“How To Create A Money Transfer App?” This has become quite a common question with the rise of remittance solutions in today’s time.

The old boring days were gone when you had to stand in a long queue to transfer money. We all crave convenience; this is the main reason for the popularity of the money transfer app.

Today, digital transactions have become the norm, and the demand for money transfer apps has been on the rise. With the increasing popularity of online payments, the need for secure and reliable money transfer apps has become more significant than ever.

“The fintech industry is a force to be reckoned with, and it’s transforming the way we do business.” – Forbes

According to the report the global fintech market is projected to reach $26.5 trillion by 2022 and is expected to grow at a CAGR of 23.58% from 2021 to 2025.

Also, if you are looking to get into the bumming industry of ewallet app development, you are at the right place. In this blog, we shall be discussing we will discuss topics such as:

- Why create a money transfer app: Market statistics

- What is a money transfer app?

- Features to include in money

- Creating a money transfer app: Step-by-step guide

- How much does it cost to create a money transfer app?

So without wasting further time, turn your money transfer app development dream into reality!

Remittance App Market Statistics

The global online money transfer market is expected to grow significantly in the coming years.

Here are some fintech statistics related to why creating a money transfer app could be a lucrative business opportunity:

- According to Statista, the total transaction value in the digital payments segment is projected to reach US$2,041bn in 2023.

- It is expected to show an annual growth rate of CAGR of 14.66% in 2023-2027

- Plus, it is projected to total amount of US$3,528bn by 2027

- The market’s largest segment is digital commerce with a projected total transaction value of US$1,362 bn in 2023.

Moving on, let’s move to the next section for an overview.

What is a Money Transfer App? Remittance Solutions

To build a successful money transfer app, one must first understand it.

Money transfer or Remittance apps are mobile applications that allow individuals or businesses to send and receive money electronically through their smart devices.

These apps not only provide a convenient & fast way to transfer money without the need for physical cash or checks.

Moreover, the transfer apps work by linking users’ bank accounts, credit cards, debit cards, or digital wallets to their mobile devices.

Users can then initiate a transfer by entering the recipient’s information. Plus, the amount they want to send and the money transferred within a few hours.

Apps like PayPal are popular examples of money transfer platforms that we use in our day-to-day lives.

These apps typically charge a fee for their services, which may be based on the amount of money being transferred.

However, some apps offer free transfers for certain transactions or under certain conditions. Also, some of them charge a small fee for each transaction.

Money Transfer Apps vs eWallet Apps

Remittance app development is often confused with eWallet app development.

Despite various similarities between these two platforms, they aren’t the same. So, before we create a remittance app, let’s first discuss the money transfer app vs the eWallet app:

| Features | Money Transfer Apps | eWallet Apps |

| Primary purpose | Transfer money between individuals or businesses | Store funds and make payments |

| Key features | Money transfers, split bills, international transfers | Digital wallet, payments, bill payments, top-up/reload, rewards/promotions |

| Focus | Transferring funds | Broader functionalities beyond transfers |

| In-store payments | Limited | Wider range through QR codes, NFC, etc. |

| Examples | Wise, Xoom, Remitly, PayPal (for transfers), MoneyGram, Western Union | Google Pay, Apple Pay, Samsung Pay, Amazon Pay, Paytm, PhonePe, MobiKwik |

| Best for | Frequent money transfers | Daily payments and in-store transactions |

With this out of the way, let’s move to the next section of the blog, we shall be discussing how money transfer apps work.

How Does the Money Transfer App Work?

So, how do remittance apps work?

Being a popular type of fintech platform, money transfer applications are very easy to use. We shall be discussing just that in this section of the blog.

The steps are, as mentioned below:

- Account Setup

- Verification

- Add Recipient

- Amount and Currency Selection

- Funding Source Selection

- Transaction Confirmation

- Authorization

- Transfer Execution

- Successful Transaction Notification

That’s how money transfer platforms work.

With this out of the way, let’s look at the different types of remittance platforms in the next section of the blog.

