Digitalization has brought a revolution in several industries and it has even changed the way of living. One of those is the finance industry.

It has made financial management easy and simple to operate from the comfort of home.

Loan lending is one of the important parts of finance and is not a struggle nowadays. With loan-lending apps, it has become just a piece of cake to get a loan in simple steps.

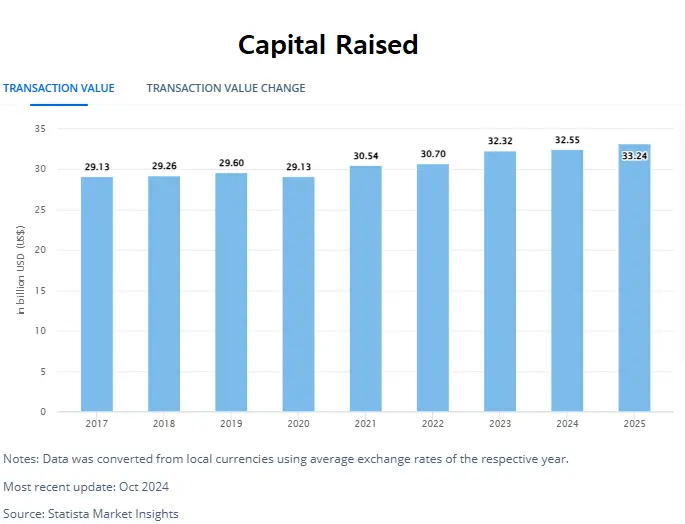

Do you know that the lending market is expected to reach a value of US $33.24 billion in the year 2025?

Are you planning to create a loan lending app? How much does it cost?

When one thinks of creating an app, we understand that cost plays a significant role in this process.

However, estimating the cost of creating a money-lending app is no longer a cumbersome process.

Well, the average cost to develop a Loan Lending App can be between $20,000 and $150,000. Moreover, certain factors can impact it.

Want to know more? Here’s all you need. Let’s get started.

What are the Factors Impacting the Cost to Develop a Loan Lending App?

Now that you have a clear idea of the cost of developing a loan lending app, it is essential to figure out some of the factors affecting it.

Here’s a detailed list to check out.

1. Complexity of App

What do you think the mobile app complexity looks like?

The more complex features you demand, the higher the amount needed to be invested. Such as including Gamification in loan lending apps can have high costs.

The complexity of an app deals with several features, components, interactions, and functionalities with the app’s codebase.

It can be technical, functional, and operational.

A wide range of functions requires more maintenance and high resources. Here’s a table to look for the complexity factor impacting the cost of creating a Loan Lending App.

| Complexity Level | Description | Cost Range |

| Low Complexity | Basic features: simple UI, minimal integrations | $20,000 – $50,000 |

| Medium Complexity | Advanced features, better UI/UX, some integrations | $50,000 – $100,000 |

| High Complexity | Comprehensive features, extensive integrations, advanced security, high scalability | $100,000 – $150,000 |

You can hire mobile app developers to identify more regarding the impact of complexity factor over the costs.

Also Read: Loan Lending App Features

2. Platform Compatibility

Cross-platform compatibility is an important ability related to software applications to run over multiple operating systems and different devices.

If you choose to launch an app over different app platforms, including Android and iOS, then get ready to pay more.

Selecting multiple platforms can cost you much more. Thus, you should select this option only in case there are higher chances to reach target audiences.

The table will help you to address the issue related to platform compatibility.

| Platform | Description | Cost Range |

| Android | Development for Android devices only | $20,000 – $75,000 |

| iOS | Development for Apple devices only | $25,000 – $75,000 |

| Cross-Platform | Develop using frameworks like React Native or Flutter for both iOS and Android | $50,000 – $100,000 |

| Web | Web-based applications accessible via browsers | $20,000 – $75,000 |

| Multi-Platform | Native apps for iOS and Android, plus a web app | $100,000 – $150,000 |

3. App Design

App design is another component affecting the development cost of a loan lending app. The complex designs cost more than the simple designs.

A more complicated design is associated with high costs due to its intricate nature and additional features.

Animations and custom interactions require more time and high investment can enhance cost to create a Loan Lending App.

The table will assist you with the app design cost.

| Design Complexity | Description | Cost Range |

| Basic Design | Simple UI/UX, standard templates, minimal customization | $20,000 – $50,000 |

| Moderate Design | Custom UI/UX, more interactive elements, some animations | $50,000 – $100,000 |

| Advanced Design | Highly custom UI/UX, extensive animations, premium design elements | $100,000 – $150,000 |

A UI/UX design company can help you in the process of deciding the cost of developing a loan lending app.

