Building a loan lending app presents a tremendous opportunity in the rapidly growing fintech industry.

These apps offer borrowers and lenders a convenient and accessible platform, leveraging advanced technologies like AI-powered credit scoring and blockchain security to revolutionize the lending process.

With the right features and a user-centric design, a loan lending app can streamline loan approvals, enhance the user experience, and ensure secure transactions.

Staying ahead of market trends and adopting innovative solutions can help your app stand out and meet the dynamic needs of today’s digital-savvy users.

Do you want to develop your money lending app?

Well, we’ve got you covered. This development guide has all you need to know about the same.

So let’s get right into it:

Understanding Loan Lending Apps

Considering diving into the world of fintech by developing a loan lending app? You’re on the right track.

Loan lending apps have transformed the financial services industry by providing a convenient, efficient, and user-friendly way to access loans.

These apps cater to a variety of financial needs.

Personal loans, payday advances, business financing, or peer-to-peer lending, you name it.

They simplify the lending process, allowing users to apply for loans, get approvals, and receive funds directly on their smartphones.

So, what exactly are loan lending apps?

At their core, these apps connect borrowers with lenders, facilitating the entire loan process digitally.

Users can fill out applications, submit necessary documents, and track their loan status—all within the app.

Advanced algorithms and automation ensure quick approvals and disbursements, often within minutes to hours, making the process far more efficient than traditional banking methods.

For those looking to build a loan app, it’s essential to understand the potential and functionalities of these platforms.

Loan lending apps offer more than just convenience.

They come equipped with features like credit score monitoring, personalized loan offers, and flexible repayment options.

Moreover, the advanced technology integration has enhanced security and efficiency

By leveraging AI, you can improve risk assessment and offer more personalized loan products, making your app more competitive in the market.

To stay compliant with regulatory standards, understanding fintech regulations is crucial in this journey.

In summary, loan lending apps have revolutionized how loans are accessed and managed, offering a seamless and efficient alternative to traditional banking.

As you move forward in your journey to create a loan app, understanding the mechanics and benefits of these apps is crucial.

Up next, we’ll dive into the detailed process of how loan lending works, providing you with a step-by-step guide.

How Does Loan Lending Work?

So how do online lending apps work?

Understanding how loan lending works is fundamental when you’re looking to build a loan lending app.

Here’s a step-by-step breakdown of the process:

1. User Registration

Users sign up on the app by providing basic information, including personal details and contact information.

Secure authentication methods, such as two-factor authentication, are often used to ensure the safety of user data.

2. Profile Verification

Once registered, users need to verify their profiles. This involves uploading the necessary documents like ID proofs, bank statements, and income proofs.

AI-driven verification systems can expedite this process by quickly validating the documents.

3. Loan Application

Users can apply for a loan by selecting the loan type and entering the required amount. They also need to specify the repayment period.

The app provides various loan options tailored to the user’s credit score and history.

4. Credit Assessment

The app uses advanced algorithms and AI to assess the user’s creditworthiness. This involves evaluating the user’s credit score, income, employment status, and other financial metrics.

The risk assessment model helps in determining the loan terms and interest rates.

5. Approval and Offer Generation

Based on the credit assessment, the app generates loan offers. Users can review these offers and choose the one that best suits their needs.

This step often involves a quick, automated decision-making process to enhance the user experience.

6. Loan Agreement

Once the user selects a loan offer, a digital loan agreement is generated. The user needs to sign this agreement electronically.

Blockchain technology can be used here to ensure the security and immutability of the agreement.

7. Disbursement

After the agreement is signed, the loan amount is disbursed directly to the user’s bank account.

The process is typically swift, leveraging secure payment gateways to ensure funds are transferred safely and quickly.

8. Repayment

Users can repay the loan in installments as per the agreed schedule. The app provides reminders and notifications for upcoming payments, ensuring users stay on track.

