FinTech has been one of the fastest-growing fields in the past decade. Combining the latest technologies with the fundamentals of finances, people have made financial services super convenient for regular users.

It all began with the rise of smartphones which allowed banks to create a digital platform that helps them reach a wider audience.

What started as a tactic to simplify banking for users, has now become a key revenue stream for financial institutions. What keeps the momentum going for FinTech is the adoption of new technologies.

These new advancements in technology help banks address the needs of a user better while preventing fraud and scams.

Hence, FinTech apps must be on top of all the trends as soon as they hit the fintech market. If you are not up with the latest technology, someone else might dominate your field of work.

In this post, let’s take a look at some of the emerging trends in FinTech that will help you stay ahead of the competition in 2025.

Keep on reading if you plan to enter the profitable market of FinTech or are already a part of it.

Let’s get started!

An Overview of Past Trends That Revolutionized FinTech

So far, the journey of FinTech has been nothing but evolving from providing a basic interface that could do limited things.

The financial institutes have now gone completely digital, allowing their customers to do more than just check balances, transaction history, and policy schedules.

Today, people can easily transfer money across borders with FinTech applications and that is just one of many advanced features that new-age best FinTech apps have.

All of this has happened due to various technical trends that were implemented in FinTech.

Some of the trends that we have already witnessed so far include –

► Implementation of Contactless Payments

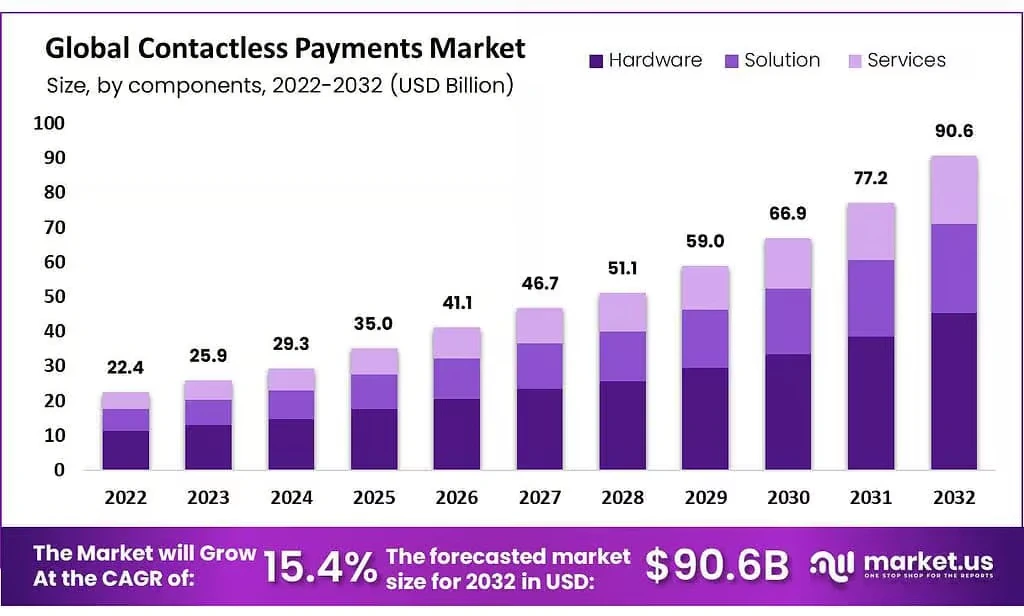

Contactless payments have been a massive success among users as they not only provide convenience but also simplify the way payments work.

With applications in both open-loop and closed-loop payment systems, contactless payments have become one of the most commonly used payment methods across the globe.

From credit/debit cards to smartphone wallets, each of the payment methods can use contactless payments.

If we take a look at the numbers, the market for contactless payments is expected to grow impressively, with a CAGR of 19.1 between 2022 and 2030.

The adoption rate is more than 90% in all developed countries, with the USA at 90%, UK at 93.4%, and Australia at 95%.

NFC (Near Field Communication) mobile payments & RFID (Radio Frequency Identification) are the key enabling technologies for contactless payments.

This has significantly enhanced the daily payment experience of the users as it helps reduce the queues and speed up the process.

With digital payments taking over, QR code payments have also become a vital part of contactless payments.

All in all, the trend of contactless payments is here to stay and while a majority of tier 1 countries have already implemented it, tier 2 and tier 3 countries will definitely adapt to it in the upcoming years.

