Read about voice payment trends and learn about voice payment trends in fintech, its implementation, challenges, and more.

Voice Payment: The Next Big Step in Digital Payment

What if we told you, it’s possible to make voice payments now?

Well, we aren’t bluffing. Voice-based payment is a real technology and for quite some time now. While it seems straight out of sci-fi, voice pay is a growing trend.

But how does it work? What are the technologies behind it? And can it help your digital payments business?

Each of those questions shall be answered in this guide to voice payment technology. But before we do that, let’s first have a look at market statistics:

Digital Payment Statistics: A Growing Trend of Voice Payment

Fintech market is huge and diverse.

So, how does the “voice payment” niche perform in this ocean of technology? Well, as the digital payment statistics show us, it’s doing quite well.

Let’s have a closer look.

- The global voice-based payments market was valued at USD 5.89 billion in 2021 and is expected to reach USD 14.66 billion by 2030, growing at a CAGR of 10.9%

- Fintech statistics show, that in the US, 8% of the adult population used voice payments in 2017, projected to reach 31% by 2022.

- 53% of global smartphone users are interested in using voice assistants for shopping.

- Voice payments reduce checkout time by 50% compared to manual card entry.

- 46% of people with disabilities find voice payments easier than traditional methods.

- 31% of the global population uses voice assistant regularly.

Global Trend of Voice Commands, A Driving Force Behind Voice Payment

While voice payment technology has become one of the most well-known digital payment trends, at large it is backed by an even larger trend.

We are talking about “voice commands”

It’s true it wasn’t as popular or forward as some of the other industry 4.0 trends we have seen over the years, but it changed the industry.

After all, this trend is to thank for the entire “microphone” button in every search bar from YouTube to Google Search Engine. One of the key reasons behind this trend is the convenience it offers as well as the hands-free experience.

At the end of the day, the main goal of modern technology is to reduce the amount of work used to achieve a task whether it is traveling from point A to B or making a simple Google search.

Voice Commands are the natural next step in the evolution of technology.

We can say the same for voice-enabled payments in the realm of digital payment and fintech itself. Speaking of which, let’s dive deeper into what voice payments are.

Understanding Voice Payment

Remember the days of searching for your card at checkout?

Imagine paying bills, sending money, or even ordering groceries, all with the simple power of your voice.

Voice payment technology is revolutionizing the way we interact with money, offering unparalleled convenience and hands-free control over our finances.

Think about it: no more typing in numbers, scanning cards, or navigating clunky apps. Just tell your smart speaker or smartphone assistant what you need, and voila! The transaction is done.

And it’s not just science fiction – the numbers speak for themselves. With smart speaker ownership booming (think 28% of US households!), and voice assistant usage on the rise (a cool 31% globally!), it’s clear that voice technology is becoming an integral part of our daily lives.

That’s why; we have seen voice payment functionality in some of the top fintech apps in recent years. Something that’s expected to grow.

Now, this begs the question, how does voice payment technology work in digital payment? Well, let’s discuss just that in the section below.

