So, What Is The Insurance App Development Cost?

This is a common question that a lot of clients ask. But the answer isn’t all that simple. You see, the cost to develop a mobile app is not easy to predict. And there are various reasons behind it.

But if you want to find out the cost to develop an insurance app, well this blog is for you. Here, we shall be going through insurance app development cost as well as types, features, development process, and everything else related to it.

So, read this blog till the end and find out the cost to make an insurance app of your own.

InsurTech, The Mega Trend: Insurance App Development

InsurTech, What is it?

Just like how when you combine finance and technology, you get fintech app development, when you bring technological advancements to the world of insurance, you get insurance.

Referring to Insurance Tech is the technical aspect of the insurance industry. An industry that generated $5.7 Trillion in revenue in 2022. These numbers make it one of the largest industries in the world.

Now, insurtech alone is expected to generate more than $10.14 billion in revenue by 2025.

These mobile apps have changed the world of insurance both for companies and clients. These apps have made it a lot easier for clients to access insurance-related products on the go.

In addition to this, it is also a lot more convenient, cheaper, and faster for companies to process things via an app rather than through an agent as it happened traditionally.

Consequently, digital insurance claim by insured person has risen by 20% in the past three years. And with a significant boost in customer satisfaction levels, at an all-time high.

The widespread use of the Insurance application doesn’t come as a surprise considering the fact that the average phone user spends 88% of their screen time on apps, checking their phones 344 times per day. And not to mention, the mobile app market itself is worth billion.

Now, the success of insurtech means there are companies in the industry that are generating millions in revenue with help of insurance apps. And it goes without saying that, this has attracted a lot of other businesses and potential start-ups from across the United States of America and the rest of the world.

They want to build their own insurance apps. Moreover, this is a good idea considering the fact that Global InsurTech investment for VCs reached $10.5 billion in 2021 alone.

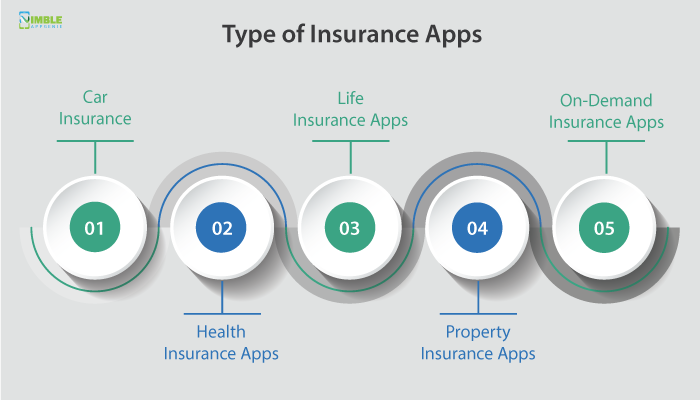

Types of Insurance Apps

Insurance is an umbrella term that branches off into various niches. There is insurance for everything today from electronics to the property and even specific body parts.

Now, if you want to build an insurance app with on demand app Development Company, it’s a good idea to good through these types and finalizes which one of the best for you.

Moreover, the insurance app development also highly depends on the type of app, something we will be discussing later down the line.

Moving on, different types of insurance apps are, as mentioned below:

Type 1: CAR INSURANCE APPS

After healthcare, car insurance is probably the biggest niche in the industry. Because cars are expensive and car accidents even the mirror ones can set you back 1000s of dollars.

Not to mention if one party is to lose their life or be crippled due to the accident, it will result in huge settlements that come out of the pocket.

With car insurance apps, it is easy to make a claim, renew, or buy new insurance. This app can be a lifesaver since driving a vehicle without insurance is actually illegal.

Therefore, this is a top area that you can invest in.

Type 2: HEALTH INSURANCE APPS

Healthcare App Development industry is huge. But as we all know, insurance and healthcare go hand in hand which makes it one of the largest markets for insurtech.

