Have you ever heard of NFC mobile payment?

You must have and that’s probably what has led you to this blog. But you aren’t the only one.

With the rise of fintech and mobile payment apps, people across the world are at peace with leaving their wallets at home and relying on their smartphones completely.

Now, we all know how mobile payment apps work. And NFC technology is taking it a step further. In fact, the United States saw a bigger increase in NFC penetration than other countries worldwide:

The US is leading the NFC mobile payments market with 4.4 billion NFC mobile payments in 2022. And the number is expected to be 8.3 billion transactions by 2027.

Consequently, there are a lot of investors, entrepreneurs, and users who are curious about NFC mobile payments.

If you are either one of these, this blog is for you.

Here, we shall be going through all you need to know about NFC mobile payment technologies, and apps, comparison to traditional payment technologies, and how you can be the next big name in the field.

Therefore, with this being said, let’s get right into it:

Understanding NFC Technology – Heart of Contactless Payments

Let’s first understand NFC technology.

NFC stands for Near Field Communication

It is a technology that allows two devices, typically a mobile device and a point-of-sale terminal, to communicate wirelessly when they are in close proximity (usually within a few centimeters).

Now, per se, the technology isn’t strictly limited to mobile payments.

Still, NFC technology forms the foundation of contactless payments, making it possible to complete transactions by simply tapping your mobile device or contactless card on a compatible payment terminal.

Now, it might sound like magic or something super high-tech, but this concept has been around for years now and is being used in many day-to-day applications.

One of the most popular examples of the same is using Credit Cards at stores. Or a rather new concept, the business card sharing apps.

Speaking of which, let’s stick to our mobile payment niche and let’s see what NFC mobile payments stand for.

What is NFC Mobile Payment?

Now that you know what NFC technology is, understanding mobile payment using NFC is pretty easy.

Just like we discussed above, NFC technology “ in layman’s terms” allows two devices to communicate in close proximity with any physical connection.

When it comes to mobile payment technology, NFC removes the need for any QR code or physical input, allowing the user to communicate with the payment receiver or sender wirelessly.

How cool is that?

This is something that we are seeing in newer versions of eWallet and mobile payment applications.

More on that later.

Meanwhile, let’s discuss how NFC mobile payment works in the section below:

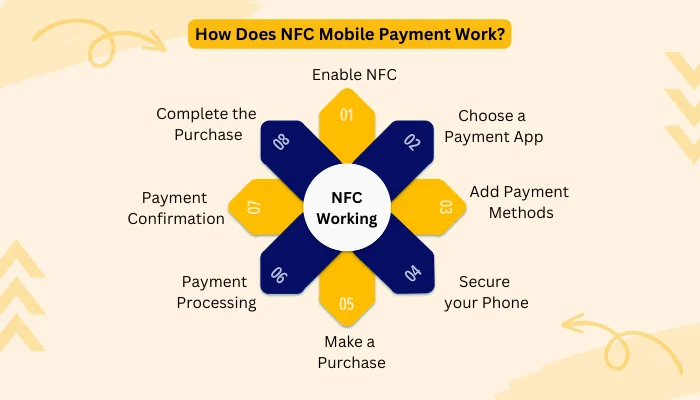

How Does NFC Mobile Payment Work?

NFC like all other fintech technologies can be pretty complex.

But in a bid to make you understand it, we have explained it in easy steps on how it works. Therefore, without wasting time, let’s get right into it:

Enable NFC

First, make sure your smartphone has NFC capability. Most modern smartphones have this feature. Then, turn on NFC in your phone’s settings.

Choose a Payment App

Download and install a mobile payment app like Apple Pay, Google Pay, Samsung Pay, or your bank’s app. These apps securely store your payment information.

Add Payment Methods

Open the app and add your payment methods, like credit cards, debit cards, or even loyalty cards. You may need to take a picture of your card or manually enter the details.

Secure Your Phone

Ensure your phone has a PIN, password, or biometric lock (like fingerprint or facial recognition) to protect your payment information.

