Are you looking for the top fintech mobile apps?

Well, you aren’t the only one; with the growing infrastructure and easier virtual finance, fintech apps are growing like anything.

To make sure you aren’t missing out on anything, we shall take you through a list of the best fintech apps of 2025, discussing their features, availability, and more.

Let’s get right into it, starting with:

Fintech Apps Statistics: Modern Money

Everyone either wants to build a fintech app or has a few of them on their phone.

But why, what’s the reason behind such popularity in the market? Well, rather than explaining, let’s look at the fintech app statistics for a deeper dive.

These are, as mentioned below:

- The global fintech market is valued at a whopping $179 billion as of 2023 and is expected to grow at a CAGR of 12.8% until 2027.

- There are approximately 30,000 fintech startups around the world constantly innovating and disrupting the financial landscape.

- The number of fintech users globally is projected to reach 1 billion by 2027, with segments like neo banking experiencing significant growth.

- The average fintech deal size stands at $18.7 million, showcasing continued interest in this dynamic sector.

- Mobile wallet transactions are expected to surpass $18 trillion globally in 2023, highlighting the shift towards cashless transactions.

- The global insurtech market is poised to reach $101 billion by 2025, fuelled by personalized insurance offerings and AI-powered claims processing.

So, with the basic landscape of the fintech market down in your mind, it’s time to look at the top fintech apps 2025 has to offer.

21+ Fintech Apps in 2025

The market is filled with apps like PayPal, and this raises the question: which are the best fintech apps?

Well, you aren’t going to miss out on anything, for we are going to discuss the top fintech apps that you can get your hands on in 2025.

So let’s get right into it, starting with.

Banking & Payments

Start a list of top fintech apps with mobile banking and eWallet app examples.

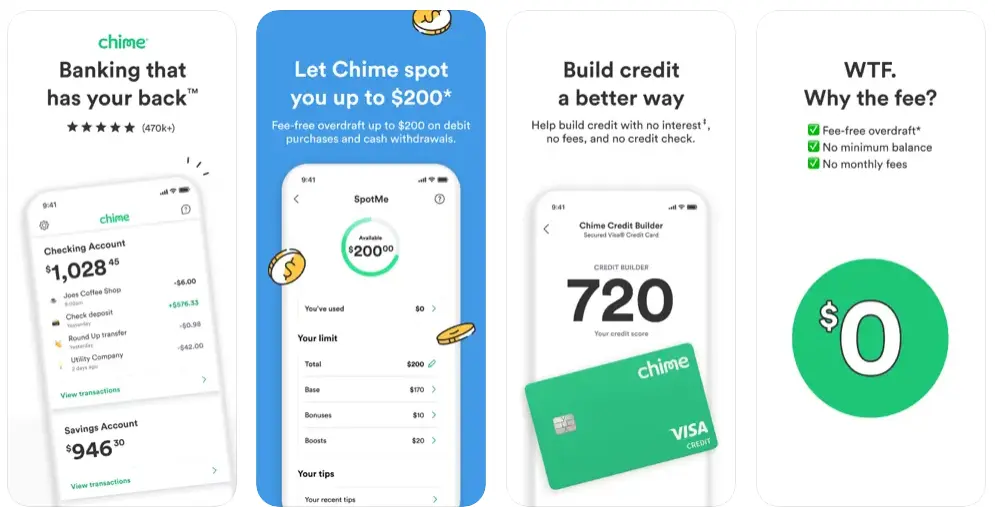

1. Chime

Let’s start with the best mobile banking app, Chime.

Innovative mobile-first banking with fee-free overdrafts and early paycheck access, it’s a well-known name in the fintech market.

Chime is revolutionizing the way you manage your finances. Think of it as your hassle-free banking buddy.

With this fintech app, you can wave goodbye to hidden fees and say hello to a smoother banking experience. It’s all about making your life easier.

Plus, you get daily balance notifications and real-time transaction alerts, keeping you in the loop without the traditional banking fuss.

And the best part?

Chime’s SpotMe feature lets you overdraft without fees. It’s like having a friend who’s got your back during those “oops” moments in your financial journey.

That’s what makes it one of the top picks on this list of the best fintech apps.

Features

- Fee-free banking: No monthly fees, minimum balance requirements, or foreign transaction fees.

- Early Direct Deposit: Get paid up to 2 days early with eligible direct deposits.

- SpotMe overdraft protection: Overdraft up to $200 fee-free (with qualifying direct deposit).

- Mobile-first banking: Manage your account easily through the Chime app.

- Automatic savings goals: Set goals and automate transfers to reach them faster.

| Downloads | Rating | Available |

| Over 10 million | 4.8 stars (iOS), 4.7 stars (Android) | iOS, Android |

2. Nubank

Second on the list of the best fintech apps, we have Nubank, Brazil’s popular neobank offering free and transparent banking services.

Nubank is a game-changer in the fintech world, and here’s why: it’s all about simplifying your financial life.

This digital bank brings a refreshing twist to your banking experience, with no complex fees and a user-friendly app that keeps you in control.

Imagine managing your finances with just a few taps on your phone – that’s Nubank for you.

Plus, their customer service is top-notch, always there to help without the long wait times. It’s like having a financial guardian angel right in your pocket, making Nubank a go-to choice for hassle-free banking.

From a technical POV, this platform is an example of what you can achieve with Neobank app development.

Serving as inspiration for many top fintech startups.

Features

- Free international transfers: Send and receive money in over 50 currencies without fees.

- Credit card with rewards: Earn cashback on eligible purchases with the Nubank Mastercard.

- No annual fees: No membership or annual fees for any Nubank accounts or cards.

- Simple and transparent pricing: Easy-to-understand fees with no hidden charges.

- 24/7 Customer Support: Get help anytime you need it through chat, email, or phone.

| Downloads | Rating | Available |

| Over 10 million | 4.8 stars (iOS), 4.7 stars (Android) | iOS, Android |

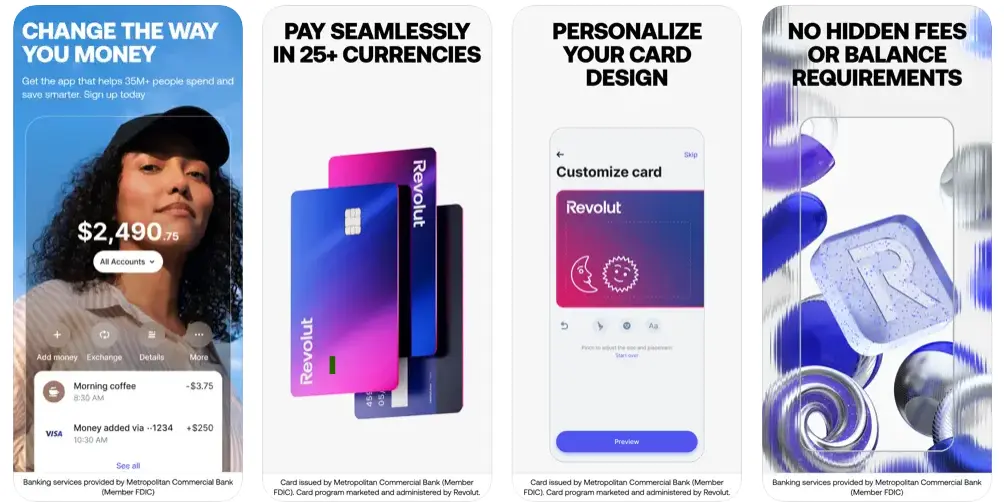

3. Revolut

Are you looking for multi-currency spending, global transfers, and investment options in a single app?

