Gamification in loan lending apps can significantly enhance user engagement and satisfaction.

Gamification leverages game-design elements like points, badges, and leaderboards to make financial tasks more interactive and enjoyable.

By making the loan process engaging, loan lending apps can attract more users, encourage responsible borrowing, and improve financial literacy.

This blog explores the benefits, implementation strategies, and challenges of loan lending app gamification to help developers and businesses optimize their apps for a better user experience.

Therefore, let’s get right into it:

Understanding Gamification

Gamification is the application of game-design elements and principles in non-gaming contexts.

This is done to enhance user engagement, motivation, and overall experience.

It involves incorporating elements such as points, badges, leaderboards, challenges, and rewards into applications or services to make them more interactive and enjoyable.

The primary goal of gamification is to tap into the human desire for competition, achievement, and recognition, thereby encouraging users to engage more deeply with the platform.

In a gamified system, users earn points or rewards for completing specific actions or reaching milestones, which can be tracked through leaderboards or progress bars.

This not only provides immediate feedback but also fosters a sense of accomplishment and progression.

Badges and virtual rewards serve as status symbols, motivating users to continue their engagement and strive for higher achievements.

Gamification has been widely adopted in various industries, including education, healthcare, marketing, and finance, due to its effectiveness in driving user engagement and behavior.

By making mundane tasks more enjoyable and rewarding, gamification helps businesses achieve higher user retention rates, increased customer loyalty, and improved user satisfaction.

In the context of loan lending apps, gamification can transform the user experience, making the process of applying for and managing loans more engaging and less daunting.

Loan Lending App Gamification Examples

Even the best loan lending apps in the market are leveraging gamification.

After all, incorporating gamification in loan lending apps can significantly enhance user engagement and satisfaction.

Here are some real-world examples of how gamification is applied in loan lending apps that are live today:

► Kiva

Kiva is a peer-to-peer lending platform that allows users to lend money to low-income entrepreneurs and students in over 80 countries.

Kiva incorporates gamification by allowing lenders to track their impact through visual dashboards and progress bars.

Lenders can see how their loans are making a difference, which motivates them to continue lending.

In addition to this, Kiva awards badges and achievements to users based on their lending activity, fostering a sense of accomplishment and encouraging continued participation.

Key Gamification Elements:

- Impact Tracking: Visual dashboards and progress bars to show the impact of loans.

- Achievements and Badges: Users earn badges for lending activity milestones.

- Motivation to Lend More: Enhanced engagement through visible social impact.

► Zopa

Zopa, a UK-based peer-to-peer lending service, uses gamification to enhance the user experience by integrating a points and rewards system.

Borrowers earn points for on-time payments and responsible financial behavior, which can lead to lower interest rates on future loans.

This system not only rewards users for good behavior but also encourages them to maintain their creditworthiness.

Key Gamification Elements:

- Points System: Borrowers earn points for on-time payments.

- Rewards: Points can lead to lower interest rates on future loans.

- Encouragement of Responsible Behavior: Promotes maintaining good creditworthiness.

► Upgrade

Upgrade is a financial technology company that offers personal loans and credit lines.

Their app incorporates gamification by offering a credit health tool that helps users monitor and improve their credit scores.

Users receive personalized tips and milestones for improving their credit health, and they can track their progress through an interactive dashboard.

This gamified approach makes the process of credit improvement more engaging and informative for users.

Key Gamification Elements:

- Credit Health Tool: Interactive dashboard for monitoring credit scores.

- Personalized Tips: Guidance on improving credit health.

- Milestones: Users achieve milestones for credit score improvement.

► Lenddo

Lenddo uses gamification to assess the creditworthiness of borrowers by analyzing their social media behavior and online activity.

The app provides users with a credit score based on their digital footprint, rewarding responsible online behavior.

Users can improve their credit score by engaging in positive online activities, which adds a unique and engaging dimension to the traditional credit scoring model.

Key Gamification Elements:

- Social Media Analysis: Creditworthiness assessment based on social media behavior.

- Digital Footprint Score: Credit score derived from online activity.

