Let’s Discuss your

IDEA!

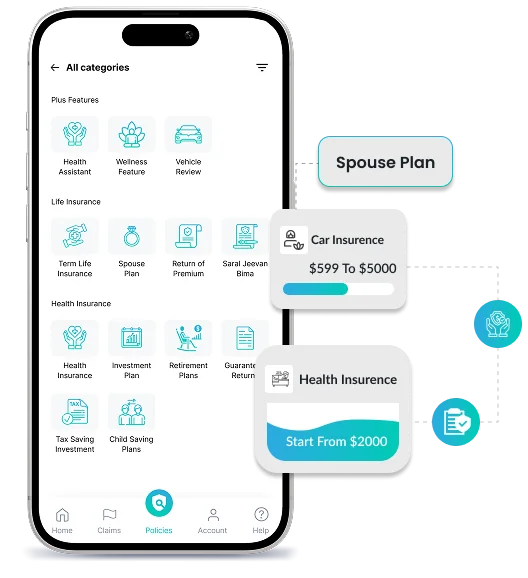

Allowing you to make the most out of digital tools and insurtech available today, we at Nimble AppGenie can help you with a spectrum of highly efficient insurance-oriented solutions that can help you take your business digital and make it easier and efficient to manage.

There's no "One size fits all" approach in insurance solutions. Every business has different requirements and that's where our custom solutions come into play!

Maintaining the complete paper-trail for insurance policies, history, and claims can be difficult to manage without an insurance document management system.

To ensure that your insurance business is always on track, an insurance agency and CRM solution can be of great help for you. Connect today to build one!

We can help you build a dedicated insurance quoting software and analysis program for redefined accuracy and optimized profile analysis done quickly.

With services like insurance system integration and modernization services, we help existing insurance apps do better by giving them the necessary upgrades.

If you plan to embed insurtech in the future, starting with a claims and policy management software is a good way to digitize the backend for operations.

Choosing the right insurance app features is crucial, as it is the functionalities that make or break an app. At Nimble AppGenie, we take pride in our research and understanding of the client requirements as it allows us to offer the best bunch of features that can optimize UI/UX.

Maintaining top-notch security & scalability is a must in any application that involves personal data and monetary transactions. Our experts always pay attention to the latest tech trends that can help in developing an iron-clad insurance app solution.

Deploying automation to manage insurance and assessing potential risks is a great technology to have in your insurance app.

Cloud services not only make the insurance app easy to access from everywhere but also make it scalable for future upgrades.

UBI helps in collecting data through a network of IoT devices, allowing insurers to analyse individual habits for better analysis.

Smart Contracts on Blockchain are digital contracts usually stored on a decentralized Blockchain that are executed automatically.

Building an insurance app with machine learning algorithms can reduce the margin of error through automation.

Big Data allows your app to manage large volumes of data without putting too much strain on the app’s performance & services.

Our portfolio is our biggest strength when it comes to showcasing our experience and achievements in insurance app development services. Over the years, we have mastered the craft of building quality app solutions that are future-proof and highly scalable, dedicated to insurance services.