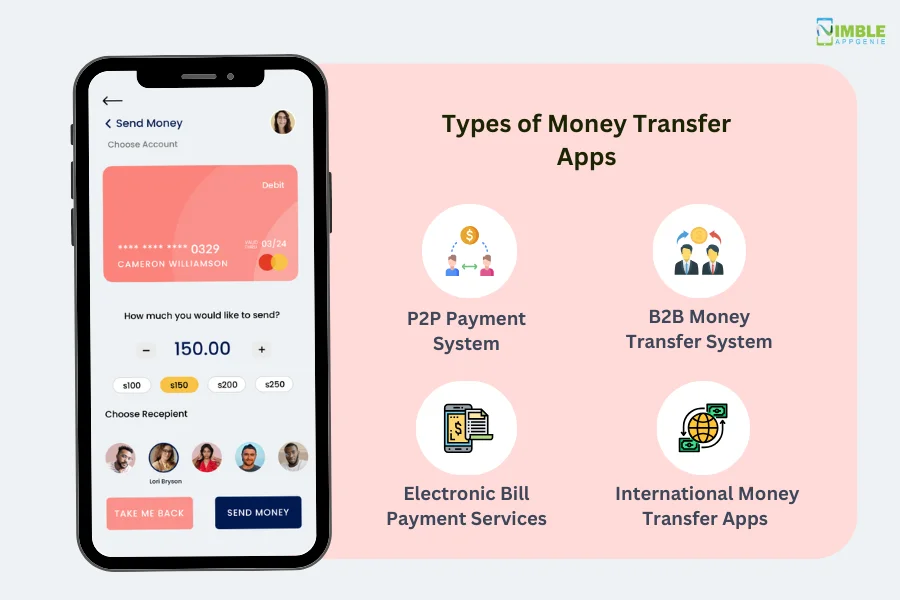

Types of Money Transfer App Development

There are two major categories of remittance platforms that fall in:

- Internal Remittance: this refers to the solution that provides money transfer services within the nation.

- External Remittance: as opposed to internal or external remittance enables

Before you invest in a money transfer app, it is essential to know the types of money transfer apps so that you can easily pitch your idea through MVP app development.

Here are some of the most common types:

1. Person-to-Person (P2P) Payment Apps

A popular form of money transfer app development is P2P payment applications.

As the name suggests, these platforms enable easy bank transfers between two individuals. In other words, they allow users to send money to friends, family, and other general purposes.

This is one of the most common types of money transfer apps, with thousands of businesses that want to create a peer-to-peer money transfer app.

2. Business-to-Business (B2B) Money Transfer System

On the flip side of P2P, we have business-to-business money transfer systems.

As the name suggests, these platforms let businesses transfer huge amounts of money between themselves effortlessly.

While there are not a lot of investors who want to build a remittance app of this sort, it is growing in popularity.

3. Electronic Bill Payment Platforms

Online bill payment has grown in popularity in recent times.

This is a functionality that has been integrated into some of the top fintech apps. However, this is also a common type of money transfer app.

Being niche-specific, the platform is entirely focused on helping users transfer money for their bills effortlessly.

4. International Money Transfer Apps

Lastly, we have the latest addition to the remittance app line we have, international money transfer apps.

It goes without saying that making cross-border money transfers isn’t easy to accomplish. That’s why cross-border money transfer apps like Wise, which have achieved these feats, have become so popular in the market.

Now that you know the types of money transfer apps, you can simply create a money transfer app with the help of expert developers. If you want your money transfer app to be successful you have to include the necessary features to it.

Benefits of Developing Money Transfer App

Why should you develop and create a mobile money transfer app?

There are a lot of questions that come to mind before going for a development project. After all, mobile app development cost isn’t low.

However, when it comes to remittance solutions, there are a lot of reasons to invest in mobile app development.

In this section, we shall be going through exactly these:

1. Lower Fees

If you are familiar with the fintech landscape, you know that money transfer apps aren’t the first remittance solutions in the market.

There are others like mobile banking apps, as the banks themselves also provide these services. The reason you should create a money transfer solution and not a mobile banking application is lower fees.

Banks are notorious for charging high fees and offering slow payment processing when it comes to internal as well as external remittances.

This is one of the big reasons why people love it, and why you should go for it.

