Building a fintech application has become a necessity for financial services as it offers them access to a wider audience. The past decade has been game-changing for the growth of fintech, as it has seen exponential growth and acceptance in the market.

It is the evolution of Fintech has made it easy for users to access their bank accounts, funds, and other financial services without having to move out of their homes.

And understandably, this growing market has attracted people to invest in and build their own fintech apps.

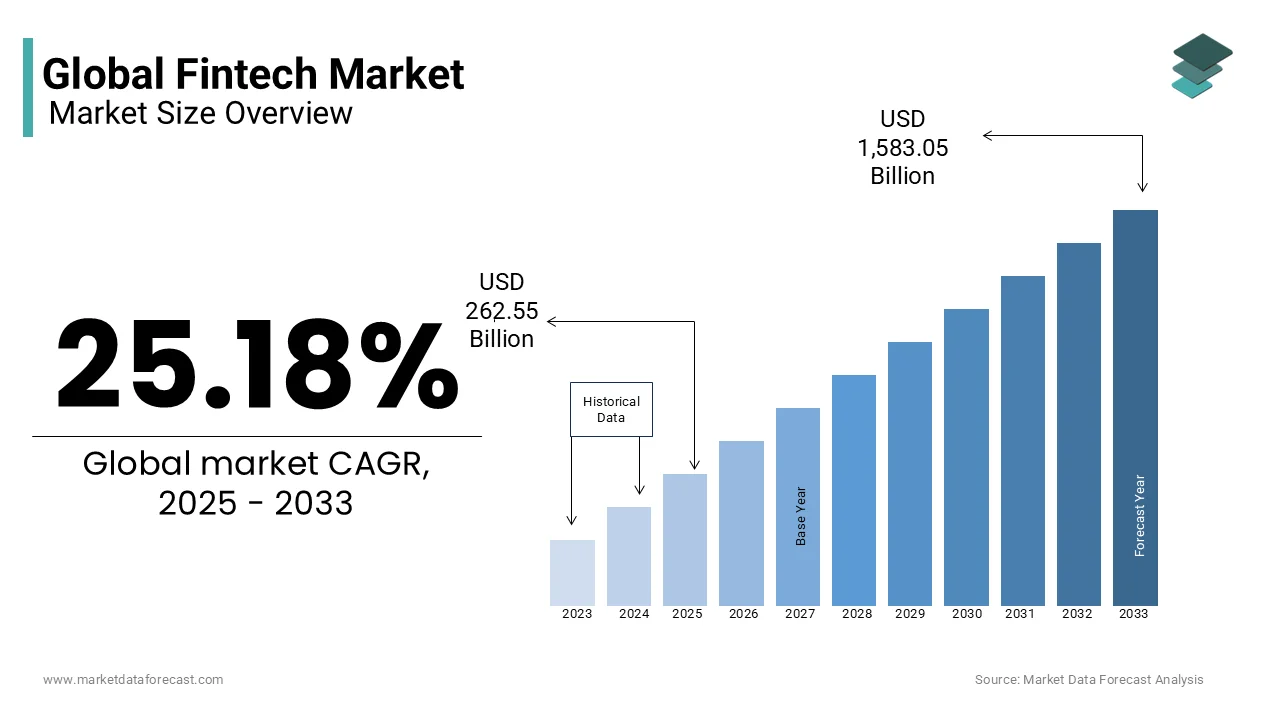

As per the report by Market Data Forecast, the global fintech market is expected to reach USD 1583.05 billion by 2033 from USD 209.74 billion in 2024, growing at a CAGR of 25.18% during the forecast period.

If you are planning to enter the fintech market, and want to know how much it would cost to develop a fintech app and what the associated costs are involved in the process. Then this is the post for you.

By the end of this blog, you will be able to plan your fintech application better as you will be aware of all the cost-related aspects of the project. So without further ado, let’s begin!

What is the Cost to Build a Fintech App?

If you are looking to get a fintech app developed by an experienced app development company, it can cost you anywhere between $20,000 to $300,000.

The estimate is based on various factors such as current fintech trends, the development process, and other things involved in the process.

If you think the gap between an entry-level fintech app and a high-spec application is high.

You should understand that there are several factors to consider, features to choose from, and technologies to be integrated that result in varied costs of development.

