Planning on building a mobile banking application?

With the fintech fever growing among users across the world, it has forced some of the world’s largest industries to contemplate their standing.

Some of the top banking and financial institutions are considering building their own app.

And the first question that comes to mind is:

“How Much Does Mobile Banking App Development Costs?”

Average the cost to develop a banking app range between $25,000 and $200,000. It highly depends on various factors like complexity, compliance, features, platform, development team, and much more.

This is to say, a lot goes behind estimating the cost to develop an app than what meets the eye.

Speaking of which, if you want to learn more about how much you might have to pay or are curious about the cost of your next project, we have got you covered.

From average cost to a complete breakdown of factors, we shall be discussing it all.

Let’s get right into it:

Why Develop A Mobile Banking App?

There are a lot of businesses, banks, & startups who want to develop a banking app.

But why?

One of the biggest questions, even more prominent than how much it costs is:

“Why should I invest in banking app development?”

Well, there are various reasons to build an app in 2024, especially, in-demand banking apps. Let’s look at some of these below:

1. Personalization and User Engagement

Banking and finance app users expect a personalized experience that caters to their individual needs.

Offering tailored features and services not only enhances user satisfaction but also encourages regular app usage.

Plus, adopting omnichannel strategies, where your banking app is integrated with various other platforms, can significantly boost client retention rates.

Firms employing such strategies see up to 89% retention compared to 33% for those that don’t.

The first mobile banking app was launched in 1994 by MeritaNordbanken (now Nordea), a Finnish bank. It allowed users to check their account balance and transfer money using SMS text messages.

2. Mobile Banking Popularity

The rise of neobanks, which are essentially banks operating exclusively through mobile apps without traditional physical branches, showcases the potential and demand for mobile banking.

For instance, fintech statistics neobanks generated $6.8 billion in revenue in 2021, with NuBank alone attracting over 40 million users.

This demonstrates the massive user base and revenue potential for mobile banking apps.

3. Consumer Demand and Trend

A staggering 89% of mobile users engage in mobile banking, with 97% of millennials and 91% of Gen Xers utilizing these services.

This highlights the widespread acceptance and reliance on mobile banking across different age groups.

Consumers value the convenience, speed, and security of mobile banking, indicating a strong and growing market for these mobile banking apps.

Security features, in particular, are highly sought after, with users demanding advanced security measures to protect their financial information.

These are some of the top reasons to go for banking app development. Now with this being said, it’s time to look at mobile banking app development costs in the section below.

Average Cost To Develop A Mobile Banking App

So, how much does it cost to develop a banking app?

On average cost to develop a mobile banking app ranges from $25,000 to $200,000+. It is highly affected by factors like complexity, features, app type, compliance, and so on.

Now, why is it so hard to estimate the cost of banking app development?

Much like any fintech app development cost, when calculating the budget for a banking app, the factors play a big role.

In layman’s terms, each project has a unique development cost.

Therefore, if you want an accurate estimate, it’s highly recommended that you consult an app development company.

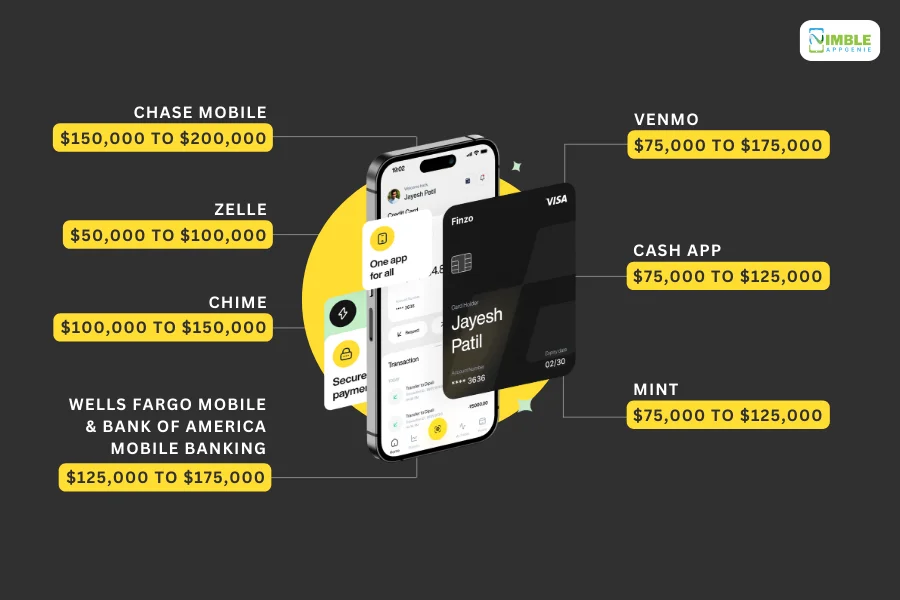

Popular Banking Apps & Cost To Develop A Clone

The market is filled with super popular mobile banking apps.