► Increasing Use of IoT in FinTech

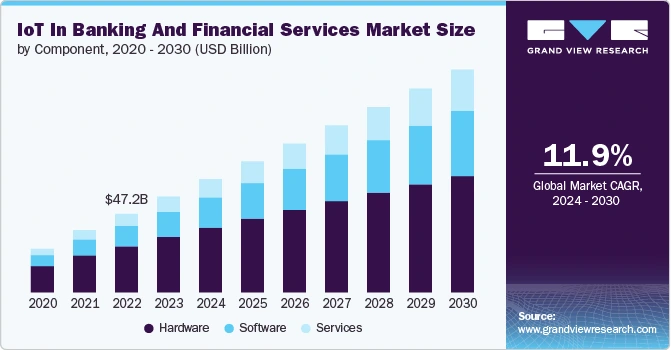

The Internet of Things has been around for a while and has certainly made its way into FinTech.

With its application in smart point-of-sale hardware, ATM management, Smart branch management solutions, and more, IoT is one of the most cutting-edge technologies that have enhanced FinTech usability.

The crucial thing that makes IoT a success in FinTech is the fact that it is not only limited to banking and payments but extends to other areas of FinTech.

Such as InsurTech as it helps in improving customer support, data analysis, and real-time decision making.

The fact that with the help of smart IoT devices and using the IoT compatibility of modern smartphones, financial institutes can move towards a smarter functioning office/business, allowing technology to enhance their user experience. IoT in FinTech is truly a game changing technology.

► Advancements of Security in FinTech

Cybersecurity has always been at the forefront of protecting the digital experiences of users, especially when it comes to managing financial transactions and user assets.

With the rise of technology, the rise of cybercrime has also seen a massive hike, and hence, security in FinTech is one of those trends that made it more usable and secure.

With the introduction of secure gateways, MFA (Multi-Factor Authentication), OTP (One-Time Passwords), and other security features that are powered by technology, things can help in making transactions secure.

One of the key issues in FinTech is that users have to share a lot of sensitive information such as their personal information, account numbers, credit/debit card details, etc.

This gives rise to a lot of security risks as if these are not shared securely, this can cause severe problems for the users.

However, with the use of modern technology, biometric authentication, and other measures of cyber security, these issues can be reduced.

You can easily rely on the latest advancements in security and keep your users away from these issues.

► Rise of Neobanking

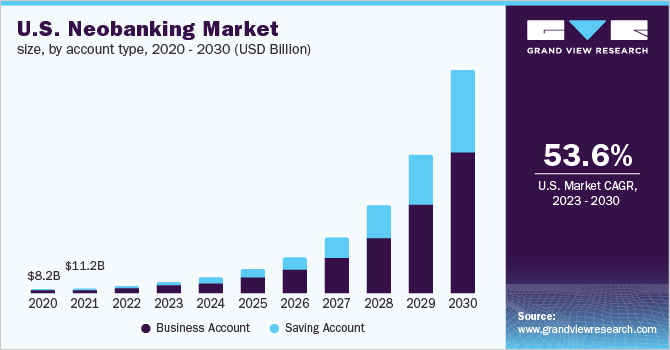

With the rise of digital banking and mobile banking applications, several financial institutions have taken the initiative of simply providing banking services online, without having any offline branches whatsoever.

These new-age banking solutions are called Neobanks. These only use smartphone apps and websites to offer their services.

In the beginning, Neobanks had to face reliability issues as people were not able to trust these services since there were no physical branches involved.

However, with the benefits that these banks offer, they were able to overcome the resistance.

Features such as higher interest rates on savings accounts, lower transaction fees, real-time notifications, etc. made these applications highly usable for the user, creating a way for neobanking in the FinTech market.

This trend has made it easier for smaller companies and entrepreneurs to enter the financial market as now there’s no need to invest in physical resources such as a dedicated bank branch, an ATM, and other aspects. Instead, all you need is a FinTech platform that is robust enough to handle the transactions.

While these trends make FinTech more and more robust, these are just the tip of the iceberg as there are so many more trends that will leave a massive impact on FinTech.

The past few years have been some of the most technically advancing years for FinTech and looking at the current trends, it is not stopping anytime soon.

10+ Trends That Will Change FinTech in 2025

The above-mentioned trends might have set a tone for the direction in which FinTech is headed.

The upcoming trends might change the way FinTech functions forever. Some of the cutting-edge technologies like artificial intelligence and machine learning have found their applications in various areas of FinTech.

Check out the following emerging FinTech trends that are all set to change FinTech forever!

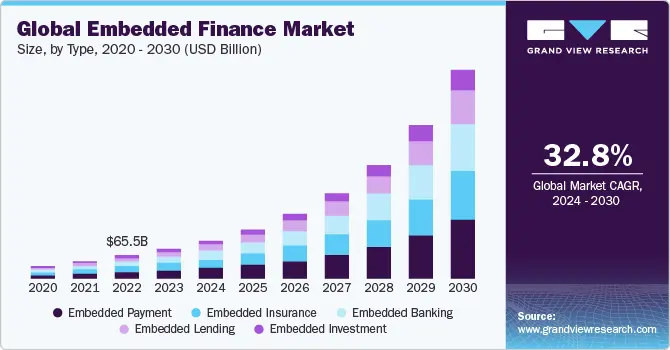

1. Adoption of Embedded Finance

If you are excited about what FinTech holds for the future, then this will be one of the most fascinating trends that you are going to find.