You see, several stages in development cost differently, and hence everyone might have different needs.

For your reference –

- A basic fintech app that has decent security and supports online banking transactions can be built for around $30,000-40,000.

- A minimal app that gets the job done can be built at the basic mark of $20,000, and the add-ons can reach up to $80,000. Though there’s no stopping when it comes to adding features, something satisfactory can be achieved at $80,000.

- An advanced app with the latest technology, features, and improved fintech app will cost you on the higher side, taking your cost to range anywhere from $70,000-300,000.

Also, you need to understand that $300,000 is not a cap on expenses. There is no end to investing, as technology is always evolving.

However, you can get the best fintech app developed within the stated range.

Fintech App Types & Their Development Costs

Fintech offers a lot of different areas to cater to. You can build an application that only deals with banking, transactions, payment processing, finance management, and more.

There are several different fintech app types, and since the functionalities of the app have to vary, the cost to build these apps also varies.

Here are a few popular fintech apps and the exact cost of such apps –

1. eWallet Apps

These are digital wallet apps that help a user maintain their online transactions.

With an e-wallet application, you can store funds, manage them, send them to someone else, and make payments easily.

The cost to build an e-wallet app can get it done within the lowest of the but, with every feature you add to it, the cost will rise significantly to $20,000 to $80,000.

2. Digital Banking Apps

Making traditional banking digital, these apps offer services that you usually have to go to a bank for. Features such as managing your account, transferring funds, and more.

Banking apps depend heavily on integrations and optimization, which is why they require a handsome amount of money to be developed.

The cost of developing a banking app ranges from $20,000 to $100,000.

3. Peer-to-Peer Lending Platforms

P2P lending has been around for a while, but the true potential of the industry was realized recently when P2P apps came around.

These are robust backend systems deployed to power these transactions and hence, can often be on the higher side of the spectrum. The basic P2P lending cost will start at $20,000 and go up to $100,000, depending on the complexity of the app.

Understanding these cost ranges for different fintech apps can help you better plan your budget based on your specific needs.

Next, we’ll take a closer look at the app development process and its cost breakdown.

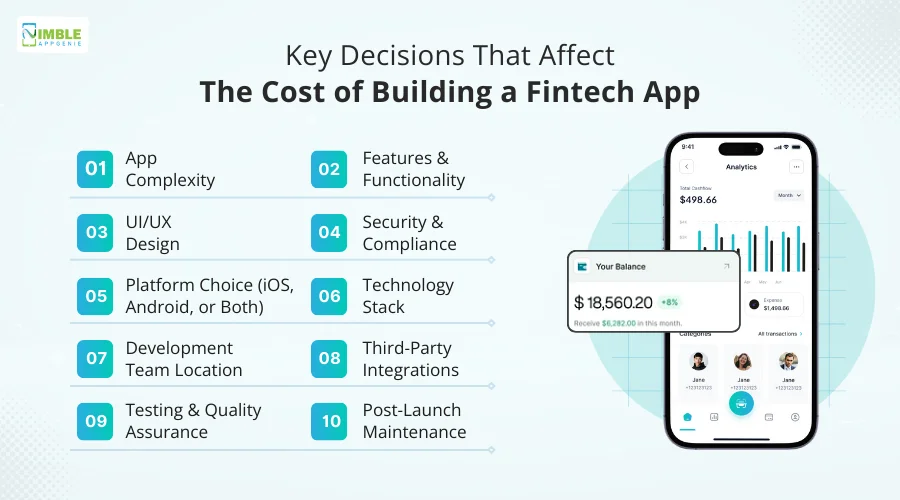

Key Decisions that Affect the Cost of Building a Fintech App

While deciding on the cost of a fintech app, there are a bunch of factors that you have to consider.

The entire development process of a fintech app poses a certain number of decisions that you have to make, and every decision you make will determine the cost of your fintech app.

Let’s explore the ten most critical factors and how they impact the cost of developing a fintech app.

1. App Complexity

The very first decision you need to make is what type of app you want to build. What will be the extent of the complexity of your app?

The decision is taken based on what type of tech stack you choose, what type of development you want to execute, and how much time you have in mind.

Deciding how complex your app will be is going to help you carve out a basic budget for your fintech app.