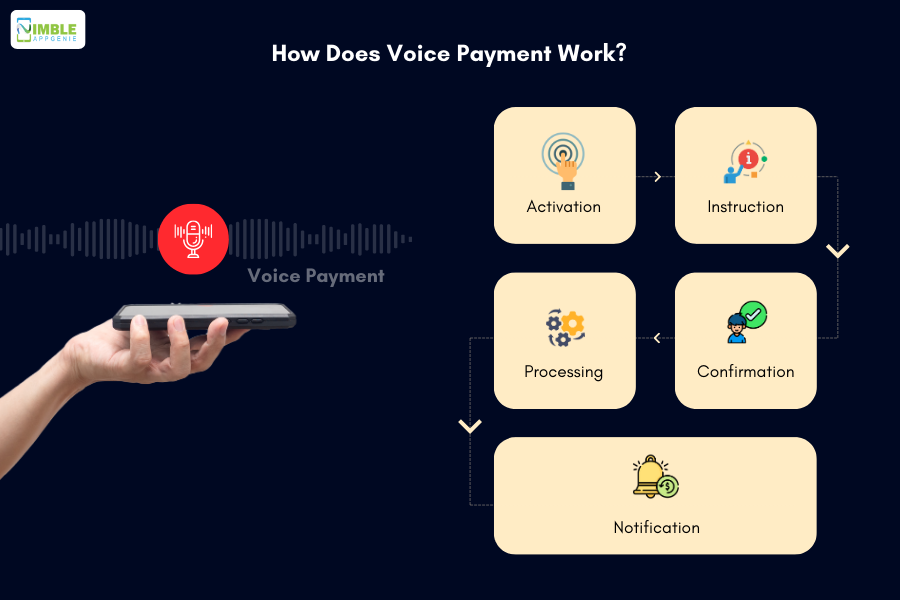

How Does Voice Payment Work?

Voice payment seems like some super advanced technology. And in every sense of the word, it’s exactly that.

However, using this isn’t rocket science. Payment via voice command is super easy.

Let’s see how it works:

1. Activation

- You trigger the voice assistant on your device if the app is integrated or you can open the app and tap on the microphone button there.

- Depending on the system, you might need to unlock the device for security reasons.

2. Instruction

- You clearly state your voice payment command, specifying:

- Action: “Pay,” “Send money,” “Transfer funds,” etc.

- Recipient: Merchant name, friend’s name, phone number, etc.

- Amount: Specify the amount for payments or leave it blank for bill payments.

3. Confirmation

- The voice assistant confirms your request, repeating the details for accuracy.

- You might need to authorize the transaction with an additional step like:

- Voice authentication (saying a passcode or key phrase).

- Fingerprint or facial recognition scan.

4. Processing

- The voice assistant securely transmits your instructions and authorization to the payment service provider.

- The provider authenticates you and verifies the recipient and amount.

- Funds are transferred between designated accounts.

5. Notification

- You receive confirmation of the successful transaction through voice feedback or on-screen notification.

- You might also receive a receipt via email or app.

So, that’s how voice payments work. This process may seem familiar due to it being based on voice commands that we have been using for years now.

Speaking of which, let’s look at the technologies behind it.

Key Technologies Behind Voice Payments in Fintech

So, what is the digital payment technology that allows users to pay via voice? Take a look at the below:

- Natural Language Processing (NLP): one of the most popular types of AI, NLP enables the voice assistant to understand your spoken instructions and intent.

- Speech Recognition: it goes without saying not everyone speaks in the same tone or accent. That’s why to accurately convert your voice into understandable text this tech is essential.

- Biometric Authentication: Biometric authentication is a digital payment security feature that adds a layer of security to confirm your identity.

- Secure Payment Protocols: to ensure digital payment app security, these protocols are added which encrypt data transmission for financial transactions.

Speaking of which, now that we are done with this brief of key technology that makes voice payment possible in fintech apps, it’s time to look at the benefits of the same.

Benefits of Voice Payment

So, why should you invest in voice payments as a fintech or eWallet app company?

Well, because you want to grow your business and become successful among people! It goes without saying a concept becomes a trend because people like it.

And speaking of that, there are various reasons why both businesses and people are crazy about it.

Here, we shall be looking at these exact voice payment benefits.

1. Increased Convenience & Engagement

Let’s start with the main selling point of voice pay, the convenience and engagement it offers.

As we discussed a few sections ago, modern technology is all about delivering convenience to the end user. And that’s something the voice payment concept does quite well.

Users don’t even need to type or touch anything, just click on the button and start speaking.

Plus, we can all agree that it’s exactly an engaging way of making payments.

Just go the memory lane to the first time you used SIRI, how fun was it? Well, expect the same excitement here. (or maybe even greater)

2. Faster Checkout process

Voice payment adds speed to the checkout process.

There are little to no clicks involved, apart from the authentication which can also be driven via faceID. This means that from starting to the end, the user doesn’t even need to touch the screen.

And in today’s fast-paced world where every moment is not worth wasting, this is something that helps digital payment apps stand out from the rest.

