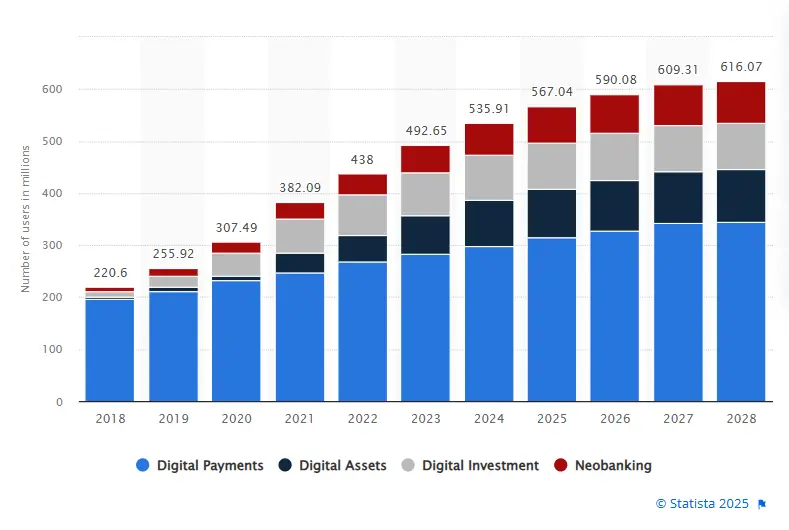

♦ Neobanking Segment to Hit $9.2 Trillion by 2027

The ‘Neobanking’ segment within the fintech market is poised for continued growth, forecasted to achieve a transaction value of 9.2 trillion U.S. dollars by 2027. This projection underscores the increasing significance of neo-banking solutions and their substantial impact on the overall fintech ecosystem.

♦ Digital Payments Market Predicted to Peak at $14.78 Trillion

A closer look at the fintech forecast period until 2028 unveils fluctuating trends in transaction value across fintech segments.

Notably, digital payments have emerged as a frontrunner, projected to achieve a peak transaction value of 14.78 trillion U.S. dollars.

This highlights the evolving preferences and growing prominence of digital payment solutions within the industry.

♦ Global Market Statistics Tell Us That While the Market is $179 Billion, It Will Reach $324 Billion By 2028

It is no secret that, following recent fintech growth statistics, the market is one of the largest in the world.

To be specific, the market today is worth more than $179 Billion as of today, which is amazing. But we have something better for you.

Well, in the next few years, by the end of 2028 to be specific, the fintech market will be worth $324 as per Statista.

♦ FinTech Growth Statistics Show 5,480 Million Users By 2027

The Digital Payments market is anticipated to witness significant user growth, with an expected total of 5,480 million users by the year 2027.

The global fintech industry report highlights the widespread adoption and increasing popularity of digital payment solutions on a global scale.

