Do you want to develop an app like Chime?

As we transition from traditional banking to mobile banking and NeoBanking, Chime and its other counterparts have become the flagship of this change.

Today, millions of people are using digital banking apps like Chime.

Plus, it has inspired thousands of businesses worldwide to develop their NeoBanking app. All of them share the same question.

How much does it cost to develop an app like Chime?

The cost to create an app like Chime ranges from $30,000 to $150,000 depending on factors like complexity, platform features, security measures, tech stack, and development team.

If you are planning to build an app like Chime, it’s crucial to understand the cost deeper.

Here, we shall discuss everything you need to know about Chime, its features, why you should develop an app like Chime, the cost to make an app like Chime, factors that affect it, and much more.

So let’s get right into it:

Chime – NeoBanks’ Flag-Bearer

Chime is a challenger bank, or NeoNank, that ditches physical branches for a mobile-first approach.

Founded in 2013, it has over 13 million users who enjoy perks like fee-free banking, early paycheck access (get paid up to 2 days early!), and a user-friendly app.

It’s available on both the platforms, App Store and Google Play Store.

Chime focuses on transparency and convenience, making it a popular choice for tech-savvy generations who want control over their finances.

So, what makes Chime such a great inspiration for Neobank app development projects? Here’s what:

- As per the latest report (2024), the mobile banking app has more than 13 million active users globally.

- Chime’s user base skews younger, with a large portion falling within the 25-44 age range. However, it attracts a diverse demographic.

- Interestingly, Chime’s user base is slightly female, with around 61% of users being women and 39% men.

- A significant number of Chime users (around 9 million) use it as their primary bank account.

- Chime is a major player in the Neobanking space, but it isn’t easy to pinpoint an exact market share due to the evolving nature of the industry.

Top Features of the Chime App

If you want to make an app like Chime that disrupts the market, you get to learn from it too.

For the development of a mobile banking app, you need to carefully select features that resonate with your target audience without overwhelming them. The balance here is very important yet so delicate.

As you embark on building your mobile banking app, here are 11 key features inspired by Chime’s success.

Remember, your target audience – the users – and their financial well-being are paramount.

1. Fee-Free Philosophy

Want to develop an app like Chime and be the next big name in the market?

Well, start by ditching hidden fees and monthly maintenance charges. Let your app be a breath of fresh air compared to traditional banks.

This transparency in pricing builds trust with users, especially those who are cost-conscious.

This way, your target audience will appreciate knowing exactly what they’re paying for, without any surprise charges.

2. Early Payday Power

Understanding the financial struggles some users face, it allows them to access their direct deposits 1-2 days earlier.

This feature has become a lifesaver for those living paycheck to paycheck, being the reason behind the rising popularity of apps like Chime.

Imagine the relief of having access to funds a bit sooner to cover unexpected bills or groceries. It’s a small yet significant perk that will endear users to your app.

3. Frictionless Money Movement

In today’s interconnected world, seamless money movement is crucial.

Allow users to send and receive money with ease, even if the recipient isn’t on your platform. Integrate peer-to-peer transfers so users can send money with just a phone number or email address.

This eliminates the hassle of bank account details and cumbersome procedures. Remember, convenience is key to keeping users engaged.

4. Mobile-First Design

Your app is the primary touchpoint for your users, so prioritize UI/UX Design.

Think clear navigation, an uncluttered interface that’s easy on the eyes, and a visually appealing aesthetic.

A mobile banking app should be a joy to use, not a source of frustration. A positive user experience will keep them coming back for more.

5. Empowering Account Management

Financial transparency goes beyond fees.

Allow users to view their account balances, and transaction history, and download statements directly within the app.

This real-time access to their financial information empowers them to make informed decisions and track their spending habits.

It fosters a sense of control over their finances.

6. Seamless Bill Pay

Help users streamline their financial management by integrating a robust bill-pay function.

