Back in the day, we had to carry cash to make payments or to buy something. But with the advent of new eWallet applications like PayPal, these applications have replaced the traditional methods. They make it easy, secure, and convenient to make transactions or send someone money with just one tap on the phone.

Over time the app PayPal has grown tremendously and has become the user’s favorite. But not every user can have a good experience with the app. This is where people start looking for apps that are like PayPal.

As a business, this gives you a chance to provide a more effective and efficient app that you think can work magic in the market and prove to be the best alternative to PayPal with the help of an eWallet app development company.

To launch another app like PayPal, you need to know what other apps like PayPal have in them and how they are ruling the market?. In this blog, we will get to know about the top players in the market.

PayPal – Statistics & Key Features

PayPal is the OG of the market. It is not wrong to say PayPal paved the way for online payment and made people aware of it. It is one of the oldest fintech development companies, which inspired other businesses to get involved in fintech by showing how ewallet apps make money and how users engage with them.

- With the current global market share of the payment service segment, PayPal owns a maximum which is 52% followed by Stripe.

- PayPal had 431 million users worldwide as of 2023.

- As of 2023, PayPal had 29 million merchant accounts.

- 200+ countries and regions put confidence in PayPal.

- 56% of US citizens have a PayPal account.

Seeing this kind of stats, PayPal is doing well. But, whenever any company launches an app, it surely has some drawbacks, which shows a promising future to its competitors to create an eWallet app to provide users with more features, security, and efficient eWallet.

With this, let’s move forward with the top PayPal alternatives that have amazing features and are best for businesses. By knowing about their features, you will get an idea of what’s trending in the market.

12 Best PayPal Alternatives

Get to know about the best PayPal alternatives that are currently at the top of the market. These apps will motivate to get a mobile banking app for your business. Once you get to know them, you will realize you are missing out on a lot of great PayPal alternatives.

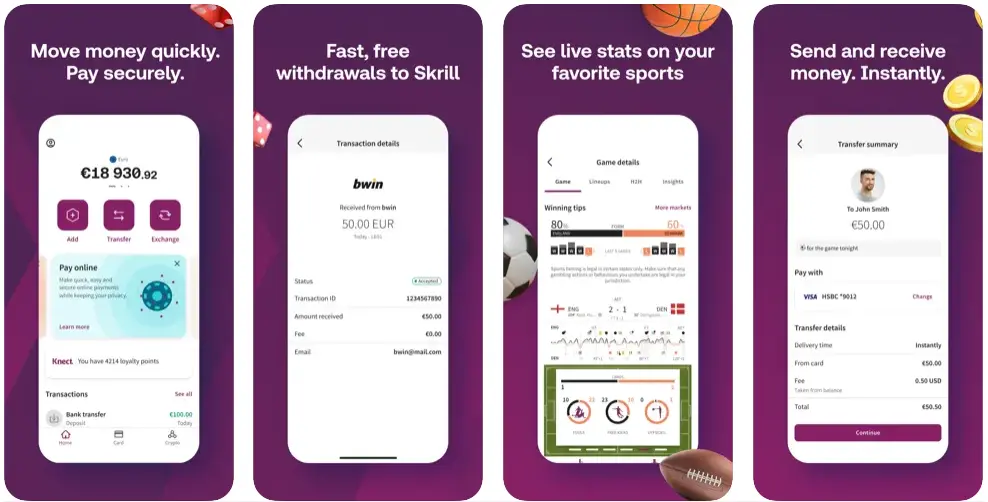

1. Skrill

On this list of PayPal alternatives, the first name is “Skill”.

Skrill was launched back in 2001, and since then it hasn’t looked back. It is another digital application and is one of the best alternatives to PayPal to make payments & manage your finances. The app supports more than 40 currencies & lets you send money in different currencies.

The app was formerly known as ‘’Money Brookers’’. Once you create your account on the app, you can save your card details and link accounts, for fast payment processing. Skrill has merchant fees in between 2.5% to 4%.

There are two levels of accounts on the app. One is Skriller level and the other is true Skriller level. At the skiller level, they have some fees whereas the latter one waives those fees.

Feature of Skrill

- You can send money to non-Skrill members easily.

- Feel free to send money to an e-mail or Skrill wallet.

- They offer a reward program to gain points.

- You can enjoy sports and gambling.

