BNPL apps like Afterpay have been growing quite popular lately. This concept is relatively new and it has taken the market by storm.

As such, 50% of total consumers utilized a buy now, pay later service in last year. In fact, as many as 67% of users prefer using buy now, pay later like Afterpay over credit cards.

Moreover, since all major e-commerce platforms also offer their own BNPL service, as many as 53% of users prefer using this option.

It goes without saying that buying electronics is one of the major expenses we have today. As per stats, 47% of users have used solutions like Afterpay to shop the same. All these amounts for 38% of buy now, pay later users who use BNPL once a month or more.

These statistics show the huge market potential and the explosive growth of this new payment concept. It goes without saying that all of this has garnered attention from a lot of businesses and start-ups alike from across the United States of America and other parts of the world.

Now, there are a lot of people who want to create their own Afterpay Clone mobile app. And if you are one of these, you have come to the right place.

In this blog, we shall be looking at everything you need to know about creating your own app like Afterpay as well as all basic information about the BNPL platform itself.

Growing Market for BNPL, Statistics

Fintech statistics shows BNPL as the growing sector of the industry, with Afterpay leading the market. Let’s have a look:

- As of 2022, there are an estimated 360 million BNPL users worldwide. This number is projected to reach 900 million by 2027, a 157% increase.

- In 2020, the BNPL market was valued at $87.2 billion. By 2030, it’s forecast to reach a staggering $3.27 trillion.

- The US currently holds the largest share of BNPL users, accounting for approximately 22% of the global total.

Now that we are done with this, let’s look at the app itself, Afterpay.

Afterpay: BNPL Market Leader, An Overview

First things first, what is Afterpay?

Well, being of the best examples of BNPL app development, this platform does exactly what it name tells. It allows you to pay after.

In layman’s terms, this is a fintech plat form which provide small loans at the time of checkout. It can be repaid or one go over a period of time.

This BNPL platform was established back in 2014 by Nick Molnar and Anthony Eisen. Then it was mainly active in Australia. However, today, it is also available in United Kingdom, United States of America, and New Zealand.

This BNPL platform has over 43,000 global retailers. Out of these, over 9,000 retailers are in the United States of America only.

Moving on, in the years leading up to from 2012 to today, this platform has become one of the most popular in its market.

But something that a lot of people might still be confused about is, how does this work?

Let’s look at the answer in the next section:

How Does Afterpay Work?

Buy Now, Pay Later platforms which are also known as BNPL are quite self-explanatory. They work like a credit card would or in other words getting a soft loan. BNPL Mobile apps like Afterpay allow the customers to purchase an item or service online and pay for it after a specific interval of time.

Usually, they also allow the users to pay in easy EMI over a long period. This is why it is also known as a pay in installments online shopping platform.

While this isn’t something that you might use for everyday shopping, it can be quite useful for those every once in while extensive shopping. After all, not every one of us wants to spend the entirety of our savings on buying a product. People have things that need to be taken care of.

Coming back to the topic, the process of availing of this service is quite easy. Especially when compared to conventional loans, this concept is much faster and less stressful, and there are little to no extra (hidden) charges.

As one might guess, if you want to avoid paying extra, your best course of action would be to pay back within the defined timeline.

You see, there is a particular reason why this concept becomes so popular. The reason is that people often used this during the Covid-19 pandemic. Consequently, making businesses want to create an app like Afterpay.

Conditions You Have to Follow When Shopping with Afterpay

- Interest-Free. The soft loan provided through Afterpay is totally interest-free if you repay it within the said time.

- Avail Without Hassle. Availing a BNPL service is quite easy, there is no hours-long process, you can login to the platform and pay for the order.

- Account management. Customers can see their upcoming payments, orders, and account information.

- Reminders. To stay away from overdrafts, Afterpay sends notices that remind clients about impending installment sums and due dates.

- With Afterpay, clients can in any case get discounts as per the store’s discount strategy.

- Pay in advance.Clients can pay portions early..

- Security. This BNPL platform is a PCI DSS Level 1 guaranteed specialist co-op.

How Does Afterpay Make Money?

With all said and done, one might be wondering how BNPL solution generates revenue.

This is quite a sound question considering the fact that the main goal of creating BNPL application is to generate revenue.