4. Tech Stack

The type of technology, database, and language you select for the app development process plays a significant role in deciding the costs.

Tech Stack comprises frameworks, APIs, databases, front-end and back-end tools along with the programming languages.

Here is the table to help you decide on the loan lending app tech stack and how this factor impacts the loan lending mobile app development costs.

| Tech Stack | Description | Cost Range |

| Basic Stack | Standard web technologies (e.g., HTML, CSS, JavaScript) | $20,000 – $50,000 |

| Intermediate Stack | Popular frameworks (e.g., React, Angular, Node.js) | $50,000 – $100,000 |

| Advanced Stack | Cutting-edge technologies (e.g., AI, blockchain, microservices) | $100,000 – $150,000 |

An effective fintech development tech stack requires you to look forward to the latest technology that can help you remain competitive in this era.

5. Development Team

Now, we will discuss the last but most important factor that impacts the cost of money-lending app development.

There are two important parameters that you need to check before deciding to connect with a fintech app development company.

These factors include the experience and locations of the developers.

The table will assist you in deciding the right team for app development.

| Team Location | Experience Level | Description | Cost Range |

| Local (US/Western Europe) | Junior | Less experienced, entry-level developers | $50,000 – $75,000 |

| Local (US/Western Europe) | Mid-Level | Moderately experienced developers | $75,000 – $125,000 |

| Local (US/Western Europe) | Senior | Highly experienced and expert developers | $125,000 – $150,000 |

| Offshore (Eastern Europe/Asia) | Junior | Less experienced, entry-level developers | $20,000 – $50,000 |

| Offshore (Eastern Europe/Asia) | Mid-Level | Moderately experienced developers | $50,000 – $75,000 |

| Offshore (Eastern Europe/Asia) | Senior | Highly experienced and expert developers | $75,000 – $100,000 |

Deciding on the location and expertise will be simple when you are determined to build a fintech app of your dreams.

Now, as you learned the diversified factors impacting the cost of building a loan lending app along with the average costs impacted through these factors, it’s time to learn certain important strategies that can help you reduce the costs.

The next section will say it all.

Strategies to Decrease the Cost to Develop a Loan Lending App

In the process of completing the best loan lending apps, learning costs and factors impacting it are okay, along with this you can optimize the overall cost.

Yes. You can do it pretty well by learning the simple ways. Here is the list you can follow.

► Clear the Objectives and Aim

You should clarify the aim and objective of developing an app before executing it. A clear objective is essential for reducing the cost to build a loan lending app.

Once you get clarity on the reason, it will become easy to decide on the cost required to make it.

► Need to Select the Right Team

If you select the wrong team, or a company at a far distant location where it is impossible to get connected then it may result in increasing the cost of creating a loan lending app.

Hence, you should decide the team successfully by evaluating two common factors: location and experience.

► Implement New Technologies

Avoiding the adoption of new technologies will automatically cut you out of the competitive market.

Thus, to remain intact in the dynamic market, it is essential to adopt current technologies that can help you to sustain. Here implementation of AI, iOT, or machine learning can help.

► Develop MVP

Developing a minimal valuable product (MVP) cannot put you at a loss; instead, it will increase your expenses.

You should develop MVP as it is an important strategy that can help to identify the features preferred by the early adopters.

This will provide you the opportunity to implement significant changes as per feedback.

► Regular Testing of Your App

You should perform regular mobile app testing that will simply assist in identifying bugs and errors that can be faced by real users.

Testing the app will increase overall performance and ensure the growth of business by targeting potential app users.

► Outsource App Development

If you do not have an in-house team, then you must adopt outsourcing process. All you need is to present a proposal to them, get estimates, and begin the idea of a journey.

However, if the team lacks the necessary tech skills, then it’s important to outsource the project to a third party.

► Resource Optimization

Wasting resources is directly related to the budget. Thus, you should evaluate that the optimization of resources is of prime importance when it comes to estimating the cost of loan lending app.

It even improves user experience and reduces frustration which simply promotes engagement.

Now that you are clear with the strategies to minimize the cost of a loan lending app, what about earning money from it?

We understand that earning money is one of the reasons behind creating an app. Let’s learn some of the important monetization models.

How to Earn Money by Developing a Money-Lending App?

Till now, you learned how much it costs to develop a loan lending app along with the factors impacting them.

With the strategies, you get a clear picture of how money lending apps make money.

Now, it’s time to know important measures to overcome costs invested in app development.

Should we start?

♦ Monetize the App With Ads

You can monetize the app with ads through mobile banners, in-app ads, rewards for an app, and gamified In-app ads.

The mobile app banners comprise desktop websites which include banner ads within the headers, sidebars, and footers.

