Robo Advisor is being thrown around a lot around the fintech industry lately.

While the concept has been around for the better part of a decade now, there’s a lot of gold to be mined in the ground still.

Whether you are a business that wants to develop a robo advisor or a fintech platform owner wanting to add this amazing concept as a feature in your existing platform, this guide to robo advisor platform development is for you.

Here, we shall be going through everything robo advisor development related.

Therefore, with this being said, let’s get right into it:

What is Robo Advisor?

Did you know that the term “robo advisor” was first coined in 2002, but it wasn’t until 2008 that the first widely recognized robo advisor platform was launched? This innovation marked the beginning of a new era in financial advice.

So, what is Robo advisor?

The term refers to a digital platform that utilizes algorithms and automation to manage investments and offer financial advice with minimal human intervention.

They cater to individuals seeking an automated, data-driven approach to wealth management.

In layman’s terms, they are AI driven systems that automate investment and deliver financial advice. How amazing is that?

Ever since robo advisors were first introduced they have helped fintech-related platforms and businesses exponentially improve their growth by a good measure.

Let’s understand that better with the help of a few statistics in the section below.

Deep Dive into the Robo Advisor Market: Statistics

Fintech statistics show the amazing growth robo advisor platforms have when through. Here’s a sneak peak into just that:

- The global robo-advisory market was valued at $7.9 billion in 2022 and is projected to reach $129.5 billion by 2032, growing at a compound annual growth rate (CAGR) of 5%.

- Estimates suggest that robo-advisors could manage between $2.2 trillion and $3.7 trillion in assets by 2020, potentially reaching over $16.0 trillion by 2025.

- Hybrid robo-advisers, which combine automated algorithms with human financial advisor support, currently hold the largest market share, accounting for 8% of global revenue in 2023

In recent years, the impact of robo advisors on businesses has been amazing! But before we discuss more of that, let’s first understand how the robo advisor platforms work.

How Robo Advisors Work?

To ball park it, Robo advisors are automated platforms that provide financial planning services with minimal human supervision.

However, there’s much more that goes into making robo advisor work than what meets the eye.

They utilize algorithms based on modern portfolio theory to offer investment advice and manage a portfolio.

Here’s a general outline of how they work:

1. Data Collection: Initially, the robo advisor collects financial information from the user through an online survey. This information includes the user’s financial situation, investment goals, and risk tolerance.

2. Analysis and Advice: Based on the collected information, the robo advisor uses its algorithm to analyze the user’s financial data and provide tailored investment advice. This advice aligns with the user’s financial goals and risk tolerance.

3. Portfolio Management: The robo advisor then automatically invests the user’s funds in a diversified portfolio, typically consisting of various asset classes such as stocks, bonds, and real estate through Exchange-Traded Funds (ETFs). The algorithm continuously monitors the portfolio and rebalances it as necessary to maintain the desired asset allocation.

4. Tax Optimization: Many robo advisors also offer tax-loss harvesting, which involves selling securities at a loss to offset taxes on gains and income.

5. Low Costs: Since robo advisors are automated, they typically have lower fees compared to traditional human advisors. This cost efficiency makes them an attractive option for investors looking for affordable financial advice and portfolio management.

6. Accessibility: Robo advisors are accessible online, making them convenient for users to track their investments and adjust their financial goals at any time.

Speaking of platform’s working, one of the leading question people ( as well as businesses) ask is, “Are robo advisors accurate?”

After all, investing is one of the most complex things finance related and how can an AI do it, right? Well, let’s look at some advantages as well as downsides of the same below”

Pros and Cons of Robo Advisors

| Pros | Cons |

| Cost-effective: Lower fees than traditional advisors, attracting more clients. | Less customization: Pre-built portfolios may not fit specific needs. |

| Scalable: Efficiently manage a larger client base with lower costs. | Limited personal touch: No personalized advice like with human advisors. |

| Easier access: User-friendly platform opens up investing to a wider audience. | Limited choices: Fewer investment options compared to traditional advisors. |

| Data-driven approach: Algorithms remove emotions and bias from investing. | Regulatory uncertainty: Evolving regulations pose compliance challenges. |

Robo Advisor Breakdown: Components & Technologies

To truly understand how robo advisors work and go for robo advisor development, one must understand all its components and technologies behind it.

You see, this sophisticated platform relies on a combination of components and technologies to give automated financial advice and portfolio management.