Create a Chime-like app that allows users to schedule and pay bills directly through the app, eliminating the need for manual payments and multiple logins.

This convenience factor will be a major selling point for users who juggle multiple bills and tight schedules.

7. Fort Knox-Level Security

Security is non-negotiable in the world of finance.

Implement robust security measures like multi-factor authentication (MFA) that require an additional security code beyond their password for login attempts.

In addition to this, use data encryption to safeguard user data. These measures build trust and assure users that their financial information is protected.

8. Widespread ATM Access

While digital payments are gaining traction, cash access remains a necessity for many users.

Provide in-network access to a wide network of fee-free ATMs. This ensures users can conveniently withdraw cash whenever needed, without incurring additional charges.

Convenience matters, and making cash withdrawals accessible goes a long way in user satisfaction.

9. Financial Fitness Tools

Your Chime app clone can be more than just a platform for transactions.

Empower users with financial fitness tools like budgeting tools, spending trackers, or even educational resources on financial literacy.

These features will help them make informed financial decisions, set and achieve savings goals, and ultimately, achieve financial wellness.

10. Real-Time Alerts

Offer customizable push notifications for transactions, low-balance warnings, or security updates.

This keeps users informed and engaged with their finances, allowing them to monitor activity and potential security risks.

For example, a low balance notification can prevent an embarrassing declined transaction, while a security update assures them their information is protected.

11. Virtual Debit Card Option

Lastly, to create a Chime clone that stands out, you should give a virtual debit card option.

These can be used for secure online transactions and provide users with more control over their spending.

Virtual cards cater to the growing trend of online shopping and offer an extra layer of security compared to traditional debit cards.

This caters to the evolving needs of today’s tech-savvy consumers.

With our furry friends becoming increasingly like family, some mobile banking apps are incorporating pet-related features. This could involve virtual wallets for pet care expenses or even pet insurance options accessible through the app.

Why Develop an App Like Chime?

Apart from how to create an app like Chime and how much it costs to build an app like Chime, people also frequently ask, why develop an app like Chime?

After all, it can be quite an investment.

So, why do so many people want to develop an app like Chime?

Well, there are various reasons to invest in app development and build your own Chime-like solution. Let’s discuss them in detail below:

♦ Capitalize on the Booming Mobile Banking Market

The global mobile banking user base is experiencing explosive growth.

According to the statistics, over 2.5 billion people worldwide actively use mobile banking.

This translates to a massive potential customer pool for your mobile app. A big reason to create your app like Chime. Imagine the possibility of attracting a significant portion of this tech-savvy demographic with a user-friendly and feature-packed app.

By entering the mobile banking arena, you gain access to a vast and engaged audience eager for innovative financial solutions.

♦ Stay Ahead of the Curve & Meet Evolving Customer Needs

Today’s banking customers, particularly millennials and Gen Z, prioritize a seamless, digital-first banking experience.

A 2023 report revealed that a staggering 64% of mobile banking users would switch banks solely for a more user-friendly mobile app.

This statistic underscores the importance of prioritizing Chime app development. By creating an intuitive and feature-rich app, you cater to the evolving needs of your customers.

This not only fosters loyalty but also attracts new customers seeking a modern and convenient banking experience.

♦ Fortify Security & Combat Fraud With Cutting-Edge Technology

Mobile banking apps offer the potential for enhanced security compared to traditional banking methods.

Biometric authentication, multi-factor authentication, and other advanced security features can be integrated into your app to safeguard user data from unauthorized access.

A report by Juniper Research estimates that global mobile banking fraud losses could reach a staggering $40 billion by 2027.

Developing a mobile banking app with advanced security features demonstrates your commitment to protecting your customers’ financial well-being.

This builds trust and positions your institution as a leader in secure and reliable mobile banking.

So, these are the reasons to invest in Chime-like app development. Now with this out of the way, we are back to the cost part.

Cost to Develop an App Like Chime

What’s the cost to build an app like Chime?

