Do you know what the hottest trends in the fintech market are?

The evolution of BNPL apps has allowed many shopping apps to encourage users to purchase objects with simple clicks without having the hassle of paying a complete amount at one time.

Klarna is one such app, and if you desire to enter the industry of BNPL apps, it’s important to know the best ones.

When you head up to develop an app like Klarna will require severe consideration of the types of steps, features, monetization strategies, challenges, and much more.

Here’s a guide to cover it all for you.

About Klarna

Let’s start by understanding the Klarna app and its related fundamentals.

Klarna was founded in 2005 in Sweden to assist people in shopping online. Within the last 19 years, technology has evolved to its maximum. It has evolved, by transforming the world around it.

The total active consumers on the platform is 85,000,000, along with the total number of merchants which is 575,000. Here the number of employees is 3,800. It is one of the leading global payments and shopping platforms assisting users in performing more flexible shopping and purchasing experiences for the 85 million active customers.

Klarna is an app that assists in enjoying secure shopping and focuses on simple and secure checkout procedures.

After evaluating the concepts of the app, now it’s time to know the working process of the app.

Without understanding it you cannot continue with the development process, right?

Let’s sneak out the working procedure below.

How Does Klarna App Work?

Before you jump into the process of creating an app like Klarna, let’s check how it works.

Here’s the list to go ahead with.

1] Choice at the Time of Payment

When the user checks out from any shopping or e-commerce app or any other app accepting BNPL pattern, the user needs to select the option.

BNPL apps like Klarna partner with physical stores and any prepaid card stores in the U.S. for proceeding to shop at any of their favorite stores.

2] Setting the Payment Intervals

This choice will guide the user to the platform where they can set the payment intervals and options according to their own preferences.

Suppose the user selects to pay $50 for 4 weeks, to pay the whole amount for the object. Hence, they can continue with the payment accordingly.

3] Checking the Credibility of the User

Now, the app checks the credibility of the respective user. With the help of different options, the app can identify if the user can pay the payments on time or not.

This assists the app to help their users with payments and to sustain in the competitive market as long as they can lead.

4] Finalizing the Payment Methods

Here, the users can set the payment options that will be used for continuing with the app. The user must set diversified payment networks according to their ability to pay for the object.

These BNPL apps do not charge interest within a defined period. But, afterward, if the user skips one payment period, they charge high interest.

5] Making the Buy

Now, it’s time to buy the app. Here an app like Klarna will pay the complete amount to the second party on the user’s behalf.

For instance, your app pays the payment of $200 to the second party. This will aid you in building contacts and assisting the target audience to fulfill their payments without any hassle.

6] Managing the Purchases

Now, if the user pays every installment on time, it will be convenient for you and your app to continue with the business.

BNPL apps direct the purchases and make it doable for the user to continue with the payments in the future.

These are all important steps to consider if you are ready to prepare a BNPL app like Klarna.

Still confused about “why create an app like Klarna?”

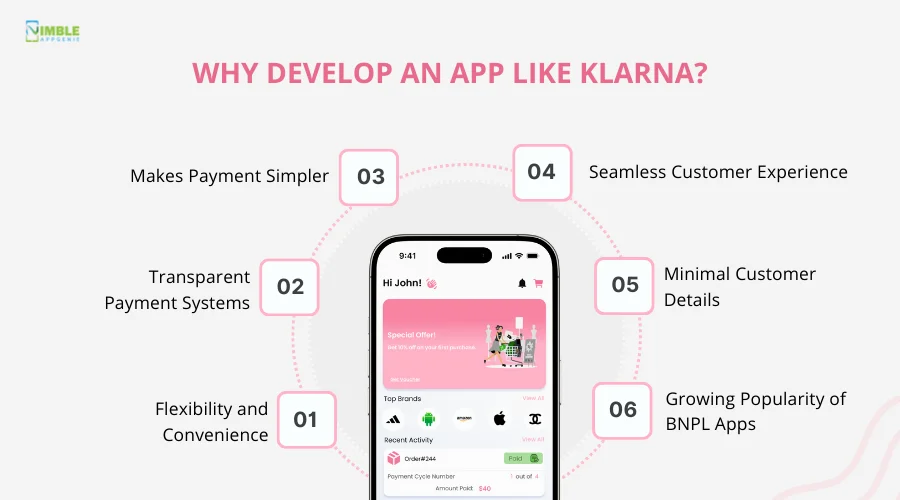

Why Develop an App Like Klarna?