2. Available 24/7

Whether you talk about the United States of America or places like the UAE, all of them have several companies that let people send money back home physically.

However, when it comes to availability, ease of use, and convenience, there’s no match for digital money transfer software.

3. Transaction Speed

Building a money transfer app solves one of the most basic eWallet app challenges, which is also seen in mobile banking apps, as well as traditional money transfer solutions, and speed of transaction.

Being a niche-specific, super dedicated app with the sole goal of enabling money transfer from one party to another, money transfer platforms offer superior speed.

4. Record Keeping

It goes without saying when it comes to mobile apps; they are excellent at record keeping.

With the money transfer app, you will have an extensive record of when the payment was sent, which account was used, the charges involved, who it was sent to, and so on.

5. Integration With Other Services

To make money transfer apps that much more capable, application integration has been started.

Meaning you can use these apps to pay for your groceries, taxi rides, eCommerce shopping, and other day-to-day uses.

6. Everything is Moving Online

In recent times with the development of digital infrastructure across the globe, everything is moving online.

Whether you talk about supply chains or local stores, digitalization has taken over.

To get the most out of it and be part of the new solution, it’s important to create a digital money transfer app that can accommodate end-users day-to-day needs.

These are some of the reasons why people love money transfer apps and why you should create one. Moving on, let’s look at features to include in your own project.

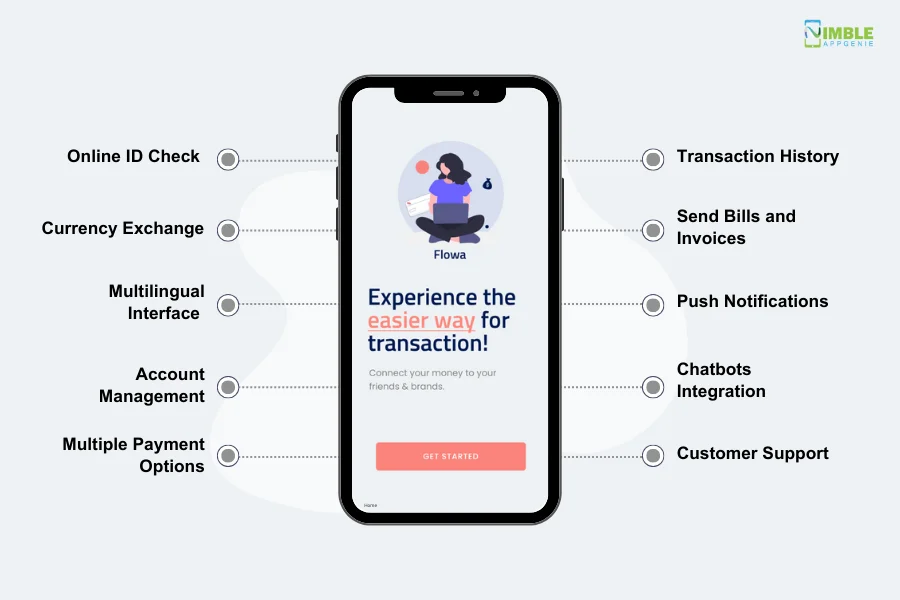

Features To Include In The Money Transfer App

Money transfer app development is not a complex task when you have a team of expert developers. The app features are solely responsible for the app’s success.

Moreover, they help increase client retention rates so including only essential features is equally important in beating the competitors.

There are several features that you may want to include in a money transfer app depending on your target audience and the goals of your app.

Here are some common features that you may want to consider:

1. Online ID Check

Also often referred to as KYC, online ID verification is an important feature that lets the platform confirm identification before enabling money transfer capacities.

2. Currency Exchange

With globalization, currency exchange has become a must-have feature to include when you build a money transfer platform.

3. Multilingual Interface

Another big feature that is a result of globalization as well as localization is a multilingual interface in money transfer applications.

4. Account Management

As the name suggests, account management is a feature that enables the user to manage different accounts added to the platform.

5. Push Notifications

Push notification is a must for app success, while you develop a money transfer app, make sure to integrate this feature.

6. Multiple Payment Options

While starting the money transfer app development, the app should offer multiple payment gateway options such as credit cards, bank accounts, and online payment platforms.