Flexible repayment options and automated deductions from the user’s account can enhance the repayment process.

9. Customer Support

Providing robust customer support is crucial. Users should have access to support for any queries or issues related to their loans.

This can be facilitated through in-app chat support, email, or phone.

Understanding these steps is essential for developing a loan app that is both user-friendly and efficient.

Each step involves intricate details that need careful planning and execution to ensure a seamless user experience.

Mobile Lending Boom: By 2023, it is expected that over 80% of personal loan applications will be processed through mobile devices.

A Dive Into the Loan Lending Market: Growth, Revenue, & More

The loan lending market has seen remarkable growth.

This growth is fueled by the increasing number of internet users, the proliferation of smartphones, and the innovation in digital financial services.

If you’re planning to create a loan lending app, understanding the market dynamics is crucial for making informed decisions and identifying opportunities for innovation and growth.

As per fintech statistics, the loan lending market is poised for significant expansion in the coming years.

Here are some key statistics that highlight the current state and prospects of the loan lending market:

- The global peer-to-peer (P2P) lending market size was valued at USD 68 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 29.7% from 2020 to 2027.

- In the United States, the online lending market reached approximately USD 40 billion in 2020, with continued expansion expected as more consumers and businesses turn to digital lending solutions.

- Mobile lending is on the rise, with the number of mobile loan app users projected to exceed 200 million by 2025, underscoring the importance of mobile wallets, offline payments, and digital transactions in the lending industry.

- Advanced technologies like AI and machine learning are being increasingly integrated into loan lending apps to streamline the lending process and improve risk assessment, enhancing both efficiency and security.

- Regulatory developments are shaping the loan lending market, with new fintech regulations being introduced to ensure compliance and build user trust.

These statistics underscore the dynamic growth of the loan lending market and the vast opportunities available for innovation.

As you make a loan lending app, staying abreast of these trends and leveraging advanced technologies will be key to creating a competitive and user-friendly solution.

Different Forms of Loan Lending Apps

Loan lending apps come in various forms.

Each is designed to cater to different types of borrowers and lending needs.

Understanding these variations can help you determine the best approach when you decide to build a loan app.

Here are the main types of loan lending apps that dominate the market:

► Personal Loan Apps

Personal loan apps provide unsecured loans to individuals for personal use.

These loans can be used for various purposes, such as consolidating debt, covering medical expenses, or funding home improvements.

The application process is typically straightforward, requiring users to fill out a form, submit necessary documents, and wait for approval.

Features:

- Easy Application Process

- Flexible Repayment Options

- Credit Score Monitoring

- Personalized Loan Offers.

► Payday Loan Apps

Payday loan apps offer short-term loans that are usually due on the borrower’s next payday.

These apps cater to users who need immediate cash for emergencies or unexpected expenses.

While convenient, these loans often come with high interest rates and fees.

They are also known as cash advance apps.

Features:

- Quick Access To Funds

- No Credit Check Required

- Direct Deposit to Bank Accounts

- Financial Management Tools.

► P2P Lending Apps

Peer-to-peer (P2P) lending apps connect borrowers directly with individual lenders, bypassing traditional financial institutions.

These platforms allow lenders to earn interest on their funds while providing borrowers with competitive loan terms.

The app typically facilitates the entire process, from loan application to disbursement and repayment.

Features:

- Direct Borrower-Lender Connection

- Competitive Interest Rates

- Automated Investment Options For Lenders

- Comprehensive Loan Management Tools.

Also Read: How To Create A Successful P2P Lending App

► Business Loan Apps

Business loan apps are designed to provide financing to small and medium-sized enterprises (SMEs).

These loans can be used for various business needs, such as expanding operations, purchasing inventory, or managing cash flow.

The app may offer different types of business loans, including term loans, lines of credit, and invoice financing.

Features:

- Flexible Credit Lines

- Quick Application Process

- Integration with Business Accounts

- Real-Time Access To Funds.