It is important to know the reasons why you want to go ahead with a BNPL app like Klarna.

Let’s discuss all the reasons below:

► Flexibility and Convenience

One of the important aspects here is flexibility and convenience. BNPL apps like Klarna help users to get instant credit without even bothering to mortgage any loan. With the help of flexible working, companies will be able to adapt to the fluctuating demand of the market.

The app helps the users select the payment plans and here the users don’t need to pay the whole amount upfront. This can suit the users best and may help them to pursue the payment without any stress.

► Transparent Payment Systems

Users always adore transparency in payments. Thus, by creating an app like Klarna, you can allow the users to have transparent pay options.

It is a user-friendly app that assists them to make an excellent choice of payments according to their feasibility and flexibility. A transparent system of payment keeps every transaction clear making it an excellent choice for online shoppers.

► Makes Payment Simpler

With the help of the Klarna app, the users don’t need to continue with the traditional way of payments of taking small loans for objects. They can enjoy the convenience of buying now and paying later with no interest over the payment.

These apps are designed to make payments simpler by breaking down the buy cost into smaller payments over a few weeks or months.

► Seamless Customer Experience

Apps like Klarna help give seamless customer experience, helping the users to pay for the object, without bothering about any interest on it.

Additionally, the app provides consistent positive personalized experiences throughout their entire journey. This results in increasing the brand value of the app around the competitors.

► Minimal Customer Details

The BNPL app like Klarna require very minimal customer details for approval. This helps the users to continue with the direct payment option even without any mortgage.

In the current era, the app has become a focus point for the majority of shoppers. Helping them out to buy the stuff that they need without covering any interest on payment.

► Growing Popularity of BNPL Apps

The mentioned stats represent how BNPL apps like Klarna can be effective for this market. Since 2015, the growth of BNPL apps has continuously increased. Downloads of Paypal were almost 1.9 million which has grown to 4.6 million in the past 10 years approx.

These stats represent the need for apps like Klarna in a competitive market. It can aid the users to continue with direct payment options while checking out of the shopping apps.

These were all important reasons to consider while develop an app like Klarna.

Now that you are ready to develop an app like Klarna, it’s important to continue with the type of features to include in it, right?

The following section states the same.

Key Features of an App Like Klarna

The list of BNPL app features can be useful in assisting and addressing the users’ issues effectively.

Here’s the section to go ahead with:

♦ User Registration and Profile Management

One of the prime features here is accompanying the user registration and managing user profiles successfully.

Here the users need to download the app and then they can create their profile for further continuation with payment methods and for making a purchase.

♦ Monthly Financing

The majority of BNPL apps require low maintenance fees. They can charge you monthly or yearly for payment. Additionally, the late fees here are very low.

Well, these businesses know well that their target users are students and people with low salaries. Thus, this feature assists the users in submitting a very low subscription fee or no fee at all for keeping up with the app.

♦ Security

Keeping up with mobile app security is a primary feature when it comes to the BNPL app. You should know and carry out the robust technologies for continuing with the payment methods.

You need to know the current market technologies and need to carry them out so as to enhance the performance of your BNPL app.

♦ Payment Scheduling and Management

This is its core feature, where BNPL apps like Klarna can schedule and manage the payment processes effectively.

It will be useful in helping the users to check for the due payments and skipped payments (if any). This can enhance the users’ connection with the applications.

♦ E-Commerce Integration

Through seamless integrations, the BNPL apps help users access payments at any shop or e-commerce website and apps.

Such integrations are developed to assist the users in accessing the payments directly via online stores without leaving the merchant’s sites or apps.

♦ Push Notifications

Through push notifications, the BNPL apps help the users to access the payments successfully. This is one of the critical components that are designed to enhance user engagement and retention.

With alerts over payments, users can get notifications about due payments or any other information related to the same. It may even include changing regulations about payments and more.

♦ Loyalty Programs and Rewards

Through loyalty programs and rewards, the users can connect with the app in a personalized manner. Here they can encourage repeat purchases and may enhance user engagement through rewarding the users for their loyalty.

By getting access to discounts, offers, and points, the users feel more valued which results in increasing engagement with the business.

