Maintenance Automation via AI

This technology leverages automation tools and scripts to identify and resolve common issues within applications without human intervention, significantly reducing downtime and improving efficiency.

At Nimble AppGenie, we deliver comprehensive mobile app maintenance services focused on helping you keep your app up and running smoothly. The mobile app maintenance checklist covers everything from fixing bugs to mobile app updating services and even UI/UX improvement.

To keep the mobile application experience smooth for the end user, our experienced team of developers and troubleshooters checks your app for bugs and errors regularly.

Our mobile application maintenance services focus on continuously improving and updating mobile apps to meet changing user needs, incorporate new features.

This application maintenance service is dedicated to protecting mobile apps from potential security threats by implementing robust security measures and security audits.

We ensure that mobile apps comply with relevant regulatory standards, including data protection laws and industry guidelines, to mitigate legal risks via perfective maintenance.

Web app maintenance services involve regular security updates & fixes to the web app to ensure it runs smoothly, remains secure, and continues to meet user expectations.

This application maintenance service from our maintenance plan involves restructuring existing code without changing its external behavior to reduce complexity.

We provide ongoing software maintenance and timely upgrades to enhance functionality, fix bugs, and ensure apps remain up-to-date with tech trends.

Regular maintenance services ensure that apps meet the highest quality standards via comprehensive testing, including features, usability, and performance.

As one of the leading maintenance and development companies, we work on optimizing the backend to ensure fast, reliable performance and reduced downtime.

Secure Your App's Future Today

Secure Your App's Future Today

Stay ahead with state-of-the-art maintenance solutions that guarantee

security, efficiency, and user engagement.

After partnering with a reliable mobile app development company, it’s time to invest in mobile application support services. Our post-deployment support mobile application services provide 24/7 support to your users, helping them to solve any issues they are having with the app and helping you to optimize the app's performance.

Nimble AppGenie offers round-the-clock application maintenance and support to address any issues users might encounter with their mobile apps, ensuring uninterrupted service and user satisfaction.

This mobile application maintenance and support focuses on quickly resolving any problems users may face while using the app, from navigation difficulties to feature malfunctions, enhancing the user experience.

As a leading Mobile app support company, Nimble AppGenie provides solutions for technical problems related to app or server configurations, ensuring smooth operation and connectivity for mobile applications.

At Nimble AppGenie, we offer tailored training sessions and expert consulting as part of application support to help your businesses and your teams effectively use and manage their mobile apps, maximizing app potential and ROI.

This web app maintenance and support service aims to enhance the efficiency and speed of mobile apps by optimizing code, reducing load times, and ensuring seamless operation across different devices and platforms.

Nimble AppGenie facilitates the integration of mobile apps with various third-party services and systems, enhancing functionality and providing a seamless user experience through expanded capabilities.

Wondering whether or not to invest in application development and maintenance services? Nimble AppGenie has the answer to your question. There are various reasons to invest in mobile app maintenance and enhancement services. And here, we shall be discussing just that.

Regular maintenance ensures your app operates smoothly, with quick loading times and minimal crashes. This optimization is crucial for retaining users and providing a seamless experience for the end user.

An app that is frequently updated and free from bugs significantly improves user satisfaction. Happy users are more likely to leave positive reviews, recommend your app to others, and stay engaged over time.

With cyber threats constantly evolving, ongoing support services help protect your app against the latest security vulnerabilities. This is a big reason to invest in web app maintenance services with Nimble AppGenie.

The digital landscape is always changing, making application development & maintenance services super important. Regular updates allow your mobile application to adapt to new technologies and user expectations.

Addressing issues as they arise, rather than letting them accumulate, can prevent costly overhauls down the line. Regular maintenance can also streamline app performance, reducing server costs and enhancing overall efficiency.

Nimble AppGenie, as a market-leading mobile application maintenance company, has a rich history where we have helped clients from across the world turn their ideas into reality and keep their apps performing well via application development & maintenance services.