7. Transaction History

Most money transfer software should keep a record of all the transactions so that users can track their payment history.

8. Send Bills and Invoices

Most users may use P2P money transfers to generate invoices. This feature can engage business representatives for your innovative solution.

9. Chatbots Integration

With chatbots being preferred over human help desks and becoming a trend, chatbot integration in fintech apps has become an essential feature.

10. Customer Support

The app should provide customer support services to help users with any issues they may encounter while using the app.

These are some of the basic apps that you should keep in mind when developing a money transfer app. With this out of the way, it’s time to look at things to consider before developing a money transfer app.

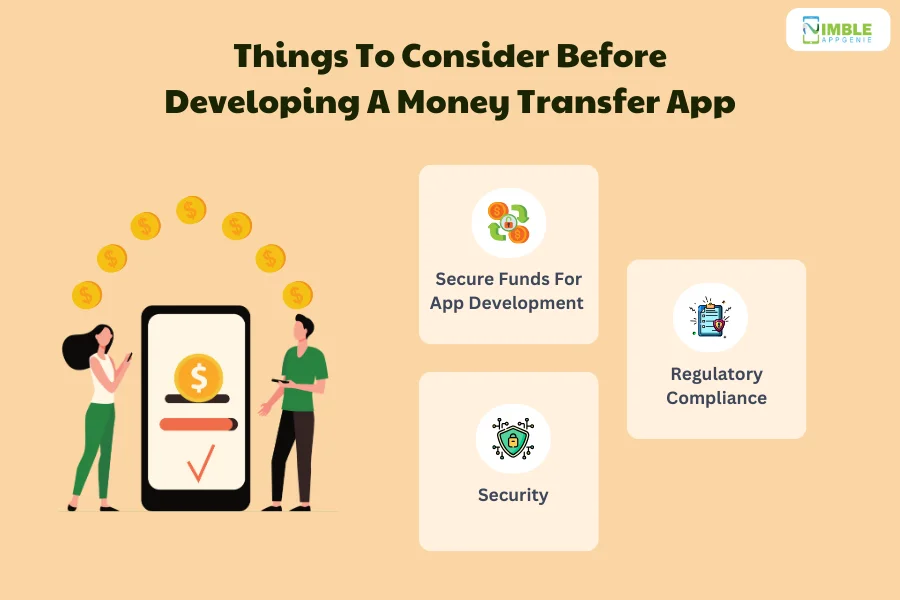

Things to Consider Before Developing a Money Transfer App

To provide a complete guide to money transfer app development, we can’t miss this point,

Mobile app development is quite a complex process on its own, however, when you speak of fintech app development, it becomes 10x more complex.

Being one of the most regulated and strict industries, there are some things that you have to keep in mind when developing a money transfer app.

Take a look at them below:

1. Regulatory Compliance

When it comes to developing a fintech app like a remittance solution, there are a lot of things to keep in mind.

Let’s look at a few of these:

Know your Customer (KYC) procedures- Customer due diligence (CDD)- Transaction monitoring- Suspicious activity reporting (SAR)- User onboarding and verification- Transaction limits and monitoring- Risk-based approach- Identity verification using official documents- Source of funds verification- Transaction screening against sanctions list- Reporting suspicious transactions to financial authorities.

| Regulatory Focus | Key Requirements | Impact on App | Examples of Compliance Measures |

| Anti-Money Laundering (AML) & Combating the Financing of Terrorism (CFT) |

|

|

|

| Data Privacy & Security |

|

|

|

| Financial Regulations |

|

|

|

| Consumer Protection |

|

|

|

2. Security

Living in the age of technology where everything is connected to a huge web, mobile app security takes an important stance.

The importance increases by 10 times when you want to create a custom money transfer app. This is the reason why, “how to create a money transfer app ” is often followed by “how to secure the app”

Well, there are various technologies that you can use here. A few of these are:

- Biometric authentication

- End-to-end encryption

- Securing communication for open banking APIs

- Tokenization

- Blockchain integration

- Dual step verification

3. Secure Funds for App Development

As every entrepreneur knows, one of the leading questions that comes to one’s mind when fondling over a potential business venture is “How to secure funding for a mobile app?”