Embedded finance is the smarter way to pay for things without having to go through traditional banking methods. It is like integrating or as the term says, embedding financial features into a regular application.

BNPL solutions are the most common application of embedded finance that you can find appearing in your regular shopping apps. A

s per the available data, the market is set to reach a whopping $7.2 trillion by 2030, which says a lot about the adoption of banking as a service (BaaS).

The market for embedded finance applications is a growing one. You may be shocked to know that in only a short period of time, embedded finance has found several use cases where it can simplify the usage of financial services for a user.

Third-party apps that allow making payments through a bank can also fall under a similar category.

With the implementation of embedded finance, FinTech will be able to explore new horizons of opportunities and use cases.

This trend is certainly going to be impeccable as it offers both businesses and consumers flexibility.

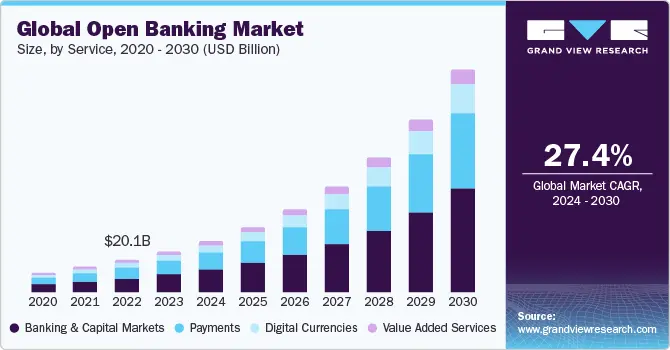

2. Use of Open Banking in FinTech

Open banking is catching up with the current trends in the FinTech market and is all set to be the next big thing. Open banking allows a consumer to share their financial data with a third-party service provider.

You may be wondering why a consumer would want to share their sensitive information with a third-party application.

Well, these third-party applications are also FinTech solutions however, they work more on personalization and simplification of a user’s experience.

The market for open banking is set to reach $204 billion by 2033. Open banking uses APIs to enable safe data sharing.

The market is already witnessing the use of open banking as several FinTech applications have appeared in the market that are not working with financial institutions but enable a user to use financial services such as variable recurring payments

Money management apps are another use case for open banking as several applications can easily fetch your financial data to manage your funds.

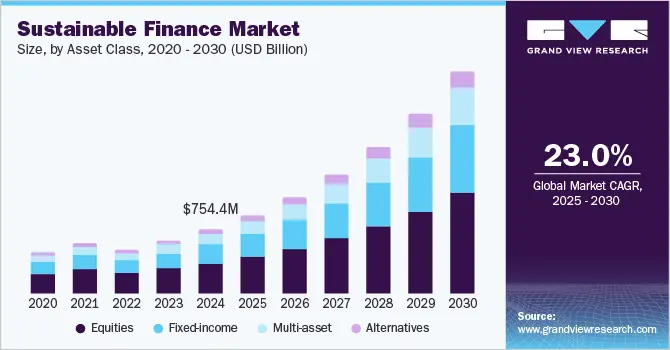

3. Rise of Sustainable Finance

Sustainable finance is going to be an added trend that will help drive sustainable development and changes in the way finances work.

More and more people are moving towards a sustainable way of living and the same can be said for FinTech.

With every FinTech organization dedicated to working on sustainability, investors have started worrying about the impact of their investments on the environment.

This understanding of sustainability will help in the growth of more and more digital payment options.

Things like sustainable investments, Sustainability-Linked Loans, and investments in renewable energy. This gives FinTech a new direction as FinTech solutions that help a user contribute to a sustainable cause.

While this may seem a trend not specifically useful for many businesses planning to make a FinTech transition.

This speaks volumes about the direction in which FinTech applications are headed and how you should plan to create a sustainable FinTech solution that thrives!

4. Artificial Intelligence (AI) Transformation Inclination

Artificial intelligence is new in FinTech as we have seen so many applications of AI in FinTech. However, this is not about implementing AI, it is transforming the entire FinTech industry with the help of AI.

Now what does that mean? Well, you may be aware that Artificial Intelligence can help in creating algorithms that automate a process and simplify data processing and prediction.