► Student Loan Apps

Student loan apps help students secure funding for their education.

These apps may offer both private and federal student loans, along with refinancing options. These have been rather popular lately.

They often provide tools and resources to help students understand their borrowing options and manage their loans effectively.

Features:

- Customizable Loan Terms

- In-School Repayment Options

- Loan Calculators

- Educational Resources for Financial Literacy.

► Mortgage Loan Apps

Mortgage loan apps streamline the process of applying for and managing home loans.

These apps provide users with the ability to apply for a mortgage, upload necessary documents, and track the progress of their application.

They may also offer tools to calculate mortgage payments and compare loan options.

Features:

- Digital Application Process

- Document Upload and Tracking

- Mortgage Calculators

- Real-Time Application Updates.

Each type of loan lending app serves a specific market segment, addressing unique financial needs and preferences.

By understanding these different forms, you can better tailor your app development efforts to target the right audience and provide the most relevant features and services.

This understanding is crucial as you move forward with plans to develop a loan lending app.

Why Should You Develop a Loan Lending App?

The demand for digital financial solutions continues to rise in 2025, making it an opportune time to develop a loan lending app.

There are several compelling reasons why businesses should invest in creating these apps.

So, let’s look at some of the top driving reasons to start a fintech business in the money lending market. They are:

1. Increasing Demand for Digital Loans

The global shift towards digital finance has accelerated the adoption of loan lending apps.

Consumers and businesses alike are seeking faster, more convenient ways to access credit without the bureaucratic hurdles of traditional banking.

According to recent fintech statistics, the digital lending market is expected to grow significantly, providing ample opportunities for new entrants.

2. Technological Advancements

Advancements in technology, particularly AI, machine learning, and blockchain, have transformed the loan lending landscape.

AI and machine learning enable more accurate risk assessment and personalized loan offerings, while blockchain ensures secure and transparent transactions.

Integrating these technologies into your loan lending app can provide a competitive edge and enhance user trust and satisfaction.

3. Financial Inclusion

Developing a loan app can significantly contribute to financial inclusion, especially in underserved and unbanked regions.

By providing easy access to credit, these apps can help individuals and small businesses overcome financial barriers, promoting economic growth and stability.

4. Regulatory Support

Governments and regulatory bodies are increasingly recognizing the importance of digital financial solutions and are creating frameworks to support their growth.

Staying updated with fintech regulations ensures compliance and builds consumer confidence, making your app more attractive to potential users.

5. Market Opportunity

With a growing number of smartphone users globally, the potential market for loan lending apps is vast.

The convenience of applying for loans through mobile apps appeals to tech-savvy consumers, driving higher adoption rates.

By offering unique features and a seamless user experience, your app can capture a significant share of this expanding market.

6. Competitive Advantage

Entering the loan lending app market now can position your business as a pioneer in digital finance.

By offering innovative features such as gamification, real-time loan processing, and personalized financial advice, you can differentiate your app from competitors and build a loyal user base.

7. Profitability

Loan lending apps can be highly profitable through various monetization strategies, including interest rates, service fees, and premium features.

With the assistance of implementing as well as developing a robust business model and understanding the over costs statement, you can ensure the importance of sustainable revenue streams that will add to make effective profits.

In conclusion, building a loan lending app in 2025 presents a lucrative opportunity to tap into a growing market, leverage advanced technologies, and promote financial inclusion.

By understanding market trends, technological advancements, and consumer needs, you can create a successful and impactful loan lending app.

First Recorded Loan: The oldest recorded loan dates back over 4,000 years in ancient Mesopotamia, where clay tablets were used to record loan agreements.

Best Loan Lending Apps – Learn From the Best

If you’re looking to create an online lending app, examining successful examples in the market can provide valuable insights into essential features, user experience, and innovative functionalities.