Here’s a breakdown of the key components and technologies involved:

Components

- User Interface (UI): This is the front-end part of the robo advisor that users interact with. It’s designed to be user-friendly and typically includes web and mobile applications. The UI collects personal and financial information from users through questionnaires and allows them to review and manage their investments.

- Algorithmic Engine: At the core of a robo advisor is its algorithmic engine, which processes user data to provide personalized investment advice. This engine uses algorithms based on modern portfolio theory, risk assessment, and other financial models to determine the optimal asset allocation for each user.

- Portfolio Management System: This system automatically implements the investment strategy recommended by the algorithmic engine. It executes trades, rebalances portfolios, and monitors investment performance to ensure alignment with the user’s goals and risk tolerance.

- Security and Compliance Layer: Robo advisors are equipped with security measures to protect user data and financial assets. This layer includes encryption, secure login mechanisms, and regulatory compliance features to adhere to financial industry standards.

- Customer Support and Education: While robo advisors are automated, many provide some level of customer support, which can range from online FAQs and chatbots to access to human financial advisors. Educational resources may also be offered to help users understand investing principles and the platform’s features.

Technologies

- Artificial Intelligence (AI) and Machine Learning (ML): These technologies are used to enhance the algorithmic engine, enabling it to learn from user interactions and market conditions to improve investment recommendations and strategies over time.

- Data Analytics: Robo advisors rely on data analytics to process large amounts of financial market data and user information, aiding in the creation of personalized investment portfolios.

- Cloud Computing: Many robo advisors are built on cloud platforms, which provide the necessary scalability and security for managing a large number of user accounts and processing extensive financial data.

- APIs (Application Programming Interfaces): APIs are used to integrate with stock exchanges, ETF providers, and other financial services, allowing the robo advisor to execute trades and access real-time market data.

- Blockchain and Cryptography: Some robo advisors incorporate blockchain technology and advanced cryptographic techniques to enhance security, particularly in the areas of transaction verification and user data protection.

- Natural Language Processing (NLP): NLP is used in customer support and education components to power chatbots and other interactive tools that can understand and respond to user queries in natural language.

The combination of these components and technologies enables robo advisors to offer efficient, personalized, and cost-effective investment management services to a wide range of users, from beginners to experienced investors.

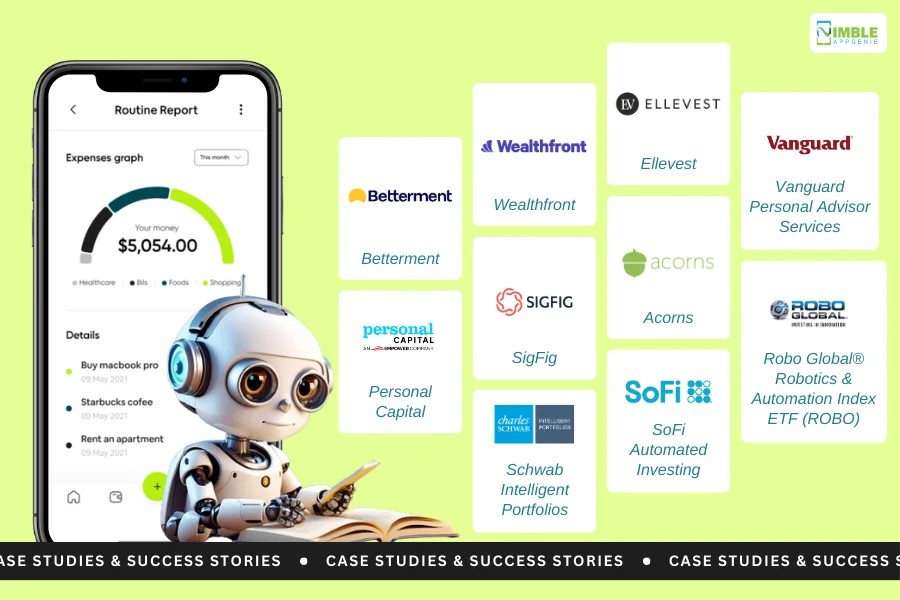

Robo Advisor Platforms: Case Studies & Success Stories

To develop the perfect robo-adviser, it’s a good idea to learn from the best.

That’s why, in this section of the Robo advisor platform development guide, we shall be looking at some of the top robo advisor platforms in the market today.