3. Better Conversion rate

Being engaging, fast, and most importantly easy to use i.e. convenient, voice payment drives a higher conversion rate.

The end-user doesn’t have to go through any of the long processes or anything.

Just a simple voice command and the world is done. This is especially beneficial for fintech start-ups who are looking to establish themselves as key players.

4. Deliver a Personalized Shopping experience

Voice payments enable a seamless and personalized shopping experience by allowing customers to complete transactions using natural language commands.

By integrating voice technology into the payment process, businesses can tailor recommendations and offers based on individual preferences and purchase history.

This personalized approach enhances customer satisfaction and loyalty, as shoppers feel understood and valued, leading to increased engagement and repeat purchases.

5. For People With Disability & Difficulty With Traditional Technology

While technology targets everyone among the masses, there are some who aren’t all that comfortable using it for one or another reason.

For instance, one case is people who aren’t all that well accommodated with modern technology i.e. the elderly.

And another case being differently and disabled people.

Voice payment is a saving grace for both of them. People who can’t understand traditional mobile payment apps will find voice pay functionality a very easy-to-use feature. The same is the case for disabled people.

Adding this as a digital payment app feature can really make it more inclusive and easier to use.

Moving on, let’s look at some voice payment examples and applications in the section below.

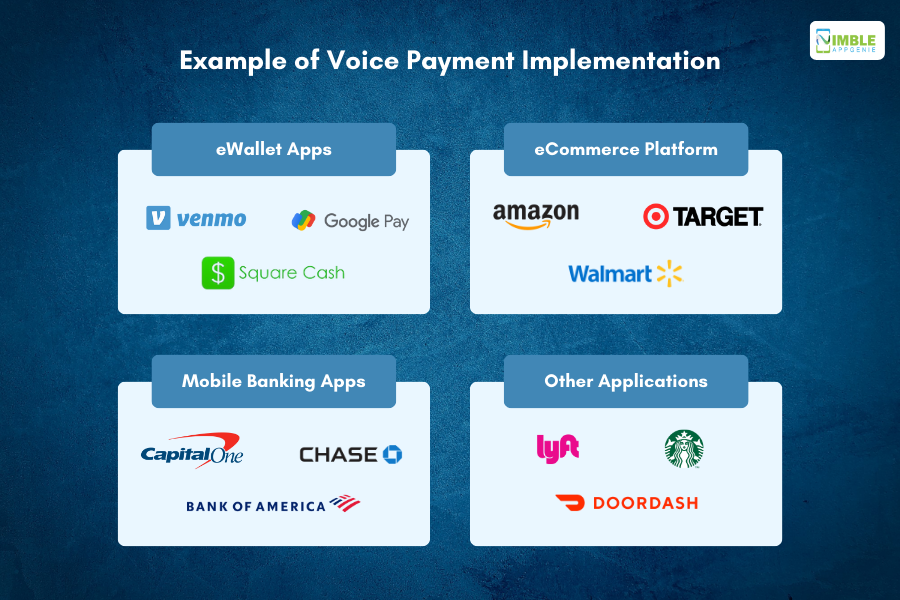

Example of Voice Payment Implementation

Voice payment technology is being used left and right.

So, let’s look at some examples of voice payment implementation across different niches and industries. You’ll be surprised to see, some of the top apps that you are using on the list.

1. eWallet Apps

Let’s start with the first voice payment integration choice i.e. eWallet apps. Here are some of the top eWallet apps with voice payment functionality.

- Venmo: Users can send and receive money using voice commands with nicknames or recipient phone numbers.

- Google Pay: With “Pay Nearby,” users can initiate contactless payments at participating stores with voice commands.

- Square Cash: Similar to Venmo, users can send and receive money by speaking recipient names or usernames.

2. eCommerce Platforms

Second, we have eCommerce platforms that take full advantage of voice-enabled digital payment functionality.

- Amazon: Users can purchase items from their shopping cart or reorder previous purchases using voice commands through Alexa.

- Walmart: Customers with the Walmart Voice Assistant can add items to their cart and pay using voice commands.

- Target: Through Google Assistant, users can purchase items from Target’s in-stock inventory using voice commands.

