Traditional loans are notoriously famous for being long and tiring. But what if we told you that you can get small amounts directly credited to your bank account?

The best part is, that repayment is also easy & flexible! That’s what cash advance apps are about.

You might have already heard of cash advance apps. After all, they are making quite a trend these days.

Though many of us already use them for payday loans and early payouts, a lot of people are skeptics too.

“Are Cash Advance Apps Legit?”

“What are the Best Cash Advance Apps?”

“How Much Can I Borrow From a Cash Advance App?”

And many more.

So, if you are curious about these outrageously popular fintech apps, this blog is for you. Here, we shall be discussing all you need to know about cash advance apps.

We will also go through the most trusted and best cash advance apps in the market. And around the end, there are some cash advance app alternatives.

Understanding Cash Advance Apps

Let’s start with the basics.

What is a cash advance app?

“Cash Advance” is a form of short-term loan. Here, users can access the funds much earlier than traditional loans.

Depending on the service provider, it can be anywhere between a few minutes to a few days. Now combine this concept with fintech app development and we get cash advance apps.

These mobile applications are closely related to eWallet and loan lending apps. Cash advance apps allow users to connect with lenders or service providers and avail of soft loans in little to no time.

With modern technology, it’s also possible to repay a loan via the phone itself. The exact specifications depend on platform to platform, but this is the gist of it.

How Do Cash Advance Apps Work?

So how do these best cash advance apps work? The process is simple enough, much like any other fintech app and apps like PayPal that we use in our day-to-day lives.

In any case, the workflow of a typical cash advance app is, as mentioned below:

- Download the app

- Signup/Register

- Link to bank account or digital wallet

- Apply for a loan

- Eligibility check

- Loan offer amount

- Accept (choose the EMI plan and deposit type)

- The amount will be credited to your account

- Set auto repay or pay EMI on said dates

These are the simple steps to use top cash advance apps. With this out of the way, let’s move on to the next section where we shall be discussing the cash advance app advantages.

A Complete List of the Best Cash Advance Apps

Every niche is filled with hundreds or even thousands of apps. This creates a lot of confusion for users who are looking for a “legit” and “trusted” app. This is more true in the fintech app market than any other, because you know, it’s high time for financial scams.

So, to help you avoid all the issues and only use the best cash advance apps, we have compiled a list of 18 apps for cash advances.

Therefore, with this being said, let’s get right into it:

| Apps | Cash Advance Limit | Normal Deposit Time | Fast Deposit With Fee |

| EarnIn | $100 per day or $750 per pay period | 1-2 business days. | Few Minutes – Up to $14 per advance |

| Brigit | $20 to $250 | 1-3 business days | 20 minutes – $0.99 to $3.99. |

| MoneyLion | $500 (up to $1,000 for account holders). |

Checking account holder – 12 – 24 hours. MoneyLion Account Holder: 2 to 5 business days |

Few minutes – $0.49 to $8.99. |

| Dave | Up to $500 | 2 – 3 business days | Within an hour – $1.99 to $13.99. |

| Empower | $10 to $250. | One business day. | Within an hour, – $1 to $8. |

| Vola Finance | Up to $300 | 5 (business) hours | – |

| Albert | Up to $250 | 2–3 business days | – |

| Cleo | up to $250 | 3 – 4 business days | Few minutes – $3.99 |

| Branch | $500 | 3 business days | An hour – $2.99 to $4.99 |

| Varo Bank | $20 to $250 | 2 business days | Within a few minutes – $0 to $15 |

| Ingo Money App | $5,000 per check | 2 business days | 5 Minutes to an hour – $5.00 for 250 or less, other 2% |

