With fintech services growing more popular than ever and becoming a household thing, it’s finally time for businesses to adapt to customers’ new payment methods. That’s what brings us to merchant service providers.

Everyone is using eWallet and another mobile wallet to pay for their shopping and businesses need to prepare for that. Now, at a stand-alone point, it can be very complex. However, to address the growing need, top digital payment industries have pushed out their solution solutions. And that’s what we call a merchant services provider.

In this blog, we shall be discussing all you need to know about merchant service providers and more. Covering different types, different solutions, merchant service provider lists, and so much more. With this being said, let’s get right into it:

What Is a Merchant Service Provider?

Wondering what a merchant service provider is?

Well, a merchant service provider (MSP), also known as a payment service provider (PSP), is a company or financial institution that enables businesses to accept various forms of electronic payments from customers.

This effectively puts merchant service providers in the financial technology category, making it a big fintech development solution.

Coming back to the topic, MSPs provide the infrastructure and services necessary for businesses to process credit cards, debit cards, and other electronic transactions securely and efficiently.

Moving on, now that you are familiar with the merchant service provider definition, let’s look at the different types of merchant service providers in the section below.

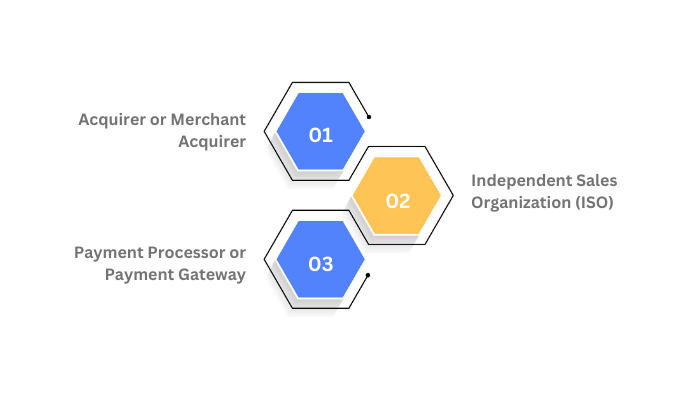

3 Types of Merchant Service Providers

Merchant service providers can be divided into three different types. Therefore, to provide you with a deeper understanding of the concept, we shall be discussing just that in the section below.

Type 1. Acquirer or Merchant Acquirer

This type of merchant service provider establishes relationships with businesses and facilitates the acceptance of electronic payments.

Moreover, Acquirers work with businesses to set up merchant accounts, manage transactions, and ensure the funds are deposited into the business’s bank account.

They typically provide payment processing equipment or software, such as point-of-sale (POS) terminals or virtual payment gateways, to facilitate transactions.

Type 2. Independent Sales Organization (ISO)

ISOs are independent entities that partner with acquirers to offer merchant services.

They act as intermediaries between businesses and acquirers, assisting with the application process, equipment provision, and ongoing support.

ISOs often focus on sales and marketing efforts to attract new merchants and earn commissions or residuals from the acquirer.

Type 3. Payment Processor or Payment Gateway

Payment processors and gateways provide technology infrastructure for securely transmitting and authorizing electronic transactions.

They handle the secure transmission of transaction data between the merchant, acquirer, and card networks.

Moreover, payment processors often offer additional services, such as fraud detection and prevention, recurring billing, and reporting tools.

These are the different types of merchant service providers. Moving on, let’s understand how these systems work in the section below.