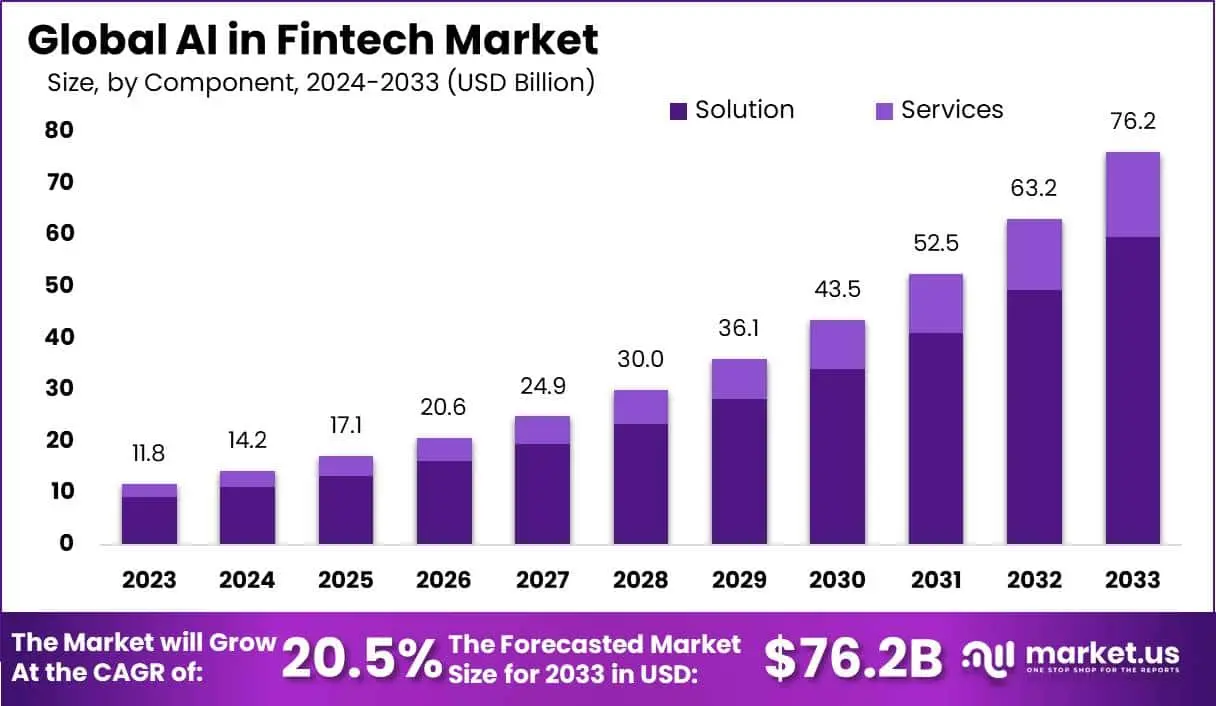

The AI in FinTech is already huge and offers so many lucrative opportunities.

The market in 2025 is valued at $18.31 billion and is expected to reach $53.30 billion by 2030 with a CAGR of 23.82%, making it one of the biggest trends in FinTech.

As far as the use cases are concerned, AI can easily simplify a user’s experience and help businesses make more impactful decisions by analyzing the data generated by the users.

It is a cost-saving solution as it reduces the requirement of human resources and does the work efficiently.

With tech giants like Apple, Google, Microsoft, and more implementing AI in their way, it is clear that AI is now in a more stable place and can be introduced in banking and financial services.

This is also the reason why AI is still a rising trend despite being in the market for a while now.

