eWallet apps are super popular. This is not only a trend among users but also investors, as there are 100s of companies and start-ups who want to create an eWallet app of their own. The first question they ask is:

“How much does it cost to develop an eWallet app?”

To ballpark it, the average cost to develop an e-wallet app ranges from $15,000 to $100,000+.

However, it is not that simple to give a correct estimation. The reason is that there is a range of factors involved in eWallet apps that affect the total cost in their own unique way.

In this blog, we shall be breaking down how the cost of building an e-wallet app is estimated, as well as how you can minimize the cost of building a digital wallet app.

So, whether you want to start your eWallet startup or improve your existing solution, this blog is for you.

Therefore, with this being said, let’s get right into it, starting with:

Understanding the eWallet App?

E-Wallet applications have become a household thing.

These are mobile-based applications that enable fintech transactions, account management, credit card management, contactless payment, and much more.

You can think of digital wallet applications as a virtual version of your real world, but much more capable. eWallet app features highly depend on the specific solution and what it’s offering. PayPal, Venmo, and Cash App are examples of popular eWallet apps.

But do mobile wallet apps need an introduction?

There are billions of people worldwide who use eWallet solutions in their day-to-day lives. And if you think this is an impressive state, here are even better ones:

eWallet App Market Stats

Fintech statistics show amazing growth in the eWallet app market.

Let’s look at some eWallet app statistics, which is why so many investors want to create an eWallet application. These are, as mentioned below:

- The digital payments market is expected to hit $10 trillion by 2026, from $4 trillion in 2023.

- eWallet app market size is forecasted to reach $567.2 billion by 2032.

- By 2025, there will be over 4 billion eWallet app users.

- Digital wallet transactions are projected to reach $16 trillion by 2028.

With billions of users and trillions in market size, these numbers describe the eWallet market quite well.

But there’s another number that’s even more concerning to investors and companies.

Let’s see how much it costs in the section below.

How Much Does it Cost to Develop an eWallet App?

The cost to create an e-wallet app on average ranges between $15,000 and $100,000.

Various factors affect the development cost of a mobile app. This includes the complexity of the application, platform, feature set, tech stack, and much more.

| Complexity of the eWallet App | Cost Range |

|---|---|

| Basic eWallet | $25,000 – $50,000 |

| Intermediate Complexity | $35,000 – $70,000 |

| Advanced Complexity | $50,000 – $100,000 |

Now, estimating the development cost for an eWallet app without knowing the project specifications is next to impossible.

Speaking of which, let’s move on to the next section where we shall be discussing the different factors that affect total development costs.

eWallet App Cost Affecting Factors

The correct answer to the question, “How much does it cost to develop an eWallet app?” is that it depends.

The reason is that there are a lot of factors involved in such a project. Each factor has its own way of affecting the total wallet app development final cost. Now, if you want to estimate the cost of your project, you must understand how these factors work.

Therefore, in this section, we will be discussing each one in detail.

Factor 1. Development Platform & Its Effect on Cost

Let’s start with the first thing you have to choose when you decide to build an eWallet app.

As such, there are three popular choices:

- Android App

- iOS App

- Hybrid App

Each of these platforms comes with its own unique associated costs.

| Platform | Cost |

|---|---|

| Web Apps | $20,000 to $35,000 |

| Native | $40,000 to $70,000 |

| Hybrid Apps | $25,000 to $75,000 |

| Cross Platform | $30,000 to $50,000 |

Even in native app development, Android and iOS have different costs. For instance, the cost to develop an Android app is usually higher than the cost to build an iOS application.

Why Is Android App Development More Expensive Than iOS?

Contrary to popular belief, the cost to develop an Android app is higher than an iOS app. And there’s a good reason behind that.

Fragmentation: The Android user base suffers from digital fragmentation as it is divided between millions of users still using old phones with outdated hardware and software. Android app development cannot be ruled out, as it will cut out a significant user base, and developing an app for each version is what adds to the cost.

This is one of the major factors that affect the cost of making an e-wallet app, and with this out of the way, let’s move on to the second.

Factor 2. Essential & Advanced Features

eWallet app features have a significant effect on the feature. Here’s how:

When we talk about developing an eWallet application, selecting features is an important part. Here, we have to select the right amount of basic features as well as advanced ones.

The basic ones are really easy to develop and don’t add that much to the cost. On the other hand, when we talk about advanced eWallet app features or something unique based on an app idea, they are a lot more expensive.