So, with this being said, let’s look at the strategies does apps like Afterpay use.

So, the main monetization strategy used by the Afterpay BNPL platform is charging a fee in form of a commission.

In addition to this, another portion of the revenue is generated through the late fees, which is charged when user don’t pay on time.

On the first instance of failed payment, the user is notified in case there is some technical problem. However, if the payment is still not made, a fee of $10 is charged. And if they pay within the next week, they have to pay another $7.

With this knowledge, you can integrate fitting monetization strategies with help of custom mobile app development services.

Other Buy Now Pay Later Mobile App Examples

If you want to create a buy now pay later app like Afterpay, you need inspiration from the best.

Let’s look at the best BNPL apps in the market and learn from them. These are, as mentioned below:

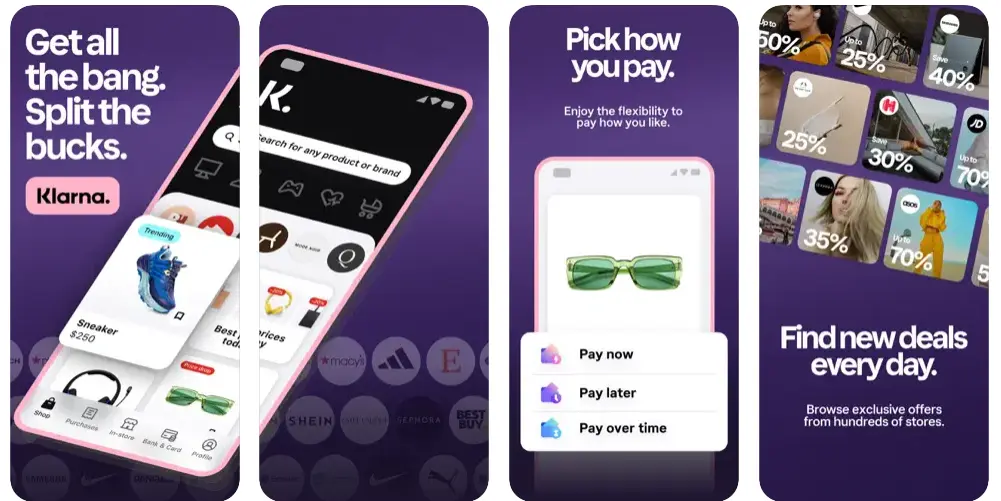

1. Klarna

Klarna is yet another top buy now pay later mobile application. This platform is compatible with almost all of the major online stores and service market place solutions.

Quite similar to Afterpay itself, allows the user to pay them the whole amount at once or in easy EMIs.

And the best part is, all of this can be done with your mobile phone, you don’t need to go anywhere or meet anyone. All in all, it is one of the best BNPL and cash advance apps in the market today.

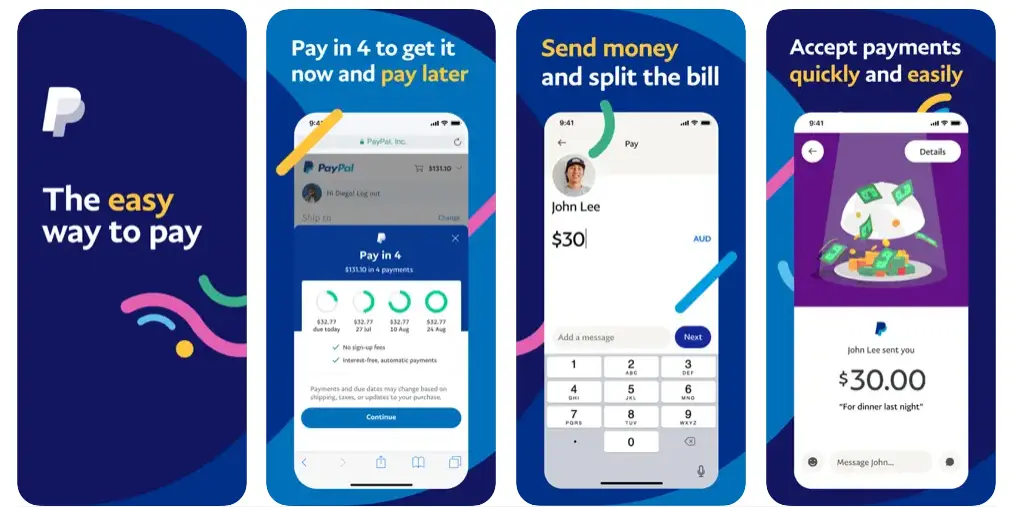

2. PayPal Credit

PayPal is the best example of eWallet app development done right. This one has been around for some time.