These are, as mentioned below:

1. Betterment

One of the pioneers in the robo-advisor space, Betterment offers personalized financial advice, automatic rebalancing, and tax-loss harvesting, catering to both beginners and seasoned investors seeking low-cost, efficient portfolio management.

2. Personal Capital

Merging wealth management with advanced financial planning tools, Personal Capital is geared towards high-net-worth individuals. This, while offering personalized strategies and access to human advisors. And Solidifying it’s stance as one of the best budgeting apps on the market.

3. Wealthfront

Known for its advanced financial planning tools, Wealthfront provides a comprehensive suite of investment management services including direct indexing, financial planning, and lines of credit, making it a favorite among tech-savvy users.

4. Vanguard Personal Advisor Services

Combining the best of both worlds, Vanguard offers a hybrid model with automated investment management complemented by access to human advisors, appealing to those seeking a more personalized touch.

5. Schwab Intelligent Portfolios

Offered by Charles Schwab, this platform provides commission-free automated investing with no advisory fees, utilizing a range of ETFs to build diversified portfolios based on user goals and risk tolerance.

6. Ellevest

Tailored specifically for women, Ellevest addresses gender-specific financial goals and challenges. It offers personalized investment portfolios along with career coaching and financial planning services.

7. Acorns

Acorns – one of the best investment platform – stands out for its micro-investing approach, rounding up users’ everyday purchases to the nearest dollar and investing the difference, making it an excellent option for those new to investing.

8. SoFi Automated Investing

art of the broader SoFi platform, its robo-adviser offers automated investing with no management fees, along with access to certified financial planners, appealing to younger investors and SoFi loan customers.

9. SigFig

Partnering with existing financial institutions, SigFig powers their robo-advisory services, providing users with portfolio tracking, rebalancing, and personalized investment advice, leveraging its technology to enhance traditional financial offerings.

10. Robo Global® Robotics & Automation Index ETF (ROBO)

While not a traditional robo advisor, ROBO is an ETF that allows investors to tap into the robotics and automation sector, reflecting the growing influence of technology in investment strategies.

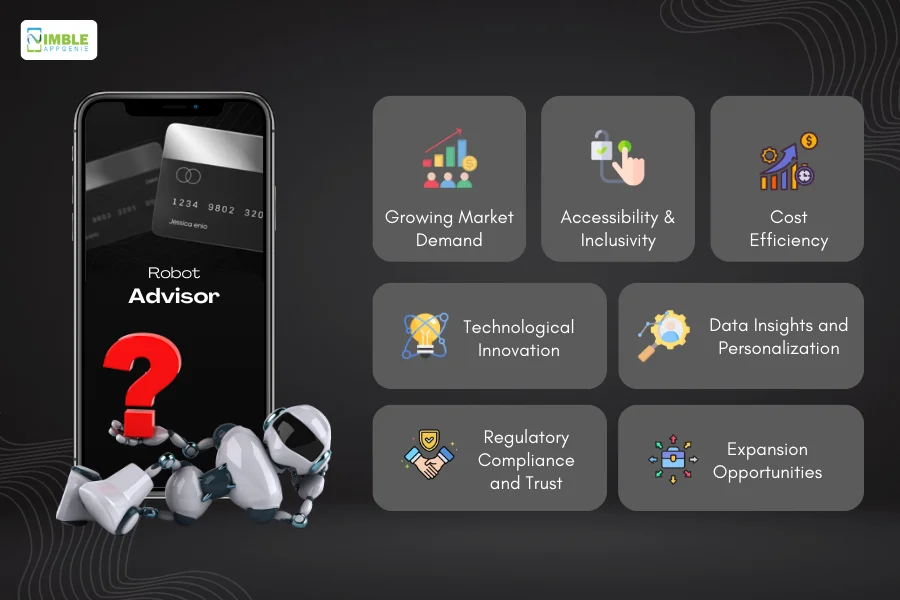

Why Should You Build a Robo Advisor Platform?

“Why should I develop a robo advisor?”

This is by far the most common question that comes to mind and gets asked in the meeting rooms. And the answer is, why not!

Building a robo advisor platform can offer numerous benefits and opportunities, especially for a fintech solution development company looking to make an impact in the financial services sector.

Here are a few pointers to understand the reason to develop a robo advisor platform:

-

Growing Market Demand

It is no secret; demand for digital financial advice and investment management services is on the rise.

