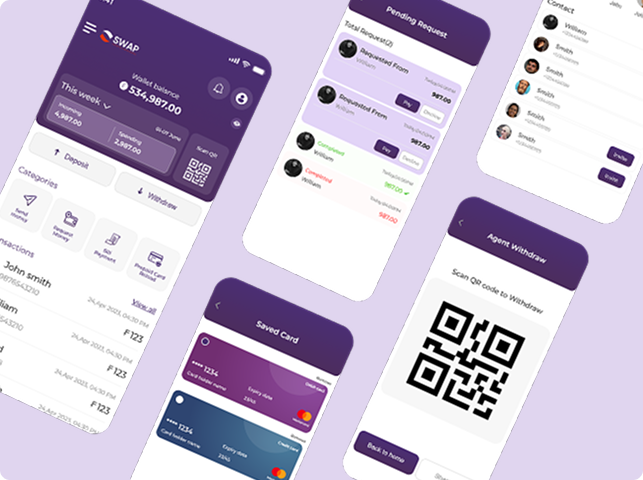

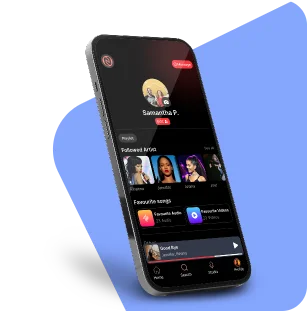

With decades of experience, our developers have helped in creating top fintech solutions. This team is what makes our fintech application development services stand out from the competition.

Our developers understand the ever-changing pattern of technology and hence for every fintech app we develop, we tend to keep scalability at the center of our vision.

To ensure that your FinTech application is accepted by every institution, you need to follow several regulatory compliances. We provide solutions that are compliant with all necessary regulatory requirements.

We keep updating the tech stacks to stay current with the latest advancements. We keep adapting to the latest tech trends and our clients do not have to worry about their apps going obsolete.

One of our key virtues is that we understand the importance of time management and deadlines. We always try to finish fintech app development before the committed deadline.

Our developed fintech apps are highly secure and well-guarded with standard encryption methods. Security and privacy are the two most important pillars and we take proper diligence to ensure 100% secure platforms.

Planning a Fintech App? It’s Time to Take Action

Planning a Fintech App? It’s Time to Take Action