Let’s look at a few advanced e-wallet features and how much they add to the cost:

| eWallet App Basic Features & Associated Cost | |

| Features | Estimated Cost |

| User Registration | $5,000 – $8,000 |

| User Authentication | $8,000 – $12,000 |

| Wallet Management | $15,000 – $20,000 |

| Transaction History | $8,000 – $12,000 |

| Notifications | $5,000 – $8,000 |

| Security Features | $15,000 – $20,000 |

| Payment Integration | $15,000 – $20,000 |

| Admin Dashboard | $10,000 – $15,000 |

♦ NFC For Contactless Payment

NFC is a new technology that enables secure and fast contactless payment. Now, if you integrate NFC mobile payment as an advanced feature, it will send you back an additional $5,000 – $8,000 to the development cost.

♦ QR Code

If you have ever used an eWallet application, you know what QR code payments are. Now, to enable this functionality in your solution, i.e., to integrate this advanced feature, you have to pay an additional cost of around $4,000 – $6,000

♦ AI integration

In Industry 4.0, AI has become a leading technology. AI integration in digital payments can be used for a great many things and add amazing functionality. This includes automation, smart suggestions, advanced personalization, AI-powered Fintech Chatbots, and much more. The cost of AI integration highly depends on its application.

♦ UPI Integration

With the popularity of UPI, there are a lot of eWallet companies that are considering this. The cost to integrate UPI functionality is estimated to be around $4,000, while the UPI app development cost is around $15,000 to $150,000.

| Advanced eWallet Features and Associated Cost | |

| Peer-to-Peer Transfers | $10,000 – $15,000 |

| QR Code Payments | $4,000 – $6,000 |

| NFC Payments | $5,000 – $8,000 |

| Bill Splitting | $8,000 – $12,000 |

| Virtual Cards | $10,000 – $15,000 |

| Loyalty Program Integration | $10,000 – $15,000 |

| Cryptocurrency Support | $12,000 – $18,000 |

| Advanced Analytics | $8,000 – $12,000 |

| Voice Commands | $5,000 – $8,000 |

| Social Media Integration | $5,000 – $8,000 |

| Advanced Security Measures | $10,000 – $15,000 |

| Multi-language Support | $5,000 – $8,000 |

These are some of the advanced eWallet app features and their associated costs.

Factor 3. eWallet App Design

First impressions are very important, especially when we are talking about eWallet app design.

But did you know that design can also affect the total digital wallet app development cost? Well, it is true. The reason is that the more complex the design is, the more expensive it is going to be.

However, this is an investment that pays for itself, as a well-designed eWallet app will drive traffic, user retention, and lead generation. If you want to create a market-leading app, collaborate with a good UI/UX design company.

Factor 4. Types of eWallet Applications

Depending on the technology and offering, there can be different types of eWallet applications. Each of these types has different development costs associated with it.

Let’s see the same below:

| Type of eWallet App | Features | Cost Range |

|---|---|---|

| Basic eWallet | Account creation, balance check, transactions | $15,000 – $50,000 |

| Peer-to-Peer (P2P) Wallet | P2P transactions, QR code scanners, notifications | $30,000 – $60,000 |

| Mobile Banking Wallet | Basic banking features, fund transfers, and bill payments | $40,000 – $80,000 |

| NFC-based Wallets | Near-field communications (NFC) payments | $35,000 – $70,000 |

| Cryptocurrency Wallet | Crypto transactions and wallet security features | $50,000 – $100,000 |

| Retail/Store Wallet | Loyalty programs and in-store payments | $35,000 – $70,000 |

| Multi-currency Wallet | Support for multiple currencies | $40,000 – $80,000 |

| Wallet with Biometrics | Fingerprint/face recognition for security | $45,000 – $90,000 |

| Virtual Card Wallet | Virtual card creation and management | $30,000 – $60,000 |

| Wallet with Chat Support | Customer support chat integration | $35,000 – $70,000 |

Factor 5. App Complexity

Complexity is the single largest factor that affects fintech app costs. Not only that, but it also affects the entire app development process at many levels.

As a general rule of thumb, the more complex an application is, the more work it requires; developers working on the platform should have more experience and whatnot. All of this combines to add to the cost.

| App Complexity | Complexity Level | Average Cost |

| Simple app | MVP functionality and Basic UI | $15,000 – $50,000 |

| Medium Complex app | Sophisticated features: Custom UI | $35,000 – $70,000 |

| Highly complex app | High-level advanced features: Bespoke UI, two platforms | $50,000 – $100,000 |

Elements That Add Complexity to eWallet App Creation

Various factors add to the complexity of mobile app development of any sort. This includes the design, features, and technologies used in development, as well as the development methodology used. This is what makes it the most important factor that affects the development cost of an eWallet app.

