Did you know that 75% of users abandon fintech apps due to security concerns? That’s what makes building a robust architecture so crucial for trust and success, so important.

But what is app architecture? How does it work? What is its role in fintech app solutions?

Whether you are a startup navigating the complexities of building secure and scalable fintech apps, an established company that wants to modernize your existing app’s architecture, or tech enthusiasts just wanting to gain insights into the technical intricacies of building trustworthy financial platforms.

This blog is for you.

In this guide to fintech app architecture, we shall be discussing everything you need to know about architecture for fintech apps and everything else related to it.

So with that being said, let’s get right into it:

What is Fintech App Architecture?

Let’s start by understanding what mobile app architecture is.

Fintech architecture is the technical structure that facilitates the streamlined flow between business needs and the mobile app’s objective.

In layman’s terms, it’s the blueprint for your fintech app, defining how components interact, how data flows, and how security measures work. It’s the foundation for security, scalability, and compliance.

App architecture becomes super important in fintech applications as it helps developers as well as businesses develop, run, and manage the solution effortlessly.

All in all, it also highly affects how the application looks, works, and deals with the load.

Importance of App Architecture in Fintech

In the fast-paced world of fintech, where innovation and security dance hand-in-hand, a robust app architecture forms the very foundation of success.

Unlike the flashy features and user-friendly interfaces we interact with, the architecture operates silently behind the scenes, ensuring our financial information remains secure, transactions happen seamlessly, and the platform scales effortlessly to meet growing demands.

-

Security First

Trust is the currency of fintech, and a secure app architecture is the vault that protects it.

From impenetrable encryption and user authentication to data protection at rest and in transit, a well-designed architecture minimizes vulnerabilities and safeguards sensitive financial information.

Think of it as a multi-layered fortress, repelling potential attacks and ensuring user data remains inviolable.

-

Scaling for Success

The fintech world is brimming with ambition, and the ability to cater to a rapidly growing user base is crucial.

A scalable architecture, often leveraging cloud-native solutions and microservices, empowers the app to adapt and expand seamlessly.

Imagine an elastic band stretching effortlessly to accommodate more users and transactions without compromising performance or stability.

-

Performance Under Pressure

Speed is of the essence in the digital age, and fintech apps are no exception. Users expect lightning-fast responses, and a well-architected app delivers.

Through techniques like load balancing, caching, and asynchronous processing, the architecture optimizes performance even under peak usage, ensuring smooth transactions and a frustration-free user experience.

-

Future-Proofing Innovation

Imagine a building with modular components, easily rearranged to accommodate changing needs and innovations.

By employing modular design, event-driven architecture, and continuous integration/deployment practices, the app can readily embrace new technologies and business models.

-

Beyond the Code

While the fintech app architecture forms the invisible backbone, it’s interconnected with other crucial elements.

Clear data governance policies protect user information, robust disaster recovery plans ensure business continuity, and performance testing identifies and rectifies potential bottlenecks.

Together, these elements create a holistic ecosystem that fosters trust and reliability.

Moving on, to better understand the app architecture, let’s look at the core principles.

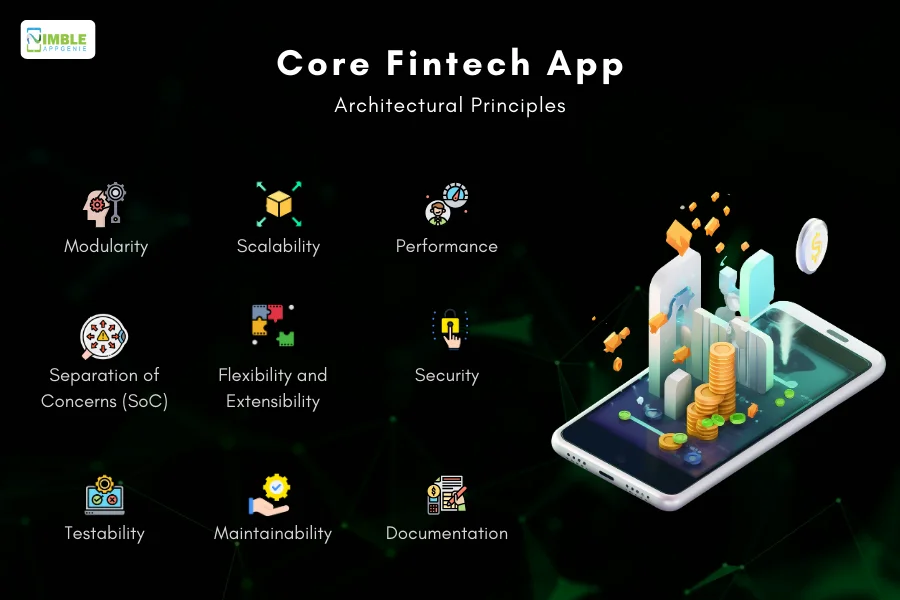

Core Fintech App Architectural Principles

Let’s look at the important fintech app architecture principles that will help you better understand the concept as a whole.