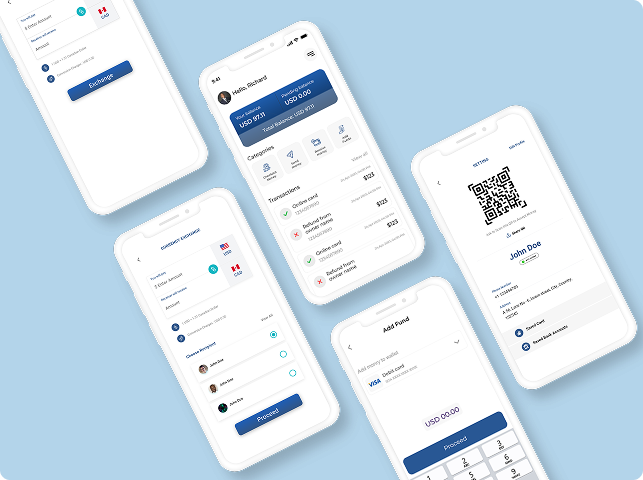

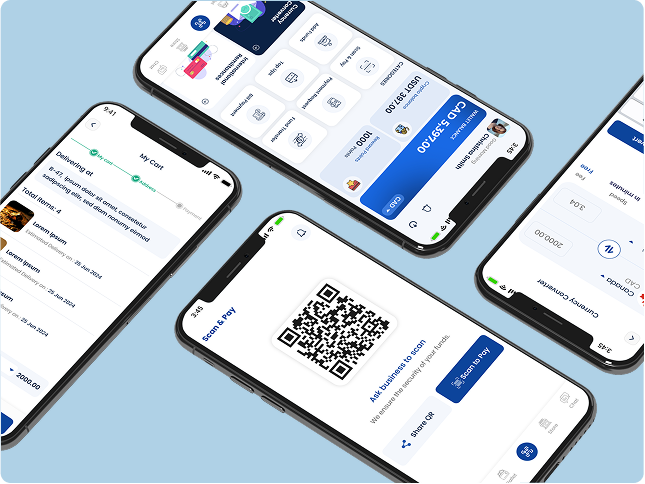

Envisioned to simplify online payments & manage financial assets, PayByCheck was brought to life by implementing a series of financial technologies that allow ACH & EFT support, making it convenient to transfer & exchange currencies on the go!

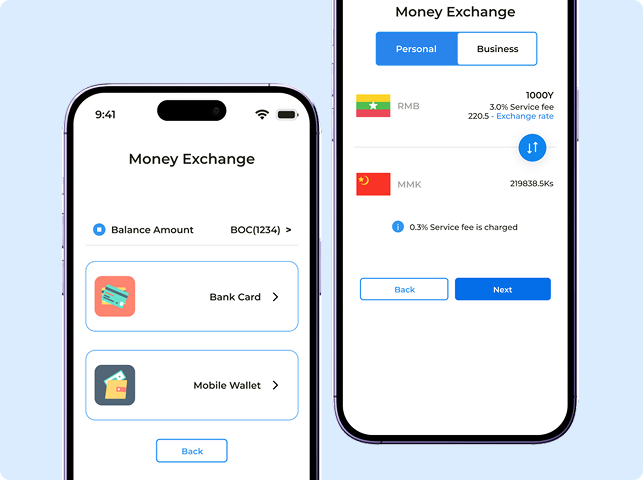

View Case StudyWith a vision to build a customized e-wallet app that caters to the unique demands of similar yet diverse markets of China & Myanmar. By integrating multiple currencies like RMB & MMK, we could deliver a seamless experience to the users, within the desired timeline.

View Case Study

After understanding the project thoroughly, our experts helped team SatPay to build an all-inclusive platform that not only allows digital payments through e-wallet, but also offers different integration options such as send & receive money, recharge, & more.

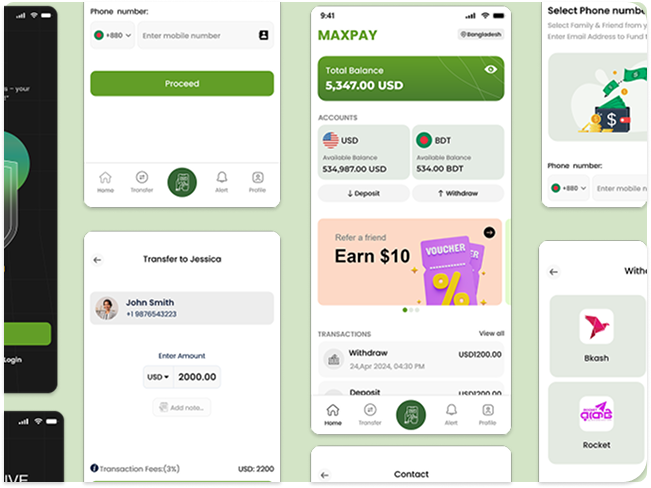

View Case StudyMaxPay is a payment gateway & wallet that helps you stay safe while making payments online. The idea came across as a game changer for betting & fantasy apps as it allows you to keep your banking details intact while you use new apps.