And more often than not, these are the inspiration behind businesses wanting to develop their own app, being the subject of clone app development.

So, to help you estimate the cost to develop a banking app, let’s look at popular apps and their cost.

These are, as mentioned below:

Chase Mobile | $150,000 to $200,000

Let’s start with Chase.

It is a comprehensive banking app from a major financial institution.

Here, users can manage accounts, transfer money, deposit checks, and access other banking services conveniently.

Its success inspires others to create similar secure and feature-rich banking apps.

So, how much does it cost to develop an app like Chase? You expect the cost to make a banking app like this one to be anywhere between $150,000 and $200,000+.

Venmo | $75,000 to $175,000

Venmo is one of the most popular person-to-person (P2P) payment apps known for its social features.

Users can easily send and receive money with friends, often with split-bill functionality.

The ease and social aspect of P2P payments make it attractive to replicate. Now, coming to the cost to develop part:

The cost to build an app like Venmo is $75,000 – $175,000.

Zelle | $50,000 to $100,000

Zelle is yet another P2P payment app known for its bank-to-bank transfers.

It offers a fast and secure way to send money directly between linked bank accounts. The speed and security of bank-backed P2P transfers make Zelle a model for similar apps.

The cost to create a banking app like Zelle costs anywhere between $50,000 and $100,000.

Cash App | $75,000 to $125,000

Want to build an app like Cash?

Well, for those who don’t know, it is a mobile payment and investing app with a millennial and Gen Z focus.

It allows users to send and receive money, make purchases, and invest in stocks.

Its appeal to a younger demographic with its multi-functionality makes it a target for similar app development.

The cost to build a banking app ranges from $75,000 to $125,000.

The Guinness World Record for the most mobile banking transactions in a single day was set in India in 2020, with over 266 million transactions processed.

Chime | $100,000 to $150,000

Chime is a challenger bank offering online banking services with no monthly fees and features like early access to direct deposits.

Its focus on low fees and innovative features makes it an inspiration for similar fintech apps.

So, the cost to develop a banking app like Chime is between $100,000 and $150,000.

Mint | $75,000 to $125,000

Mint is one of the most popular fintech apps, a personal finance management app allowing users to track budgets, manage bills, and monitor investments.

Its budgeting and financial organization tools are valuable to users, making it a model for similar money management apps.

So, how much does it cost? The cost to develop a mobile banking app like Mint is between $75,000 and $125,000.

Wells Fargo Mobile & Bank of America Mobile Banking | $125,000 to $175,000

Lastly, we have the Wells Fargo mobile banking app.

Similar to Chase Mobile, these are secure and feature-rich banking apps from major institutions.

They offer account management, money transfer, bill pay, and other functionalities, making them strong examples of similar apps, particularly those focused on established banking brands.

The cost to make such a banking app ranges from $125,000 to $175,000.

