Have you recently heard about the BRICS payment system?

While the BRICS payment system has made headlines recently, it has been around for some time. And it is quite a beacon of innovation in the concerned countries.

If you are curious about the recent partnership between Russia and China, leveraging the BRICS currency and financial system, this blog is for you.

Here, we shall be looking at BRICS pay news from the perspective of eWallet and digital payment businesses. Therefore, with this being said, let’s get right into it, starting with:

“Spanning 30% of the world’s land areas, the BRICS nations are a colossal market for digital payments. With BRICS Pay, this vast territory is ripe for financial innovation, offering unprecedented growth opportunities in digital finance.”

BRICS Pay – Understanding the BRICS Payment System

Let’s start with the big question, What is the BRICS payment system?

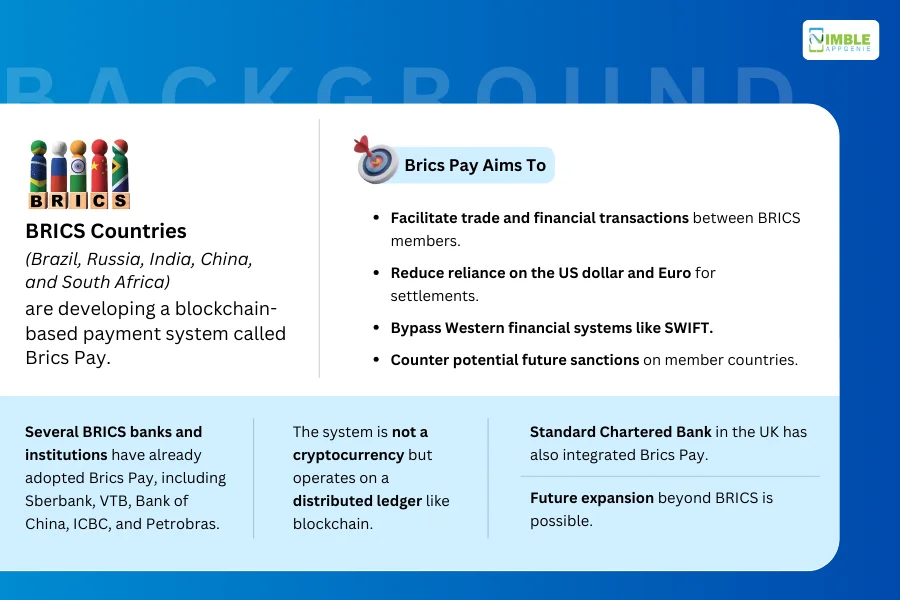

BRICS Pay is a blockchain-based payment system designed to facilitate cross-border transactions between member countries of the BRICS economic bloc (Brazil, Russia, India, China, and South Africa).

Launched in 2018 by the BRICS Business Council, it is the result of a collective vision shared by experts in payments, banking, and technology from the five member countries.

The BRICS payment app gaining popularity, being available on both Android and iOS platforms.

It aims to bypass the traditional SWIFT (Society for Worldwide Interbank Financial Telecommunication) network and enable settlements in local currencies, reducing reliance on the US dollar and Euro.

From a technical POV, this is a good example of crypto payment app development that businesses from across the world should learn from.

Features

- Cross-border transactions: Being among the top international payment apps, BRICS Pay allows businesses and individuals to send and receive payments across borders between BRICS member countries.

- Local currency settlements: BRICS Pay transactions are settled in the local currencies of the sender and receiver, eliminating the need for currency conversion and associated fees.

- Financial Messaging: An independent distributed system with asymmetric encryption, compatible with various messaging standards like SWIFT, CIPS, and SPFS.

- Message Conversion: A system to convert payment messages between different formats, enhancing interoperability.

- BRICS CBDC: Digital currency settlements between member countries, with principles for interaction, rate calculation, and clearing still in development.

Key Players

- New Development Bank (NDB): Acts as the central hub for processing financial transactions between BRICS nations.

- Member Countries’ Institutions: Banks like Sberbank, VTB, Bank of China, ICBC, and Petrobras have already integrated the BRICS Payment system, enabling their customers to make cross-border payments seamlessly.

How Does BRICS Pay Work? Technologies Behind BRICS Pay

So, how does the BRICS payment system work?

Well, there are a lot of advanced technologies that go behind making cross-process payment solutions like BRICS currency work.

