Zelle is one of the top platforms in the market today, in it’s respective industry. And it has inspired people from across the world to clone it’s business model. And this brings us to the question of we shall be answering in this blog, what is “zelle business model”?

If you want to learn about zelle business model, how it works, how the platform makes money, and so on, this blog is for you. Here, we shall be discussing all you need to know about zelle platform and everthing related to it.

Therefore, with this being said, let’s get right into it, starting with the overview:

What is Zelle? Overview

So, what is Zelle?

As many of you might already know, Zelle is a peer-to-peer (P2P) payment network that enables users to send money digitally from their bank account to another. This is something we also know as eWallet today.

You see, being an one of the best example of fintech app development, this is a source for many other fintech app ideas.

And in a bid to better understand the platform, let’s look at platform’s brief history:

Short History of Zelle

This market leading platform was launched in 2017.

Zelle is result of a merger between two competing payment networks namely: ClearXchange and Early Warning Services.

This merger two largest US banks and enabled new product i.e. zelle to offer unmatched services in the market. Moving on, let’s look at which banks use this instant money transfer solution.

Which Banks Use Zelle

Zelle makes alot of money! And one of the main ways it does that is, partnering with banks.

Speaking of which, there are a number of banks that use this platform. These are, as mentioned below:

- Bank of America

- BB&T

- Capital One

- Chase

- Citi

- Fifth Third Bank

- First National Bank

- PNC Bank

- U.S. Bank

- Wells Fargo

Now, before we discuss zelle business model, let’s see how to create zelle business account and send money in the section below.

How to use Zelle? P2P Payment

Now that we know who all use zelle, let’s see how you can use it. All you need to do is follow the simple steps mentioned below:

1. Open the Zelle app or your banking app that supports Zelle.

2. Select the option to send money.

3. Enter the recipient’s email address or phone number.

4. Confirm the recipient’s information, including their name and the bank they use.

5. Enter the amount you want to send.

6. Add a memo, if desired.

7. Review the details of the transaction, including the recipient’s information and the amount being sent.

8. Confirm the transaction.

And once the transaction is confirmed, the recipient should receive the money within minutes. Condition being the reciever are enrolled in Zelle and have a U.S. bank account.

How Does Zelle Make Money?

Have you ever asked, how zelle business model makes money? Well, that’s the question we are here to answer.

One of the main revenue stream is, charging participating banks a fee to use its network. In addition to this, it is also assumed that charge a flat fee per transaction.

However, the fee structure is not public, so there’s no way ensure this. Now that we know how it makes money, let’s look at how much it makes:

According to a report by eMarketer in 2020, Zelle’s transaction value is expected to reach $299.24 billion by 2023, indicating that the company’s revenue stream is likely to continue growing in the coming years.

With this out of the way, let’s look at the zelle business model in the section below.

Zelle Business Model

Let’s understand Zelle business model

The model in question here is centered around generating revenue by charging participating banks a fee to use its network.

Though the fee structure is not public, it is assumed that, flat fee per transaction is charged. Then the revenue is split between the bank and zelle.

Big part of zelle business model is partnering with other big banks. This allows the company to quickly gain widespread adoption and become a popular payment option among consumers.

The platform has faced stiff competition from other mobile payment apps such as Venmo, PayPal, and Cash App. Despite this Zelle remains a popular choice among users due to its seamless integration with the mobile banking apps of its partner banks.

And now that you are well-versed with zelle business model, let’s look at it’s competition in next section of the blog.

Top competitors of Zelle App

If you are planning to create an app like zelle or studying zelle business model, it is a good idea to browse through it’s competitors.

And that’s exactly what we shall be doing in this blog. Therefore, let’s get right into it, starting with Venmo:

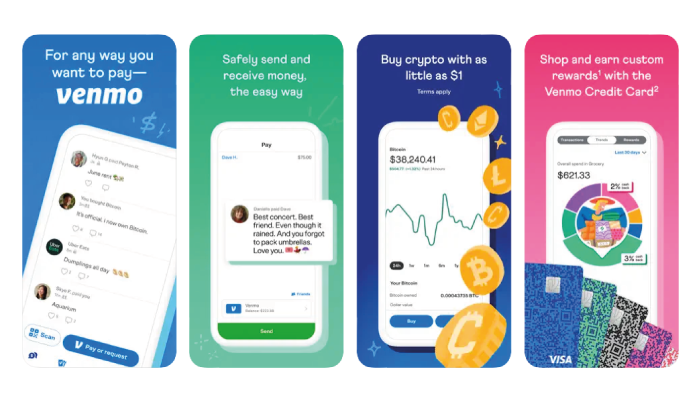

Venmo

If you are from US, you have definietly heard of this one.