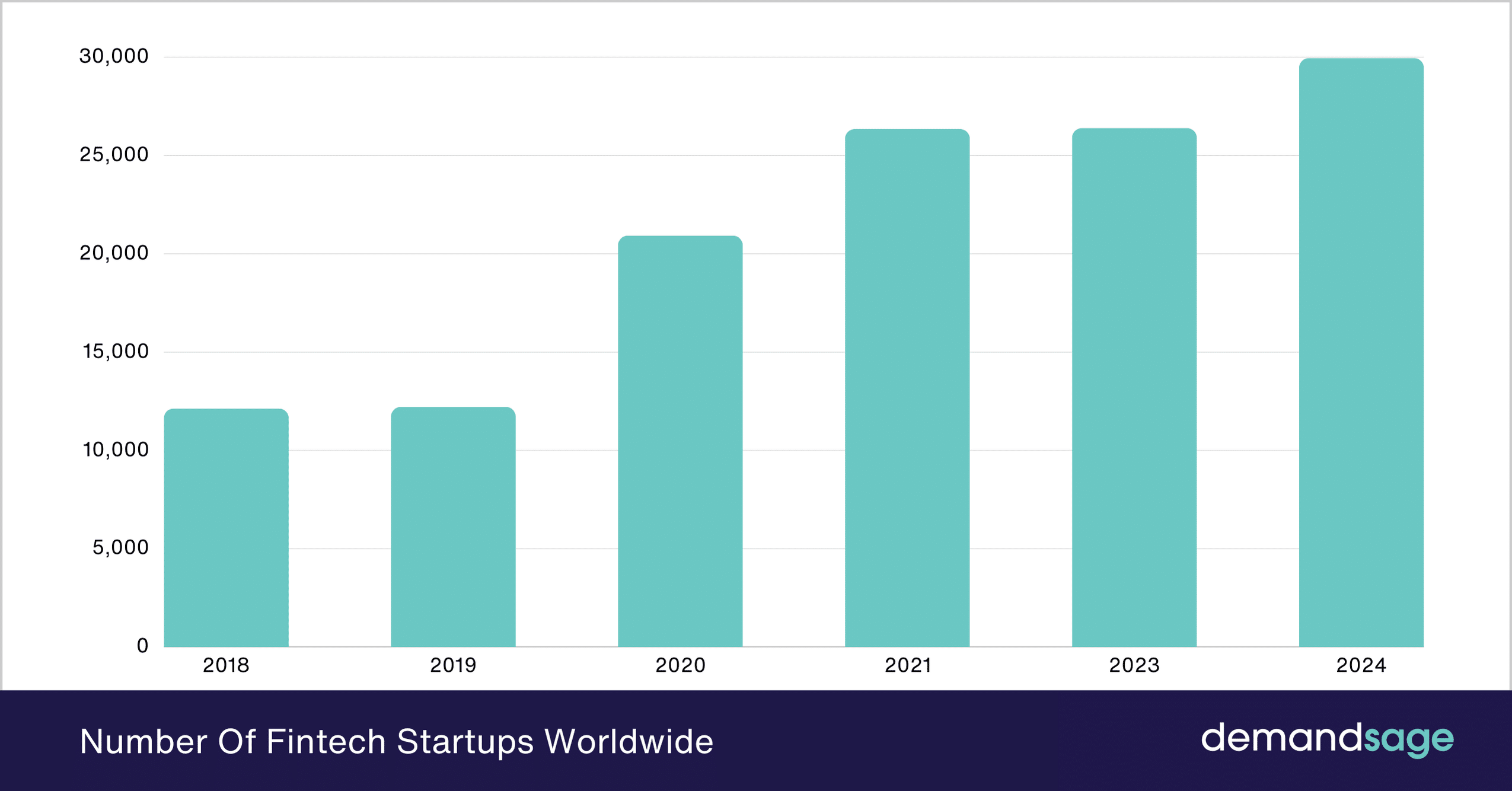

♦ How Many FinTech Companies Are There? 30,000 in 2024

The fintech industry has experienced staggering growth in recent years, reaching 30,000 companies globally in 2024.

♦ More Than 90% of People Are Using Mobile Payments

This is one of the most interesting fintech statistics that you can read.

Do you know how many people or smartphone users are utilizing mobile payments?

Well, as of this year, more than 90% of smartphone users are using eWallet payment services in their day-to-day lives.

And the best part is, that this number is growing as we discuss the matter.

FinTech Startups Statistics

The market is filled with fintech ideas for startups. But what do the fintech startup statistics tell us? Well, we will be discussing that in this section of the fintech report.

[A] FinTech Startup Numbers Hit 30,000

Fintech Startup Statistics from Exploding Topics shows us that there are a total of 30,000 fintech startups today.

Most of these startups are based around payments, lending, and investment.

This clearly shows how there are so many people who want to create their own fintech solutions app for start-ups.

[B] The average age of a FinTech Founder is 34 years old

Did you know that most fintech founders are middle-aged?

Well, fintech statistics from various sources show us that the average age of a fintech founder is no more than 34 years.

This shows that the fintech industry is being driven by a new generation of entrepreneurs.

So, if you have an idea for a fintech app, go ahead and reach out to an app development company that can help you convert it to reality.