Not to mention, while places like Europe and Singapore provide free healthcare with an amazing system for public benefit, the USA isn’t too keen on it. So, rather than going bankrupt, people prefer getting health insurance plans.

However, today’s insurance for healthcare isn’t that easily accessible and the middleman makes it even more difficult for a common person to get these. In fact, there are 29.6 million Americans who still don’t have healthcare insurance. This means there’s still a vast untapped market.

With help of a health insurance mobile app, you can tap into the full potential of this market and generate sizable market revenue.

Type 3: LIFE INSURANCE APPS

Loss of life is a tragedy in any case. And with the current situation of the world, where families are based on a single breadwinner, this can be a very devastating situation.

While it is not possible to get back a loved one, what one can do is prepare for these events with life insurance.

Now, with insurtech life insurance mobile apps, it’s much easier to avail of life insurance services. The family of the deceased doesn’t need back and forth from the office.

This is yet another large area of the insurance field which can benefit from a mobile application. In the process of connecting clients to insurance companies, you can generate healthy revenue.

Type 4: PROPERTY INSURANCE APPS

Property insurance is big. It is expected that by the year 2027, the insurance market for the property will be worth more than $395 billion.

It is no secret that real estate is one of the world’s largest industries even large than the insurance market. And when both of these are combined, you get skyrocketing revenue.

This is one of the reasons behind the popularity of property insurance applications. Nevertheless, if you want to set foot in the market and also make a fortune while doing so, it is highly recommended that you go through this option.

Type 5: ON-DEMAND INSURANCE APP

The on-demand model which is also known as Uber for X is a popular one.

And it doesn’t come as a surprise when you see a demand insurance app. After all, this is one of the best models in the world which lead to revenue generation and amazing growth for the business.

Moreover, the cost to build on-demand app isn’t all that much either. This is what makes it an ideal choice for insurtech app development.

These are some of the popular types of insurance apps. Now, it’s time to go through some of the features that should be included in insurance app development.

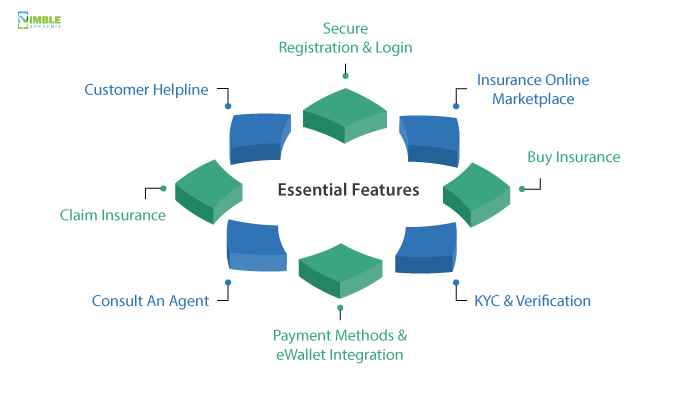

Essential Features To Consider When You Build an Insurance App

Features often depend on the type of insurance app you are developing. Nevertheless, there is some essential features that should be included when you build an insurance app.

Why are features important? Well, the answer is simple:

Firstly, features are the driving force behind user engagement and the real-world performance of the platform. With the right features, the app can capture customers and keep them engaged. On the other hand, a bad feature set can be the downfall of an app.

Secondly, the feature affects the insurance app development cost. Simple features or in other words, the basic feature doesn’t take all that much effort to integrate. But we can’t say the same when it comes to complex and unique features; they are expensive and add to the total cost.

Now that you know why features are important, let’s look at some of the common and essential ones that you should definitely include in your solution.

1) Secure Registration & Login

This is an essential feature for any app.

The account registration feature allows the user to enter the account with cross-platform and cross-device synchronization.

Moreover, it is easily done via the phone number, email id, Social security number, or a combination of them. The log-in can be enabled via biometric scans which are available on almost every mobile phone today.

2) Insurance Online Marketplace

Well, online marketplace integration into the insurance app is a must.