Venmo is a mobile payment app that’s super popular in United States of America. This fintech app enables users to send and receive money instantly.

But what makes it stand out is its social aspect. Let us explain: the platform allows users to share their transactions with friends. Thus, making it a popular choice among millennials and younger generations.

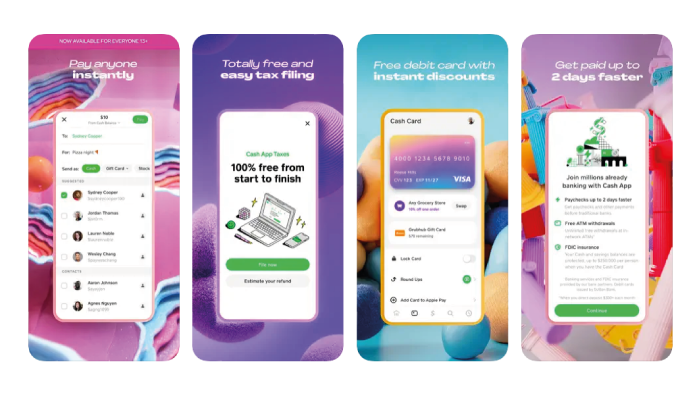

Cash App

Owned by square, it is the most popular fintech app in the world, at least one of them.

The cash app enables effortless mobile payment. This means it enables users to send and receive money. But that’s not all, Cash App has a debit card that users can use to spend their Cash App balance at retailers.

Therefore, providing added convenience to its users.

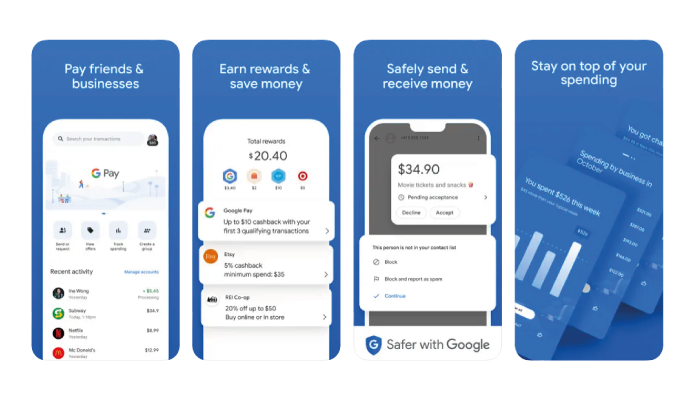

Google Pay

Coming from the tech giant, we have Google Pay. A mobile payment app, which stands as one of the best fintech app in market.

In addition to its P2P payment feature, it also offers a contactless payment option that allows users to pay for purchases using their phone.

What makes it so special is, Google Pay’s integration with other Google services also makes it a convenient payment option for users.

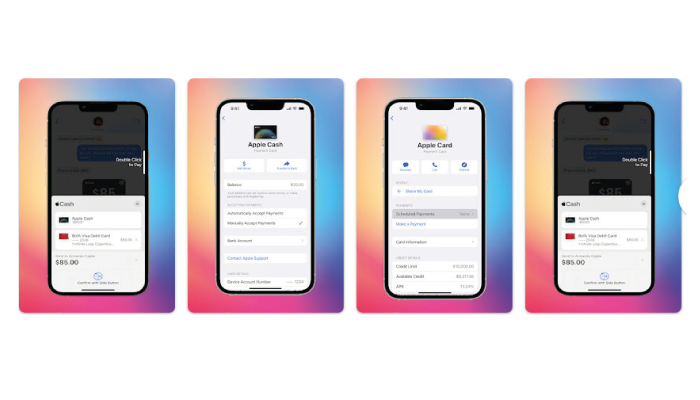

Apple Pay

Since we have mentioned a Google App, we have to talk about Apple Pay.