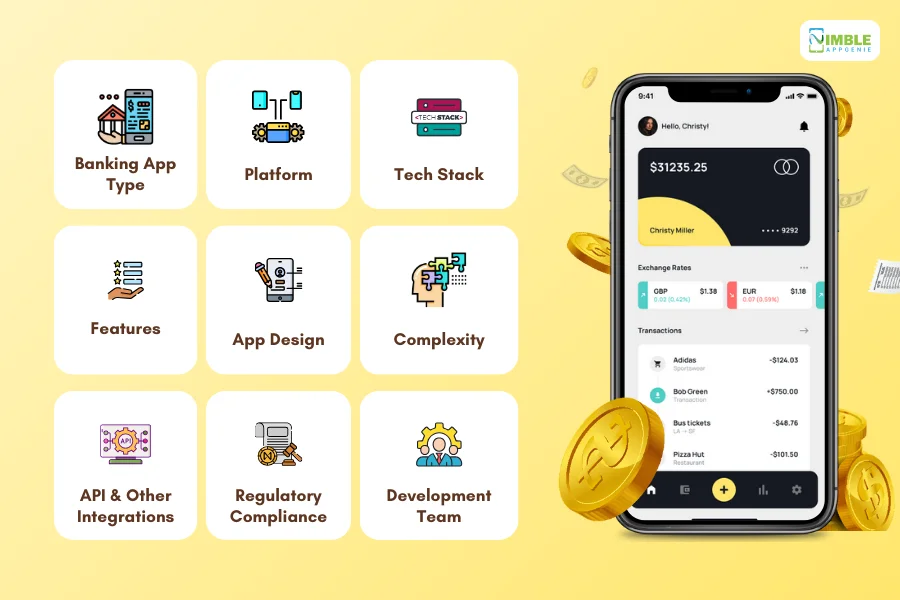

Factors That Affect Banking App Development Cost

If we have learned anything about app development cost, it is, there are a lot of factors.

So, if you want to estimate how much you might have to pay for building a banking app, you need to understand this factor. And that’s exactly what we shall be doing in this section of the blog.

Now, it’s time to look at the factors that affect mobile banking app development costs:

1. Banking App Type

The very first factor is the type of app.

While the mobile banking app itself is a form of fintech app development, it can be further divided into two types. Let’s see what these are:

Dedicated Banking App: $100,000+

Let’s start with dedicated banking app development.

As the name suggests, this is when a bank or any other financial institution wants to develop an app for their brand.

For instance, the Bank of America App. This is solely dedicated to their brand, hence the name.

Now, the cost to develop a dedicated banking app will be 100,000+.

Banking App Aggregator: $50,000 – $150,000+

On the other hand, we have aggregator banking app development.

A good example of this model would be, Zelle.

These apps connect with n number of banks and let users enjoy their services, without being limited to any one of them.

Now, the cost to develop a banking application in an aggregator model ranges between $50,000 and $150,000.

This establishes that, the type of app you are developing or the app idea behind your development project, can highly affect total development cost.

Now, with this out of the way, let’s look at the second factor…

2. Platform

Once you have an idea for a banking app, the next thing you need to focus on is a platform.

Typically, people choose between Android app development and iOS app development, however, platforms go beyond that.

Let’s have a deep dive below:

| Development Platform | Description | Cost Impact |

| Native Development (iOS/Android): | Separate apps are built for each platform using platform-specific languages (Swift/Kotlin). Offers optimal performance and user experience. | High Cost: Requires two separate development teams with expertise in native languages and platforms. Estimated Cost: $100,000+ per platform for a complex app. |

| Cross-Platform Development (React Native, Flutter): | Single codebase used to build apps for both iOS and Android. Offers faster development and lower maintenance costs compared to native development. | Moderate Cost: Single development team needed, but performance might not be as optimized as native apps. Estimated Cost: $50,000 – $100,000+ for a complex app. |

| Hybrid Development (HTML5, CSS, JavaScript): | Uses web technologies to create a mobile app experience. Offers quickest development time and potentially lower costs, but may have limitations in functionality and user experience. | Low to Moderate Cost: Relatively simple development process, but user experience might be less intuitive compared to native or cross-platform apps. Estimated Cost: $25,000 – $75,000+ for a moderately complex app. |

The “emoji” you use for money () is actually a Japanese Yen symbol within a money bag. It wasn’t originally intended to represent any specific currency.

3. Tech Stack

Once done with the idea and platform, it’s time to choose a tech stack.

Fintech tech stack plays an important role in dictating the performance of mobile banking applications and also highly affects the banking application development cost.

Here’s how:

| Back-End Development | Java/Kotlin | Popular languages for building secure and scalable back-end systems. | Moderate Cost: Large pool of developers, but development time can be higher compared to some other options. |

| Python (Django, Flask) | Offers rapid development and clean syntax, often used for building APIs. | Moderate Cost: Growing popularity, but might require additional libraries for complex functionalities. | |

| Node.js (Express.js) | Popular for real-time applications and microservices architecture. | Moderate Cost: Large developer community, but requires expertise in JavaScript for back-end development. | |

| Database | SQL Databases (MySQL, PostgreSQL) | Well-established and reliable for structured data. | Low to Moderate Cost: Familiar technology with various open-source options. |

| NoSQL Databases (MongoDB) | Flexible solution for storing large amounts of unstructured data. | Moderate Cost: Requires expertise in NoSQL data modeling and querying. | |

| Security | Encryption (AES-256) | Industry-standard encryption for data at rest and in transit. | Moderate Cost: Implementation cost for encryption libraries, but essential for security. |

| Authentication (OAuth, Multi-Factor Authentication) | Secures user login and access to sensitive data. | Moderate Cost: Integration with secure authentication protocols adds complexity. | |

| APIs & Third-Party Integrations | Pre-built APIs | Existing APIs for common functionalities can be integrated with the app. | Variable Cost: May have one-time setup fees, ongoing subscription fees, or transaction-based fees depending on the API. |

| Custom API Development | Requires building custom APIs for unique functionalities. | High Cost: Significant development effort needed compared to pre-built solutions. |

Choosing the right tech stack is super important at so many levels. In any case, let’s move to the next.