3. Mobile Banking Apps

Mobile banking apps were one of the first fintech niches to jump at the opportunity of voice payment technology.

Here are some of the top banking apps that offer voice pay functions.

- Capital One: Customers can manage their accounts, pay bills, and check balances using voice commands with Alexa or Google Assistant.

- Chase: Users can check account balances and pay bills through voice commands with Alexa or Google Assistant.

- Bank of America: Customers can manage their accounts, transfer funds, and pay bills using voice commands with Erica, their virtual assistant.

4. Other Applications

Apart from the fintech and eCommerce niche, Top Food Delivery Apps are also taking great benefit of voice command payments.

Here are a few of them:

- DoorDash: Users can order food delivery and complete payment using voice commands with Google Assistant.

- Lyft: Riders can request and pay for rides through voice commands with Google Assistant.

- Starbucks: Users can order and pay for their coffee upfront using voice commands through the Starbucks app.

Voice Payment Integration Opportunity

With everything out of the way, it’s finally time to look at the integration options.

Usually, when there’s a technology trend so niche like voice payments, there are two options. Either you can:

- Building a Fintech App

- Or Integrate It As a Feature In Your App.

The first option is an entire topic on its own.

For this voice payment guide, let’s focus on the integration part. Mentioned below are the industries and app development projects that can benefit from the implementation of voice payment.

| App Development Solutions | Voice Payment Integration |

| 1. Ride-Hailing App | Integrate voice commands to book rides and make payments for transportation services. Allow users to hail a ride, specify their destination, and complete payment using voice prompts. Integration with ride-hailing platforms and payment gateways for seamless transactions. |

| 2. Grocery Delivery App | Enable users to add items to their shopping cart and make payments for grocery deliveries using voice commands. Integration with grocery store inventories and payment gateways for secure transactions. Voice-based order tracking and delivery notifications. |

| 3. Fitness App | Implement voice-enabled workout routines and training sessions where users can subscribe and make payments using voice commands. Integration with fitness plans, instructor services, and payment gateways for secure transactions. Voice-based progress tracking and motivation prompts. |

| 4. Education App | Integrate voice payment functionality for online courses, tutoring services, and educational resources. Allow users to enroll in courses, purchase study materials, and make payments using voice commands. Integration with learning platforms and payment gateways for seamless transactions. |

| 5. Real Estate App | Enable users to search for properties, schedule viewings, and make payments for real estate transactions using voice commands. Integration with property listings, scheduling tools, and payment gateways for secure transactions. Voice-based property alerts and updates on new listings. |

| 6. Travel App | Allow users to book flights, hotels, and rental cars using voice commands. Integration with payment gateways to enable voice-based payments for reservations and bookings. Provide real-time confirmation and updates through voice prompts. |

| 7. Food Delivery App | Enable users to place orders and make payments for food deliveries using voice commands. Integration with restaurant menus and payment gateways for seamless transactions. Voice-based order tracking and updates on delivery status. |

| 8. eWallet App | Incorporate voice recognition for authentication and authorization of transactions within the eWallet app. Allow users to check balances, transfer funds, and make payments using voice commands. Integration with banking systems for real-time transaction processing. |

| 9. Retail App | Implement voice-enabled shopping experiences where users can browse products, add them to a cart, and make payments using voice commands. Integration with inventory management and payment gateways for smooth transactions. Voice-based order tracking and delivery notifications. |

| 10. Healthcare App | Integrate voice payment functionality for medical services such as appointment bookings, prescription refills, and telemedicine consultations. Allow users to make payments for healthcare services using voice commands securely. Integration with electronic health records (EHR) systems for seamless data exchange. |

| 11. Entertainment App | Enable users to purchase tickets for movies, concerts, or events using voice commands. Integration with ticketing platforms and payment gateways for secure transactions. Voice-based event recommendations and updates on |

Possible Challenges & Considerations

72% of consumers are concerned about unauthorized voice payments and 63% of consumers are worried about personal data collected through voice assistants.

So, is it really that big of a concern?