Here are five of the best loan lending apps, highlighting their standout features and what you can learn from them:

| Apps | Availability | Downloads | Rating |

| SoFi | iOS & Android | 1M+ | 4.8/5 & 4.1/5 |

| Earnin | iOS & Android | 5M+ | 4.7/5 & 4.7/5 |

| LendingClub | iOS & Android | 100K+ | 4.8/5 & 4.6/5 |

| College Ave | iOS & Android | 10K+ | 2.0/5 & 4.2/5 |

► SoFi

SoFi is a prominent personal finance company that offers a variety of loan products, including personal loans, student loans, and mortgage refinancing.

Known for its competitive rates and user-friendly app, SoFi provides a seamless borrowing experience.

Features:

- Easy online application process

- Competitive interest rates

- Flexible repayment terms

- No origination fees or prepayment penalties

- Financial planning tools and career coaching

Similar Topics: Cost To Develop An App Like SoFi

► Earnin

Earnin is a payday loan app that allows users to access their earned wages before payday, helping them manage short-term financial needs without the high interest rates of traditional payday loans.

Features:

- Access up to $100 per day of earned wages

- No fees or interest charges

- Balance Shield to avoid overdraft fees

- Health Aid feature to help pay medical bills

- Financial tips and community support

Explore More: Cost To Develop An App Like Earnin

► LendingClub

LendingClub is a peer-to-peer lending platform that connects borrowers with individual investors, offering personal and small business loans with competitive rates and flexible terms.

Features:

- Personal loans up to $40,000

- Business loans up to $500,000

- Automated investing options for lenders

- Transparent fee structure

- Credit monitoring and financial education resources

What You Can Learn: LendingClub’s peer-to-peer model emphasizes transparency and community engagement.

When building a loan lending app, consider incorporating features that foster trust and transparency, such as clear fee structures and comprehensive loan information.

Offering tools for both borrowers and lenders can also expand your user base.

Don’t Miss: How To Develop An App Like LendingClub

► College Ave

College Ave specializes in student loans, offering both private and federal loan options along with refinancing.

It provides a tailored approach to student financing with tools to help students understand their borrowing options and manage their loans effectively.

Features:

- Customizable loan terms

- In-school repayment options

- Loan calculators to estimate costs

- No origination fees

- Financial literacy resources

What You Can Learn: College Ave’s focus on customization and education helps it stand out in the student loan market.

When creating a loan app, consider offering customizable loan terms and educational resources to help users make informed financial decisions.

User-friendly tools like loan calculators can also enhance the overall user experience.

By learning from these top loan lending apps, you can incorporate their successful strategies and features into your own app, ensuring a competitive edge in the market. When you’re ready for the next section, please let me know.

Essential Loan Lending App Features

If you are planning to build a loan lending app, you must know the important features.

Well, this section is all about that.

Here we highlight the key features you should consider when planning to create a loan lending app, helping you build a robust and competitive product.

For a detailed overview, here are some must-have loan lending app features:

➤ User Registration and Profile Management

Users should be able to easily register, create, and manage their profiles.

The process involves capturing personal information, verifying identity through documents like ID proofs, and allowing users to set up their account preferences.

➤ Loan Application Process

A streamlined application process where users can apply for different types of loans by providing relevant details such as the loan amount, purpose, and repayment period.

This feature should guide users through each step, from filling out forms to submitting required documents.

➤ Credit Scoring and Risk Assessment

Integration of AI and machine learning to evaluate user creditworthiness based on various financial parameters.

This involves analyzing credit history, income, employment status, and other relevant data points to assess the risk associated with lending to the user.

The system should provide a transparent credit score and insights into factors affecting it.

➤ Loan Approval and Disbursement

Automated processes for loan approval and fund disbursement to the user’s bank account.

The system should facilitate quick decision-making and secure transfer of funds, providing users with timely access to their loans.

➤ Repayment Scheduling and Notifications

Tools for setting up repayment schedules and sending reminders/notifications to users.

