Buy Now, Pay Later (BNPL) solutions have emerged as a revolutionary payment method.

As the BNPL market continues to grow, understanding the latest trends and developments is crucial for businesses aiming to stay competitive.

This blog explores the key trends shaping the Buy Now, Pay Later (BNPL) industry, providing insights into why startups are investing in BNPL solutions and what the future holds for this innovative payment method.

Rising Market for BNPL Solutions

The buy now pay later (BNPL) industry is experiencing rapid growth, driven by increasing consumer demand for flexible payment solutions and the proliferation of digital commerce.

Here are some key BNPL statistics highlighting the rising market:

- Market Size Growth: The global BNPL market size was valued at $90.69 billion in 2020 and is expected to reach $3.98 trillion by 2030, growing at a compound annual growth rate (CAGR) of 45.7% from 2021 to 2030.

- Consumer Adoption: In the US, the number of BNPL users is projected to grow from 10.3 million in 2020 to 59.3 million by 2026, representing nearly 20% of the US population.

- Transaction Volume: According to Worldpay, BNPL transactions accounted for 2.1% of global e-commerce transactions in 2020 and are expected to reach 4.2% by 2024.

- Usage Among Younger Generations: Approximately 60% of BNPL users in the US are Gen Z and Millennials, indicating a strong preference for flexible payment options among younger consumers.

- Market Penetration in Retail: In 2021, 42% of online retailers in the U.S. offered BNPL as a payment option, up from 28% in 2019.

- Average Transaction Value: The average transaction value for Buy Now, Pay Later (BNPL) purchases is $100-$200, with higher acceptance for high-value purchases such as electronics and fashion.

- Regional Growth: The BNPL market is growing significantly in regions such as Europe, where it is projected to account for 30% of all e-commerce transactions by 2025.

The increasing adoption of Buy Now, Pay Later (BNPL) services is driven by the convenience and financial flexibility they offer consumers. This growth presents significant opportunities for businesses and developers in the fintech sector to create innovative BNPL solutions that cater to evolving consumer needs.

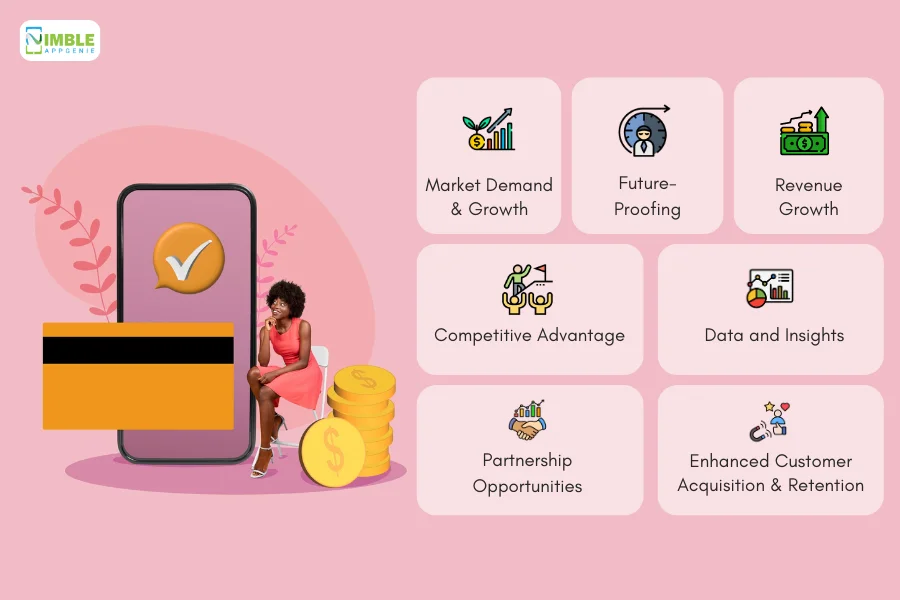

Why Startups Invest in Buy Now, Pay Later (BNPL) Solutions?

Investing in Buy Now, Pay Later (BNPL) solutions offers numerous advantages for startups, particularly those in the fintech and e-commerce sectors.

Here’s why these innovative payment solutions are gaining traction among new businesses:

► Market Demand and Growth

BNPL industry trends indicate robust growth.

Consumers increasingly prefer Buy Now, Pay Later (BNPL) options due to their flexibility and convenience.

According to Insider Intelligence, the number of BNPL users in the US is expected to reach 59.3 million by 2026.

This growing demand presents a lucrative opportunity for startups to capture a significant market share early on.

► Enhanced Customer Acquisition and Retention

BNPL options can attract a broader customer base, including younger consumers who are more inclined towards alternative payment methods.

Offering BNPL can reduce cart abandonment rates and boost conversion rates.

