Fintech being one of the fastest-growing tech fields has caught the eyes of many companies and businesses.

Now, if you are considering fintech development, app, software, or any other form, one important concept is, “tech stack”.

Also known fintech technology stack, it is one of the most important considerations in development. In this guide to fintech development tech stack, we shall be discussing all you need to know about the same.

Therefore, with this being said, let’s get right into it, starting with an intro:

What’s A Tech Stack?

A tech stack, short for technology stack, refers to the combination of programming languages, tools, frameworks, and software that are used together to build a digital product or application.

The stack is divided into two main components:

- Front-end (Client Side) – This is what users interact with. It includes everything the user experiences directly: from text and colors to buttons, images, and navigation menus.

- Back-end (Server Side) -The back-end consists of a server, an application, and a database. It’s a part of the website you can’t see but is crucial for functioning.

Now that we know what the tech stack is in mobile app development, it’s time to look at what fintech tech stack means in the section below.

Understanding Fintech Tech Stack

The fintech tech stack is a combination of technologies a financial technology company uses to build fintech applications.

This stack encompasses the software, frameworks, languages, and tools that together enable the company to deliver its services.

Because fintech companies operate in the financial services sector, their technology stack needs to be secure, reliable, and compliant with various financial regulations.

But why is it important? Let’s find out.

Also Read: Fintech Architecture

Importance of Tech Stack in Fintech

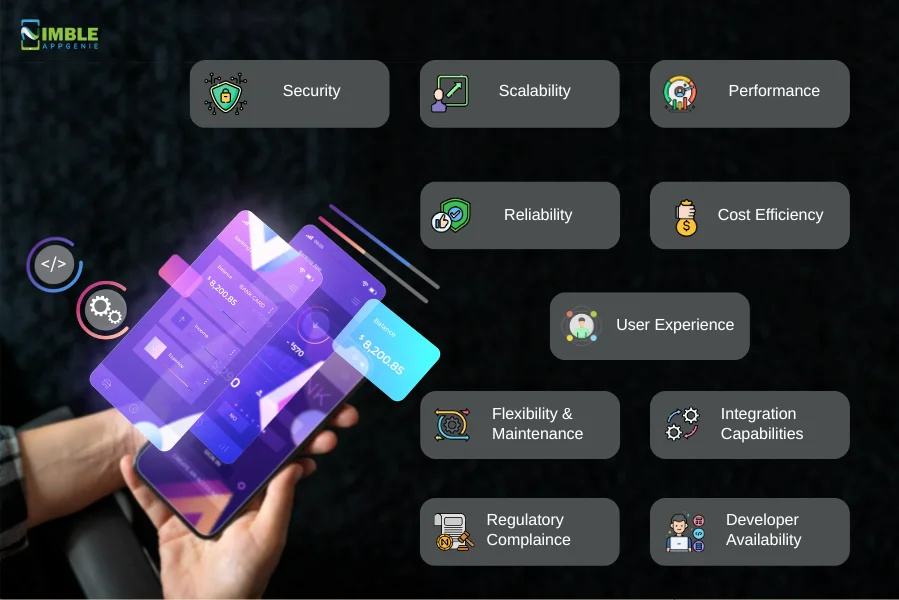

Want your fintech solution to be successful among the masses?

Then you can’t ignore the fintech technology stack and its importance in the performance of the platform.

But why is it important?

Let’s learn an important lesson for fintech startups and find out why they are important below:

Security

The first one is security.

Fintech applications deal with sensitive financial data, requiring the highest levels of security.

The right tech stack for fintech ensures that the application is built on secure frameworks and languages that can support strong encryption, secure authentication, and compliance with regulations.

Scalability

As fintech solutions often experience rapid growth.

The tech stack must be able to scale quickly and efficiently to handle increasing loads of transactions and users without performance degradation.

This is one of the reasons why choosing a tech stack for fintech development is crucial.

Performance

Fintech applications require high-performance tech stacks that can process large volumes of transactions quickly and reliably.

Performance affects user experience, which is paramount in maintaining customer trust and satisfaction.

Not to mention, the tech stack for fintech development is also an important consideration for application optimization and everything else related to the same.

Reliability

Downtime and errors can be incredibly costly in fintech.

A reliable FinTech Development Technology Stack means having a robust architecture that can handle failures and is backed by strong community support and regular updates.

Regulatory Compliance

If you know anything about fintech, you know that it is a heavily regulated industry.

The tech stack must facilitate compliance with various legal frameworks and standards that govern data protection, privacy, and financial transactions.

All in all, fintech regulations and the fintech tech stack go hand in hand.

