Robotic Process Automation (RPA) is revolutionizing the fintech industry.

As fintech companies strive to stay competitive in a rapidly evolving market, the integration of RPA offers a strategic advantage by streamlining operations and freeing up human resources for more value-added activities.

From customer onboarding and loan processing to fraud detection and compliance reporting, RPA handles a variety of tasks with precision and speed.

This not only minimizes errors but also ensures compliance with stringent financial regulations.

Want to learn more? That’s what this blog is all about. Let’s get right into it:

Understanding RPA – Robotic Process Automation

The full form of RPA is Robotic Process Automation.

It is a technology that uses software robots to automate repetitive and mundane tasks.

These robots can mimic human actions, making them highly effective in handling routine operations across various industries.

The beauty of RPA lies in its ability to work alongside existing systems without requiring significant changes.

RPA in Fintech

Robotic Process Automation (RPA) is transforming the fintech industry by automating complex processes and enhancing operational efficiency.

One of the most significant impacts of RPA in fintech is its ability to streamline operations, reducing the time and effort required for tasks such as loan processing, customer onboarding, and fraud detection.

RPA helps fintech companies manage large volumes of transactions with greater accuracy and speed.

Much like AI in fintech, RPA’s efficiency not only reduces operational costs but also enhances the customer experience by providing faster and more reliable services.

Automation in finance and accounting ensures that routine tasks are handled consistently, minimizing the risk of human error and improving compliance with regulatory standards.

Use Cases of RPA in Fintech

It’s time to look at some major fintech use cases of RPA.

Therefore, without further ado, let’s get right into it, starting with the first one:

1. Customer Onboarding

RPA in banking significantly improves the customer onboarding process by automating identity verification, background checks, and document validation.

They are working side by side with the Digital Onboarding API to make this possible.

This not only speeds up the onboarding time but also ensures compliance with KYC (Know Your Customer) regulations.

By using financial automation tools, fintech companies can reduce manual errors and enhance customer satisfaction through a seamless onboarding experience.

2. Loan Processing

Robotic process automation in banking automates the loan processing workflow, from application to approval.

This has made it a favorite for loan lending app development.

RPA tools in finance can quickly gather and verify applicant information, assess credit scores, and determine loan eligibility.

This automation reduces processing time, minimizes errors, and provides customers with faster loan approvals, enhancing overall efficiency.

3. Fraud Detection

RPA in financial services plays a crucial role in fraud detection by continuously monitoring transactions for suspicious activities.

Robotic accounting systems can analyze large datasets in real-time, identifying patterns and anomalies indicative of fraud.

This proactive approach helps fintech companies detect and prevent fraudulent transactions, safeguarding both the business and its customers.

4. Compliance and Regulatory Reporting

Fintech regulations are a big part of the industry. And so is being compliant.

Automation in finance and accounting ensures that compliance and regulatory reporting is correct and prompt.

RPA can automate the gathering and analysis of financial data, generating reports that meet regulatory standards.

This reduces the burden on compliance teams and ensures that companies stay in good standing with regulatory bodies.

5. Invoice Processing

Robotic process automation in finance streamlines the invoice processing cycle by automating data entry, validation, and payment approvals.

Finance automation software can extract data from invoices, match it with purchase orders, and process payments without human intervention.

This leads to faster processing times, reduced errors, and improved vendor relationships.

If you are planning to start a fintech business, this is an application that you need to look into.

6. Financial Reporting

Automating financial reporting involves using RPA to compile and analyze financial data, generating comprehensive and correct reports.

This automation ensures that reports are produced faster and with higher accuracy, enabling better decision-making.

Financial reporting automation helps fintech companies maintain transparency and accountability in their financial practices.

7. Account Reconciliation

RPA in accounting automates the account reconciliation process by matching transactions and identifying discrepancies.

This reduces the time spent on manual reconciliations and ensures that financial statements are correct.