Well, here are some voice payment challenges and considerations that you need to keep in mind.

- Authentication concerns: Users may worry about unauthorized voice payments, posing a challenge for widespread adoption.

- Data privacy issues: With personal data collected through voice assistants, ensuring privacy remains a priority amidst user concerns.

- Security measures: Implementing robust authentication methods and encryption protocols is essential to safeguard transactions.

- Natural Language Processing (NLP) accuracy: Limitations in NLP technology may affect the accuracy of voice commands, impacting user experience.

- Integration complexity: Ensuring seamless integration with existing systems and compatibility across platforms presents a technical challenge for developers.

Remember every technology has its ups and downs. Some of the technologies and products we use today we once advertised as harmful or predicted to fail. At the end of the day, you should always look at both potential and risk before making a decision.

Nimble AppGenie: Offering Trend Driven Solutions

The fintech market is lucrative, filled with platforms that are pushing the numbers when it comes to revenue generation.

As the demand for innovative fintech solutions continues to rise, voice payment technology is emerging as a game-changer.

Whether you’re a budding entrepreneur inspired to create your own fintech app or an established player looking to stay future-ready, Nimble AppGenie being a top fintech app development company can help.

With a proven track record of success and experience working with industry giants like Pay By Check, and SatPay, we’re well-equipped to turn your fintech vision into reality.

Hire app developers to leverage voice payment technology and propel your fintech app to new heights

Conclusion: Future of Voice Payment

Voice payment is set to revolutionize digital transactions with its unparalleled convenience and speed. Market projections highlight its significant growth potential, while sophisticated technologies ensure secure and seamless transactions. Despite challenges like security concerns, the future of voice payment is promising. With opportunities spanning various industries, businesses can enhance user experiences and drive growth. At Nimble AppGenie, we’re committed to staying at the forefront of technology trends, offering tailored solutions to help businesses harness the power of voice payment. Together, we’ll shape a future where voice-enabled transactions redefine the digital payment landscape.

FAQs

Voice payments refer to the process of initiating and completing financial transactions by speaking commands to a smart device or app. Instead of manually selecting options or typing information, you simply instruct the system with your voice to perform actions like: Paying bills, Sending money to friends or family, Making purchases online or in-store, Checking account balances, etc.

Voice payment functionality is increasingly integrated into various platforms, including:

- Smart speakers: Google Assistant, Amazon Alexa, Apple Siri, Samsung Bixby

- Mobile wallets: Apple Pay, Google Pay, Samsung Pay

- Fintech apps: Venmo, PayPal, Chime

- Banking apps: Many banks offer voice-enabled features within their mobile apps.

- Retail apps: Some brands integrate voice payments within their shopping apps.

The specific apps supporting voice payments will depend on your device and your region.

The market for voice payments is still young but experiencing rapid growth. Estimates suggest it was valued at USD 5.89 billion in 2021 and is expected to reach USD 14.66 billion by 2030, indicating a CAGR of 10.9% (Grand View Research). This signifies significant potential for widespread adoption in the coming years.

Several factors point towards voice payments becoming a major player in the future of finance:

- Growing user adoption

- Convenience and accessibility

- Evolving technology

- Seamless integration

- Personalized finance

You simply speak clear instructions like “pay,” “send money,” or “transfer funds,” specifying the recipient and amount. The system verifies your identity and executes the transaction securely.

Some top benefits are, as mentioned below:

- Convenience: Hands-free and faster transactions compared to traditional methods.

- Accessibility: Easier for people with disabilities who might find manual methods challenging.

- Personalization: Can integrate with financial management tools for personalized insights and reminders.

- Security: Advanced authentication methods like voice recognition enhance security.

Many smart speakers, smartphones, and even wearables are integrating voice payment functionality. Popular platforms include Google Assistant, Amazon Alexa, Samsung Bixby, and Apple Siri.

Yes, robust security measures like biometrics and multi-factor authentication are implemented to protect your data and transactions.

Compatibility might vary depending on devices and platforms. Data privacy concerns need to be addressed effectively. Accessibility for non-native speakers needs improvement.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.