In today’s world, using your phone to pay via a digital wallet is becoming more common.

Following the growing market, lots of entrepreneurs want to create their apps to make this even easier.

But creating a successful digital wallet app isn’t easy, and many who try end up failing. This leads to the question, why do digital wallet app startups fail?

This blog will look into the common mistakes people make when they try to build these digital wallet apps.

We’ll also share some tips on how to avoid digital wallet app development mistakes so you can make an app that people love to use. Whether you’re just curious about why some apps succeed and others don’t, or you’re thinking about creating your own digital wallet app, this blog has got you covered.

Let’s dive in and learn more about the digital wallet world!

Understanding the Digital Wallet Scene

With the growing market and demand, every entrepreneur wants to develop a digital wallet.

Wondering what these are?

Well, digital wallet apps let users replace everything in their physical wallets such as cash, credit & debit cards, and important documents like membership cards, and driving licenses, and store them digitally.

This enables users to undertake a multitude of transactions. M-PESA in Kenya and AliPay in China are the best examples of such wallet apps.

However, digital wallets offer more than just payments.

Furthermore, digital wallet apps can allow users to cut down their physical wallet contents or eliminate the physical wallet by storing everything digitally.

Developing a digital wallet and establishing a digital wallet startup is easier said than done.

And this begs the question, why do so many people want to go for one? Well, here are some fintech market statistics that show exactly why:

- Over 6.6 billion people owned smartphones in 2023, and the ubiquitous presence of smartphones serves as the perfect platform for digital wallets, making them readily accessible and convenient for everyday transactions.

- Global e-commerce sales are expected to reach $6 trillion by 2027, with a CAGR of 14.7%. The booming e-commerce landscape creates the perfect environment for digital wallets, simplifying online checkout processes and offering faster, more secure payment options.

- eWallet statistics show that global contactless payment transactions are projected to reach $816 billion by 2026, with a compound annual growth rate (CAGR) of 19.4%.

- Millennials and Gen Z now make up over 50% of the global workforce and are driving the demand for digital financial solutions, making them prime adopters of digital wallets that cater to their mobile-first lifestyles and financial needs.

Now that you know the reason behind startup app ideas more focused on digital wallets, it’s time to move on.

It’s time to answer “why digital wallet app startups fail” by going through some of the common development problems to avoid.

Why Do Digital Wallet App Startups Fail?

Well, with a market filled with digital wallet ideas, every other startup is in this niche. More often than not, these startups fail. So, what’s the reason?

Some things can go wrong and so it does.

In this section of the blog, we shall be looking at the common development mistakes to avoid while developing an e-wallet app. After which, we shall also look at some tips to avoid failure of digital wallet apps.

Let’s get right into it, starting with the first one.

1. Misunderstanding the Target Audience

Want to be successful among people?

Well, the first thing you need to do is understand your audience. And that’s one of the biggest reasons why digital wallet startup fails.

Regardless of what industry or what niche you are in now, you can no longer be product-centric.

Instead, you must think about your customers because that requires a thorough understanding of their behavior. Nowadays, this is why customer behavior is such a crucial perspective of marketing and businesses.

Misunderstanding their customer base is one of the most obvious mistakes digital wallet app startups make. Unfortunately, most businesses exaggerate their market by assuming that anyone who uses a mobile app is equally interested in using a mobile wallet.

However, you must remember that while digital wallet apps are a type of mobile application, they are different.

Now, you’re wondering, why? Well, because it offers a unique method of transacting.

As a result, people who are used to purchasing through credit cards and cash will initially be opposed to adopting this new technology. This inactivity in user behavior means that you must alter your financial business model accordingly.

Thus, you must create a plan that sells your wallet app and helps alter the customer’s mindset. Remember, cashback and discounts are only short-term solutions to the problem. If you want to run in the long race, you must alter this consumer behavior.

Therefore, change customer perception through customer support, marketing campaigns, and overall business model.

If you are planning to be the next big thing in the app world and not just another addition to a failed start-up, you’ll do well to avoid these development pitfalls.

2. Being Dependent on the User

Indeed, in general, mobile apps are dependent on end-users.