| Tala | $10 to $500 | Less than 24 hours. | – |

| CashNetUSA | $500 – $1,000 loan | 1- 2 business days | – |

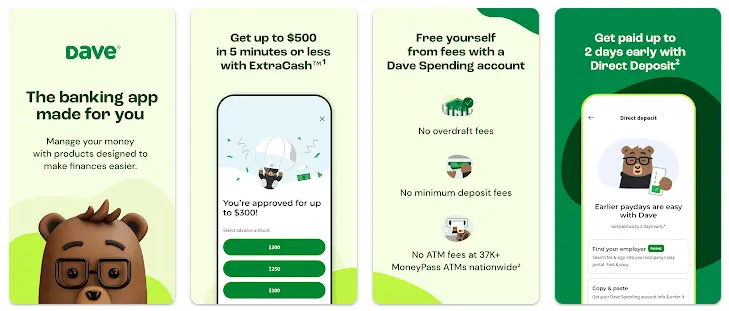

1. Dave – Fast Cash & Banking

TheDave, this is the fintech app that has helped more than 5 million users save at least $2.5B in overdraft fees, sending out 71 million cash advances.

Now, that’s a stat to look out for. As a market-leading easy cash advance app, it is known for its effective business model and high advance limit i.e. $500.

But there’s more. Apart from the cash advance itself, the platform also offers a high-yielding account that gives around 4% APY.

Moving on, the app also helps users earn extra money with side gig opportunities. Now it’s nowhere comparable to apps like ZipRecruiter, but you get the idea.

Features:

- Range of Budgeting features

- Dave spending account

- High-yield savings account

- Offers side gig opportunities to users

Pros:

- Limits up to $500

- In-app side hustle opportunities

- Offers a high-yield savings account

- No risk of overdraft

| App | Availability | Downloads | Rating |

| Dave | iOS & Android | 10M + | 4.8/5 & 5.0/5 |

| Loan Amount | Up to $500 |

| Fees | Subscription fee: $1. Instant Deposit fee: $1.99 to $13.99. Tip (optional): Up to 25% of the total amount. |

| Time to Get Funds with Fees | Within an hour |

| The Time to Get Funds without Fees | 2 to 3 business days |

| Time to Repay | Payday-to-payday |

| Repay Method | Automatic |

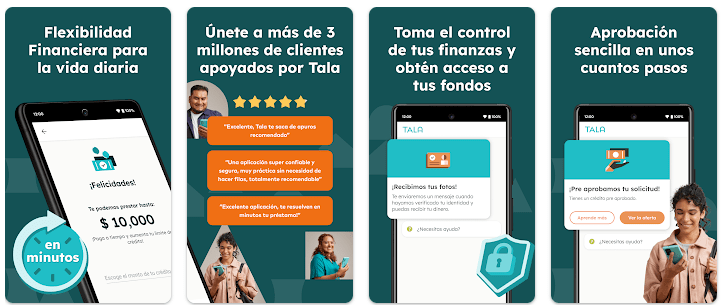

2. Tala: Borrow Cash in Minutes

Getting attention from financial institutions is really difficult when a user doesn’t have a credit history. But where there is a problem, there’s an app that solves it.

This time, it’s Tala.

As a leading platform, it offers a range of digital financial services targeted at underbanked and unbanked audience groups with the goal of helping them grow their financial stature.

The app claims to be “world’s most accessible”. In addition, it is also easy to avail loans up to $400 with an interest rate as low as 4%.

Features:

- Financial management tools

- Easy money transfer

- Instant cash advance deposit

- AI embedded tools

Pros:

- Easy-to-use app with AI integration

- Improve your user’s credit score

- All-in-one fintech solution

| App | Availability | Downloads | Rating |

| Tala | Android | 10M + | 4.8/5 |

| Loan Amounts | $10 to $500 |

| Fees | Interest fee: $4/ 5%-15% |

| Time to Get Funds | Less than 24 hours. |

| Time to Repay | up to 61 days |

| Repay Method | Debit card, credit card, in-app wallet |

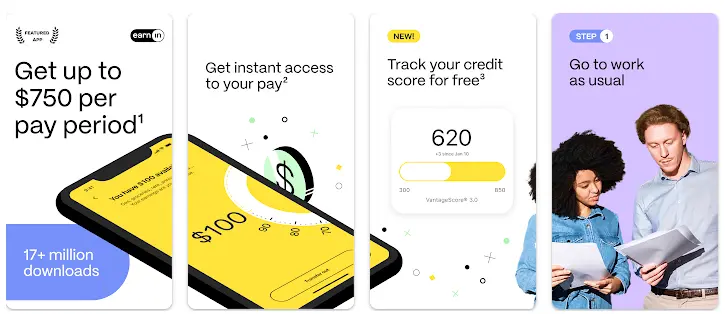

3. EarnIn: Why Wait For Payday?

The first one on our list is EarnIn.

What makes this payday loan stand out from the other online cash advance apps is that it lets you borrow up to 100$ per day.

And as it goes for cash advance loans, there are no credit checks or mandatory fees bothering you.

But that’s not all, being the top fintech app in the cash advance niche, it is not limited to money lending. Rather, the platform also offers other additional services like credit monitoring. In today’s time where a lot of people suffer from poor credit scores, this is an advantageous feature.

As the saying goes “Every day is pay day”, EarnIn offers many advantages over other platforms. Take a look at that and its other features below:

Features:

- Low bank balance alert with “Balance shield”

- Boost feature allows users to increase the limit up to $50

- Credit monitoring enables deep insight into financial profit of user

- Manage your deposit account via the app

- Get instant advance credit instantly with lighting speed

Pros:

- Avail and access cash advance as soon as the same day

- ‘Tipping’ is no mandatory like many other top cash advance apps

- Instead of creating an account on a platform like other platforms require, users can get advance in their existing account.

- Monitor your credit score for free of cost.

| App | Availability | Downloads | Rating |

| EarnIn | iOS & Android | 5M + | 4.7/5 & 4.3/5 |

| Loan Amount | $100 per day or $750 per pay period |

| Fees | Instant Credit Fee: $: $1.99 to $4.99. Tip (optional): Up to $14 per advance. |

| Time to Get Funds with Fees | A Few Minutes |

| The Time to Get Funds without Fees | 1-2 business days. |

| Time to Repay | Repayments are debited directly from your bank account |

| Repayment Method | Automatic |

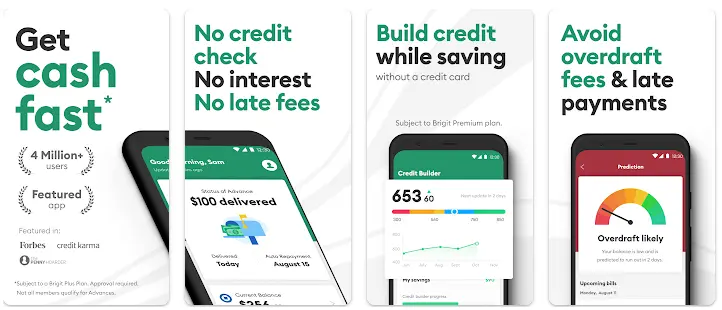

4. Brigit: Cash Advance & Credit

With more than 4 million users, Brigit is one of the top cash advance apps you can get your hands on today.

This cash advance platform offers up to $250. Now, if you want this to be credited instantly, you have to pay up to 4 dollars based on the total loan out. There’s also a subscription model for 9.99$ per month.

Speaking of which, Brigit has a lot more to offer.

It doubles as one of the best gig apps on the market where you can look for side gigs, jobs, part-time jobs, and much more. How amazing is that?

Speaking of which, let’s look at the top features and advantages offered by this cash advance app.