We have got you covered, let us introduce Revolut.

It is your passport to managing money globally. Whether you’re a traveller or love shopping from international stores, Revolut makes currency exchange a breeze.

Say goodbye to pesky fees and hello to real-time exchange rates. Plus, its budgeting tools help you keep your spending in check.

It’s like having a savvy financial advisor in your pocket, making Revolut a must-have for the modern money manager.

The ability to transfer money internationally is what makes it one of the best cross-border money transfer apps.

Features

- Global spending and currency exchange: Spend and hold 28 currencies in your Revolut account.

- International money transfers: Send and receive money internationally with low fees.

- Investment options: Invest in stocks, ETFs, and cryptocurrencies directly from your Revolut app.

- Virtual cards and subscription management: Generate secure virtual cards for online purchases and manage subscriptions easily.

- Travel insurance and other benefits: Get access to travel insurance, airport lounge access, and other perks with premium plans.

| Downloads | Rating | Available |

| Over 20 million | 4.6 stars (iOS), 4.5 stars (Android) | iOS, Android |

4. N26

We have another neobanking app, the N26.

As a European neobank known for its sleek design, fee-free ATM withdrawals, and instant cards, there are high chances you have probably heard of it.

The pinnacle of banking app development is redefining mobile banking in Europe and beyond. It’s sleek, secure, and super user-friendly.

With N26, you get real-time alerts on your spending, free ATM withdrawals, and innovative budgeting features.

It’s like having your financial control centers on the go, offering a smooth and transparent banking experience. Perfect for those who want their bank in their pocket, without the traditional banking hassles.

Features

- Mobile-first banking with a sleek design: Manage your account and make payments through the user-friendly N26 app.

- Free ATM withdrawals worldwide: No fees for ATM withdrawals anywhere in the world.

- Multiple account types: Choose from different account types to suit your needs, including joint accounts and metal accounts with additional perks.

- Subcategories and budgeting tools: Track your spending in detail and set budgets to stay on top of your finances.

- Instant card replacement: Get a new card instantly if yours is lost or stolen.

| Downloads | Rating | Available |

| Over 5 million | 4.2 stars (iOS), 4.3 stars (Android) | iOS, Android |

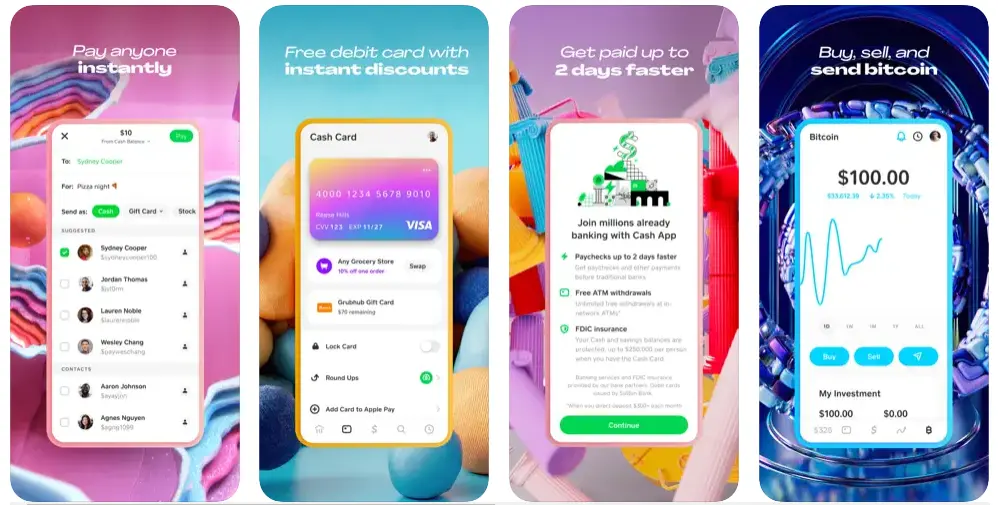

5. Square Cash App

Today, every fintech startup wants to build an app like Cash! That’s just how famous our 5th fintech app is.

We are talking about the Cash app from Square.

Peer-to-peer payments, integrated investing, tax-free “boost” for early deposits, you name it, the app has covered it.

Cash App is more than just a way to send and receive money; it’s the pinnacle of eWallet app development.

Here’s your go-to for quick and easy financial transactions. Split bills, pay friends, or receive payments with just a few taps.

Plus, its investing features let you dabble in stocks and Bitcoin, making it a versatile tool for the financially curious.

It’s simple, fast, and hassle-free – perfect for today’s on-the-go lifestyle.

Features

- Send and receive money instantly: Easily transfer money to friends and family for free.

- Direct deposit: Get your paycheck up to 2 days early with direct deposit.

- Cash Boost program: Earn bonus cash back on eligible purchases at certain retailers.

- Investment options: Invest spare change in Bitcoin through the Cash App.

- Mobile payment options: Pay businesses and individuals directly through the Cash App.

| Downloads | Rating | Available |

| Over 100 million | 4.8 stars (iOS), 4.7 stars (Android) | iOS, Android |

Investing & Trading

With investment and trading being such a popular niche in recent times, let’s look at apps that let users tap into that.

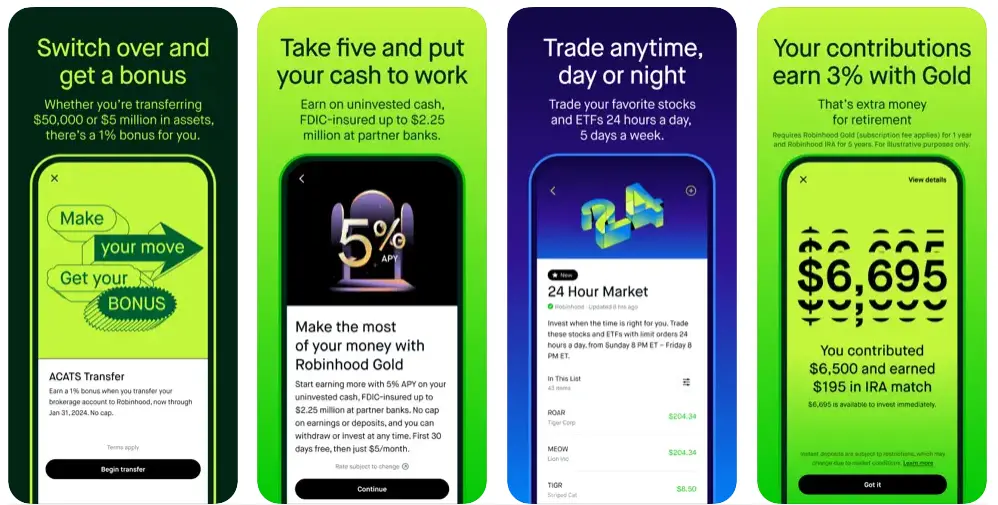

6. Robinhood

Stepping into the investing and trading category of fintech apps, the first one we have is Robinhood.

Robinhood is a gateway to investing for everyone and lives up to its name, offering commission-free stock and crypto trading with a user-friendly interface.

Its user-friendly platform demystifies the stock market, making investing accessible to novices and pros alike.