But we are talking about apps that deal with one’s secure or confidential information like biometric authentication, account details, or medical background.

This can overwhelm the user and as a result, people abandon these types of mobile apps.

Many people still balk at the idea of saving card numbers and account details in a mobile app.

Here, lack of digital trust is one reason such apps often don’t work well and often fail in the market.

Let us give you a few examples of the same:

-

Chicken-and-egg problem

Scenario: A digital wallet relies heavily on user features like peer-to-peer payments or social sharing. Without a critical mass of users, these features become useless, discouraging further sign-ups.

Consequence: This creates a chicken-and-egg problem where the lack of users hinders feature adoption, which in turn discourages new users, leading to a downward spiral.

-

Unrealistic expectations

Scenario: Overestimating user engagement can lead to unsustainable business models. Relying solely on transaction fees from a small user base might not cover operational costs.

Consequence: This dependence on high volumes of user activity can lead to financial strain, forcing the startup to either pivot its model or shut down.

-

Feature bloat

Scenario: Focusing solely on adding features to please users can lead to complexity and clutter. A bloated app with overwhelming options can alienate users and hinder adoption.

Consequence: Prioritizing quantity over quality can backfire, as users might struggle to navigate the app and ultimately abandon it for simpler alternatives.

Much easier to understand now, right?

Well, that’s what makes it one of the biggest development mistakes to avoid, and those who don’t become failed digital wallet startups.

3. Misunderstanding Their Offering

Lack of self-awareness is one of the top reasons why digital wallet app startups fail.

You see, digital wallets are not just mobile wallets. They are much more than that. This holds for all industries.

As a result, business owners must look at their offerings beyond the surface level. Undoubtedly, innovative features and relevant attributes matter.

But in the end, you must be selling a solution and a benefit to your customers. The masses won’t find your app relevant enough to switch their purchasing behavior if you don’t.

You must understand what your mobile app delivers in terms of benefits and value to the customers to market it according to the requirements.

So, don’t repeat this mistake as most startups do. Instead, ensure that you are not one of them.

Whether you want to build an app like Cash or go with a PayPal clone, try to avoid these development pitfalls.

4. Complex Navigation & App Design

UI/UX design is more important than ever.

Apps with good design have 22% higher conversion rates and 80% higher user retention rates, users form an opinion about an app within the first few seconds of using it, based solely on its design.

Meaning if the design is clunky, confusing, or visually unappealing, users are more likely to uninstall the app and never come back.

And digital wallet development companies have confessed that startups based on such ideas fail because of the complexity of their use. Make it one of the biggest digital wallet app creation mistakes to avoid.

End users cannot find simple digital wallet features like making payments, tracking transactions, checking history, balance inquiries, and many more.

As a result, without thinking much, customers can easily uninstall such apps.

But, no matter how complex or simple an app is, any app’s UI (user interface) and UX (user experience) always matter.

So, always keep in mind that a mobile app is developed to simplify day-to-day life and not complicate it further.

That’s why you should pay special attention to your digital wallet app design.

5. Digital Wallet Security Concerns

When it comes to mobile apps, security is paramount, let alone in the fintech industry that holds sensitive data.

It is witnessed that people are slow to adopt financial tools because of security issues in digital banking, and this skepticism causes various startups to fail.

Have you ever wondered? Why are digital wallet apps met with uncertainty and hesitance?

Don’t fret; I’ve explained this here. It is mainly because of the abrupt number of bank frauds that occur.

Indeed, digitalization has been a blessing for most of us, but it has also made our data vulnerable to potential cyber criminals and data breaches.

It is understandable why many potential customers find it hard to trust digital wallet apps at the aforementioned times.

Regrettably, one of the biggest reasons why digital wallet app startups fail is the failure to build trust from the get-go. This has caused various digital wallet apps to fail.

Therefore, it is essential to highlight what you do to ensure the digital wallet security of the data of your customers to achieve success in this industry.

6. Not focusing on App Marketing

One of the top 10 reasons why digital wallet app startups fail is not focusing on app marketing.

Indeed, there could be a possibility that the digital wallet app you are about to launch is pitch-perfect, and your users would love it.

