What are the best core banking software?

This is a commonly asked question in the world of business since every top tech and non tech company deals with money.

Core banking software makes everything that much easier. Now, with this being said, we shall be discussing everything you need to know about core banking software and go through the best core banking software list.

So with this being said, let’s get right into it:

Core Banking Software Market

Let’s start with an fintech statsitics overview of the core banking software market.

- The global core banking software market size was valued at USD 12.51 billion in 2022 and is projected to grow to USD 47.37 billion by 2030, at a CAGR of 18.4% during the forecast period.

- Growth in core banking software market share is driven by increasing demand for digital banking, the need to improve operational efficiency, and the growing adoption of cloud-based solutions.

- Moving on, the key players in the core banking software market include Temenos, Oracle, SAP, Infosys, Finastra, Mambu, Backbase, and TCS.

We shall be discussing more of these market leading and best core banking software in the world later down the line. Meanwhile, let’s look at the definition of the same, in section below:

What is Core Banking Software?

Core banking software is a good example of modern fintech software development. As such, these are a centralized system that handles the primary banking functions of a financial institution.

It serves as the backbone of a bank’s operations and is responsible for managing customer accounts, processing transactions, and maintaining financial records.

Moreover, Core banking software enables banks to provide services such as account management, deposits, loans, payments, and other financial transactions.

Moving on, in an attempt to better understand the core banking software, let’s look at what are the functions or features of core banking software in the section below.

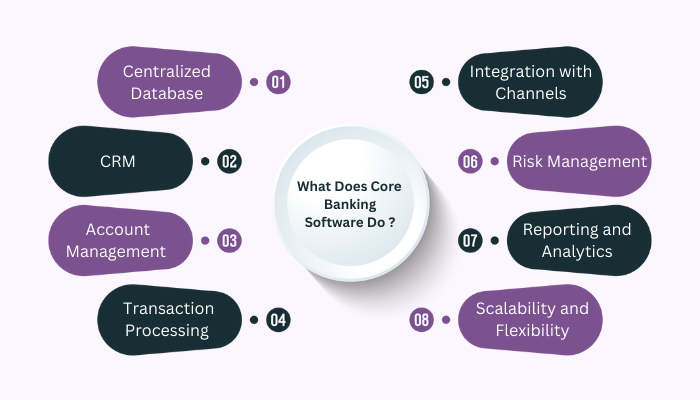

What Does Core Banking Software Do

Wondering what are the features of core banking software or in layman’s terms, what you can do with these software? Well, there are a great many things.

Let’s discuss them here:

1. Centralized Database

For starters, Core banking software operates on a centralized database that stores customer information, account details, transaction history, and other relevant data.

This database allows for easy access and retrieval of information across different banking channels.

2. Customer Relationship Management (CRM)

The software includes CRM capabilities to manage customer data effectively.

It stores customer profiles, tracks interactions, and provides a comprehensive view of customer relationships, allowing banks to offer personalized services.

3. Account Management

Core banking software facilitates the creation, modification, and closure of customer accounts. It maintains account balances, tracks transactions, and generates account statements.

Plus, it also manages account-related activities such as interest calculations, overdraft facilities, and account linking.

4. Transaction Processing

The software handles various types of financial transactions, including deposits, withdrawals, fund transfers, loan disbursements, and repayments. It ensures the accuracy and security of transactions, validates them against predefined rules, and updates account balances in real-time.

5. Integration with Channels

One of the big features of Core banking software solution is that it integrates with multiple banking channels, such as online banking portals, mobile applications, ATMs, and branch terminals.

In addition to this, the integration allows customers to access their accounts and perform transactions through their preferred channels while maintaining data consistency.

6. Risk Management

The software incorporates risk management features to monitor and mitigate financial risks.

It also enforces compliance with regulatory requirements, performs anti-money laundering checks, detects fraudulent activities, and manages credit risk.

7. Reporting and Analytics

Core banking software generates reports and provides analytical insights into banking operations.

It offers customizable reports on financial performance, customer behavior, transaction trends, and other key metrics, enabling banks to make informed decisions and optimize their services.

8. Scalability and Flexibility

Core banking software is designed to accommodate the growing needs of a bank. It can handle a large volume of transactions and support multiple branches and users.

The software is often modular, allowing banks to add or modify functionalities as per their specific requirements.