The cost of building a fintech app depends on how complex or tricky your project is.

An experienced development team can guide you through all the factors and allow you to choose the best app configuration.

A basic app is always less complex and is low in cost.

2. Features & Functionality

Choosing all the fintech app features and functionalities that you need beforehand can be a little helpful. It is completely your decision whether you want advanced features or basic features.

The cost of your app will revolve around this decision. The correlation between the functionality and complexity of an app is uncanny.

Hence, make sure you do your research and choose only those features that matter, as they will control the complexity of your app.

When it comes to building a fintech app, there are tiers of features based on what type of fintech application you want to develop.

For instance, if you plan to build a banking app that offers a basic user profile, balance fetching, and login logout features.

It will cost you less than an app with advanced features like real-time analytics, data fetching, AI bots, etc.

3. UI/UX Design

When crafting a solid user interface and user experience, there are several small decisions that you need to make.

These decisions include the nature of UI/UX, the approach you want to take, and the technologies you want to implement for the UI/UX.

Some prefer a minimal, fintech application design that is not too flashy and gets the job done. Some prefer making their app a bit loud and full of features.

Based on what type of approach you decide on, the cost to build a fintech app is determined. Investing in the user interface and experience is always a good decision, as it can help improve user engagement and boost user retention in fintech apps.

4. Security & Compliance

Choosing what type of security you want to deploy in your fintech application is another crucial decision that makes a difference.

While you may not have much control over what type of compliance you have to follow (as these are mandatory in almost every part of the world), you can choose the type of security measures you want to carry out in your fintech app.

The cost of building a fintech app can increase when advanced security measures and added compliance requirements are introduced into the development.

Fintech regulations and compliance, such as AML. KYC and others can cost you a bit more than your basic security and compliance measures like GDPR compliance, which includes your data encryption and SSL.

5. Platform Choice (iOS, Android, or Both)

The next decision depends completely on your vision for your app. If you want to target a wider audience, you will have to start with your presence on both platforms, i.e., Android & iOS.

However, it will double the cost of building a fintech app as the entire process will be done separately for both platforms in native app development.

On the other hand, you can go for a cross-platform development approach, but it has its pros and cons.

Fintech apps are usually targeted at the majority of users, as everyone uses financial services online.

Hence, going for cross-platform development can help you reach a wider audience, but keep in mind that it will cost you more than a single native app development.

However, the investment is completely worth it as a wider presence means more downloads and active users, boosting your presence in the fintech market.

6. Technology Stack

Technology is the foundation of everything you build in a fintech app. Choosing the right fintech stack can help you build the best version of your app.

However, with technology evolving every day, you need to make the right decisions to ensure that the tech you choose is affordable and scalable in the long run.

Based on the type of technology you choose, the development cost of your fintech app will vary.

Technology is always changing, and hence, you cannot go for the lowest-hanging fruit or the cheapest tech stack, as it might become obsolete soon.

7. Development Team Location

Another crucial factor that can define the cost of building a fintech app is the development team’s location.

Geographically, where your app development team is located determines the cost of service that you will have to pay them as per the availability of talent and currency differences.

If you plan to go towards the Asian region to hire an app developer, it might cost you less than what it would cost you to hire a company from the European region.

It’s just how currency inflation affects the hiring cost of app developers. The hourly rates are usually highest in North America and the lowest in the Asian region. So choose your fintech developers wisely.

| Location | Hourly Rate | Estimated Cost |

| North America | $150 – $250/hour | $200,000+ |

| Eastern Europe | $50 – $100/hour | $100,000 – $150,000 |

| Asia | $20 – $50/hour | $20,000 – $100,000 |

8. Third-Party Integrations

Integrations are a necessity when it comes to building a fintech app. This is because these apps require dedicated payment gateways, analytics, financial data providers, creditworthiness data, and whatnot.

All these can be integrated into an app with the help of fintech API integration.

It affects the cost of building your fintech app as these APIs have their fees along with integration charges. Depending on the complexity of these APIs, you may be charged.

Hence, you should keep that in mind. Decide on the type of API you plan to integrate with, and you will have a rough estimate as to what it would cost to build a fintech app.

9. Testing & Quality Assurance

Choosing the right testing and quality assurance measures is a must for a fintech app.