But tech-savvy customers would fall for your app only if they know about it.

This is a major mistake that most digital wallet apps make. So, always keep in mind that you are not reaching your audience nor success in any case without the right marketing strategy.

These are a few likely reasons why so many E-Wallet-based startups have crashed miserably.

Here’s an example of this happening to a popular app:

Vine (short-form video platform, 2012-2017)

What it did: Pioneered short-form video sharing with six-second clips

Why it failed: Despite massive popularity and cultural impact, Vine struggled with monetization and competition from Instagram Stories. They failed to capitalize on their early success and adapt to changing user preferences. Additionally, internal conflict and a lack of investment from Twitter ultimately led to its demise.

Lesson: Adaptability and innovation are key in a fast-paced digital landscape. Apps need to evolve with user trends and adapt to competitive threats to stay relevant and secure long-term funding.

Don’t worry. Now that we have talked about what brings an app to the trench, let’s see how to take your digital wallet apps to the peak.

While this isn’t technically one of the most common development pitfalls in digital wallet apps as it comes after, you get the gist of it.

7. Not Standing Out

The market is filled with digital wallet apps like PayPal.

There are over 10,000 startups in this area of technology and that’s one of the answers to why digital wallet app startups fail.

You see, a lot of digital wallet startups make the mistake of not standing out enough.

The digital wallet niche, being a crowded market, makes it important to stand out in a field full of established players like Google Pay, Samsung Pay, and Apple Pay.

How does this happen?

Well, this starts with one of the common development pitfalls in e-wallet apps i.e. minimal added value.

If the wallet app doesn’t offer significant advantages over existing options, users won’t see the point in switching. In addition to this, as we already discussed, a poor user experience can be a great reason too.

This point is directly connected to the last one we discussed. To not fail as a digital wallet startup, one can take advantage of mobile app marketing.

8. Not Following Compliance & Regulations

One of the biggest challenges startups face is non-compliance.

And don’t be fooled, many digital wallet app startups failed, by not avoiding the development mistakes we are talking about.

Some examples are, as mentioned below:

Vault of Satoshi (Bitcoin wallet, 2013-2016):

What happened: Launched as a simple Bitcoin wallet, Vault of Satoshi failed to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This attracted legal scrutiny and eventually led to its shutdown by the New York Department of Financial Services.

Lesson: Compliance isn’t optional. Understanding and adhering to financial regulations, especially KYC and AML, is crucial for any digital wallet operating in regulated markets.

There are currently many types of regulations in place for the fintech industry as a whole. Including popular ones like GDPR and PCI.

Being one of the most common development mistakes in digital wallet apps, you can take the help of RegTech experts to become compliant as a startup. Doing this will take you a long way.

Now that we are done with the top reasons why digital wallet app startups fail, it’s time to look at some examples of successful ones in the section below.

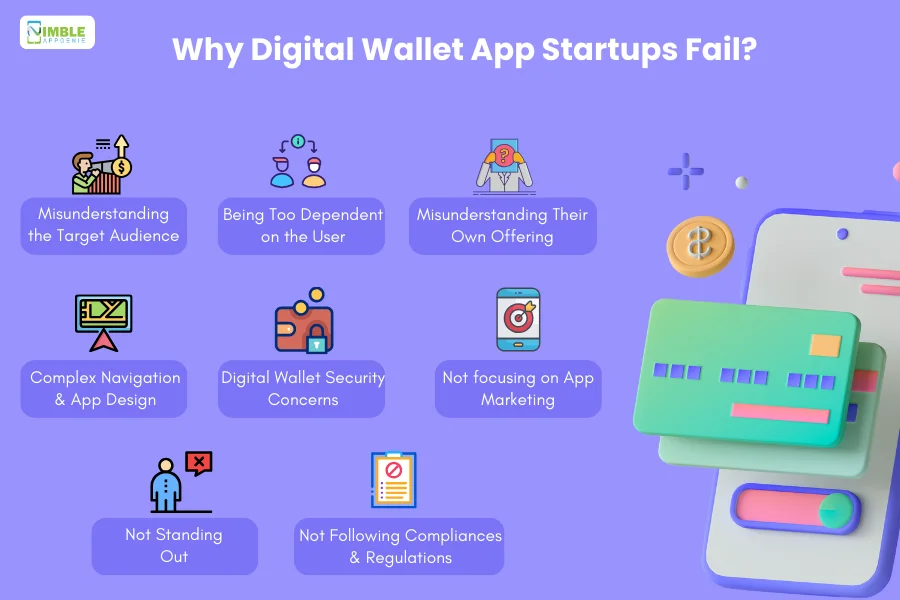

Bonus Infographic: Why eWallet Startups Fail?