Being one of the most popular mobile wallet solutions, it doesn’t come as a surprise when you learn that, they came up with their own Buy Now Pay Later solution known as, PayPal credit.

With this, PayPal users can now get credit straight to their wallet and pay back later as per their convenience. This is one of the top Afterpay-like mobile applications.

3. Sezzle

Sezzle might not be as popular as apps like Afterpay or PayPal Credits, but it is definitely growing popular at a steady pace and a top fintech app.

This application, just like other BNPL platforms, enables the users to buy things by paying the entire amount up front and then paying back in easy EMI with no involvement of interest (if all conditions are meant).

Still not inspired enough to build your own BNPL App like Afterpay? Lets give you some reason to go for it in the section below.

Why You Should Consider Afterpay App Development?

While a lot of people ask, how to create an app like Afterpay, another important question would “why build an app like Afterpay?”

People often look for reasons to invest in app development with it being a big venture. So, let’s look at some of the top reasons below:

| Upfront Payment. | The BNPL service provides pay the full concerned amount upfront. So, there is no risk to the seller. |

| More Shopping, More Profit. | Industry information demonstrates the way that traders can expand their change rate by 20% to 30% with a BNPL administration. |

| Transaction Cost. | With the BNPL services, the transaction cost is considerably lower when compared to the alternative. |

| Growing User Base. | With more than 50% of the consumer base using this platform, we can say the user base is expanding at a good rate. |

| Revenue Generation Opportunity. | With all the feature and opportunities combined, one can say that it is quite easy to generate record breaking revenue in this market. |

Essential Features to Include When You Build an App Like Afterpay

Features are an essential part of Building a BNPL app like Afterpay that’s successful among users. Now, it is recommended that you fill your app with a unique feature that caters to market demand.

With this being said, let’s look at the feature that you should include when you make a BNPL app like Afterpay.

| Features | User Panel | Admin Panel |

| 1. Account Management |

|

|

| 2. Transactions |

|

|

| 3. Loan Management |

|

|

| 4. Security & Compliance |

|

|

| 5. Notifications & Messaging |

|

|

| 6. Additional Features |

|

|

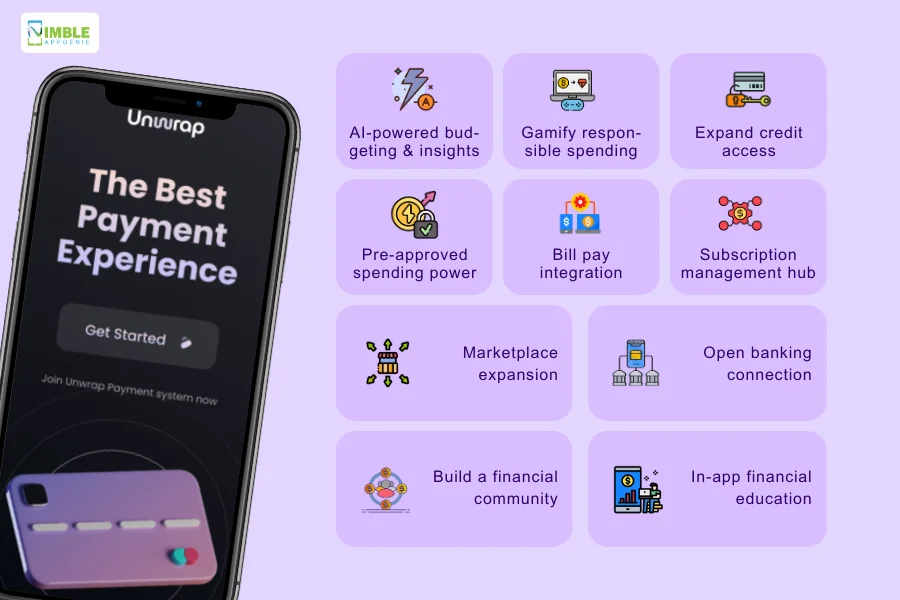

Advanced Features for Afterpay Like App

If you want to create a fintech app that disrupts the market, you can’t ignore the importance of unique features.