Let’s see what these are:

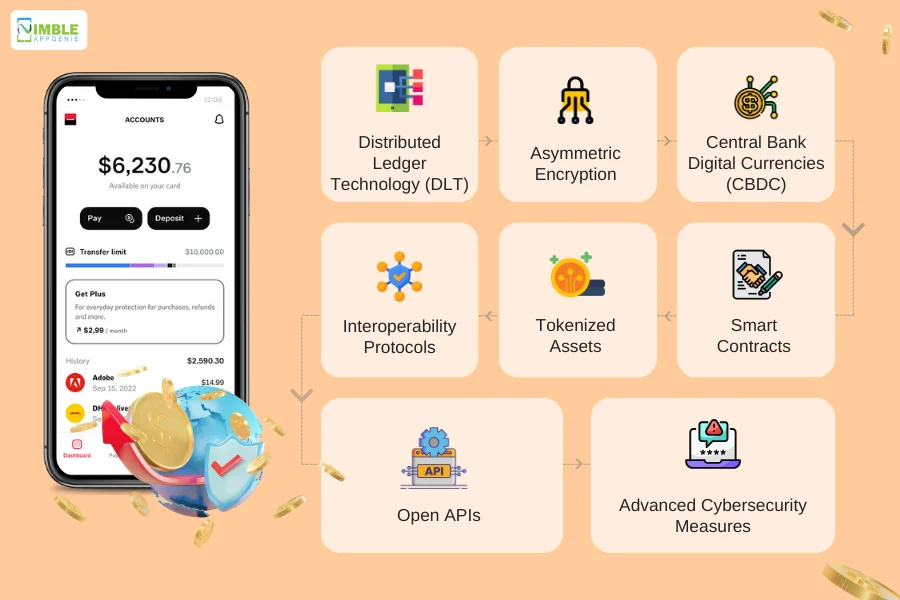

1. Distributed Ledger Technology (DLT)

At the heart of BRICS Pay is Distributed Ledger Technology, which underpins the system’s decentralized nature.

DLT allows for secure, transparent, and tamper-proof recording of transactions across multiple nodes.

Thus, enhancing the system’s resilience against fraud and cyber-attacks.

2. Asymmetric Encryption

The BRICS banking system employs asymmetric encryption to secure communications within its financial messaging system.

This type of encryption uses pairs of public and private keys to encrypt and decrypt messages.

This way, it ensures only the intended recipient can access the information, thereby safeguarding transaction data.

3. Central Bank Digital Currencies (CBDC)

The platform’s integration with Central Bank Digital Currencies (CBDCs) represents a forward-thinking approach to digital currency.

CBDCs provide a digital form of a country’s fiat currency, backed and issued by the central bank, offering a reliable and regulated digital currency option for transactions within the BRICS Pay system.

4. Smart Contracts

Smart contracts play a crucial role in automating and enforcing the terms of agreements within the BRICS Pay ecosystem.

These self-executing contracts with the terms of the agreement directly written into code facilitate trustless transactions and reduce the need for intermediaries, streamlining operations and reducing costs.

5. Tokenized Assets

Tokenization is a process by which real-world assets are converted into digital tokens on a blockchain, allowing for their easy and secure exchange within the BRICS Pay system.

This technology enables the seamless transfer of various types of assets, including securities, commodities, and real estate, in a digital format.

6. Interoperability Protocols

To ensure compatibility and seamless interaction between different financial systems and technologies, BRICS Pay utilizes interoperability protocols.

These protocols enable diverse payment systems and platforms to connect and communicate with one another, facilitating cross-border transactions and access to various financial services.

7. Open APIs

Open Application Programming Interfaces (APIs) are pivotal for BRICS Pay.

They allow third-party developers to build applications and services that can interact with the platform.

This openness fosters innovation, enabling a wide range of financial services and applications to be developed on top of the BRICS Pay infrastructure.

8. Advanced Cybersecurity Measures

Given the digital nature of BRICS Pay, advanced cybersecurity measures are integral to protecting the platform from digital threats.

These measures include multi-factor authentication, regular security audits, real-time monitoring, and the use of cutting-edge cryptographic techniques to ensure the integrity and confidentiality of transactions.

BRICS Payment System Benefits: What Does It Mean For eWallet & Digital Payment Providers

Ever considered developing an eWallet app?

Well, for all the startups considering digital payment projects or businesses already in the field, understanding the impact of the BRICS financial system is important.