Features:

- Amazing feature offers credit score monitoring

- This app has an online job portal section

- Overdraft tracking to avoid paying extra

- Users can set-up real-time alerts

- Much needed savings tracking feature

Pros:

- Helps build credit score

- Super-fast loan credit

- Offers unmatched security standards

- The platform doesn’t sell information to third parties

| App | Availability | Downloads | Rating |

| Brigit | iOS & Android | 5M + | 4.8/5 & 3.0/5 |

| Loan Amount | $20 to $250 |

| Fees | Subscription fee: $9.99 per month. Instant deposit fee: $: $0.99 to $3.99. |

| Time to Get Funds with Fees | 20 minutes |

| The Time to Get Funds without Fees | 1-3 business days |

| Time to Repay | Payday to payday |

| Repayment Method | Taken from next paycheque |

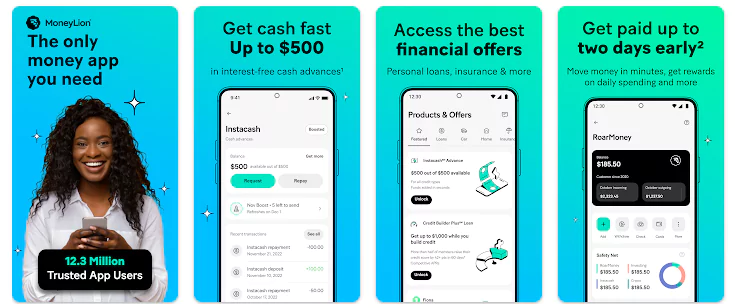

5. MoneyLion: Bank & Earn Rewards

If you are familiar with fintech apps, there is a high chance you have heard of MoneyLion.

Known as the ultimate finance app and as one of the best cash advance apps, this platform is a good example of what you can achieve with a good idea and mobile banking app development.

Though not its focus, MoneyLion does offer instant cash advance services. As such, the platform offers a range of options, with 500-dollar cash advances, which go up to 1,000 dollars for its premium members.

But that’s not all, the platform comes with much-needed educational content based around fintech and day-to-day finances. In addition to this, it offers all the features that you expect from a leading financial app.

Features:

- Open Roar Money deposit account with MoneyLion

- Let users open and manage investment account

- Also Provide Fintech Educational Content

- Personalized financial offers based on user’s activity and needs.

Pros:

- Higher borrowing limit compared to competitors

- App doesn’t bind user to repay, they can cancel at anytime.

- Platform offers 24/7 customer support

- (4.7 stars) 27,000 customer reviews tells you all you need to know about the platform

| App | Availability | Downloads | Rating |

| MoneyLion | iOS & Android | 5M + | 4.8/5 & 4.7/5 |

| Loan Amount | $500 (up to $1,000 for members) |

| Fees | Instant Deposit fee $: $0.49 to $8.99.

Tip (Optional): No maximum |

| Time to Get Funds with Fees | Few minutes |

| Time to Get Funds without Fees | Checking account holder – 12 – 24 hours.

MoneyLion Account Holder: 2 to 5 business days |

| Time to Repay | Payday-to-Payday |

| Repayment Method | Debited from account |

6. Empower: Advance & Credit

Core idea behind cash advances is financial independence, empowering people to break out of the paycheque-to-paycheque cycle.

And there are hardly a few who do it better than the “Empower”.

Though the advance limit is on the lower side at $250, there are other things to compensate for it. For instance:

- No interest

- No late fees

- No credit checks

Due to its prowess, the platform has been featured on top sites like NerdWallet, Credit Karma, Forbes, and many more.

So, how does this fintech company perform so much better than others?

Well, for starters, they follow are popular fintech business models known as freemium, where you get access to premium features following a monthly subscription.

However, if you wish to cancel the premium subscription, you have to pay 0$.

To better understand it, let’s look at its features and the advantages it offers.