And this is something that you need to deal with before you get down to P2P money transfer app development.

Speaking of app development, let’s move to the next section of the blog, where we shall be discussing how to create a remittance app.

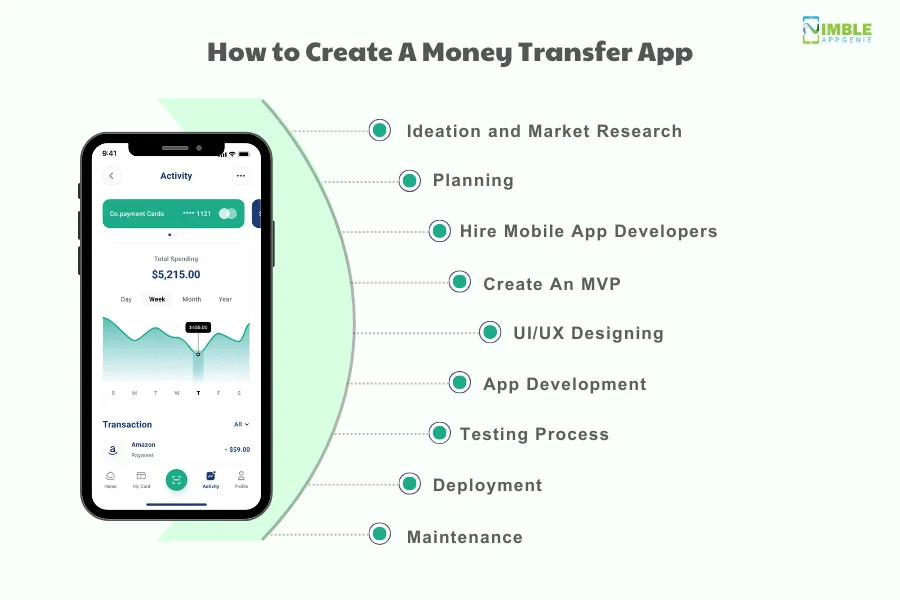

How to Create a Money Transfer App: Step-by-Step Guide

It’s time to answer the most important question of all, how to create a money transfer app?

App development process isn’t exactly rocket science, but it is not that simple either.

Therefore, to guide you through the process to create a money transfer app, we shall be going through each and every step.

Therefore, with this being said, let’s get right into it, starting with:

Step 1. Ideation and Market Research

Let’s start with a fintech idea.

For instance, an international money transfer app that lets users send money free of cost, with an element of gamification.

Now that you have an idea, it’s time to get down to mobile app market research.

This is where you take the competitor analysis, find the target audience base, get to know the market, and other things like that.

And once all of that is done, we move to the next step…

Step 2. Partner With an App Development Company

Now that you have a vision and information to back it, it’s time to find an app developer.

There are various ways you can find a development partner; here are a few of those:

- Assemble in-house team

- Outsource to development company

- IT staff augmentation to strengthen the existing team

These are some of the best ways to choose one of the top fintech app development companies for your next project, i.e. money transfer app development.

Step 3. Planning

With information and an idea at hand, it’s time to start planning.

There are a few things that we need to take care of here, starting with:

Choose an App Development Platform

The first thing you need to choose is the app development platform. Here, you can either go for native app development or hybrid app development.

Hybrid app development can be made possible with various technologies, cost is also low, however, there are some downsides as well.

On the other hand, native app development gives you two options.

Being a native, both of these platforms offer amazing performance, unmatched customization, and robust feature sets.

Moving on, once you have selected a platform, it’s time to choose a tech stack.

Build a Tech Stack

What is a tech stack? The term mobile app tech stack refers to the set of technologies used to create a custom money transfer app.

Common tech stack options for the same are as mentioned below:

| Components | Options |

|---|---|

| Frontend |

|

| Backend |

|

| Database |

|

| APIs & SDKs |

|

| Security & Compliance |

|

| DevOps & Testing |

|

Create a Development Road Map

With all technologies selected and finalized, it’s time to create a roadmap for money transfer app development.

