When it comes to Open banking API it’s a term that transcends a new era for the financial industry. So what exactly is open banking APIs, you might ask?

Well, let’s unravel this financial enigma together. These APIs connect your bank account to a marketplace of financial services. They enable secure and seamless data sharing between third-party apps. This paves the way for a host of innovative services that cater to your financial needs like never before.

Now you might be wondering what the fuss is about Open Banking APIs.

According to Statista, the number of open banking users worldwide is expected to grow at an average annual rate of nearly 50% between 2020 and 2024, with the European market being the largest.

The value of open transactions has reached worldwide 57 Bn U.S dollars in 2023. And it’s expected to increase in the following years. The number of these calls will increase to 580 Bn in 2027.

The number of open banking application programming interface (API) calls is forecast to grow from 102 Bn in 2023 to 580 Bn in 2027. During this period, the value of open banking transactions is expected to grow to & reach 330 Bn in US dollars in 2027.

By looking at the reports, you can see that it opens the door for innovations. Plus, serves consumers with their needs while maintaining a strong focus on privacy and security.

With this blog, we will discuss everything related to open banking APIs, their working, necessity, and benefits. This being said, many of us are using open banking services, but few know about this trend or what’s going on behind the scenes, let’s dive right in.

What is open banking API?

The open banking API refers to the use of application programming interfaces ( APIs) to enable secure and standardized sharing of financial information and services between different financial institutions, like banks and third-party providers (TPPs).

Simply, it’s like having a secret handshake that allows your bank account to communicate with various other financial apps and services, securely with user permission.

These open banking APIs act as a bridge between the banks’ system and external applications, allowing them to access account data, initiate payments and perform various financial tasks on your behalf.

Although, the whole concept of this open banking is rooted in enhancing customer experience and fostering competition in the financial landscape. By allowing third-party developers to access bank data wide array of innovative and convenient services can be created.

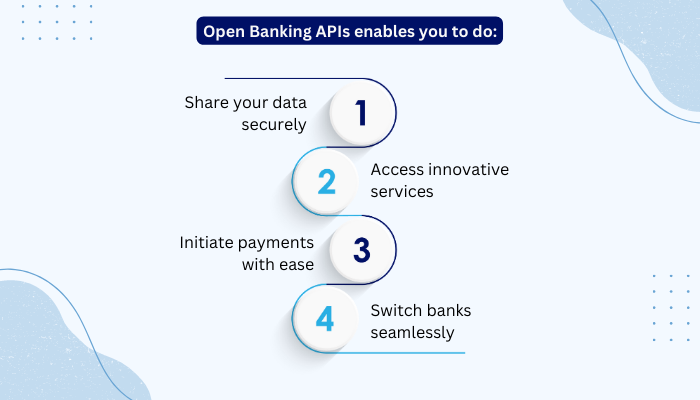

Open Banking APIs enable you to do:

· Share your data securely

With open bank API robust security measures are in place, and users can share financial information selectively and safely with authorized third-party apps. Plus, it helps you to manage your money better.

· Access innovative services

Financial apps that can analyze user spending, help you save money, provide personalized financial advice, and much more all powered by data from your bank account.

· Initiate payments with ease

Making payments to merchants or transferring money to friends can become a breeze with open banking APIs as users can initiate transactions directly from trusted financial apps.

· Switch banks seamlessly

Open banking promotes the ability to switch between banks effortlessly, as user financial data can be transferred securely to your new provider, eliminating the hassle of starting from scratch.

Open Banking APIs around the world

The number of open banking users worldwide is expected to grow at an annual rate of 50% between 2020 and 2024, and the European market is the largest among all. The rise of fintech apps, they are changing the entire landscape of the fintech industry.

Many countries and regions have either implemented or were in the process of introducing open banking regulations to promote financial innovation.

Here are some key regions and countries where bank open API was making significant strides:

· European Union

The European Union’s revised payment services directive (PSD2) became a driving force behind open banking in Europe.

They made mandatory that banks allow third-party providers to access customers’ account information through APISs with explicit customer consent.

· United Kingdom

When it comes to early adopters UK is on the list. The Competition and Markets Authority (CMA) mandated the nine largest banks in the UK to open up their APIs to third-party providers.

