Do you want to develop an app like Wise?

Formerly known as TransferWise, it is an international money transfer app. Being a kind platform, it has grown very popular among users from across the world.

Consequently, many want to develop their own wise clone.

This begs the question:

“How much does it cost to build an app like Wise?”

The average cost to build an app like Wise ranges from $75,000 to $200,000 based on the app’s features, platform, tech stack, overall complexity, and development team.

Estimating wise-clone development cost can be difficult without understanding the different factors in play.

So, to help you on your journey of payment app’s success, let’s discuss just that:

Wise – Formerly TransferWise

Wise is a mobile app that allows users to transfer money between bank accounts.

It offers users a mid-market exchange rate with a transparent fee structure, making it one of the best international payment apps.

Wise provides users with a multi-currency debit card that can be used to spend money abroad.

It is available on both iOS and Android app stores. The Wise app enjoys a positive reputation with a 4.6-star rating on the App Store

To better understand the platform, let’s look at some related statistics:

- Fintech statistics show they ease the transfer of more than 6 billion GBP a month, with customers saving an estimated total of 3 million GBP daily compared to using a bank.

- There was significant growth in Q3 FY2022 with 4 million users transferring over 20 billion GBP.

- One of the things that makes it stand out is that it’s competitive fees, averaging around 60% per transaction

- Wise itself operates in over 170 countries and facilitates transactions with over 50 currencies.

- As of 2024, the platform had over 16 million users globally, adding 4 million new users recently.

- Speaking of users, over 50% of desktop users are under 35 years old, with the largest group being 25-34 years ol

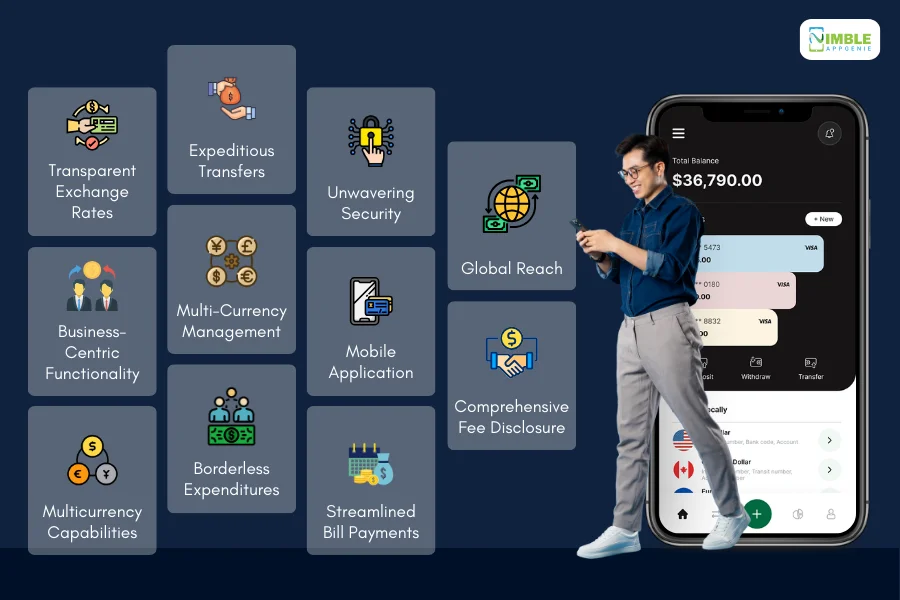

Top Features of Wise App

Features play a huge role in the success of a platform.

So, what are the right features to include in your app like Wise?

Well, the ewallet app’s features should be a good mix of core, advanced, and unique functionalities. Let’s get inspired by Wise’s own feature set.

1. Transparent Exchange Rates

Bid farewell to exorbitant bank fees that erode your transfer value.

Wise prioritizes transparency by utilizing the mid-market exchange rate, the very rate employed by major financial institutions for currency trades.

This commitment to fairness translates into substantial cost savings, particularly for large transfers.

2. Comprehensive Fee Disclosure

Eliminate the uncertainty of hidden charges and surprise deductions!

Wise presents the total transfer fee upfront before you finalize the transaction.

This fee encompasses the operational costs associated with facilitating your transfer and ensuring a smooth and efficient process.

3. Multicurrency Capabilities

Transcend the limitations of a singular currency.

Wise empowers you to send and receive funds in over 150 currencies, catering to a vast network of international transactions.

Need to send Euros to a colleague in France or Australian Dollars to your family overseas?