User Experience

Front-end technologies must be capable of delivering a seamless and intuitive user experience.

A good fintech development tech stack will support responsive designs, fast loading times, and smooth interactions, which are essential for customer retention.

Flexibility and Maintainability

Fintech trends and customer needs evolve rapidly.

A flexible tech stack allows for quick adaptation to market changes and ease of maintenance.

This ensures applications can evolve without requiring a complete overhaul.

Integration Capabilities

Fintech applications often need to integrate with banks, payment gateways, and other third-party services.

The tech stack of fintechs should support such integrations seamlessly, both in terms of technical compatibility and performance.

Cost Efficiency

Fintech app development cost is significantly affected by the chosen tech stack.

Some Tech Stacks Used in Fintech may have higher initial costs but lower long-term maintenance costs, or vice versa.

Cloud-native stacks can also help in optimizing operational costs.

Developer Availability

The more popular and widely adopted a tech stack, the easier it is to find app developers.

This availability can affect development speed, cost, and the ability to scale your development team.

With the importance of the fintech tech stack out of the way, it’s time to look at the fintech development tech stack itself. Let’s get right into it.

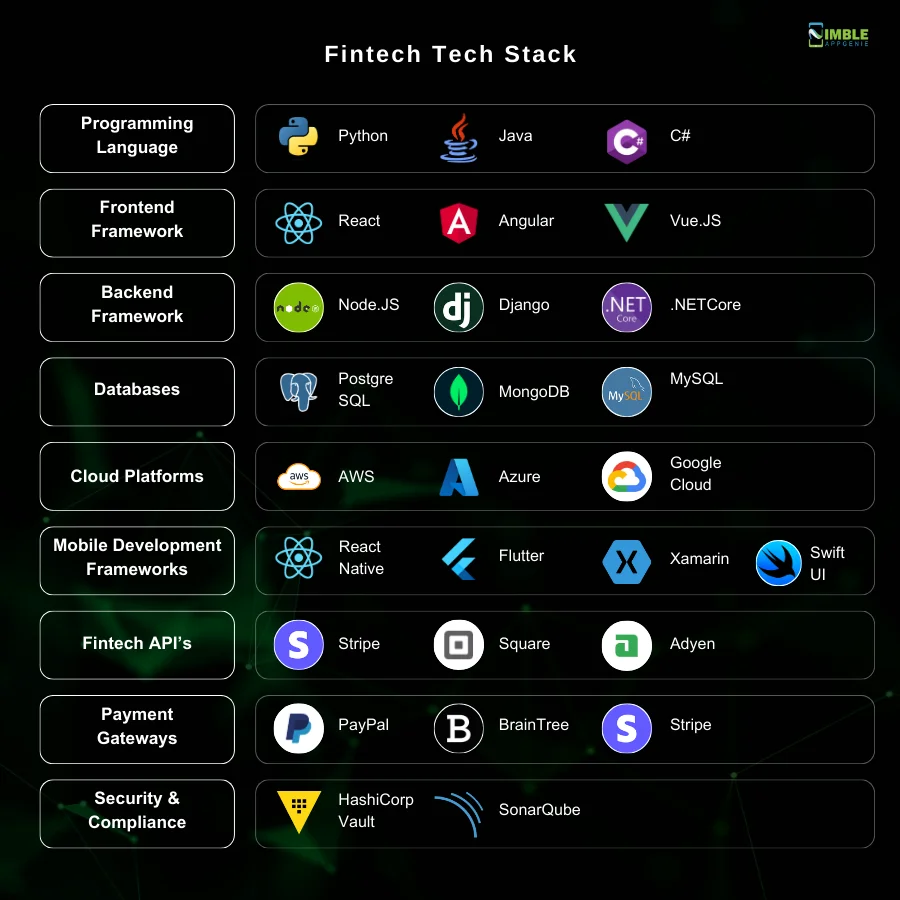

Fintech Development Tech Stack

Knowing that we know everything you need to know about the fintech tech stack, it’s finally time to discuss the thing itself.