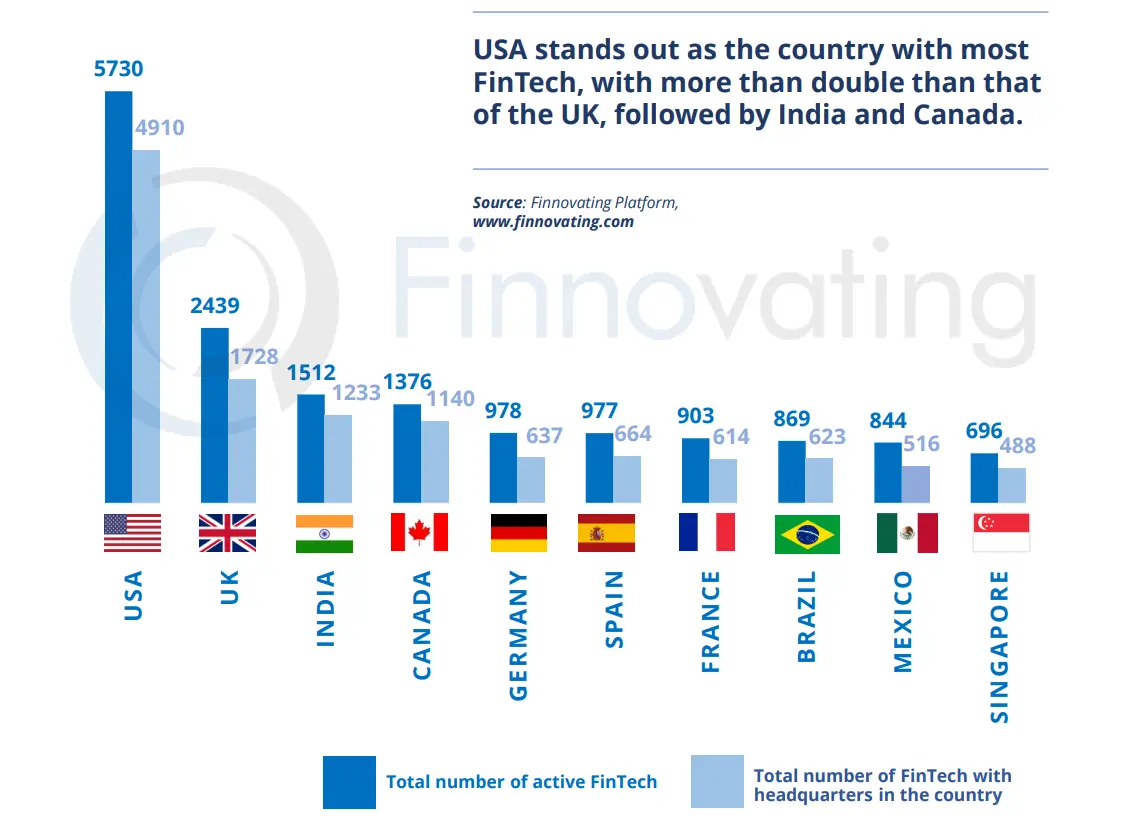

[C] 11,651 Startups as of 2023, Showing US FinTech Statistics

As of 2023, there are 11,651 fintech startups based in the United States, reflecting the country’s vibrant and diverse fintech ecosystem. This is affected by the size of the US fintech market.

This large number underscores the United States’ position as a leading hub for innovation and entrepreneurship in the financial technology sector.