This is driven by a growing segment of tech-savvy investors, including millennials and Gen Z, who prefer automated, low-cost investment solutions.

All in all, as the concept of digital finance continues to gain acceptance, more individuals are seeking accessible, straightforward ways to invest and manage their finances,.

And thus, further expanding the market for robo advisors.

-

Accessibility and Inclusivity

Traditional wealth management services often come with high fees and minimum investment requirements, making them inaccessible to a large portion of the population.

On the other hand, Robo advisors democratize financial advice, making it affordable and accessible to a broader audience, including those with lower investment amounts.

By developing a robo advisor platform, you can tap into this underserved market, providing valuable services to those who are often overlooked by traditional financial advisors.

-

Cost Efficiency

Robo advisors operate with lower overhead costs compared to traditional advisory services, thanks to automation and the use of AI.

This efficiency allows for competitive pricing models, which can attract more users.

For a software development company, building a robo-advisor platform can be a cost-effective way to enter the investment management space, with the potential for high scalability and lower operational costs.

-

Technological Innovation

Robo Advisor Platform Development provides an opportunity to leverage the latest technological advancements in AI, machine learning, data analytics, and blockchain.

These fintech technologies can enhance the platform’s capabilities by offering personalized and dynamic investment strategies that adapt to market changes and user needs.

Innovation in this space can also lead to new intellectual property and proprietary algorithms, setting your platform apart from competitors.

-

Data Insights and Personalization

Robo advisors collect a wealth of data on user preferences, financial goals, and behaviors.

This data can be analyzed to gain insights into consumer trends and to further personalize investment strategies, improving user satisfaction and engagement.

Data-driven personalization can lead to better financial outcomes for users and increase their loyalty to the platform.

-

Regulatory Compliance and Trust

Financial services are heavily regulated, and trust is a critical factor in attracting and retaining users.

By building a robo advisor platform that prioritizes regulatory compliance, data security, and transparency, you can establish a trustworthy brand in the fintech space.

Compliance with fintech regulations also ensures the longevity and stability of your platform, protecting both your company and your users.

-

Expansion Opportunities

Who doesn’t want to grow their business?

Well, a robo advisor platform can serve as a foundation for expanding into other financial services, such as banking, insurance, and personal finance management.

This can open up additional revenue streams and increase the value proposition for your users.

Thus, making it one of the top reasons to make robo advisor platform.

Speaking of Robo advisor platform development, it’s time to discuss features.

Robo Advisor Platform Features

A big part of understanding how to build a robo-advisor platform that’s successful is to recognize the importance of its features and functionality.

Starting with the basics, here are some core features to include when you create a robo advisor for your platform.

We’ll discuss the advanced ones in a bit.

| Features | User Panel | Admin Panel |

| 1. Account Management |

|

|

| 2. Investment Management |

|

|

| 3. Goal Setting & Tracking |

|

|

| 4. Financial Tools & Resources |

|

|

| 5. Security & Compliance |

|

|

| 6. Communication & Support |

|

|

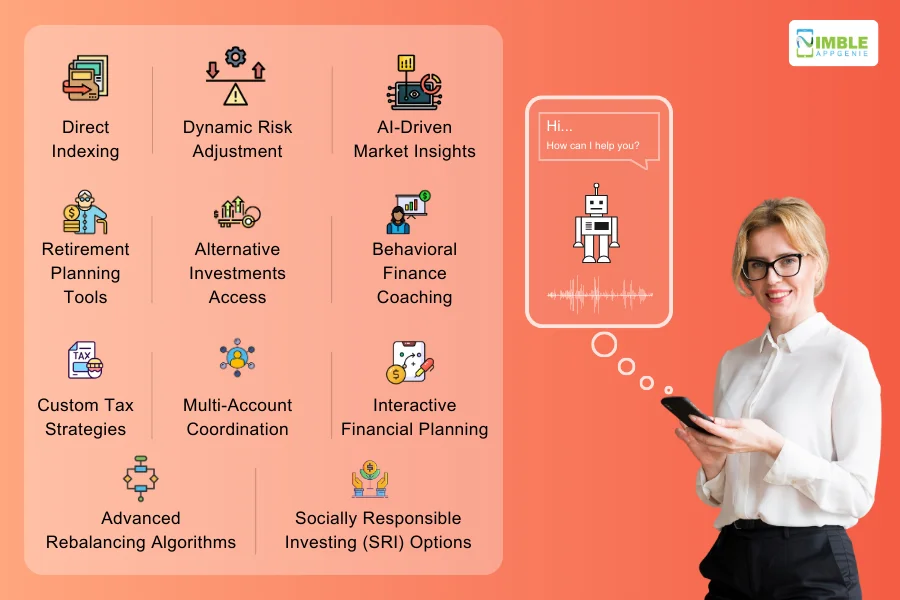

Advanced Features

Core features cover the essential needs, but to add that little bit of spice it’s important to include some advanced features.