With this out of the way, we shall be discussing some of the best core banking software in the world in the next section of the blog.

Best Core Banking Software in the World

Now, let’s look at some of the best core banking software in the world. Let’s look at them below, discussing each of them in detail.

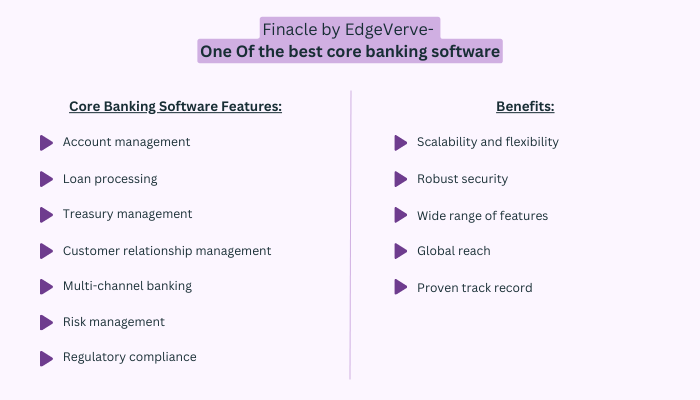

1. Finacle by EdgeVerve- One of the best core banking software

Finacle, developed by EdgeVerve (a subsidiary of Infosys), is a banking software solution that has gained significant popularity in the industry.

Known for its robustness and flexibility, Finacle empowers financial institutions with the ability to streamline their operations and enhance customer experiences.

Moreover, Its user-friendly interface and comprehensive suite of tools enable banks to deliver seamless banking services, whether it’s through traditional channels or digital platforms.

Finacle’s innovative approach towards core banking, online banking, mobile banking, and analytics allows banks to stay ahead in a rapidly evolving digital landscape.

All in all, this is an absolute example of banking software development.

Core Banking Software Features:

- Account management

- Loan processing

- Treasury management

- Customer relationship management

- Multi-channel banking

- Risk management

- Regulatory compliance

Benefits:

- Scalability and flexibility

- Robust security

- Wide range of features

- Global reach

- Proven track record

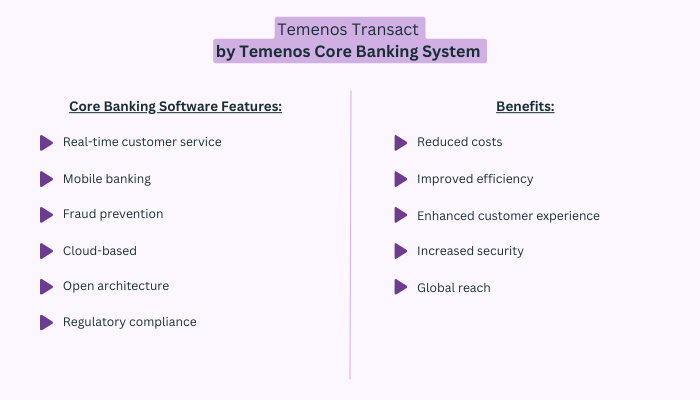

2. Temenos Transact by Temenos Core Banking System

Temenos Transact is a core banking software solution that has established itself as a leading player in the market.

What sets Temenos Transact apart is its ability to cater to diverse banking needs, ranging from retail and corporate banking to universal banking.

With a strong focus on scalability and efficiency, Temenos Transact enables financial institutions to manage their operations seamlessly and deliver personalized services to their customers.

The solution’s comprehensive suite of features and its integration capabilities with other systems make it a preferred choice for banks seeking to modernize their infrastructure.

Core Banking Software Features:

- Real-time customer service

- Mobile banking

- Fraud prevention

- Cloud-based

- Open architecture

- Regulatory compliance

Benefits:

- Reduced costs

- Improved efficiency

- Enhanced customer experience

- Increased security

- Global reach

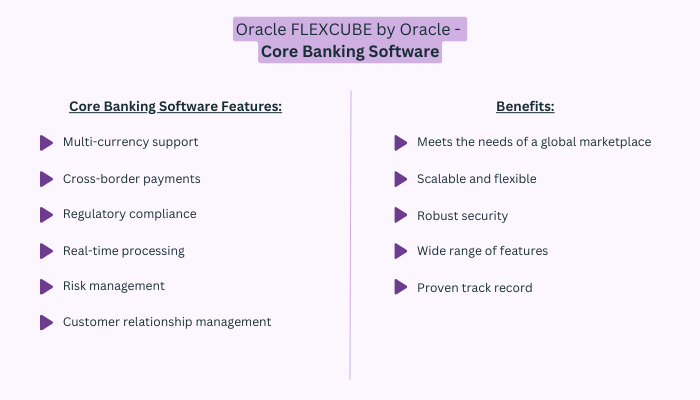

3. Oracle FLEXCUBE by Oracle – Core Banking Software

Oracle FLEXCUBE is a comprehensive banking platform offered by Oracle, one of the world’s leading technology companies. Designed to meet the complex requirements of modern financial institutions,

FLEXCUBE provides an extensive range of functionalities beyond core banking, such as customer relationship management, wealth management, and risk management.

Oracle’s deep industry expertise combined with its robust technology infrastructure ensures that FLEXCUBE delivers high performance, security, and scalability to banks of all sizes.

Core Banking Software Features:

- Multi-currency support

- Cross-border payments

- Regulatory compliance

- Real-time processing

- Risk management

- Customer Relationship Management

Benefits:

- Meets the needs of a global marketplace

- Scalable and flexible

- Robust security

- Wide range of features

- Proven track record

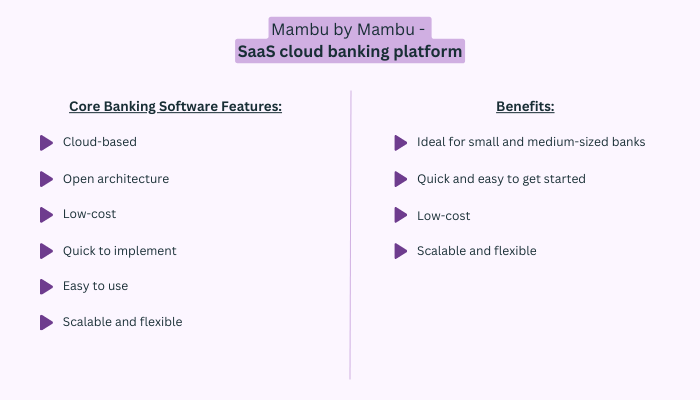

4. Mambu by Mambu – SaaS cloud banking platform

Mambu is a cloud-native banking platform that has emerged as a disruptor in the banking software space.

Built on modern technology principles, Mambu empowers financial institutions to deliver agile and innovative banking services.

Its cloud-based infrastructure enables banks to scale their operations rapidly and provides the flexibility to adapt to changing market dynamics. Mambu’s modular architecture and extensive API capabilities allow for easy integration with existing systems and the seamless launch of new products and services.

This makes it an ideal choice for banks looking to accelerate their digital transformation journey.

Core Banking Software Features:

- Cloud-based

- Open architecture

- Low cost

- Quick to implement

- Easy to use

- Scalable and flexible

Benefits:

- Ideal for small and medium-sized banks

- Quick and easy to get started

- Low cost

- Scalable and flexible

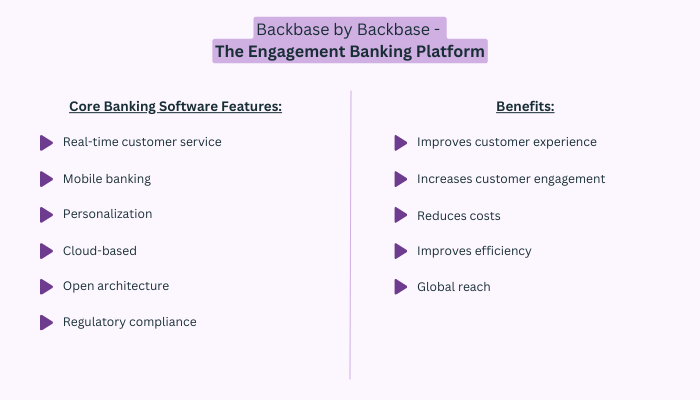

5. Backbase by Backbase – Engagement Banking Platform

Backbase offers a digital banking platform that revolutionizes the way financial institutions engage with their customers.

By combining sleek designs with powerful functionality, Backbase enables banks to deliver immersive and personalized experiences across multiple channels.