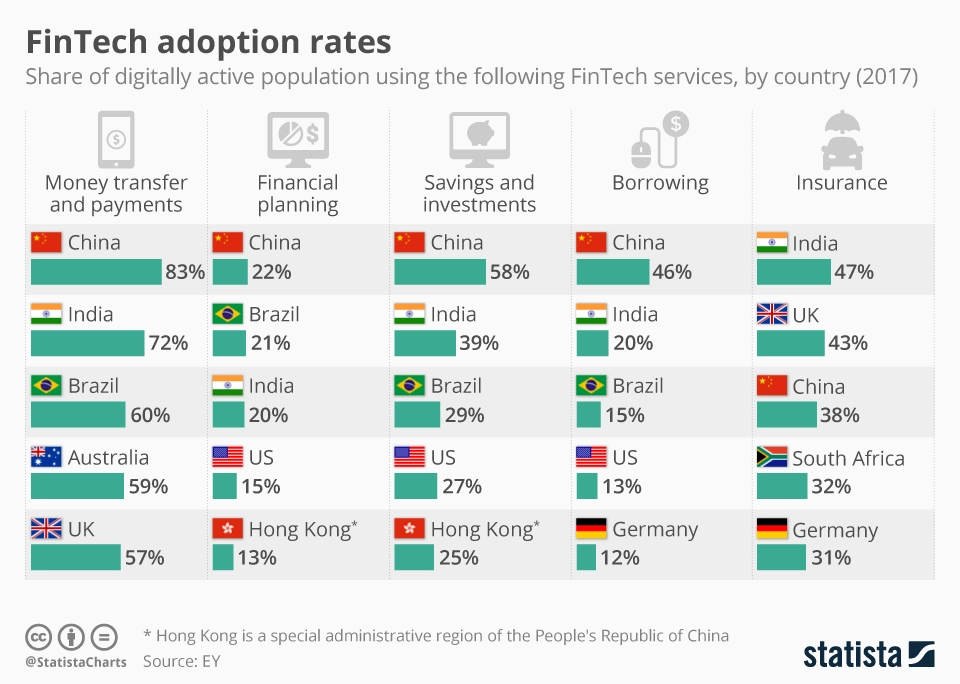

FinTech Adoption Statistics

Are you looking for fintech adoption statistics? Well, we will be discussing all about fintech adoption rates across the world in this section.

♦ US saw 54% in 2019, exceeding $26 billion in the investment deal value

In 2019, the fintech market in the United States experienced a large surge in investment, reaching over $26 billion.

Fintech data statistics reflect the increasing confidence and financial backing of the sector, showcasing its significance in the overall market.

♦ Banks have adopted chatbots to reduce costs, with predictions estimating savings of $7.3 billion by 2023.

In response to the need for efficiency and cost reduction, banks embraced chatbots, anticipating savings of $7.3 billion in 2023 shows fintech data statistics.

The strategic integration of technology not only enhances operational efficiency but also positions chatbots as a cost-effective solution for financial institutions

♦ FinTech Integrated Into Operational Strategies of More Than 48% Financial Businesses

Half of financial institutions have embraced fintech, integrating it into their operational strategies.

These fintech growth statistics emphasize the sector’s growing influence in reshaping traditional financial services and underscore its integral role in modern banking operations.

♦ 15 Unicorn FinTech Companies in India Attracting Investment of $8 Billion in 2021

In 2021, the Indian fintech ecosystem saw remarkable growth, yielding 15 unicorns valued at over $1 billion each. Thanks to the growing popularity of UPI payment app development.

The total investment of $8 billion underscores the robust investor confidence and the thriving innovation in India’s fintech sector.

♦ 9.6% CAGR, making the market worth $37 billion by 2026, shows The FinTech Global Market Report 2022

The financial services market is poised for large growth, with a projected CAGR of 9.6%.

By 2026, the market is expected to reach a value of $37 billion, reflecting ongoing expansion and opportunities within the global fintech landscape.

♦ FinTech firms surged from $48.9 billion in 2020 to $131.5 billion in 2021 in Global VC investment

The fintech sector experienced a remarkable influx of venture capital, escalating from $48.9 billion in 2020 to an impressive $131.5 billion in 2021.

This substantial increase underscores the attractiveness and growth potential of fintech innovations in the eyes of investors.

♦ 1 in 10 holds some type of cryptocurrency

Cryptocurrency adoption is becoming widespread, with one in ten individuals holding some form of digital currency.

AI-based Fraud detection systems reduce fraud investigation time by 70% and also increase accuracy by 90%.

The integration of AI-powered fraud detection systems showcases the industry’s commitment to enhancing security measures, reducing investigation time, and improving accuracy.

♦ The worldwide fintech market is projected to reach $188 billion by 2024

Fintech market statistics show significant growth, expanding from a valuation of $90.5 billion in 2017 to a projected $188 billion by 2024.

This trajectory signifies the industry’s evolution and increasing relevance in the global financial landscape.

♦ North America accounted for 56.3% of global fintech VC funding in Q1 2021

In the first quarter of 2021, North America emerged as the dominant force in fintech venture capital funding, securing 56.3% of the global funding, according to US fintech statistics.