With this initiative, it has increased competition, improve services and provide customers with better financial choices.

· Australia

Australia has opened its open banking regime in 2020. It started with sharing data related to credit and debit cards and transition accounts.

However, this initiative has aimed to empower consumers by allowing them to share their banking data with authorized third-party providers.

· Singapore

The Monetary Authority of Singapore (MAS) introduced the Singaporean version of Open Banking, known as the Singapore Financial Data Exchange (SGFinDex). When it comes to East Asian countries Singapore’s open banking has a rigid foundation.

It allowed consumers to consolidate their financial information from various banks and financial institutions through a single platform or app.

· Canada

This country was in its early stage of exploring open banking, as the discussions among the stakeholders and financial institutions were taking place.

Therefore, the Canadian government is considering risk factors related to open banking before implementing it in real-time.

· Brazil

Another counter introduced its open banking initiative, which aims to facilitate the sharing of customer data between financial intuitions and authorized third parties.

As it started by sharing customer data and eventually allowing transactions.

· Japan

Japan is techno-driven, Japan Financial Services Agency (FSA) had discussions and trials regarding Open Banking. Currently, the country was exploring the benefits and its impact on the financial sector.

Types of open banking services

Open banking services encompass a diverse range of offerings that leverage Application programming interfaces (APIs) to facilitate secure data sharing and financial transactions. Whether it’s digital boarding APIs or open banking APIs, they have transformed the fintech industry in many ways.

| Account information services (AIS) | It allows third-party providers to access and consolidate a user’s financial data from multiple accounts across various banks or financial intuitions. With the user’s consent, AIS can provide a comprehensive view of their finances, including account balance transaction history, income, and expenses.

|

| Payment initiation services | It enables users to initiate payments directly from their bank accounts through third-party applications. |

| Personal finance management | PFM tools help users to create budgets, track expenses and set financial goals to improve their overall financial well-being. |

| Investment and wealth management | Open banking can also be used to offer investment & wealth management services. By analyzing users’ financial data and risk tolerance, investment platforms can provide personalized investment advice and portfolio recommendations. |

How does Open banking work?

Simply, we know that banks use APIs for sharing data. Before we explain the working of open banking, let’s understand how APIs work first.

Simply, APIs are a set of rules that define how two pieces of software can communicate with each other.

When it comes to open banking API security, banks give their APIs to authorized financial providers as these contain various pieces of information, such as an account type, account holder’s name, transaction, currency, etc.

Therefore, when the consumers agree to share their data with third-party service providers they can access the shared information via APIs. Implementing and building the APIs are up to the banks.

Why do we need open banking?

Open banking addresses several key challenges and offers numerous benefits that make it a crucial development in the financial industry. The open banking API solution has brought innovations in the banking industry.

Moreover, open banking is a system that puts control of financial data back into the hand of customers. It allows them to securely share their financial information with trusted third-party providers of their choice.

With this, it empowers consumers to access more personalized financial services and make better-informed decisions about their money.

However, there are many reasons why we need open banking; here are some of the most important ones:

Increasing competition

It can help to increase competition in the financial services market. This is because it allows new and innovative financial service providers to enter the market and compete with traditional banks.

Moreover, this can lead to lower prices, better products, and more choices for consumers.

Making financial services more accessible

Open banking can make financial services more accessible to consumers who are currently underserved by traditional banks. For example, people who do not have a credit history or who live in rural areas may be able to get better access to financial products and services through open banking.

Reducing fraud

Open banking can help to reduce fraud by giving customers more control over their financial data. For example, customers can choose to share their data only with trusted third-party providers.

Improving customer experience

Open banking API services can help to improve the customer experience by making it easier for customers to manage their finances.

For example, customers could use open banking to see all their accounts in one place, track their spending and set up automatic payments.