5. Continued Growth of Buy Now, Pay Later (BNPL)

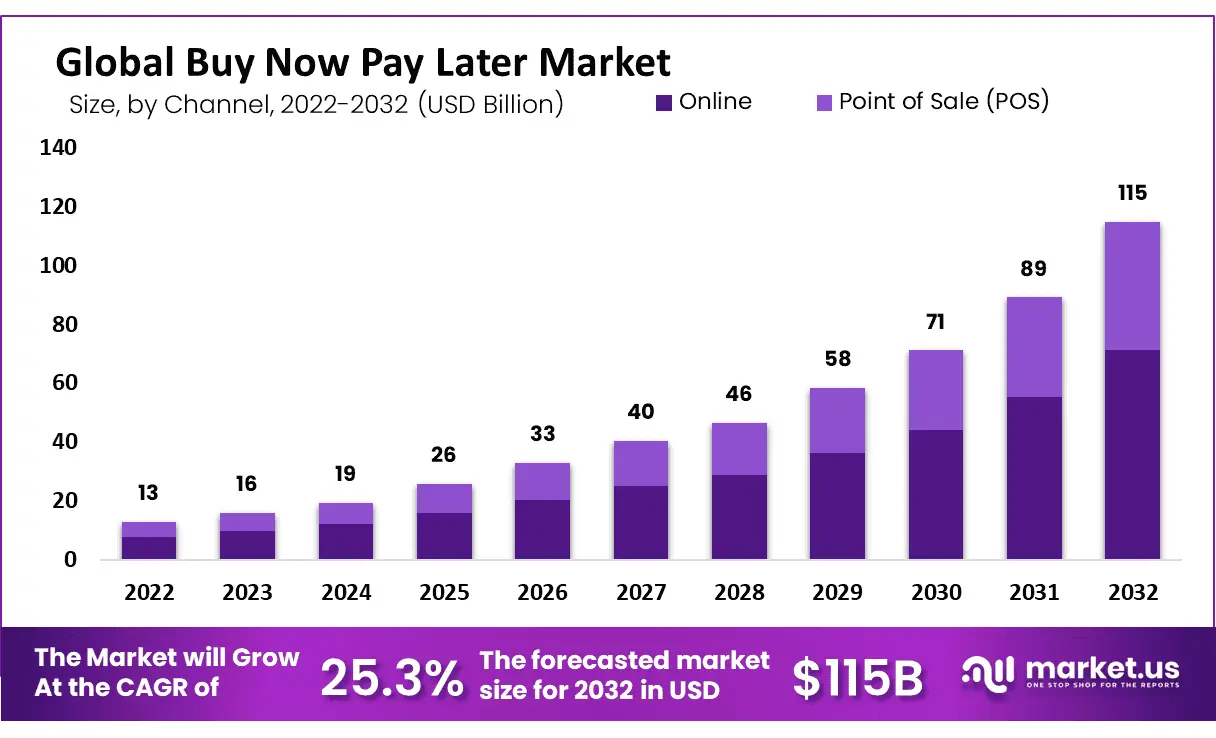

Buy Now Pay Later, as shared earlier, is continuously rising as one of the most common applications of FinTech.

With the rise in embedded financial services, BNPL services have become a great entity to invest in. In the upcoming years, it is going to be one of the core verticals that existing financial services will expand to.

It not only offers flexibility of use but also solves the complications of using existing payment options for online payments.

The market for Buy Now Pay Later was $16 billion in 2023 and is expected to reach $115 billion by 2032. The expected growth clearly states the growth potential of the market.

What makes BNPL a rising trend in FinTech is the increased use of online shopping and digital payments. BNPL is going to play a crucial role in making digital payments more and more convenient for the user, for easy transitioning.

Also Read: The Ultimate Guide to BNPL Integration for Businesses

6. Introduction to Alternative Lending

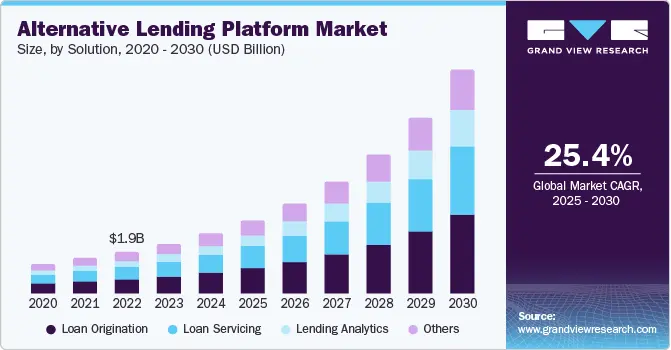

Also referred to as Peer-to-Peer lending and marketplace lending, this is one of the new trends that is going to be on the rise in the future.

Lending and borrowing have always been connected with traditional financial practices. Alternative lending will change the way these work as it offers a new digital way of allowing individuals to find people for lending/borrowing.

This means that you do not have to be a bank or associated with a financial institution to invest your money in a lending business. Alternative lending platforms are usually funded by institutional investors.

The global alternative lending platform market size was estimated at USD 3.82 billion in 2024 and is expected to grow at a CAGR of 25.4% from 2025 to 2030.

While it may seem a bit difficult to digest the fact that now individuals will be able to lend money without involving any banking institution as it seems unsecured and more the regulations may become an issue.

However, you may be shocked to know that these have been highly successful.

P2P lending is slowly catching up and can be a hit in markets like the USA, UK, and Australia where people are more educated about the benefits of investing their extra income in lending businesses.