This feature should allow users to choose their repayment plan, set up automatic payments, and receive timely reminders to ensure they stay on track with their payments.

➤ Customer Support

In-app customer support options such as live chat, email, or phone support.

The support system should be accessible and responsive, providing users with assistance whenever they encounter issues.

Advanced Features of a Loan Lending App

1. AI-Powered Insights and Recommendations

AI-driven insights to provide users with personalized loan recommendations and financial advice. The feature analyzes user data and behavior to offer tailored financial solutions and tips.

2. Blockchain for Security and Transparency

Utilizing blockchain technology to ensure secure, transparent, and immutable transaction records.

This feature leverages the decentralized nature of blockchain to provide secure and transparent financial transactions.

3. Gamification Elements

Integrating Gamification in loan lending apps, you can include elements such as rewards, badges, and leaderboards to engage the users.

This feature uses game-like elements to make the loan application and repayment process more interactive and enjoyable.

4. Multi-Language Support

Offering the app in multiple languages to cater to a diverse user base. This feature ensures that non-English speaking users can access and use the app comfortably.

Provide users with an advanced analytics dashboard to track their financial health, loan performance, and repayment status.

This feature offers detailed insights into financial activities, helping users manage their loans more effectively.

6. Integration With Financial Services

Integration with other financial services like insurance, investment platforms, and credit bureaus.

This feature provides a holistic financial solution, making the app a one-stop platform for users’ financial needs.

By incorporating these essential and advanced features, you can create a loan lending app that not only meets the basic requirements but also offers enhanced functionalities that differentiate it from competitors.

This approach ensures a superior user experience and helps in building a loyal customer base.

Pre-Development To-Do List For Your Loan Lending App

Before diving into the development of a loan lending app, thorough preparation is essential to ensure a smooth process and a successful launch.

Here’s a comprehensive checklist to guide you through the crucial steps necessary to lay a solid foundation for your app.

♦ Conduct Market Research

Begin by conducting comprehensive market research to understand current trends, user demands, and the competitive landscape.

Analyze your target audience, their preferences, and any gaps in the market that your app can fill.

This insight will help you identify unique selling points and features that can set your app apart from competitors.

♦ Define Your Value Proposition

If you want to create a money lending app that captures that market and becomes the next big thing, then you need a UVP.

Unique value proposition.

Here, you need to clearly define what makes your loan lending app unique and valuable.

Highlight key features and benefits that will attract and retain users, such as quick approval times, low interest rates, or advanced security measures.

A strong value proposition will guide your marketing efforts and help you connect with your target audience.

♦ Compliance and Regulatory Requirements

Ensure your app complies with all relevant financial regulations and standards.

This includes data protection laws, lending regulations, and consumer protection standards.

Staying updated on fintech regulations is crucial to avoid legal issues and build trust with your users. Consult with legal experts to navigate these requirements effectively.

♦ Legal and Licensing Requirements

Obtain the necessary licenses and approvals to operate legally.

Depending on your jurisdiction, this may include lending licenses, data protection certifications, and other regulatory compliance.

Ensure you understand the legal landscape and adhere to all necessary regulations to avoid potential legal challenges.

♦ Capital for Loan Lending

You need to determine the amount of capital required to fund the loans you will be offering.

This involves securing enough capital to meet the demands of your users while maintaining liquidity.

Consider various funding options such as investors, loans, or partnerships with financial institutions. This capital is crucial for sustaining operations and providing reliable loan services.

♦ Define Technical Requirements

A fintech app’s tech stack is super important.

So what you need to do is outline the technical requirements for your app. This includes the tech stack, platform compatibility, and scalability considerations.