It’s important to set yourself apart when robo advisor platform development.

Speaking of which, these are, as mentioned below:

1. Direct Indexing

Allows for ownership of individual stocks within an index, enabling more personalized portfolio management and potential tax optimization through individual security sales.

2. Responsible Investing (SRI) Options

Provides investment options that adhere to social, environmental, and governance (ESG) criteria, allowing users to invest in line with their ethical values.

3. Dynamic Risk Change

adjust investment risk levels based on changes in the market or the user’s financial situation, ensuring the portfolio remains aligned with the user’s risk tolerance.

4. AI-Driven Market Insights

Utilizes artificial intelligence to analyze market data and provide users with actionable insights, potentially enhancing investment decision-making and portfolio performance.

5. Retirement Planning Tools

Offers advanced calculators and simulation tools to help users plan for retirement, taking into account various income sources and expenses to create a comprehensive retirement strategy.

6. Alternative Investments Access

Grants users access to non-traditional investments like real estate, hedge funds, and private equity, diversifying portfolios beyond stocks and bonds.

7. Behavioral Finance Coaching

Integrates behavioral finance principles to provide personalized nudges and coaching, helping users make more rational investment decisions and avoid common cognitive biases.

8. Custom Tax Strategies

Beyond basic tax-loss harvesting, it offers personalized tax management strategies, including tax bracket management and optimization for charitable giving and estate planning.

9. Multi-Account Coordination

Efficiently manages and coordinates investments across multiple accounts (like 401(k), IRAs, and taxable accounts) to optimize for taxes and asset allocation holistically.

10. Advanced Rebalancing Algorithms

Utilizes complex algorithms to rebalance portfolios, taking into account factors like market conditions, tax implications, and trading costs, to maintain optimal asset allocation.

11. Interactive Financial Planning

Offers sophisticated financial planning modules that allow users to input various life scenarios (like buying a house or changing jobs) to see potential impacts on their financial goals and investment strategy.

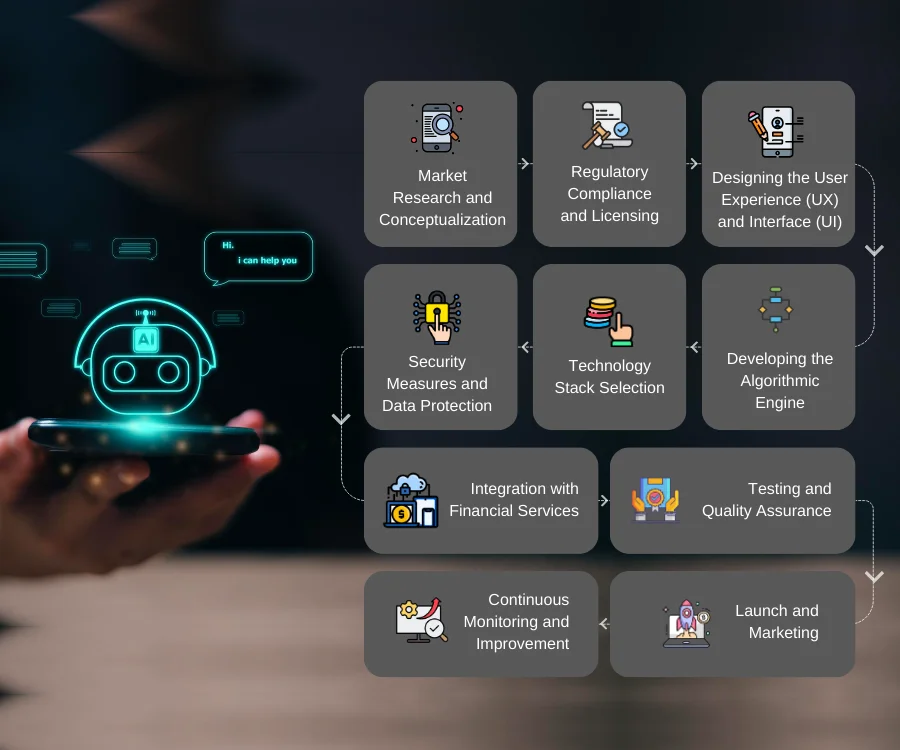

How to Create a Robo Advisor Platform?

