Are you confused about outsourcing fintech development?

In the current competitive world, fintech is creating a new history.

Do you know, that the fintech global market is projected to be USD 340.10 billion by 2024, which is expected to reach USD 1,152.06 billion by 2032?

You can enter this world and may earn millions by learning the nuances of fintech development outsourcing.

Are you ready?

Understanding Fintech Development Outsourcing

Let’s understand the importance of outsourcing fintech development first.

When it comes to outsourcing, it is all about the practice of hiring an external provider to do the services as well about create the products that are handled by the organization’s internal employees.

Let’s understand it in the case of fintech development.

Fintech development outsourcing assists companies in collaborating with experienced software development teams to take new fintech innovations to the market.

It helps banks get to market faster by leveraging the essential resources and expertise of external fintech developers.

Here, fintech outsourcing helps businesses to have a pool of global software experts. You can select the experts based on project requirements, with this assistance.

Now, the question is, “Why proceed with fintech development outsourcing?”

Learn it all in the following section.

Why Outsource Fintech Development?

Are you confused about why to outsource fintech development?

Here are the reasons to be considered:

♦ Access to Specialized Expertise

Outsourcing fintech development will give you a pool of experts to select the best team based on your project. Through outsourcing, you will be able to connect with the experts and skilled people who will help you to lead the industry.

In the case of outsourcing, you will be able to connect with the experts belonging to other locations and may test their skills abruptly. Thus, it is one of the best ways to develop your dream project.

♦ Cost-Effectiveness

Different companies outsource specific tasks to reduce costs. That’s the specialty of adopting outsourcing.

Similarly, outsourcing fintech software development can be useful in saving the total cost. Here you need not hire employees who are skilled in development. Additionally, you need not spend on the training process of the developers, which minimizes office expenses.

♦ Faster Time to Market

Do you want to launch your fintech app faster to stay competitive? Outsourcing fintech development can be an important choice here.

By partnering with an outsourcing team, you give a launch date to the developers who will be responsible for delivering your dream app on time. Here, you don’t need to spend time in recruiting and training the developers. Starting with experts is a choice.

♦ Scalability

If you prefer to adopt emerging trends while developing your dream project, then outsourcing them is a great choice. Outsourcing can be an important tool for scaling fintech businesses, through providing access to specialized talent, cost savings, and scalability.

You can start immediately with outsourcing fintech development by skipping the slow version of the in-house development procedure.

♦ Focus on Core Business

Through outsourcing, you can focus on core businesses and may make strategies for your target business, abruptly. With the help of back-office outsourcing, you can free up fintech organizations from unnecessary chores.

This will assist you to concentrate on optimizing the most crucial activities in the business. It is important to focus on the business core activities, and outsourcing fintech development can be helpful here.

These were all the reasons to be considered for choosing a fintech.

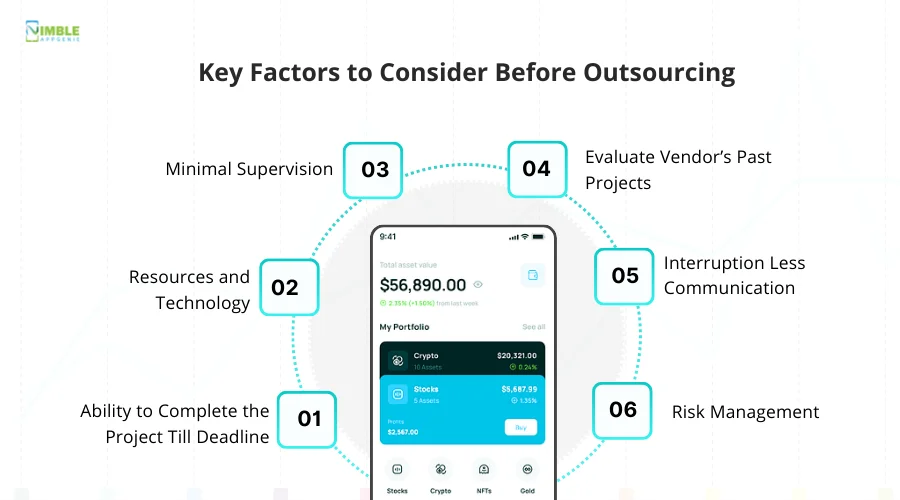

Key Factors to Consider Before Outsourcing

Are you ready to outsource the fintech development process?

Here are certain factors to be fintech development outsourcing that impact the outsourcing of fintech development.

1. Ability to Complete the Project Till Deadline

You need to meet the deadlines of the project and launch the app as planned. Thus, you should check the project deadline and then make the decisions related to Fintech development outsourcing.

You need to analyze the FinTech development outsourcing at the vendor and stick to the promised timeliness and quality. One of the ways to do this is to pre-compile all the queries beforehand.

2. Resources and Technology

You must ask the vendor for the respective tools and technologies that they are going to use within the project.