Features:

- Empower users with a Credit card

- Autosave to save the day

- Powerful yet simple-to-use budgeting tools

- Smart recommendations to make it easier

- In-depth credit score monitoring

- Spending tracker for those overspenders

Pros:

- Custom repayment plans, adding flexibility

- No subscription cancelation charges

- Automation helps users save more

| App | Availability | Downloads | Rating |

| Empower | iOS & Android | 5M + | 4.8/5 & 3.0/5 |

| Loan Amount | $10 to $250. |

| Fees | Subscription fee: $8. Instant deposit fee: $1 to $8. Tip (optional): Up to 20% per advance. |

| Time to Get Funds with Fees | One business day. |

| The Time to Get Funds without Fees | Within an hour. |

| Time to Repay | Predetermined dates |

| Repayment Methods | Automatically debit from the account |

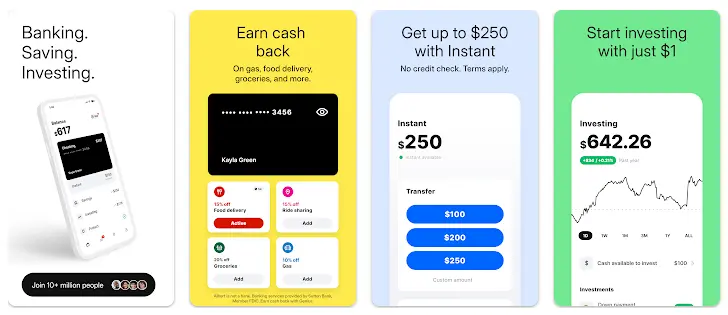

7. Albert: Budgeting and Banking

Tired of juggling between different apps to get cash advances, invest your savings, and mobile banking? Well, Albert is just the app for you.

To set the tone, in addition to offering cash advances up to the platform a card. With it, users can avail cashback on essentials like Gas, Groceries, and On-Demand Delivery Apps.

Furthermore, Albert Banking lets users consult industrial experts for the best advice. It is with these capabilities that the platform has helped its users save up to $1 Billion. Amazing, right?

Features:

- The platform offers its users a card to access the account

- Invest and save all in one app

- In-depth credit score insight

- Advanced Budgeting features

Pros:

- Ease of tracking account balance and net worth

- Fee-free cash advances

- Access to paycheque two days early

- Start investing with just 1$

| App | Availability | Downloads | Rating |

| Albert | iOS & Android | 5M + | 4.6/5 & 3.0/5 |

| Loan Amount | Up to $250 |

| Fees | Subscription Fee: $6 per month. |

| Time to Get Funds | 2–3 business days |

| Time to Repay | Next paycheck |

| Repay Method | External bank transfers/direct deposit |

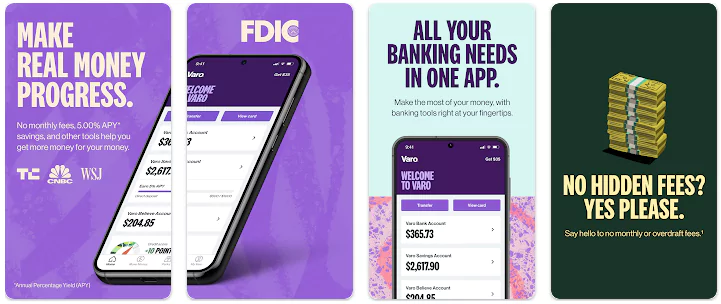

8. Varo Bank: Online Banking

Easy to use, fast working, affordable services, and no interest charged are the best characteristics of this app.

We are talking about varo money.

The cash advance platform is known for its quick services and secure solutions. If you are looking for that extra buck for the odd situation, this app is perfect for you.

To round it all up, the platform offers a free debit card and a high-yield savings account.

Features:

- Free debit card for platform users

- High-yielding saving account

- Financial insights

Pros:

- Low interest rates

- Flexible repayment dates

- Safe and secure platform

| App | Availability | Downloads | Rating |

| varo | iOS & Android | 5M + | 4.9/5 & 4.7/5 |

| Loan Amounts | $20 to $250 |

| Fees | Instant Deposit Fee:$0 to $15 |

| Time to Get Funds with Fees | Within few minutes |

| Time to Get Funds without Fees | 2 business days |

| Time to Repay | Up to 4 weeks |

| Repay Method | Automatically debited from account |

9. Cleo AI: Cash advance & Credit

If you are stressed about money, meet Cleo.