Let’s discuss the tech stack for fintech software development in detail.

| Area | Option | Key Characteristics | Advantages | Use Cases |

| Programming Languages | Python | Dynamic, high-level, interpreted; extensive support for numerical and financial libraries. | Easy syntax and rapid development, strong in data analysis and machine learning. | Backend services, data analysis, algorithmic trading, machine learning. |

| Java | Object-oriented, platform-independence nt, robust with a strong ecosystem. | High-performance, scalable, and extensive collection of open-source libraries. | Enterprise-level applications, banking, and financial services systems. | |

| C# | Simple, modern, object-oriented, type-safe programming language. | Integration with .NET, strong memory management, good for Windows platforms. | financial services applications, desktop applications, and games. | |

| Frontend Frameworks | React | JavaScript library to build user interfaces; component-based. | High performance, reusable components ts, and large community support. | Dynamic web apps, single-page applications (SPAs), mobile apps. |

| Angular | TypeScript-based open-source web application framework: MVC architecture. | Two-way data binding, comprehensive solution, suitable for large-scale projects. | Enterprise-level web applications, SPAs, and dynamic content apps. | |

| Vue.js | Progressive JavaScript framework for building UIs; easily integrable. | Lightweight, easy to learn, reactive data binding. | Single-page applications, web interfaces, lightweight projects. | |

| Backend Frameworks | Node.js | JavaScript runtime is built on Chrome’s V8 JavaScript engine, an event-driven, non-blocking I/O model. | Scalable, supports thousands of concurrent connections, and fast execution. | Real-time applications, microservices architecture, and web APIs. |

| Django | High-level Python web framework; encourages rapid development and clean, pragmatic design. | Secure, scalable, and comprehensive, including ORM for database operations. | web applications, data-driven applications, CMS systems. | |

| .NET Core | Cross-platform, open-source, managed framework for building various types of applications. | Versatile, high performance, supported microservices and cloud applications. | Web APIs, microservices, serverless functions, cloud apps. | |

| Databases | PostgreSQL | Open-source, object-relational database system; ACID-compliant. | Advanced features, strong integrity, extensible. | Complex queries, financial records, and data warehousing. |

| MongoDB | NoSQL database; document-oriented, high performance, high availability. | Scalability and ease of use with dynamic schemas. | Big data applications, content management, real-time analytics. | |

| MySQL | World’s most popular open-source database: reliable, scalable, and easy to use. | Cost-effective, widely used and tested, strong community support. | web applications, online transactions, e-commerce sites. | |

| Cloud Platforms | AWS | Comprehensive and evolving cloud computing platform provided by Amazon. | A broad set of tools, global presence, and flexible pricing. | Web hosting, big data storage, and analytics, serverless computing. |

| Azure | Cloud computing services for building, testing, deploying, and managing applications. | Seamless integration with Microsoft products and hybrid cloud capabilities. | Enterprise applications, IoT applications, AI, and machine learning. | |

| Google Cloud | A suite of cloud computing services running on the same infrastructure as Google. | High-performance infrastructure, data, and analytics, machine learning. | Data analytics, machine learning projects, scalable web applications. |

1. Push Notification Services

Let’s start with one of the most important parts, push notifications.

Here are the different technologies that go behind the fintech tech stack that enables notifications.

- Firebase Cloud Messaging (FCM): A free service by Google that allows you to send notifications across platforms: Android, iOS, and the web. Ideal for real-time updates like transaction alerts and personalized offers.

- OneSignal: Offers a wide array of features including A/B testing, real-time analytics, and segmentation, making it versatile for engaging users with personalized and timely notifications.

- Airships: Provides advanced messaging capabilities, including automation, personalization, and A/B testing, suitable for delivering targeted messaging campaigns and improving customer engagement.

2. Mobile Development Frameworks

Now, to enter the “mobile app development” field, here are some frameworks.

Let’s go through them:

- React Native: Enables you to build genuinely native apps for both Android and iOS platforms with a single JavaScript codebase, favored for its hot-reloading feature and vast community support.

Also Read: Flutter Vs React Native

- Flutter: Google’s UI toolkit for crafting natively compiled applications for mobile, web, and desktop from a single codebase, known for its fast rendering and expressive, flexible UIs.

- Xamarin: A Microsoft-owned framework that uses C# for building native apps for Android, iOS, and Windows with a shared .NET code base, reducing development time and cost.

- SwiftUI: A framework by Apple for declaring user interfaces in Swift code, enabling simpler and more concise coding for Apple platforms, ideal for building high-performance, native iOS apps.

3. Message Brokers

Now, to enable that chat app like messaging functionality in your fintech solution, here are some message broker services that make Best Payment Tech Stack For Financial Industry.

- Apache Kafk: Designed for a high-throughput, distributed, publish-subscribe messaging system, it’s excellent for real-time streaming data pipelines and applications that require reliable, high-performance processing.

- RabbitM: Widely used open-source message broker that supports multiple messaging protocols, offering features like reliability, delivery acknowledgments, and flexible routing.

- AWS SQS: A fully managed message queuing service that enables you to decouple and scale microservices, distributed systems, and serverless applications, ensuring secure and reliable message queuing.

4. Analytical Tools

Analytics is a really important part of running and managing a fintech solution. Therefore, it also becomes on of the core technologies of fintech.