It’s time to learn how to develop a robo advisor platform.

Here, we shall go through every detailed step that leads to this automated financial brilliance. Let’s get right into it, starting with the first:

Step 1: Market Research and Conceptualization

Start with in-depth mobile app market research to understand the needs and preferences of your target audience, as well as the competitive landscape.

This is important to, identify gaps in the current market offerings and conceptualize your robo advisor’s unique value proposition.

Step 2: Regulatory Compliance and Licensing

To build a robo advisor platform, familiarize yourself with the financial regulations in the jurisdictions you plan to operate.

This may involve obtaining necessary licenses and ensuring your platform complies with all relevant laws and standards, including those related to investment advice, data protection, and cybersecurity.

In any case, once all of this is done, we finally move to the decision part!

Step 3: Designing the User Experience (UX) and Interface (UI)

Focus on creating an intuitive and engaging user interface and experience.

This includes the design of the onboarding process, portfolio management dashboard, and any other user interactions with the platform.

The goal is to make complex investment processes accessible to users with varying levels of financial knowledge.

Step 4: Developing the Algorithmic Engine

Since we are talking about robo advisor development, AI and algorithm have to be our best friends.

Let us explain:

The algorithmic engine is the backbone of your robo advisor, responsible for generating personalized investment advice and managing user portfolios.

This involves developing algorithms based on modern portfolio theory, risk assessment models, and other financial theories.

Incorporating artificial intelligence and machine learning can enhance the engine’s capabilities, enabling more personalized and adaptive investment strategies.

Step 5: Technology Stack Selection

Now, it’s time to choose a robust and scalable fintech tech stack that supports the complex computational needs of your platform, including data analysis, security, and user interface design. This often involves a combination of backend technologies (for the algorithmic engine and database management) and frontend technologies (for the user interface).

| Component | Technology Options | Description |

| 1. Backend Development |

|

These technologies provide robust frameworks for server-side logic, data handling, and integration with other services. |

| 2. Frontend Development |

|

These JavaScript frameworks/libraries are popular for building dynamic and responsive user interfaces. |

| 3. Database Management |

|

These databases offer reliable data storage solutions. PostgreSQL and MySQL are relational, while MongoDB is NoSQL. |

| 4. Machine Learning |

|

These libraries are used for implementing machine learning algorithms for predictive analytics and personalization. |

| 5. Cloud Infrastructure |

|

These platforms provide scalable cloud services for hosting, computing, storage, and more. |

| 6. Security |

|

These technologies ensure secure data transmission and authentication. |

| 7. DevOps and CI/CD |

|

These tools support containerization, orchestration, and continuous integration/continuous deployment processes. |

| 8. Data Analytics |

|

These frameworks and tools are used for processing and analyzing large volumes of data. |

| 9. Blockchain |

|

For platforms considering incorporating blockchain for enhanced security or other features, these are popular choices. |

Step 6: Security Measures and Data Protection

To develop a robo advisor platform that’s full proof, it’s important to implement rigorous cybersecurity protocols to protect user data and financial transactions.

This includes encryption, secure authentication methods, and compliance with data protection regulations.

In addition, also plan regular security audits and updates are essential to maintaining the integrity of the platform.

Step 7: Integration with Financial Services

Fintech APIs play a crucial role in facilitating these integrations.

That’s why, your platform will need to integrate with various financial services and data providers, including stock exchanges, ETF providers, and banking services.