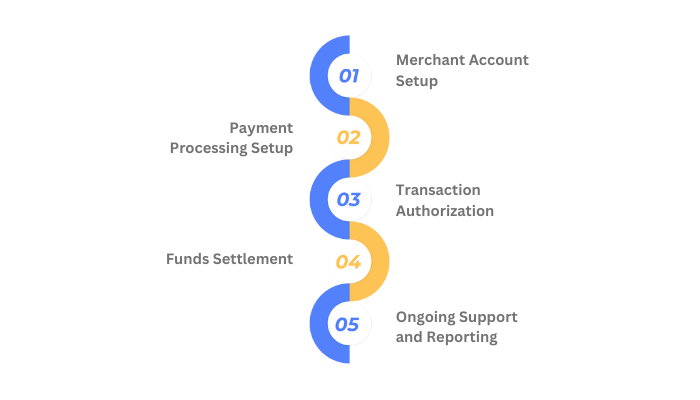

How Does a Merchant Service Provider Work?

Wondering how these merchant service provider platforms work? Well, wonder no more, we shall be discussing just that in this section of the blog.

Let’s go through the different steps involved in working with merchant service providers.

Step 1. Merchant Account Setup

The business owner or merchant applies for a merchant account with the MSP or its partnering acquirer.

Moreover, this involves providing relevant business information and financial details, and agreeing to terms and conditions.

Step 2. Payment Processing Setup

Merchant service providers assist merchants in setting up the necessary payment processing infrastructure, which can include physical POS terminals, virtual payment gateways, or mobile payment solutions.

Step 3. Transaction Authorization

When a customer makes a purchase using a credit or debit card, the transaction details are securely transmitted to the MSP or payment processor for authorization.

The processor communicates with the relevant card networks (e.g., Visa, Mastercard) to verify the cardholder’s information and ensure the availability of funds.

Step 4. Funds Settlement

Once the transaction is authorized, the funds are transferred from the customer’s cardholder account to the merchant’s account.

Merchant service providers facilitate this transfer and ensure the settlement process is completed efficiently.

Step 5. Ongoing Support and Reporting

Merchant service providers provide ongoing support to merchants, assisting with any issues or questions related to payment processing.

They also offer reporting tools and insights that help the merchant track transaction data, reconcile funds, and monitor business performance.

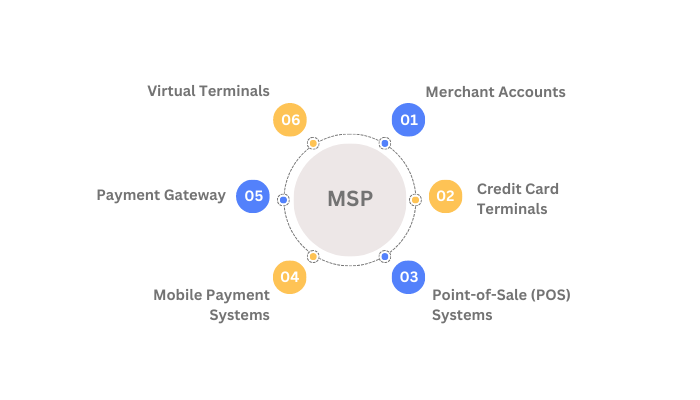

Merchant Service Products

It goes without saying that merchant services offer a range of different types of products that merchants can use to their benefit. So before we look at the best merchant service providers, let’s first discuss these different types.

1. Merchant Accounts

One of the most common offerings from merchant service providers is a merchant account. It is a type of bank account that enables businesses to accept and process credit card payments.

It allows funds from customer transactions to be deposited into the business’s bank account.

2. Credit Card Terminals

These are physical devices used to accept credit and debit card payments in brick-and-mortar stores. Moreover, they typically have card readers, keypads for entering transaction amounts, and display screens.

Credit card terminals are connected to the payment processor or gateway to authorize and process transactions.

3. Point-of-Sale (POS) Systems

POS systems are comprehensive solutions that combine hardware and software to facilitate payment processing and manage various aspects of a business’s operations.

They often include features like inventory management, sales reporting, customer relationship management (CRM), and employee management.

POS systems can integrate with credit card terminals or offer built-in payment processing capabilities.

4. Mobile Payment Systems

With the rise of mobile technology, many merchant service providers offer mobile payment solutions.