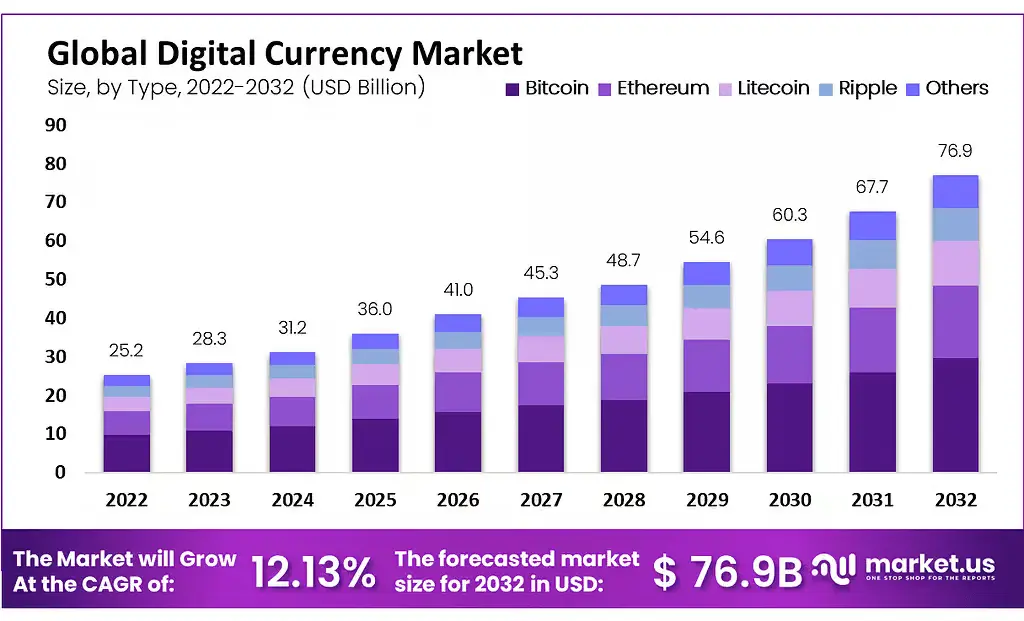

7. More Use of Central Bank Digital Currencies (CBDCs)

Another interesting FinTech trend is the use of CBDCs. These are digital currencies that are issued by the central banks of a country, making them legal for use throughout the country.

These can be a game changer for people who do not have direct access to financial services.

The use of these central bank digital currencies could open new opportunities for FinTech businesses.

Managing CBDCs allows users to interact better with these digital currencies, and many other use cases can give rise to new FinTech applications that will further boom.

One of the key features of Central Bank Digital Currencies is that they can help all walks of life.

From retail to wholesale and from fiscal transactions to cross border payments, everything can be done with the help of authorized Central Bank Digital Currencies.

Since these can offer more regulated digital payment options, it can be a great option to minimize money related crimes.

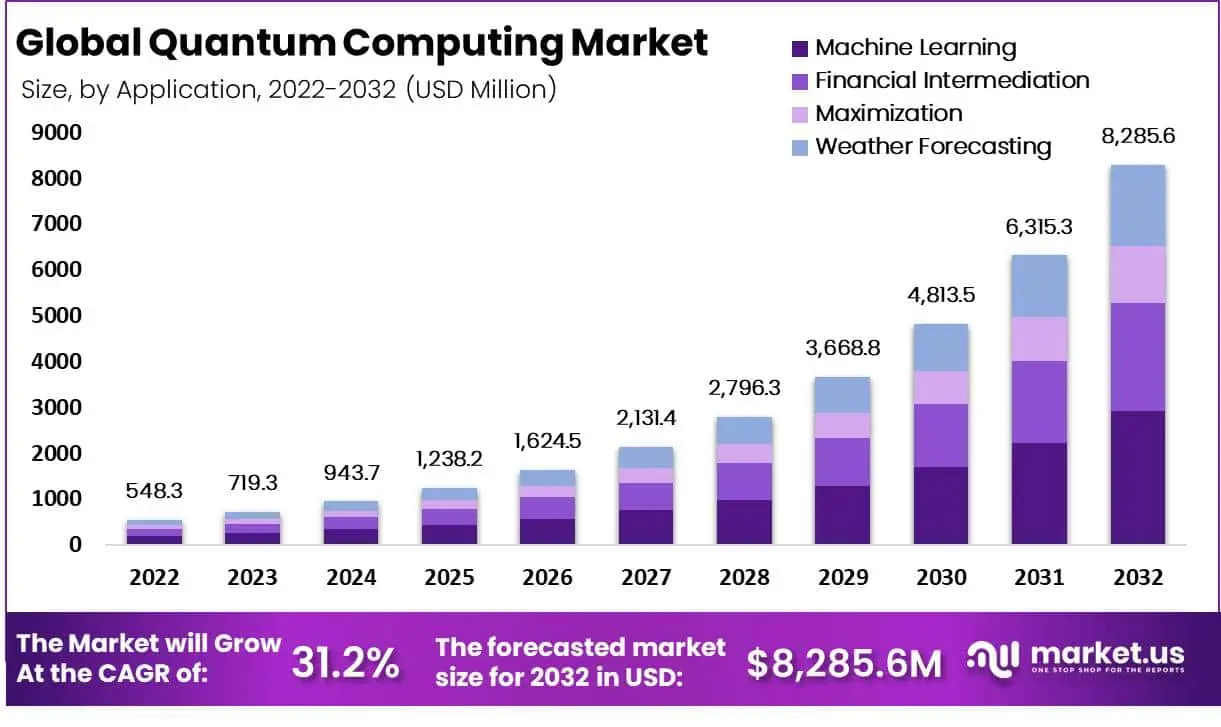

8. Impact of Quantum Computing on FinTech

Quantum computing as a concept allows the use of quantum mechanics to solve complex problems faster.