Decide whether your app will be developed for iOS, Android, or both. You can select the loan lending app tech stack wisely via the following table.

| Components | Technology Options | Description |

| Frontend | React, Angular, Vue.js | Choose a modern front-end framework for building responsive and dynamic user interfaces. |

| Backend | Node.js, Express.js, Django, Ruby on Rails | Select a robust backend framework to handle server-side logic, database interactions, and API creation. |

| Database | MongoDB, PostgreSQL, MySQL | Opt for a scalable and reliable database solution to store user data, loan information, and transaction records. |

| Mobile Development | Swift (iOS), Kotlin (Android), React Native, Flutter | Use native languages for platform-specific apps or cross-platform frameworks for broader reach. |

| Hosting/Cloud | AWS, Google Cloud Platform, Microsoft Azure | Utilize cloud services for scalable infrastructure, storage, and computing power. |

| Authentication & Security | OAuth, JWT, SSL/TLS, Firebase Authentication | Implement secure authentication mechanisms and protocols to protect user data and ensure secure transactions. |

| Payment Gateway | Stripe, PayPal, Braintree, Square | Integrate with reliable payment gateways for handling financial transactions and loan disbursements. |

| Notifications | Firebase Cloud Messaging (FCM), Twilio | Implement push notifications and SMS alerts to keep users informed about their loan status and updates. |

| Analytics | Google Analytics, Mixpanel, Firebase Analytics | Use analytics tools to track user behavior, app performance, and other critical metrics. |

| DevOps | Docker, Kubernetes, Jenkins, GitHub Actions | Implement CI/CD pipelines and container orchestration for efficient development and deployment. |

| Blockchain | Ethereum, Hyperledger | Consider blockchain for enhanced security and transparency in loan transactions and agreements. |

| AI/ML | TensorFlow, PyTorch, Scikit-learn | Utilize AI/ML frameworks for credit scoring, risk assessment, and personalized recommendations. |

♦ Infrastructure Setup

The loan lending app’s infrastructure is super important.

Set up the necessary infrastructure to support your loan lending app.

This includes secure servers, databases, and network configurations to ensure smooth operations and data protection.

Invest in cloud services for scalability and reliability, and ensure you have robust backup and disaster recovery plans in place.

♦ Budget and Funding

Determine the budget for your app development, including development costs, marketing expenses, operational costs, and the capital needed for loan disbursement.

Identify potential funding sources if needed. Breaking down the budget into categories like development, marketing, legal, and operational costs can help you manage finances effectively.

Also Read: How To Get Funding For A Fintech App?

♦ Create a Detailed Project Plan

Develop a comprehensive project plan that includes timelines, milestones, deliverables, and responsibilities.

This plan should cover the entire development lifecycle, from ideation to launch.

Use project management tools like Jira, Trello, or Asana to track progress and manage tasks effectively.

♦ Assemble Your Development Team

It’s time to hire app developers.

To develop a loan app that makes an impact, you first need to build a skilled development team that includes developers, designers, QA testers, and project managers.

Here, you must ensure your team has experience in fintech and mobile app development.

Depending on your budget and project requirements, consider both in-house and outsourced development options.

♦ Plan Marketing and Launch Strategy

Lastly, before we go into the steps to make a loan app, first we develop a marketing plan that includes pre-launch, launch, and post-launch strategies.

Identify key marketing channels, create a content plan, and set measurable goals. Utilize social media, SEO, content marketing, and paid advertising to create buzz and attract users.

By following this comprehensive pre-development checklist, you can ensure that your loan lending app is well-prepared for development and positioned for success in the competitive fintech market.

Loan Sharks Origin: The term “loan shark” originated in the 1800s to describe moneylenders who charged excessively high interest rates, similar to the way a shark aggressively hunts its prey.

Development Process of a Loan Lending App

After completing the pre-development steps, it’s time to dive into the actual development process of your loan lending app.

This comprehensive guide will walk you through the detailed steps involved in developing a successful loan lending app.

Step 1: UI/UX Design

Design an intuitive and engaging user interface (UI) that offers a seamless user experience (UX).

Create wireframes to outline the app’s structure and flow, followed by interactive prototypes to visualize the user journey.