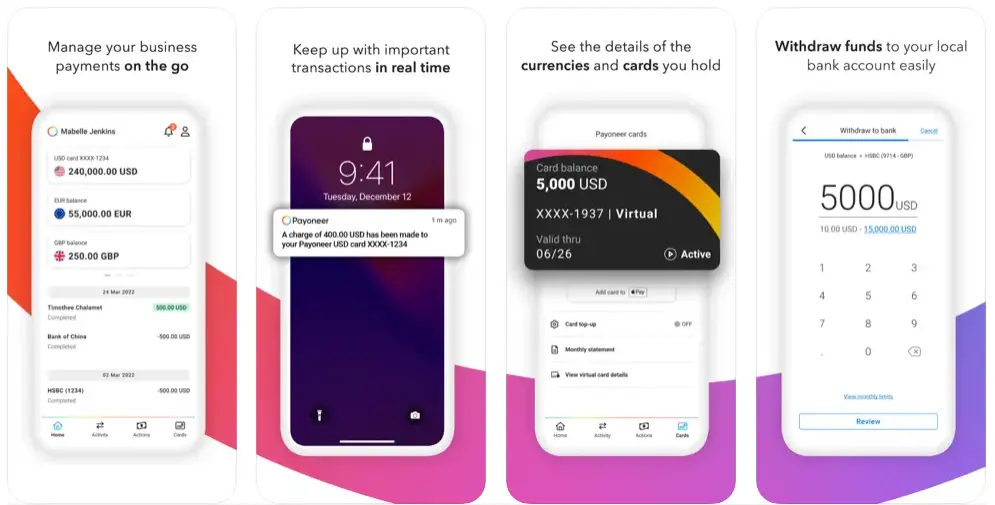

2. Payoneer

If you are looking for the best PayPal alternatives for your business? You should definitely give Payoneer a try.

Payoneer provides business-oriented solutions to these companies and emphasizes international commerce. The platform also provides a debit card that you can use to make a purchase or even withdraw funds from it. It offers a variety of services to different industries with safe, flexible, and low-cost solutions, networks, and businesses anywhere in the world.

Transactions between Payoneer accounts are free. The platform has 100 million registered users and the numbers are still growing, making it one of the PayPal alternatives for online payments.

Features of Payoneer

- International Contractor Payment

- Please open a local account in different countries.

- You can convert the currency and then transfer.

- Small capital advances for businesses.

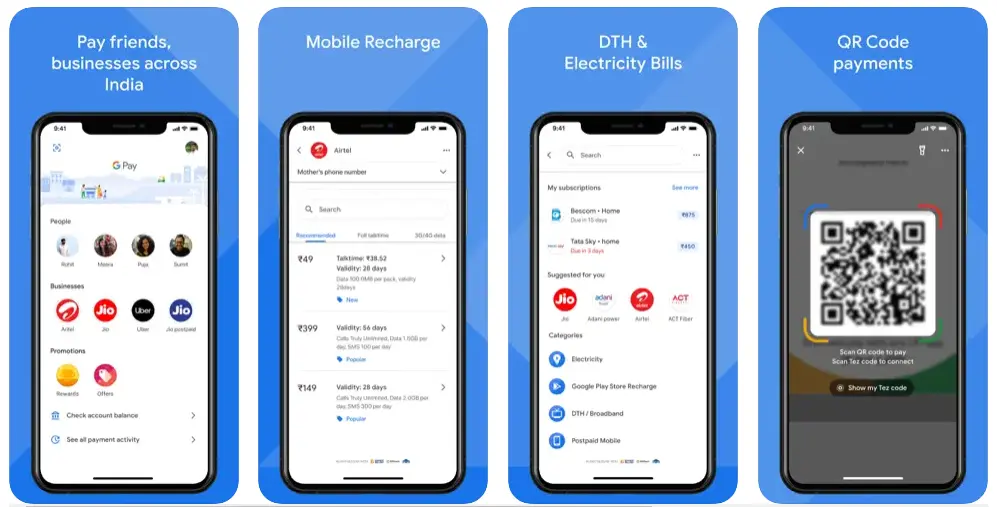

3. Google Pay

Google Pay is one of the top apps like PayPal through which you can pay on the website, make in-store purchases, and win exciting rewards after payment. You can also link your bank account and store your card details for easy and convenient payment next time.