- Rewards for Positive Behavior: Encourages responsible online engagement.

Incorporating gamification elements like these into loan lending apps not only makes the process more engaging for users but also promotes responsible financial behavior, ultimately benefiting both lenders and borrowers.

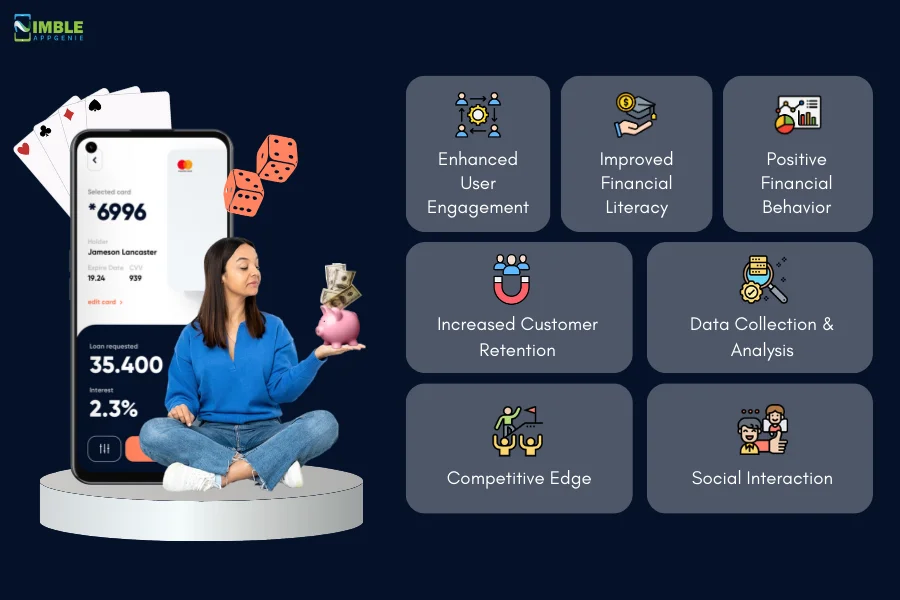

Benefits of Gamification in Loan Lending Apps

Do you want to be successful among target audience?

Gamification in loan lending apps offers numerous advantages that can enhance user engagement, improve financial behavior, and ultimately benefit both lenders and borrowers.

Here are some key benefits:

♦ Enhanced User Engagement

Gamification elements like points, badges, and leaderboards make the loan application and repayment process more interactive and enjoyable.

Users are more likely to engage with the app regularly, which helps in maintaining a consistent interaction with the platform.

- Increased App Usage: Users return to the app more frequently to check their progress and earn rewards.

- Interactive Features: Engaging elements keep users interested and invested in the app’s functionality.

♦ Improved Financial Literacy

Gamification can educate users about financial concepts in a fun and engaging way.

By incorporating quizzes, challenges, and tips, users can learn about budgeting, credit scores, and responsible borrowing.

This is commonly seen in the best financial literacy apps.

- Educational Tools: Quizzes and tips help users understand complex financial concepts.

- Financial Challenges: Encourages users to achieve financial milestones, improving their literacy.

♦ Encouragement of Positive Financial Behavior

Rewarding users for on-time payments and responsible borrowing behaviors promotes financial discipline.

This not only benefits the users but also reduces the risk for lenders.

- Rewards System: Points and badges for timely payments incentivize responsible financial behavior.

- Behavioral Nudges: Gamified elements nudge users towards making better financial decisions.

♦ Increased Customer Retention

Gamification helps in retaining customers by making the app experience enjoyable and rewarding.

Satisfied users are more likely to stay loyal to the platform and recommend it to others.

- Loyalty Programs: Reward systems encourage users to stick with the app.

- User Satisfaction: Engaging features create a positive user experience, increasing retention rates.

Also read: User Retention In Payment Apps

♦ Competitive Edge

In a competitive market, gamification can set a loan lending app apart from its competitors.

Unique and engaging features can attract more users and build a larger customer base.

- Differentiation: Stand out in a crowded market with innovative gamification features.