This allows for real-time data access, trade execution, and fund transfers.

| Integration Category | Provider/Service Options | Description |

| Market Data |

|

These services provide real-time and historical financial market data, including stock prices, indices, forex, and commodities. |

| Trade Execution |

|

APIs from brokerage firms that allow automated trading, including stock, ETF, and options trades. |

| Banking Services |

|

These APIs facilitate secure access to banking services, account information, and fund transfers. |

| Payment Processing |

|

Widely used payment gateways that support secure online transactions and can be integrated to add funds or withdraw gains. |

| Identity Verification |

|

These services provide KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance through identity verification. |

| Portfolio Analysis |

|

Offers detailed analytics, performance metrics, and risk assessment tools for portfolio management and optimization. |

| Customer Support |

|

Integrations for customer support services, including ticketing systems, live chat, and knowledge bases. |

| Financial Planning |

|

These platforms offer advanced financial planning tools that can be integrated to enhance advisory capabilities. |

| CRM Integration |

|

Customer Relationship Management (CRM) tools that can be integrated to manage client interactions, sales, and marketing. |

Step 8: Testing and Quality Assurance

Once you create a robo advisor platform, it’s time to test it.

You see, rigorous testing is crucial to ensure the platform’s reliability and performance.

This includes functional testing of the algorithmic engine, user interface testing, security vulnerability assessments, and user acceptance testing to gather feedback from early users.

Step 9: Launch and Marketing

With all said and done, it’s time for deployment.

Develop a strategic marketing plan to launch your robo advisor platform.

This should include a mix of digital marketing, content marketing, partnerships, and public relations to build awareness and attract users.

While we might be done with robo advisor platform development, there’s work to be done.

Step 10: Continuous Monitoring and Improvement

After launch, continuously monitor the platform’s performance, user feedback, and market trends.

Use these insights to make iterative improvements, adding new features, refining investment strategies, and enhancing the user experience.

Creating a robo advisor platform is a complex but rewarding endeavor that combines financial expertise with cutting-edge technology.

A successful platform requires a deep understanding of the target market, strict adherence to regulatory standards, and a relentless focus on security, user experience, and continuous improvement.

How Much Does It Cost To Build A Robo Advisor Platform?

So, how much does it cost to make robo advisor platform? Well, robo advisor platform development cost can range from $25,000 to $250,000+.

Now, there are a lot of factors that goes into calculating the cost to build a fintech app. Here’s a breakdown:

| Cost Category | Estimated Cost Range | Details |

| 1. Market Research | $2,000 – $10,000 | Initial research to understand the market, competition, and target user needs. Includes surveys, focus groups, and industry analysis. |

| 2. UI/UX Design | $5,000 – $20,000 | Design of the user interface and user experience, including wireframes, prototypes, and final design assets. |

| 3. Backend Development | $10,000 – $100,000 | Development of server-side logic, database management, algorithmic engine, and API integrations. Cost varies by complexity and development hours. |

| 4. Frontend Development | $8,000 – $50,000 | Development of the client-side application, including web and potentially mobile apps. |

| 5. Security & Compliance | $5,000 – $25,000 | Implementation of security measures, data encryption, and compliance with financial regulations. |

| 6. Testing & Quality Assurance | $3,000 – $15,000 | Functional testing, performance testing, security testing, and user acceptance testing to ensure reliability and performance. |

| 7. Cloud Hosting & Services | $500 – $5,000/month | Ongoing costs for cloud infrastructure, depending on the scale of operations and user base. Includes servers, databases, and other cloud services. |

| 8. Third-Party Services | $1,000 – $10,000 | Costs of integrating third-party services, including market data feeds, payment processors, and other financial APIs. |

| 9. Marketing & Launch | $5,000 – $50,000 | Initial marketing efforts to promote the platform, including digital marketing, content creation, and public relations. |

| 10. Legal & Administrative | $3,000 – $20,000 | Legal fees for incorporating the business, obtaining licenses, and drafting terms of use, privacy policies, and other necessary documents. |

As of 2021, robo advisors are managing over $1 trillion in assets globally, a number expected to grow exponentially as more individuals and institutions recognize the value of data-driven, automated investment management.

How Much Money Can You Make With Robo Advisor?

One of the main goals of investing in robo advisor platform development is to make money.

But exactly how much money can you make with robo advisor platform?

Well, the revenue potential of a robo-advisor platform depends on various factors, including its pricing model, user base size, market positioning, and operational efficiencies.

Here are the key fintech business models and factors that influence the financial success of a robo advisor:

1) Asset Under Management (AUM) Fees

The most common revenue model for robo advisors is charging a percentage fee on the assets under management. The fee typically ranges from 0.15% to 0.50% annually, which is lower than traditional financial advisors who may charge upwards of 1%.