It can be said to be PayPal’s alternative for businesses that can help them to make payments freely. One of the amazing factors is their most services are free, such as they don’t charge fees for debit card transactions.

Plus, companies can provide loyalty programs, special mobile offers, gift cards, offers, and much more. It is a great alternative that you can use within India, Singapore, or the USA.

Features of Google Pay

- Backed by Google.

- Get an insight into your transactions.

- You can group and split payments.

- Make contactless payments easy.

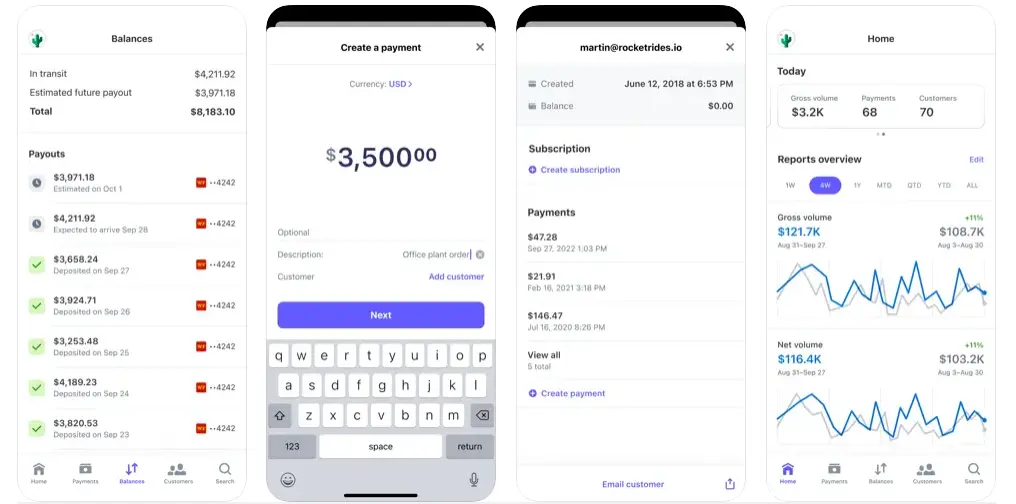

4. Stripe

Stripe is one of the fastest-growing similar apps like PayPal in the market. Initially, the app started as assistance to startups to gather funds. But, soon it became one of the widespread payment services for online businesses.

They consider themselves to be a ‘developers first’ business. Due to this, they provide a clean, user-friendly API that is easy to integrate. Due to this, it is used in a lot of SAAS applications. Stripe API helps businesses to easily take payments or accept payments through different methods using Credit cards, debit cards, or any other mode.

Features of Stripe

- Offer card updates.

- Available in 46 countries.

- Programmer friendly.

- Extensively adopted.

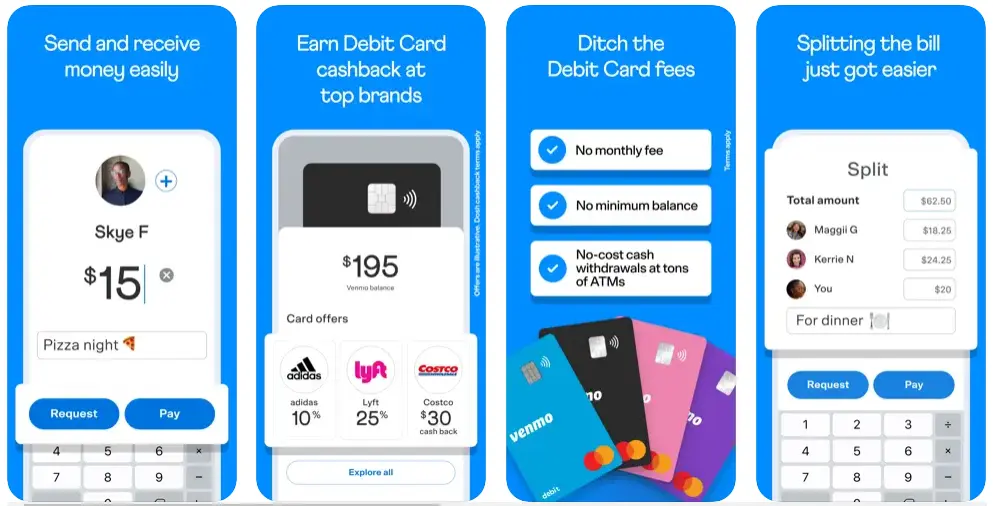

5. Venmo

While writing about the best alternatives to PayPal, we can’t forget about “Venmo”.