So, here are 10 advanced features that will keep your users engaged, promote responsible financial behavior, and make your app the go-to choice for savvy spenders:

1. AI-Powered Budgeting & Insights

Go beyond basic transactions. Help users understand their spending habits, set realistic goals, and make informed financial decisions with personalized recommendations powered by AI.

2. Gamify Responsible Spending

Make saving and responsible borrowing fun! Implement gamified elements like points, badges, and rewards to incentivize users and keep them on track.

3. Expand Credit Access

Don’t limit yourself to traditional credit scores. Leverage alternative data and machine learning to assess creditworthiness, opening doors for a wider user base.

4. Pre-Approved Spending Power

Empower users to shop confidently with pre-approved BNPL limits displayed at checkout. No more checkout surprises!

5. Bill Pay Integration

Simplify bill management. Allow users to pay all their bills, including BNPL installments, from one convenient location within your app.

6. Subscription Management Hub

Take control of recurring payments. Offer an easy-to-use tool for users to track, pause, cancel, or adjust their BNPL subscriptions and other recurring payments.

7. Marketplace Expansion

Partner with other financial institutions and services. Provide users with a one-stop shop for managing their finances, offering access to savings accounts, investments, and more.

8. Build a Financial Community

Foster engagement and empower users. Create social features that allow them to connect, share tips, and participate in discussions around responsible spending and financial wellness.

9. Open Banking Connection

Unlock the power of open banking. Integrate with user bank accounts for automatic transaction categorization, real-time balance updates, and personalized financial insights.

10. In-app Financial Education

Empower informed decisions. Provide users with access to educational resources and articles on financial literacy, responsible borrowing, and debt management, helping them navigate their financial journey with confidence.

Now that we are done with this, let’s move to the next section, where we shall learn to make a BNPL app like Afterpay.

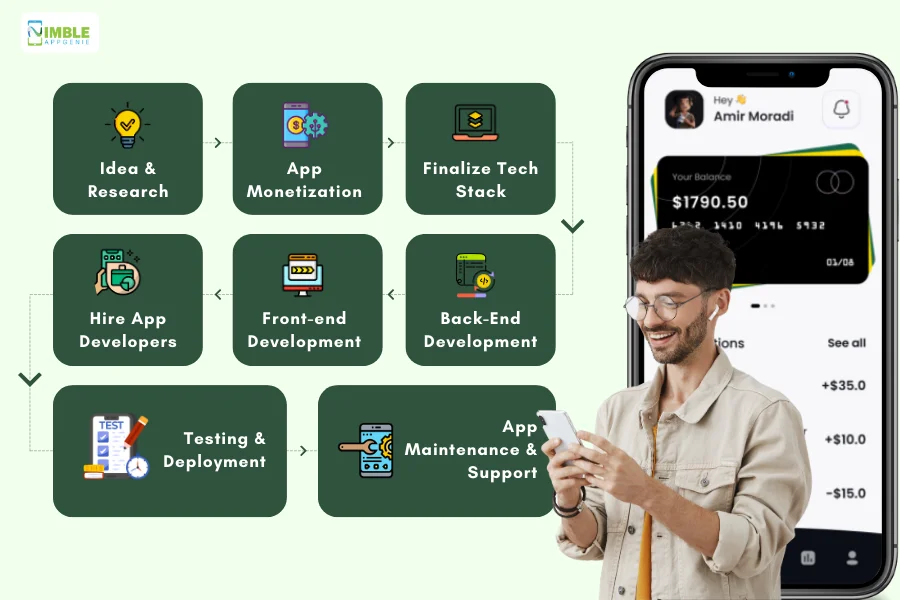

How to Develop a BNPL App? Afterpay App Development

Developing a mobile app isn’t all that hard, but isn’t a piece of a cake either.

Rather, you can say, it highly depends on your knowledge of the matter. You see, there are a number of steps involved in developing apps like Afterpay.

Therefore, in this section of the blog, we shall be looking at all you need to know about Afterpay App Development.