4. Features

The next step in the app development process is choosing features for the mobile banking app.

When we speak of features, we are using umbrella terms as they can be divided into a lot of subsections like User features, admin features, core features, advanced features, and so on.

In any case, let’s look at some of the important features of banking apps and how they affect cost:

| Feature Category | Description | Estimated Cost Impact |

| Core Features | Essential functionalities for basic banking operations. (Account Management, Balance Viewing, Money Transfers) | Low Cost ($5,000 – $10,000): Relatively simple to develop and often included in pre-built development frameworks. |

| Transaction Management | Features related to managing transactions. (Transaction History, Filters, Budgeting Tools) | Moderate Cost ($5,000 – $15,000): Requires additional development effort compared to core features, but still utilizes established functionalities. |

| Payment Features | Enables various payment options within the app. (Bill Pay, Mobile Deposits, P2P Transfers) | Moderate to High Cost ($10,000 – $25,000+): Complexity varies depending on the payment method (P2P is typically more complex). May involve integration with third-party services. |

| Security Features | Measures to protect user data and financial information. (Fingerprint Authentication, Two-Factor Authentication, Secure Login) | Moderate Cost ($5,000 – $15,000): Standard security features are well-established, but advanced features may require additional development effort. |

| Advanced Features | Functionalities beyond basic banking needs. (Investment Tracking, Credit Score Monitoring, Loyalty Program Integration) | High Cost ($20,000+): Often involves complex integrations with third-party services or the development of custom functionalities. |

A study in the UK found that people are more likely to trust their mobile banking app than their romantic partner! (Let’s hope that’s not entirely true…)

5. App Design

It’s time to design the app.

UI/UX design as statistics show, plays an important role in user attraction, retention, and satisfaction. Therefore, investing in your fintech app’s design is a good idea.

To the point, it can highly affect online banking app development costs.

But how? Let’s see below”

| Design Complexity | Description | Estimated Cost Impact |

| Simple & Intuitive | Clean layout, clear hierarchy, minimal animations. Focuses on usability and ease of navigation. | Reduces Cost by $5,000 – $10,000: Less development time needed, potentially uses pre-built UI components. |

| Moderately Complex | Incorporates some visual elements and animations for better user engagement. Maintains a focus on usability. | Moderate Cost Impact ($2,500 – $7,500 increase): This may require additional design time and potentially custom UI development. |

| Highly Complex | Features intricate animations, custom illustrations, and a unique visual style. Prioritizes aesthetics over simplicity. | Increases Cost by $10,000 – $20,000+: Requires significant design effort, potentially involving UI and UX specialists. May necessitate custom development of UI components. |

Additional Cost Considerations:

- Number of Screens: For each additional screen with a unique layout, expect a design cost increase of $500 – $1,000.

- Design Iteration: Multiple design revisions throughout the development process can add $1,000 – $3,000 per iteration to the design cost.

- Design Team Experience: Senior designers with expertise in mobile app design will command higher fees compared to junior designers. The cost difference can range from $10,000 – $20,000 for the entire project.

6. Complexity

As a general rule of thumb, the more complex the project is, the higher cost of banking app development will be.

That’s what makes complexity the biggest factor to consider when estimating app development costs. Here’s a breakdown:

| App Complexity | Estimated Cost Range | Description |

| Basic | $25,000 – $50,000 | Offers core functionalities like account management, balance viewing, and money transfers. |

| Moderate | $50,000 – $100,000 | Includes features from basic apps, along with bill payments, mobile deposits, and basic security features. |

| Advanced | $100,000 – $150,000 | Integrate features from moderate apps with more advanced functionalities like investment options, budgeting tools, and enhanced security measures. |

| Complex | $150,000+ | Offers all the features from advanced apps, along with complex functionalities like peer-to-peer (P2P) payments, integration with third-party services (loyalty programs, credit scoring), and top-tier security features. |

Now, let’s see how third-party integration can affect development costs.