On average, the cost to develop an app like Chime typically ranges from $30,000 to $150,000.

It highly depends on the platform’s complexity first, then on the development platform, tech stack, feature set, security measures, and development team’s location as well as experience.

| Development Complexity | Estimated Cost Range (USD) |

| Basic Mobile Banking App | $30,000 – $75,000 |

| Feature-Rich Mobile Banking App | $75,000 – $150,000 |

| Complex Mobile Banking Apps with Core Chime-Like Features (Our Focus) | $100,000 – $150,000+ |

Due to the involvement of so many factors and variables, it becomes very difficult to estimate the development cost of a mobile banking App.

That’s why, if you are looking for a closer estimate for your Chime clone development project, it’s highly recommended that you consult an app development company.

They will be able to give you a quote based on your project specifications.

Factors that Affect the Cost of Creating an App Like Chime

To create or even plan to make a NeoBank app similar to Chime, one must understand the cost and different factors that affect it.

The development cost of a mobile app isn’t calculated at once, but rather an amalgamation of different aspects and their associated costs.

So let’s get right into it:

➤ App Type

First things first, the app idea.

Or in other words, the type of banking app.

While we are talking about the cost of making an app like Chime, there can be significant variations that can highly affect the end price.

Let’s look at a general breakdown below:

| App Type | Description | Estimated Cost Range (USD) |

| Feature-Rich Mobile Banking App (Chime-Like) | Provides a comprehensive suite of features for a single financial institution, similar to Chime. Offers functionalities like account management, money transfer, bill pay, budgeting tools, debit card management, and potentially basic investment options. | $120,000 – $150,000+ |

| Limited Account Aggregator App (Focused View) | Allows users to view and manage a limited number of connected accounts (2-3) in one place, focusing on data visualization and basic money management tools. It may not include direct transactions. | $100,000 – $120,000 |

| Enhanced P2P Payment App with Additional Features | Offers core P2P money transfer functionalities along with additional features like social integration, bill splitting, and in-store payments. | $100,000 – $130,000 |

| Niche Banking App with Advanced Features | Cater to a specific user segment with tailored features beyond basic functionality. Think budgeting-focused apps with gamification elements or student banking apps with scholarship management and loan application tools. | $110,000 – $140,000 |

When you are building a banking app, the level or type of app is surely important to consider.

Believe it or not, due to glitches or typos, some mobile banking users have accidentally received large sums of money in their accounts. While exciting in the moment, these situations usually involve working with the bank to return the mistaken funds.

➤ Development Platform

In the second step of the development process of a banking app, we need to choose a platform.

Native vs. hybrid, and Android vs. iOS, are common debates here.

However, the choice of platform highly affects the cost to build an app like Chime. Here’s how it works:

| Development Platform | Description | Estimated Cost Range | Considerations |

| Native Development (iOS & Android) | Develop separate apps for each operating system (iOS and Android) to leverage native features and optimize performance. | $120,000 – $150,000+ | Offers the best user experience and performance but requires a larger development team and potentially higher costs, especially if exceeding the planned features within the budget. |

| Cross-Platform Development (React Native, Flutter) | Uses a single codebase to create apps for both iOS and Android, reducing development time and cost. | $100,000 – $140,000 | More cost-effective than native development but may have limitations in performance or accessing certain native device features. |

The cost for hybrid, Android, and iOS app development is unique due to the inherent differences in the platforms and their development styles.

Speaking of which, let’s move to the next step.

➤ Tech Stack

Tech stack refers to the technologies used to develop an app like Chime. Thus, as one might assume, it highly affects development costs as well.

How? Well, depending on what you are developing and the type of features you want, the banking app’s tech stack would be different, thus, giving a unique cost.

| Tech Stack | Cost Impact |

| Frontend Development | $20,000 – $30,000 |

| Backend Development | $25,000 – $35,000 |

| Database | $10,000 – $15,000 |

| Cloud Services | $15,000 – $25,000 |

| Security | $10,000 – $20,000 |

| API Integration | $10,000 – $15,000 |

| Testing & QA | $10,000 – $15,000 |

With the tech stack done, let’s move to the designing part.