Let’s get right into it.Steps to Build a Buy Now Pay Later App Like Afterpay are:

Step 1: Come up With an Idea & Research

The first step of developing a mobile application is to come up with an idea. While it might seem like the most simple step, this is probably the hardest one.

In any case, once you are done with the ideation, it’s time to confirm the validation of idea via mobile app market research.

This is the part where you dive into the market and learn about competitors, market barriers, people’s opinion, your target user base, and so on.

Step 2: Monetize it

When you have an idea, you need to monetize the same.

There are various monetization strategies and we too discussed the same earlier in the blog. You can choose the one that best fits your fintech business model.

Some of the top monetization model for Afterpay like platform are, as mentioned below:

| Revenue Stream | Description | Example |

| Merchant Fees | Charge merchants a fee for each transaction processed through the BNPL platform. | Typically a percentage of the transaction value (e.g., 3-6%) or a fixed fee per transaction. |

| Late Fees | Charge customers a late fee for missed or delayed payments. | Varies depending on the platform and regulations, but often a flat fee or a percentage of the outstanding balance. |

| Interest on Extended Plans | For longer repayment plans, charge customers interest on the outstanding balance. | Rates vary depending on the platform, creditworthiness, and loan duration. |

| Subscription Fees | Offer premium features or benefits for a monthly or annual subscription fee. | This could include priority access to credit lines, lower interest rates, or additional financial services. |

| Data Monetization | Leverage anonymized user data for targeted advertising or partnerships with other financial institutions. | Requires careful consideration of user privacy and compliance with data regulations. |

| Value-added Services | Offer additional financial services like budgeting tools, savings accounts, or insurance products within the app. | Generates revenue through transaction fees, interest charges, or partnerships with other providers. |

Step 3: Finalize Tech Stack

It’s time to choose the technologyies.

For instance, choose between android and iOS app development. Or go for, hybrid app development to get the best of both worlds.

Apart from this, there are many more technologies that goes in to mobile app’s tech stack. There are, as mentioned below:

| Components | Technology Options | Pros | Cons |

| 1. Frontend | React Native, Flutter | Cross-platform development, flexible UI, large community | Requires more development effort for native look and feel |

| 2. Backend | Node.js, Python (Django/Flask) | Scalable, mature frameworks, large developer pool | Can be complex for beginners |

| 3. Database | PostgreSQL, MongoDB | Robust, ACID compliant (PostgreSQL), flexible schema (MongoDB) | Choosing the right one depends on specific needs |

| 4. Payment Gateway | Stripe, Braintree, Adyen | Secure, integrated payment processing solutions | Fees associated with transactions |

| 5. Fraud Detection | Sift, Riskified, FraudeLabs Pro | Reduce fraudulent transactions, ensure financial security | Requires ongoing monitoring and configuration |

| 6. Credit Scoring | Plaid, LexisNexis Risk Solutions | Assess creditworthiness of borrowers, make informed lending decisions | May require additional compliance measures |

| 7. Notifications | Twilio, Pushwoosh | Send real-time updates to users, improve engagement | Cost associated with sending notifications |

| 8. Analytics | Google Analytics, Firebase Analytics | Track user behavior, measure app performance | Requires integration and data analysis expertise |

Step 4: Hire App Developers

It’s time to find an app developer for your project.

Now, there are various ways you can go looking for a development partner, however, here are some of the most commonly used ones:

- Outsource the fintech development

- Assemble an in-house team

- Or strengthen the existing team via staff augementation

Also Read: In-House Vs Outsourcing

Step 5: Front-End Development

Since we have already specified the features, we can directly start with the front-end development.

Here, the UI/UX Design team will be creating they will be the design of the app and integrating all the other components together.

When this is done, we can move to the back-end development process.

Step 6: Back-End Development

During the back-end development, the developers will be writing the source code of the application.

This is quite a long as well as resource-consuming process. Therefore, it is recommended that you pay especially attention when you create a BNPL App Like Afterpay.

Step 7: Testing & Deployment

Mobile app testing is essential to ensure quality and consistency before deployment. Here, it is deployed in the live environment to check for bugs and errors.

When all of that is done, it will be deployed. This process itself depends based on your choice between android and iOS app development i.e. the app development platform.