Make a Purchase

a. Find a Compatible Terminal: Look for a payment terminal at the store that has the NFC symbol. It typically looks like a Wi-Fi signal icon.

b. Unlock Your Phone: If your phone is locked, unlock it using your PIN, password, or biometrics.

c. Hold Your Phone Near the Terminal: Hover your smartphone close to the NFC symbol on the payment terminal (usually within 1-2 inches). Your phone and the terminal communicate through NFC.

d. Confirm Payment: Follow the on-screen instructions on your phone. You may need to verify the payment with your fingerprint or PIN.

Payment Processing

The NFC technology securely sends your payment information to the terminal, and the transaction is processed almost instantly.

Payment Confirmation

Once the payment is approved, you’ll receive a confirmation on your phone and sometimes a receipt via email or in the app.

Complete the Purchase

Collect your items if you’re in a physical store, and you’re done!

NFC mobile payments are fast and secure because they use short-range wireless communication to transmit your payment details to the terminal.

Plus, they don’t share your actual card number, adding an extra layer of security to your transactions.!

Traditional Mobile Payment vs. NFC Mobile Payment

Now, it’s time to compare traditional mobile payments vs. NFC mobile payments. Let’s see which one is better and why.

Aspect | Traditional Mobile Payment | NFC Mobile Payment |

Technology | Uses SMS, USSD, or mobile app | Utilizes Near Field Communication (NFC) technology |

Hardware Requirement | Requires a basic mobile phone with SMS capabilities or a smartphone with internet access and a mobile banking app | Requires an NFC-enabled smartphone and an NFC-compatible payment terminal or device |

Authentication | Typically involves a PIN, password, or biometric verification for access to mobile banking apps | Usually requires a secure device unlock (PIN, fingerprint, face recognition) and proximity to the NFC terminal for payment |

Security | Security is primarily dependent on PIN/password and encryption for data transmission. Susceptible to phishing attacks and SIM card cloning | Generally considered more secure due to tokenization and encryption of payment data. Less susceptible to phishing attacks as it doesn’t transmit card information |

Payment Process | Involves sending payment instructions via SMS, USSD, or mobile app to the recipient or payment gateway | Requires tapping or bringing the NFC-enabled device near the payment terminal to initiate a transaction |

Transaction Speed | Slower compared to NFC payments, as it involves manual entry of payment details or SMS confirmation | Faster, as it requires only a brief physical interaction between the NFC device and the terminal |

Merchant Acceptance | Limited merchant acceptance, as not all vendors support mobile payments, especially in remote areas | Increasingly widespread acceptance at retailers, restaurants, and public transportation systems, especially in urban areas |

Contactless Payments | May or may not support contactless payments, depending on the technology used and merchant acceptance | Specifically designed for contactless payments, allowing quick and convenient transactions without physical contact |

Accessibility and Convenience | Maybe less convenient due to the need for typing and manual input of payment details | Offers greater convenience and speed, especially for small and frequent transactions |

Cost and Fees | Costs may include SMS charges (if applicable), data usage fees, and any fees imposed by the mobile payment service provider | Fees may be associated with specific NFC mobile payment services or banks, but they are often minimal |

Supported Payment Methods | Typically supports a range of payment methods, including bank transfers, mobile wallets, and card payments | Primarily supports card payments, but can also integrate with mobile wallets and other payment methods |

So, with that said, what are some of the reasons to go for NFC mobile payment technology? Well, there are plenty!

For instance, it’s faster, more secure, future tech, and so on. And this gives rise to another question:

Why Isn’t Everyone Using NFC Mobile Payment?

If NFC mobile payment technology is better than everything else, why isn’t everyone using it? Well, there are multiple reasons behind it.

For starters:

- Not every smartphone has NFC capabilities. This is something only seen in higher-end smartphones. However, the number of payments-enabled smartphones is expected to grow to 99% by 2027.

- Lack of infrastructure. This is one of the big reasons why NFC mobile payment technologies aren’t being used across the world is the lack of Infrastructure to accommodate it.