As such, complexity also has a great effect on mobile app development time, as that’s the second thing people are most concerned about after the cost of creating an eWallet app.

Factor 6. App Development Tech Stack

eWallet app tech stack is an important factor to consider when discussing not only the cost but eWallet app itself.

The reason is that in addition to development costs, it also affects time, feature set, developer team choice, and much more.

So, a table considering everything from software development tools to eWallet app security tools and their associated costs is shown below:

| Backend Development | Node.js, Django, Flask, Ruby on Rails, Laravel | $5,000 – $15,000 |

| Database | MySQL, PostgreSQL, MongoDB | $3,000 – $10,000 |

| User Authentication | OAuth 2.0, JWT | $2,000 – $5,000 |

| Payment Gateway | Stripe, PayPal, Braintree | $3,000 – $10,000 |

| Push Notifications | Firebase Cloud Messaging (FCM), OneSignal | $2,000 – $5,000 |

| Cloud Storage | Amazon S3, Google Cloud Storage, Azure | $1,500 – $4,000 |

| eWallet Security | SSL/TLS, Two-Factor Authentication, biometric authentication | $2,000 – $5,000 |

| Analytics | Google Analytics, Mixpanel | $1,500 – $4,000 |

| UI/UX Design | Custom design, Adobe XD, Sketch | $3,000 – $8,000 |

| Quality Assurance | Testing and Bug fixing | $3,000 – $8,000 |

| Project Management | Jira, Trello, Asana | $1,500 – $4,000 |

Apart from this, there are also other miscellaneous things like Fintech APIs and integration with mobile payment technology that add around $3,000 – $6,000 to eWallet software development cost.

How to Choose the Right Development Tech Stack for Your eWallet App?

The tech stack greatly affects the performance of eWallet applications.

That’s why it is super important to choose the right tech stack during the development process. So how do you choose the right tech stack?

Well, here are some factors to consider:

- Project requirements

- Team expertise

- Scalability needs

- Community support

- Cost considerations

- Integration capabilities

- Security features

- Performance factors

- Future-proofing

- Prototyping and testing

- Regulatory compliance

- User experience

- Flexibility and maintenance

One of the easiest ways to create or choose a tech stack for your project is to consult an on-demand app development company.

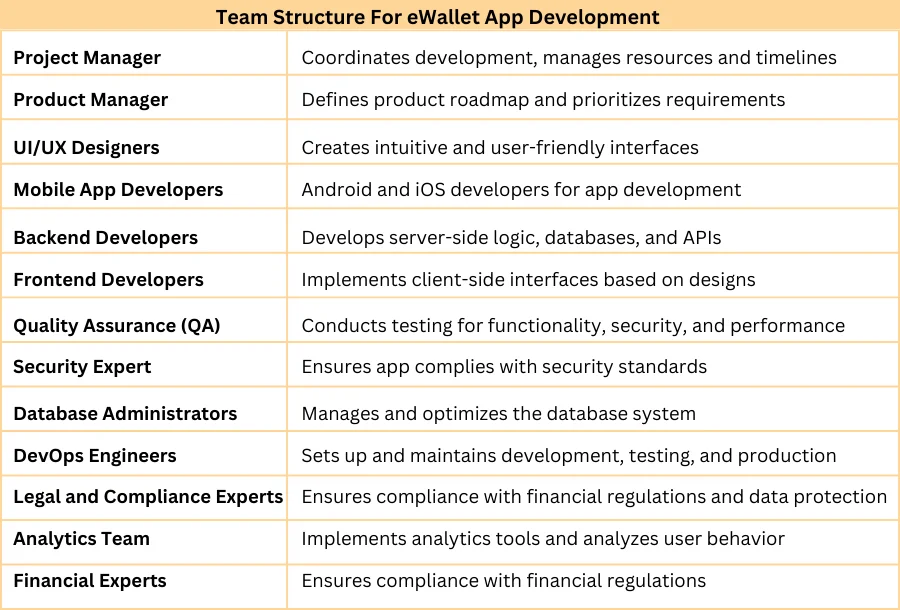

Factor 7. Development Team

If you want to create an eWallet app, the first thing you need is an app development partner. So, it’s time to hire mobile app developers. This will give you a few options.

♦ In-house Team

The first and most expensive way to acquire a development team is in-house. Currently, there are various benefits of having an in-house team, but they are easily outweighed by the total cost associated.