Benefits of open banking

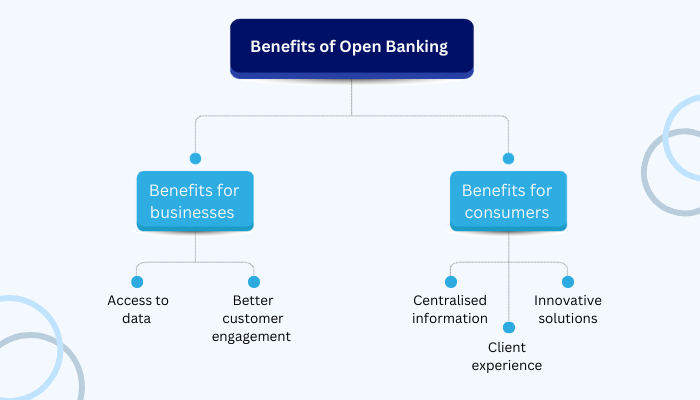

Open banking has several benefits for both financial institutions and businesses or customers. Let’s look at the main benefits of open banking are

Benefits for businesses

Access to data

Open banking API architecture has changed the traditional banking landscape. Now not only fintech companies can access the data, but even small fintech companies have the tools to join the competition.

Better customer engagement

The data shared by open banking helps businesses offer their customers personalized offerings. Although the data analysis helps in making suggestions to different clients based on their financial habits which significantly increases client engagement.

Benefits for consumers

Centralized information

Open banking integration has made it possible to track all financial information in one place. With this users can make better financial decisions and deal with better financial betterment. In this way, consumers can gain more control over their finances.

Client experience

Since the introduction of open banking, there is not a single bank that is not providing its banking services via banking apps. In the same order, fintech has introduced various solutions that improve payment flows and which simplify overall transactions.

Innovative solutions

With open banking API integration, many solutions have been developed to give new banking systems to benefit consumers. With quicker checkout flows, it’s easier for mobile payments and digitalized banking services to open banking.

Is Open Banking Safe?

The main core of open banking is security and data protection. Implementing open banking APIs adheres to strict regulatory standards to ensure the safety of customer data and financial transactions.

Moreover, the data transmitted between banks and third-party providers is encrypted, ensuring that sensitive information remains secure and protected from unauthorized access.

It has a strong authentication system, with robust authentication methods, such as two-factor authentication and biometrics, which are employed to verify the identity of customers. It ensures that only authorized users can access their financial data.

However, the open banking API pricing depends on the financial intuition or third-party provider offering the services.

Some APIs have a subscription-based model, while others might charge per transaction or based on the volume of data accessed. The pricing structure can also differ based on the specific use case and the level of service provided.

Lastly, open banking initiatives are subject to strict regulations, such as GDPR in Europe and other local data protection laws. Compliance with these regulations is essential to maintain the security and privacy of customer data making opening banking safest.

Conclusion

Open Banking API is a transformative force in the financial industry, reshaping the way customers interact with their banks and unlocking new possibilities for innovation and collaboration. Through this blog, we’ve explained the potential of Open Banking API, its impact on seamless transactions, and the opportunities it brings for a more connected financial future.

As the financial landscape continues to evolve, staying informed about the latest trends and insights in Open Banking is crucial for businesses, developers, and consumers alike. By embracing the power of APIs, we can create a more open, secure, and efficient financial ecosystem.

Together, we can harness its potential to shape a better, more inclusive future for the financial services industry. Keep exploring, learning, and innovating – the possibilities are boundless. If you want to know more feel free to contact us.

FAQ

Open Banking refers to the use of APIs that enable secure data sharing between financial institutions and third-party providers. It allows customers to share their financial data with authorized apps, fostering innovation and competition in the financial sector.

Open Banking empowers consumers by providing them with better financial services, personalized recommendations, enhanced transparency, streamlined payments, and improved control over their data.

Yes, Open Banking is designed with strong security measures. Customers must provide explicit consent before data sharing, and APIs are built with encryption and authentication protocols to protect sensitive information.

Yes, you have control over which third-party providers can access your data, and they must adhere to strict regulations and security standards to ensure the safety of your information.

Open Banking APIs allow businesses to access real-time financial data, make better lending decisions, create innovative products, and offer more tailored services to their customers.

Open Banking APIs facilitate account information services, payment initiation services, personal finance management tools, investment advice, real-time payments, and much more.

Open Banking encourages collaboration between traditional banks and fintech startups, leading to the development of new and innovative financial products and services that cater to diverse customer needs.

Absolutely! Open Banking APIs enable personal finance apps to analyze your spending habits, set budgets, and offer insights that can help you save money and achieve your financial goals. If you want to create a mobile banking app, contact us we are experts in creating fintech apps.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.