Therefore, these are, as mentioned below:

1. Modularity

Let’s start with the first principle, that of, Modularity.

It’s all about breaking down your application into smaller, self-contained modules or components.

This makes it easier for you to understand, develop, test, and maintain. Thus, ensuring each module has a single responsibility and is loosely coupled with other modules.

2. Separation of Concerns (SoC)

Quite similar to the previous one, this principle of fintech app architecture says that, divides your application into distinct sections.

Each section addresses a separate concern or aspect of functionality (such as presentation, business logic, and data access).

This approach promotes maintainability and reusability by preventing tightly coupled code.

3. Scalability

If you want your fintech app to be a success, design your architecture to accommodate growth in users, data, and functionality without significant changes to the underlying structure.

Here, you should consider using distributed systems, load balancing, and other techniques to handle increased demand effectively.

4. Flexibility and Extensibility

Another thing you need to ensure is that your FinTech architecture allows for easy modification and extension without impacting existing functionality.

This can be achieved through well-defined interfaces, dependency injection, and design patterns like the Open/Closed Principle.

5. Performance

Want to get amazing performance out of your fintech solution?

Well, you’d better follow this principle and optimize your architecture for performance by minimizing bottlenecks, reducing latency, and optimizing resource usage.

This may involve implementing caching, asynchronous processing, and other techniques to improve responsiveness and efficiency.

6. Security

Fintech app security is paramount when talking about fintech apps.

That’s why it’s important to incorporate security measures into your architecture to protect against threats such as unauthorized access, data breaches, and injection attacks.

Carry out authentication, authorization, encryption, and other security mechanisms to safeguard your application.

7. Testability

Fintech app testing is the security behind quality.

You must design your architecture to allow testing at various levels (unit, integration, and end-to-end).

To do this, you need to write code that is easily testable, use dependency injection to mock dependencies, and design for test automation to ensure the quality of your application.

8. Maintainability

Write clean, well-structured code and adhere to coding standards and best practices.

This makes your codebase easier to understand, debug, and modify, reducing the time and effort required for maintenance tasks.

9. Documentation

Documentation is like writing a guidebook, as all developers know.

Document your architecture, design decisions, and codebase to provide guidance for developers, facilitate onboarding, and ensure knowledge transfer.

Create architectural diagrams, write code comments, and produce other documentation to aid in understanding and maintenance.

Now that we’re done with the basic principles, it’s time to look at the layers of app architecture in the section below.

Layered Fintech App Architecture: Building a Secure and Scalable Foundation

Fintech apps handle sensitive financial data and transactions, making robust architecture crucial.

Understanding the different layers provides a clear picture of how components function and interact.

Here’s a breakdown:

1] Presentation Layer

The first and outermost layer of the architecture is the presentation layer.

As the name suggests, it is the User interface (UI) or what we often call the client side. This is consistent across mobile apps, web interfaces, as well as other user-facing elements.

2] Business Logic Layer

At the second, we have a business logic layer.

This layer sits behind the UI and handles core functionalities like account management, transactions, and investment decisions.

It comprises business rules, algorithms, and logic specific to your app’s offerings.

3] Data Layer

Moving to number three, we have the data layer of the fintech app architecture.

This layer stores and manages financial data like account balances, transaction history, and user information.

It comprises databases, data warehouses, and other data storage solutions.

4] Integration Layer

As the name suggests, the integration layer facilitates communication between the app and external systems like payment gateways, credit bureaus, and third-party APIs.

Thus, it enables functionalities like sending/receiving payments, credit checks, and data exchange.

5] Infrastructure Layer

Let’s talk about the infrastructure layer.

This forms the foundation, providing essential hardware and software resources to run the fintech app. It includes servers, networks, cloud platforms, and other infrastructure components.

