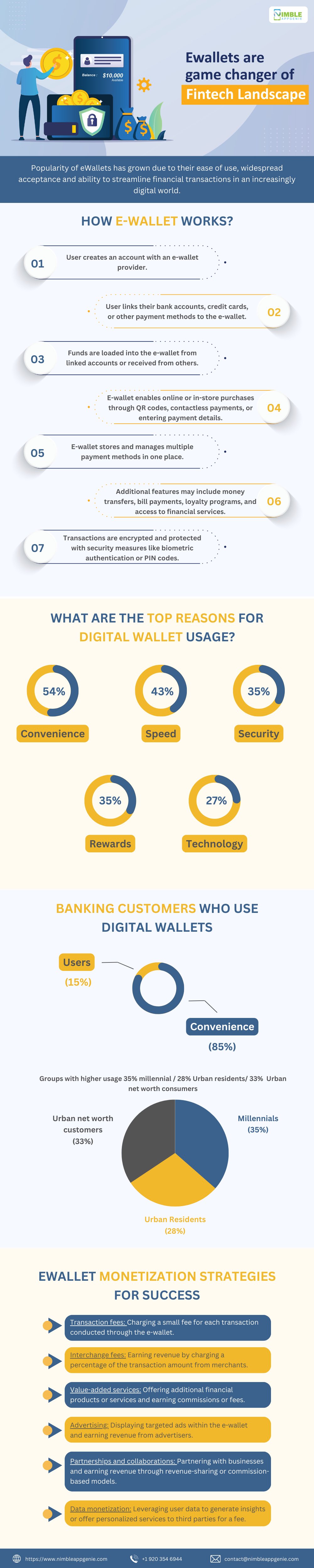

Have you ever wondered “How To Make Money With eWallet App?”

With eWallet app development becoming a trend in the business world, there are a lot of people exploring app monetization strategies. After all, turning digital transactions into cold hard cash is as satisfying as finding money in the pocket of your old Levi’s.

Now you are wondering why monetization is such a big deal.

First of all, developing an e-wallet is not an easy feat, it takes months and many sleepless nights to develop the user-friendly app. But if you are unable to monetize it properly, all the hard work goes in vain.

When you have proper planning and the right strategies, you can become the next tech giant in the e-wallets like Venmo, PayPal, and many more.

The mobile wallet market size was valued at $1,043 Bn in 2019 and is projected to reach $7,580 bn by 2027 according to Allied market research. It is expected to grow at a CAGR of 28.2% from 2020 to 2027.

This report shows the future of the e-wallet app market is exceptional. There isn’t one size fits all approach to e-wallet app monetization.

Whether you are an entrepreneur or start-up looking forward to entering the digital domain, it’s important to know about monetization channels to be successful. And that’s exactly what we shall be complete guide to ewallet app monetization.

Therefore, let’s get right into it:

What is App Monetization?

eWallet apps are technology pinnacle that comes to life with amalgamation of several components. This includes the idea going from founder’s head to table of developer’s team and turned into 1s and 0s to be given a digital life.

All of this trouble, for what? To make Millions or even more in profit. And that’s why App Monetization comes in.

Every business wants to make money and when they want to do it through eWallet apps like PayPal, monetization strategies are what makes it possible.

In layman’s terms, these are channel that use offerings of eWallet to generate revenue for the business. Let us tell, you, there are quite a few different strategies. Each one of them have their unique benefit and fits different apps types and business models.

For those who still don’t understand why eWallet app monetization is important, let’s move to the next section.

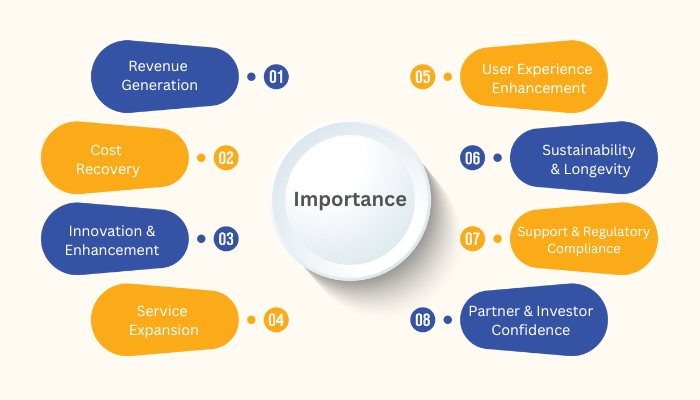

Why Are eWallet App Monetization Strategies Important?