Its user-centric approach ensures that customers can effortlessly access banking services, manage their accounts, and conduct transactions, thereby fostering loyalty and satisfaction.

Backbase’s intuitive interface and advanced analytics capabilities empower banks to gain valuable insights into customer behavior and make data-driven decisions.

Core Banking Software Features:

- Real-time customer service

- Mobile banking

- Personalization

- Cloud-based

- Open architecture

- Regulatory compliance

Benefits:

- Improves customer experience

- Increases customer engagement

- Reduces costs

- Improves efficiency

- Global reach

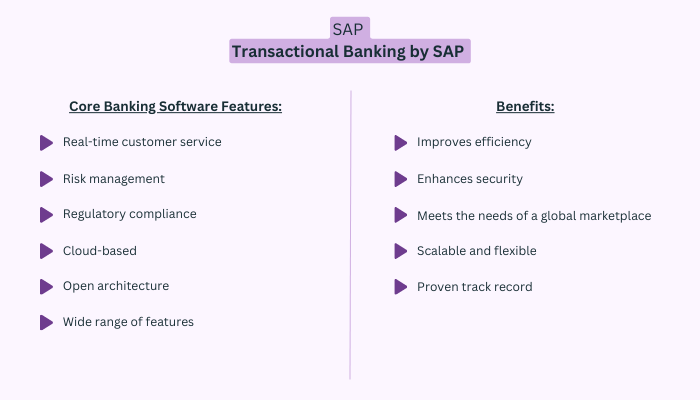

6. SAP Transactional Banking by SAP

Let us introduce you to one of the best core banking software.

SAP Transactional Banking is a comprehensive banking solution offered by SAP, a global leader in enterprise software. Designed to support end-to-end banking operations, SAP Transactional Banking provides a unified platform for core banking, payments, liquidity management, and regulatory compliance.

Leveraging SAP’s extensive experience in the financial services industry, the solution helps banks streamline their processes, enhance operational efficiency, and ensure compliance with evolving regulatory requirements.

With its integration capabilities and robust reporting tools, SAP Transactional Banking equips banks with the tools they need to thrive in a highly competitive market.

Core Banking Software Features:

- Real-time processing

- Risk management

- Regulatory compliance

- Cloud-based

- Open architecture

- Wide range of features

Benefits:

- Improves efficiency

- Enhances security

- Meets the needs of a global marketplace

- Scalable and flexible

- Proven track record

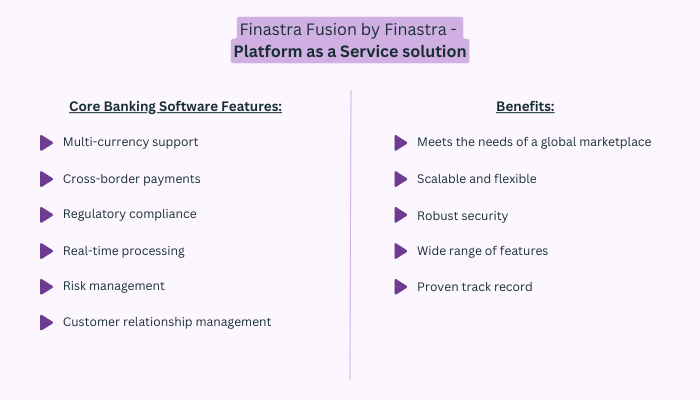

7. Finastra Fusion by Finastra – Platform as a Service solution

Finastra Fusion is a core banking software platform that combines core banking capabilities with a wide range of additional financial services functionalities.

With a focus on empowering financial institutions to drive innovation and agility, Finastra Fusion offers a unified view of customer data, enabling banks to provide personalized services and streamline their operations.

The platform also includes features for lending, payments, treasury management, and risk management, making it a comprehensive solution for banks looking to transform their digital offerings.

Finastra Fusion’s modular architecture allows banks to choose and integrate specific modules based on their requirements, providing flexibility and scalability as their business evolves.