Now that we are done with the different layers of fintech app architecture, it’s time to look at the importance of the same in.

What If You Deploy Fintech Apps Without Architecture?

If you want to build a fintech app, many possibilities and questions come to mind.

For instance, what if you launch the app without architecture?

Deploying a fintech app without a well-defined architecture is like building a house without a blueprint.

While this might seem feasible at first, the consequences can be disastrous and far-reaching, potentially impacting your business, your users, and their finances.

Here’s the result on different aspects of :

- Security: Financial data scattered invites hackers, leading to breaches and hefty fines, tarnishing reputation.

- Scalability: Explosive user growth strains apps, causing slowdowns and crashes; robust architecture ensures smooth scaling.

- Maintenance: Tangled code hampers updates, inflating costs; modular architecture streamlines changes, saving resources.

- Compliance: Non-compliant architecture invites legal action; well-designed architecture ensures adherence to regulations.

- User Experience: Confusing interface frustrates users; user-centric design builds trust and engagement.Top of Form

All in all, deploying a fintech app without an architecture is a recipe for disaster.

It’s not just about saving time or money in the short term; it’s about building a secure, scalable, and compliant foundation for your business and protecting your users’ financial well-being.

Invest in a well-defined architecture from the start, and your fintech app will be on the path to success.

Fintech App Architecture Diagram

App Architecture vs App Tech Stack

Do you often get confused between fintech app architecture and fintech mobile app tech stack?

Well, despite them seeming quite similar and overlapping in different areas, the app’s tech stack is very, very different from the app architecture.

Let’s discuss the details below:

| Features | App Architecture | App Tech Stack |

| 1. Definition | Blueprint outlining the overall structure and organization of the app, defining its components, interactions, and data flow. | Set of specific technologies, frameworks, programming languages, and tools used to build the app. |

| 2. Focus | High-level, conceptual design principles. | Concrete, implementation-specific choices. |

| 3. Objectives | Addresses functionality, scalability, security, maintainability, and performance. | Enables the chosen architecture to be translated into a working application. |

| 4. Level of Abstraction | More abstract, focusing on the overall structure and relationships. | More concretely, focusing on specific tools and technologies. |

| 5. Flexibility | more readily adaptable to changing requirements and technologies. | Requires changes to the architecture if the tech stack requires significant alterations. |

| 6. Impact on Development | Guides development decisions and influences tech stack selection. | Directly determines the development process and tools used. |

| 7. Examples | Choose a layered architecture (presentation, business logic, data) to ensure separation of concerns. | Utilizing React for the front-end and Python with Django for the back-end. |

| 8. Key Considerations | business requirements, user needs, scalability goals, security concerns, and future growth projections. | Programming language familiarity, developer expertise, performance requirements, and budget constraints. |

| 9. Change Management | Relatively easier to modify due to its abstract nature. | Requires more effort and potential rewrites if changes are fundamental. |

Architectural Styles for Fintech Apps

When speaking of app architecture, there are multiple choices.

In this section of the blog, we shall be going through the different app architecture examples and look at their benefits as well as downsides for fintech apps.

These are, as mentioned below:

1. Monolithic Architecture

Let’s start with one of the most popular app & web app architectures, the monolithic.

It’s a single, tightly integrated system where all components are interconnected.

For a fintech app, this could mean a single application handling all functionalities like transactions, account management, and customer support.

Benefits: simplicity, ease of development.

Drawbacks: scalability limitations, maintenance challenges.

2. Microservices Architecture

Microservices architecture is growing very popular for modern mobile app development.

This one decomposes the application into smaller, independent services, each responsible for specific tasks.

If you apply this to a fintech app, it could involve separate services for payments, account management, fraud detection, etc., allowing for easier scalability and maintenance.

Benefits: Higher scalability, independent deployment, improved agility.

Drawbacks: Increased complexity and development overhead.

3. Event-Driven Architecture

Event-driven architecture relies on asynchronous communication between services through events.

The architecture of fintech mobile applications can trigger actions based on events such as a successful transaction or a detected fraud attempt, enhancing real-time processing and responsiveness.

Benefits: real-time processing, high adaptability, fault tolerance.

Drawbacks: requires expertise and potential debugging challenges.

4. Hybrid Architecture

Much like hybrid app development, it combines elements of monolithic, microservices, and event-driven architecture.