Rewarded advertising has a big impact on people, where app users get some additional points or vouchers to get loans at discounts.

♦ Subscription Method

This is one of the popular methods to overcome the developing cost of a loan lending app.

In this subscription monetization model, revenue gets generated by charging users a recurring fee at regular intervals.

Here your app may need a monthly and annual membership charge rather than a one-time purchase.

Users pay repeatedly on the intervals which grant them access to loan-lending services.

♦ In-App Purchases

An in-app purchase helps the users to buy additional features, services, or content within the app.

This monetization method not only helps to cover the development cost of loan-lending apps but also provides a steady source of revenue.

Here users are provided with some basic features to use within the app. Once they get familiar with the app services, they are asked to pay an additional amount to use premium features or services.

♦ Monetization With Data-Licensing

Data monetization is a method where you can monetize the data collected from the app in exchange for money.

This data can be used to learn more about the customers and their changing preferences. Here you should remember that the data should be exchanged only with the consent of the app users.

Many of the popular brands buy this data to create reports on users’ behaviors related to using apps.

♦ Affiliate Marketing

Affiliate marketing is one of the trendy techniques to overcome the developing cost of a loan lending app. Under this method, affiliates get a commission for every visit or sale they generate.

It can be a useful method in increasing user engagement on loan lending apps.

In return, for affiliate marketing the business owners make a commission on the sale that provides them a stable way of earning money.

♦ Partnerships and Sponsorships

You can align the loan lending app with diversified sponsors and find that the return extends beyond the immediate revenue generation.

This can provide them with long-term benefits after including enhanced brand perception and user retention that automatically contribute to overall success and brand sustainability.

Here you can connect with the fintech firms and form partnerships to reach potential users.

When you decide to develop an app like Afterpay, it’s obvious to search for a trusted app development team.

Before you proceed to select a team for your app, keep a note to select a company that has genuine client reviews, is trustworthy, understands the market, and has experience enough to continue with the process.

Partner With Nimble AppGenie to Develop a Loan Lending App

Learning about cost estimation is the foremost step toward app development. The next is to select a trustworthy team.

Collaborate with Nimble AppGenie, we are an experienced loan lending app development company with a well-skilled panel of app developers.

We can help you to decide on the features, can provide you with budget estimation, and will stick to it till the completion of the whole project.

Understanding the client’s requirements and their needs is one of the prime alternatives that our firm serves.

Conclusion

The average cost to develop a money lending app can be decided by understanding factors impacting it.

These factors comprise complexity, app design, tech stack, and development team.

Several strategies can be adopted to reduce the overall cost of building a money-lending app including outsourcing, regular testing, developing MVPs, and resource optimization.

Furthermore, the adoption of multiple monetization strategies can be effective in overcoming invested costs.

These techniques can be in-app purchases, subscription methods, data licensing, partnerships, and sponsorships.

Overall, the selection of the right team can help you succeed in the market competition.

FAQs

The average cost to develop a loan lending app can vary from $20,000 to $150,000. However, there are certain factors that you should consider before deciding the costs including complexity, app design, platform compatibility, tech stack, and app development team.

The multiple factors that impact the money-lending app can be defined as below.

- Complexity: The more complex app demands a high investment cost.

- App Design: Complicated app designs including graphics and animation can cost a lot although they are built to attract potential users.

- App Compatibility: If you want to launch the app on different app platforms including Android and iOS then it can impact your overall budget to make an app.

- Tech Stack: The type of technologies you select to make an app including database, computer languages, and the implementation of the latest technologies can impact the overall costs.

- Development Team: The right team is capable of reducing the cost or can manage it accordingly. To select a team, you should consider location and expertise as crucial factors.

Yes, you can outsource the app development process, implement new technologies, develop an MVP, and perform resource optimization strategies to reduce the cost of building a loan lending app.

Suitable monetization strategies can be in-app purchases, affiliate marketing, data monetization, advertisements, and subscription methods. These methods are effective in earning revenue from building a loan lending app.

The choice of platform significantly impacts the development cost. Here’s a breakdown:

- iOS or Android Only: Developing for a single platform costs between $20,000 and $75,000.

- Cross-Platform: Using frameworks like React Native or Flutter to develop for both iOS and Android can cost between $50,000 and $100,000.

- Multi-Platform: Developing native apps for iOS, Android, and web applications costs between $100,000 and $150,000.

Design complexity directly influences the development cost:

- Basic Design: Simple UI/UX with standard templates and minimal customization costs between $20,000 and $50,000.

- Moderate Design: Custom UI/UX with interactive elements and some animations costs between $50,000 and $100,000.

- Advanced Design: Highly custom UI/UX with extensive animations and premium design elements costs between $100,000 and $150,000.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.