Buy and sell stocks, ETFs, and cryptocurrencies without paying commissions.

With Robinhood, you’re not just investing; you’re joining a movement toward financial inclusivity and empowerment.

In fact, the app is so famous that whoever wants to build an investment platform, Robinhood, is the inspiration behind it.

Features

- Commission-free stock & ETF trading: Buy and sell most stocks and ETFs with no trading fees.

- Fractional shares: Invest in stocks with any amount of money, even less than the price of one share.

- Margin investing: Access leverage to amplify your potential returns (but also increases risk).

- Cryptocurrency trading: Buy and sell popular cryptocurrencies like Bitcoin and Ethereum.

- News and research: Stay informed with market news and research tools within the app.

| Downloads | Rating | Available |

| Over 100 million | 4.2 stars (iOS), 4.1 stars (Android) | iOS, Android |

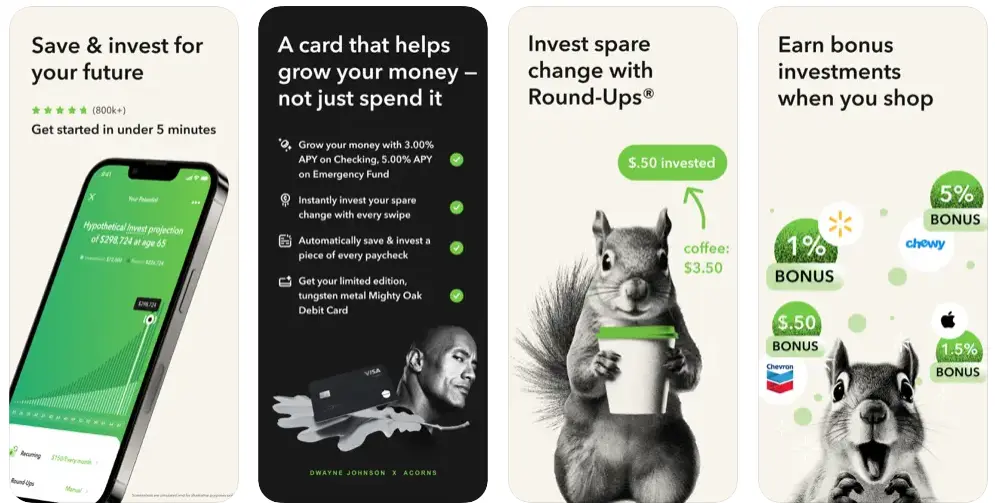

7. Acorns

One of the best fintech apps, Acorns, is a micro-investing app that rounds up purchases and invests spare change.

This is a financial wellness application that helps users get the most out of their investment money. They offer video tutorials and helpful videos, as well as financial advisory blogs.

Also to, as one of the top money-making apps, it allows the customers to deposit or withdraw funds as they like. It has also been part of the Forbes Fintech 50 list.

So, in simple words, it not only allows you to invest but helps you do it better. So, if you are new to the world of investment, this app is for you.

Features

- Micro-investing: Round up your daily purchases to invest your spare change automatically.

- Automated investing: Choose from pre-built portfolios or customize your own based on your risk tolerance and goals.

- Recurring investments: Set up automatic contributions to your Acorns account regularly.

- Retirement accounts: Invest in retirement through IRA and Roth IRA options.

- Educational resources: Learn about investing through articles, quizzes, and other educational content.

| Downloads | Rating | Available |

| Over 10 million | 4.7 stars (iOS), 4.6 stars (Android) | iOS, Android |

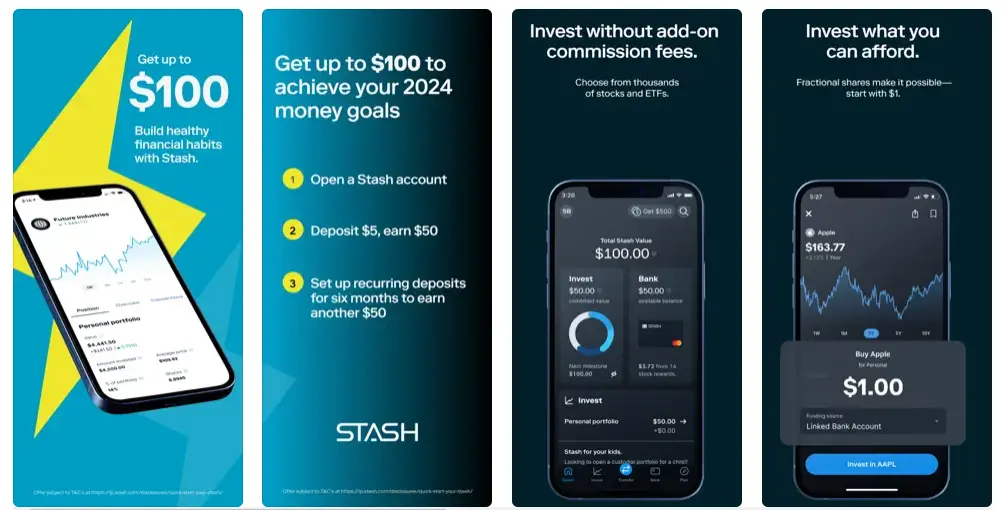

8. Stash

This is what happens when you convert one of the best fintech ideas into reality.

We’re talking about Stash, a robo-advisor with customizable investment themes and socially responsible portfolio options.

In layman’s terms, it’s all about personalized investing.

As one of the top fintech apps of 2025, it allows you to start small and learn as you go, making it ideal for beginners.

In addition to this, you can invest in themes you care about, from clean energy to tech innovation. It’s an app that not only helps grow your money but also aligns with your values and interests.

Features

- Themed stock slices: Invest in curated baskets of stocks aligned with specific themes like “Tech Innovators” or “Climate Champions.”

- Automated investing: Build a diversified portfolio with recurring investments based on your goals and risk tolerance.

- Stockback rewards: Earn Stash Rewards points on eligible purchases, which can be redeemed for fractional shares of stock.

- Financial Education: Access articles, courses, and tools to learn about investing and personal finance.

- Roth IRA accounts: Invest for retirement with a Roth IRA choice.

| Downloads | Rating | Available |

| Over 5 million | 4.6 stars (iOS), 4.5 stars (Android) | iOS, Android |

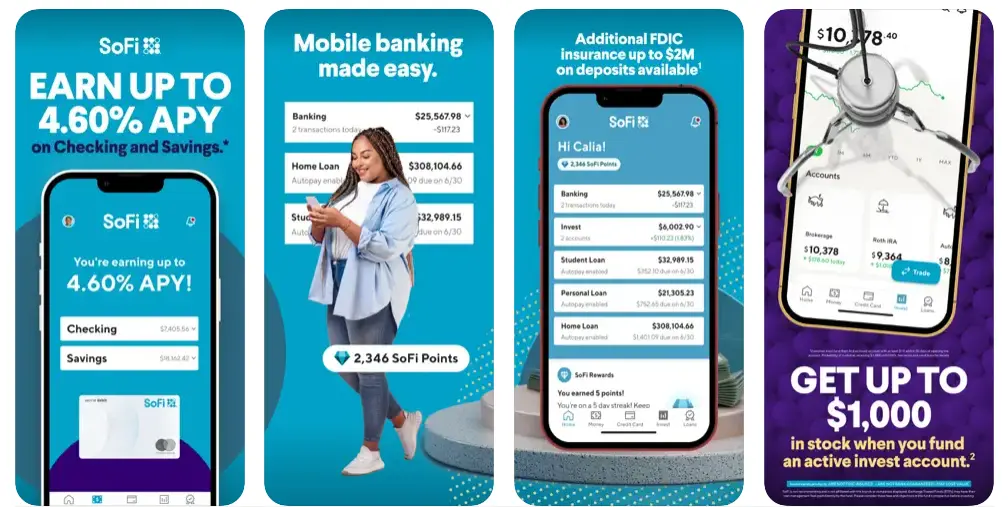

9. SoFi Invest

Ever wondered why so many people want to develop a stock trading app, suddenly?