This underscores the region’s leadership and attractiveness for investors in the fintech startup ecosystem.

♦ 90% of Chinese citizens use fintech banking, payment, and financial management solutions

China leads in fintech adoption, with a staggering 90% of its citizens utilizing fintech solutions for banking, payments, and financial management.

This fintech statistic reinforces China’s frontrunner position in embracing financial technology across various sectors.

♦ In the US, personal loan agreements using fintech have increased by 33%, while 65.3% of the population uses digital banking as of 2022

Fintech’s impact is evident in the US, with a significant increase in personal loan agreements and a growing percentage of the population adopting digital banking.

The shift towards digital financial services continues to reshape the banking landscape in the United States.

♦ Number of FinTech Companies by Country

The global fintech map is dotted with a diverse array of companies, with the US and China as clear frontrunners. The US takes the top spot with over 8,000 fintech firms, while China boasts a vibrant scene of around 5,000.

Europe, with its bustling tech hubs in the UK and Germany, contributes 4,000, highlighting its innovation prowess.

Established FinTech Niche: eWallet, Mobile Wallet, Loan Lending Statistics

Fintech accounts for the entire financial industry. And as we know, it can be divided into different categories.

This is what gives us the different areas of fintech, or what you call fintech business models. Please see the same below:

1. eWallet Statistics

With fintech statistics suggesting the eWallet market will hit USD 489.3 Billion by 2030, this is one of the largest categories of fintech.

So, what are eWallets?

Well, eWallets are the virtual counterpart of your physical wallet that allows you to send money, receive it, access your bank account, top up, pay bills, and much more.

Speaking of which, let’s look at some key eWallet statistics.

- The global eWallets market is expected to reach $3.5 trillion by 2025.

- Asia-Pacific region is the largest eWallet market in the world

- The most popular eWallets in the world include AliPay, PayPal, Apple Pay, and Google Pay.

- A recent study predicts that the number of mobile wallet users globally could increase by 2.7 to 4.8 billion by the year 2025, representing almost half of the world’s population.

This is one of the biggest reasons why everyone wants to create an eWallet app.

2. Loan Lending Statistics

Loan lending app development is a simple yet popular and effective fintech concept.

As the name suggests, loan lending apps allow users to avail of a soft loan without the long and tiring process of its traditional counterpart.

- The global loan lending market is expected to reach $138 trillion by 2025.

- The US loan market is worth an estimated $35 trillion, and it is growing at a rate of 5% per year.

- P2P Lending Fintech Platform, worth only $3.5 Billion in 2013 is forecasted to reach $1 Trillion by 2025.

- The United States is the largest lending market in the world.

- The loan-lending app growth in the year 2025 is projected an average of 5.9% increase, which prompts a surge in the mortgage origination volume from $1.68 trillion to $2.155 trillion.

3. Mobile Banking Statistics

Mobile banking app development is one of the most popular concepts in fintech. This is one of the main contributors to the growth of the fintech industry as a whole.

These apps are what would happen if you converted the online banking concept into a mobile application. And there are of these today, including popular ones like Bank of America.

- The global mobile banking market is expected to reach $3.6 trillion by 2025.

- The Asia-Pacific region is the largest mobile banking market in the world. China, India, and Southeast Asia are the leading countries in the region for mobile banking adoption.

- The most popular mobile banking features include account balance checking, bill payment, and money transfers.

- The estimated user base of mobile banking apps could reach 80 million by the year 2028.

With that out of the way, and before we dive into fintech statistics, let’s look at the top emerging fintech sectors.

Global FinTech Industry Report: Emerging FinTech Segments

Fintech is a broad industry. Various fintech reports show various new niches gaining popularity. So let’s see what the global fintech industry report says.

► InsurTech Statistics

Do you want to launch an insurance app?

With the growing popularity of InsurTech App Development, some do. Let’s look at the insurtech statistics.

- The InsurTech sector is poised to hit $26.8 billion by 2027, with a robust 12.7% CAGR, according to Statista.

- Parametric insurance and P2P platforms tackle underinsured areas like cyber risk and climate change, driving alternative risk transfer solutions.

- InsurTech startups are bridging the insurance gap in developing nations with mobile-based solutions and micro-insurance products.