Venmo is backed by PayPal and is utilized widely by people to make payments, send money to someone, and much more. However, Venmo may not be as huge as PayPal but it has 83 million-plus customers using it already.

Making payments on Venmo is easy and user-friendly, all you have to do is enter the receiver’s phone number or scan the QR and send them money within just a few taps on your smartphone. You can see your past transactions on the app; add notes or emojis to make payments, and do much more. For that, you have to use the app. Although PayPal is already famous and used by many, Venmo has become quite a famous P2P payment app that people enjoy using.

Features of Venmo

- Offer ACH payment processing.

- No monthly or annual charges.

- Offers credit cards.

- You can make purchases and sell crypto.

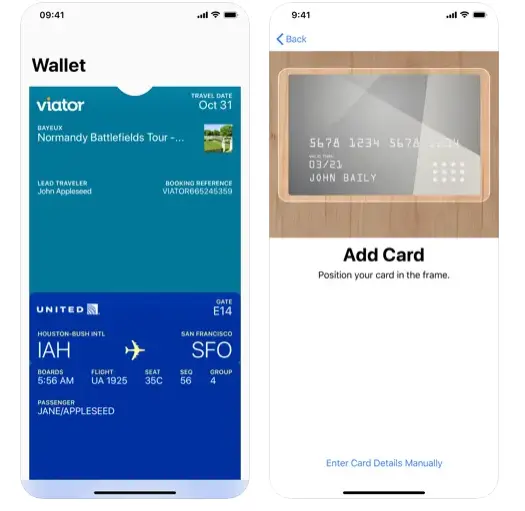

6. Apple Pay

One of the top apps like PayPal for online payment is built for Mac, iPhone, and other Apple products. Apple Pay is used for receiving and sending money and make in-store payments. Currently, the app may not be as popular as PayPal but 85% of retailers have already accepted it in the United States.

The outstanding factor about Apple Pay is it doesn’t charge fees. Furthermore, you can register your credit/debit card details on the app and it can digitize the way you make payments, all you have to do is hover your phone over the POS terminal and the payment will be cleared without the need to remove your card.

Features of Apple Pay

- Make contactless payments.

- Even replacing the need for cards.

- Backed by Apple.

- Doesn’t charge fees and provides cash back either.

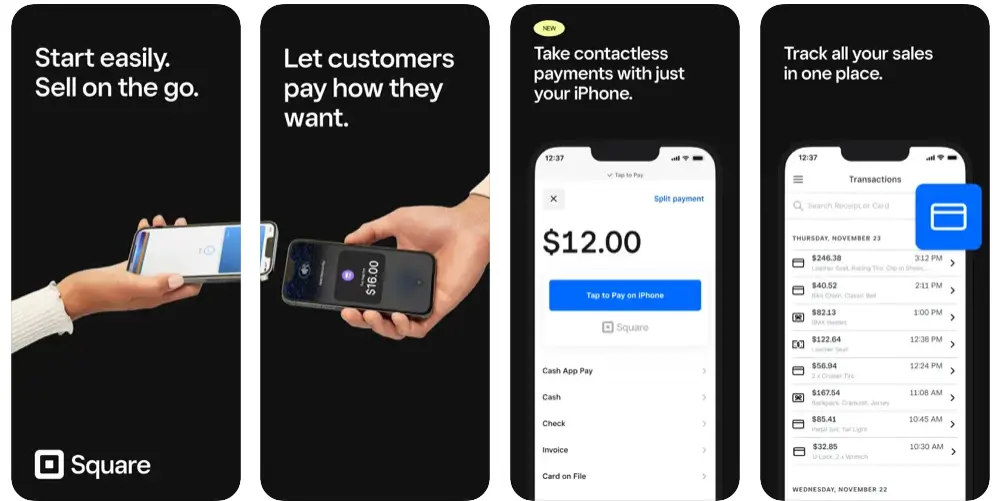

7. Square

Square is one of the best alternatives to PayPal for businesses of any size. The app is quite known for its point–of–sale system which is affordable and easy to use. It helps to keep track of customers and accepts cards, cash, and more.