Well, the inspiration behind the trend is, SoFi invests.

It is for the modern investor.

Whether you’re into stocks, ETFs, or crypto, SoFi makes investing straightforward and commission-free.

With its robo-advisor feature, you get customized investment recommendations based on your goals and risk tolerance. It’s like having a financial planner in your pocket, but without the hefty fees.

Features

- Stock & ETF trading: Buy and sell stocks and ETFs with low commission fees.

- Fractional Shares: Invest in any stock with any amount of money.

- Cryptocurrency trading: Buy and sell Bitcoin and Ethereum within the SoFi app.

- Automated investing: Create a customized portfolio and invest on autopilot.

- Financial advice: Access guidance from SoFi financial advisors (may involve additional fees).

| Downloads | Rating | Available |

| Over 5 million | 4.4 stars (iOS), 4.3 stars (Android) | iOS, Android |

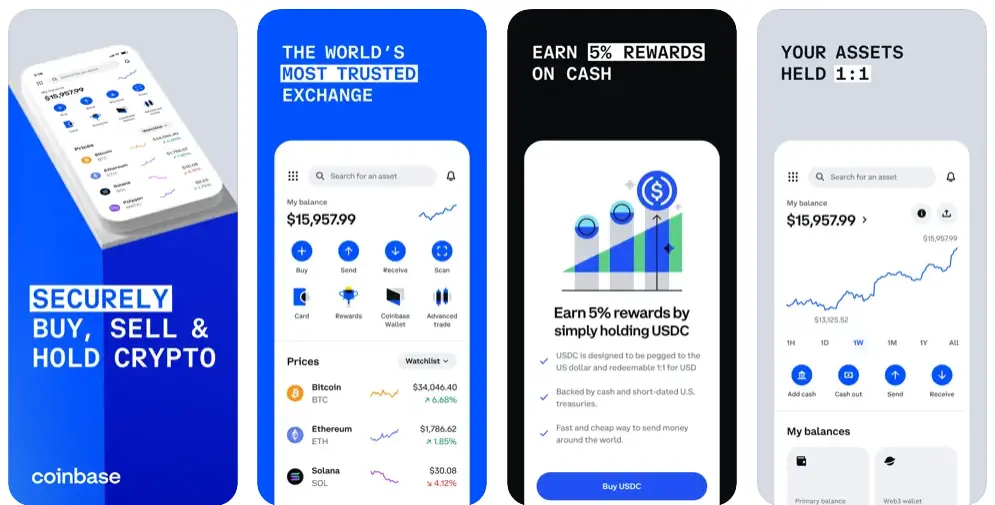

10. Coinbase

Next up on our list of the best fintech apps for 2025, we have Coinbase.

Coinbase is your trusted gateway to the world of cryptocurrency. It’s a secure platform where you can buy, sell, and manage your crypto portfolio.

With user-friendly features and robust security measures, Coinbase is perfect for both crypto newbies and seasoned traders.

Dive into the digital currency space with confidence, knowing Coinbase has got your back.

However, if you are an investor considering building a cryptocurrency app, this also serves as a great guiding example for the same.

Features

- Buy and sell cryptocurrencies: Trade over 200 cryptocurrencies, including Bitcoin, Ethereum, and several stablecoins.

- Recurring purchases: Set up automatic purchases of cryptocurrency regularly.

- Earn crypto rewards: Earn interest on your crypto holdings with various staking and lending options.

- NFT Marketplace: Buy, sell, and trade non-fungible tokens (NFTs) on the Coinbase NFT platform.

- Educational resources: Learn about cryptocurrency through articles, tutorials, and explainer videos.

| Downloads | Rating | Available |

| Over 80 million | 4.2 stars (iOS), 4.3 stars (Android) | iOS, Android |

Budgeting & Personal Finance

With budgeting being one of the major issues of the user base, here are the apps that will help you with personal finance and budgeting.

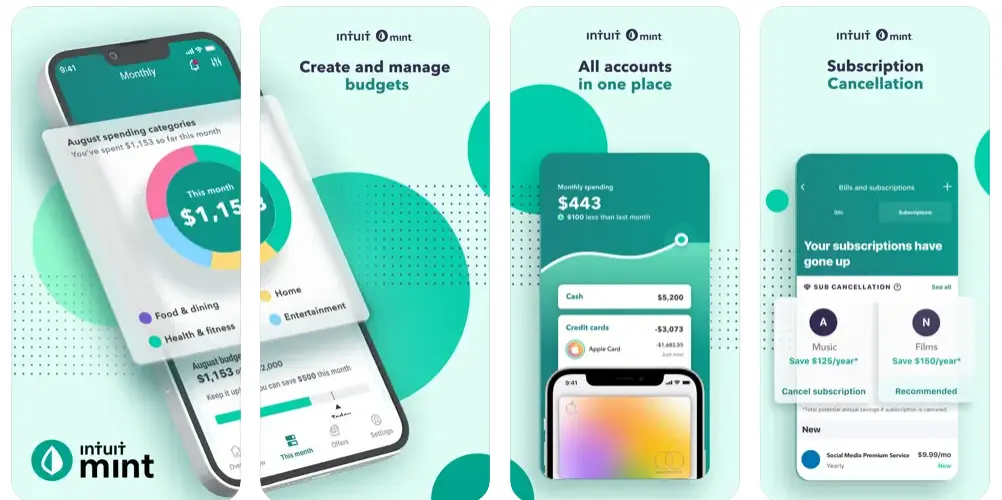

11. Mint

Here’s the answer for all those who are looking for a free budgeting app with comprehensive spending tracking, bill reminders, and financial insights.

Mint.

It is your all-in-one financial organizer that tracks your spending, budgets, and bills in one place.

What makes it one of the best fintech apps on the list is that it lets you see your entire financial picture at a glance.

It’s like having a personal finance coach that helps you stay on top of your finances effortlessly. For those looking to take control of their financial life, Mint is a must-have.

The sad news is that, despite being one of the top budgeting apps, it’s retiring in 2024-03-23. The reason is that it’s being absorbed into Credit Karma.

Features

- Budgeting and expense tracking: Categorize your spending and set budgets to stay on top of your finances.

- Bill pay and reminders: Schedule bill payments and receive payment reminders to avoid late fees.

- Account aggregation: View all your accounts (bank, credit card, investment) in one place for a holistic financial picture.

- Goal setting and tracking: Set financial goals and track your progress towards achieving them.