That’s why in the debate of in-house vs outsourced, companies prefer the latter one. Let’s go discuss that.

♦ Outsource to Fintech Development

There are various benefits of fintech development outsourcing.

For instance, it reduces the overall cost of developing an eWallet app, there is less responsibility, the solution is delivered faster, and you have more control over everything.

This is why it has become a trend in the market to outsource app development projects.

♦ Staff Augmentation (if you already have an in-house team)

This is an option for when you already have an in-house team of mobile app developers but need a helping hand to speed up the project. You want a specific skill set from the developer.

IT staff augmentation is much cheaper than hiring developers.

| Developer Experience Level | In-House (Onshore/US) | Outsourcing (Offshore) | Staff Augmentation (Mixed) |

|---|---|---|---|

| Junior Developer | $30 – $50 | $10 – $20 | $20 – $30 |

| Mid-Level Developer | $50 – $80 | $20 – $30 | $30 – $40 |

| Senior Developer | $80 – $100 | $30 – $40 | $40 – $50 |

| Lead Developer/Architect | $100 – $150+ | $40 – $60+ | $50 – $75+ |

Factor 8. Developer’s Location & Experience

Well, apart from the type of development team you are working with, there’s another factor that affects the cost to hire an app developer. Thus, adding to the total cost of developing a digital wallet app.

| Developer Experience Level | United States (Onshore) | United Kingdom (Onshore) | Western Europe (Onshore) | Eastern Europe (Offshore) | India (Offshore) | Southeast Asia (Offshore) |

| Junior Developer | $30 – $50 | £20 – £40 | €25 – €40 | $10 – $20 | ₹500 – ₹800 ($7 – $11) | $10 – $20 |

| Mid-Level Developer | $50 – $80 | £40 – £60 | €45 – €70 | $20 – $30 | ₹800 – ₹1,200 ($11 – $16) | $15 – $25 |

| Senior Developer | $80 – $100+ | £60 – £80+ | €70 – €90+ | $30 – $40+ | ₹1,200 – ₹1,500+ ($16 – $20+) | $20 – $35+ |

| Lead Developer/Architect | $100 – $150+ | £80 – £120+ | €90 – €130+ | $40 – $60+ | ₹1,500 – ₹2,000+ ($20 – $27+) | $30 – $50+ |

The differing costs based on the location of the developer are what make it an important factor to consider when you find an app developer.

How Does an App Developer’s Location Affect Cost?

There are a lot of factors behind the different costs of hiring developers in different locations. For instance, the country’s currency strength depends on the number of developers, and so on.

So, these are the major factors that affect the digital wallet app development cost. Now, it’s time to look at some of the hidden factors involved:

Hidden Factors that Affect the Cost to Build an eWallet App

Whenever the cost of a product is mentioned, we can’t help but think, “Is there a hidden cost?”

And this remains true when we speak of development costs. Now, whether you want to create a fintech app for a startup or an online payment solution for a Fortune 500 company, hidden factors play a big role.

So, to remove the veil, let’s see what these factors are.

1. Quality Assurance

First up, we have Quality Assurance, often also known as mobile app testing.

The main goal of QA is to make sure that the eWallet app is meeting the stated requirements. Simple apps don’t need as much rigorous testing as complex apps do. These complex apps need comprehensive testing to make sure they are working fine.

Therefore, depending on the complexity of the application, app testing may require more funds, thus adding to the total cost.

2. Infrastructure Cost

Another major factor is infrastructure costs.

IT infrastructure is important to ensure the smooth running of an eWallet business. When we speak of Infrastructure costs, we are talking about the expenses included for data storage, delivery, servers, and app hosting.

These services require load sharing for backup, leading to more complexity in the project. This can affect and vary the development cost.

3. IT Support Cost

If you want your eWallet app to be among the top fintech apps, IT support is crucial as it contributes to proper app functioning. This includes API maintenance, troubleshooting, other preventive and corrective measures, new updates, and much more.

Although this ongoing support is necessary, it can affect your budget a lot. So, this is another factor to consider that affects the cost to create an e-wallet app.

4. App Publishing Cost

Whether you want to deploy your app on the Play Store or App Store, there’s a significant fee you have to pay.

5. App Security

E-wallet app security is super important. Even a small security alteration can impact your business in any way possible.

As eWallets are prone to breaches and hacks, it becomes necessary to implement proper security measures and quality controls to ensure your app’s safety.

If not taken initially, it can lead to the vulnerability of the app, resulting in higher costs later.

How Can You Reduce Your Development Cost?