Robotic process automation accounting tools can handle large volumes of data, improving efficiency and reducing the risk of errors.

8. Risk Management

RPA in finance and accounting enhances risk management by automating the monitoring of financial transactions and risk assessments.

Robotic process automation finance tools can identify potential risks and alert relevant stakeholders in real-time.

This allows fintech companies to address risks proactively, maintaining the stability and security of their operations.

9. Data Management

Financial process automation includes the automation of data entry, extraction, and management.

RPA tools can handle large volumes of financial data, ensuring accuracy and consistency. That’s what makes it a go-to technology to include when you build a fintech app.

This improved data management supports better analytics and reporting, providing valuable insights for strategic planning.

10. Customer Service

RPA enhances customer service in fintech by automating routine inquiries and support tasks.

Automation for accountants and customer service representatives means they can focus on more complex issues, improving service quality.

Automated chatbots and virtual assistants can handle common queries by providing quick and efficient support to customers.

In summary, RPA in fintech offers many use cases that streamline operations, enhance accuracy, and improve customer experience. As fintech continues to evolve, the integration of RPA will stay a critical factor in driving innovation and efficiency in the industry.

Some Challenges of Integrating RPA in Fintech Solutions

There are of lessons for fintech startups.

But the most important one is recognizing the challenges and figuring out their solutions.

Let’s see what and how:

![Some_Challenges_of_Integration_RPA_in_Fintech_Solutions[1]](https://www.nimbleappgenie.com/blogs/wp-content/uploads/2024/05/Some_Challenges_of_Integration_RPA_in_Fintech_Solutions1.webp)

A] Data Security and Privacy

Implementing RPA in fintech involves handling sensitive customer data and raising concerns about data security and privacy.

Financial institutions must ensure that their automated processes follow regulatory standards and protect against data breaches.

Solution: To mitigate these risks, companies should implement robust encryption methods and access controls. Regular security audits and compliance checks are essential to maintain data integrity and privacy.

B] Integration with Legacy Systems

Many financial institutions operate on outdated legacy systems that can be difficult to integrate with modern RPA tools.

This integration challenge can hinder the seamless adoption of automation technologies.

Solution: A phased approach to integration can help. Start by automating simpler processes and gradually move to more complex ones. Using middleware solutions can also facilitate communication between legacy systems and new RPA platforms.

C] High First Investment

RPA can really ramp up the cost to build a fintech app.

The initial cost of implementing RPA can be high, covering software licensing, infrastructure upgrades, and training.

This can be a barrier for smaller fintech companies with limited budgets.

Solution: To manage costs, companies can start with a pilot project to demonstrate ROI before full-scale implementation. Additionally, choosing scalable and flexible RPA solution can help manage expenses as automation needs grow.

D] Change Management

One of the major challenges is change management.

Adopting financial automation requires significant changes in workflows and employee roles.

Thus, leading to resistance from staff who may fear job displacement or disruption of their routine.

Solution: Effective change management strategies include clear communication about the benefits of RPA, offering training programs to upskill employees, and involving them in the implementation process to foster acceptance and collaboration.

E] Maintaining RPA Systems

Despite maintenance and support services, RPA systems can be difficult to manage.

Once deployed, RPA systems require ongoing maintenance to ensure they adapt to changing processes, regulatory updates, and technological advancements.

This can be resource-intensive and require specialized skills.

Solution: Establishing a dedicated RPA support team can ensure that the automation systems remain efficient and up-to-date. Regularly reviewing and updating RPA workflows will help in maintaining their effectiveness over time.

F] Scalability Issues

As fintech companies grow, their automation needs evolve, and the initial RPA solutions might not scale effectively to meet increasing demand.

So, how do you solve this problem?

Solution: Selecting scalable RPA tool that can handle increased workloads and integrate with new technologies is crucial. Conducting regular assessments of the RPA system’s performance and capacity will help in planning for future scalability.

