Apps like Revolut are changing the way we handle money.

From applying for loans to sending money to your friends, mobile banking apps enable everything. And people love it!

But there must be more mobile banking apps, right? Yes! There are. If you are someone who is looking for banking apps like Revolut, this blog is for you.

Whether you are someone who wants to create an app like Revolut, or just want to learn more about neo-banking apps, read till the end.

Here, we shall be discussing the rise of banking apps, a brief overview of Revolut, and more popular apps like Revolut.

The Rise of Neo Banking Apps Like Revolut

In an increasingly interconnected world, the demand for convenient and user-friendly banking solutions has skyrocketed.

With the advent of mobile banking apps, individuals can now perform various financial transactions right from the palm of their hands.

Apps like Revolut have Revolutionized the way people manage their money, offering a range of features that traditional banks often lack.

In fact, the successes of such apps have attracted a lot of other investors to develop fintech apps. Well, we shall discuss that, but let’s first explore Revolut app.

Revolut App: One App, All Things Money

We have all heard of this Neobanking app!

It is a leading mobile banking app known for its exceptional features. For instance:

- multi-currency accounts

- fee-free international transfers

- budgeting tools

And more

With digital financial solutions growing more and more common, this platform has gained immense popularity among frequent travelers, digital nomads, and individuals seeking enhanced control over their finances.

Looking at it from a business POV, it’s an exemplary fintech solution.

You see, the platform has attracted a lot of people to create other apps like Revolut. And we shall be discussing this as well as Revolut alternative app in the section below.

Best Apps Like Revolut: Chime, MoneyLion, & More

Look for other apps like Revolut. Well, we have plenty!

Here, we shall be discussing market-leading neo-banking apps like Revolut and its alternatives. Therefore, let’s get right into it, starting with:

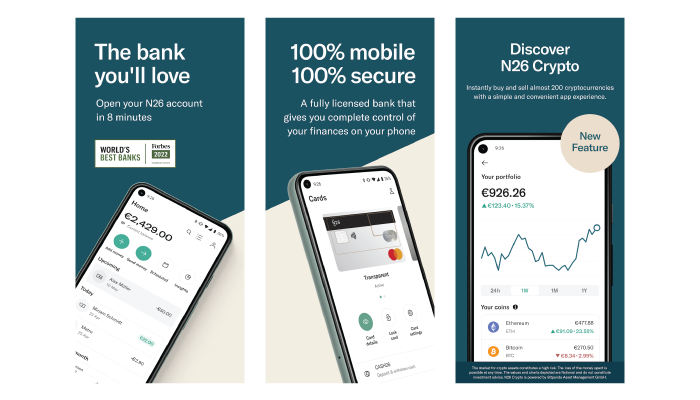

1. N26 – Neo Banking App

Imagine having a personal banker at your fingertips, ready to assist you on your financial adventures.

Well, that’s exactly what N26 brings to the table.

Equipped with a sleek mobile banking app, N26 offers a host of features that will make you feel like a financial connoisseur.

From a free debit card that saves you from dastardly foreign transaction fees to intuitive budgeting tools that help you track your spending, N26 ensures you stay in control of your finances.

So, whether you’re navigating the bustling streets of Tokyo or sipping espresso in a quaint Parisian cafe, creating an app like N26 is the trusty sidekick you need.

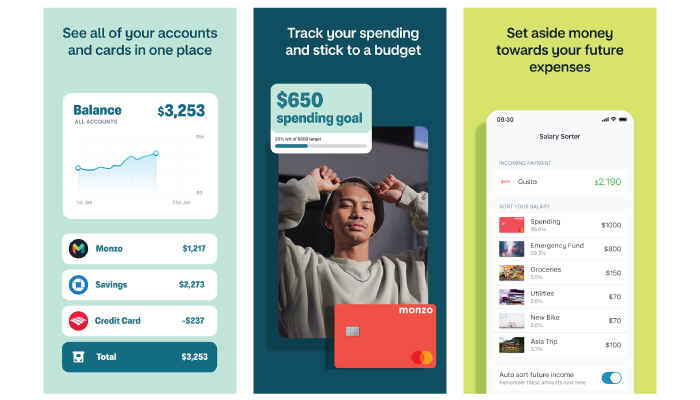

2. Monzo – New Age Bank

Are you tired of traditional banks and their antiquated ways? Well, then this is the mobile banking app for you!