It’s one of the best apps for cash advances for a reason. For starters, the platform combines fintech and AI into one, giving you powerful educational and financial tools.

This not only makes using the platform that much easier but also makes it super effective.

Cleo helps you with everything from building a good credit score to escaping the bottomless pit of overdraft fees.

Not to mention, the platform also offers a card.

Features:

- Innovative Features To Create Budgets

- App Helps Users Automate Spending Tracking

- With powerful-feature, user can maximize on saving

- AI-powered savings advice and recommendations

Pros:

- Everything is easier with AI powered tools

- More suitable for people who want to grow faster

- A real (human) expert helps users get familiar with fintech scenario

| App | Availability | Downloads | Rating |

| Cleo | iOS & Android | 1M + | 4.6/5 & 4.0/5 |

| Loan Amounts | up to a $250 |

| Fees | Fee per advance: $4 Instant Deposit Fee: $3.99 |

| Time to Get Funds with Fees | Few minutes |

| The Time to Get Funds without Fees | 3 – 4 business days |

| Time to Repay | 3 – 28 business days |

| Repay Method | Automatically debited from account |

10. Branch: A Better Payday

If you want to get paid before payday, Branch is for you.

But it’s not like any other app for cash advances we have discussed on the list so far. Here’s how:

The branch app is not something you can just download and use. Rather, this is a platform that is availed to employees by their employees. It was developed to give workers a fast and flexible way of getting access to their earnings early.

Now, this model might filter out a lot of you, but those who can use this app, absolutely love it. Reason being that, there is a lot less headache to deal with, like signing up, KYC, and so on, with more or less the same benefits as the others on the list.

Moving on, let’s look at some top features of this platform.

Moving on, let’s look at some top features of this platform.

Features:

- Linked directly to salary account

- Insight on spending

- Easy to use app interface

- W-2 Pay Options

Pros:

- No interest or membership fees are charged.

- Same-day funding available for $2.99 to $4.99

- Withdraw up to $500 per pay period

- Option to send cash advances to a Branch debit card

- Platform to manage your work schedule and finances

| App | Availability | Downloads | Rating |

| Branch | iOS & Android | 1M + | 4.7/5 & 4.2/5 |

| Loan Amounts | $500 |

| Fees | Instant Deposit Fee: $2.99 to $4.99 |

| Time to Get Funds with Fees | An hour |

| The Time to Get Funds without Fees | 3 business day |

| Time to Repay | Depends |

| Repay Method | Automatically debited from account |

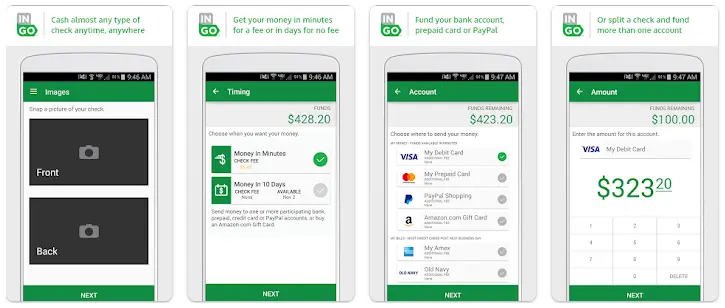

11. Ingo Money App – Cash Checks

If any app claims to be an Instant cash advance app and it’s not Ingo, there’s a problem.

Ingo Money stands as a defining platform in the world of fintech. With embedded p2p payment capacities and industry-leading technology, there are only a few other platforms that are like this.

Moreover, the platform offers a cash advance limit of $5,000 per check. In addition, $5,000 in cumulative checks per day and $10,000 in cumulative checks per month.