Here are some options that you get when we talk about analytical tools.

- Google Analytics: A staple for tracking website and app performance, user engagement, and customer behavior, helping businesses optimize their marketing strategies and improve user experiences.

- Tableau: Known for its ability to create rich visualizations and dashboards from complex data, making it invaluable for financial reporting, trend analysis, and decision-making.

- Mixpanel: Specializes in event tracking and user engagement analysis, providing detailed insights into user interactions, and making it useful for optimizing product features and user journeys.

- Looker (Now part of Google Cloud): Offers a data exploration and discovery platform that integrates with any SQL database or warehouse, providing real-time insights through its powerful analytics engine.

5. Open Banking APIs

Now, if you want to develop a modern fintech application, you can’t miss this one.

Open Banking APIs are one of the most important parts of Tech Stack for Fintech Development.

These are, as mentioned below:

- Plaid: Offers a range of APIs that allow developers to connect apps with users’ bank accounts for transactions, identity verification, account balance checks, and more, fostering innovation in personal finance management.

- TrueLayer: Provides a platform to build financial apps that connect to bank data, verify accounts, and access transactions in real time, supporting the development of budgeting, investment, and payment applications.

- Yodlee: A pioneer in the data aggregation industry, Yodlee’s APIs facilitate access to financial account information, enabling services like personal finance, risk assessment, and lending solutions.

6. Fintech APIs

Open banking APIs are just a part of larger integration options that are available.

Now, if you want to choose the right tech stack for your fintech project, you need to consider Fintech APIs as well.

These are, as mentioned below:

- Stripe API: Beyond payment processing, Stripe’s suite of APIs includes billing for recurring payments, marketplace transactions, and business finance management, making it a comprehensive toolkit for ecommerce and online marketplaces.

- Square: Offers a set of APIs that cover payment processing, point of sale, ecommerce, and business operations, suitable for retailers and service providers looking to digitize their operations.

- Adyen: Provides APIs for end-to-end payment solutions, supporting a wide range of payment methods globally, ideal for businesses seeking a single platform to manage payments across online, mobile, and in-store channels.

7. Payment Gateways

Now that we are done with APIs, it’s time to discuss another important part of fintech solution development tech stack, the Payment gateway integration.

Here are some of the best integration service providers:

- PayPal: One of the most widely used payment systems, PayPal offers APIs for integrating payment services into websites and apps, allowing for secure and convenient transactions.

- Braintree: A service by PayPal, Braintree offers sophisticated payment solutions, including mobile payments, subscription billing, and global commerce tools, with a focus on seamless user experiences.

- Stripe: Known for its developer-friendly API and extensive documentation, Stripe supports a wide array of payment options, including credit cards, ACH transfers, and Apple Pay, making it versatile for various business models.

8. DevOps Tools

Another important part of fintech technology stack is DevOps Tools.

These are, as mentioned below:

- Docker: A platform for developing, shipping, and running applications in containers, allowing for consistency across development, staging, and production environments, and facilitating microservices architecture.

- Kubernetes: An open-source system for automating the deployment, scaling, and management of containerized applications, enhancing application reliability and scalability, which is vital for fintech applications dealing with high volumes of transactions.

- Jenkins: An extensible, open-source automation server used to automate the parts of software development related to building, testing, and deploying, facilitating continuous integration and continuous delivery.

- GitLab CI/CD: A part of GitLab providing a powerful platform for software development through version control and CI/CD tooling, allowing fintech teams to deliver code faster and more efficiently.

- Ansible: An open-source automation tool for configuration management, application deployment, and task automation. It’s simple to start yet powerful enough to automate complex multi-tier IT application environments.

- Terraform: An infrastructure as code tool that allows you to build, change, and version infrastructure safely and efficiently. This includes low-level components such as compute instances, storage, and networking, as well as high-level components such as DNS entries.

9. Monitoring and Logging

It’s time to look at the monitoring and logging tech stack used in fintech.

Tools used here are, as mentioned below:

- Prometheus: An open-source monitoring and alerting toolkit widely used in cloud-native environments. Its powerful querying language and visualization capabilities make it effective for tracking application metrics and understanding system behavior.

- Grafan: Often used in conjunction with Prometheus, Grafana is an open-source platform for monitoring and observability. It allows you to query, visualize, alert on, and understand your metrics regardless of where they are stored.

- ELK Stack (Elasticsearch, Logstash, Kibana): A set of tools that work together to provide insights into your system using the data derived from logs, metrics, and web applications. It’s highly scalable and provides real-time insights.

10. Security and Compliance

Lastly, when it comes to fintech tech stack or any part of the platform, you just can’t ignore security part.