These solutions allow businesses to accept payments using mobile devices such as smartphones and tablets. They may utilize mobile card readers or Near Field Communication (NFC) technology for contactless payments.

5. Payment Gateway

A payment gateway is a technology platform that securely transmits transaction data between the merchant, the payment processor, and the card networks.

It encrypts sensitive payment information and facilitates the authorization and settlement of transactions. Payment gateways are commonly used in e-commerce and online businesses to accept payments over the Internet.

6. Virtual Terminals

Virtual terminals are web-based interfaces that allow businesses to process card-not-present transactions.

These transactions occur when the customer’s credit card is not physically present, such as when accepting payments over the phone or through mail orders.

Virtual terminals enable merchants to manually enter transaction details and process payments securely. This is one of the most common types of offering from merchant service providers.

Now, with this out of the way, we shall be looking at the best merchant service providers in the section below:

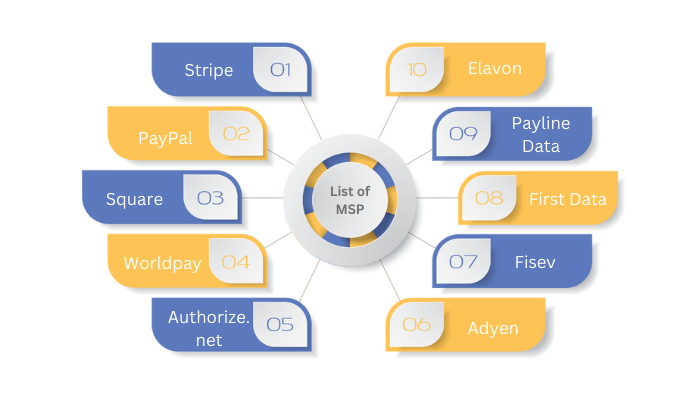

List of Merchant Service Providers

Looking for merchant service providers in the USA? Well, your search is over. Here is a list of merchant service providers that you can get your hands on today.

Let’s discuss them briefly below:

1. Stripe

Being one of the most popular fintech apps, Stripe doubles as a merchant service provider.

It is a popular payment gateway that offers a comprehensive suite of payment processing tools and APIs.

Thus, enabling businesses to accept payments online securely and easily integrate payment functionality into their websites or applications.

2. PayPal

PayPal is a well-known and widely used payment service provider that allows businesses and individuals to send and receive payments online.

We offer a range of payment solutions, including PayPal Checkout, PayPal Here for in-person payments, and various developer tools.

3. Square

Square provides a range of merchant services, including point-of-sale solutions, payment processing, and online payment tools.

Its user-friendly hardware and software options, such as Square POS systems and Square Reader, make it easy for businesses to accept payments in-store and online.

3. Worldpay

Worldpay is a global payment processing company that offers a suite of merchant services, including card processing, online payments, and advanced fraud prevention tools.

Moreover, the service provider serve businesses of all sizes and industries, providing secure and reliable payment solutions.

4. Authorize.Net

Authorize.Net is a leading payment gateway that enables businesses to accept online payments securely.

They offer a robust platform with features like recurring billing, fraud detection tools, and integration options with various e-commerce platforms.

5. Adyen

Adyen is a payment technology company that provides a single platform for global payment processing.

Moreover, their solution allows businesses to accept multiple payment methods, manage transactions across different countries, and optimize their payment processes.

6. Fiserv

Fiserv offers a range of payment and merchant services, including payment processing, POS systems, and e-commerce solutions.

Their offerings cater to businesses of all sizes, providing secure and efficient payment processing capabilities.

7. First Data

First Data is a global payment technology company that offers a wide range of merchant services, including card processing, POS solutions, mobile payments, and e-commerce tools.

They provide comprehensive payment solutions designed to meet the needs of businesses in various industries.