Now, it highly depends on which type of app you’re developing. Nevertheless, in this marketplace, the user can explore various insurance deals and get the one that is best for them.

This is an absolute must-have feature.

3) Buy Insurance

This feature allows the user to buy insurance they like.

This is yet another must-have feature. Now, depending on the type of insurance the process to buy the same can highly differ.

If it requires documentation and document verification, we have to include another feature for that.

4) KYC & Verification

This is one of those features that will certainly affect the Insurance App Development Cost. Nevertheless, this is also essential from both the user experience and the security point of you.

Getting insured highly depends on the related documents. While an agent checks the same in their physical visit, it can also be done through the mobile app.

KYC which is short for knowing your customer is one of the essential steps of getting something insured.

5) Payment Methods & eWallet Integration

To pay for insurance and the monthly installment, eWallet integration is a must.

Moreover, it also comes in handy when the client or user is making an insurance claim as the money can be credited right to their mobile wallet integrated into the app.

6) Consult an Agent

Sometimes things can be confusing and the users just don’t know which insurance is the right fit. However, the insurtech app comes with a feature that allows them to consult an insurance agent.

This feature is very useful. Thus, should be included in every app.

7) Claim Insurance

One of the major benefits that an insurance app offers is easy insurance claims.

So, to deliver more value to the customers, you should ask mobile app development services to include this feature in your solution because this is the soul of the insurtech.

8) Customer Helpline

Last but not least, the customer helpline is yet another basic feature that users need.

After all, there are thousands of things on these technical platforms, and not every one of them is that obvious. Therefore, it is a good idea to include this feature in the insurance app.

These are some of the basic features of an insurance app. Now, it’s time to look at some of the top examples of these apps in the next section.

Examples of Insurance Apps

The insurance app market is huge. And before you hire dedicated developers to help you with the development process, it’s a good idea to go through these apps and learn from them.

So, some of the best insurance apps in the market are, as mentioned below:

| App | Platform |

| 1. Oscar Health | iOS/Android |

| 2. myCigna | iOS/Android |

| 3. Religare Health | iOS/Android |

| 4. MyAmFam | iOS/Android |

| 5. Blue Shield of California | iOS/Android |

| 6. Reliance Self-i | iOS/Android |

| 7. Aetna | iOS/Android |

| 8. MyHumana | iOS/Android |

| 9. Star ATOM | Android |

With all said and done, it’s time to look at the average insurance app development cost in the next section of the blog.

Average Insurance App Development Cost

The average insurance app development cost ranges from $25,000 to $250,000.

Now, it is not possible to predict accurate app development costs. The reason is that there are various factors involved in the app development process which highly affect the cost.

Therefore, to get an accurate prediction, the business needs to consult a mobile app development company that will provide insight on the same based on the project specifications and provide more valuable insight.

Speaking of which, let’s look at the various factors which affect the total cost to develop an insurance app in the section below.

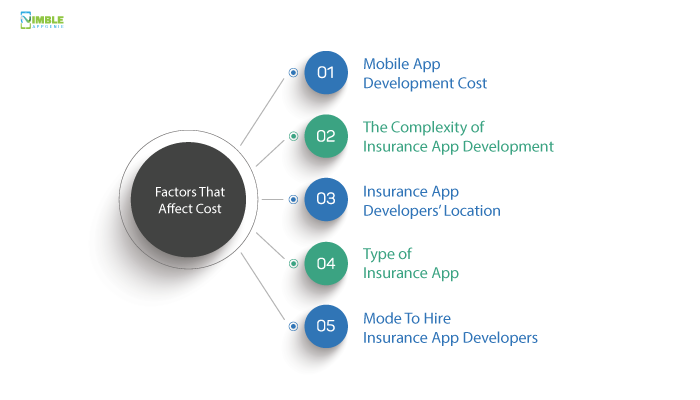

Factors That Affect the Cost to Build Insurance App

Mobile app development costs are hard to predict without learning about project specifications. The reason being is that there are a lot of factors that can affect the total cost.