Monzo, with its bright coral-colored card and modern mobile banking app, is all about making finance fun and easy.

Now, picture this: instant spending notifications that pop up on your phone as you swipe your card, helping you stay on top of your transactions in real-time.

And with zero foreign transaction fees, Monzo becomes the ideal travel companion, freeing you from the clutches of those pesky fees that drain your wallet.

You get all of this with market leading neobanking app. And you can embrace the coral Revolution and let Monzo Revolutionize your financial journey.

Also Read: Cost to Develop an App Like Monzo

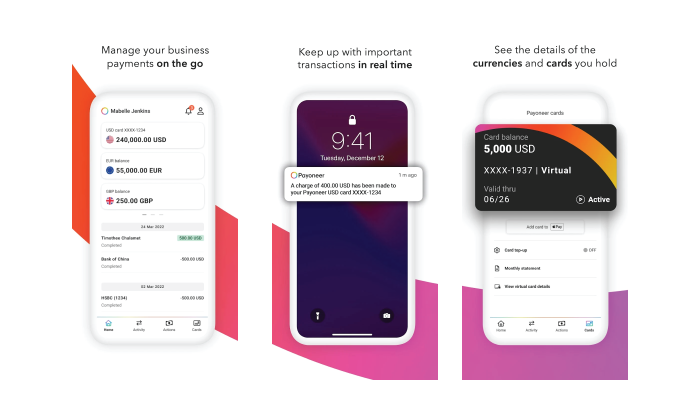

3. Payoneer – Pioneering Online Payment

Have you ever heard of the Payoneer? You must have!

In a world where borders are merely lines on a map, Payoneer steps in to connect people across the globe.

With its virtual hands reaching out to both individuals and businesses, Payoneer simplifies international payments like a true globetrotting guru.

Need to receive funds from a client in a foreign land? No problem! Payoneer’s global payment service and prepaid Mastercard have got you covered.

It’s like having your very own magic carpet ride, transporting your money securely and swiftly to wherever it needs to go.

So, let Payoneer be your trusted genie, granting your international payment wishes.

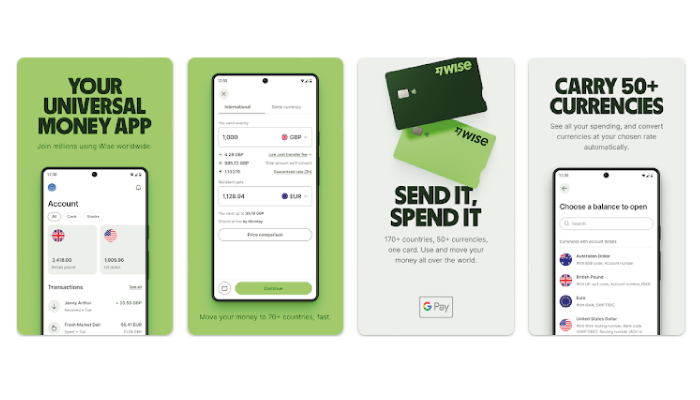

4. Wise (formerly known as TransferWise)

Wise, the chameleon of banking apps, adapts to your every need.

With its multi-currency accounts and borderless functionality, Wise allows you to effortlessly juggle currencies like a skilled circus performer.

This market-leading mobile banking app will help you say goodbye to the frustration of dealing with multiple bank accounts for different currencies. This is what makes it a leading app like Revolut.

Wise lets you hold and convert money in different currencies, ensuring you’re always in control of your global finances.

And with its Wise debit card, you can spend like a local wherever you go. It’s financial flexibility at its finest.