Another outstanding feature that differentiates it from other payment apps like PayPal is its credit card swiper, which allows it to securely accept payments from other parties. You can also swipe cards without any internet.

Features of Square

- Plug it into a mobile device and it becomes a cash register.

- You can connect it to different channels such as PayPal, Google Wallet, and more.

- Make payments in online and offline stores.

- Provide payroll tools and invoicing.

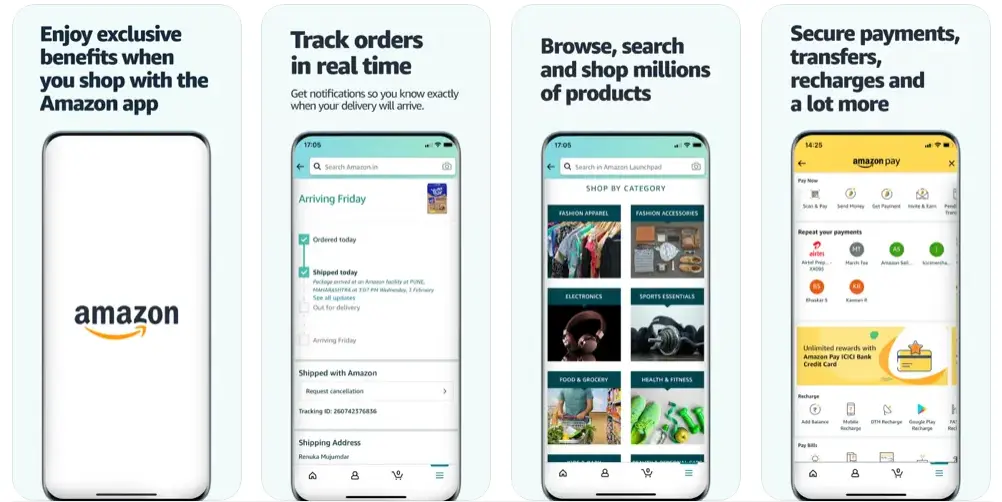

8. Amazon Pay

One of the best alternatives to PayPal is Amazon Pay, you might ask the reason is because customers are familiar with its interface and brand. The app is designed to be used from any device, so it is easy for customers to make and receive payments through the app.

The app is presented by Amazon, where you can link your debit/credit card and make a purchase and even pay for many apps like Netflix, Spotify, DoorDash, and more. Moreover, companies looking for a secure digital payment gateway and cross-device payment option should consider Amazon Pay as an option for their business. You can easily just set up your account and start receiving it. The transaction fees for Amazon Pay are the same as for PayPal.

Features of Amazon Pay

- Fraud detection security.

- Easy debit/credit card processing.

- Easy mobile payment option.

- No requirement for credit card details.

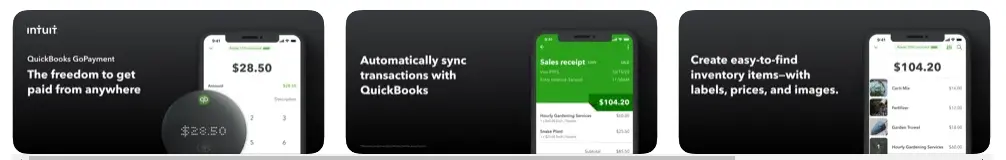

9. QuickBooks Go Payment

Backed by top accounting firms and can be used by businesses that use Quickbooks for accounting. It is a point-of-sale system that assists small businesses in processing transactions. You can use the GoPayment app to make cash and credit card payments, and much more. The platform also accepts Apple Pay, Samsung Pay, and Google Pay.

One of the biggest pros of QuickBooks Go Payment is that you get accounting software, payment processing solutions, and even a Point-of-sale system all in one that saves you time and effort of jumping from one app to another.

Features of QuickBooks Go Payment

- Easy to make payments.

- Utilise Bluetooth-enabled mobile card readers.

- Accepts credit card payments.

- Works on different devices.