This is where you need to sit down with the development team to finalize dates, meeting frequency, KPIs, and more.

Once this is done, we will move on to the next step.

Step 4. Create an MVP (Optional)

This is an optional step.

If you are low on budget or want to cross-check the viability of the idea first, it’s good to go for MVP Development.

This is a barebones version of the application which can be launched for user feedback as well as stakeholder feedback. It is also a good tool for raising funds.

Step 5. UI/UX Designing

It’s time to get into development, but first, let’s make a design.

The UI/UX designing process is one of the most important parts, as a first impression even in the digital world, matters a lot.

Collaborate with app designers to create a design that’s aesthetically pleasing and easy to navigate.

Step 6. App Development

It’s time for fintech app developers to create the digital money transfer app’s final version.

Being the most resource, cost, and time-intensive part of the “how to build a money transfer app” process, it’s highly recommended that you maintain good communication with the development side.

Once the app is developed, it will be sent for testing.

Step 7. Testing Process

While mobile app testing continues for the entire duration of remittance app development, there’s a final QA round before deployment.

Here, it is checked for errors, bugs, and whether or not it matches user preferences. If there is any issue, it is dealt with and then it is sent for deployment.

Step 8. Deployment

Mobile app deployment isn’t exactly rocket science.

However, you should know that these are two different things to launch an iOS app on the App Store and Deploy an Android app in Play Store.

In any case, after submission, it takes 2 weeks to get approval (or rejection).

Speaking of rejection, there are various reasons why apps are rejected by Apple and it happens more often as well. The Google Play Store has more relaxed policies.

Step 9. Maintenance

Following the deployment, it’s time to start mobile app maintenance and support services.

These are essential services that make sure the app is up and running for the duration of its lifetime.

So, this is how to develop a money transfer app, and it’s time to move to the next section, where we shall be discussing the trends.

Money Transfer App Development Trends

With “how to make a money transfer app” out of the way, it’s time to discuss how to make your app successful among people.

The simple answer is, by including trends.

Therefore, in this section of the Step-by-Step Guide on Building Money Transfer apps, we shall be looking at money transfer app trends.

1. Contactless Payments

Much like eWallet app trends, money transfer apps are also moving towards contactless payment technologies.

This trend is being driven by top technologies like QR codes and NFC payments.

2. Payments in Messengers

Recently in the top chatting apps, we have seen money transfer integration.

Meaning, you can send money within the conversation, without leaving the screen. And people love it. Make it a must-have trend when you make a remittance app.

3. International Payments

We have already discussed it before, but with the rise of globalization, there are more people living internationally.

This is why top platforms like going for collaboration. A popular example is the UPI and PayNow merger to enable international payment possible.

So this is something you should go for.

4. Cash Advance Integration

With the rise in popularity of cash advance apps, people are going crazy over this offering. Therefore, it’s a good idea to integrate cash advance soft loans into your money transfer platform.

In fact, it can help you generate millions in revenue if done right.

5. Payments Via Smart Speakers

With voice commands and smart home systems becoming a trend, it was only about time before we got this trend.

Using IoT technology, money transfer apps are making payments possible via smart speakers for a better user experience.

These are some of the top trends. And with this out of the way, let’s look at the cost.

How Much Does it Cost to Create a Money Transfer App?

What are the app development cost related to the money transfer app?

The cost to create a money transfer app will be around $25,000 to $80,000 or more depending on the features of the app.

An MVP is less costly compared to a full-functionality app. On the other hand, a unique app with extensive design and advanced feature set is way higher than the average.

Therefore, if you want to learn the accurate cost of app development, it is recommended to consult a Mobile app Development Company.

To give you a better insight into the money transfer app development cost, let’s look at the major factors.

Factor 1. Complexity

The more features you include, the more complex your app will become and take more time to develop.

| Complexity Level | Estimated Development Cost |

| Basic App | $25,000 – $40,000 |

| Medium App | $40,000 – $60,000 |

| High App | $60,000 – $80,000 |

If you want your app to build within budget make sure to include essential features so that it comes under fintech app development cost and is developed timely.