7. API & Other Integrations

When develop a banking application or any fintech app for that matter, a lot of third-party integrations are required.

While a lot of them are free to use, the majority of fintech APIs are paid.

This adds up to banking app development cost. Here’s how some APIs add to the total cost of development.

| Integration Type | Description | Estimated Cost Range |

| Account Aggregation APIs | Connects to various financial institutions to provide a holistic view of a user’s finances across accounts. (e.g., Plaid, Finicity) | ~$10,000 – $25,000+ (one-time setup fee + ongoing usage fees) |

| Payment Processing APIs | Enables in-app payments and money transfers. (e.g., Stripe, Braintree) | ~$5,000 – $15,000+ (one-time setup fee + transaction fees) |

| Financial Data APIs | Provides access to real-time financial market data and analytics. (e.g., IEX Cloud, Intrinio) | ~$3,000 – $10,000+ (subscription-based pricing) |

| Credit Scoring APIs | Integrates creditworthiness checks for loan applications or investment opportunities. (e.g., Equifax, Experian) | ~$2,000 – $5,000+ (transaction-based pricing) |

| Identity Verification APIs | Verifies user identity for security purposes. (e.g., Acuant, Jumio) | ~$1,000 – $3,000+ (transaction-based pricing) |

| Location Services APIs | Enables features like ATM location finder or mobile check deposit with geolocation verification. (e.g., Google Maps Platform) | ~$1,000 – $5,000+ (usage-based pricing) |

Choosing which APIs to include and which not is an important decision and can highly affect cost.

Also Read: Open Banking API

8. Regulatory Compliance

Banking app development cost is highly affected by fintech regulations and rules.

Let’s see how compliance can affect the cost of banking app building:

| Regulatory Body | Description | Potential Impact on Cost |

| Financial Industry Regulatory Authority (FINRA) (US) | Oversees broker-dealer activities. Applicable if your app offers investment features like stock trading. | Moderate to High Cost ($10,000+): Requires additional development efforts to ensure compliance with FINRA regulations and ongoing monitoring for adherence. |

| Securities and Exchange Commission (SEC) (US) | Regulates securities markets. This applies if your app facilitates the buying and selling of securities. | High Cost ($20,000+): Requires robust compliance measures and ongoing reporting to the SEC. |

| Consumer Financial Protection Bureau (CFPB) (US) | Protects consumers in the financial services industry. This applies to all banking apps that collect and store user data. | Moderate Cost ($5,000 – $15,000): Requires implementing strong data security practices and user privacy controls to comply with CFPB regulations. |

| General Data Protection Regulation (GDPR) (EU) | Governs data privacy and protection for individuals within the European Union. This applies if your app collects data from EU residents. | Moderate Cost ($5,000 – $15,000): Requires implementing measures for user consent, data security, and breach notification procedures to comply with GDPR. |

| Payment Card Industry Data Security Standard (PCI DSS) | Security standard for organizations that handle cardholder information. This applies to all banking apps that process debit or credit card transactions. | Moderate Cost ($5,000 – $10,000): Requires implementing PCI DSS-compliant data security measures and annual security audits. |

Some banks are experimenting with using facial recognition or fingerprint scanning for even more secure mobile banking logins.

9. Development Team

The cost of banking app development is also proportional to the cost to hire app developers.

So, how do you figure out either of them? Well, worry not, a detailed breakdown of the cost of hiring banking app developers is, mentioned below:

| Team Factor | Description | Cost Impact | |

| Team Size | Small Team (2-3 Developers) | Suitable for basic apps. May require outsourcing for specialized tasks like design or security. | $25,000 – $50,000 per month for development costs (assuming junior/mid-level developers). |

| Medium Team (4-7 Developers) | Can handle moderate to complex apps with a mix of generalists and specialists. | $50,000 – $100,000+ per month for development costs (depending on developer experience). | |

| Large Team (8+ Developers) | Manages highly complex apps with extensive functionalities. Often includes dedicated specialists for UI/UX design, security, and backend development. | $100,000+ per month for development costs (due to multiple salaries and potentially higher rates for specialists). | |

| Team Location | North America/Western Europe | Developers typically command higher hourly rates due to higher living costs. | $50 – $100+ per hour for developer rates. |

| Eastern Europe/Asia | Developers’ hourly rates tend to be lower compared to North America/Western Europe. | $25 – $50 per hour for developer rates. | |

| Team Experience | Junior Developers | Lower hourly rates but may require more senior oversight, potentially impacting development speed. | Cost-effective option for basic apps, but might require longer development time (factor in additional project management costs). |

| Mid-Level Developers | Balance between cost and experience. Can handle most development tasks efficiently. | $30 – $60 per hour for developer rates. Provides a good balance for most app complexities. | |

| Senior Developers & Specialists | Highest level of expertise and efficiency. Can handle complex functionalities and ensure best practices. | $75 – $100+ per hour for developer rates. The most expensive option but offers the fastest development speed and highest quality. |