In a fintech context, this might involve using microservices for certain functionalities like payment processing while maintaining a monolithic structure for others like account management, providing flexibility and optimization based on specific needs.

Speaking of benefits and drawbacks, that directly depends on the architecture involved.

Now that we know of the different types of fintech architectures, it’s time to learn how to choose the right one.

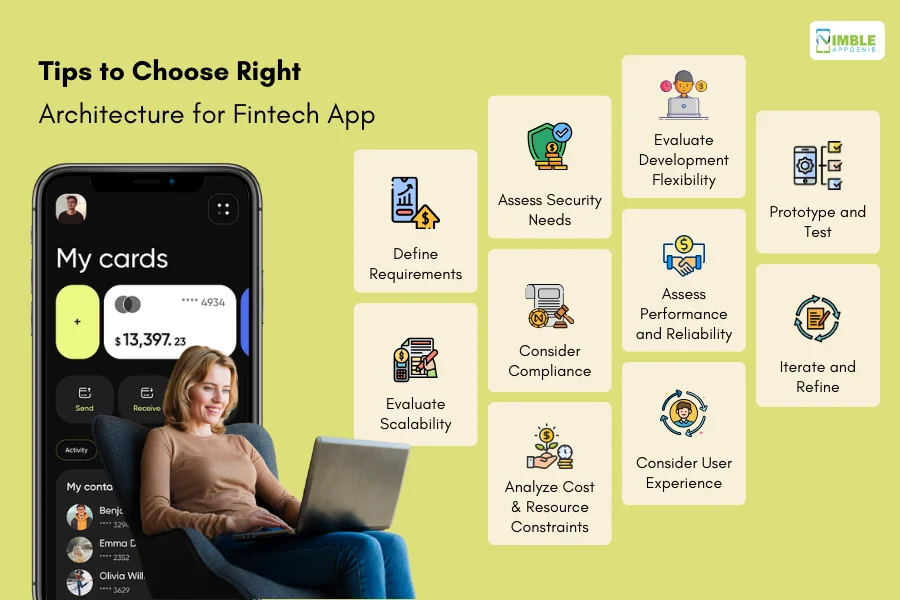

Choosing the Right Architecture for a Fintech App

It’s time to know how to choose the right app architecture.

Here are some steps that you commonly follow to evaluate the right criteria for choosing fintech application architecture.

Take a look at the steps below.

1. Define Requirements

First, we need to understand the specific needs of your fintech app.

This includes the expected user base, functionalities, security requirements, compliance regulations, expected growth, and budget constraints.

2. Evaluating Scalability

When choosing an architecture, you need to consider the scalability requirements of your app. Also determine whether your app needs to handle large volumes of transactions, users, or data.

If scalability is a critical factor, microservices architecture might be more suitable.

3. Assess Security Needs

As we have discussed again and again, security is super important.

That’s why we need to evaluate the security requirements of your fintech app, including data encryption, identity verification, fraud detection, and regulatory compliance (e.g., PCI, GDPR).

Based on that, choose an architecture that provides robust security measures to protect sensitive financial data.

4. Consider Compliance

Since we are talking about fintech apps, you need to ensure that the chosen architecture complies with relevant financial regulations and data privacy laws.

Determine whether the architecture allows for easy auditing, monitoring, and compliance reporting.

5. Analyzing Cost and Resource Constraints

Time to address the most important question, fintech app building cost.

In simpler words, it’s important to consider the budget, resources, and technical expertise available for developing and maintaining the app.

Evaluate the cost-effectiveness of each architecture option in terms of development time, infrastructure requirements, and ongoing maintenance.

6. Evaluating Development Flexibility

With budgeting done, we need to consider the flexibility and agility required for future development and updates.

Based on that evaluation, determine whether the architecture allows for easy integration of new features, third-party services, and technology upgrades.

7. Assessing Performance and Reliability

Finally, it’s time to assess the performance and reliability implications of each fintech architecture option.

This includes factors such as response time, uptime, fault tolerance, and disaster recovery capabilities.

8. Consider User Experience

It goes without saying that when developing an app that responds highly to the user, we need to consider user experience.

That’s why we assess how each architecture option impacts the user experience of your app.

Here, you need to consider factors such as latency, responsiveness, ease of use, and scalability to ensure a seamless and engaging user experience.

9. Prototype and Test

Develop prototypes and proof-of-concepts using different architectural options to assess their feasibility and suitability for your app.

Once this is done, we will test the final version and then move to the next step.