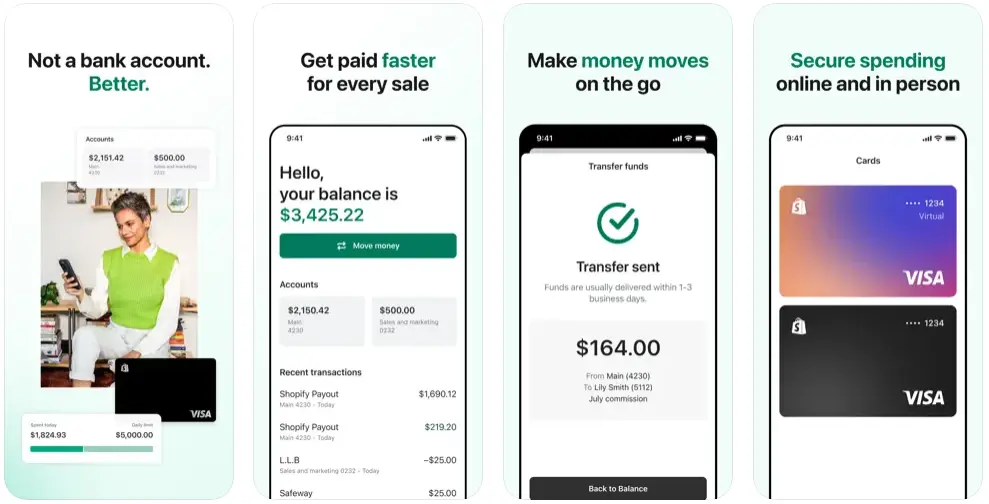

10. Shopify Payments

Shopify Payments is one of the easiest and most secure ways to make payments. Within a few years, it gained popularity due to providing three platforms simultaneously eCommerce, POS, and payment integration under one roof. Furthermore, the platform accepts credit/ debit cards without the need for any third-party integrations.

It is one of the best apps like PayPal with amazing features that were specially built to promote merchants selling goods and services on the app. It can be utilized with other social media accounts such as Amazon, Facebook accounts and more.

Features of Shopify Payments

- Easy to integrate

- Multiple payment gateways.

- No transaction fees.

- Support offline sales.

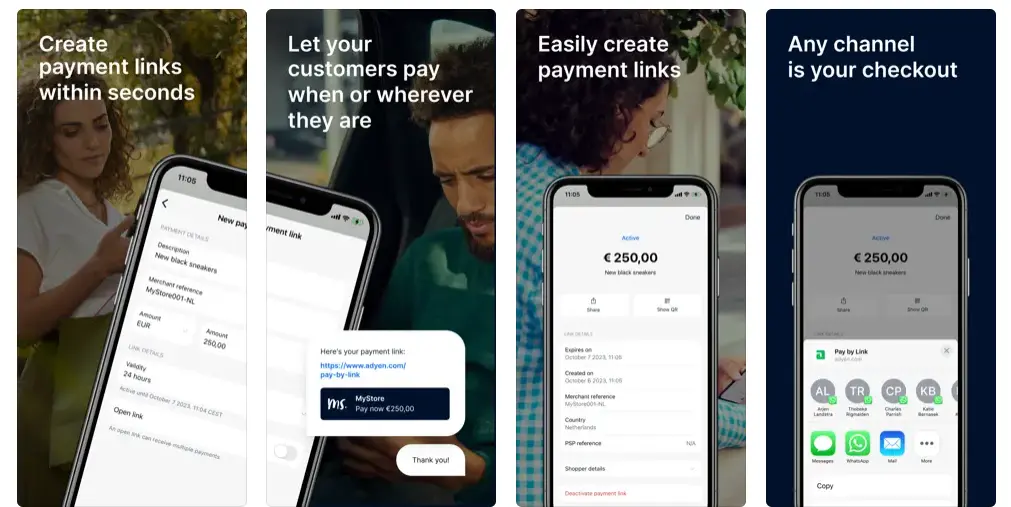

11. Adyen

Adyen is on the list of international money apps like PayPal that help ventures accept and make payments online and in person. The platform helps businesses accept a wide variety of payments, including eCommerce, POS systems, and mobile.

The Dutch company is a financial technology platform that helps businesses achieve their goals faster with data-driven insights and better payment processes. Adyen has 1700+ clients around the globe including eBay, Uber, Bank of America, and more.

Features of Adyen

- Easy and instant payment.

- Support debit/credit card transactions.

- Win exciting rewards, coupons, and gift cards.

- Plug and play payment packages.