Here are some top technologies used in the best tech stack for fintech development.

- HashiCorp Vault: Helps fintech organizations securely store and access tokens, passwords, certificates, and encryption keys. Its capabilities are critical in managing secrets and protecting sensitive data in the financial sector.

- SonarQube: An open-source platform for continuous inspection of code quality to perform automatic reviews with static analysis of code to detect bugs, code smells, and security vulnerabilities.

Now that we are done with the core technologies and overview of the tech stack for fintech software development. Now, it’s time to look at the different areas of fintech and the tech stack used in them.

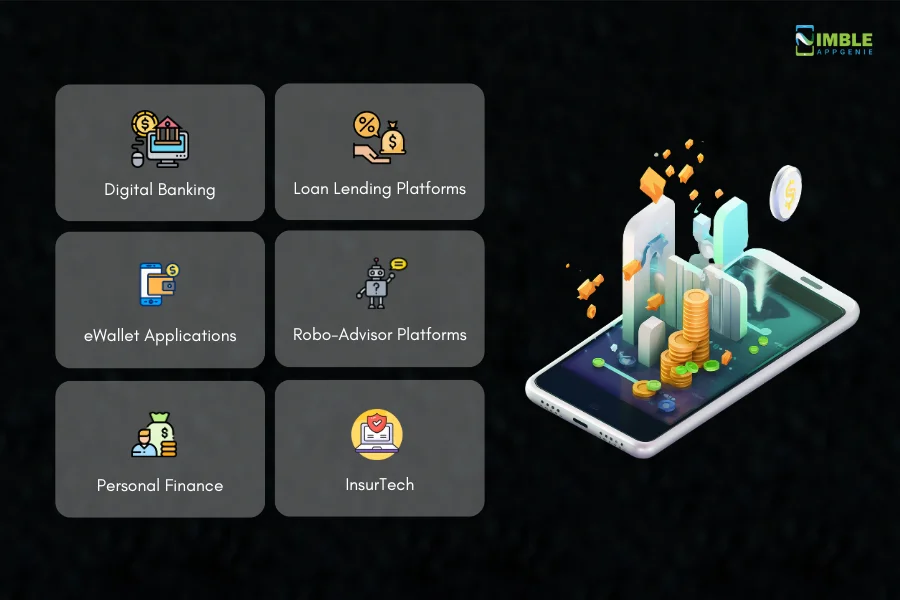

Fintech Development Tech Stack Based on Type

The market is filled with fintech solution ideas.

However, there are various different types fintech development and the tech stack follows.

So let’s look at tech stack used in them:

Type 1. Digital Banking

Here’s tech stack for digital banking solution development:

- Front-end: React or Angular for dynamic web apps; Swift or Kotlin for native mobile apps.

- Back-end: Java with Spring Boot for robust backend services; Node.js for a lightweight, scalable event-driven architecture.

- Database: PostgreSQL for relational data needs; Cassandra for scalability and fault tolerance.

- Security: OAuth 2.0 for authorization; Transport Layer Security (TLS) for secure data transmission.

- Infrastructure: AWS or Azure for cloud services; Docker and Kubernetes for containerization and orchestration.

Type 2. Loan Lending Platforms

Loan lending platform development has become super popular among businesses with billions in the market to be made.

Let’s look at the general fintech tech stack for lending platforms.

- Front-end: Angular to build administrative dashboards; React for a seamless customer-facing application.

- Back-end: Node.js for a non-blocking, event-driven server, perfect for handling multiple loan applications simultaneously; PHP with Laravel for a more traditional approach with a robust ecosystem.

- Database: MySQL for structured data like user profiles and loan records; MongoDB for more flexible, document-oriented storage of varied loan application data.

- Security: Advanced Encryption Standard (AES) for encrypting sensitive personal and financial data; HTTPS and TLS 1.3 for secure communication.

- Infrastructure: AWS for reliable cloud hosting with services like AWS Lambda for serverless operations; Kubernetes for managing containerized applications.

- Additional Technologies: Credit scoring algorithms using Python; automated background and credit check integrations.

Type 3. eWallet Applications

Want to develop an eWallet app?

Well, let’s look at the eWallet app tech stack that you can choose from for development:

- Front-end: React Native to build cross-platform mobile applications; Swift to iOS for a more native approach.

- Back-end: Java with Spring Framework for secure transaction processing; Python with Flask for rapid API development.

- Database: PostgreSQL for ACID compliance and transactional integrity; Redis for fast in-memory data caching to improve performance.

- Security: FIDO Alliance protocols for secure authentication; PCI DSS compliance for handling credit card information securely.