Wise makes it effortless.

4. Expeditious Transfers

Time is a valuable commodity, especially when dealing with international transfers. Wise prioritizes speed with its lightning-fast transfer service.

Nearly half of all transfers are completed instantaneously, meaning your recipient receives the funds within seconds!

Even for transfers requiring slightly longer processing times, the process remains remarkably swift, typically reaching the destination bank account within 1-2 business days.

5. Global Reach

The world awaits, and Wise serves as your gateway.

It transcends geographical boundaries, enabling you to send and receive money directly to bank accounts in over 190 countries.

Consider it your universal bank account, facilitating connections with individuals and businesses across the globe.

6. Borderless Expeditions

Escape the double whammy of foreign transaction fees and unfavorable exchange rates when spending internationally.

Utilize Wise debit cards for purchases in local currency.

Wise adheres to the mid-market rate for conversions, and you’ll be presented with the exact amount deducted from your account beforehand – complete transparency for a stress-free experience.

7. Unwavering Security

The safety of your funds is paramount to Wise.

Two-factor authentication serves as an additional layer of security, requiring a code from your phone in conjunction with your password whenever you log in or initiate transactions.

In addition to this, industry-standard encryption safeguards your personal and financial information, keeping it secure from unauthorized access.

8. Mobile Application

The Wise mobile app empowers you to manage your international finances with ease.

Manage transfers on the go, track currency fluctuations in real-time, and monitor your account balance – all conveniently accessible from your smartphone.

The app boasts a user-friendly interface and keeps you informed throughout the entire process.

9. Streamlined Bill Payments

Conquer the complexities of international bill payments with Wise (availability subject to location).

You can schedule and pay bills directly through the app, eliminating the hassle of currency conversions. Wise handles the complexities, saving you valuable time and effort.

10. Multi-Currency Management

Planning an international escapade or anticipating future transfers in various currencies? Wise empowers you to hold balances in multiple currencies within your account.

Need to convert between them? No problem!

Utilize advantageous mid-market rates for conversions whenever necessary, all conveniently facilitated within the app.

This feature equips you to be a financial strategist and avoid last-minute currency exchange predicaments.

11. Business-Centric Functionality

Wise extends its reach beyond individual users, offering a dedicated suite of features designed to streamline international payments for businesses.

Manage employee payrolls, pay international vendors, and receive payments from clients around the world – all with transparent fees and a user-friendly platform.

Wise empowers businesses to thrive by simplifying their global financial operations.

The global money transfer market is expected to reach a staggering $3 trillion by 2026, highlighting the immense potential for innovative apps like Wise.

Why Develop an App Like Wise?

So, you want to develop an ewallet app.

But should you? One of the biggest questions that creeps into my mind, even bigger than “How much does it cost to develop an app like Wise?” is,

Should I develop an international payment app like wise, at all?

Yes, you should! There are several reasons to why should business invest in apps.

Let’s look at the same below:

-

Addressing a Growing Market

The global demand for international money transfers is projected to reach $327 trillion by 2026, according to international digital wallet statistics.

This significant growth is fueled by factors like globalization, an increase in remote workforces (over 25% globally as of 2022), and a growing international student population.

An app like Wise can cater to this increasing demand by offering a convenient and affordable solution.

Millennials are the most frequent users of money transfer apps, driven by their preference for digital solutions and international connectivity.

-

Disrupting Traditional Money Transfer Services

Traditional banks and money transfer services are often criticized for hidden fees, slow transfer times (averaging 3-5 business days), and unfavorable exchange rates.

You can develop an app like Wise and disrupt this market by providing greater transparency, faster processing (Wise boasts nearly 50% of transfers are completed instantly!), and competitive exchange rates based on the mid-market rate.

Also Read: How to Create a Money Transfer App?

-

Cater to a Tech-Savvy Audience

The target demographic for international money transfers is likely to be tech-savvy and mobile-dependent.

Over 6.6 billion people worldwide will use smartphones in 2023.

Building a user-friendly and accessible mobile app like Wise allows you to tap into this audience and provide a seamless user experience.

-

Offer Niche Features

While Wise excels in core functionalities, there might be room for specialization.

Your app could focus on specific geographic regions and cater to a particular user group (like freelancers or students making tuition payments).

Or integrate with popular accounting or business management software like Xero or QuickBooks for a more comprehensive financial solution.

Also Read: How to Build a Payment App Like Cash?

-

Build a Global Brand

With the right approach, an app like Wise has the potential to become a global brand.