This is a mobile payment app that allows users to send and receive money. Much like Google Pay, it offers a contactless payment feature that allows users to pay for purchases using their phone.

Furthermore, Apple Pay seamlessly integrates with Apple’s hardware. For instance the Apple Watch and MacBook Pro with Touch Bar.

Zelle Vs Venmo

Whenever we talk about Zelle business model, we also have to mention Venmo!

For those who don’t know, it is a P2P payment app owned by PayPal that allows users to send and receive money from friends and family.

However, unlike Zelle, Venmo is not tied to a user’s bank account and can be linked to a credit or debit card. Venmo also offers a social aspect to its platform, allowing users to share payment details with friends.

So, which one would you choose in this contest of venmo vs zelle.

How To Create App Like Zelle

It’s time to create an app like Zelle.

There are many investors who want to create their own fintech app clone of zelle. Though not everyone can copy zelle business model, we sure can create an app like this.

Therefore, in this section of the blog, we shall be doing exactly that. So, let’s start with the first step which is…

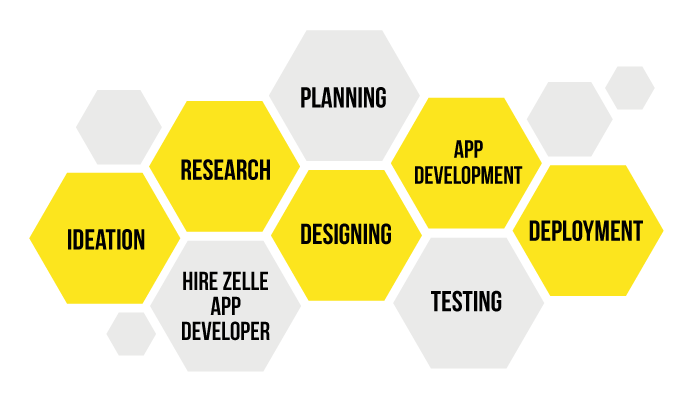

1. Ideation

The first step in creating an app like Zelle is to come up with an idea. And brainstorm potential features and functionalities for the app.

This could involve considering the needs of the target audience, identifying gaps in the market, and researching the competition.

And once we are done with this, we conduct….

2. Research

In the second step, you will need to conduct research to determine its feasibility and identify any potential challenges or roadblocks.

This could involve researching industry regulations, interviewing potential users, and analyzing market trends.

3. Hire Zelle app developer

Want to build an app like Zelle?

First you need to hire zelle app developers. There are various ways to do it, but you must ensure they are skilled in mobile app development. Plus, they must also hold experience working with banking APIs and financial services.

Following this, we start planning.

4. Planning

With your team in place, you will need to create a detailed project plan.This plan should outline the app’s functionality, features, and design.

In addition to this, it should also include a timeline, budget, and list of resources required to complete the project.

5. Designing

With planning done, we must first design the app and then create the back-end.

For this, we must design the user interface and user experience for the app. There are alot of things involved here, for instance, creating wireframes, mockups, and prototypes to test and refine the design.

In anycase, following this, we get into zelle app development.

6. App Development

Once the design is finalized, your development team can begin the app development.

As you can imagine, this will involve programming the app’s functionality. As well as integrating it with banking APIs and other third-party services.

7. Testing

With the app built, you will need to conduct thorough testing. This is to ensure that it functions as intended and is free of bugs and errors.

Here, you can go for both automated and manual testing, as well as beta testing with a group of selected users. After this is done, we deploy the app.

8. Deployment

Finally, once the app has been tested and refined, it can be deployed to the app store and made available to the public.

With this, we have developed an app like zelle successful. And now, it’s time to find out how much all of this will cost you.

Cost To Build An App Like Zelle

Do you want to know how much does it cost to build an app like Zelle? On an average, the fintech app development cost can range from $100,000 to $500,000.

Now it depends from project to project, based on the specifications like features, size, complexity, and so on. Therefore, if you want to learn more about it, we recommend you consult a Fintech App development company.

Conclusion

This is the payment network that has quickly grown in popularity since its launch in 2017. Allowing them to offer P2P payment services to their customers. While Zelle’s top competitors offer similar services. Its integration with the mobile banking apps of its partner banks provides a unique advantage in the market.

FAQ

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.