- Infrastructure: Microsoft Azure & Docker for creating isolated environments for wallet microservices.

- Additional Technologies: QR code generation and scanning capabilities.

Type 4. Robo-Advisor Platforms

Planning to build your own robo advisor?

Well, here’s fintech solution tech stack for robo advisor platform development:

- Front-end: Vue.js for creating dynamic and responsive client-side applications; Kotlin for native Android app development.

- Back-end: C# and .NET Core for robust backend services with a focus on financial algorithms; Ruby on Rails for a convention-over-configuration approach.

- Database: MariaDB for high-performance, open-source databases; InfluxDB for time-series data management, which is crucial for market data.

- Security: Role-based access control (RBAC) for secure and granular user permissions; secure RESTful APIs using OAuth2 for data access.

- Infrastructure: Google Cloud Platform (GCP) for AI and machine learning services; CI/CD with GitLab for efficient deployment cycles.

Type 5. Personal Finance

Personal finance is yet another field growing super popular, covering everything from budgeting apps to financial literacy ones.

In any case, the tech stack used in fintech personal finance app development is:

- Front-end: Ember.js for a convention-over-configuration approach; Ionic for hybrid mobile apps.

- Back-end: Python with Django for data-heavy applications; Go for high concurrency needs.

- Database: MongoDB for flexible document storage; Elasticsearch for search and analytics.

- Security: Two-factor authentication; secure JSON Web Tokens (JWT) for information exchange.

- Infrastructure: DigitalOcean for simpler cloud services; Ansible for configuration management.

Type 6. InsurTech

If you are planning to launch an insurance app, here’s what you need to use in tech stafck.

- Front-end: Svelte for highly reactive apps; Flutter for expressive and flexible UIs.

- Back-end: Node.js with Express for RESTful APIs; Scala with Play for reactive systems.

- Database: SQL Server for data warehousing; Neo4j for graph-based data relationships.

- Security: Identity and Access Management (IAM); regular security audits.

- Infrastructure: Alibaba Cloud for global reach; GitHub Actions for CI/CD workflows.

These are the best fintech development tech stacks for different types of solutions. And with this out of the way, it’s time to look at some of the most popular fintech apps and their tech stack.

Popular Fintech App’s Tech Stack

Want to develop a clone app?

Most of the startups and businesses are inspired by top fintech apps to develop their own.

So, let’s take some inspiration in terms of fintech tech stack too.

Therefore, here are some of the top fintech apps and the technology stack used, these are, as mentioned below:

1. Venmo

Venmo is a popular peer-to-peer payment app that allows users to easily send and receive money from friends and family.

Tech Stack:

- Programming Languages: Kotlin, Swift

- Cloud: AWS

- Database: NoSQL (e.g., Cassandra)

2. Mint

Mint is a personal finance management app that helps users track their spending, create budgets, and monitor their bills.

Tech Stack:

- Programming Languages: Java, Python

- Framework: Spring, Django

- Database: SQL (e.g., MySQL)

3. Personal Capital

Personal Capital offers a comprehensive suite of tools for managing finances, including budgeting, investment tracking, and retirement planning.

Tech Stack:

- Programming Languages: Java, Python

- Frameworks: React, Flask

- Cloud: Google Cloud Platform (GCP)

4. Acorns

Acorns is a micro-investing app that allows users to invest spare change automatically.

Tech Stack:

- Programming Languages: Swift, Kotlin

- Frameworks: SwiftUI, Compose

- Cloud: AWS

- Database: Likely combination of SQL and NoSQL

5. Robinhood

Robinhood is a commission-free stock trading app known for its user-friendly interface.

Tech Stack:

- Programming Languages: C++, Python

- Frameworks: Likely Proprietary Frameworks

- Cloud: Likely AWS or GCP

6. Chime

Chime is a neobank that provides mobile banking services without physical branches, focusing on offering a streamlined and fee-free banking experience.

Tech Stack:

- Programming Languages: Java, Python

- Framework: Likely React Native

- Cloud: Likely AWS or GCP

7. Webull

Webull is another popular stock trading app that offers advanced features for active traders alongside a competitive commission structure.

Tech Stack:

- Programming Languages: C++, Java

- Frameworks: Likely Proprietary Frameworks

- Cloud: Likely AWS or GCP

8. SoFi

SoFi is a neobank that goes beyond mobile banking by offering student loan refinancing, investing products, and other financial services.

Tech Stack:

- Programming Languages: Java, Python

- Framework: Likely React and React Native

- Cloud: Likely AWS or GCP

9. Betterment

Betterment is a robo-advisor that automates investing based on your financial goals and risk tolerance. It uses advanced algorithms to manage your portfolio and rebalance it as needed.