Here’s a visual representation of the reasons for the failure of digital wallet app startups.

Work With Nimble AppGenie – A Digital Wallet Solution Partner for your Startups

Do you have an idea for a digital wallet startup that you think will disrupt the market?

We have a secret formula that turns ideas into successful digital wallet app startups. We are here to help you.

Nimble AppGenie is a renowned eWallet app development company that is a master at delivering innovation in the form of digital products.

Recognized by platforms like DesignRush, TopDevelopers, GoodFirms, and Clutch. co, we have the right tools and hands-on experience for 700+ projects. Includes:

- Pay By Check– Pay by Check is a popular e-wallet mobile app in the United States of America. It allows users to transfer, pay, or even exchange currency.

- SatPay – A Versatile eWallet Platform that allows users to request, receive, and send payments without hassle.

- CUT– an E-wallet Mobile App, CUT is available in China and Myanmar. It works well with both RMB and MMK currencies.

- SatBorsa – a Currency Exchange Fintech app. SatBorsa is one of the platforms that is available on both platforms, iOS and Android.

If you want to Hire mobile app developers who can convert your idea into reality, we are here to help you.

Conclusion

The guide gives the top reasons why digital wallet app startups fail. The success of a digital wallet startup hinges on avoiding common mistakes, understanding user behavior, prioritizing security, and embracing market trends.

Learning from examples like Square, M-PESA, Chime, Klarna, and Revolut, startups can thrive by offering value, ensuring a great user experience, and adapting to evolving customer needs.

Effective marketing, compliance, and transparent communication are also vital factors that contribute to the growth and longevity of digital wallet apps in today’s competitive landscape.

FAQs

Some common mistakes to avoid include misunderstanding the target audience, being too dependent on the user for sensitive information, failing to understand the unique value proposition of your digital wallet, having a complex navigation and app design, overlooking security concerns, not focusing on app marketing, not standing out in a crowded market, and not following compliances and regulations.

Understanding the target audience is crucial because digital wallet apps require a change in user behavior. Assuming that anyone who uses a mobile app will automatically be interested in using a mobile wallet is a mistake. Startups need to alter customer perception through marketing campaigns and customer support to encourage the adoption of digital wallets.

Security concerns in digital wallet apps include the potential for data breaches and cybercriminal activity. Users are hesitant to trust digital wallets due to the increased risk of bank fraud and data vulnerability. Digital wallet startups need to prioritize security and build trust with customers.

To ensure the success of a digital wallet startup, consider providing clear information about where the app can be used, offer immediate payment status updates to users, keep the app user-friendly and simple, prioritize security, and stay flexible to technological advancements. Additionally, analyze market trends and adapt your business model to fit user behavior.

Sure! Some examples of successful digital wallet startups include Square App in the USA, M-PESA in Kenya, Chime in the US, Klarna in Europe, and Revolut (Europe and beyond). Each of these startups targeted specific user needs and provided innovative solutions.

Successful digital wallet startups typically stand out by offering added value, prioritizing a great user experience, focusing on security, following regulations, and staying adaptable to market trends. They also often target specific niches or user groups and understand their unique needs.

Marketing is crucial for the success of a digital wallet app. Even if the app is well-designed and functional, it won’t succeed if users are not aware of it. Effective marketing strategies are essential to reach and engage potential users.

Successful digital wallet apps often offer features like seamless point-of-sale integration, peer-to-peer payment capabilities, business-oriented tools, fast and reliable transactions, mobile accessibility, offline functionality, versatile transaction options, and a wide network of agents for cash-related services.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.