- Stricter regulations loom as concerns about data privacy and algorithmic bias grow, prompting increased scrutiny of InsurTech companies.

► Artificial Intelligence in FinTech

AI solution development has become a popular concept and has been adopted by various industries, including fintech startups and established companies.

Here are several applications of AI in fintech, leading to ever-growing fintech spending statistics:

- Banking-related chatbot interactions are set to grow by a staggering 3,150% from 2019 to 2023.

- Robo-advisors are anticipated to manage assets totaling $2 trillion by 2024.

- Over the next decade, AI is poised to power 95% of all customer interactions, reflecting a consumer preference for machine interactions over human interactions.

- AI technologies are projected to boost labor productivity by up to 40% by 2035.

- Artificial intelligence has the potential to increase industry profitability by an average of 39% by the year 2035.

► WealthTech Statistics

WealthTech is a new concept within the ever-growing Fintech global market. Let’s look at some related fintech statistics.

- The global robo-advisor market is set to hit $514.6 billion by 2027, reflecting the widespread adoption of automated investment platforms.

- WealthTech startups democratize wealth management by providing low-cost and user-friendly financial planning tools to a broader audience.

- The rise of ESG investing is fueling growth in WealthTech platforms offering sustainable and ethical investment options.

- Fierce competition is driving consolidation and partnerships between traditional financial institutions and WealthTech companies.

► RegTech Statistics

One of the fastest-growing fintech segments, let’s learn how RegTech is changing the fintech market.

- The RegTech market is projected to reach $30.9 billion by 2027, boasting an impressive CAGR of 24.8%, as per Mordor Intelligence.

- RegTech automates KYC/AML processes, transaction monitoring, and regulatory reporting, enhancing efficiency and reducing costs.

- Rising cyber threats propel the demand for RegTech solutions, focusing on data breach prevention, fraud detection, and identity verification.

- Governments can foster collaboration by introducing regulatory sandboxes for testing and implementing innovative RegTech solutions.

► Blockchain-Powered FinTech

Blockchain development has been powering the fintech industry to reach new heights. Let’s see how this technology powers up fintech statistics.

- Globally, 24% of people are familiar with blockchain technology.

- Blockchain and regtech are among the fastest-growing segments in the fintech industry.

- The blockchain technology market is projected to reach US$20 billion by 2024.

- The peer-to-peer (P2P) digital lending market, valued at US$43.16 billion in 2018, is expected to reach US$567.3 billion by 2026 with a CAGR of 26.6%.

Competitive Analysis: FinTech Market

Finally, it’s time to compare some of the top fintech segments, starting with eWallet apps, NeoBanking Apps, and more.

| Segment | Market Share | Growth Projections | Key Players | Competitive Advantages | Challenges and Opportunities |

| Digital Payments | 25% | Strong growth | Visa, Mastercard, PayPal, Apple Pay, Google Pay | Superior user experience, global reach, and established partnerships | Regulation, financial inclusion, cybersecurity |

| Neobanking | Rapidly growing | $9.2 trillion in transaction value by 2027 | Chime, N26, Revolut, Starling Bank | Lower fees, personalized financial tools, and a mobile-first approach | Regulation, financial inclusion, and customer acquisition costs |

| Lending Fintech | Diverse and growing | $138 trillion global market size by 2025 | Upstart, Affirm, Klarna, Zopa | Faster loan approvals, flexible repayment options, and data-driven credit scoring | Regulatory compliance, risk management, and responsible lending practices |

| RegTech | Growing support for compliance demands | $55.2 billion market size by 2027 | Jumio, Fenergo, ThetaLogic, ComplyX, | Streamlined compliance processes, reduced costs, improved risk management | Data privacy concerns, integration challenges, and evolving regulations |

| WealthTech | Emerging | $16.4 billion market size by 2026 | SoFi, Stash, Personal Capital, M1 Finance | Innovative investment tools, AI-powered portfolio optimization, and financial education | Customer acquisition costs, competition from established wealth managers, data privacy concerns |

| Insurance Technology (InsurTech) | growth, disrupting traditional industries | $285 billion global market size by 2025 | Lemonade, Clover Health, Oscar Health, Root | Personalized insurance models, data-driven risk assessment, streamlined claims processing | Regulatory hurdles, customer trust, and building brand awareness |