By addressing these challenges with strategic solutions, fintech companies can effectively leverage RPA to enhance their operations, improve efficiency, and stay competitive in the dynamic financial industry.

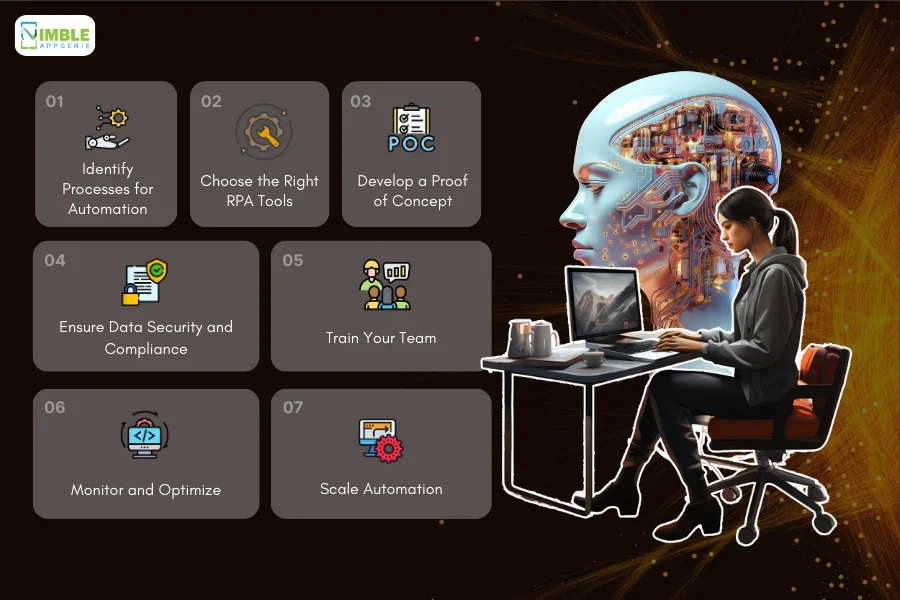

How You Can Integrate RPA in Fintech?

So, how do you use RPA in your fintech solution?

Let’s look at the integration process. The steps are as mentioned below:

Step 1: Identify Processes for Automation

Evaluate current processes to find repetitive, rule-based tasks that consume significant time and resources, such as data entry, transaction processing, and compliance reporting.

Step 2: Choose the Right RPA Tools

Compare different RPA platforms based on features, ease of use, integration capabilities, and support. Tools like UiPath and Automation Anywhere offer robust solutions tailored to financial tasks.

Step 3: Develop a Proof of Concept

Implement RPA on a small scale to automate a specific process. Measure performance, efficiency gains, and potential issues. This helps refine the approach and demonstrate ROI.

Step 4: Ensure Data Security and Compliance

Implement strong encryption methods, access controls, and regular security audits. Ensure RPA processes comply with industry standards and regulatory requirements.

Step 5: Train Your Team

Provide comprehensive training on selected RPA tools and processes. Encourage continuous learning to keep up with advancements in robotic process automation in finance.

Step 6: Monitor and Optimize

Set up a dedicated team to oversee RPA operations, monitor performance, and make necessary adjustments. Regularly review and update automation strategies to align with business goals.

Step 7: Scale Automation

Gradually expand RPA to other processes and departments. Use insights gained from initial implementation to improve and streamline further deployments.

Why Integrate RPA in Fintech?

- Enhanced Efficiency: Automation in finance reduces the time spent on repetitive tasks, allowing employees to focus on more strategic activities.

- Cost Savings: By automating manual processes, companies can significantly cut operational costs and improve their bottom line.

- Accuracy and Compliance: Robotic process automation in financial services ensures tasks are performed consistently and accurately, reducing errors and enhancing compliance with regulations.

- Improved Customer Experience: Faster and more accurate processing of transactions and services enhances customer satisfaction.