From primary factors to hidden costs, the cost of developing an e-wallet app can rise in no time. Some might assume this to be overweight gains from eWallet app monetization channels.

So, is there any way to reduce this cost? Well, there it is!

Before you start your journey with a fintech app development company, knowing these aspects will help you take care of these factors and reduce the development costs.

1] Create a Product Requirement Document

The key to building a successful product is to plan for it.

The document you will hand over must have your vision, the objectives of the app, features, tech stack, budget, and vital information. This will help them to have a good understanding of your goals and work on them accordingly.

Consequently, it will save you a lot by eliminating errors and reducing further costs.

2] Prioritize App Features Correctly

If you want your app to be successful among people, you need to get the features right.

It’s a smart move to add important eWallet app features that are relevant & necessary for your users. You can add extravagant app features later, adding to unnecessary costs. Putting it simply, every additional feature can add to development costs.

So, prioritize the ones that are important for both businesses and customers.

3] Build an MVP

MVP app development is a must for businesses.

It has all the must-have features that will help you see more success. Building an MVP helps you to understand your customers’ needs and see whether your product meets their requirements or not.

This helps in understanding if your solution would be viable and also helps to grasp business opportunities in the market at a very affordable price. So, it is highly advisable to get the MVP developed to know about the early version of the app.

4] Build for the Future

Currently, the market is very dynamic. So the e-wallet app idea you have right now may not be relevant in a few years.

It may be possible that your app may not be future-proof, or the dynamics of your market may change. So, it is best to plan in that direction beforehand. It is advisable to clarify the ultimate objective of your eWallet app, as it can affect your development cost.

Suppose you have the MVP with the necessary features to lower costs, but in the future, as your business scales, you might want to add some more functionalities to it. So, thinking thoroughly can help to get ready beforehand.

Moreover, creating a future-ready platform saves a lot of cost in mobile app maintenance as well as upgradation.

5] Involve Quality Assurance Early on

eWallet apps are exposed to errors and bugs.

To make sure your app is functioning well, you need to get hold of them as quickly as possible. By employing quality specialists from the early stage, you can not only eliminate severe issues but also save a lot of money. It also ensures higher security when enabling Open Banking API integration and payment gateway integration.

Also, we can make sure your app is free of technical issues and complies with rules and regulations.

6] Build for Multiple Devices

Users are scattered across multiple platforms, so it becomes important to launch an app that works seamlessly on all platforms.

If you are going to create an app separately for iOS and Android, it will not be a cost-effective option for you. To save on your cost of building a fintech app, we suggest you employ cross-platform apps.

These apps eliminate the need to be rewritten separately, saving you a large chunk of money and providing a better reach for your app.

How Nimble AppGenie Can Help You Make an E-wallet App?

Considering all the necessary points in the above write-up, creating an e-wallet app is the best decision you can make for your business. If you are planning to take things further with the help of a reliable partner, then look no further than Nimble AppGenie.

We are a market-leading eWallet app development company delivering solutions with innovative and out-of-the-box features. With the growing demand for eWallet applications, we believe getting solutions from us will help your business see a bright future.

Nimble AppGenie has professionals who have hands-on experience with the latest tools and technologies to make your eWallet a big success in the market.

Conclusion

eWallet has been around for a few years. It has gained popularity for providing a seamless and secure way for users to make payments & manage finances. E-Wallet apps help businesses gain a competitive edge and follow market trends.

While creating an app for eWallet, you have to choose the right set of features to make your app memorable to your users. Most importantly, you need to focus on enhancing the customer experience.

To mark your presence in the fintech industry, join hands with a reliable company, Nimble AppGenie, and get your idea turned into a creative digital solution.

FAQs

If you have any queries, we believe the FAQs below will help you understand further.

Yes, you can. You can link credit/debit cards, bank accounts, crypto wallets, and many more. To provide users with better choices, you should get payment integration with different channels in your app.

Digital wallets are becoming popular for providing numerous benefits to both businesses and users. This includes easy and secure payment processing, removing the need to carry cash, proper cash flow management, enhanced user experience, and much more.

It depends on your business’s complexity and features. However, on average, the development time of an e-wallet app ranges from three to nine months, which may vary for different reasons.

The cost to develop an eWallet app also varies depending on various factors that include features, tech stack, development company experience, platform for development, and many more. This may cost you $15,000 to $100,000. The cost can increase or decrease as per changes in the solution.

You can reduce the development cost of an e-wallet app by creating a detailed product need document, building an MVP, testing & quality assurance, cross-platform, and prioritizing the right app features for your solution.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.