Features:

- Mobile payment capacity

- Risk management

- Account funding and transfer

- Instant cash advance payouts

Pros:

- One of the fastest cash advance apps

- No need to check cashing lines

- The app doesn’t have deposit holds

| App | Availability | Downloads | Rating |

| Ingo Money | iOS & Android | 1M + | 4.1/5 & 3.0/5 |

| Loan Amounts | $5,000 per check |

| Fees | $5.00 for 250 or less, other 2% |

| Time to Get Funds | 5 Minutes to One hour |

| Time to Get Funds without Fees | 2 business days |

| Time to Repay | Flexible repayment options |

| Repay Method | From debit card, credit card, or bank account |

12. Vola Finance

Vola Finance is in a league of its own

This fintech company is on a mission to “help you permanently avoid overdraft fees” through lightning-fast cash advances, of course.

Well, there’s more to this app.

As a starter, the platform charges a monthly fee which is totally justified with the services and advantages it offers.

Features:

- Financial insights with an array of tools

- Learn better financial practices with educational content

- Credit score building aid

- Set up smart alert with vola app.

Pros:

- There is no interest for cash advances up to $300

- Lighting fast cash advances

- Platform offers services across the nation

| App | Availability | Downloads | Rating |

| Vola Finance | iOS & Android | 500K + | 4.5/5 & 3.0/5 |

| Loan Amounts | Up to $300 |

| Fees | Subscription fee (per month): $2.99 |

| Time to Get Funds | 5 (business) hours |

| Time to Repay | Flexible repayment date |

| Repay Method | Bank Account or debit card |

13. CashNetUSA

Lastly, we have CashNetUSA

This is a well-known financial company based in the USA as suggested by the name. To be specific, this is a loan lending app. And among all the different types of loans it offers is, Cash Advance.

Now, there is not much to say about this platform apart from the fact that it offers a very high cash advance limit. Though the interest rates are a little high, the repayment range is unmatched.

Features:

- Same-day loan deposit

- Different loan types

Pros:

- High cash advance limit

- Flexible repayment options

| Loan Amounts | $500 – $1,000 loan |

| Fees | Interest Fee: $25.00 per $100.00 |

| Time to Get Funds | 1- 2 business days |

| Time to Repay | 3 – 24 months. |

| Repayment Method | Cheque, debit card, credit card, bank account. |

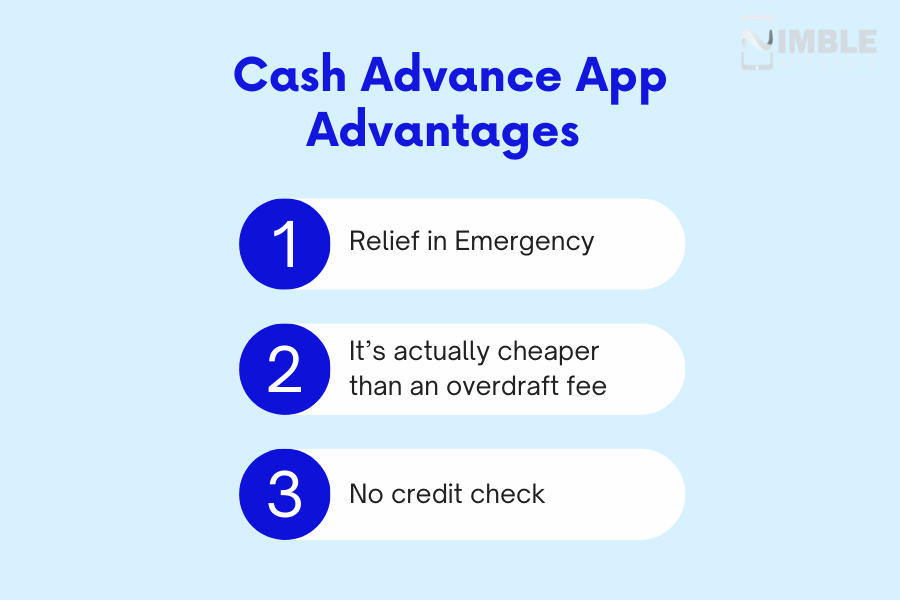

Why Do People Love Cash Advance Apps?