➤ UI/UX Design

To create a Chime clone app that’s successful in capturing a user’s attention, you need to focus on the design.

UI/UX design costs work differently from everything else, yet are quite similar in the complexity in that: The higher the level of design you opt for, the more it adds to the cost to create an app like Chime.

Here’s a breakdown:

| UI/UX Design Approach | Description | Estimated Cost Range | Considerations |

| Basic Design with Established Patterns | Utilizes well-established UI/UX patterns for mobile banking apps, focusing on clarity, functionality, and ease of use. Limited visual customization. | $50,000 – $70,000 | Most cost-effective option, keeping design costs within budget. May lack a unique brand identity. |

| Custom Design with Mid-Level Complexity | Create a custom user interface that aligns with your brand identity while maintaining a user-friendly layout and intuitive navigation. Incorporate some unique design elements. | $70,000 – $100,000 | Offers a balance between cost and brand differentiation. Well-suited to stay within budget while creating a visually appealing app. |

| High-Fidelity Prototype with Extensive User Testing | Develops a high-fidelity prototype with advanced visual elements and animations. Conducts extensive user testing to refine the design for optimal user experience. | $100,000 – $130,000+ | Prioritizes user experience with a focus on usability testing and iteration. This approach can push the design cost towards the upper limit of the budget, potentially requiring adjustments in other areas. |

Any banking app’s design has huge significance not only in terms of app development cost but also performance of the app at a greater level.

So the point here isn’t to minimize cost but to develop an app like Chime that attracts users and retains them.

➤ Features

Finally, it’s time to look at features.

Features aren’t add-ons, but rather built into the platform, much like microservices work.

Therefore, the complexity of the functionality of the Chime clone i.e. NeoBank app, highly affects the total development cost.

Here’s a detailed breakdown

| Feature Category | Features | Cost Impact | Description |

| Essential Features |

|

Low-Medium ($40,000 – $60,000) | Core functionalities required for basic banking operations. |

| Intermediate Features |

|

Medium-High ($60,000 – $100,000) | Features that improve the user experience and add value. |

| Advanced Features |

|

High ($150,000+ ) | Features requiring significant development effort and potentially third-party integrations. |

Emoji PINs? Maybe Soon: While current security measures focus on passwords and fingerprint recognition, some banks are exploring emoji PINs for added security and personalization. Imagine unlocking your bank app with a sequence of your favorite emojis!

➤ Security

Banking application security is paramount.

And there’s no two ways about it. Especially in 2024, when regulations are more advanced & strict than ever.

Here’s a breakdown of security and its impact on cost:

| Security Features | Cost Impact | Description | Considerations |

| Basic Security Measures | Low |

|

Typically included within the base development cost ($100,000 – $120,000 range). Standard encryption libraries are readily available. |

| Enhanced Security Features | Medium |

|

Increases development time and cost. MFA integration with third-party providers may incur additional fees. |

| Advanced Security Considerations | High |

|

Significantly increased costs. Penetration testing often requires specialized security firms. Secure enclaves require specialized hardware and expertise, potentially exceeding the budget |

As financial fraud increases day by day, it’s wise to invest in high-level security. This doesn’t only ensure the success of the platform but also inspires confidence among users.

➤ Development Team

To create an app like Chime and calculate its cost, you must figure out the cost to hire app developers.

Now, there are various ways to find an app developer in 2024. Each of them has a unique cost of its own. Here’s a breakdown of that.

| Development Team Structure | Cost Impact | Description |

| In-House Development Team | Medium-High ($120,000+) | Building a dedicated team of developers, designers, and project managers within your company. |

| Freelance Developers | Low-Medium ($80,000 – $120,000) | Hiring individual freelance developers for specific skills needed for the project. |

| Development Agency | Medium-High ($100,000 – $150,000+) | Contracting a development agency with a team of experienced developers, designers, and project managers. |

| Offshore Development Team | Low-Medium ($70,000 – $100,000) | Hiring a development team located in a country with lower development rates. |

How Long Does it Take to Make Chime Clone?