10. Iterate and Refine

Based on the evaluation results and feedback, iterate on the fintech architecture design and refine your approach as needed.

This is how to choose the right app architecture for a fintech solution. Now that we are done with this, let’s move on to the next section where we shall be discussing best practices for app architecture.

Best Practices for Fintech App Architecture

As we have learned in this blog, a fintech app’s architecture is a serious deal.

So, here are some mobile app architecture best practices that you need to follow when dealing with your solution.

Best practices along with their importance are, as mentioned below:

| Aspect | Best Practice | Why it Matters |

| 1. Security | Implement multi-factor authentication, data encryption, access controls, and regular security audits. | Protects user data from breaches and ensures regulatory compliance. |

| 2. Scalability | Utilize microservices architecture and serverless functions for independent scaling of components. | Enables smooth handling of increased user base and transaction volume. |

| 3. Maintainability | Employ a modular design with clear interfaces and documentation. | Facilitates easier updates, bug fixes, and new feature additions. |

| 4. Compliance | Integrate compliance requirements into the architecture from the outset. | Avoid legal repercussions and operational disruptions. |

| 5. Performance | Optimize code for efficiency, leverage caching mechanisms, and monitor performance metrics. | Delivers fast response times and a smooth user experience. |

| 6. Disaster Recovery | Implement data backups, disaster recovery plans, and redundancy measures. | Minimizes downtime and data loss in case of outages or failures. |

| 7. API | Utilize secure and well-documented APIs for communication between components. | Enables clean integration with future functionalities and external systems. |

| 8. Logging & Monitoring | Implement comprehensive logging and monitoring systems for all critical components. | Facilitates troubleshooting, performance analysis, and security incident detection. |

| 9. User Experience | Prioritize intuitive design, clear navigation, and accessibility. | Increase user adoption, engagement, and satisfaction. |

| 10. Testing & Quality Assurance | Conduct rigorous testing throughout the development process, including security testing. | Delivers a reliable and secure app with minimal bugs. |

Challenges in Fintech App Architecture Implementation

With best practices out of the way, it’s time to look at some of the fintech app architecture challenges and their solutions.

| Challenge | Description | Mitigation Strategies |

| 1. Security: Protecting sensitive user data and financial information | Data breaches, fraud, and regulatory non-compliance |

|

| 2. Scalability: Accommodating rapid growth in users, transactions, and data volume | System outages, performance bottlenecks, increased costs |

|

| 3. Performance: Ensuring a fast and responsive user experience under high load | Delayed transactions, frustrated users, negative brand perception |

|

| 4. Reliability: Maintaining app availability and resilience to outages and errors | Loss of access to financial services, financial losses, and reputational damage |

|

| 5. Future-proofing: Adapting to evolving technologies and changing business needs | Technological obsolescence, inability to cater to new user demands, difficulty integrating new features |

|

| 6. Integration complexity: Managing integration between multiple internal and external systems | Data inconsistencies, operational challenges, increased development time, and cost |

|

| 7. Compliance: Navigating complex and evolving regulatory requirements | Legal penalties, operational disruptions, and reputational damage |

|

| 8. Talent acquisition and retention: Finding and retaining skilled architects and developers with fintech expertise | Limited access to specialized talent, increased development costs, and potential delays in implementation |

|

| 9. Data governance: Establishing clear ownership, access control, and management policies for data | Data privacy violations, misuse of information, and operational inefficiencies |

|

Case Studies: Popular Fintech Apps & Their Architecture

To be the best, you have to learn from the best.

Luckily for us, the market is filled with leading fintech apps.

To learn more about how fintech apps leverage different architectures, let’s look at the detailed brief below:

1. PayPal

Let’s start with PayPal, the digital payments giant.

This platform leverages a monolithic architecture where all functionalities are bundled into a single codebase.

This approach offers stability and ease of management, making it ideal for PayPal’s early growth stages. However, as the platform expands, scalability becomes a concern.

The market is filled with apps like PayPal, with hundreds more on the way, so take inspiration from OG and build a robust fintech solution.

- Architecture: Primarily monolithic, with tightly coupled components.

- Pros: Streamlined development, efficient resource utilization, easier initial setup.

- Cons: Less scalable, limited flexibility for future growth, potential single point of failure.

2. Venmo

Venmo, one of the most popular eWallet apps, embraces a microservices architecture.