Core Banking Software Features:

- Multi-currency support

- Cross-border payments

- Regulatory compliance

- Real-time processing

- Risk management

- Customer relationship management

Benefits:

- Meets the needs of a global marketplace

- Scalable and flexible

- Robust security

- Wide range of features

- Proven track record

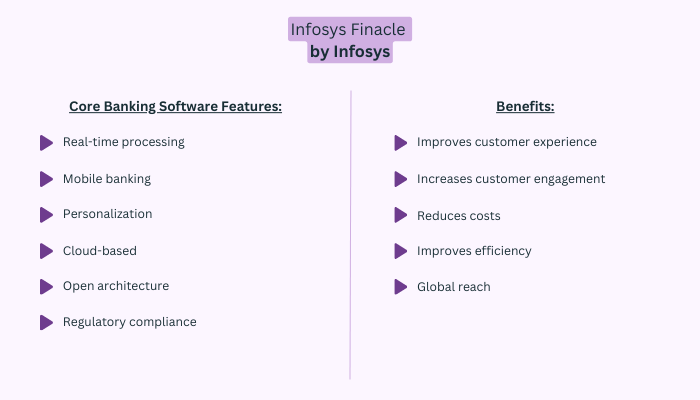

7. Infosys Finacle by Infosys

Infosys Finacle is a leading banking suite offered by Infosys, a renowned global consulting and IT services company.

Finacle provides financial institutions with a comprehensive set of tools to manage their banking operations efficiently and deliver exceptional customer experiences. With its modular architecture, Finacle enables banks to tailor the solution to their specific needs, ensuring a seamless integration with existing systems.

The solution’s advanced analytics capabilities help banks derive valuable insights from customer data, enabling personalized offerings and targeted marketing campaigns.

Finacle’s continuous innovation and commitment to emerging technologies make it a trusted choice for banks worldwide.

Core Banking Software Features:

- Real-time processing

- Mobile banking

- Personalization

- Cloud-based

- Open architecture

- Regulatory compliance

Benefits:

- Improves customer experience

- Increases customer engagement

- Reduces costs

- Improves efficiency

- Global reach

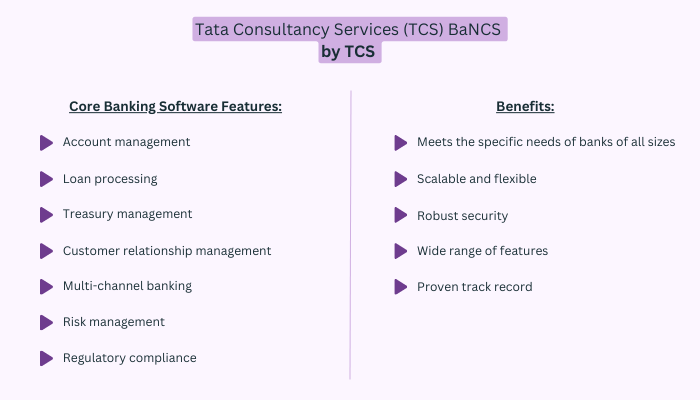

8. Tata Consultancy BaNCS

TCS BaNCS is a comprehensive banking software suite developed by Tata Consultancy Services (TCS), one of the largest IT services and consulting firms globally.

BaNCS caters to a wide range of financial institutions, including banks, insurers, and capital market firms. Its modular architecture and extensive functionality cover core banking operations, payments, risk management, and compliance.

TCS BaNCS leverages emerging technologies like artificial intelligence (AI) and blockchain to drive innovation and help banks stay ahead in a rapidly changing industry. With its robust infrastructure and global presence, TCS BaNCS is trusted by financial institutions worldwide.

Core Banking Software Features:

- Account management

- Loan processing

- Treasury management

- Customer Relationship Management

- Multi-channel banking

- Risk management

- Regulatory compliance

Benefits:

- Meets the specific needs of banks of all sizes

- Scalable and flexible

- Robust security

- Wide range of features

- Proven track record

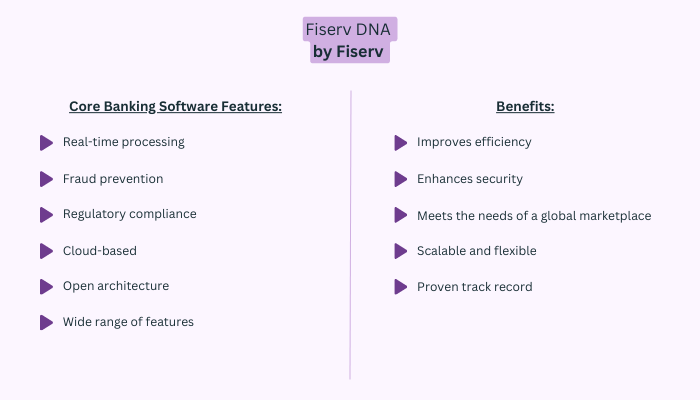

9. Fiserv DNA by Fiserv

Fiserv DNA is a comprehensive core banking platform offered by Fiserv, a leading provider of financial technology solutions.