A survey by Afterpay found that retailers offering Buy Now, Pay Later (BNPL) options see a 20-30% increase in conversion rates and a 25% increase in average order values.

► Revenue Growth

BNPL solutions can drive higher sales volumes and larger transaction sizes.

By allowing customers to split payments over time, startups can encourage more purchases and increase overall revenue.

This is particularly beneficial for high-ticket items, where the ability to pay in installments can make a significant difference in purchasing decisions.

► Competitive Advantage

Integrating BNPL options can provide a competitive edge in the crowded e-commerce and fintech markets.

As more consumers seek flexible payment options, startups that offer BNPL can differentiate themselves from competitors who do not.

► Data and Insights

BNPL platforms provide valuable data on customer purchasing behavior, preferences, and payment patterns.

Startups can leverage this data to refine their marketing strategies, personalize customer experiences, and optimize inventory management.

► Partnership Opportunities

Collaborating with established BNPL providers can offer startups additional resources and support.

These partnerships can enhance credibility, provide access to larger customer bases, and offer technical and marketing support, accelerating growth and adoption.

► Future-Proofing

As Buy Now, Pay Later (BNPL) trends in fintech continue to evolve, investing in these solutions positions startups at the forefront of payment innovation.

Adopting BNPL early can ensure that startups stay relevant and adaptable to changing consumer preferences and technological advancements.

Overall, investing in BNPL solutions aligns with the current BNPL market trend, offering startups a strategic advantage through enhanced customer acquisition, increased revenue, and valuable data insights. These benefits collectively contribute to the long-term success and sustainability of new ventures in the dynamic fintech landscape.

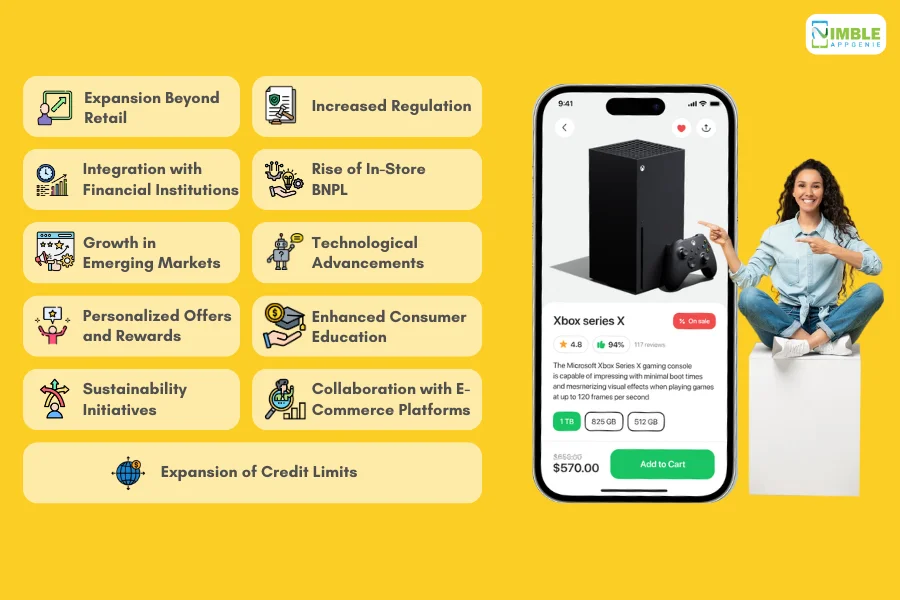

Top 11 Buy Now, Pay Later (BNPL)Trends to Look Out For

The Buy Now, Pay Later (BNPL) market is rapidly evolving, with significant trends shaping its growth and adoption. Here are the top 11 BNPL trends to look out for:

1. Expanding Beyond Retail

Buy Now, Pay Later (BNPL) services are expanding beyond traditional retail into sectors like healthcare, travel, and education.

Consumers can now use BNPL options to finance medical treatments, vacations, and even educational courses, making high-cost services more accessible.

- Healthcare: Companies like Walnut and Affirm are allowing patients to pay medical bills in installments. This includes not only elective procedures but also emergency services, dental work, and even veterinary care. This flexibility helps patients manage large medical bills without immediate financial stress.

- Travel: Travel platforms such as Expedia and Fly Now Pay Later offer BNPL options for booking flights, accommodation, and vacation packages. This allows consumers to manage travel expenses more efficiently without upfront costs, making travel more accessible to a broader audience.

- Education: BNPL providers are partnering with educational institutions to finance courses, certifications, and training programs. Companies like Climb Credit and EdAid offer installment plans for tuition fees, making education more accessible and affordable. This trend is particularly significant as it supports continuous learning and skill development in a rapidly changing job market.

2. Increased Regulation

As the BNPL market grows, fintech regulators are paying closer attention.

In regions like the EU, UK, and USA, the new regulations aim to protect consumers from over-borrowing and ensure transparent terms.