How Long Does It Take To Develop A Banking App?

Another big question that comes to mind along with How Much Does Mobile Banking App Development Costs, is “How Long Does It Take To Develop A Banking App?”

Well, depending on almost the same factors as cost, it can range starting from 3 Months to all the way up to 18 or more.

Here’s a breakdown of app development time:

| App Complexity | Development Time (Months) |

| Basic Banking App (Account Management, Balance Viewing, Transfers) | 3-6 |

| Moderate Banking App (Bill Pay, Mobile Deposits, Basic Security Features) | 6-12 |

| Advanced Banking App (Investment Tracking, Budgeting Tools, P2P Transfers) | 12-18 |

| Complex Banking App (All of the above, plus complex features like Loyalty Program Integration, Credit Score Monitoring) | 18+ |

The popularity of mobile banking has led to a decline in the number of checks being written. In the US, the number of checks written annually has dropped by over 70% since 2000.

Nimble AppGenie – Your Partner in Banking App Development

Do you want to make your own banking app? We have got you covered.

As a market-leading, mobile banking app development company, Nimble AppGenie has what it takes to develop the next best banking app.

We have worked on over 700 projects, delivering 95% client satisfaction.

Plus, we have extensive knowledge of developing the next best mobile banking solution, we have delivered master class projects before:

- Pay By Check– Pay by Check is a popular ewallet mobile app in the United States of America. It allows users to transfer, pay, or even exchange currency.

- SatPay– An eWallet platform is a Versatile eWallet Solution that allows users to request, receive, and send payments without hassle.

- CUT– an E-wallet Mobile App, CUT is available in China and Myanmar. It works well with both RMB and MMK currencies.

- SatBorsa– a Currency Exchange Fintech app. SatBorsa is one of the platforms that is available on both platforms, iOS and Android.

And we can do it again!

Hire Mobile app developers and start your journey today.

Conclusion

The cost to develop a mobile banking app doesn’t have to be a mystery. By understanding the factors we’ve explored – from app complexity to development team structure – you can create a realistic budget for your financial brainchild. Remember, a well-designed mobile banking app isn’t just a cost, it’s an investment in user engagement, operational efficiency, and a competitive edge in the ever-evolving financial landscape. Now you’re armed with knowledge, take the next step!

FAQs

Mobile banking apps provide a user-friendly and convenient way to manage finances. They offer 24/7 access to accounts, mobile deposits, and a user-friendly interface. Additionally, features like real-time notifications and personalized services boost engagement, while frictionless mobile payments streamline transactions. Mobile banking apps can also lead to operational efficiency and cost savings for banks by reducing branch traffic and automating repetitive tasks. They also play a crucial role in staying competitive in today’s digital landscape.

The cost to develop a mobile banking app can vary widely depending on complexity, ranging from $25,000 for a basic app to over $200,000 for a feature-rich app with complex functionalities.

Several factors influence the cost of developing a mobile banking app. This includes the type of app (dedicated banking vs. aggregator), chosen development platform (native vs. cross-platform vs. hybrid), and the tech stack used (backend languages, databases, security measures). Additionally, features, app design complexity, and the need for regulatory compliance all play a role in determining the final cost.

Mobile banking apps come in varying complexities. Basic apps with core functionalities like account management and money transfers cost less to develop than complex apps offering advanced features like investment tracking or loyalty program integration. The more features and functionalities an app offers, the higher the development cost.

The development timeline for a mobile banking app depends on its complexity. Basic banking apps can take 3-6 months to develop, while complex apps with extensive features may require 18 months or more.

The size, location, and experience of your development team significantly affect the cost of building your mobile banking app. Larger teams with specialists can handle complex features but come at a higher cost compared to smaller teams. Developer location (North America vs. Eastern Europe) and experience level (junior vs. senior) also influence the cost per month.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.