Tech Stack:

- Programming Languages: Python

- Framework: Likely Django

- Cloud: Likely AWS or GCP

- AI/ML Libraries: TensorFlow

10. Coinbase

Coinbase is a leading cryptocurrency exchange platform that allows users to buy, sell, and trade various digital currencies.

Tech Stack:

- Programming Languages: Python, C++

- Frameworks: Likely Proprietary Frameworks

- Cloud: Likely AWS or GCP

- Blockchain Technology

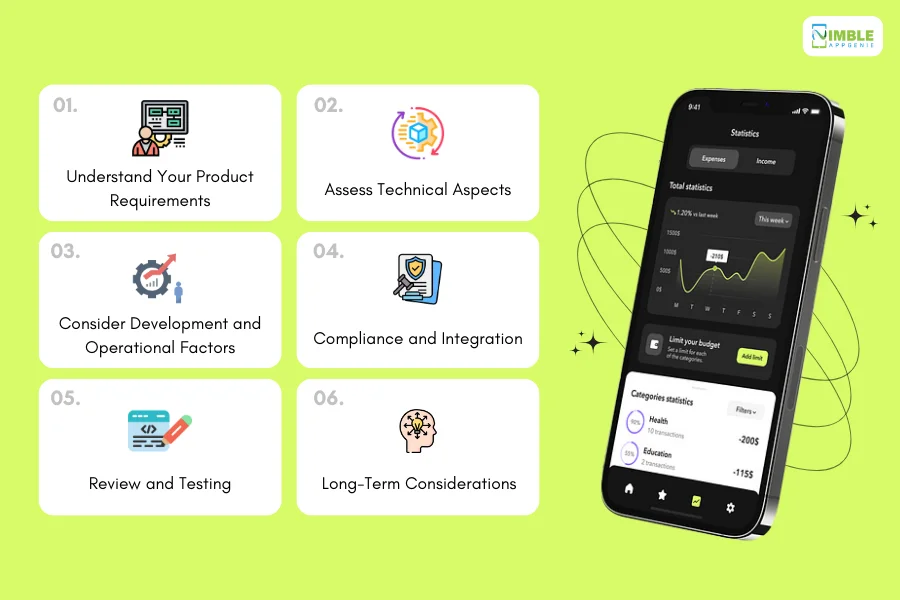

How To Choose Right Fintech Development Tech Stack?

Lastly, it’s time to learn how to choose right tech stack for your fintech project.

Here are some steps that you can follow and some things that you should keep in consideration.

These are, as mentioned below:

► Understand Your Product Requirements

We will start by understanding your fintech project requirements.

- Type of Fintech Application: Is it a banking app, payment gateway, investment platform, or insurance app? Each might require different technologies.

- Target Audience: Cater to the devices and technology your audience is most likely to use.

- Geographical Reach: This influences decisions around multi-language support, localization, and regulatory compliance.

► Assess Technical Aspects

It’s time to pay attention to the technical aspect part, here’s how you do it.

- Security Needs: Given the sensitive nature of financial data, prioritize technologies with robust security features.

- Performance and Scalability: High concurrency and large volumes of transactions necessitate a stack that can scale and perform under pressure.

- Data Handling: Depending on whether you need real-time processing or complex data analytics, you might choose different databases and data-processing frameworks.

► Consider Development and Operational Factors

It’s time to hire dedicated developers and make some decisions.

- Developer Expertise: Your team’s familiarity with certain technologies will impact development speed and quality.

- Community and Ecosystem: Technologies with larger communities offer more resources, libraries, and third-party integrations.

- Development Cost and Time: Some stacks are more cost-effective and quicker to develop with due to the abundance of resources and tools.

► Compliance and Integration

Goes without saying that when we are talking about fintech, we are talking about compliance and regulations.

- Regulatory Compliance: Your stack should enable you to comply with relevant financial regulations like GDPR, PSD2, KYC, and AML directives.

- Third-party Integrations: Choose technologies that will smoothly integrate with banks, payment processors, and other third-party services.

► Review and Testing

Finally, with all said and done, it’s time to deal with prototypes and testing:

- Prototype: Create a minimal viable product (MVP) to validate the tech stack’s feasibility for your application.

- Testing and Feedback: Thorough testing and user feedback can reveal if adjustments are needed.

► Long-Term Considerations

The work isn’t done yet, to make the most out of your product and really test fintech tech stack, you need to invest in maintenance and support services:

- Maintenance: Consider the ease of maintaining and updating the technologies chosen.

