If you are looking for the best financial literacy app you are in the right place!

Today, financial management is power and can pave the way to financial success. It is a crucial skill to navigate the complex landscape of personal finance.

Are you unsure about how to budget effectively, save for the future, or make wise investment choices? If so, you are not alone. Today many people face financial uncertainties and lack the necessary knowledge to navigate the world of finance.

Fortunately, with the rise of technology, there is now a plethora of financial literacy apps available to help you manage your money wisely, invest intelligently, and achieve your financial goals. Whether you want budgeting tools to investment trackers, these apps can be powerful resources for boosting your financial IQ.

However, by equipping yourself with financial knowledge, you can gain the confidence and skills needed to take control of your financial destiny. So whether, you are a recent graduate starting your career or a seasoned professional planning for retirement, investing in financial education is a wise choice that can pay dividends for a lifetime.

Financial literacy is not an option; it is a necessity- Oprah Winfrey

In this blog, we will explore the best financial literacy app that can empower you to make informed financial decisions and improve your financial well-being. So let’s dive into the world of financial literacy apps and discover how they can revolutionize your financial literacy journey.

Financial Literacy App Usage Statistics

At the current time, most likely Gen Z is using apps that teach financial literacy. It’s not a surprise younger generation is more aware of financial management and most early adopters of financial literacy apps.

Let’s look at the Google report:

- 73% of smartphone users manage their finances with financial management apps.

- 67% of users prefer finance apps that store their preferences to make future activities easier

- 53% of users using finance apps have abandoned apps because they no longer needed

- 6 in 10 smartphone users prefer using a finance app to check their investments rather than a website.

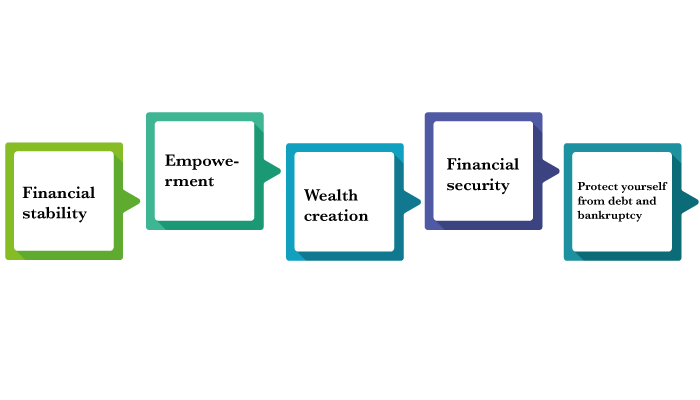

Importance of financial literacy

Financial literacy gives financial freedom to the individual making money as a tool to manage finances. With financial literacy applications consumers not only manage money with more confidence but also prevent financial issues at the same time.

However, it is a critical skill that plays a significant role in an individual’s financial well-being and overall financial management. The importance of financial literacy app can be summarized as follows:

Financial stability

Financial literacy plays a crucial role in achieving and maintaining financial stability. It helps individuals to maintain financial stability.

Moreover, financially literate individuals are better equipped to build a solid financial foundation. which helps them with financial challenges and achieve long-term stability.

Empowerment

Yes, financial literacy empowers individuals to make responsible financial decisions. It equips them with the knowledge and skills necessary to manage money effectively.

Wealth creation

Knowledge of finance is essential for wealth creation. With the financial literacy app, individuals can understand the various investment options available to them.

Financial security

It also helps individuals to understand the importance of insurance, estate planning, and retirement planning. It enables them to make informed decisions about insurance coverage

Protect yourself from debt and bankruptcy

A financially literate person knows how to save expenses and how much to save for an emergency. It takes up to three to six months to maintain that level all the time.

Overall, it is recommended to use the best apps for financial literacy and you are good to go. In the next section, we are going to discuss financial literacy apps from budgeting to investing.

Unlocking your financial success: Best apps for financial literacy

There are several financial literacy apps available in the market. It is important to research and choose an app that aligns with your financial goals, preferences, and comfort level with technology.