- Attractiveness: Engaging elements draw in users who might otherwise choose a different service.

♦ Data Collection and Analysis

Gamification can provide valuable data on user behavior and preferences.

This information can help lenders tailor their services and improve the overall user experience.

- User Insights: Data from gamified interactions provides insights into user preferences and behaviors.

- Service Improvement: Analyze data to enhance loan lending app features and user satisfaction.

♦ Social Interaction

Gamification often includes social features such as sharing achievements and competing with friends.

This social interaction can drive more user engagement and foster a sense of community within the app.

- Social Sharing: Users can share their achievements, promoting the app through word-of-mouth.

- Community Building: Social features create a community feel, enhancing user loyalty.

By incorporating loan lending app gamification, developers and financial institutions can create a more engaging, educational, and rewarding experience for users.

This not only enhances the user experience but also drives business growth and improves financial outcomes for all parties involved.

How to Implement Gamification in Loan Lending Apps

Implementing gamification in loan lending apps requires a strategic approach to ensure it enhances user engagement and improves financial behavior.

Here’s a detailed step-by-step guide to effectively incorporate gamification elements into your app:

➤ Define Objectives

Clearly outline the goals of gamification in your app. Common objectives include increasing user engagement, promoting responsible borrowing, and enhancing financial literacy.

Steps:

- Identify Key Performance Indicators (KPIs): Determine metrics such as user retention rates, repayment timeliness, and user satisfaction to measure success.

- Align with Business Goals: Ensure that gamification supports the overall business objectives, such as increasing loan application rates or reducing default rates.

- Set Specific Targets: For instance, aim to improve on-time payment rates by 20% within the first six months.

➤ Understand Your Audience

Conduct thorough market research to understand your target audience’s preferences and motivations. Different demographics may respond to different gamification techniques.

Steps:

- Surveys and Interviews: Collect data on user preferences, habits, and motivations through surveys and one-on-one interviews.

- Behavioral Analytics: Use app analytics to track user behavior and identify patterns.

- User Personas: Develop detailed user personas that represent different segments of your audience to guide gamification design.

➤ Choose Appropriate Gamification Elements

Select gamification components that align with your objectives and appeal to your audience. Common elements include points, badges, leaderboards, and challenges.

Examples:

- Points and Rewards: Users earn points for completing tasks such as timely loan repayments, which can be redeemed for rewards or benefits.

- Badges and Achievements: Award badges for milestones such as the first loan repayment, six months of on-time payments, or attending financial literacy workshops.

- Leaderboards: Display top performers to foster a sense of competition and encourage users to improve their rankings.

➤ Integrate Educational Content

Incorporate educational features to help users understand financial concepts, making learning enjoyable and engaging.

Examples:

- Quizzes and Challenges: Implement quizzes that test users’ knowledge of financial terms and responsible borrowing practices.

- Interactive Tutorials: Provide interactive tutorials that guide users through the loan application process, explaining each step and its significance.

- Financial Literacy Programs: Offer programs that educate users on managing their finances, budgeting, and improving credit scores.

➤ Create a Progress Tracking System

Enable users to track their progress through visual indicators such as dashboards and progress bars, which help maintain motivation.

Examples:

- Progress Bars: Show users how close they are to achieving their financial goals, such as paying off a loan or saving a certain amount.

- Dashboards: Provide a comprehensive view of users’ achievements, points earned, badges obtained, and progress towards financial goals.

➤ Ensure a Seamless User Experience

Integrate gamification elements smoothly into the app’s design and functionality to enhance the user experience without causing disruption.

Steps:

- UX/UI Design Collaboration: Work closely with UX/UI designers to ensure that gamification elements are intuitive and enhance the overall app experience.

- Usability Testing: Conduct regular usability testing to gather feedback on the gamification features and make necessary adjustments.

➤ Implement Real-Time Feedback

Provide immediate feedback on user actions to keep them engaged and informed.

Examples:

- Instant Notifications: Notify users instantly when they earn points, achieve milestones, or unlock new badges.