In this section of the blog, we shall be discussing just that.

► Global Reach

The global eWallet market is huge

And via the new BRICS pay platform, eWallet providers can expand their services to a broader international market, catering to users in BRICS countries and potentially beyond.

By integrating with BRICS Pay, eWallets can facilitate transactions in multiple currencies, appealing to a more diverse user base.

► Financial Inclusion

Mobile payment is banking the unbanked, but the BRICKS payment system opens new doors.

The inclusive nature of BRICS Pay opens up opportunities for eWallet services to reach underbanked or unbanked populations in BRICS countries, contributing to greater financial inclusion.

► Seamless Transactions

Who doesn’t love seamless international transactions? Well, everyone does.

BRICS Pay’s emphasis on interoperability and decentralized financial flows enables eWallets to offer more seamless and efficient cross-border transactions.

This reduces the cost and complexity traditionally associated with international payments.

Also Read : UPI & PayNow Merger

► Currency Flexibility

The ability to handle transactions in various local currencies, supported by the system’s multi-currency capability, will enhance the user experience.

And making eWallets more versatile and user-friendly for international transactions.

► Integration with New Technologies

The adoption of technologies such as DLT, CBDCs, and smart contracts within BRICS Pay is a major step ahead in the fintech market.

And this encourages eWallet businesses to innovate and integrate these technologies into their offerings, staying ahead in a competitive market.

► Unique Value Propositions

By leveraging BRICS Pay’s capabilities, eWallets can develop unique value propositions.

This covers enhanced security features, lower transaction fees, or faster settlement times, distinguishing themselves from competitors.

► Navigating Regulatory Landscapes

It goes without saying that fintech regulations are super important (& strict!)

As BRICS Pay will be subject to the regulatory frameworks of its member countries, eWallet providers will need to ensure compliance with these diverse regulations.

This could involve significant legal and operational considerations.

► Robust Security Measures

When it comes to eWallet, security is important.

The advanced security protocols and encryption techniques employed by BRICS Pay set a high standard for eWallets.

This ensures the protection of user data and transaction integrity, potentially driving improvements in security measures across the board.

► Shift in Economic Power

The collective economic might of the BRICS nations, combined with a successful BRICS Pay system, could shift the balance of power in the global financial system.

Thus, impacting the strategic decisions of eWallet and digital payment providers worldwide.

In fact, this is one of the main goals of the BRICS payment system as a whole, gaining intemperance from SWIFT.

► Geopolitical Implications

The geopolitical dynamics of the BRICS countries and their relationships with other nations may influence the adoption and usage of BRICS Pay-integrated eWallet services.

All in all, affecting market strategies and operations.

Future of BRICS Pay

The fintech market is unpredictable!

So, what does it hold for BRICS pay? Well, the future of the BRICS payment system is amazing, here’s what we can expect.

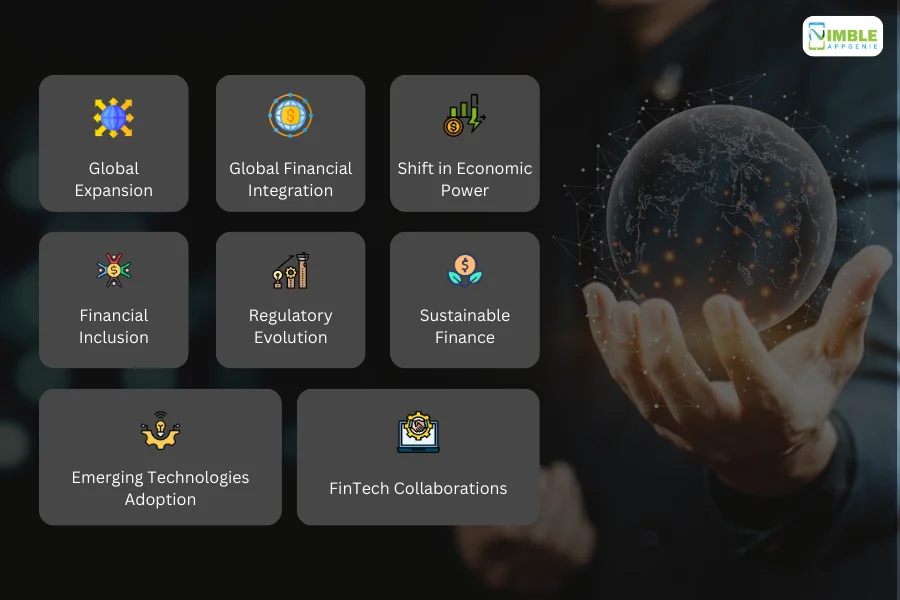

- Global Expansion – BRICS Pay could extend its services beyond the BRICS nations, enhancing economic collaboration globally, especially with developing countries.