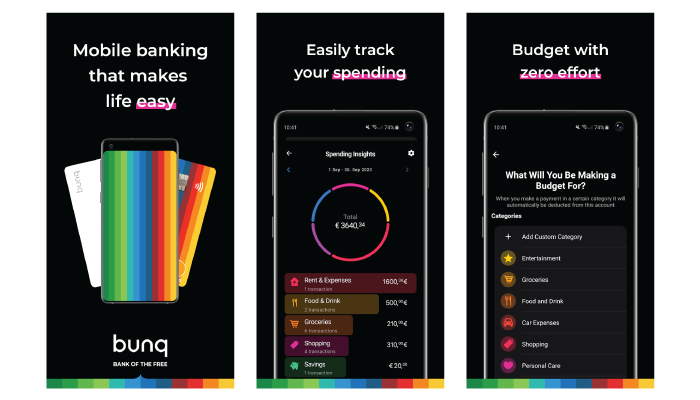

5. Bunq

Bunq is a good example of what the development of a mobile banking app can be.

With its vibrant orange interface and an array of features, Bunq empowers you to take charge of your financial destiny.

Fancy setting up multiple accounts for different purposes? Bunq lets you do just that, ensuring you stay organized and focused on your financial goals.

Plus, with real-time notifications, you’ll always be in the loop about your transactions, making budgeting a breeze.

So, if you are someone who is looking for mobile banking apps or market-leading apps like Revolut, this is the one that you should not miss.

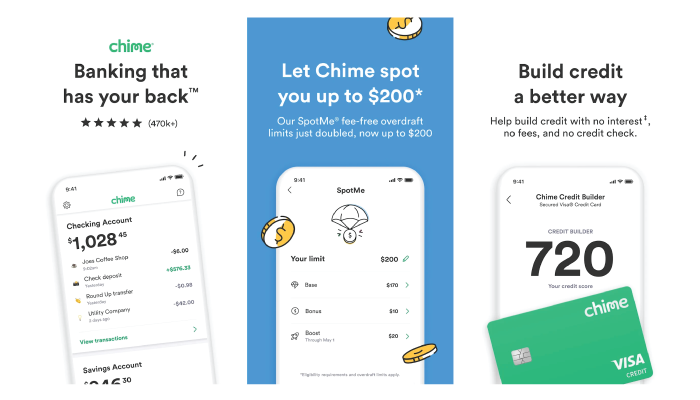

6. Chime – Best Mobile Banking App

If you are looking for other apps like Revolut, you shouldn’t miss Chime.

This mobile banking app has a refreshing approach, making you feel like a valued member of a community rather than a faceless customer.

Moreover, Chime showers you with perks like early direct deposit, ensuring you get your hard-earned money before everyone else.

With no monthly fees, you can bid adieu to those pesky charges eating away at your savings. It’s time to join the Chime Revolution and reclaim your financial freedom.

All in all, this is market leading platform, that everyone looking for list of neobanking should definitely check out!

Also Read: Know the Cost to Develop an App Like Chime

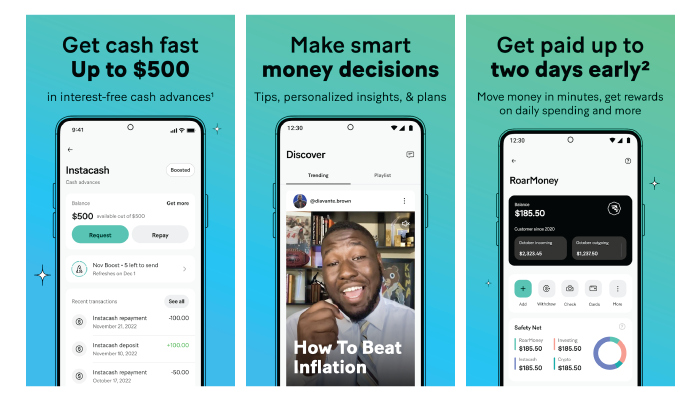

7. MoneyLion – Personal Finance App

Wouldn’t you love if you had a personal finance guru in your pocket, guiding you towards financial success?

Well, that’s exactly what MoneyLion is.

This financial app combines banking, investing, and personal finance tools into one mighty package.