Picture this: You have created an incredible e-wallet app with a sleek design, seamless functionality, and user experience that’s smoother than a buttered slide.

But how does this benefit the business? This is where eWallet app monetization comes in. And it benefits the business in several important ways.

Some of these are, as mentioned below:

Reason 1: Revenue Generation

Who doesn’t want to generate billions in market like top fintech apps?

These are, eWallet App monetization strategies enable business to generate income and ensure the financial sustainability of their operations.

By implementing various revenue models, e-wallet providers can generate revenue streams that support the ongoing development, maintenance, and improvement of their services.

Reason 2: Cost Recovery

Truth be told, cost to build an eWallet app can be high!

Apart from development cost, there are others like IT infrastructure, security measures, user support, marketing, and compliance with regulations. And businesses want to recover them, because why not.

Well, this is done by making money, A LOT of money. What better do enable this other than, monetization channels? There you have it, why these are so important?

Reason 3: Constant Innovation

Do you want to create an eWallet app that delivers constant innovation to end-users? Running fintech companies isn’t cheap. You need funds to keep the platform up and running.

The money generated through app monetization let e-wallet providers to invest in research and development, innovation, and continuous improvement of their applications.

Thus, enabling them to stay competitive, introduce new eWallet App features enhance user experiences, and adapt to evolving market trends and customer expectations.

Reason 4: Service expansion

Effective monetization strategies provide the necessary financial resources for eWallet companies to expand their services and offerings.

This can be expanding partnerships with merchants, integrating with additional payment networks, or introducing new features and functionalities to cater to a broader range of user needs.

Reason 5: User experience enhancement

Implementing monetization strategies in a user-friendly and non-intrusive manner is essential to maintain a positive user experience.

By generating revenue, e-wallet providers can invest in user-centric improvements such as:

- Enhanced security measures

- Faster transaction processing

- Improved customer support

- Personalized features

Reason 6: Sustainability

A robust Android app monetization strategy ensures the long-term viability and sustainability of the e-wallet application.

By generating consistent revenue, e-wallet providers can continue to operate, innovate and deliver value to users without relying solely on external funding resources.

Reason 7: Support and regulatory compliance

Fintech industry is filled with regulatory compliances like GDPR Compliance and PCI compliance.

Monetization strategies can help e-wallet providers comply with regulatory requirements by ensuring they have the necessary financial resources to implement and maintain robust compliance measures.

This includes investing in secure infrastructure, implementing anti-money laundering and know-your-customer procedures, and adhering to privacy and data protection regulations.

Reason 8: Partner and investor confidence

When you have a solid monetization strategy can attract potential partners, investors, and financial institutions.

A clear revenue model and sustainable monetization approach showcase the viability and growth potential of the e-wallet apps instilling confidence and attracting potential collaborations and investments.

With all out of the way, it’s time to look at the way to monetize an eWallet app.

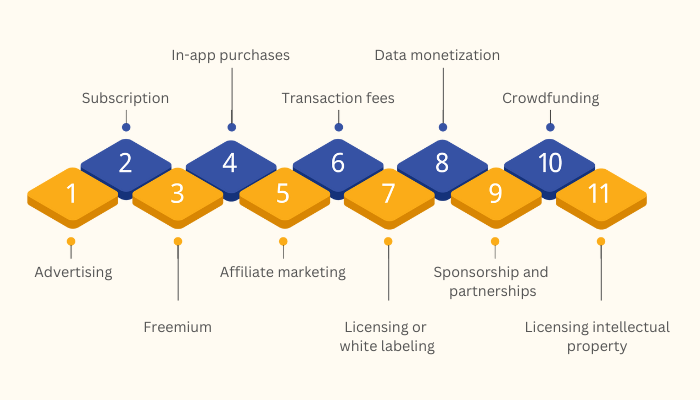

Best eWallet Application Monetization Strategies

Most of the start-ups fails in the early stages of ewallet app development because they didn’t ask the important question.