- Credit Score Monitoring: Monitor your credit score and get alerts for any changes.

| Downloads | Rating | Available |

| Over 100 million | 4.6 stars (iOS), 4.5 stars (Android) | N/A |

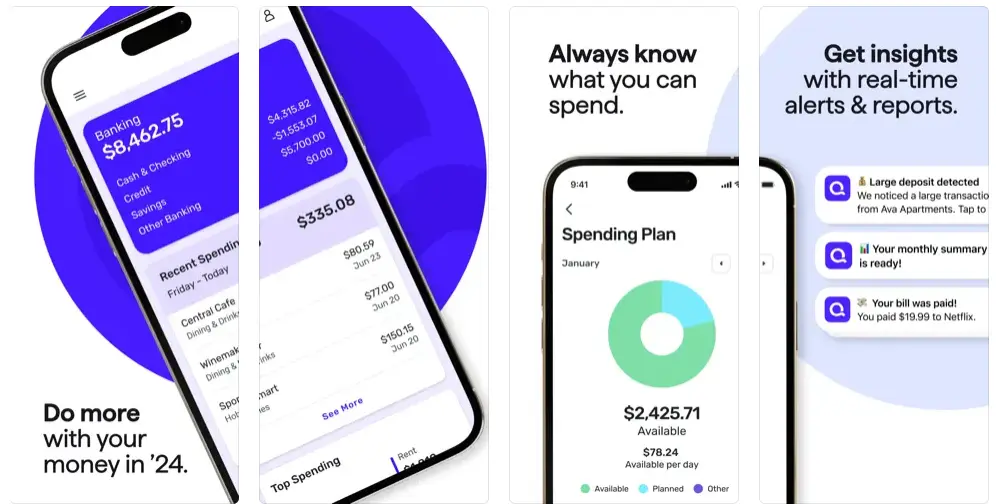

12. YNAB

YNAB stands for You Need a Budget. This zero-based budgeting app that promotes proactive money management and debt reduction is giving users just that.

You can’t develop an expense manager app better than this.

It’s built on the principle that every dollar has a job, helping you to be intentional with your spending. YNAB’s proactive budgeting approach is perfect for those who want to get out of debt and save more.

It’s not an app; it’s a pathway to financial peace.

Features

- Zero-based budgeting: Divide every dollar of your income into specific spending categories before the month begins.

- Debt payoff tools: Carry out various debt payoff methods like the debt snowball or avalanche to manage your debt efficiently.

- Rule-based savings: Automate transfers to savings goals based on pre-defined rules and triggers.

- Off-budget accounts: Track accounts like retirement savings separately from your day-to-day spending.

- YNAB community: Connect with other YNAB users for support and motivation.

| Downloads | Rating | Available |

| Over 1 million | 4.8 stars (iOS), 4.7 stars (Android) | iOS, Android, Web |

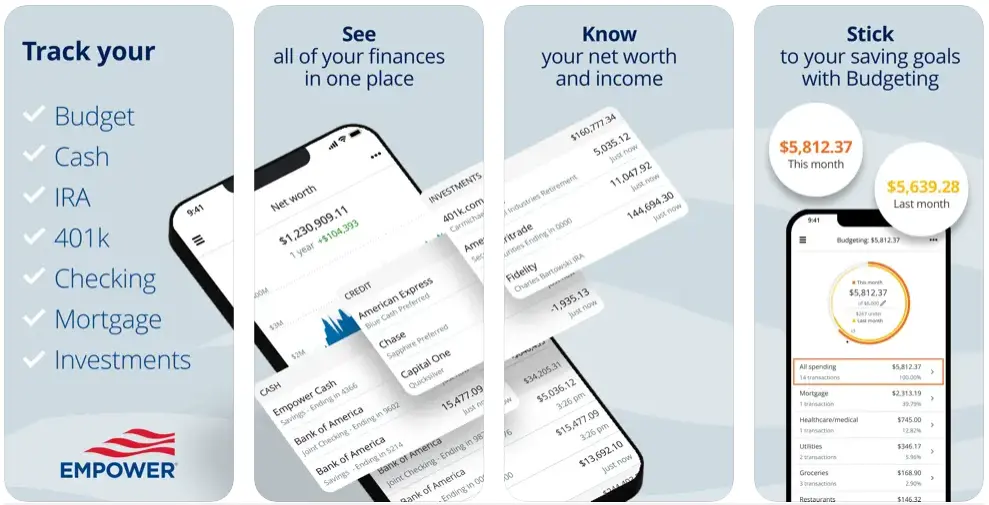

13. Personal Capital

As the name suggests, Personal Capital is a wealth management platform offering free tools for budgeting, investments, and net worth tracking.

This fintech app is for those who want a 360-degree view of their financial life.

It’s a wealth management tool that combines budgeting with investment tracking. Get insights into your spending, net worth, and investment performance.

Personal Capital is ideal for individuals looking to streamline their finances and grow their wealth strategically.

All in all, the platform shows what a good fintech app challenge is, thus catering value to the users.

Features

- Investment portfolio tracking: Monitor your investment accounts and track their performance.

- Net worth tracking: Get a real-time view of your overall net worth, including assets and liabilities.

- Fee analysis: Identify hidden fees and potential cost savings across your financial accounts.

- Retirement planning tools: Estimate your future retirement income needs and adjust your plans accordingly.

- Financial advisor access: Get personalized financial advice from registered advisors for a fee.

| Downloads | Rating | Available |

| Over 5 million | 4.7 stars (iOS), 4.6 stars (Android) | iOS, Android, Web |

14. Simplifi

AI in mobile apps has been doing wonders.

And Simplifi by Quicken is the best example of that.

This AI-powered expense tracking app with automatic categorization and bill negotiation is a new-age financial planning tool.

It simplifies money management with customizable budgets, watchlists, and savings goals. Track your finances in real time and get insights to make smarter financial decisions.

Simplifi is perfect for anyone who wants straightforward, yet powerful, financial aid.

That’s what makes it a contender for the top fintech apps list.

Features

- Automated expense categorization: Save time by letting Simplifi categorize your transactions.

- Spending insights: Gain deeper insights into your spending habits with personalized reports and graphs.

- Smart goals: Set financial goals and track your progress with real-time updates and alerts.

- Bill reminders and autopay: Receive bill reminders and set up automatic bill payments to avoid late fees.

- Investment tracking (premium feature): Monitor your investment accounts and track their performance within the app.

| Downloads | Rating | Available |

| Over 1 million | 4.4 stars (iOS), 4.3 stars (Android) | iOS, Android |

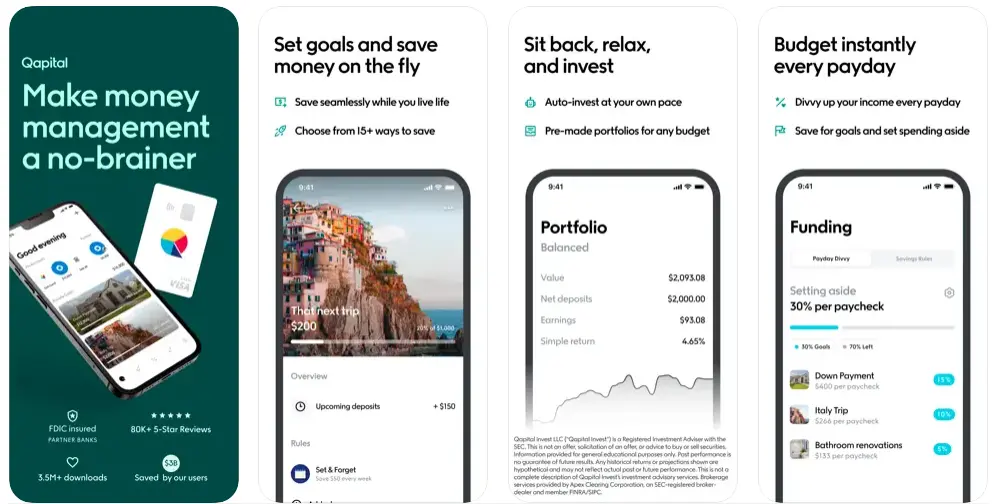

15. Qapital

Are you looking for a goal-based savings app with automatic transfers and fun features for motivation?