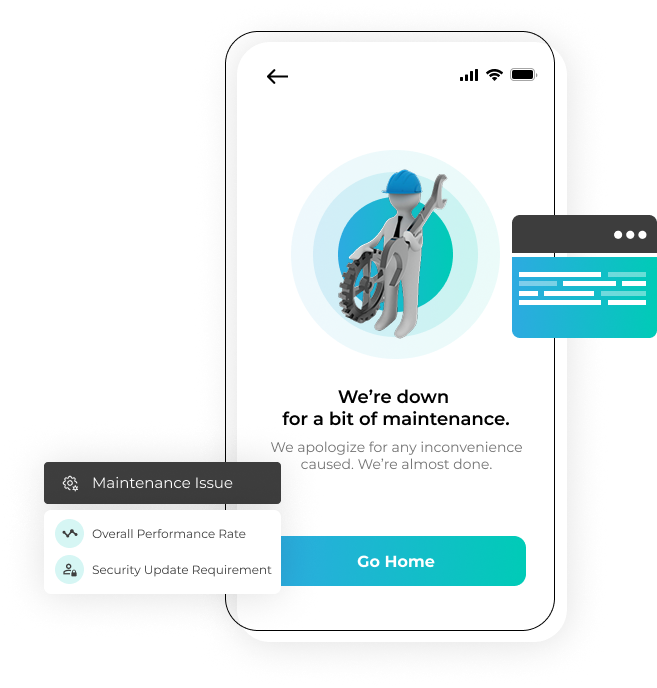

MaxPay is a payment gateway & wallet that helps you stay safe while making payments online. The idea came across as a game changer for betting & fantasy apps as it allows you to keep your banking details intact while you use new apps.

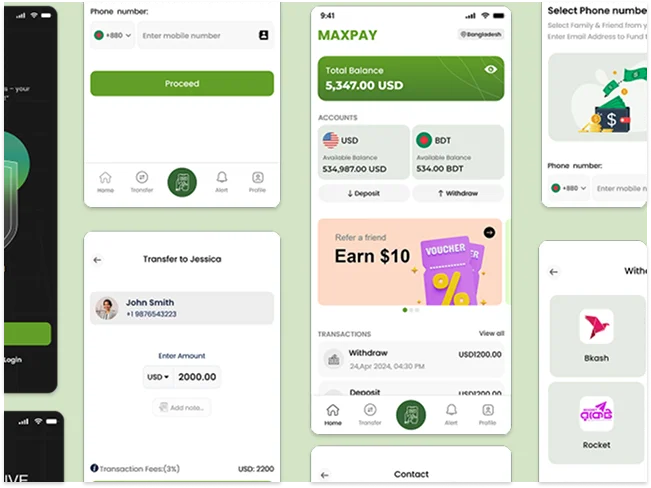

View Case StudyGlu stands at the forefront of digital education, revolutionizing the way we learn with its cutting-edge e-learning platform. Designed for seamless navigation and comprehensive learning experiences, Glu makes education accessible to everyone, everywhere, in multiple languages. With its intuitive design and cross-platform availability, Glu is the bridge between knowledge and learners across the globe, setting new benchmarks in educational technology.

View Case Study

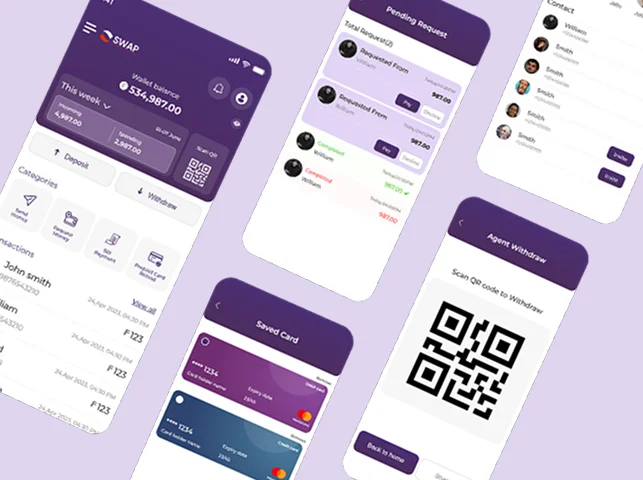

With SwapWallet, the idea of execution revolved around building an e-wallet that not only offers basic transactions, but also offers modes to simplify payroll transactions, allowing a user to send funds to up to 50 users at the same time!