- UK FCA Regulation: The UK’s Financial Conduct Authority (FCA) is introducing stricter rules for BNPL providers. These include mandatory credit checks, clear communication of terms and potential impacts on credit scores. The move is aimed at preventing consumers from accumulating unmanageable debt.

- EU Consumer Credit Directive: The European Union is revising its Consumer Credit Directive to include BNPL services. This ensures consumer protection and responsible lending practices by implementing standardized disclosure requirements, caps on late fees, and enhanced consumer rights.

- U.S. Regulation: The Consumer Financial Protection Bureau (CFPB) in the U.S. is also scrutinizing BNPL providers to ensure they adhere to fair lending practices and transparency. This includes monitoring the reporting of BNPL loans to credit bureaus and ensuring that terms and conditions are clearly communicated to consumers.

3. Integration with Traditional Financial Institutions

Banks and credit card companies are increasingly integrating BNPL options into their offerings.

This trend is driven by the need to compete with fintech startups and meet consumer demand for flexible payment solutions.

- Partnerships: Goldman Sachs has partnered with Apple to offer BNPL through Apple Card, allowing users to split their purchases into monthly installments directly from their Apple devices. This integration leverages the trust and user base of established financial institutions while providing modern payment flexibility.

- In-House BNPL Services: Major banks like HSBC and Barclays are developing their own BNPL solutions to offer alongside traditional credit products. These banks are leveraging their existing customer base and infrastructure to provide seamless BNPL experience. For example, HSBC’s “Splitit” allows users to divide purchases into interest-free installments, providing a competitive edge in the digital payment landscape.

Also Read: BNPL vs Credit Cards

4. Rise of In-Store Buy Now, Pay Later (BNPL)

While BNPL started primarily as an online payment option, it is increasingly being offered in physical stores.

Retailers are integrating BNPL services at the point of sale to provide customers with flexible payment options in-store.

- Point-of-Sale Integration: Companies like Afterpay and Klarna offer in-store BNPL options through QR codes and digital wallets. This enables customers to make purchases and pay later while shopping in brick-and-mortar stores, enhancing the flexibility and convenience of the shopping experience.

- Enhanced Shopping Experience: In-store BNPL services enhance the shopping experience by allowing consumers to make larger purchases without immediate full payment, thereby increasing customer satisfaction and sales. Retailers benefit from higher average order values and increased customer loyalty as a result of offering BNPL options at checkout.

5. Growth in Emerging Markets

BNPL is gaining traction in emerging markets, providing access to credit for underserved populations and boosting local economies.

- Latin America: Companies like Kueski and MercadoPago are expanding BNPL services in Mexico and Brazil. These services cater to the needs of the growing middle class, providing flexible payment options for consumers who may have limited access to traditional credit facilities. This expansion supports economic growth and financial inclusion in these regions.

- Southeast Asia: Fintech startups in countries like Indonesia, the Philippines, and Vietnam are introducing BNPL options to cater to the increasing demand for flexible payment solutions. These services help bridge the gap for consumers who have limited access to traditional credit, fostering greater financial inclusion and enabling more people to participate in the digital economy.

6. Technological Advancements

Advancements in technology are driving innovation in the BNPL sector.

Artificial intelligence (AI) and Machine Learning (ML) are being used to enhance credit assessments and fraud detection.

- AI and ML: These technologies help BNPL providers assess creditworthiness more accurately and prevent fraudulent activities, ensuring safer transactions for both consumers and merchants. AI-driven models can analyze vast amounts of data to predict consumer behavior and assess risk, reducing the likelihood of default.

- Blockchain: Some BNPL platforms are exploring blockchain technology to offer transparent and secure transactions, reduce the risk of fraud and improve the efficiency of payment processing. Blockchain can provide immutable records of transactions, enhancing trust and security in the BNPL ecosystem.

7. Personalized Offers and Rewards

BNPL providers are leveraging data analytics to offer personalized financing options and rewards to users. This enhances user experience and loyalty.

- Customized Plans: Users receive personalized installment plans based on their spending habits and financial behavior, making repayment easier and more convenient. This tailored approach ensures that consumers are offered payment plans that align with their financial capabilities.

- Loyalty Programs: BNPL services introduce loyalty programs where users earn rewards and discounts for using the service regularly. This includes cashback offers, discounts on future purchases, and exclusive deals. By incentivizing repeat use, BNPL providers can foster long-term customer loyalty and engagement.

8. Enhanced Consumer Education

To promote responsible borrowing, BNPL providers are focusing on educating consumers about the implications of using these services.

- Financial Literacy Programs: Educational resources and tools are provided to help consumers understand how BNPL works, manage their finances better, and avoid excessive debt. These programs often include webinars, online courses, and interactive tools that guide consumers through the basics of credit management and responsible borrowing.