- Global Financial Integration – The platform may increasingly integrate with existing financial systems, creating seamless transaction experiences worldwide.

- Emerging Technologies Adoption – Future advancements may involve leveraging new technologies like AI and quantum computing to improve efficiency and security.

- Shift in Economic Power – As BRICS Pay grows, it could challenge the dominance of Western financial systems, contributing to a more balanced global economic landscape.

- Financial Inclusion – BRICS Pay has the potential to significantly enhance financial inclusion, bringing unbanked populations into the formal economy.

- Regulatory Evolution – The platform’s expansion will likely drive the development of new regulatory frameworks to accommodate digital currencies and cross-border transactions.

- Sustainable Finance – BRICS Pay could focus on promoting transactions that support social and environmental sustainability, aligning with global development goals.

- FinTech Collaborations – Collaborations with FinTech innovators could introduce new features and services, accelerating BRICS Pay’s growth and utility.

How Nimble AppGenie Can Help You Prepare?

Finding it hard to navigate the ever-so-sophisticated fintech world?

Whether you are planning to develop a fintech app for international payment using the B.R.I.C.S. financial system or make your current eWallet compatible, we are here to help you.

Nimble AppGenie is a market-leading eWallet app development company with hands-on experience working on some of the largest payment and fintech apps.

- Pay By Check– Ewallet Mobile App

- DafriBank– Digital Bank Of Africa

- SatPay– Ewallet Platform

- CUT–E-Wallet Mobile App

- SatBorsa– A Currency Exchange Fintech App

We are just a click away! Contact us today and achieve that fintech brilliance in no time.

Conclusion

BRICS Pay represents a transformative leap towards redefining global financial transactions, promising enhanced inclusivity, efficiency, and security. As it evolves, its potential to reshape economic dynamics and foster greater financial inclusion on a global scale positions the BRICS Payment system as a pivotal player in the future of digital finance.Top of Form

FAQs

BRICS Pay is a digital payment platform developed by the BRICS nations (Brazil, Russia, India, China, and South Africa) to facilitate secure and efficient cross-border transactions between member countries, using local currencies and reducing reliance on traditional systems like SWIFT.

BRICS Pay utilizes Distributed Ledger Technology (DLT) for secure and transparent transactions, supports multiple currencies, and integrates advanced technologies such as CBDCs, smart contracts, and open APIs to ensure interoperability and accessibility across different financial systems.

BRICS Pay is designed for both businesses and individuals in the BRICS nations looking to conduct cross-border transactions efficiently in their local currencies. Financial institutions within these countries are key players in integrating and facilitating the BRICS Pay system.

Key features include cross-border transactions in local currencies, decentralized financial messaging with asymmetric encryption, message conversion for interoperability, digital currency settlements (BRICS CBDC), and advanced cybersecurity measures.

BRICS Pay employs asymmetric encryption for secure communication, advanced cybersecurity measures including multi-factor authentication and real-time monitoring, and leverages the inherent security features of Distributed Ledger Technology.

Yes, BRICS Pay is designed to be interoperable with existing financial infrastructure, allowing eWallets and digital payment providers to integrate with the system through open APIs, enhancing their offerings with BRICS Pay’s cross-border transaction capabilities.

BRICS Pay offers global reach, financial inclusion, seamless transactions, currency flexibility, integration with new technologies, unique value propositions, and robust security measures, providing competitive advantages for eWallet and digital payment providers.

Yes, BRICS Pay operates within the regulatory frameworks of its member countries, and users and providers must ensure compliance with these diverse regulations, which can involve navigating a complex legal and operational landscape.

Interested parties can begin by contacting their local financial institutions or the BRICS Business Council to understand how they can integrate or access BRICS Pay services, depending on the availability and rollout in their specific country.

BRICS Pay aims to expand its services beyond the BRICS nations, potentially offering a viable alternative to traditional international payment systems on a global scale, promoting financial inclusion and efficiency in cross-border transactions.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.