Loans, much like credit cards, are financial products that are frowned upon, labeling them as debit traps. So, are cash advance loans debt traps? Well, they aren’t if you use them right.

There are some use cases of cash advance apps that are super beneficial. Let’s look at these below:

► Relief in Emergency

Cash advances can be a much-needed relief in case of those emergency situations.

Now, it’s not like cash advance apps offer you thousands of dollars. But in our day-to-day life, we have those emergencies where we are just a few hundred dollars short or a few days of drought before payday.

To ballpark it, most of the cash advance apps will provide up to 500$ within minutes (or days, depending on the platform).

► It’s actually cheaper than an overdraft fee

One thing that unites people like nothing else is hate against paying late or overdraft fees. Well, cash advance loan apps can save you from just that.

That’s not to say that the funds from the best cash advance apps are free of fees or extra charges. But answer this: if you had to choose between a paycheck advance or an overdraft, which would you go with?

The former one is actually cheaper as you only have to pay around $10 at most. Compared to the overdraft fee that easily reaches 35$, this is much better, wouldn’t you agree?

► No credit check

Just now we were discussing how everyone hates long processes for loan approval. Well, there’s no such thing in cash advances.There are no credit checks, no long waiting period, just instant deposit to your account. Amazing, right?

Enough praises of cash money advance apps. Let’s move to the next section where we shall be diving into the market for these platforms.

Cash Advance App Alternative Methods

Instant cash advance apps and their strict rules can be too much to handle for some users. But worry not, because there are some alternative methods that you can go for.

These are, as mentioned below:

♦ Personal loans

This might be a step back to traditional methods but it is worth it at times. You should definitely check it out.

♦ BNPL Apps

BNPL stands for Buy Now Pay Later. This is yet another popular form of fintech app that allows you to buy on a cash advance that you have to pay later. You can use apps like Klarna and AfterPay.

♦ Ask From Friends & Family

Not as high-tech as other methods on the list, but this is an interest-free and stress-free method. Doesn’t hurt to ask for help once in a while does it?

Or, you can work with an eWallet app development company and create your own version of a cash advance app, how does that sound? Well, in any case, with this, we have concluded the blog.

Conclusion

With the financial landscape changing rapidly and the economic situation of different classes drastically changing, cash advance apps have appeared as a much-needed savior.

However, one has to confirm before giving their financial information to an app. That’s why in this blog we discussed some of the most trusted and legit cash advance apps in the market.

With this, you have flexible options and a high advance limit. Each app has different offers, appealing to different user bases.

FAQs

Cash advance apps give the user access to limited funds that are directly credited to their bank account or eWallet and have to be repaid within a short period of time.

The working process of a cash advance app is, as mentioned below:

- Download & Signup

- Link bank account

- Eligibility & Apply

- Loan offer amount

- Choose the EMI plan and deposit type

- Amount is credited to account

- Repayment

Cash advance apps fall in the loan lending app category. So, the average cash advance app development ranges between $10,000 to $100,000. It depends on a range of different factors such as complexity, tech stack, features, size, design, and more. For accurate cost estimation, contact an app development company.

Cash advance apps are absolutely safe to use. These apps have to pass government compliance tests and follow strict guidelines that ensure user data and funds’ safety. However, it’s always advised to go through.

Nimble AppGenie is a leading fintech app development company that does offer market-leading loan lending app development services. Users can avail these services to convert their cash advance app idea into a working digital concept. Reach out to us and let’s discuss this further.

Payday loans are available in brick-and-mortar payday lending stores, online lenders, and banks. The process to avail of these is typically longer than cash advances. Moreover, the pay structure also differs. On the other hand, cash advance apps are entirely digital solutions, where funds are credited instantly. Some features of both services may be overshadowed, but they are two different concepts.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.