View Case Study

MoneyMoov was built to simplify currency exchange and international transactions. We delivered an e-wallet that converts funds to desired currencies and completes the transaction in real-time with additional features such as transaction history & more!

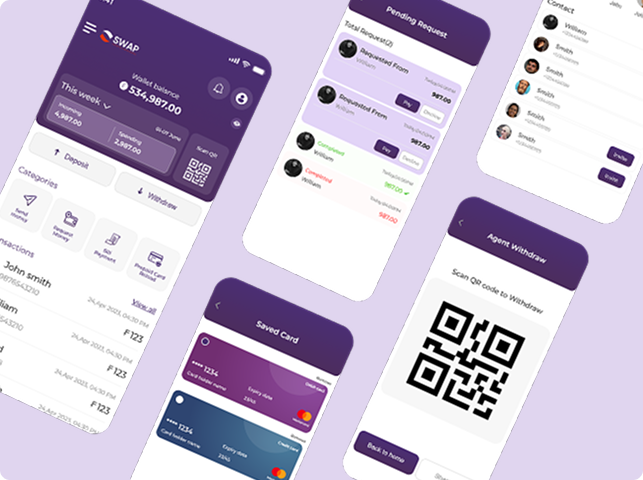

View Case StudyWith SwapWallet, the idea of execution revolved around building an e-wallet that not only offers basic transactions, but also offers modes to simplify payroll transactions, allowing a user to send funds to up to 50 users at the same time!

View Case Study

Looking for insurance app development services that are recommended by the best? Well, we are rated highly on multiple public platforms, including Clutch, the most popular marketplace for finding development services.

Our experts support your application at all stages of the development, while keeping you in the loop at all times.

We always support our clients who are bold enough to take brave decisions and do things differently with our custom app development services that offer apps unique to your demands!

Having a proof of concept for your insurance app idea can help you pave the way for execution. Our experts can help you build the MVP, giving you a sneak peek into the final product.

At Nimble AppGenie, we believe the job is not done until the app is live for all. Hence, we make sure that the experts get the job done and deploy the solution for you with perfection.

Get your answers to some of the most common queries around Insurance App Development.

It can take anywhere between 3-15 months depending on the requirements and complexity of the application. It can further go beyond 15 months if you have some additional demands that require customization. Generally, a full-fledged app is ready between 9-12 months.

Cost To develop an insurance app, you require anywhere between $25,000 - $250,000. The lowest amount can help you build an MVP to get an idea about how your insurance app will look and work. The budget can go further than 250,000, depending on the additional technologies and functionalities you offer.

At Nimble AppGenie, we are highly transparent about our privacy policies and work ethics. If you bring a customized idea to us that is unique to the industry, and you wish to sign an NDA, we are more than happy to do the same.

The tech stack for insurance apps requires a combination of different technologies such as a cloud platform, a database, some security measures, and frontend and backend tech. You can also integrate advanced technologies such as AI, Blockchain, IoT, etc.

Yes, at Nimble AppGenie we have a vast team of developers and analysts who are experienced in both iOS and Android app development, helping you build an insurance app that reaches the masses easily.

Well, we have a dedicated team for app maintenance and support services that help you resolve initial issues and ensure that there are no performance errors on your latest application.

An insurance app must-have significant security measures such as password protection, encryption, biometric (if available on device), and data protection mechanism as it has a lot of sensitive information included in the app.

Yes, our mobile app developers are fully equipped to identify the exact needs of the client and can accordingly build customized insurance applications.

Nimble AppGenie is committed to delivering results that satisfy our client’s needs and their business objectives. Here are testimonials from our clients about their experiences of working with us.

We hired Nimble AppGenie for web development services related to our edtech platform, Glu Learning. They integrated well with our team to solve all the problems and deliver remarkable solutions. Their team have great command of both client side and server side technology. We highly appreciate and recommend their services.

"Our journey with Nimble AppGenie is defined by their consistent availability, reliability, and efficiency. As we look towards expansion, I'm confident our partnership will grow even stronger. And we are eagerly anticipating the next chapter with them.

Read our blogs about the latest industry trends and much more inthe mobile app development industry.