- Flexibility to Future Changes: The tech stack should be adaptable to future changes, whether it’s scaling up or pivoting to a new model.

Too complex selecting a fintech development tech stack or all the stuff related to it? Well, let it to the experts.

Nimble AppGenie – Fintech Software Development Company, is Here To Help You

Don’t have to deal with the complex fintech solution development tech stack, leave it to the experts.

Nimble AppGenie is a market leading fintech software development company.

We have what it takes to turn your idea into next big thing.

We have worked on over 700 projects with an amazing 95% project satisfaction. Our team has worked on some big projects like DafriBank, CUT, Pay By Check, and many more.

If you are ready for fintech innovation, we are here to help you.

Conclusion

The fintech landscape is evolving rapidly, driven by technologies that prioritize security, personalization, and seamless user experience. As we embrace trends like DeFi and open banking, selecting the right technology stack for fintech development is crucial for innovation and growth. The future of fintech, poised to integrate deeper into our digital lives, promises exciting advancements, ensuring that finance remains both accessible and forward-thinking.

FAQs

In fintech, the tech stack is crucial because it ensures the application is secure, reliable, scalable, and compliant with financial regulations. It also impacts the overall user experience, cost efficiency, and long-term maintainability of the application.

The five key types of technology in finance are:

- Digital Payments: Technologies enabling electronic transactions such as NFC, RFID, and digital wallets.

- Personal Finance Management: Tools for budgeting, tracking expenses, and financial planning, often leveraging AI.

- Peer-to-Peer (P2P) Lending Platforms: Online platforms that match borrowers with individual lenders.

- Crowdfunding Platforms: Websites that allow individuals or businesses to raise funds from many people, typically via the internet.

- Robotic Process Automation (RPA): Automating routine tasks in financial processes, improving efficiency and reducing errors.

Fintech applications commonly use HTML, CSS, and JavaScript for structuring and styling, with frameworks like React, Angular, and Vue.js for more dynamic and responsive interfaces.

The core technologies of fintech include:

- Mobile Platforms: iOS and Android for app development.

- Data Analytics: Big data technologies to analyze large datasets for insights.

- Cybersecurity: Tools and protocols for protecting sensitive financial data.

- Payment Gateways: Secure online transaction processing systems.

- APIs: Application Programming Interfaces for integrating various financial services.

Popular back-end technologies include programming languages such as Python, Java, and C#, along with their respective frameworks like Django, Spring Boot, and .NET Core. They handle the application’s logic, data processing, and server-side functionalities.

Fintech applications often use databases such as PostgreSQL, MongoDB, and MySQL, depending on their data storage needs, performance requirements, and scalability.

Push notification services like Firebase Cloud Messaging (FCM), OneSignal, and Airship are used in fintech apps to send real-time updates, transaction alerts, and personalized notifications to users.

Companies should consider their product requirements, target audience, and geographical reach. Technical aspects like security, performance, scalability, and data handling also play a critical role. Additionally, development costs, regulatory compliance, third-party integrations, and the availability of developers for chosen technologies are important factors.

The next big thing in fintech is often debated, but several emerging trends could be transformative:

- Decentralized Finance (DeFi): Using blockchain technology to provide financial services without traditional intermediaries.

- Open Banking: Enhanced consumer choice and financial innovation facilitated by sharing data through APIs.

- Quantum Computing: Potential to revolutionize risk analysis and fraud detection by processing data at unprecedented speeds.

- Sustainable and Green Finance: Incorporating environmental, social, and governance (ESG) criteria into business and investment decisions.

- Embedded Finance: Integration of financial services into traditionally non-financial platforms, like social media or retail marketplaces.

Yes, the choice of a tech stack can significantly impact development speed and costs. Technologies with a large community and ecosystem can lead to quicker development and lower costs due to the abundance of resources, tools, and developer availability.

A fintech tech stack is made secure and compliant by using encryption protocols, secure authentication methods, and adhering to financial regulations like PCI DSS and GDPR. It should also facilitate secure data management and privacy standards.

A fintech tech stack should be flexible and adaptable to market changes to ensure that the application can evolve without requiring a complete overhaul. This includes ease of maintenance, updating technologies, and scaling as the user base grows.

Fintech companies leverage a variety of technologies, including:

- Blockchain: For secure and transparent transactions.

- Artificial Intelligence and Machine Learning: To analyze data, predict trends, personalize services, and automate processes.

- Cloud Computing: For scalability, flexibility, and cost-efficiency in managing IT resources.

- Mobile Technologies: Apps and mobile-first strategies for on-the-go banking and financial services.

- Biometric Security Measures: Such as fingerprint scanning and facial recognition for enhanced security.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.