Now, when we talk about the use of quantum computing in FinTech, we can easily refer to the volumes of data that are generated by users and transactions that are often too complicated for average computers to process.

As you may be aware, data has become the ultimate currency of today as with the help of data a user can easily predict what a user wants and what will be beneficial for a business.

These decisions are taken by processing bulk data that is generated after checking multiple factors such as usage patterns and industry standards.

With the help of quantum computing, many complex processes such as financial modeling, risk assessment, decision making, and optimization are simpler for FinTech businesses.

The trend is yet to see its peak as quantum computing is a less explored area.

However, with the latest resources and advancements in quantum computing technology, this trend can very well become widespread in FinTech offering better risk assessment and predictive decision making.

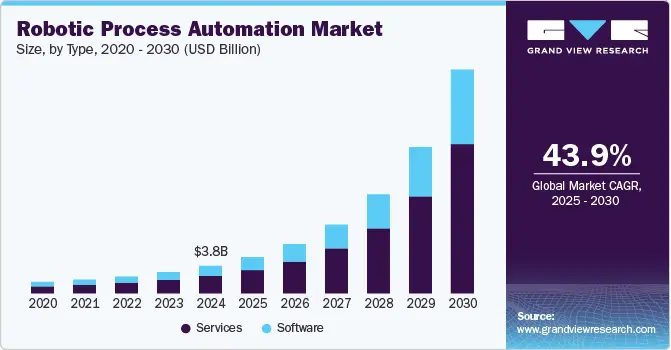

9. Implementation of Robotic Process Automation (RPA)

RPA is one of the trends that almost every FinTech institution is looking forward to. This is because just like in traditional banking, there are several operations that are repetitive and while there are resources available to perform these tasks, they are not always optimized or up to the mark. Hence, automating these processes with the help of a robotic process is the best option.

Robotic Process Automation can be used to facilitate faster processing, reduce errors, and increase efficiency of repetitive tasks in FinTech.

A bank, insurance company, or any FinTech solution can use RPA to automatically address frequent queries of the users with the help of a chatbot.

RPA also finds its application in support and assistance for a FinTech application.

The implementation of robotic process automata has already started as several FinTech applications have been using these chatbots to greet their customers online.

In the coming years, RPA can be trained for advanced operations as well. Processes such as identifying credit worthiness, collecting details for checking insurance premium, and automating other basic steps of a FinTech service.

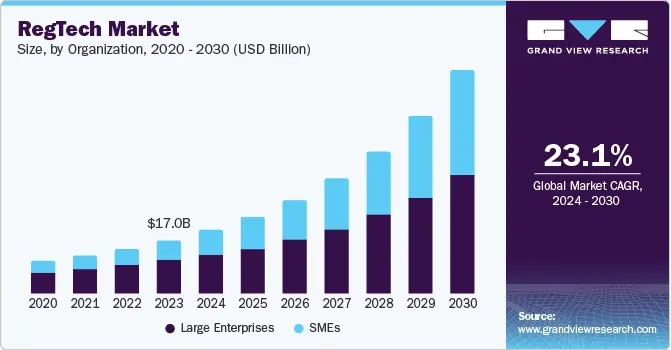

10. Evolution of Regulatory Technology (RegTech)

One of the key problems that FinTech applications face is complying with ever-changing regulatory requirements.

Since the entire field focuses on money transactions and sensitive user information, there are some really strict regulations that FinTech applications must pay attention to.

However, it is not always possible to keep track of them, which is why regulatory technology, or RegTech, has caught the attention of several development companies.

With the help of RegTech, you can easily make your solution compliant with all the regulations as this technology analyzes the functioning of your application and checks for fintech regulatory compliance.

If issues are found, it instantly notifies the developer, allowing them to take care of the same.

This offers advanced opportunities for people struggling with different issues related to maintaining their regulations properly. Hence, the implementation of RegTech is one of the key trends in FinTech to watch out for!