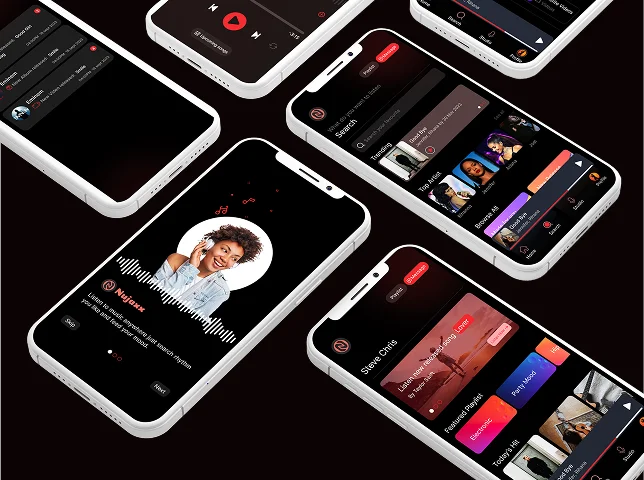

View Case StudyNUJAXX is redefining music streaming in the UK, providing a unique way to enjoy your favorite tunes. Available on both iOS and Android, the app offers a Discover panel to explore new music, a personalized My Studio for playlists, and an innovative Voucher system. Artists and vendors can create profiles, share singles, and even offer exclusive vouchers. With an in-app music player and a dynamic interface, NUJAXX ensures a revolutionized music experience for users.

View Case Study

The Executioner League is the most famous fantasy sports app that delivers an exciting way to play football. It introduces a blend of traditional fantasy football with Guillotine and Survivor. Here weekly losers are eliminated and the players enter a fast-paced waiver wire. With a user-friendly interface, the app engages players all season long.

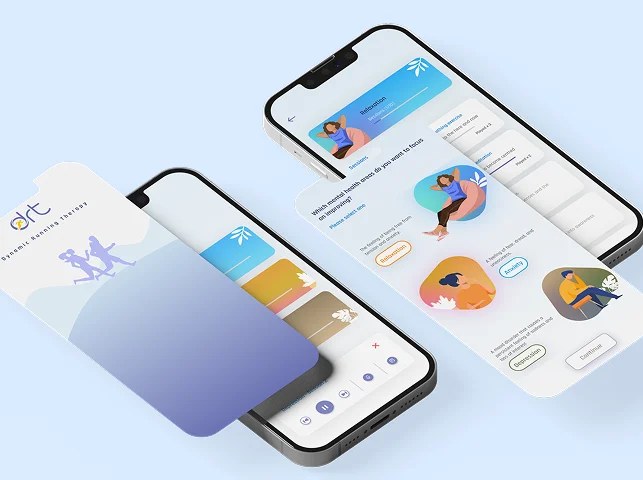

View Case StudyDRT addresses mental health needs in the UK through its innovative healthcare app, available on iOS. Offering online consulting, addiction and anxiety therapy, childhood issue therapy, and relationship consulting, DRT is a comprehensive mental health support system. Depression therapy is also provided to combat the common issue of depression. DRT aims to improve the quality of life by making mental health services easily accessible to users, fostering a healthier and happier community.