- For example, if a robo advisor manages $1 billion in assets with a 0.25% fee, the annual revenue would be $2.5 million.

2) Subscription Fees

Some robo advisors opt for a subscription model, charging users a flat monthly or annual fee regardless of their investment amount. This model may appeal to users with larger balances, as the cost may be lower than a percentage-based fee.

- Subscription fees can vary widely, from a few dollars to several hundred dollars per year, depending on the service level and features offered.

3) Freemium Models and Added Services

Offering basic services for free and charging for premium features (like tax-loss harvesting, access to financial advisors, or advanced analytics) can attract a broad user base and generate additional revenue from engaged users.

- Additional services, such as personal financial planning, educational content, or premium customer support, can also be monetized.

Factors Influencing Revenue

- Market Positioning and Target Audience

- User Acquisition and Retention

- Operational Efficiency

- Regulatory Compliance and Security

- Scalability

Develop a Robo Advisor for Your Users with Expert

At Nimble AppGenie, we understand the intricacies of developing state-of-the-art robo advisor platforms.

Being an expert fintech app development company, we combine with a deep understanding of the financial sector positions us as an ideal partner for your robo advisor project.

We are committed to leveraging the latest technologies, from AI and machine learning to blockchain, ensuring your platform is not only robust and secure but also ahead of the curve in terms of innovation and user experience.

Bottom Line

Robo advisor platform development represents a significant opportunity in the fintech space, promising to democratize financial advice and make wealth management accessible to a broader audience. From understanding the mechanics of robo advisors and the technology that powers them to recognizing their potential and the challenges they face, it’s clear that these platforms are more than just a trend—they are a pivotal part of the future of financial services.

With the right approach, technology stack, and focus on user experience, a robo advisor platform can offer a compelling value proposition to users while providing substantial ROI to its creators.

FAQs

A robo-advisory platform is a digital solution that provides automated, algorithm-driven financial planning services with minimal human supervision. It collects personal and financial data from users to offer tailored investment advice and manage portfolios, making wealth management accessible to a broader audience.

Building a robo-advisor platform involves several key steps, including:

- Conducting Market Research

- Regulatory Compliance

- Designing an Intuitive UI/UX

- Developing an Algorithmic Engine

- Selecting a Robust Technology Stack

- Integrating With Financial Services

- Implementing Security Measures

- Continuous Testing and Quality Assurance

Robo-advisers leverage various technologies, including Artificial Intelligence (AI) and Machine Learning (ML) for enhancing the algorithmic engine, Data Analytics for processing financial data, Cloud Computing for scalability and security, APIs for integration with financial services, and Blockchain and Cryptography for enhanced security measures.

The biggest downfall of robo-advisers is their limited ability to handle complex financial situations that require human judgment and empathy. While they excel in managing standardized investment portfolios, they may not fully address unique financial planning needs, emotional decision-making, or sudden market anomalies that benefit from human intuition and experience.

The Return on Investment (ROI) for a robo-advisor can vary significantly based on its pricing model, operational efficiency, user base, and market positioning. Robo-advisors typically charge a percentage of Assets Under Management (AUM) or a subscription fee, and their cost efficiency and scalability can lead to substantial ROI, especially as the platform grows.

Robo-advisors represent a significant trend in the future of wealth management, offering scalable, efficient, and personalized financial advice. Their integration of advanced technologies and ability to democratize investment services suggest a growing role in the financial landscape, complementing traditional advisory services and expanding access to financial planning.

Robo-advisors manage investments by using algorithms to allocate assets in a diversified portfolio based on the user’s risk tolerance and financial goals. They automatically rebalance portfolios and can employ strategies like tax-loss harvesting to optimize returns, relying on ETFs and other investment vehicles for broad market exposure.

While robo-advisors provide an efficient and cost-effective solution for portfolio management and basic financial planning, they currently cannot replace the nuanced understanding and personalized advice that human financial advisors offer, especially for complex situations and high-net-worth individuals.

Robo-advisers generate revenue primarily through management fees based on a percentage of AUM, subscription models offering tiered services for a fixed fee, or a combination of both. Some also offer premium services, like access to human advisors, for additional fees.

Before choosing a robo-advisor platform, consider factors like the platform’s fee structure, the range of services and features offered, the technology and algorithms used, security measures, regulatory compliance, and the level of customer support and educational resources provided.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.