Qapital is an app that makes saving fun.

It uses the principles of behavioral economics to help you save money effortlessly. Set goals, create rules, and watch your savings grow. Thus, also doubles as a financial literacy app.

Whether it’s for a vacation or a rainy day fund, Qapital turns saving into a rewarding experience. This is what makes it one of the best choices on this best fintech apps list.

Features

- Rules-based saving: Set up automatic transfers to savings goals based on specific rules, like spending milestones or income triggers.

- Shared goals and accounts: Create joint savings goals and accounts with friends or family members.

- Boost your savings: Utilize features like round-up and bonus rewards to accelerate your savings progress.

- Financial Education: Access educational resources and tips to improve your financial knowledge and habits.

- Games and challenges: Make saving fun with interactive games and challenges to stay motivated.

| Downloads | Rating | Available |

| Over 500,000 | 4.6 stars (iOS), 4.5 stars (Android) | iOS, Android |

Lending & Insurance

Here, we shall be looking at some of the best examples of insurtech and loan lending app development, starting with:

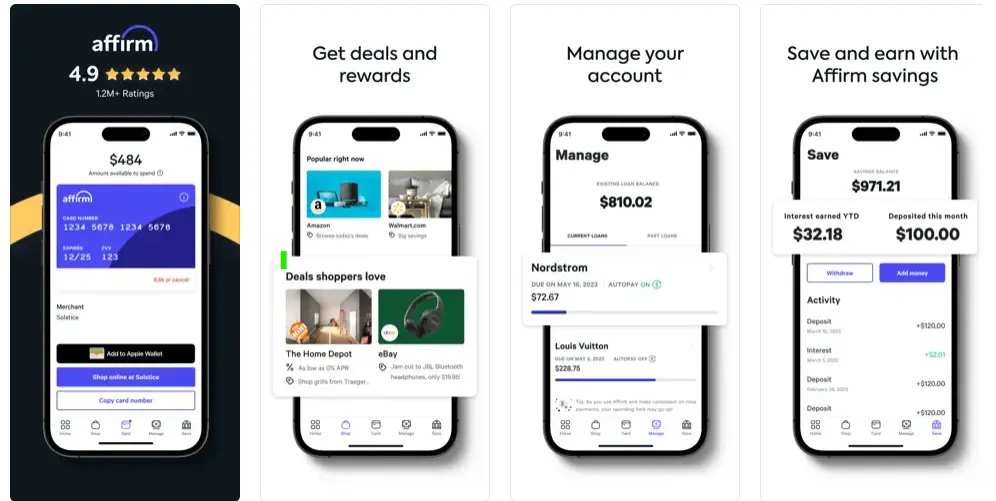

16. Affirm

Affirm is a buy-now-pay-later service with flexible payment options and responsible credit building.

Redefining credit for the better, this is one of the best fintech apps in the lending niche today.

It offers transparent, flexible financing options for your purchases. With Affirm, you’ll know exactly what you’ll owe – no hidden fees, no surprises.

BNPL app development is ideal for those who want to make responsible financial choices without compromising on their needs or desires.

That’s what makes it one of the best loan lending apps in the fintech market.

Features

- Buy now, pay later: Finance purchases through installment plans with no hidden fees or interest, as long as paid on time.

- Flexible payment options: Choose payment terms ranging from 6 weeks to 12 months, depending on the purchase amount.

- Wide merchant network: Shop with Affirm at thousands of online and in-store retailers.

- Built-in buyer protection: Enjoy buyer protection against damage, loss, or non-delivery of goods.

- Early payoff option: Pay off your loan early without any prepayment penalties.

| Downloads | Rating | Available |

| Over 10 million | 4.8 stars (iOS), 4.7 stars (Android) | iOS, Android |

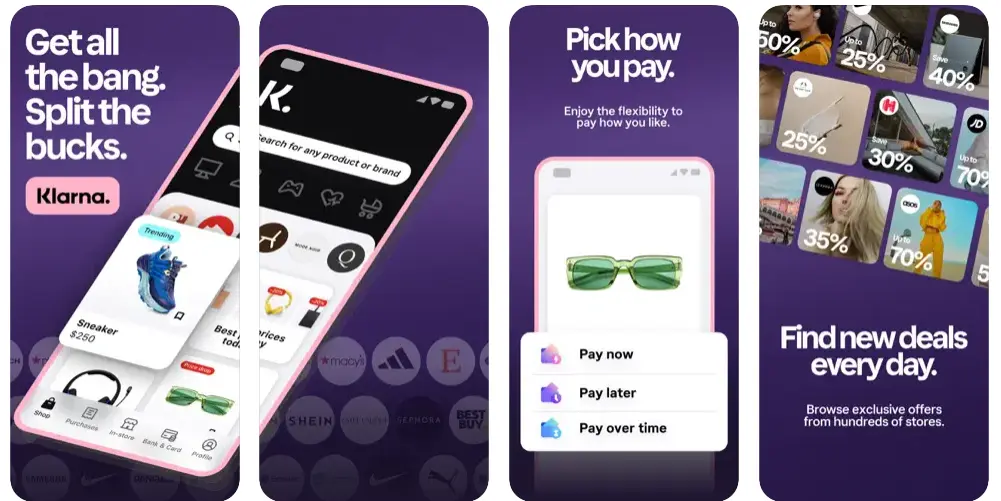

17. Klarna

Klarna is a popular buy-now-pay-later app with virtual shopping and flexible payment terms.

It’s more than that; it is your shopping buddy, making online purchases smoother and more manageable.

With Klarna, you can shop now and pay later in split payments or get personalized deals. It’s a hassle-free way to manage your shopping expenses, giving you flexibility and control over your budget.

With this, your search for the best BNPL app is over.

Features

- Buy now, pay later: Split your purchase into equal interest-free installments over 3 or 4 months.

- Financing options: Finance larger purchases with longer payment terms and interest rates.

- Flexible payment schedules: Choose your payment due date and adjust it within certain limits.

- Virtual cards for online shopping: Generate one-time virtual cards for secure online purchases.