You should analyze the type of technologies and resources that can be used for creating the app and bringing the idea to life. Answering questions like this type of resource that the vendor will use is essential for achieving the desired app aim.

3. Minimal Supervision

When you connect with a team of developers to proceed with fintech development outsourcing, it’s vital to take care of every little aspect from scratch. You should select the vendor, to whom the supervision is required at a minimum level.

Considering this factor, you will be left with more time to focus on the core business functionalities.

4. Evaluate Vendor’s Past Projects

You must check the vendor’s past projects and previous assignments based on their past networks and clients. This will help you find out more about the vendor and the respective services that they are offering to you.

You can connect with the clients for whom they have worked before signing up for the respective project.

5. Interruption Less Communication

Another major and crucial factor here is to consider communication. You should check how you are going to communicate with the respective vendor and how quickly the process, here.

The channel of communication should be free of any barriers that might produce misunderstanding with the project.

6. Risk Management

You should know how capable the vendor is of addressing the frequent risks that might arise from unforeseen circumstances. Under a risk management plan, it is important to analyze regular performance assessments, contract compliance, and other factors.

An effective outsourcing partner should define the services and standards for evaluating each aspect of the project by ensuring that everything works as per the plan.

Apart from the stated factors, other determinants needed to be considered, such as service-level agreement, top-quality talent, and the firm’s industry expertise for outsourcing the project.

Well, as you got the details about the factors, now it’s time to know the steps to outsource fintech development projects.

Let’s learn it all in the given section.

Steps to Outsource Fintech Development

When creating a fintech app, it’s important to decide on the right partner.

What are the important steps to consider when outsourcing fintech development?

Here are the significant steps to undertake:

Step 1: Define Your Project Requirements

The first step in outsourcing fintech development is defining the complete project requirements. Here you should be able to define the details related to the type of app, different features you want to include, and a complete detail of the project.

Here, you can include the type of budget you want to include, along with the launch date of your project in the competitive market.

Step 2: Choose the Right Outsourcing Partner

Well, defining the details will be suitable, when you can select the right team of developers. It is important to hire mobile app developers who can aid you with the procedure.

The right outsourcing partner should depend on different parameters such as your budget, the user-friendly behavior of the developers, the location and skills of the developers, and several other things.

Step 3: Assess Skills and Expertise

It’s important to assess the skills and expertise of the developers to create a fintech project. You should evaluate the skills that will be helpful to successfully determine if the team is sufficient for outlaying the project or not.

Additionally, you can check the value of the expertise of the outsource partners, and can ensure that they have a deep knowledge of the frameworks, programming languages, and tools of the project.

Step 4: Set Clear Expectations and Milestones

The project’s aim and objectives should be clear while financial technology outsourcing. Vague expectations will result in a vague project that doesn’t allow you to achieve the desired goal of the project.

You should set metrics as the benchmarks which are connected to the specific goals. Certain goals are less directly linked to numbers and dates. Thus, setting milestones will be helpful to attain the project’s aim on time.

Step 5: Ensure Legal and Security Compliance

Now it’s time to ensure that legal and security compliance is within the project, effectively. You need to know the regulations and rules of the industry and need to build the app so.

Evaluating security compliance is essential for establishing a network. It’s important to conduct regular privacy and security audits to identify potential weaknesses and check compliance.

Step 6: Collaborate and Monitor Progress

Now, it’s time to have a continuous check on the project and its progress. You need to set up communication conventions, through fostering the collaboration value in the competitive market.

With the aid of online collaboration tools, you can allow for real-time instantaneous messaging and integrate the chat functions, and other effective tools.

In addition to online tools, incorporating SMS communications can ensure important updates are received instantly, especially in situations where team members may not have consistent access to internet-based platforms.

You can go ahead with custom fintech solutions outsourcing with the right guidance.

Well, while selecting the right outsourcing partner, you must know the types of challenges that may disrupt this procedure.

Here are some specific challenges in selecting the right fintech outsourcing company.

Common Challenges in Fintech Outsourcing

Frequent risks and challenges are common measures that cannot be avoided while outsourcing fintech development activities.

Learn about them below:

► Maintaining Quality Standards

If your app has certain quality standards, then you can survive in the competitive world.

However, when you go ahead with app development outsourcing, your app might face challenges related to quality standards as making the other team understand the project can be difficult.

► Data Security and Confidentiality

Another challenge that your project might face is related to data security. While connecting with the outsource team, there can be a risk of confidentiality as they can disclose the app or idea to any other company.

This can impact your business reputation and project. This can further lead to affecting the complete app and connectivity with your target users.

► Communication Barriers

Outsourcing the project can raise issues of communication, and over distance, it can become difficult to connect with the targeted developers. Poor communication can lead to misunderstandings and missed deadlines for app launches.

Communication barriers prevent people from receiving and evaluating the messages. This can create an obstacle in preparing the project and may hamper the complete construction of the app.

► Technological Gaps

By outsourcing fintech development activities, blockchain offers enhanced security, transparency, and efficiency within financial transactions. If you avoid the implementation of updated technologies, this can make your project outdated.