Here are some of the best financial literacy apps that can help you with budgeting to investing:

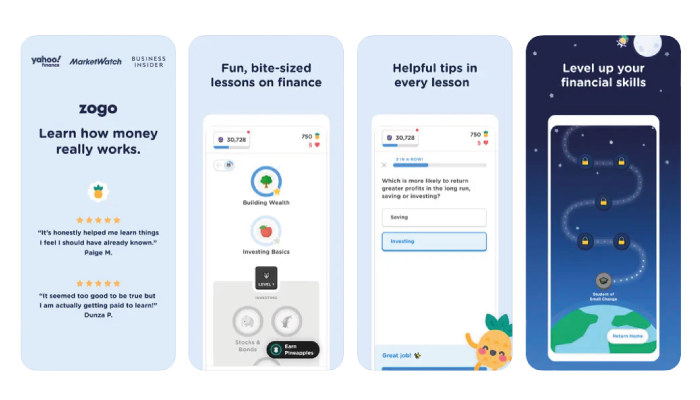

Zogo

The best financial literacy app, it provides users with financial knowledge and empowerment. This app is the ultimate destination for those seeking to master their finances.

With its unique approach to financial education, Zogo has transformed the landscape of financial literacy apps for adults. By making learning about money management not only informative but also incredibly fun.

Whether it’s budgeting to investing, credit to saving Zogo covers a wide range of essential financial topics that are relevant to adults of all ages. The best thing about Zogo is that it pays you to complete lessons. And pay rewards to users with gift cards including Amazon, Starbucks, and Target.

Plus, the app’s gamified approach to financial education like thrilling quests, solving financial puzzles, and competing with friends to earn points, badges, and rewards as you level up your financial knowledge.

iOS app rating: 4.8/5

Android app rating: 4.3/5

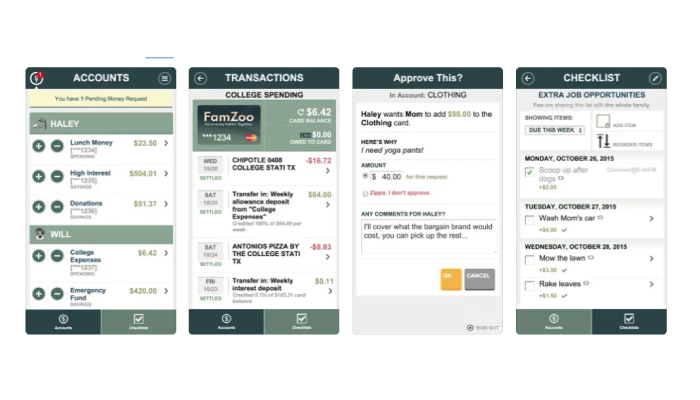

FamZoo

Financial literacy with Fam Zoo become exciting as it is the ultimate tool for parents and kids to master personal finance in a fun and interactive way. In other words, FamZoo is just another financial literacy app but a complete family financial management system. With these apps “try financial literacy” sound exciting.

This app empowers parents to guide their children’s financial education. With FamZoo parents can set up virtual family banks to create customized budgets all in one place.

Moreover, the game offers a gamified experience that makes learning about money enjoyable and exciting. Parents can automate allowances, create budgets and give out loans, and much more.

The best thing about this app is parents can start with simple teaching and can teach more sophisticated financial concepts later. Also, kids can track their spending, saving and set saving goals and even invest in virtual stocks. And earn rewards and badges for completing financial challenges and quizzes making the learning process rewarding and motivating.