Having experienced quality assurance experts can help you get things sorted from the point of view of optimization and efficiency.

Testing your application can help you make the right decisions about the deployment of your services.

Since testing is done using all the possible test cases where the app might show a bug, it gives you enough confidence to push out your app and get it done.

Some fintech app developers include basic testing and quality assurance to make the app ready for the market, while some have dedicated services to ensure that there are no recurring bugs in the app and it is always covered.

10. Post-Launch Maintenance

Keep in mind that your job does not end once the app is deployed. It is just the beginning. You need proper post-launch maintenance.

It is your decision whether you want a dedicated post-launch maintenance team working for you, or you can manage it through an in-house tech team.

While your team can manage the app’s functionality, a dedicated team can take care of regular fintech app maintenance, bug checking, feature updates, security patches, etc., making your app appear better optimized with every version upgrade.

These upgrades play a crucial role in your app’s performance, and hence, you should take this decision accordingly.

Your final estimate can be calculated based on everything you choose and decide, but it starts somewhere around $10,000.

These decisions can be difficult to make if you have never had experience with app development.

This is also the reason why the majority of users prefer outsourcing the entire process to someone who is experienced and gets the job done diligently. These factors collectively influence the overall cost of developing a fintech app, and understanding them will help you plan a more realistic budget.

In the next section, we will break down the costs associated with different types of fintech apps, including eWallets, investment platforms, and more.

Also Read: Fintech Super App: Here’s How To Build One

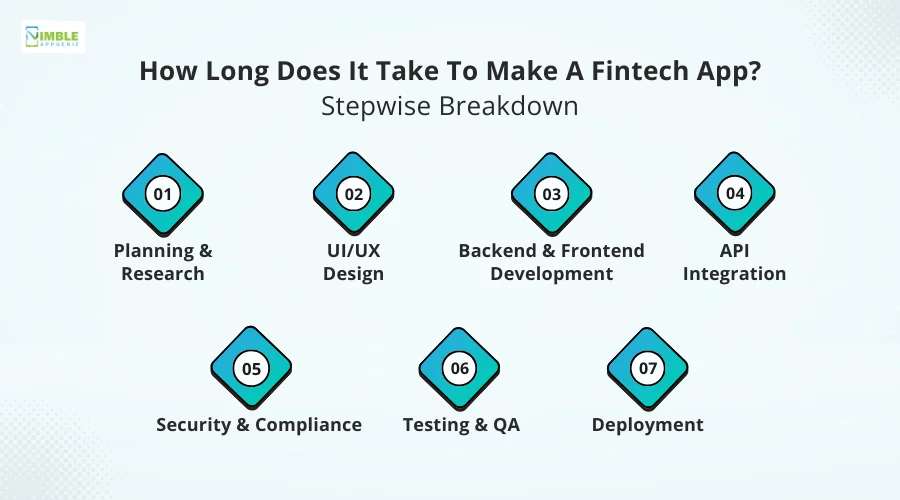

How Long Does It Take To Make A Fintech App?

Usually, it can take anywhere from 3 months to 15 months. When you build a fintech app, it can be difficult to calculate the exact time required to finish the project.

This is because the time required to develop a fintech app depends on functionality and complexity.

It can become interestingly confusing for you to choose and stick to a particular approach if the development time increases significantly.

If we talk from the perspective of the project, different steps take different durations to be completed.

Take a look at the following table to understand more about these steps and an estimation of time for each.

| Steps | Time Spent |

| Step 1 – Planning & Research | 2-4 Weeks |

| Step 2 – UI/UX Design | 4-8 Weeks |

| Step 3 – Backend & Frontend Development | 3-6 Months |

| Step 4 – API Integration | 4-8 Weeks |

| Step 5 – Security & Compliance | 4-8 Weeks |

| Step 6 – Testing & QA | 3-6 Weeks |

| Step 7 – Deployment | 1-2 Weeks |

After these steps comes the post-launch maintenance, which is an ongoing process.

Generally, users can expect the app to be ready within the timeline, but you should consider all types of unforeseen issues and circumstances and manage the time.