- Feedback Loops: Create feedback loops that provide continuous updates on users’ progress, encouraging them to stay engaged and motivated.

➤ Foster Social Interaction

Encourage users to share their achievements and compete with others to create a sense of community and drive engagement.

Examples:

- Social Sharing: Allow users to share their progress and achievements on social media platforms, fostering a sense of community and promoting the app.

- Community Features: Create forums or groups within the app where users can discuss their progress, share tips, and compete in challenges.

➤ Regularly Update and Improve

Continuously monitor the effectiveness of gamification strategies and make adjustments based on user feedback and data analytics.

Steps:

- User Feedback Collection: Regularly gather feedback from users through surveys, in-app feedback forms, and app reviews.

- Data Analytics: Use analytics tools to track the performance of gamification elements, such as engagement rates and user retention.

- Iterative Improvements: Make iterative improvements based on feedback and data insights to enhance the effectiveness of gamification features.

➤ Ensure Security and Compliance

Ensure that all gamification features comply with regulatory standards and protect user data. This can greatly affect app’s security.

Steps:

- Regulatory Compliance: Adhere to financial regulations and industry standards, such as data protection laws and lending regulations.

- Data Security Measures: Implement robust security measures to protect user data, including encryption, secure authentication, and regular security audits.

By following these detailed steps, you can successfully implement loan lending app gamification, enhancing user engagement and satisfaction while promoting responsible financial behavior.

This approach not only makes the loan process more engaging but also encourages users to interact more frequently with the app, ultimately benefiting both users and lenders.

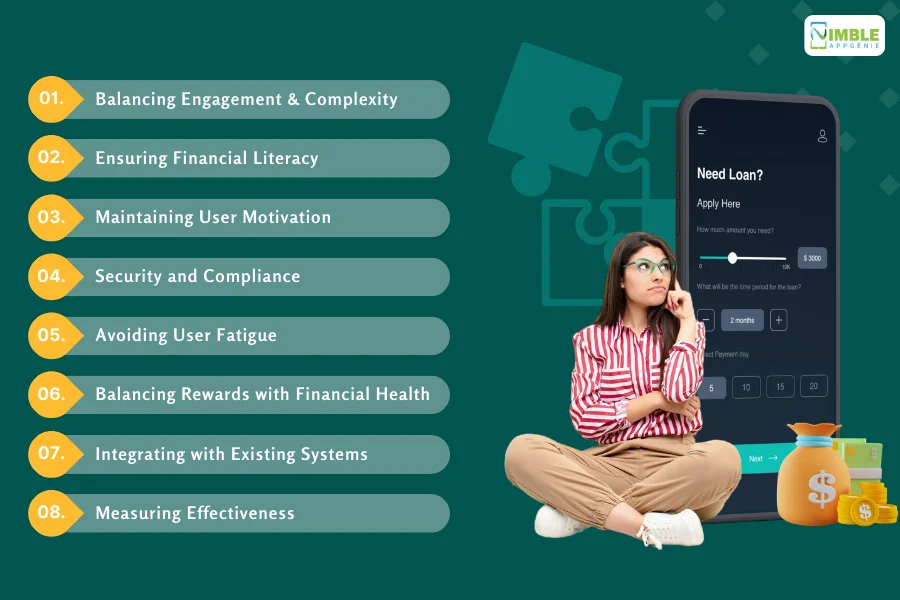

Navigating the Challenges of Gamification in Loan Lending Apps

It’s common to make mistake when developing loan lending app.

However, you don’t always have to learn from your own. Let’s look at some common mistakes, challenges, and pitfalls that you might face during this venture.

Therefore, let’s get right into it:

♦ Balancing Engagement and Complexity

One of the primary challenges is ensuring that the gamification elements are engaging without adding unnecessary complexity to the app.

Solution: Design intuitive and straightforward gamification elements that integrate seamlessly with the app’s core functionalities. Conduct user testing to ensure that the gamification features are easy to understand and use.

♦ Ensuring Financial Literacy

While gamification can enhance user engagement, it’s important to ensure that users also gain meaningful financial literacy and do not perceive the app as merely a game.