With features like:

- fee-free checking accounts

- access to loans

- and investment opportunities

MoneyLion equips you with the tools you need to conquer your financial goals. So, embrace your inner lion and let MoneyLion roar with financial wisdom.

So, these are some of the best mobile banking apps like Revolut! And with this out of the way, let’s look at how to develop an app like Revolut in the next section.

How to Create an App Like Revolut?

Reading through the entire list of mobile banking apps like Revolut we discussed above must have got you thinking: wait? Can’t I develop my own mobile banking app?

Well, you can!

In fact, in Industry 4.0, creating a mobile banking app can be quite beneficial if done right! And this leaves us with a question, how do you create a fintech app? how much it costs and how long does it take?

Well, let’s answer all of these questions, below:

Steps to Create an App Like Revolut?

Want to create an app like Revolut?

Well, it is not exactly rocket science, but it’s not all that easy either. In order to create an app like Revolut, you need to understand a few things.

To save you all the trouble of learning from your own mistakes, we have mentioned the entire process to create apps like Revolut.

The process is, as mentioned below:

- First, come up with an idea

- Market research (very important)

- Hire a fintech app development team

- Choose a platform (android, iOS, or PWA)

- Build a tech stack (finalize language, framework, and so on.)

- List out features

- UI/UX Designing

- App development (front-end & back-end)

- Mobile app testing (again, very important)

- Deployment (takes upto 2 weeks at most)

- Maintenance

This is the process to create a fintech app for start-ups.

Always focus on the steps mentioned above and if you want to learn more about it, consult a mobile app development company.

Now, you must be wondering how much all of these costs.

Cost to Develop an App Like Revolut

So, how much is the development cost of a banking app like Revolut?

The cost to build an app like Revolut for that matter, highly depends on a lot of different factors. For instance, how big is the app, the platform, specific features, and so on?

However, the average cost to develop an app like Revolut typically ranges from $15,000 to $100,000.

How Long Does It Take To Build Apps Like Revolut?

Well, mobile app development time is much similar to fintech app development cost! In the sense that to calculate the same, you need to first understand the project specifications.

On average, development time ranges from 4 weeks to 12 months or even more.

If you are looking for more accurate cost estimation and development time, it’s highly recommended that you consult a development company like Nimble AppGenie.

Conclusion

It goes without saying that apps like Revolut are growing very popular among users as well as investors. This has attracted a lot of investors who want to learn about alternative mobile banking apps.

FAQs

Yes, most of these banking apps, including Revolut alternatives, offer international functionality. They support multiple currencies, international money transfers, and seamless usage across different countries.

Some of the apps mentioned, such as Revolut and Wise, offer specific features for business banking, including multi-currency accounts, expense management, and integration with accounting software. However, it’s important to review the individual app’s offerings to determine the best fit for your business needs.

While many of these banking apps offer free account options, they may have certain limitations or charge fees for premium features and services. It’s crucial to review the fee structure of each app and consider your banking requirements before making a decision.

Mobile banking apps prioritize security and employ various measures to protect user information. These may include end-to-end encryption, biometric authentication, and secure data storage. However, it’s always recommended to review the app’s security features and follow best practices, such as using strong passwords and keeping your devices updated.

Many banking apps allow you to link your existing bank accounts for a consolidated view of your finances. This feature enables you to manage multiple accounts within a single app, making it easier to track transactions and balances.

Some banking apps, such as Revolut, Wise, and N26, have expanded their offerings to include investment options. These may range from basic savings accounts to more advanced investment portfolios. However, it’s essential to review the specific investment features, associated risks, and regulatory aspects before investing through these apps.

Banking apps typically offer customer support through various channels, including in-app chat, email, and phone support. The quality and availability of customer support may vary, so it’s advisable to check the app’s support options and user reviews for insights into their responsiveness.

Most banking apps are designed to be accessible on multiple devices, including smartphones, tablets, and web browsers. This flexibility ensures that you can manage your finances conveniently from any device with an internet connection.

Yes, many of these banking apps support contactless payments through digital wallets like Apple Pay, Google Pay, or their own proprietary solutions. These payment methods enable users to make secure and convenient transactions using their mobile devices.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.