♦ Dashboard

The use of admin dashboards can be useful for the users to check out for the installments due or have been made.

They can track the payments and the type of methods they can pursue according to their feasibility.

♦ Customer Support with Chatbots

It is essential to include customer support and chatbots within the app as a crucial feature to assist the users to mention their views about the experience with the app.

This feature can help engage the users and address the issues of the users on time. With this feature, the users can be answered on time. This might enhance their trust in the brand.

♦ Automated Payments

Through the integration of technology, apps like BNPL are useful for accessing automated payments. It is an amazing feature where the users need not go for payment apps that fuel up the approval rates.

With this feature, the users can directly pay for any time subscription plan, successfully.

These were all the types of features to consider for continuing with develop an app like Klarna.

Until now, we have evaluated the basics of Klarna, the working process of apps like Klarna, reasons to consider for continuing with the development, along features.

Now, the wait to access the right steps is over.

The following section will be useful in answering “How to develop an app like Klarna?”

Steps to Create an App Like Klarna

What are the important steps to create an app like Klarna? It is vital to know the right process. Check out the steps below.

Step 1: Identifying the Value Proposition

What’s the value of your idea in the market? Well, answering the question totally depends on market research.

Value proposition is all about a clear statement that will explain how your idea in the market will be useful to address the users’ concerns. It is one of the prime steps to undertake before you step into a competitive market.

In market analysis, you need to process the type of product or services preferred by the brand, the number of competitors available, along with identifying the target audience in the market. You should define your BNPL model and how it will be useful for the target users.

Step 2: App Design Selection

UI/UX app design is all about selecting the color, and theme, and then making a blueprint after evaluating the current market trend of app design.

Here it is important that you need to develop a wireframe and prototype for sketching out the core part of the user flow. You need to sketch out the type of functions to develop a Klarna clone app.

You should be able to finalize the BNPL app design by going through its fundamentals and principles.

Step 3: Selecting Features

Well, while identifying the right design, feature selection is an internal part. Still, if you haven’t done it yet, proceed now.

You need to analyze the core and advanced features to build an app like Klarna. The features depend on the aim and objective of the app and the type of service it will provide to the target users.

The BNPL app features need to be simple to implement and use. A range of complicated features can make your app too complicated and even overburdened.

Step 4: Tech Stack Development

Can you imagine your app without a tech stack? It is all about the set of technologies used by organizations for building and running a website, project, or application.

When it comes to the BNPL app tech stack, it needs to be clear with secure coding and through accessing a suitable frontend framework for cross-platform app development and for reaching both Android and iOS users.

It’s vital to select the type of technology by considering microservices architecture to ensure scalability, modularity, and easy maintenance.

Step 5: Creating the Complete App

Now, it’s time to build the complete app and combine the front-end and back-end processes of the same. It’s essential to look for suitable tools useful for combining the complete app development process.

You need to select the type of platform and then build the BNPL app accordingly. Here the type of platform can be Android app development, iOS app development, or Hybrid app development based on the objective of your project.

Additionally, you may create mockups, may plan for app security by implementing robust technologies, and may begin coding under this step.

Step 6: Testing and Quality Assurance

It’s important to hire mobile app developers who don’t just focus on the development part but also on quality assurance. This is one of the essential phases for ensuring the app’s functionality, security, and performance to meet the high standards.

Mobile app testing is all about using the right tools to check the software thoroughly before it is launched in the competitive market.

It is essential to ensure that the app doesn’t contain any kind of bugs or errors and runs as per the expectations of the target users. This step involves rigorous evaluations as well as resolving any type of issues before launch.

Step 7: App Deployment and Maintenance

After testing, your app will be ready to deploy in the competitive market. This will make the app more accessible. You should evaluate the license before continuing with the app launch.

Another segment that you cannot ignore is app maintenance. The process of app building might end here, but for sustaining your business in a long-term aspect, you should not ignore maintenance activity.

Analyze the importance of app maintenance and then connect to established services that can help you with the same. Most probably, the hired development experts can do it for you, successfully.

These are all essential steps to undertake to create an app like Klarna. Well, as we discussed about technologies, right?

Now, let’s talk about it in detail.

Key Technologies for Developing an App Like Klarna

To develop an app like Klarna, you need to evaluate the type of programming language, database, and much more.