- Scalability: RPA in banking and fintech can easily scale to handle increased workloads, supporting business growth without the need for proportional increases in staffing.

Integrating RPA in fintech is a strategic move that drives operational efficiency, cost savings, and customer satisfaction, positioning your business for success in a competitive market.

Nimble AppGenie, Your Partner in Fintech Innovation

Nimble AppGenie is a leading fintech app development company with a proven track record of delivering top-notch solutions.

With over 250 clients and 350 successful projects, we’ve developed innovative apps like Cut Wallet and Sat Pay.

Our expertise and dedication ensure exceptional results for your fintech needs.

Recognized by Clutch.co, TopDevelopers, GoodFirms, and DesignRush, Nimble AppGenie stands out for its excellence and innovation.

When you hire dedicated developers from us, you gain access to a team committed to driving your project’s success.

Partner with us to transform your fintech vision into reality with cutting-edge technology and unmatched expertise.

Conclusion

Robotic Process Automation (RPA) is revolutionizing the fintech industry by enhancing efficiency, reducing costs, and improving accuracy. By understanding its benefits, challenges, and implementation strategies, fintech companies can leverage RPA to stay competitive. Nimble AppGenie, with its extensive experience and recognition, is your ideal partner in navigating the complexities of fintech automation.

FAQs

RPA in finance involves using software robots to automate repetitive and manual tasks. These robots can mimic human actions, such as data entry and transaction processing, to improve efficiency, accuracy, and compliance with financial regulations. This automation frees up human resources for more strategic and value-added tasks.

RPA benefits fintech companies by streamlining operations, reducing operational costs, and improving accuracy. Automated processes minimize human error, ensure faster transaction processing, and enhance customer satisfaction. Additionally, RPA helps in maintaining compliance with regulatory standards, which is crucial in the financial sector.

Common RPA use cases in fintech include customer onboarding, loan processing, fraud detection, compliance reporting, and invoice processing. For example, RPA can automate identity verification during customer onboarding or monitor transactions for suspicious activities to detect fraud, thereby enhancing operational efficiency and security.

RPA improves customer service by automating routine inquiries and support tasks. Automated chatbots and virtual assistants can handle common queries by providing quick and efficient support. This allows customer service representatives to focus on more complex issues, improving overall service quality and customer satisfaction.

Challenges include data security concerns, integration with legacy systems, high initial investment, change management, and maintaining RPA systems. Ensuring data security and compliance with regulations, managing costs, and training employees to adapt to new workflows are critical to overcoming these challenges.

Fintech companies can ensure data security with RPA by implementing robust encryption methods, access controls, and regular security audits. Ensuring compliance with industry standards and regulatory requirements is crucial. Regularly updating security protocols and monitoring RPA systems can also help protect sensitive financial data.

RPA plays a crucial role in fraud detection by continuously monitoring transactions and analyzing data for suspicious activities. RPA systems can identify patterns and anomalies that indicate potential fraud. By automating this process, fintech companies can detect and prevent fraudulent transactions more effectively and in real-time.

RPA streamlines financial reporting by automating the compilation and analysis of financial data. This automation ensures that reports are generated quickly and accurately, providing valuable insights for strategic decision-making. Automated financial reporting reduces the time and effort required for manual report generation, improving efficiency.

Commonly used RPA tools in finance include UiPath, Blue Prism, and Automation Anywhere. These tools offer comprehensive solutions for automating financial processes, with features like drag-and-drop interfaces, integration capabilities, and robust security measures. Choosing the right tool depends on specific business needs and scalability requirements.

Nimble AppGenie excels in delivering innovative fintech solutions with a proven track record of success. With over 250 clients and 350 successful projects, including apps like DafriBank, Cut Wallet, and Sat Pay, we are recognized by industry leaders like Clutch.co, TopDevelopers, GoodFirms, and DesignRush. Our expertise ensures exceptional results for your fintech needs.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.