Solution: Incorporate educational content that is engaging and informative. Use quizzes, tutorials, and challenges that educate users on financial concepts and responsible borrowing practices.

♦ Maintaining User Motivation

Sustaining user interest over the long term can be challenging. Gamification elements need to be dynamic and continuously engaging to maintain user motivation.

Solution: Regularly update the gamification elements with new challenges, rewards, and features. Offer personalized recommendations and challenges based on user behavior and preferences to keep them engaged.

♦ Security and Compliance

Integrating gamification should not compromise the app’s security and compliance with financial regulations.

Solution: Ensure that all gamification features comply with industry regulations and maintain robust security measures to protect user data. Regularly audit the app for compliance and security vulnerabilities.

♦ Avoiding User Fatigue

There is a risk that users may become fatigued or overwhelmed by too many gamification elements, leading to disengagement.

Solution: Implement gamification elements gradually and provide users with the option to opt-in or opt-out of certain features.

Monitor user feedback and engagement metrics to adjust the intensity of gamification elements.

♦ Balancing Rewards with Financial Health

Providing rewards and incentives must be balanced with promoting users’ financial health. Overemphasis on rewards could lead to irresponsible financial behavior.

Solution: Design rewards that encourage responsible financial behavior, such as timely loan repayments and savings. Avoid rewards that might promote excessive borrowing or spending.

♦ Integrating with Existing Systems

Integrating gamification elements with existing loan management and financial systems can be technically challenging.

Solution: Work with experienced developers and designers who can ensure seamless integration. Use APIs and modular designs to facilitate the addition of gamification features without disrupting existing systems.

♦ Measuring Effectiveness

Evaluating the success of gamification elements in achieving the desired objectives can be difficult.

Solution: Establish clear metrics and KPIs to measure the impact of gamification. Use data analytics to track user engagement, retention, and financial behavior improvements, and adjust strategies accordingly.

By carefully considering and addressing these challenges, you can successfully implement loan lending app gamification, creating an engaging and beneficial experience for users while promoting responsible financial behavior and ensuring regulatory compliance.

Nimble AppGenie: Your Partner in Developing Robust Loan Lending App

At Nimble AppGenie, we specialize in creating innovative, user-friendly loan lending apps that stand out in the competitive fintech market.

As a leading loan lending app development company, we integrate cutting-edge gamification strategies to enhance user engagement, promote responsible financial behavior, and improve customer retention.

Our experienced team understands the intricacies of fintech and is dedicated to delivering high-quality, customized solutions tailored to your business needs.

Partner with Nimble AppGenie to transform your loan lending app into a powerful tool that engages and delights users.

Contact us today to turn your ideas into reality.

Conclusion

Implementing gamification in loan lending apps offers a multitude of benefits, from increased user engagement and financial literacy to improved customer retention and competitive advantage.

While there are challenges to navigate, a well-executed gamification strategy can transform the user experience and drive significant business growth.

By understanding and applying the principles discussed in this blog, developers and businesses can create engaging, educational, and rewarding loan lending apps that stand out in the fintech market.

FAQs

Gamification in loan lending apps involves integrating game-like elements such as points, badges, and leaderboards to make financial tasks more engaging and enjoyable for users.

Gamification enhances user engagement by making the app experience interactive and rewarding, encouraging users to frequently interact with the app.

Common elements include points for completing tasks, badges for achievements, leaderboards for competition, and challenges to motivate users.

By rewarding users for on-time payments and responsible financial behavior, gamification encourages users to manage their loans wisely.

Benefits include increased user engagement, improved financial literacy, higher customer retention, and a competitive edge in the market.

Challenges include balancing engagement with complexity, maintaining user motivation, ensuring security and compliance, and integrating gamification with existing systems.

Educational content can be integrated through quizzes, interactive tutorials, and financial literacy programs that make learning enjoyable.

Regular updates are recommended to keep the content fresh and engaging, based on user feedback and performance analytics.

Yes, gamification features can be personalized based on user behavior, preferences, and demographics to enhance engagement.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.