Also Read: How To Deploy iOS App? And How To Launch Android App?

Step 8: App Maintenance & Support

The App Maintenance & Support services are important to keep the app up and running. This is something that you should be considering.

After this, you may also start the app marketing process to generate demand for the solution in market.

So, those are the steps to build a buy now pay latr app like Afterpay. Now, let’s see how much this will cost you.

How Much Does It Cost to Develop BNPL App Like Afterpay?

Developing a mobile app does come with a cost. And this remains true when you develop a BNPL app like Afterpay.

However, the cost associated the developing a mobile application isn’t accurately predictable. Reason is that each of project is unique and so are its requirements. Therefore, the cost associated with them is also unique.

There are so factors though which can affect the development cost. These are, as mentioned below:

- Tech stack

- Developer’s Experience

- Security

- Security

- App Size and Hosting

- Developer’s Location

- Feature and Design

- Testing Process

- App Maintenance

These are some of the factors that can affect the development cost. However, if we talk about average BNPL app development cost you can expect anything between $30,000 and $60,000.

For a closer buy now pay later app development estimation, it is recommended that you consult a mobile app development company as they can give you a better quote based on your specifications.

Partner With Nimble AppGenie & Build An App Like Afterpay

If you want to build the next best BNPL app like Afterpay, we are here to help you.

With 700+ projects under our name and recognition from top platforms like Clutch.co, DesignRush, and GoodFirms, we are the best fintech app development company in the market.

Here are some of our top projects.

- Pay By Check– Ewallet Mobile App

- DafriBank– Digital Bank Of Africa

- SatPay– Ewallet Platform

- CUT–E-Wallet Mobile App

- SatBorsa– A Currency Exchange Fintech App

So, if you want to be the next best in BNPL and give platforms like Apple Afterpay and Klarna a run for their money, hire mobile app developers with us.

We are just a click away.

Conclusions

The BNPL market presents a dynamic and exciting space for entrepreneurs to make their mark.

By delving into the intricacies of this sector, you can gain valuable insights into the essential features, functionalities, and development process required to craft a robust and user-centric BNPL app that rivals industry leaders like Afterpay.

Remember, the key to success lies in prioritizing user experience. Design an app that is intuitive, user-friendly, and fosters responsible financial practices.

Don’t shy away from incorporating innovative features that set you apart from the competition.

By focusing on these crucial aspects, you can attract and retain a loyal user base, propelling your BNPL app towards long-term success in this ever-evolving market.

FAQs

While credit cards are usually concerned with larger amounts and takes a long process to acquire one, the BNPL is quite a fast process and usually deals with a much smaller amount. This is the basic difference between BNLP vs credit card.

Afterpay is a popular Buy Now, Pay Later (BNPL) platform that allows users to make purchases online and pay for them in installments over a short period, typically four installments every two weeks.

When you shop at a store that partners with Afterpay, you can choose Afterpay as your payment method at checkout. The total purchase amount is then split into four equal installments, which you pay off over six weeks. There are no interest charges if you make your payments on time.

- Spread out payments: Break down your purchases into smaller, more manageable payments.

- No interest: Pay no interest if you make your payments on time.

- Shop now, pay later: Enjoy your purchases immediately while spreading out the cost.

- Late fees: If you miss a payment, you will be charged a late fee.

- Insufficient funds fee: If there are insufficient funds in your account to make a payment, you will be charged a fee.

Afterpay uses industry-standard security measures to protect your personal and financial information. However, it’s important to be responsible with your spending and make sure you can afford the repayments before using any BNPL service.

- Klarna

- PayPal Credit

- Sezzle

- Affirm

The cost of developing a BNPL app can vary depending on several factors, such as the features, complexity, and chosen tech stack. However, a rough estimate can range from $30,000 to $60,000.

- Monetization strategy: How will the app generate revenue? (e.g., merchant fees, late fees)

- Compliance with regulations: Ensure adherence to relevant financial regulations.

- Security: Implement robust security measures to protect user data and financial information.

- User experience: Design a user-friendly and intuitive app interface.

The BNPL market is growing rapidly, but it is also becoming increasingly competitive. Before developing a BNPL app, it’s crucial to conduct thorough market research, identify a unique value proposition, and have a solid business plan in place.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.