So, how long does it take to develop an app like Chime?

The average time required to make an app like Chime is between 4 and 10 months. Development time has the same factors as cost.

| Development Phase | Description | Estimated Time (within Budget) |

| Discovery & Planning (10%-15% of Budget) | Gather requirements, define user personas, create product roadmaps, and establish project scope. | 2-4 weeks |

| UI/UX Design (15%-20% of Budget) | Design user interface mockups, wireframes, and prototypes to ensure a user-friendly experience. | 3-5 weeks |

| Development (50%-60% of Budget) | Front-end and back-end development based on chosen tech stacks and prioritized features. | 12-16 weeks |

| Testing & Quality Assurance (10%-15% of Budget) | Rigorous testing on various devices and scenarios to identify and fix bugs. | 4-6 weeks |

| Deployment & Launch (5%-10% of Budget) | App store submissions, marketing preparation, and launch activities. | 2-4 weeks |

With the Chime clone app development cost and development time done, it’s time to look at monetization.

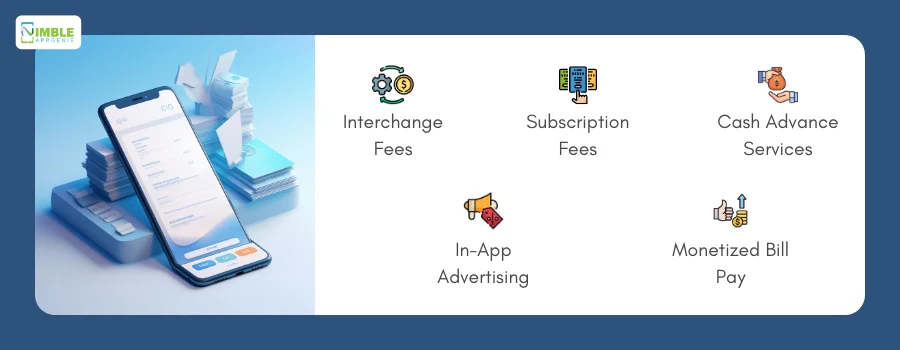

How to Make Money With an App Like Chime?

The cost to develop an app like Chime isn’t cheap by any means.

So how about we make some good money back from our NeoBanking app?

That’s where app monetization comes in.

We shall go through some top monetization strategies for banking apps that you can apply to your Chime clone; Plus, how they affect cost.

These are, as mentioned below:

1] Interchange Fees

This is the most common revenue stream for many mobile banking apps. Every time a user swipes their debit card at a merchant, the merchant’s bank pays a small fee to the issuing bank (your app in this case). These fees, known as interchange fees, can be a significant source of income, especially with a large user base.

-

Budget Considerations

While you won’t need a significant budget allocation to benefit from interchange fees, a larger user base translates to more transactions and potentially higher revenue.

2] Subscription Fees

Offer premium tiers with additional features or benefits for a monthly or annual subscription fee. These features could include advanced budgeting tools, higher ATM withdrawal limits, or cashback rewards programs.

-

Budget Considerations

Developing and maintaining a tiered subscription system might require additional development effort impacting your initial budget (within $100,000 – $150,000). However, subscription fees can be a recurring revenue stream.

3] Cash Advance Services

Partner with a financial institution to offer cash advance services to your users. This allows users to access a small amount of money instantly, typically at a higher interest rate, which you could earn a portion of as a referral fee.

-

Budget Considerations

Partnering with a financial institution requires establishing a business relationship, potentially requiring legal and integration costs. However, this can be a lucrative revenue stream if managed effectively.