By offering multilingual support, catering to diverse currency needs (Wise offers over 150!), and complying with international regulations, you can establish a trusted presence in the international financial landscape.

This can lead to a loyal user base and significant growth opportunities.

These are the top reasons to create an app like wise of your own. Now, with this being said, let’s move back to the cost part in the section below.

Average Cost to Develop an App Like Wise

How much does wise-like app development cost?

Much like any other cost to develop a fintech app, when building an international payment app, cost depends on a lot of different factors.

The average cost to make a wise clone ranges from $75,000 to $200,000. It depends mainly on the complexity of the app along with factors like platform, tech stack, features, and developer’s location, also affecting the cost.

This is the exact reason why it is so difficult to predict development costs.

You see, every wise-clone app development project is unique in its own way. Therefore, each also costs uniquely.

Consequently, if you are looking for an accurate estimation for a wise clone project, it’s highly advised you consult an app development company.

Factors That Affect Wise Like App Development Cost

Let’s discuss the different factors that affect app development cost.

From complexity to the app platform and tech stack, each has its own diverse effect on total cost estimates when you are building a platform like Wise.

Now, to estimate the cost and set a budget for the project, you need to understand this.

That’s why, in this section of the blog, we shall be discussing exactly that.

1. Complexity

There’s a general rule in fintech apps or any form of app development for that matter:

As the complexity of the solution increases, so does the development cost. The reason being, more complex solutions require more time, more effort, a larger team, more experienced developers, and better tools.

That’s how complexity affects the wise clone app development cost.

| Feature Complexity | Development Cost | Explanation |

| Basic Features | Low ($50,000 – $75,000 ) | Core functionalities like user registration, login, currency selection, and basic money transfer. |

| Moderate Complexity | Medium ($75,000 – $125,000 ) | Add features like multi-currency wallets, exchange rate tracking, transaction history, and basic security measures. |

| High Complexity | High ($125,000 – $200,000+) | Implementing advanced features like real-time currency conversion, international bill pay, integration with accounting software, and robust security protocols with multi-factor authentication. |

Now that we are done with how complexity affects wise app development costs, it’s time to look at the platform.

2. Platform

When you are developing an app like Wise, the first thing you need to do is, select a development platform.

In layman’s terms, you need to choose between hybrid and a native platform. And within native, select between Android & iOS App.

So, what does all of this have to do with cost to make Wise like app?

Well, android app development cost, iOS app development cost, and hybrid app development cost are all different from each other.

Here’s a detailed breakdown”

| Platform | Pros | Cost Impact |

| Native Development (iOS & Android) |

|

High ($150,000+) |

| Cross-Platform Development (React Native, Flutter) |

|

Medium ($75,000 – $125,000) |

| Hybrid Development (Combining Native & Cross-Platform) |

|

Medium to High ($100,000 – $175,000+) |

The first online money transfer service emerged in 1994, paving the way for the development of user-friendly mobile apps like Wise today.

3. Tech Stack

Done with the platform and time to look at the tech stack.

You see, when you are creating a cross-border payment app like Wise, fintech tech stack becomes super important.

Whether it is facilitating international transfers or handling complex data sets while maintaining security, you need to carefully select it. But that’s not all, the tech stack for the wise app development will also highly affect the wise app development’s cost.

Here’s how:

| Components | Technology Options | Cost Impact (USD) |

| Front-End | React, Angular, Vue.js | $5,000 – $30,000– More complex UI/UX designs and interactions can increase costs. |

| Back-End | Node.js, Ruby on Rails, Django, .NET | $10,000 – $50,000– Choice of more comprehensive frameworks may initially increase costs. |

| Database | PostgreSQL, MySQL, MongoDB | $4,000 – $20,000– SQL databases may require more setup and maintenance, affecting costs. |

| Mobile App | Swift (iOS), Kotlin (Android), React Native (Cross-Platform) | $15,000 – $80,000 – Native development for each platform can increase costs due to separate codebases. |

| Payment Gateway | Stripe, PayPal, Adyen | $2,000 – $10,000 – Integration complexity and transaction fees vary by provider. |

| Security | OAuth, JWT, SSL, Encryption Libraries | $5,000 – $25,000 – Implementing advanced security measures and compliance can affect costs. |

| Cloud & DevOps | AWS, Google Cloud, Azure, Docker, Kubernetes | $3,000 – $15,000– Cloud services can introduce variable operational costs. Kubernetes setup might increase initial costs. |

| Third-Party APIs | Currency Conversion APIs, KYC/AML Services | $1,000 – $10,000 – Costs vary based on usage and complexity of integration. |

4. App UI/UX Design

UI/UX design makes all the difference when it comes to customer retention.