Factor 2. Developer location

One of the major factors is the developer’s location. Location highly affects the cost of hiring mobile app developers.

| Location | Hourly Rate Range (USD) |

| United States (Tier 1 Cities) | $80 – $250 |

| United States (Tier 2 Cities) | $50 – $150 |

| Eastern Europe | $40 – $100 |

| South America | $30 – $70 |

| South Asia (e.g., India) | $20 – $50 |

| Southeast Asia (e.g., Philippines) | $25 – $60 |

| Africa | $20 – $40 |

In addition to this, cost to hire Android app developers is very different from the cost to hire iOS app developers or hybrid app developers.

Factor 3. Tools and Technologies

Software Development Tools and technologies are other factors that add to the cost of building a money transfer app.

| Technology/Tool | Impact on Cost | Cost Range ($25,000 – $80,000) |

| Cross-platform development tools (e.g., React Native, Flutter): | Faster development, reduced codebase maintenance | Can reduce development time by 30-50%, potentially saving $7,500 – $40,000 |

| Pre-built APIs and SDKs: | Faster integration with third-party services reduced development time | Can save $5,000 – $20,000 depending on API complexity |

| Cloud-based infrastructure: | Scalable, flexible, and cost-effective | Can reduce upfront server costs, but ongoing cloud service fees can add $10,000 – $20,000 per year |

| Open-source libraries and frameworks: | Reduced development time, free to use | Can save $5,000 – $15,000 depending on usage |

| Machine learning and AI features: | Enhanced security, personalized experiences, but require specialized expertise | Can significantly increase development cost by $20,000 – $50,000 |

| Blockchain integration: | Secure and transparent transactions, but complex and expensive to implement | Can add $30,000 – $80,000 to development costs |

| Advanced security and compliance tools: | Enhanced data protection and regulatory compliance, but requires additional investment | Can add $10,000 – $30,000 to development costs |

The latest tools and technologies are expensive compared to the traditional ones. And using the latest tools are necessary to build advanced feature app.

Overall, the money transfer app development will cost up to a minimum of $25,000 up to $100,000 or more depending on the complexity of your apps. Plus, the services you want to give to your audience.

How Nimble AppGenie Can Help You Create a Money Transfer App?

Do you want to develop a money transfer app?

Nimble AppGenie is a renowned fintech app development company with hands-on experience in developing top fintech apps.

We have worked on money transfer apps like Pay-By-Check, and SatPay.

With over 700 projects and 95% customer satisfaction, we have earned places on top platforms like DesignRush, Clutch.co, TopDevelopers, GoodFirms, and many more.

If you want to bring your idea to reality, Nimble AppGenie is here to help you.

Conclusion

With the technological gradation, we are moving fast toward a cashless society. There are several best money transfer apps available in the market. If you want to be successful in the competitive market, find a reliable partner for you.

It can easily understand the demands and needs of your users and provide them with the best services available in the market. If you want to discuss the money transfer app, feel free to contact us.

FAQs

A money transfer app is a software application that allows users to transfer money electronically between bank accounts, credit/debit cards, and digital wallets using a mobile device or computer.

P2P (peer-to-peer) payment is a type of money transfer that enables individuals to send and receive money directly from one another without the need for an intermediary, such as a bank.

The time required to develop a money transfer app depends on several factors such as:

- Complexity of the features

- Development platform

- Testing requirements

Generally, it can take anywhere from a few weeks to several months.

The cost of developing a money transfer app varies depending on factors such as the features, technology stack, and development team’s hourly rate. On average, the cost can range from $25,000 to $100,000 or more for a high-end app.

There are various monetization strategies that money transfer apps can use:

- Freemium model

- Per transfer commission

- Advertisement

The working process of money transfer apps is, as mentioned below:

- Account Setup

- Verification

- Add Recipient

- Amount and Currency Selection

- Funding Source Selection

- Transaction Confirmation

- Authorization

- Transfer Execution

- Successful Transaction Notification

Some of the essential feature that every money transfer should have, are:

- Online ID check

- Currency exchange

- Account management

- Push notifications

- Transaction history

There are various technologies which can be used to ensure security in money transfer applications.

- Biometric authentication

- End-to-end encryption

- Tokenization

- Blockchain integration

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.