- Price drop notifications: Monitor price changes on saved items and get notified when prices drop via push notifications.

| Downloads | Rating | Available |

| Over 100 million | 4.6 stars (iOS), 4.5 stars (Android) | iOS, Android |

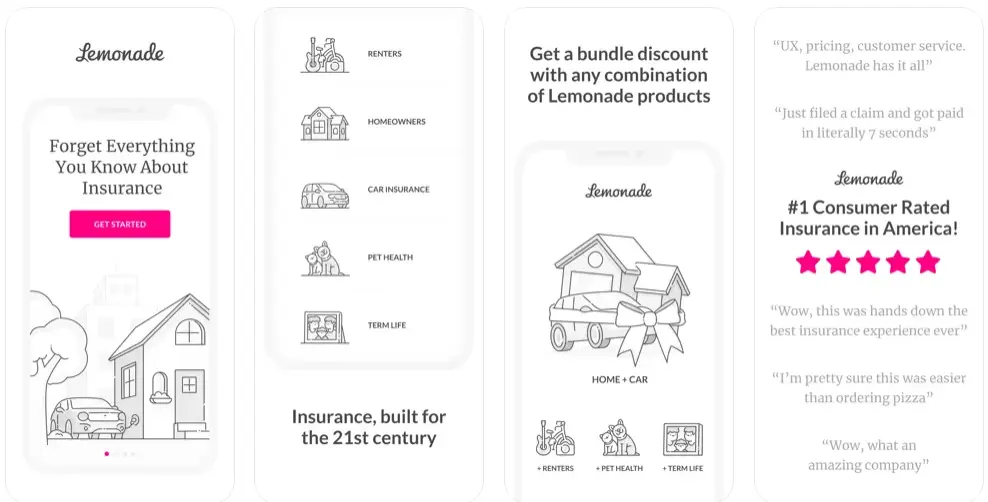

18. Lemonade

Here we have another example of an AI solution in app development, AI-powered insurance with customizable coverage options and instant quotes.

Lemonade is changing the insurance game with its tech-driven approach. We offer hassle-free, affordable insurance for your home, pets, and more.

With its AI-powered platform, claims are fast and easy.

Lemonade is perfect for those who want a modern, straightforward insurance experience without the traditional complexities.

Features

- On-demand insurance: Customize your insurance coverage for renters, homeowners, pets, and life at any time.

- Peer-to-peer model: Premiums are pooled, and claims are paid out of the pool, lowering costs.

- Instant quotes and coverage: Get a quote and start coverage instantly through the Lemonade app.

- AI-powered claims processing: Claims are handled through AI technology.

- Behavioral discounts: Earn discounts for proactive risk-mitigating measures like installing home security systems.

| Downloads | Rating | Available |

| Over 1 million | 4.7 stars (iOS), 4.6 stars (Android) | iOS, Android, Web |

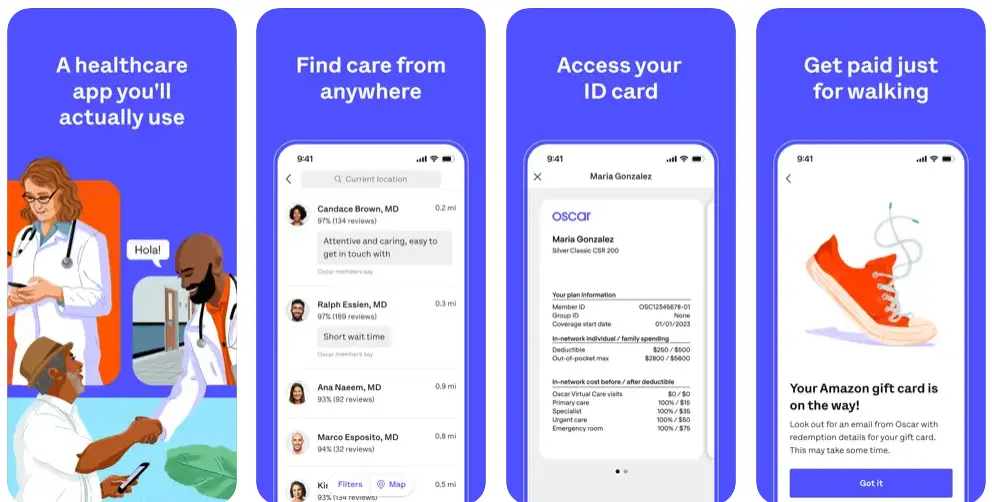

19. Oscar Health

If you are looking for transparent and affordable health insurance with 24/7 doctor access and direct payments, this is a fintech app.

Oscar Health is a health insurance company that’s all about patient-centered care. It’s a user-friendly app that makes managing your health insurance easy.

With features like direct messaging with doctors and digital prescription management, Oscar Health is ideal for those seeking a more personalized and accessible healthcare experience.

The best part is, it comes with mobile payment integration.

Features

- Individual and family health insurance: Choose from various plans tailored to your needs and budget.

- Direct access to doctors and specialists: Connect with doctors through video consultations or in-person appointments.

- Transparent pricing and fees: View detailed pricing information to avoid hidden fees.

- 24/7 Customer Support: Get help anytime you need it through chat, phone, or email.

- Rewards program: Earn rewards for healthy activities like getting preventive care or completing online courses.

| Downloads | Rating | Available |

| Over 500,000 | 4.2 stars (iOS), 4.1 stars (Android) | iOS, Android, Web |

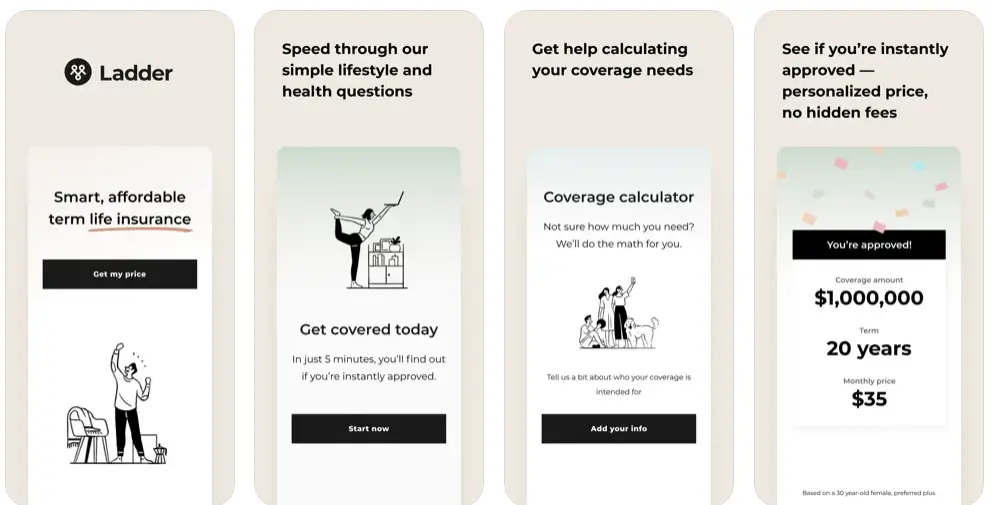

20. Ladder Life

Another Insurtech solution we have is term life insurance with instant quotes and no medical exams in the app.

Ladder Life Insurance is about flexibility and convenience.

Apply online, get instant decisions, and adjust your coverage as your life changes. It’s life insurance for the modern world – simple, transparent, and tailored to your needs.

Ladder is perfect for those who want life insurance that keeps up with their life’s pace, making it a top fintech solution.

Features

- Term Life Insurance: Get affordable term life insurance coverage with customizable terms and lengths.

- Instant online application: Apply for coverage online and receive a decision within minutes.

- No medical exams required: Get covered without the need for invasive medical exams in most cases.

- Flexible payment options: Choose from monthly, quarterly, or annual payment schedules.