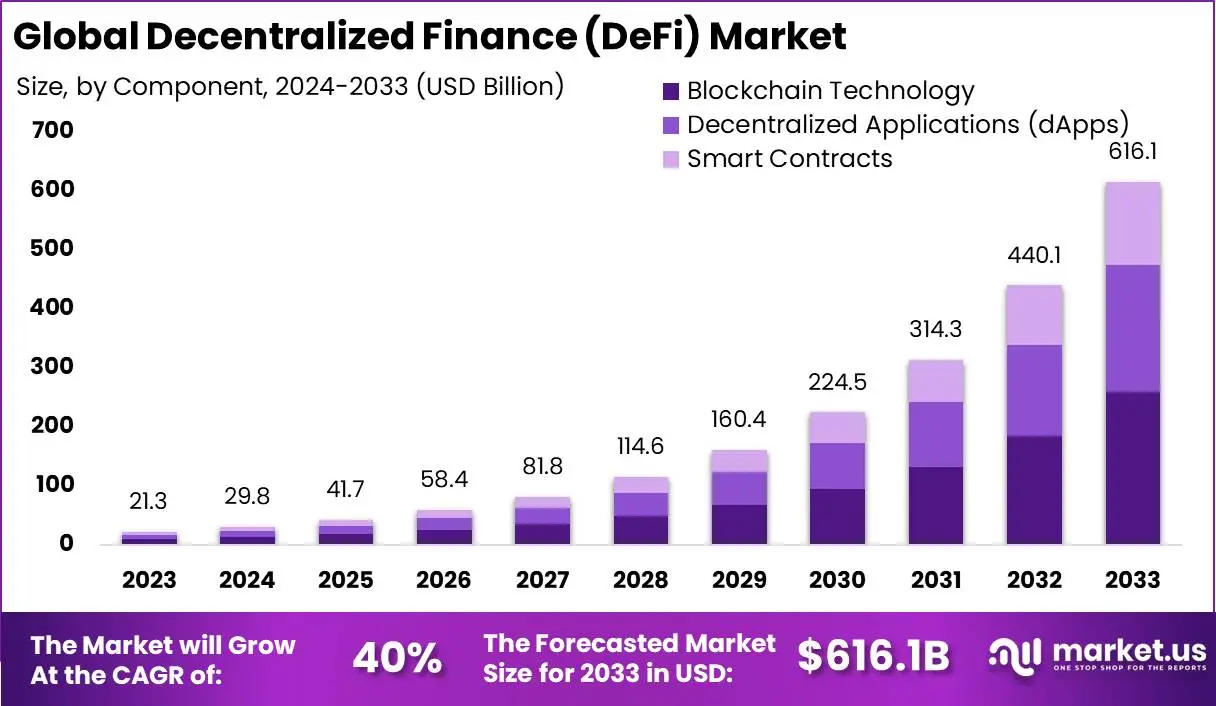

11. Decentralized Finance (DeFi)

Decentralized Finance has been the talk of the town for a while now. And in the upcoming years, it is going to be a great application of FinTech as it addresses a huge issue that traditional FinTech applications offer, i.e. unnecessary transaction fees.

DeFi solutions offer a more direct approach towards finances as it plans to eliminate the complexities of traditional financial institutions.

For instance, it uses direct smart contracts on a programmable and permissionless blockchain to reduce intermediaries such as brokerage, exchanges, or any other institution.

It somewhat functions as peer-to-peer financial services on public blockchains making it more and more accessible, transparent, and secure!

However, so far there have been so many issues in implementing decentralized finance such as lack of conceptual understanding, issues in regulating DeFi, and other implementation errors.

But looking at the current trends and technologies available to better-implement DeFi, it can be said that it is going to be a promising year for DeFi.

While the past few years focussed on making FinTech more accessible and more convenient for users, the upcoming trends seem to focus on making it faster, smarter, and automated.

This also means that while users of FinTech will get better services that are more secure than ever, the businesses that offer FinTech solutions will also have new opportunities.

The growth stats for FinTech are already enticing new businesses to enter the market and with all these upcoming FinTech trends favoring growth, this year might just be the best one to step into the FinTech realm.

But how do you do that? Well, we might have just the solution you are looking for!

Nimble AppGenie: Your Partner in FinTech Innovation

It does not matter how trends support FinTech growth if you do not have a FinTech app development company by your side to implement these innovations in your solution.

At Nimble AppGenie, we have some of the finest experts in all the emerging technologies working to make your next FinTech solution.

With recognition from across the world, we have worked on hundreds of FinTech apps that are currently dominating the market in their respective domains.

If you too are looking for a FinTech solution that helps you make an impact in the market, then simply reach out to us and we can help you out!

Not only do we offer development services, but we also help you maintain the quality of your FinTech services while assisting you in implementing newer technologies in existing solutions.

So what’s stopping you from making the move? Call us today and start your journey toward success!

Conclusion

Knowing about the trends can help you stay ahead of the competition. However, it is the implementation of these technologies that makes all the difference.

While these trends do seem to make your application future-ready, you need to understand what the requirements are for your particular business. Implementing these trends can help you in the long run, but is also quite expensive.

Hope all these trends help you identify the potential in the market and how you can make the most of the technological advancements in FinTech.

That will be all for this post, thanks for reading, and good luck!

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.