View Case Study

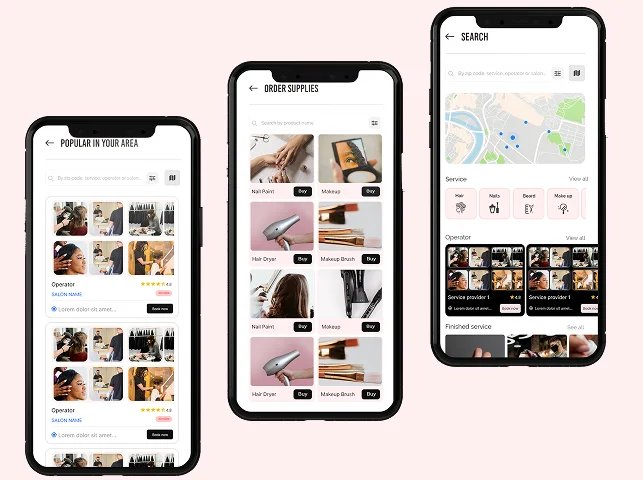

A one-stop app for all your beauty needs, YouSeeStyle is a revolutionary idea that we executed to build a beauty salon app. The idea behind the platform was to build an application that allows a user to find and book skilled hair stylists, nail artists, and salons as per their preferences.

View Case StudyWe have a great presence on the Clutch platform and are awarded as a top mobile app development company across the globe.

Our web app maintenance services are driven by a powerful tech stack. We use only the latest and best technologies and tools to maintain an app, delivering optimal results.

Are you looking for a tech partner to help you with maintenance and support? Nimble AppGenie has got you covered. As a market-leading, mobile app maintenance and support service provider, we have the qualities you are looking for as well as the experience required to get the job done.

Our team comprises industry veterans and specialists with extensive experience and a deep understanding of the latest technologies and trends. Their expertise ensures that your projects are handled well.

We prioritize the stability and reliability of your applications by quickly identifying and resolving bugs. Our systematic approach to bug fixing minimizes disruptions and enhances user experience, ensuring your software runs smoothly.

We understand the importance of a seamless user experience, which is why we focus on optimizing the performance of your applications. From reducing load times to improving responsiveness, we ensure software operates at peak efficiency.

Our team doesn't just react to issues; we anticipate them. By staying ahead of potential problems and industry shifts, we ensure that your projects remain innovative, secure, and relevant, giving you a competitive edge.

We recognize that each client's needs are unique. Our flexible approach allows us to tailor our services to fit your specific requirements, whether it's custom development, integration, or scaling your existing solutions.

Transparency is key to our client relationships. We provide regular updates and progress reports, ensuring you're always informed about the status of your projects and can make timely decisions based on accurate data.

Application maintenance and support are essential for several reasons:

App maintenance should be considered regularly, ideally on an ongoing basis. Regular maintenance helps in:

Nimble AppGenie offers several advantages for app maintenance:

Application support services can address various problems, including:

Application maintenance services can address a range of issues, such as:

Yes, Nimble AppGenie offers personalized services, including custom feature development and enhancements. Their flexible approach allows them to tailor solutions to meet specific client requirements.

Nimble AppGenie employs strategies such as performance optimization, server optimization, and scalability measures to handle high-traffic periods effectively. They ensure that the app remains responsive and stable even during peak usage.

The cost of application maintenance services can vary depending on factors such as the complexity of the app, the scope of maintenance required, and the frequency of updates. Nimble AppGenie typically offers customized pricing based on individual client needs.

Yes, Nimble AppGenie offers long-term maintenance contracts tailored to meet the specific needs of clients. They also prioritize confidentiality and security, often signing Non-Disclosure Agreements (NDAs) to protect sensitive information and intellectual property.

Nimble AppGenie is committed to delivering results that satisfy our client’s needs and their business objectives. Here are testimonials from our clients about their experiences of working with us.

We hired Nimble AppGenie for web development services related to our edtech platform, Glu Learning. They integrated well with our team to solve all the problems and deliver remarkable solutions. Their team have great command of both client side and server side technology. We highly appreciate and recommend their services.

"Our journey with Nimble AppGenie is defined by their consistent availability, reliability, and efficiency. As we look towards expansion, I'm confident our partnership will grow even stronger. And we are eagerly anticipating the next chapter with them.

Read our blogs about the latest industry trends and much more inthe mobile app development industry.