| Mobile Banking | Integrated within Neobanking and Digital Payments | Strong adoption in developing markets | Apple Pay, Google Pay, Samsung Pay, M-Pesa | Convenient access to banking services and increased financial inclusion | Data security risks, dependence on mobile infrastructure, and digital literacy gap |

| eWallet | Within Digital Payments, gaining traction | High adoption of contactless payments and mobile-first spending | Alipay, WeChat Pay, Apple Pay, Google Pay | Secure and convenient transactions, loyalty programs, integration with other financial services | Privacy concerns, competition from traditional banks, and potential for fraud |

Nimble AppGenie, A FinTech App Solutions Specialist For You

Do you have app ideas that you want to bring to reality?

Well, whether you want to build an eWallet, digital wallet, or mobile wallet, we have got you covered.

Nimble AppGenie, being a renowned fintech app development company, knows how to create a fintech app that people love. Don’t believe us? Our work speaks for itself:

Pay By Check– Pay by Check is a popular e-wallet mobile app in the United States of America. It allows users to transfer, pay, or even exchange currency.

SatPay– An eWallet platform is a versatile eWallet solution that allows you to request, receive, and send payments without hassle.

CUT– an E-wallet Mobile App, CUT is available in China and Myanmar. It works well with both RMB and MMK currencies.

SatBorsa– a Currency Exchange Fintech app. SatBorsa is one of the platforms that is available on both platforms, iOS and Android.

Recognized by platforms like DesignRush, TopDevelopers, GoodFirms, and Clutch, we have the right tools and hands-on experience for 350+ projects and add to 97% client satisfaction.

If you want to hire mobile app developers who can convert your ideas into reality, we are here to help you.

Conclusion

The fintech app’s statistics show unprecedented growth, with a current valuation of $179 billion and projections indicating it will reach $492 billion by 2028.

The sector is driven by innovative startups, with 30,000 contributing to its value. Key players like Visa, Chime, and Coinbase lead the landscape, while digital payments claim a significant market share.

Fintech startup statistics show more than 30,000 globally, reflecting the industry’s dynamism, and emerging segments such as InsurTech, AI in fintech, WealthTech, and RegTech are reshaping the financial landscape.

As the industry continues to evolve, it presents lucrative opportunities for both investors and entrepreneurs.

FAQs

As of 2023, the global fintech sector is valued at $179 billion, driven by approximately 30,000 startups.

Visa leads the fintech landscape with a valuation nearing half a trillion USD. Additionally, there are 48 fintech unicorns with a market share surpassing $187 billion.

Digital payments claim 25% of the fintech market share, and the Nasdaq lists 463 fintech-related stocks, highlighting the sector’s significance.

The current valuation of the fintech industry is $194 billion, and projections suggest it will reach $492 billion by 2028 with a CAGR of 16.8%.

The global fintech industry has experienced over 100% growth since around $90.5 billion in 2017. The neo-banking segment is forecast to achieve a transaction value of 9.2 trillion U.S. dollars by 2027.

The fintech market is projected to reach $324 billion by 2028. The Digital Payments market is anticipated to have 5,480 million users by the year 2027.

There are a total of 30,000 fintech startups globally. The average age of fintech founders is no more than 34 years.

The market size of fintech apps is continually evolving, but as of recent statistics, the global fintech sector is valued at $179 billion, with projections indicating it will reach $324 billion by 2028.

The United States is a prominent leader worldwide in the fintech industry, with a significant number of fintech startups and a dominant presence of top fintech companies. The U.S. houses nearly half of the top 20 fintech companies by market cap.

Fintech app retention averages 73% after 30 days, but drops after. To boost it, focus on onboarding, personalizing features, engaging users, and gathering feedback. This helps build trust and value, leading to loyal customers.

The fintech market in the United States is large, reflecting the country’s vibrant and diverse fintech ecosystem. As of 2023, the fintech market in the U.S. has experienced significant growth, with 11,651 fintech startups based in the country. North America, including the U.S., accounted for 56.3% of global fintech VC funding in Q1 2021, indicating the region’s leadership in fintech investment.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.