- Ladder Life app: Manage your policies and track your coverage easily through the app.

| Downloads | Rating | Available |

| Over 500,000 | 4.5 stars (iOS), 4.4 stars (Android) | iOS, Android |

Emerging Fintech

Last but not least, let’s look at some top examples of fintech innovation in mobile app development.

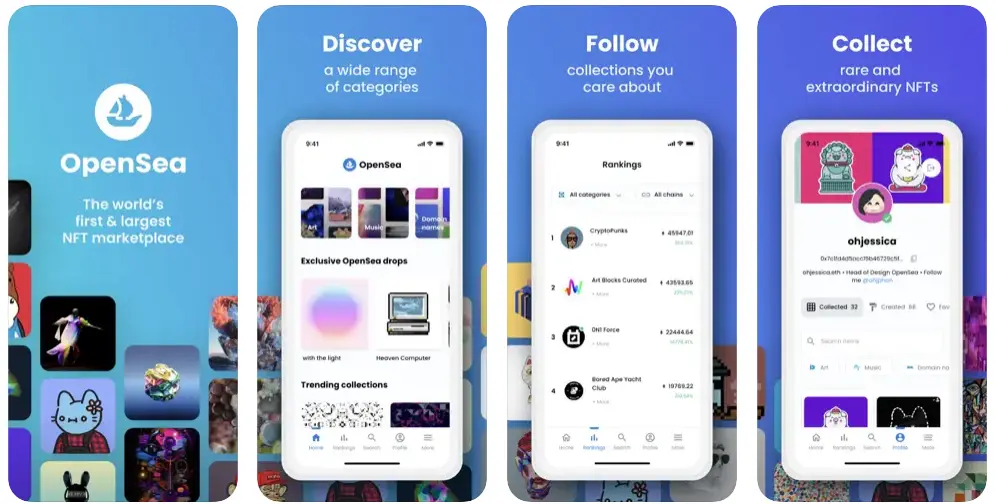

21. OpenSea

Open Sea is a leading NFT marketplace for buying, selling, and creating digital art and collectibles.

The platform lets users buy and sell NFTs like Bored Apps, pioneering the way we think about digital ownership and creativity.

It’s a hub for buying, selling, and discovering digital assets like art, domain names, and virtual worlds. OpenSea is perfect for artists, collectors, and anyone interested in the cutting-edge world of NFTs.

Platform sites are a perfect example of online marketplace development.

Features

- NFT Marketplace: The world’s largest marketplace for buying, selling, and trading non-fungible tokens (NFTs).

- Wide variety of NFTs: Supports a wide variety of NFTs, including art, music, collectibles, and even virtual real estate.

- Easy-to-use interface: Makes it easy for anyone to buy, sell, and create NFTs.

- Secure and transparent: Built on the Ethereum blockchain, providing a secure and transparent platform for NFT transactions.

- Active community: A large and active community of NFT enthusiasts and collectors.

| Downloads | Rating | Available |

| Over 10 million | 4.6 stars (iOS), 4.5 stars (Android) | iOS, Android, Web |

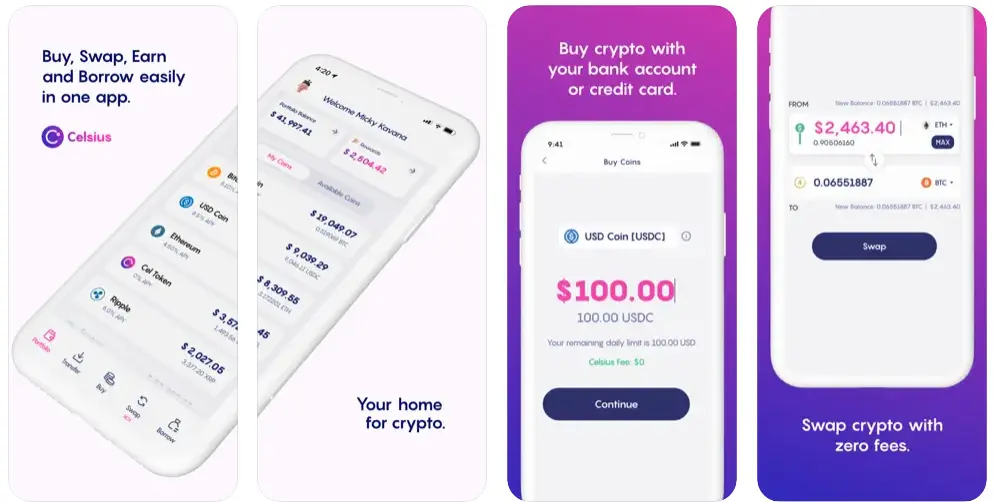

22. Celsius

Lastly, we have Celsius.

A high-yield cryptocurrency lending platform with rewards for storing and borrowing digital assets.

It’s a platform that offers high-interest earnings on your crypto, easy access to loans, and fee-free transactions.

For those looking to maximize their crypto holdings and access new financial opportunities, Celsius offers a unique and powerful solution.

Features

- Cryptocurrency lending and borrowing: Earn interest on your crypto holdings or borrow crypto with your holdings as collateral.

- High interest rates: Offers some of the highest interest rates in the crypto lending market.

- No lockup period: Access your deposited crypto at any time without penalty.

- Mobile app: Manage your crypto holdings and transactions on the go with the Celsius mobile app.

- App Security: Focuses on security with features like multi-signature wallets and cold storage for user funds.

| Downloads | Rating | Available |

| Over 1 million | 4.5 stars (iOS), 4.4 stars (Android) | Android, Web |

Enter the Fintech App Market With the Help of Fintech Experts

Are you inspired by these top fintech mobile apps to build your own?

With the industry churning billions in revenue, it’s no secret that thousands want to join the race.

Nimble AppGenie is a market-leading fintech app development company. Here to help you convert your concept into a digital product that disrupts the market.

Hire a mobile app developer within 24 hours and be the next big one.

Conclusion

The fintech landscape is incredibly diverse, offering something for everyone. From hassle-free banking with Chime and Nubank to investment ease with Robinhood and Coinbase, these apps are redefining our financial experiences.

Budgeting and financial planning have never been easier, thanks to Mint and You Need a Budget (YNAB). Meanwhile, Square and Celsius are revolutionizing business transactions.

These apps simplify finance and open doors to new possibilities, embodying the future of money management. Embracing these fintech innovations means joining a world where managing money is more accessible, efficient, and secure than ever.

FAQs

The most interesting fintech apps include Chime for its fee-free banking, Revolut for its multi-currency features, Robinhood for commission-free trading, and Coinbase for cryptocurrency transactions. Apps like Mint and YNAB are notable for budgeting, while Square and Stripe stand out in business financial services.

A fintech mobile app is a software application designed for smartphones and tablets that offers financial services. These apps typically provide features like mobile banking, investment, budgeting, digital payments, and cryptocurrency trading, utilizing technology to enhance and streamline financial management and transactions.

Popular fintech trends include blockchain and cryptocurrency, mobile-first banking, peer-to-peer lending, automated investment services (robo-advisors), and AI-driven personalized financial advice. There’s also a growing focus on financial inclusion, cybersecurity, and the integration of financial services with other tech like IoT and wearables.

The future of fintech apps lies in greater personalization, enhanced security, and wider financial inclusion. Expect advancements in AI and machine learning for customized financial advice, more robust cybersecurity measures, and the integration of fintech services into everyday devices. Blockchain and decentralization might also play a significant role in shaping the future landscape of fintech.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.