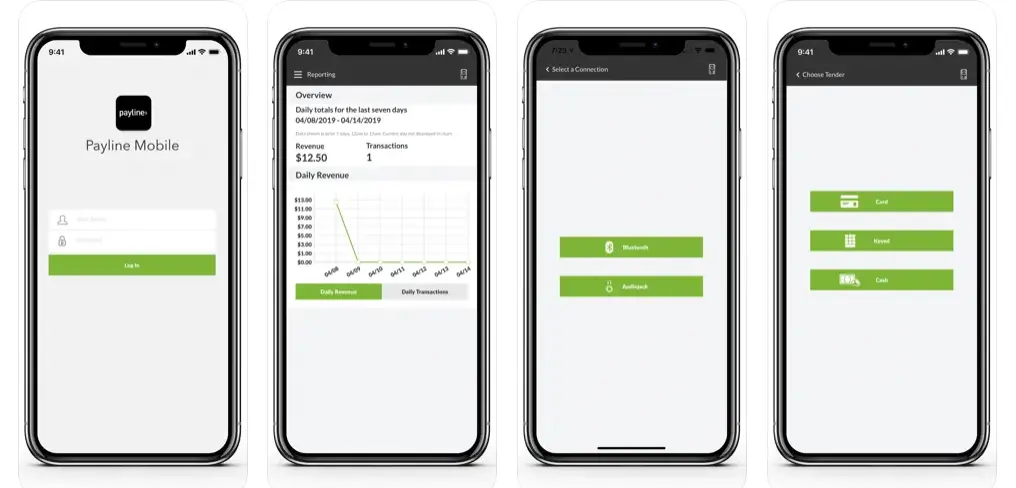

12. Payline

On the list of similar apps like PayPal, another name is Payline.

Payline is a payment app like PayPal that helps businesses with better payment solutions. The app provides top-notch eWallet app security with features like fraud detection, integrated payment gateways, and much more.

It offers a flexible payment processor that accepts credit/debit cards, ACH transfers, and e-checks that streamline payment processing. Moreover, you can utilize a POS system that helps to get better insights into inventory, customer data, and more.

Features of Payline

- Prevention of fraud.

- Enhanced mobile payment capabilities.

- Offers transparent pricing.

- All-in-one solution.

Why Choose Nimble AppGenie to Build an App like PayPal?

The eWallet market size was $27 billion in 2020 and will see a rise of 18% up to 2026. Clearly, mobile wallet is an ongoing trend that helps people to make payments without carrying cash through some taps on the phone.

Now and then, people search for faster, more reliable, and less complicated payment solutions motivating businesses for mobile banking app development.

If you are looking to leverage this time, then we are here to help. Nimble AppGenie is the best eWallet App Development Company that provides secure eWallet application development solutions for various businesses of different sizes and types.

We take the time to understand your goals, features you want and target audience. Keeping that in mind, our developers create a money transfer app that goes well with your brand and also enhances the customer experience.

Should you want to know the timeline for developing a digital wallet or the cost to develop an e-wallet app, feel free to contact us.

Conclusion

If you are interested in building PayPal-like apps, you should work to make the idea turn into a digital solution. These apps have surely made people understand their importance and since the market is also growing, there is no reason not to move ahead.

You can add extra features such as gamification in your app and also promise extra security in the app to lure customers. All you have to do is make your app user-friendly and adaptable and the app will automatically pull users.

Also, partnering with a top company that develops secure apps for cyber security in Fintech is a major concern and no user wants to oversee this.

FAQs

We believe we have covered all the vital details. But. if you have any doubts then these FAQs will help you-

Some of the best alternatives to PayPal are Skill, Payoneer, Google Pay, Venmo, Square, Amazon Pay, Payline, Adyen, and more. Any alternative is best if it helps you with your requirements and needs. However, these are some of the top apps that provide an all-in-one solution.

It is not necessary that if an app is popular, every user will be satisfied with the app. Poor customer service, strict rules, and hidden fees are some of the reasons people look for PayPal alternatives.

Some of PayPal’s biggest competitors are Stripe, Shopify payments, and Authorize.Net that have an amazing market share and are found in users’ smartphones.

Both have their advantages. PayPal is a well-known and familiar platform for sending and receiving payment for users whereas Stripe is good for bulk payment processing and is used by businesses when there is a high sales volume.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.