But that’s not all. It also highly affects the cost of making cross-border payment apps. UI/UX design cost itself depends on a lot of different factors thus, adding to the total cost.

In any case, here’s how ewallet app’s design navigates budgeting.

| UI/UX Design Approach | Pros | Cost Impact |

| Basic Design |

|

Low ($10,000 – $20,000) |

| User-Centered Design (UCD) |

|

Medium ($20,000 – $40,000) |

| Premium Design |

|

High ($40,000+ per platform) |

Now that we are done with the design, let’s move to the next factor which is…

5. Features

Currently,cost to develop an ewallet app highly depends on the features.

While basic features are not a big contributor to the cost, advanced ones are a different story. Please see the detailed representation of the same below:

| Features | Cost Impact | Cost Range |

| Basic features (login, user profiles, etc.) | Low | $5,000 – $10,000 |

| Push notifications | Medium | $3,000 – $7,000 |

| In-app chat | Medium | $5,000 – $10,000 |

| Payment Gateway Integration | High | $10,000 – $20,000 |

| GPS functionality | Medium | $7,000 – $15,000 |

| Social media integration | Medium | $5,000 – $12,000 |

| Complex animations or 3D graphics | High | $15,000 – $30,000 |

| Machine learning and AI integration | High | $20,000 – $50,000 |

| Backend server development | High | $15,000 – $30,000 |

| Admin panel for content management | Medium | $7,000 – $15,000 |

That’s why it is so important to choose features, not only to maintain budget but to also guarantee the app itself.

6. Development Team

It’s time to find an app developer to create wise-like solutions.

Now, there are various ways to hire wise clone app developers and the cost to do so also highly ranges. Let’s see how you can estimate the cost to hire app developers.

There are two factors to take into consideration:

-

App Development Team Type

The cost of developing an in-house team differs from fintech development outsourcing. Here’s how:

| Development Team | Cost Impact | Cost Range |

| In-house team (North America/Western Europe) | High | $150 – $250 per hour |

| In-house team (Asia/Eastern Europe) | Medium | $75 – $125 per hour |

| Freelance Developer | Medium-High | $50 – $175 per hour (depending on experience) |

| Outsourcing Company (Offshore) | Low-Medium | $30 – $80 per hour |

-

App Developer’s Location

The location of mobile app developers also highly affects the bill of wise app development cost. Here’s how:

| Developer Location | Cost Impact | Cost Range |

| North America / Western Europe | High | $150 – $250 per hour |

| Asia / Eastern Europe | Medium | $75 – $125 per hour |

| Latin America / Southeast Asia | Low-Medium | $30 – $80 per hour |

These are the different factors that affect the wise clone app development cost. Now that we are done with this, let’s move to the next section.

How Long Does It Take to Make a Wise Clone?

Questions like “how to develop an app like wise?” are often followed by questions like how long does it take?

Well, on average it takes 17-34 weeks to develop an app like wise.

Here’s app development time breakdown:

| Development Stage | Time Range (Estimated) | Description |

| Planning & Requirements Gathering | 2-4 weeks | Defining app functionalities, user journeys, and technical specifications. |

| UI/UX Design | 2-4 weeks | Designing user interface mockups and user flows for a smooth user experience. |

| Front-end Development | 4-8 weeks | Building the app’s user interface using programming languages like Swift (iOS) or Kotlin (Android). |

| Back-end Development & API Integration | 6-12 weeks | Developed the server-side logic and integrated with financial APIs for money transfer functionalities. |

| Testing & Quality Assurance | 2-4 weeks | Rigorous testing on various devices and scenarios to ensure app stability and functionality. |

| Deployment & App Store Approval | 1-2 weeks | Submitting the app to the Apple App Store or Google Play Store to address any potential feedback. |

| Total Estimated Time | 17-34 weeks | This is a broad range; the exact time will depend on the chosen features and the development team’s efficiency. |

How to Make Money With App Like Wise?

Cost to make an app like wise can be a little too much.

So, now it’s time to learn how to earn back some of the hard-earned money you spent of wise app development.

We are talking about digital wallet app monetization.

So, let’s see what ways to make money with a wise like app are:

-

Transaction Fees

Think of transaction fees as the engine that drives the money transfer business. Wise and similar apps typically charge a small fee for each transaction.