- Transparent Communication: Clear communication about fees, interest rates, and repayment terms is being prioritized to ensure consumers make informed decisions and understand the full cost of their purchases. BNPL providers are investing in user-friendly interfaces and communication strategies that demystify financial terms and conditions.

9. Sustainability Initiatives

BNPL providers are incorporating sustainability initiatives to appeal to environmentally conscious consumers.

- Eco-Friendly Purchases: Partnerships with eco-friendly brands and products encourage users to make sustainable choices, aligning their spending habits with their environmental values. BNPL providers are collaborating with sustainable brands to offer exclusive deals and incentives for eco-friendly purchases.

- Carbon Offsetting: Some Buy Now, Pay Later (BNPL) platforms offer carbon offset programs where a portion of each transaction is used to fund environmental projects, helping to mitigate the carbon footprint of consumer purchases. These initiatives appeal to consumers who are conscious of their environmental impact and seek to support businesses that prioritize sustainability.

10. Collaboration with E-Commerce Platforms

Buy Now, Pay Later (BNPL) providers are forming strategic partnerships with major e-commerce platforms to expand their reach and offer seamless payment experience.

- Integration with Marketplaces: Collaborations with platforms like Amazon, Shopify, and WooCommerce enable BNPL services to be integrated directly into the checkout process. This seamless integration provides a smooth and convenient payment option for online shoppers, reducing friction and increasing conversion rates.

- Enhanced User Experience: These partnerships ensure a seamless user experience, reducing friction at checkout and increasing the likelihood of purchase completion. E-commerce platforms benefit from higher sales and increased customer satisfaction, while BNPL providers gain access to a larger customer base.

11. Expansion of Credit Limits

As BNPL becomes more established, providers are increasing credit limits and offering more substantial financing options for high-ticket items.

- Higher Credit Limits: Providers are extending higher credit limits to users with good repayment histories, enabling them to finance larger purchases such as electronics, furniture, and home improvement projects. This trend supports the purchase of big-ticket items that might otherwise be out of reach for many consumers.

- Flexible Repayment Options: Longer repayment periods and more flexible installment plans are being introduced to accommodate higher-value transactions. This flexibility allows consumers to manage their finances more effectively, making it easier to afford significant expenses without compromising their financial stability.

These BNPL trends in fintech highlight the dynamic nature of the industry and the opportunities for innovation and growth. For startups and businesses in the fintech sector, staying abreast of these trends is crucial for developing competitive Buy Now, Pay Later (BNPL) solutions that meet evolving consumer needs. By leveraging these trends, companies can create innovative BNPL services that enhance user experiences and drive business growth.

What’s the Future of Buy Now, Pay Later (BNPL)?

Are you planning to start a fintech startup offering BNPL services on the go?

The future of Buy Now, Pay Later (BNPL) looks promising as it continues to reshape the financial and retail sectors.

One significant trend is the expansion into new markets and sectors beyond traditional retail, such as healthcare, travel, and education. This growth is driven by the increasing demand for flexible payment options and the convenience they offer consumers.

Technological advancements will play a crucial role in the evolution of BNPL services. Innovations like artificial intelligence (AI) and machine learning (ML) will enhance credit assessments and fraud detection, ensuring safer transactions. Blockchain technology could further revolutionize the BNPL landscape by providing transparent and secure transactions.

Increased regulation is another key factor shaping the future of BNPL. Regulatory bodies in the EU, UK, and USA are introducing stricter guidelines to protect consumers and ensure responsible lending practices. These regulations will likely lead to more transparent and fair BNPL services.

Moreover, collaboration with traditional financial institutions and e-commerce platforms will drive further integration of BNPL options, enhancing the customer experience and expanding the reach of these services. Banks and credit card companies are already partnering with BNPL providers to offer more flexible payment solutions.

Nimble AppGenie, Your Buy Now, Pay Later (BNPL) Solution Partner

In the rapidly evolving world of fintech, developing a robust BNPL app can set you apart in a competitive market. Nimble AppGenie, a leading BNPL app development company that specializes in creating innovative and secure Buy Now, Pay Later (BNPL) solutions tailored to your business needs.

With extensive experience and a team of expert developers, we ensure that your Buy Now, Pay Later (BNPL) app integrates the latest technologies, adheres to regulatory standards, and provides an exceptional user experience. Our end-to-end development services cover everything from initial consultation and design to deployment and ongoing maintenance.

Conclusion

The BNPL sector is poised for significant growth and transformation, driven by technological advancements, regulatory changes, and expanding market opportunities. For businesses looking to capitalize on these trends, understanding the factors influencing the development cost of a BNPL app and strategies for cost optimization is essential. As the market evolves, staying informed and agile will be key to leveraging the full potential of BNPL services.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.