Designed to meet the complex needs of financial institutions, DNA offers a modern, flexible, and scalable architecture. It provides a wide range of banking functionalities, including deposits, lending, payments, customer relationship management, and business intelligence.

Moreover, DNA’s open architecture enables seamless integration with other systems, allowing banks to create a unified ecosystem that supports their digital transformation initiatives.

Fiserv DNA’s industry expertise and commitment to innovation make it a preferred choice for banks seeking to deliver exceptional customer experiences.

Core Banking Software Features:

- Real-time processing

- Fraud prevention

- Regulatory compliance

- Cloud-based

- Open architecture

- Wide range of features

Benefits:

- Improves efficiency

- Enhances security

- Meets the needs of a global marketplace

- Scalable and flexible

- Proven track record

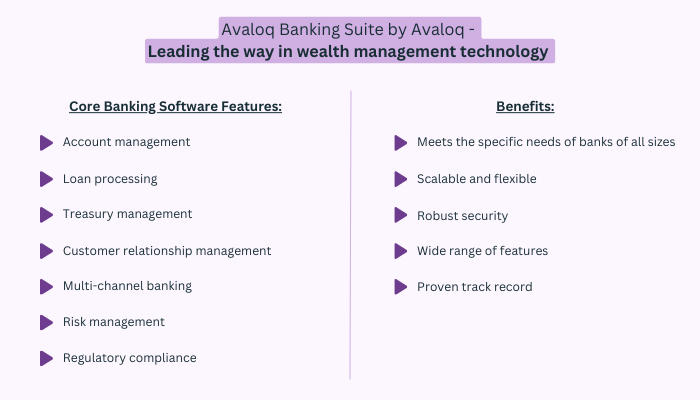

10. Avaloq Banking Suite by Avaloq – Leading the way in wealth management technology

Avaloq Banking Suite is a comprehensive banking software solution developed by Avaloq, a leading provider of digital banking solutions.

The suite covers various aspects of banking operations, including core banking, wealth management, payments, and regulatory compliance.

Avaloq Banking Suite’s modular architecture enables banks to choose and integrate specific modules based on their requirements, ensuring flexibility and scalability. With its focus on automation and digitization, Avaloq empowers banks to streamline their processes, enhance operational efficiency, and deliver personalized services to their customers.

The suite’s advanced analytics capabilities provide valuable insights, enabling data-driven decision-making for banks.

Core Banking Software Features:

- Account management

- Loan processing

- Treasury management

- Customer relationship management

- Multi-channel banking

- Risk management

- Regulatory compliance

Benefits:

- Meets the specific needs of banks of all sizes

- Scalable and flexible

- Robust security

- Wide range of features

- Proven track record

Conclusion

All of these platforms are amazing in their own right, deserving of the title of the best core banking software in the world. But at the end of the day, it depends on the needs of your business. With this said, we conclude the blog.

FAQ

It depends on specific bank requirements, but popular options include Finacle, T24, and Flexcube.

It streamlines operations, improves customer service, and enhances efficiency and scalability.

Yes, most core banking software supports multiple currencies for global banking operations.

Yes, core banking software can be integrated with various systems like CRM, payment gateways, etc.

Yes, core banking software provides real-time processing for quick and accurate transactions.

Yes, core banking software incorporates robust security measures to protect sensitive data.

Yes, core banking software offers comprehensive reporting and analytics functionalities.

Yes, most core banking software provides mobile banking capabilities for convenient customer access.

Yes, core banking software helps banks comply with regulations and perform necessary checks.

Yes, core banking software can be customized and configured based on individual bank requirements.

Yes, core banking software is designed to handle high transaction volumes efficiently.

Yes, core banking software caters to the needs of banks of all sizes.

Yes, core banking software often includes CRM features for effective customer management.

Yes, core banking software automates loan processes and helps manage loan portfolios.

Yes, vendors typically offer training and support during the implementation of core banking software.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.