“How to monetize the eWallet app?”

In this section of the blog, we shall be discussing top wants to generate revenue through eWallet apps. Therefore, let’s get right into it, starting with:

1. Advertising

One of the oldest tricks to monetize mobile wallets in the book, Advertisement.

You can look at mobile apps like bill boards of new age. There are companies and people willing to millions to advertise themselves, their services, or products to smartphone’s user base.

And this monetization model is an opportunity to turn that demand into revenue.

Generating revenue through advertisements placed within or alongside the product or service. This can include display ads, video ads, sponsored content, or native advertising. Typically revenue is earned based on the number of impressions, clicks, or conversions.

Speaking of which, the revenue generate through these advertisement can reach millions in no time. That’s what make it a popular model.

2. Subscription Model

Subscription-based monetization.

This is a popular business model that is followed by apps like Hulu, Netflix, and so on. These are also known as, Subscription based apps. And we are all quite familiar with it.

Charging users a recurring fee to access the eWallet application and it’s different services. This can be a monthly, quarterly, or annual subscription. This model often provides additional features, content, or benefits to subscribers.

This is one of the top ways to monetization an digital wallet, so, definitely consider this one.

3. Freemium (Free + Premium)

Whether you create a money transfer app or good online app like PayPal, this is a strategy that won’t fail you.

We are talking about FreeMium Model.

Much like the terminology that consists of two words, FREE and preMIUM, the model divides the app into two parts. While basic version of the product or service for free, and business charge a fee for premium features, functionality, or advanced content.

This model allows users to experience the product before deciding to upgrade to the paid version.

But this doesn’t end here, within the free version, you can integrate other strategies like advertisement and paid promotion to get extra out of the model.

4. In-app Purchases

If you really want to innovate and take it from 0 to 100, you can start selling digital content, assest, or even NFTs like Bored Apes.

The money generated from direct sales can become a good revenue stream as some of them sells for upwards of millions. And this strategy is what we call, in-app purchases.

While it is not something that we often see in eWallet app monetization guide, it is viable option, considering how digital wallets are turning into super apps.

5. Transaction Fees

Unlike other fintech app development solutions, eWallet apps are focused around one purpose i.e. making transactions possible.

This is a commodity that is rarely found in other areas of digital solutions. And even if it is, they aren’t as fast or secure as digital wallets. Based on this advantage, business create a renowned Ewallet Application Monetization Strategy, transaction free.

This becomes even better considering the fact that, eWallet integrate well and are often used with food delivery app like DoorDash and other on-demand apps.

Businesses as a platform can charges a fee or a percentage of the transaction value for each financial transaction conducted through the platform or service.

6. Licensing or White labeling

It is no secret that a lot of business want to create an eWallet app. And you can monetize this demand.

One of the unique tips to make money with a eWallet app is to White label it.

You see, to hire mobile app developer and build a custom app is expensive. You can offer a white-label mobile app at half the price and virtually no cost to your business.

In other words, you are allowing other businesses or individuals to license the product or service and use it under their branding. Licensing fees are charged based on usage or revenue generated by the license.

7. Data Monetization

Yeah, Yeah, data monetization quite conterversial topic.

However, it doesn’t always have to be unethical sort. Some of the largest platforms including (espeically) apps like Instagram and YouTube, use big data to earn billions.

eWallet app with a lot of users can help your business aggregating and analyzing user data to derive insights, trends, or targeted and sold to third parties for marketing research or business intelligence purposes.

8. Sponsorship and Partnerships

Sponsorship and partnership, is the way to monetize an eWallet app seen in Zelle business model.

Zelle as a platform is totally free to use for their user base. On the flip side, they are partnered with 1000s of digital banking apps and generate their money through them. Although this isn’t the highest earning platform, they have generate Millions in platform.

After all, collaborating with other businesses or brands to sponsor or partner is a good idea. Apart from revenue, it can also greatly increase digital footfall

So, these are some of the best tips to monetize an eWallet app. Moving on, it’s time to learn from the best.

Top eWallet Apps & Their Monetization Approaches

Today, there are several tech giants have emerged with their unique monetization approaches.