- Not Enough NFC Mobile Payments Apps. Another big issue that is hampering the NFC mobile payment growth is the lack of good enough mobile apps. Though some apps offer the services their offering are limited to an area.

These are some of the top reasons why not everyone is using or can’t use NFC mobile payment technology.

Developing a Custom NFC Mobile Payment App

Now that we have quenched the curiosity of users, let’s focus on the investors and payment companies.

If you are interested in developing an NFC-enabled eWallet app, we will answer your every question and more.

Is It Worth It?

The first question any investor would is, is it worth it? Well, it sure is.

Let’s see:

For starters, reports strongly claim that, by 2026, consumers will double their contactless spending. To be more specific, per-user contactless spending will reach $7,827 in 2026

This means the market is growing at an amazing rate.

With a popular NFC app, you can generate millions or even billions in the market. This is one of the big reasons to go for NFC enabled – Fintech App Development.

Is NFC payment secure?

Yes, NFC payments use encryption and tokenization to protect your data. They are as secure, if not more, as traditional chip card transactions.

With this Q/As out of the way, let’s look at the features that you should be including in your own NFC mobile payment app.

Features To Include in Your NFC Mobile Payment Apps

- User Registration and Authentication

- Wallet Integration

- Contactless Payments

- Transaction History

- Push Notifications

- Tokenization

- Remote device deactivation.

- Balance Management

- Rewards and Loyalty Programs

- Bill Splitting and Request Payments

- Multi-Currency Support

- Peer-to-Peer (P2P) Transfers

- Integration with Other Apps

- Customer Support

- Offline Payments

- Privacy Controls

- Location-Based Services

- In-App Wallet Top-Up

- Accessibility Features

- Language and Currency Preferences

- Compliance and Regulations

- Feedback and Ratings

- User Tutorials and Help Center

- Offline Mode

- Analytics and Reporting

- Fingerprint/Face ID Enrollment

- Cross-Platform Compatibility

- Customization Options

- Digital Receipts

- Card Management

NFC Mobile Payment App Development Process

Finally, it’s time to go down the eWallet app development process.

Let’s see how you can create your own app for NFC mobile payment. The steps are, as mentioned below:

- Ideation

- Market research

- Cross-check the idea

- Hire app developers

- Create MVP

- Design the app

- Develop the NFC mobile payment app

- Testing

- Deployment

- Maintenance

Now that we are done with this, let’s see how much does it cost to develop an app like this.

Cost To Develop NFC Mobile Payment App

The cost to develop a mobile app can range from one end of the spectrum to another, ranging from a few thousand to a hundred thousand.

The reason is that there are a range of different factors that affect the cost of building an NFC app.

Therefore, if you are looking for an accurate cost estimation, it’s highly recommended that you consult a mobile app development company that can help you with the same.

Conclusion

This is all you need to know about the NFC mobile payment technology and developing an app for NFC mobile payment. With your own NFC payment solution, you can take over the market in no time. Therefore, get down that road and build a name for your business. Dare to Be Great, We are here to help.

FAQ

NFC (Near Field Communication) mobile payments enable secure, contactless transactions using smartphones or other devices equipped with NFC technology.

NFC allows two devices, like a phone and a payment terminal, to exchange data wirelessly over short distances. To make a payment, simply tap your NFC-enabled device near the terminal.

Most modern smartphones, including iPhones and Android devices, support NFC payments. Ensure your device has NFC capability and the necessary app installed.

NFC payments are accepted at a growing number of retailers, restaurants, and public transit systems. Look for the contactless payment symbol.

Yes, you can add multiple credit or debit cards to your NFC payment app and select your preferred card when making a payment.

Transaction limits vary by the payment provider and the retailer. Some may require a PIN or fingerprint for higher-value transactions.

Immediately contact your bank or payment provider to deactivate your NFC payment app to prevent unauthorized transactions.

Typically, there are no additional fees for using NFC mobile payments. However, check with your bank or payment provider for any specific terms and conditions.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.