Hence, technological gaps may create issues in adopting the fintech app outsourcing strategies. Based on the growing fintech industry, it’s essential to adopt and implement the current trends for boosting app growth.

► Regulatory Compliance

The implementation of fintech compliance comprises proactive measures and vigilance, along with an in-depth understanding of the regulations. Avoiding the regulations will make your project out of use by the target customers.

Additionally, with time, fintech companies note a prospective change in the compliance and regulations. These continuous changes result in the implementation of current compliance practices that follow the state and country. Thus, it is a quiet issue here.

► Integration and Coordination

Integration with other technologies and apps can be a challenging task for your project while outsourcing it. You can lower the productivity of your business if you lack integration and coordination. This can be minimized by implementing a knowledge base for your product.

Via outsourcing, your project can be in question to excel in the practices. Here, the vendor might ignore the interactions that are required to build strong relationships with the clients.

These were all the challenges in fintech outsourcing. Well, when it comes to identifying the challenges, it becomes important to include the type of best practices for successful fintech outsourcing.

Within the given section, let’s consider the crucial practices for continuing with fintech outsourcing.

Best Practices for Successful Fintech Outsourcing

What are the top practices to be considered before initiating fintech development outsourcing?

Here are some specific Fintech outsourcing best practices:

1] Clear the Project Scope

If your project scope is not clear or transparent, it can impact the complete journey of fintech development. While outsourcing the project, it’s essential to analyze what you want from it.

A clear project goal will help you lead the respective industry with ease. Additionally, with a defined goal, you can set up milestones to achieve it concerning time.

2] Security and Compliance

Outsourcing fintech development can lead to a risk of data security and compliance practices which may further impact your brand connections with the target audience.

Thus, it’s essential to ask the vendor to keep the agreement secure and not disclose any internal project activities to outsiders.

3] Check the Expertise of the Developers

While outsourcing your fintech development, you should analyze the expertise of the developers and the type of resources or steps they will take to make your project completion process simple and smooth.

Identifying the expertise will be useful in predicting the result of outsourcing the fintech development process.

4] Consider Market Reputation

Without evaluating the current market parameters and competitors’ strategies, you cannot succeed in the industry. Hence, it’s essential to look for a diversified market channel and different types of options to select the best.

So, it’s important to analyze the market reputation of the outsourcing partner before you sign any agreement.

5] Define the Budget

Outsourcing partners can add certain charges after completion of the project. Thus, you should clearly state your budget and the maximum push limits for investments.

A well-defined budget project will result in reaching the target audience and earning their trust in the brand.

These are some of the practices that you should adopt to continue with the fintech development outsourcing.

Till now, we have discussed the concept of fintech outsourcing development, why to proceed with the same, factors impacting selection, and the steps needed to undertake along with challenges and practices.

The following section may be helpful here.

Cost Analysis of Fintech Development Outsourcing

Well, the cost to develop a fintech app will depend on the outsourcing parameters. Hence, let’s analyze the cost of outsourcing fintech development.

The average cost to outsource can vary from $20,000 to $300,000 depending on two critical factors: the expertise and location of the developers.

You should connect with developers based on their ability to provide quality and transparent services.

Connect with Nimble AppGenie to Outsource Fintech Development

Are you looking for reputed fintech development outsourcing services?

Nimble AppGenie is here to help. We offer an effective journey full of knowledge, expertise, and skills for enabling your dream app to lead.

We are the best Fintech App Development Company focused on delivering quality with transparency. Our team is dedicated to evaluating the current market dynamics and then using the solutions in your favor.

Conclusion

When considering outsourcing your fintech development, it’s essential to know why you want to do it. There are diversified reasons to check such as outsourcing helps to have access to skilled experts, cost-effectiveness, faster time to market, scalability, and helps to have a focus on core business activities.

There are a series of steps to outsource fintech development that start from defining the project requirements, selecting the right partner, assessing skills and expertise, and end with collaborating and progress tracking.

You should evaluate diversified challenges such as maintaining quality standards, maintaining data security, communication barriers, and many others. It’s essential to connect with the right partner and mitigate issues with best practices.

FAQs

Let’s consider the following list of steps to undertake for outsourcing fintech development.

- Clarify the Requirements: It is essential to define the project scope, goals, and objectives with the vendor before proceeding with the same.

- Select the Outsourcing Partner: You need to consider the location and expertise of the outsourcing partner and then select the best for your project.

- Assess Skills and Expertise: With an open discussion, you can evaluate the skills and expertise of the team and can proceed with the project successfully.

- Set Clear Expectations and Milestones: Now, you should set clear expectations and milestones for achieving the deadline of the project.

- Ensure Legal and Security Compliance: You need to know the legal challenges along with security compliance to proceed with the outsourcing fintech development.

- Collaborate and Monitor Progress: It’s important to collaborate and monitor the progress of your outsourcing partner to successfully lead the industry and track every activity.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.