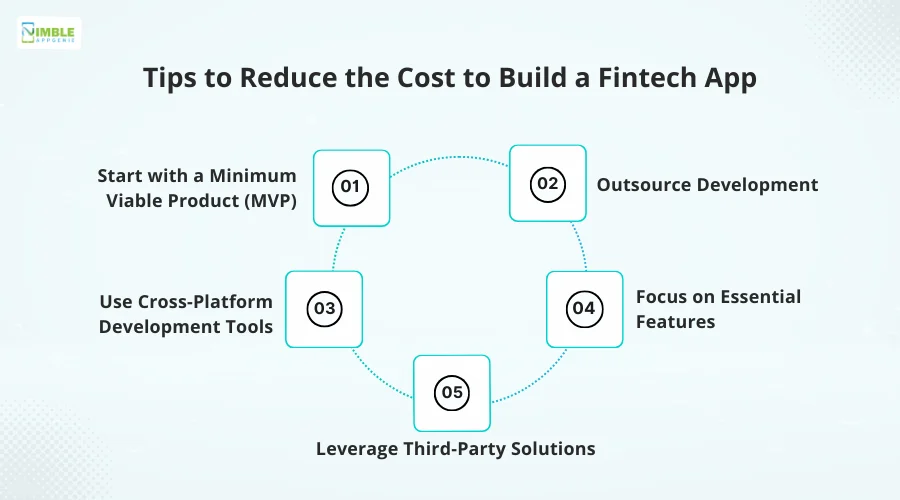

Tips to Reduce Fintech App Development Cost

While it is understood that fintech applications will require you to invest time and a dedicated budget.

Here are a few things that could help you save some money and make better decisions while building a fintech app.

♦ Start with a Minimum Viable Product (MVP)

The first thing you should do is try and build an MVP of your idea. This way, you can get a glimpse of how your final product will look based on your requirements.

This will also help you identify if you need any changes in the chosen technology, design, or usability. With MVP, you can easily discard features that appear unnecessary, reducing your costs.

♦ Outsource Development

If you are looking to hire fintech app developers to get the job done, it is always recommended that you outsource the entire process instead of hiring new resources permanently.

Onboarding a resource is going to cost you more than what it would take to hire a fintech app expert from another company. Outsourcing fintech development will be light on your pocket in the long run.

♦ Using Cross-Platform Development Tools

If you plan to build a fintech application, you might as well go for a cross-platform development strategy.

It helps you double your presence while spending on a single development process. Some of you may be thinking that using a native app development can make you create a more optimized app that can use device resources to the best.

However, it will surely cost you more as you will have to finish the process twice, and it will take double the time.

♦ Focus on Essential Features

Every application today looks to create a wow factor in its features. While this approach works well to garner attention, these features are hardly usable, and they cost a lot of money to implement.

Hence, it is always better to focus on essential features only, as they get the job done and are easy to implement without hampering your budget.

♦ Leverage Third-Party Solutions

Instead of building modules from scratch, you should start leveraging third-party solutions like APIs.

Integrating them will save you time, effort, and money, reducing the cost of building a fintech app.

Use services that are already being offered and thriving. In fintech, you need to create trust with your users. Existing solutions like payment gateway integration can help you gain the trust of your users.

Other than these tips, choosing the right service provider can help you build a fintech app within the budget you have decided on. But how do you find an ideal team that can manage the cost and create an application for you?

Check out the next section, as you might have reached the best service to help you keep the cost to build a fintech app under control.

Nimble AppGenie – Making Fintech Innovation Affordable

Building a fintech app under a defined budget is something that many services struggle with.

That is because of the uncertain nature of app functionalities, technologies, and compliances used. Fortunately for you, Nimble AppGenie is here to help you.

If you have already decided on the cost to build a fintech app, share your idea with us, and we can help you accordingly.

With years of experience in financial technology and a team of experienced developers, we at Nimble AppGenie are a global fintech app development company.

Simply bring your idea, and our experts will be able to give you an idea of how much it would cost to build a fintech app.

Our in-house team of experts helps us control the expenses, allowing us to deliver the best development services at affordable prices. Reach out today!

Conclusion

The cost of building a fintech app depends on several factors and hence cannot be stable in all markets. It eventually depends on your budget, time-to-market, and other factors.

Sure, you do have the option to choose from a plethora of services available in the market, but make sure you do not compromise on the quality just to reduce the fintech app development cost.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.