- iOS app rating: 4.6/5

- Android app rating:4.4/5

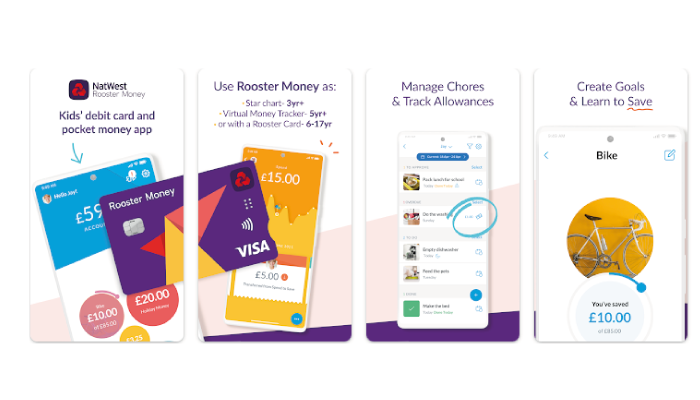

RoosterMoney

With innovative features and a user-friendly interface, Rooster Money has become one of the top financial literacy apps for kids. It helps kids to raise financially responsible and savvy children.

Moreover, with this app kids can set saving goal, tracks their spending, and manage their allowances or earnings in a virtual bank account.

One of the standout features of Rooster Money is its unique parent-child collaboration. Parents can set up chores and tasks for their kids, assign allowances or payments, and track their progress.

When kids can complete chores and mark them as done, it provides a sense of responsibility and accomplishment. Parents can also set up automated allowances and rewards, helping kids to learn about regular income and savings.

With this app, kids can think about different ways of using their money and parents can also split allowances with this app. If you want to enhance the financial literacy of your kids, there is no better app than RoosterMoney.

- iOS app rating: 4.7/5

- Android app rating:4.6/5

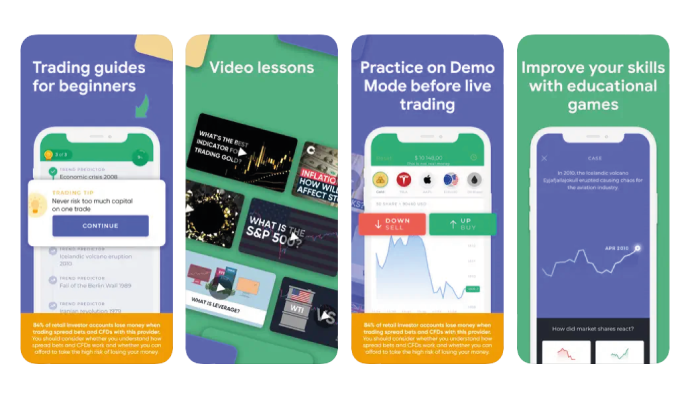

Investmate

Investmate is a cutting-edge app that provides a comprehensive learning experience to build financial literacy app and help individuals achieve their trading goals. It is more than just a financial literacy app, a complete trading education platform that offers a wide range of educational resources for beginners and experienced traders.

The app covers a variety of topics, including market analysis, technical and fundamental analysis, risk management, and trading psychology. It also offers a step-by-step learning path that is designed to empower users with the knowledge and skills needed to make informed trading decisions.

Moreover, the app offers a variety of educational materials, including articles, videos, quizzes, and interactive exercises that cater to different learning styles. Users can track their progress, earn badges, and unlock new levels as they complete each module.

It also provides users with a practical approach to learning by offering a simulated trading experience. Plus, users can practice their trading skills in a risk-free environment with a virtual trading account, allowing them to apply what they have learned without risking real money.

So, whether you’re a beginner who is just starting to learn about trading or an experienced trader looking to further enhance your skills. Investmate is the perfect companion to help you build your financial literacy application and succeed in the trading world.

- iOS app rating:4.8/5

- Android app rating:4.5/5

Saving Spree

It is an award-winning financial literacy app specially made for children from ages 7 and up. This app is available on the app store. Best financial literacy application that offers a fun and interactive way to build money management skills.

With Saving Spree, kids can embark on virtual spending making choices and decisions that impact their budget and savings. It also creates a sense among the kids of emergency funds.

Moreover, the app features a kid-friendly interface with colorful graphics and easy-to-understand instructions, making it accessible to children of all ages.

Kids can track their progress, set savings goals, and earn virtual rewards for making smart financial decisions. Plus the app also includes features such as budget tracking and spending analysis to help kids develop good money habits from a young age.