Consider the table below for more.

| Component | Technology |

Purpose |

|

Front-End |

React Native, Flutter, Swift, Kotlin, React.js |

Mobile app development, UI/UX design. |

|

Payments |

Stripe, PayPal, Klarna API, Afterpay |

Payment gateway and BNPL integration |

|

Back-End |

Node.js (Express), Python (Django), Ruby on Rails |

Handle API requests, user authentication, and business logic. |

|

Database |

PostgreSQL, MongoDB |

Store user data, transaction records, real-time data |

|

Security |

TLS/SSL, Tokenization, Two-Factor Authentication |

Data encryption, secure transactions, and fraud prevention. |

|

Analytics |

Google Analytics, Mixpanel, Tableau |

Cloud hosting, containerization, continuous integration, and deployment |

|

Monitoring |

Datadog, Prometheus, Sentry |

Monitoring of the application |

Till now, we have learned about the Klarna app, the reasons for creating it, the working procedure, and the steps to build an app like Klarna, along with the tech stack required to build it.

The next section is all about defining the type of resources needed for developing an app like Klarna.

Resources Required to Develop an App Like Klarna

What’s the cost of creating a fintech app?

Deciding on an accurate budget that is not too low and not too high can be a difficult task. Additionally, deciding on the budget will depend on different factors such as the complexity of the app, design, maintenance cost, security, and many other attributes.

Well, the average cost to build an app like Klarna can vary from $120,000 to $250,000.

Another important resource is time, other than cost.

How much time does it take to build a mobile app?

Here’s the table to undertake for the same.

After checking out the resources part, let’s move forward to the monetization strategies needed to consider for creating an app like Klarna in the following section.

|

Development Process |

Time Required |

|

Market Analysis |

1-2 Months |

|

App Design |

1-2 Months |

| Choice of Features |

1-2 Months |

|

Tech Stack Development |

1-2 Months |

| Complete App Development |

2-3 Months |

|

App Testing |

1-2 Months |

| App Launch and Deployment |

1-2 Months |

|

Total Time Required |

8-15 Months |

Well, this time can vary depending on diversified factors such as the complexity of the app, design, and many others.

Monetization Strategies for an App Like Klarna

How do BNPL apps make money?

Let’s discover the number of app monetization strategies below.

• In-App Advertising

BNPL apps opt for advertising by connecting to other brands and providing them a space to promote their products and services.

In exchange, you can charge a commission for using your app’s space for marketing. This is a more relevant strategy if your brand has great connections with end users.

• Merchant Fees

Similar to credit cards, BNPL apps can charge a fee from the retailers who are utilizing your platform to help out the customers to pay.

The fee here will cover the cost of payment processing and will assist in offering BNPL services as well as earning a permanent source of revenue from the same.

• Late Payment Fees

The late fee charge will totally depend on the amount borrowed from the app. Additionally, the payments that are made after 30 days or not under the decided installment period, are valid to charge interest from the end users.

BNPL apps like Klarna charge late fees to encourage users to pay on time. This can become one of the important and permanent sources of income. Here, late fee policies can vary by app and business.

• Interest Charges

BNPL apps and businesses often charge users for the amount paid on their behalf after a certain time. For longer periods, these apps might charge up to 36%.

Here, the fees might include rescheduling payments or even being capped at 25% of the total purchase value. This interest can act as one of the crucial frameworks for earning money.

• Data Monetization

A data monetization strategy can be useful only when you get approval from the target users. This type of monetization framework assesses the information collected from the users and then uses it to make money.

Under this monetization framework, the users should be asked to sell their data to a third party and make reports to help other brands get to know users better.

These are all important monetization frameworks to consider for earning money while creating an app like Klarna.

Well, when you go after developing an app like Klarna, you might face a number of challenges.

Check them out below.