How to Choose a Merchant Service Provider

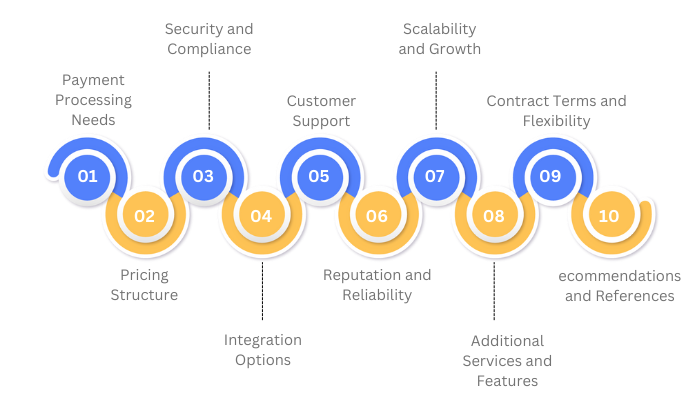

Going through the best merchant service provider list can get really confusing. So, how to choose a merchant service provider for your business?

Well, there is no secret magic trick to this, but there are some things you can consider. These are, as mentioned below:

1. Payment Processing Needs

Evaluate your business’s specific payment processing needs.

Determine whether you need in-store, online, or mobile payment capabilities, as well as any specialized features or integrations required for your industry.

2. Pricing Structure

Understand the pricing models offered by different merchant service providers.

Compare fees such as transaction fees, monthly fees, statement fees, and any other additional costs. Consider the overall cost-effectiveness and transparency of the pricing structure.

3. Security and Compliance

Ensure that the merchant service provider adheres to industry security standards such as Payment Card Industry Data Security Standard (PCI DSS) compliance.

Look for features like encryption, tokenization, and fraud detection tools to protect customer data and mitigate risks.

4. Integration Options

Consider the provider’s compatibility with your existing systems and software.

If you use specific point-of-sale (POS) systems, e-commerce platforms, or accounting software, make sure the merchant service provider offers seamless integration options.

5. Customer Support

Assess the level of customer support provided by the merchant service provider.

Prompt and reliable customer support is crucial when issues arise or assistance is needed. Look for providers that offer 24/7 support and multiple channels of communication.

6. Reputation and Reliability

Research the reputation and reliability of the merchant service provider.

Read customer reviews, and testimonials, and check their track record in terms of uptime, transaction success rates, and overall customer satisfaction.

7. Scalability and Growth

Consider the scalability of the merchant service provider’s offerings. Ensure that the provider can support your business’s growth and handle increased transaction volumes without compromising on performance or customer experience.

8. Additional Services and Features

Assess any additional services or features offered by the provider.

This could include analytics and reporting tools, recurring billing options, multi-currency support, or customized solutions tailored to your business’s specific requirements.

9. Contract Terms and Flexibility

Review the contract terms, cancellation policy, and any long-term commitments required.

Ensure that the terms align with your business goals and allow flexibility if needed.

10. Recommendations and References

Lastly, seek recommendations from other businesses in your industry or network. Their experience and insights can provide valuable information when making your decision.

Conclusion

With the growing digitalization trend and fintech among users, there are a lot of businesses that are exploring merchant service providers. In this blog, we learned all you need to know about the same. With this said, we conclude the blog.

FAQ

A merchant service provider is a company that enables businesses to accept electronic payments, such as credit cards, debit cards, and mobile payments.

The types of merchant service providers include acquirers, independent sales organizations (ISOs), payment processors or gateways, and mobile payment providers.

Merchant service providers set up merchant accounts, provide payment processing equipment or software, authorize and settle transactions, and offer ongoing support for businesses to accept electronic payments securely and efficiently.

Common merchant service products include merchant accounts, credit card terminals, point-of-sale (POS) systems, mobile payment systems, payment gateways, and virtual terminals.

Consider factors such as your payment processing needs, pricing structure, security measures, integration options, customer support, reputation, scalability, additional services/features, contract terms, and recommendations from other businesses.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.