It not only empowers kids with knowledge but also enhances their financial skills. This is among the best apps that teach financial literacy to kids. Download Savings Spree from the App Store today and help your kids build a strong foundation of financial literacy.

- iOS app rating:4/5

- Android app rating: N/A

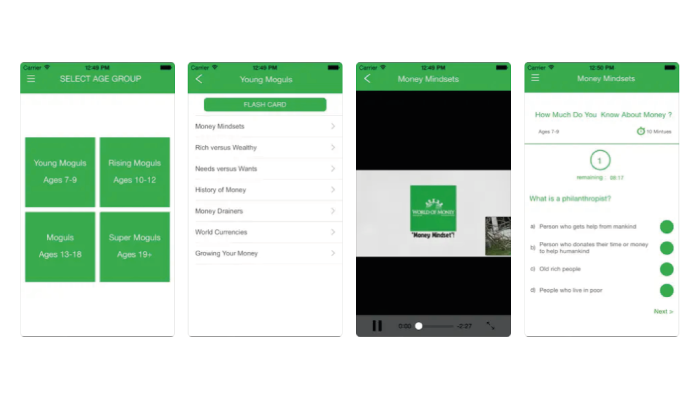

World of Money

This financial literacy app is not only the best financial literacy app for adults but also provides finance content for everyone. The best thing about this app is that its modulus is taught by the world of money graduates who are of the same age as the target audience.

World of Money offers a wide range of features and resources to empower the user with financial literacy. One of its unique features is its focus on real-world scenarios and practical financial advice. With practical tips, tools, and strategies users make informed financial decisions in their daily lives.

It doesn’t matter whether you are a beginner or an experienced investor, this app has all the resources you need to build a strong foundation of financial literacy. The world of money is the best if you want to master your financial knowledge.

- iOS app rating: 5/5

- Android app rating: 5/5

GoHenry

Lastly, it is a popular financial literacy app that aims to educate young users about financial literacy. One of the key features of GoHenry is its goal-setting functionality that allows users to set savings goals and track their progress.

The app also provides real-time notifications to parents. Plus, allowing them to monitor their children’s spending, set spending limits, and provide allowances or rewards based on financial behaviors.

In addition to goal-setting, GoHenry includes educational content such as financial quizzes and interactive lessons. This covers various financial topics, including budgeting, earning money, and making responsible spending decisions. The app also provides a virtual Visa debit card for kids and teenagers, which can be used for online and in-store purchases, helping them learn about responsible card usage and financial transactions in a controlled environment.

While GoHenry does not include the Goalsetter financial literacy app within its platform, it shares similar goals of promoting financial literacy among students and young individuals.

Both GoHenry and Goalsetter are examples of financial literacy apps that aim to provide practical tools and educational resources to help young users develop good financial habits.

- iOS app rating:4.8/5

- Android app rating:3.8/5

Conclusion

When it comes to the best financial literacy apps, there are various options available, including GoHenry, Goalsetter, and other similar apps. They focus on financial literacy for students and young individuals.

In addition to financial literacy apps, financial literacy game apps are also gaining popularity as a fun and interactive way to educate individuals about personal finance.

We hope that with this blog, you can download the financial literacy app and enhance your financial knowledge. If you want to know more related to financial apps consult with fintech app development company.

FAQs

Financial literacy refers to the knowledge and understanding of financial concepts. Also, the skills necessary to make informed financial decisions and manage personal finances effectively.

Financial literacy is important as it empowers individuals to make informed financial decisions, manage money wisely, & avoid financial pitfalls. And build a strong foundation for long-term financial success.

The cost of building a financial literacy app depends on various factors such as features, complexity, platform, and development team. It can range from thousands to tens of thousands of dollars.

To build a financial literacy app, one needs to define the app’s goals, research financial topics, create engaging content & design user-friendly interfaces. Plus, develop relevant features such as budgeting tools, goal-setting, and educational content.

The development time for a financial literacy app depends on its complexity and features, ranging from a few weeks to several months, considering the design, development, testing, and deployment stages.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.