4] In-App Advertising

Carefully integrate targeted in-app advertising that complements your financial services but doesn’t disrupt the user experience. You can earn revenue based on clicks or impressions on these ads.

-

Budget Considerations

While in-app advertising can be a revenue source, intrusive or irrelevant ads can damage user trust. Carefully select advertising partners and integrate ads thoughtfully to avoid impacting user experience.

5] Monetized Bill Pay

Partner with bill payment processors who offer a revenue-sharing model. This could involve a small fee applied to each bill paid through your app, generating income without directly charging your users.

-

Budget Considerations

Negotiating revenue-sharing agreements with bill payment processors might require time and effort. However, this can be a passive income stream once established.

Nimble AppGenie – Your Partner in the Development of a Mobile Banking App

Revolutionize your financial landscape with a pioneering mobile banking app built by Nimble AppGenie, a leading mobile banking app development company.

We’re not just another app developer.

With over 350+ successfully completed projects and a staggering 95% client satisfaction rate, Nimble AppGenie is a trusted name in the mobile app development industry.

Our unwavering commitment to excellence has been recognized by leading platforms like Clutch.co, DesignRush, and GoodFirms, solidifying our position among the best in the industry.

Our team of experts boasts a proven track record, having developed industry-leading banking applications like Pay By Check, SatPay, CUT, and SatBorsa.

We go beyond these examples. We understand that every financial institution has unique requirements.

That’s why we take a collaborative approach, working closely with you to understand your vision, target audience, and desired functionalities.

Ready to unlock your financial future?

Hire mobile app developers from Nimble AppGenie today for a free consultation. Let’s leverage our award-winning expertise to build a secure, user-friendly app that revolutionizes your banking landscape.

Conclusion

Developing an app like Chime involves careful consideration of various factors including key features, development complexity, and cost.

With Chime-like app development costs ranging from $30,000 to $150,000, the success of such an app hinges on its ability to offer a user-friendly, secure, and feature-rich banking experience.

As the financial landscape continues to evolve towards digital-first solutions, an app that encapsulates the essence of Chime’s successful model—focusing on transparency, convenience, and user empowerment—stands a strong chance of capturing the tech-savvy market and revolutionizing the way users interact with their finances.

FAQs

Chime is a mobile-first NeoBank that offers user-friendly banking solutions with perks like fee-free transactions, early paycheck access, and a focus on transparency and convenience. Its popularity stems from its appeal to tech-savvy generations looking for control over their finances without the traditional banking hassles.

Key features inspired by Chime’s success include a fee-free philosophy, early payday access, seamless money transfers, a mobile-first design, empowering account management, seamless bill pay, robust security, widespread ATM access, financial fitness tools, real-time alerts, and a virtual debit card option.

Developing an app like Chime can range from $30,000 to $150,000, depending on the complexity and the specific features you want to include. A basic mobile banking app can start at $30,000, while more feature-rich and complex apps that closely mirror Chime’s functionalities can go beyond $150,000.

Several factors can impact the development cost, including the app type (feature-rich, account aggregator, P2P payment, etc.), the development platform (native vs. cross-platform), the tech stack involved (frontend, backend, database, etc.), the UI/UX design approach, the inclusion of core and advanced features, security considerations, and the development team’s structure (in-house, freelance, agency, offshore).

For a feature-rich mobile banking app similar to Chime, costs can range from $120,000 to $150,000+. Costs vary based on the development platform, with native development for iOS and Android at the higher end ($120,000 – $150,000+) and cross-platform development being more cost-effective ($100,000 – $140,000).

The development timeline can vary, but it generally includes phases such as discovery and planning (2-4 weeks), UI/UX design (3-5 weeks), development (12-16 weeks), testing and quality assurance (4-6 weeks), and deployment and launch (2-4 weeks).

Revenue streams for a Chime-like app could include interchange fees from debit card transactions, subscription fees for premium features, income from cash advance services, targeted in-app advertising, and monetized bill pay options.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.