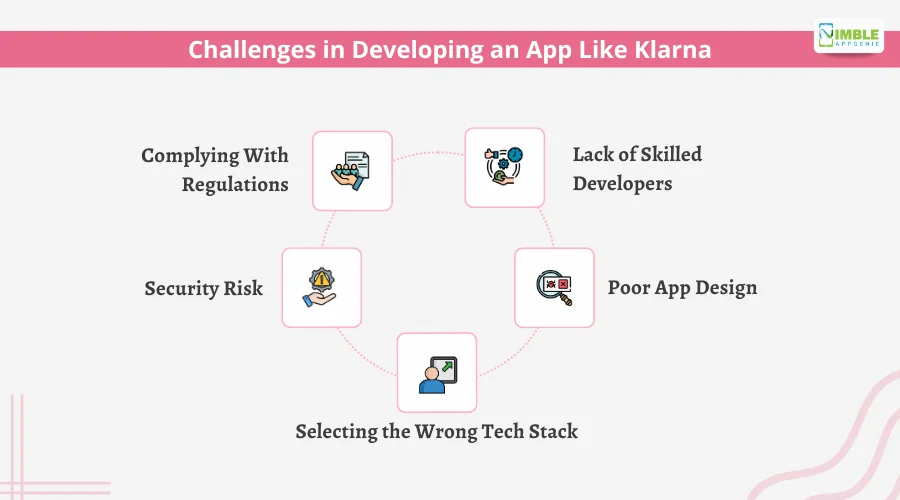

Challenges in Developing an App Like Klarna

To build an app like Klarna, it is essential to cross-check the types of challenges that your app might face.

Here’s the list to proceed with.

➤ Complying With Regulations

Does your app comply with the fintech regulations?

Unawareness of regulations can impact your development process and might hamper the brand image.

You should check out the current regulations for BNPL apps and then adopt them to address the app’s aim.

➤ Lack of Skilled Developers

Poor skills of developers might impact the procedure. If the developers are not skilled in implementing the latest technologies, your app might get outdated.

This might lead to delays in project timelines, which will affect the brand image and even the business profits.

The inability of developers can have a large impact on development procedures.

➤ Security Risk

When handling the development task to a third party, a risk of security can affect your budget.

If the development company transfers the sensitive data and information to any outsider, this can destroy the overall objective of creating an app.

There are many cyber threats that might impact the technicalities and even the user’s data. It will result in you losing the complete app.

➤ Poor App Design

App design results in engaging the users for long intervals. Thus, a poor design can result in losing users.

This will harm the overall brand reputation of your business and can even hamper your connection with the users.

A lack of suitable app design will result in negative reviews about the app. This event will restrict the users from fulfilling their desired tasks successfully.

➤ Selecting the Wrong Tech Stack

Is your tech set selection for the dream BNPL app suitable to address the growing number of issues?

Well, selecting the wrong tech stack will result in raising issues related to security, scalability, and usability challenges.

It will even require constant troubleshooting, workarounds, and patches to keep things running smoothly.

These are all challenges that might interrupt the creation of an app like Klarna.

Still confused about the process?

Connecting with a team of experienced developers and critically examining details will be useful here.

Why Choose Nimble AppGenie to Develop an App Like Klarna?

There are several developers in the market and selecting the best can be a hassle.

Well, you need to examine certain important elements before finalizing the team. There are different things to be evaluated such as the budget-friendliness of the company, location of the experts, and their expertise.

With Nimble AppGenie, you need not bother about any of such things. We are the best BNPL App Development Company effective at delivering quality and focusing on the integrity of the project.

Our team will be ready to deliver the project within your budget and help you out in preparing it. We know the market requirements well and then match them with your needs to make it excel.

Conclusion

With the right process to create an app like Klarna, you can lead the industry. The procedure will begin with market analysis, identifying value propositions, selecting features, developing the technology stack, building the complete app, and then deploying the app for launch.

There are many reasons to continue with creating an app like Klarna such as a transparent payment system, provides seamless customer experience, minimal customer details, and more.

While developing it, you might come across different challenges such as complying with regulations, security risks, lack of skilled developers, poor app design, and selection of false tech stack. Connecting with the right company can be helpful here.

FAQs

1: Market Analysis: It is important to evaluate the market and then focus on the type of value you can provide to the users.

2: App Design: While designing the app, it’s essential to look for the wireframe and prototype of the app.

3: Selecting the Features: You should select the number of core features and advanced features based on the aim of the project.

4: Tech Stack Development: The technology should be according to the features and app’s industry.

5: Combining the Complete App: It is important that the app should be combined and developed here.

6: Testing: App testing can be effective in checking for quality assurance.

7: Deployment and Maintenance: Now, it’s time to deploy the app on the designated platform.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.