Therefore, to get a better understanding of the cost to build an insurance app, one must understand these factors and how they affect the cost.

For that reason, in this section of the blog, we shall be going through some of the top features which affect the total cost. Enough said, these are, as mentioned below:

1. Mobile App Development Platform

To create a mobile app, you need to choose a platform.

Now, there are two major platforms to choose from, these are iOS and android app development. Both of these are native platforms. On the other hand, you can also go with the hybrid option.

Coming to the cost part, contrary to popular belief, android apps are actually more difficult and expensive to develop when compared to iOS. This is due to the fragmented nature of the platform.

On the other hand, hybrid apps are even cheaper than iOS apps for various reasons. Therefore, it might be a good idea to consider react native app development services.

2. Complexity of Insurance App Development

This is one of the biggest factors that affects the cost of build an insurance app. But the big question here is, how?

The answer is simple. A basic app will have basic features and a generic design as well as a back-end. Therefore, it doesn’t require much effort or expertise.

Flipside, complex apps require more of everything which makes them more expensive. Therefore, the cost to develop the app goes up by a long shot.

| Simple Insurance App Development | $11,000-$50,000 |

| Medium Insurance App Development | $50,000 – $90,000 |

| Complex Insurance App Development | $90,000-$150,000 |

3. Insurance App Developers’ Location

Location highly affects the cost to hire mobile app developers.

Well, every region has different average wages, local currency, competition, and so on. Therefore, the cost to hire developers in different parts of the world is different.

A table depicting the same is, as mentioned below:

| Mobile App Developer Hourly Rate in the US | $60 – $120 per hour |

| Mobile App Developer Hourly Rate in Europe | $40-95 per hour |

| Mobile App Developer Hourly Rate in South America | $45-65 per hour |

4. Type of Insurance App

As we discussed at the beginning of the blog, there are some different types of Insurance apps.

These insurance apps are vastly different from each other based on both niche and development. Therefore, the cost to develop these apps is also very different.

Moving on, mentioned below is the cost of developing different insurance apps.

App Type | Cost |

| Car Insurance Apps | $80,000 |

| Health Insurance Apps | $125,000 |

| Life Insurance Apps | $210,000 |

| Property Insurance Apps | $190,000 |

| On-Demand Insurance App | $125,000 |

This is just an estimated cost, for more details on the same, contact a mobile app development company.

5. Mode of Hire Insurance App Developers

How to Find An App Developer?

Well, there are various ways to find developers. And the one you choose can highly affect the cost. Thus, the cost to hire developers via different methods is, as mentioned below:

| Hire Freelancers | $60 to $100 per hour |

| Outsource to Fintech Development Company | $25-$45 per hour |

| Assemble In-House Team | $50,000 – $120,000 |

These are the factors that affect the cost to develop an insurance app. Now, let’s look at the development process required to develop an insurtech app.

Insurance App Development Process

So, how do you develop an insurance app? Well, apart from securing Insurance App Development Services, there are also several other steps.

In this section of the blog, we shall be going through the Insurance App Development process. It is, as mentioned below:

- Come up with an idea

- Conduct market research

- Cross check idea

- Monetize it

- Choose App Platform

- Choose Tech Stack

- Hire Mobile App Developers

- Create MVP

- Front-end Development

- Back-End Development

- Testing

- Deployment Maintenance

Consequently, t his is the process you follow to create an insurtech app. With this, we have come to the end of our blog.

Conclusion

Insurance app development is growing very popular with the rise of insurtech. With this, there are businesses that are generating millions and billions in revenue. While there are many who are interested in this, people often ask, what’s the Insurance App Development Cost?

This blog gave answers to all of that. Thus, if you are someone who wants to learn more or want to build an insurance app, all you need to do is reach out to the Insurance App Development Company.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.