This means the app is broken down into small, independent services responsible for specific tasks like user authentication, transaction processing, and social features.

This allows for rapid development, easier updates, and superior scalability as Venmo’s user base grows.

- Architecture: Microservices-based, with independent services communicating via APIs.

- Pros: Highly scalable, adaptable to changing needs, easier to deploy and update individual services.

- Cons: Increased development complexity and potential performance overhead due to API calls.

3. Robinhood

Do you want to build an investment platform?

Well, you have probably heard of Robinhood. This investment platform employs a hybrid architecture.

Its core functionalities like order management and account details, reside in a monolith, ensuring stability and performance.

Meanwhile, features like news and market data are handled by independent microservices, enabling faster updates and easier integration with third-party providers.

- Architecture: Hybrid, combining elements of both monolithic and microservices approaches.

- Pros: Balances scalability and development efficiency, caters to evolving needs, and leveragesthe strengths of both architectures.

- Cons: Requires careful planning and integration of different architectural styles.

4. Chime

Enter the realm of mobile banking apps, we have, Chime, the mobile-first challenger bank.

This popular fintech app utilizes a serverless architecture.

Instead of managing its own servers, Chime relies on cloud providers like AWS Lambda to execute code on demand.

This approach offers exceptional scalability and cost-effectiveness, allowing Chime to focus on its core banking functionalities.

- Architecture: Serverless, leveraging cloud functions and managed services.

- Pros: Highly scalable, cost-effective, minimal server management required.

- Cons: Vendor lock-in, potential lack of customization, and performance considerations for specific use cases.

5. Nubank

This digital bank from Brazil boasts a unique “multi-layered” architecture.

It combines elements of microservices for specific functionalities like credit card processing and loans, with a central platform managing core banking operations and data.

This hybrid approach provides scalability and flexibility while ensuring the security and stability needed for financial transactions.

- Architecture: Multi-layered with microservices for specific features and a central platform for core banking.

- Pros: Balances scalability, flexibility, and security, enables rapid innovation and feature development.

- Cons: Requires careful coordination between layers, and potential complexity in managing different technologies.

Conclusion

Fintech apps hold our financial data, demanding a robust foundation. This blog explores the blueprint known as Fintech app architecture, its principles, layers, and popular styles.

We discussed choosing the right fit, considering scalability, security, and user experience. Remember, it’s not just about tech stacks, but crafting a secure, adaptable solution for the ever-evolving fintech landscape.

By following best practices and staying ahead of trends, you can build a Fintech app architecture that empowers your business and fosters user trust. But why bother dealing with it when you can leave it to fintech experts?

Nimble AppGenie is a market-leading fintech app development company with years of experience in developing and maintaining some of the most well-known fintech apps.

Our team of fintech developers has the right tools to bring your concept to reality and turn it into a sophisticated application.

Hire an app developer today with just a click. We are here to help you.

FAQs

Fintech app architecture is the blueprint for building a secure, scalable, and reliable financial technology application. It defines how different components interact, data flows, and security measures work. It’s like the foundation of your house, crucial for stability and future expansion.

Unlike other apps, Fintech apps handle sensitive financial data and transactions. A robust architecture is essential to:

- Ensure security: Protects user data from breaches and unauthorized access.

- Guarantee scalability: Accommodates growth in users, data, and functionality smoothly.

- Maintain performance: Delivers fast response times and a seamless user experience.

- Simplify compliance: Adhere to relevant financial regulations and data privacy laws.

- Facilitates maintenance: Makes updates and bug fixes easier.

Consider factors like:

- Specific requirements of your app

- Scalability needs

- Security requirements

- Compliance regulations

- Budget and resources

- Development flexibility

- Performance and reliability

- User experience

- PayPal: Primarily monolithic, offering stability for early growth but facing scalability challenges.

- Venmo: Microservices-based, enabling rapid development and superior scalability.

- Robinhood: Hybrid architecture, balancing stability with flexibility for evolving needs.

- Chime: Serverless architecture, providing exceptional scalability and cost-effectiveness.

- Nubank: Multi-layered architecture, combining scalability with security for core banking operations.

Some of the common challenges are, as mentioned below: Complexity, Security, Compliance, Cost, and Talent and expertise.

As Fintech continues to innovate, the role of architecture will become even more critical. We can expect to see:

- Increased adoption of emerging technologies

- Focus on user experience

- Evolving regulatory landscape

- Growing importance of data privacy

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.