The fee can be a flat rate, a percentage of the transfer amount, or even a tiered system based on the transfer size.

This flexibility allows them to cater to different user needs and transaction sizes.

-

Competitive Rates With a Twist

Transparency is crucial for Wise.

They advertise competitive exchange rates, often much better than traditional banks.

However, there’s usually a small markup compared to the mid-market rate. This markup isn’t hidden – it’s factored into the upfront fee users see before initiating a transfer.

This is one of the best app monetization strategies when you are building apps like wise.

-

Premium Features

Imagine a world where your international transfer gets priority processing or you have access to dedicated customer support.

That’s the power of premium features!

Some Wise-like apps offer subscription plans that unlock these benefits and more.

Faster transfers, increased limits, and even multi-currency wallets are becoming available, catering to frequent users or those who need extra convenience.

-

Inactivity Fees

While some accounts might be dormant, resources are best used for active users.

A small inactivity fee may be implemented for accounts unused for a long period. This discourages dormant accounts and frees up resources to serve active users more efficiently.

This is one of the best ways to monetize fintech apps.

-

Interbank Advantage

Here’s a secret weapon: the interbank network.

Wise, like other money transfer services, taps into this network where banks exchange currencies directly.

These rates are generally much better than what retail customers get. By participating in this network, Wise can offer competitive rates while maintaining a healthy profit margin.

Nimble AppGenie – Your Partner in Payment App Development

Do you want to create an app like Wise?

While Wise app development cost can be a bit high, you don’t have to worry about that.

Nimble AppGenie, as a leading ewallet app development company and is here to help you. Offering affordable solutions to create your own app like wise, we have what it takes to turn your idea to reality.

We have done it before:

- Pay By Check– Pay by Check is a popular e-wallet mobile app in the United States of America. It allows users to transfer, pay, or even exchange currency.

- SatPay – An eWallet platform is a Versatile eWallet Platform that allows users to request, receive, and send payments without hassle.

- CUT– an E-wallet Mobile App, CUT is available in China and Myanmar. It works well with both RMB and MMK currencies.

- SatBorsa – a Currency Exchange Fintech app. SatBorsa is one of the platforms that is available on both platforms, iOS and Android.

If you want to be the next big name in cross-border payment app market, we can turn your idea into reality.

Hire app developer with a click and start your project within 24 hours.

Conclusion

Building a money transfer app like Wise can be a lucrative venture, but careful planning and execution are crucial.

By understanding the development process, cost factors, and potential revenue streams, you can make informed decisions to bring your innovative financial app to life.

Remember, a user-centric approach, competitive fees, and a seamless experience are key to success in this competitive market.

FAQs

Wise, formerly known as TransferWise, is a mobile app designed for international money transfers. It offers users the real mid-market exchange rate and displays a transparent fee structure upfront. Wise also provides a multi-currency debit card for spending abroad, making it a preferred choice for international transactions.

The cost to develop an app like Wise typically ranges from $75,000 to $200,000. The cost can vary based on the app’s complexity, chosen technology stack, platform (iOS, Android, or cross-platform), UI/UX design, and the development team’s location and expertise.

Several factors influence the development cost, including the app’s feature complexity, chosen platforms (native, cross-platform, or hybrid), technology stack (front-end, back-end, database), UI/UX design, payment gateway integration, security measures, and the development team’s geographical location and rate.

Developing a Wise clone can take approximately 17 to 34 weeks, depending on the development stages. This includes planning, UI/UX design, front-end and back-end development, testing, and deployment. The timeline can vary based on the app’s complexity and the development team’s efficiency.

Key features to consider include real-time currency conversion, transparent fee structure, multi-currency wallets, fast transaction processing, global reach, multi-currency debit card functionality, robust security protocols, user-friendly mobile app design, and integration with accounting and business management software for business users.

A Wise-like app can generate revenue through transaction fees (either flat rates, percentages of the transfer amount, or tiered systems), competitive exchange rates with slight markups, premium features or subscription plans for added benefits, and inactivity fees for dormant accounts.

To ensure success, focus on providing a seamless and intuitive user experience, competitive and transparent pricing, fast and reliable transaction processing, robust security measures, and cater to the specific needs of your target audience, including individual users and businesses.

You can partner with experienced developers or a software development company that specializes in financial applications. Look for teams with a proven track record in building similar apps and who understand the complexities of international money transfers, security, and regulatory compliance.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.