Most of the digital wallet start-up fails when they don’t apply the right e-wallet monetization strategy.

That’s why we learn from the best eWallet apps that have implemented the right eWallet application monetization strategies to generate millions.

These are, as mentioned below:

1) PayPal

The OG in eWallet app world, PayPal has generated more than 25 Billlion USD as of writing this blog. Let’s see how they do it.

Transaction fees

PayPal charges transaction fees for receiving and sending money. The fee structure varies based on factors such as the transaction amount, currency conversion, and the types of transactions like business or personal.

Cross-border transactions

PayPal monetizes cross-border transactions by charging additional fees for currency conversion and international transfers like cross-border transaction apps.

Merchant services

It also offers merchant services, including payment processing for businesses. It earns revenue through transaction fees and value-added services for merchants.

2) AliPay

A popular eWallet from China that has made 54.2 Billion USD uses the following monetization strategies for monetization.

Merchant services

AliPay generates revenue by offering various services to merchants such as payment processing customer analytics and marketing tools. Merchants pay fees for using these services.

Financial services

It provides financial services like loans, wealth management, and insurance. Plus, it earns revenue through interest charges, fees, and commissions from these services.

International remittances

AliPay charges fees for international remittances and currency conversions generating revenue from cross-border transactions.

3) WeChat Pay

A super app in digital wallet industry, here are the tricks used by WeChat to make 48.6 Billion USD:

In-app advertising

WeChat incorporates advertising within the WeChat app, allowing businesses to promote their products and services to WeChat users. Revenue is generated through ad placements and sponsored content.

Payment processing

It charges merchants transaction fees for accepting payments through its platforms. The fees vary depending on the transaction volume and value.

Financial services

It offers financial services such as wealth management and microloans. The revenue is generated through interest charges, fees, and commissions from these services.

4) Google Pay

Google Pay is one of the leading money transfer apps in world. With the following strategies, this app has generated more than 11.8 Billion USD:

In-app advertising

Google Pay integrates targeted advertising within its app, allowing businesses to reach users with relevant offers. Revenue is generated through ad impressions, clicks, and conversions.

Peer-to-Peer Payments

It charges a fee for certain P2P transactions such as transferring money using a credit card. The fee structure may vary based on transaction type and amount.

Partnerships

It forms partnerships with banks, financial institutions, and merchants. Plus, the revenue is generated through referral fees, commissions, and revenue-sharing agreements.

5) Samsung Pay

Lastly, let’s see how Samsung’s home-grown digital payment solution added another 2.9 Billion USD revenue to company’s treasury:

Transaction fees

Like all others, it earns revenue by charging transaction fees for payments made through its platform. The fees can vary based on factors such as transaction volume and value.

Partnerships and Co-Branding

Samsung Pay collaborates with banks, card issuers, and merchants for partnerships and co-branded promotions.

Value-Added Services

It offers value-added services such as loyalty programs and discounts. It generates revenue by charging fees to merchants or earning a percentage of the transaction value.

Conclusion

Ewallet mobile app development is the new trending wave at the current time. Indeed a lot of start-ups fail due to improper e-wallet app monetization strategies.

But don’t worry if you are planning to develop an e-wallet app our team at Nimble AppGenie are experts in developing digital wallets that can help you with everything. Feel free to contact us.

FAQs

The most common e-wallet app monetization strategies include in-app advertising, freemium, in-app purchases, and paid app models.

The right e-wallet app monetization strategy for your business will depend on a number of factors, including your target audience, your app’s features, and your budget.

There are a number of ways to improve your e-wallet app’s monetization, including:

- Offering a variety of monetization options to your users

- Targeting your ads to the right audience

- Personalizing your app’s experience for each user

- Providing excellent customer service

In-app advertising, freemium, in-app purchases, and paid app are the most common e-wallet app monetization strategies.

Consider your target audience, app’s features, and budget when choosing the right e-wallet app monetization strategy.

In-app ads can generate revenue but can be disruptive to user experience.

Pros: Revenue generation, monetizing user base, targeted advertising, enhancing user experience.

Cons: User experience disruption, privacy concerns, app performance impact, potential damage to brand reputation.

Freemium model can be effective if free version is valuable and users are willing to pay for additional features.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.