Focus on ease of navigation, accessibility, and visual appeal to ensure a positive user experience.

Step 2: Frontend Development

Develop the user-facing part of the app using modern front-end technologies.

Ensure that the interface is responsive and functioning smoothly across various devices and screen sizes.

Implement UI designs and integrate user interaction elements, ensuring they align with the overall app design and functionality.

Step 3: Backend Development

Develop server-side logic, database interactions, and API integrations.

The backend should handle data processing, user authentication, loan transactions, and other core functionalities.

Focus on creating a scalable, secure, and efficient backend that can handle high loads and provide fast response times.

Step 4: Database Management

Choose and configure a reliable database to store user data, loan information, and transaction records.

Implement data models and schemas that ensure efficient data storage and retrieval. Ensure that the database is secure, scalable, and capable of handling large volumes of data.

Step 5: Integration of Essential Features

Integrate core features such as user registration, loan application, credit scoring, loan approval, disbursement, and repayment schedule.

These features form the backbone of the app, providing users with the essential functionalities needed for loan management.

Step 6: Advanced Feature Implementation

Add advanced features such as AI-powered insights, blockchain security, gamification elements, multi-language support, and advanced analytics.

These features enhance the app’s competitiveness and user engagement, providing users with added value and innovative functionalities.

Step 7: Quality Assurance and Testing

Conduct thorough testing to identify and fix bugs, ensure security, and validate that the app meets all requirements.

Perform various testing methods such as unit testing, integration testing, and user acceptance testing to ensure the app is reliable and performs well under different conditions.

Step 8: Deployment

Deploy the app to production servers and make it available to users. Ensure a smooth transition from development to the live environment by setting up production configurations and monitoring the deployment process closely to address any issues that arise.

Step 9: Post-Deployment Support and Maintenance

Provide ongoing support and maintenance to fix bugs, improve features, and ensure the app remains secure and up-to-date.

Regular updates and enhancements based on user feedback and technological advancements will help maintain the app’s relevance and user satisfaction.

This detailed development process ensures that all aspects of building a loan lending app are covered, from initial planning to post-deployment support, leading to a successful and competitive product in the fintech market.

Cost to Build a Loan Lending App

On average, the cost to develop a loan lending app can range from $50,000 to $150,000.

The exact cost depends on various factors such as the complexity of features, the development team’s location, and the time required for development.

Here’s a detailed breakdown of the key cost components:

| Component | Description | Estimated Cost Range |

| UI/UX Design | Designing an intuitive and engaging user interface and experience. This includes wireframes, prototypes, and final design. | $5,000 – $15,000 |

| Frontend Development | Developing the user-facing part of the app using modern front-end technologies. | $10,000 – $30,000 |

| Backend Development | Develop server-side logic, database interactions, and API integrations. | $15,000 – $40,000 |

| Database Management | Setting up and configuring a reliable database to store user data and transaction records. | $5,000 – $10,000 |

| Integration of Essential Features | Implement core features such as user registration, loan application, credit scoring, loan approval, disbursement, and repayment schedule. | $10,000 – $30,000 |

| Advanced Feature Implementation | Add advanced features like AI-powered insights, blockchain security, gamification elements, multi-language support, and advanced analytics. | $15,000 – $40,000 |

| Quality Assurance and Testing | Conduct thorough testing to identify and fix bugs, ensure security, and validate that the app meets all requirements. | $5,000 – $15,000 |

| Deployment | Deploying the app to production servers and making it available to users. | $3,000 – $8,000 |

| Post-Deployment Support and Maintenance | Provide ongoing support and maintenance to fix bugs, improve features, and ensure the app remains secure and up-to-date. | $5,000 – $12,000 per year |

The total cost can vary based on specific requirements, the complexity of the app, and additional features that might be required.

It’s important to budget for potential changes and ongoing maintenance to keep the app updated and secure.

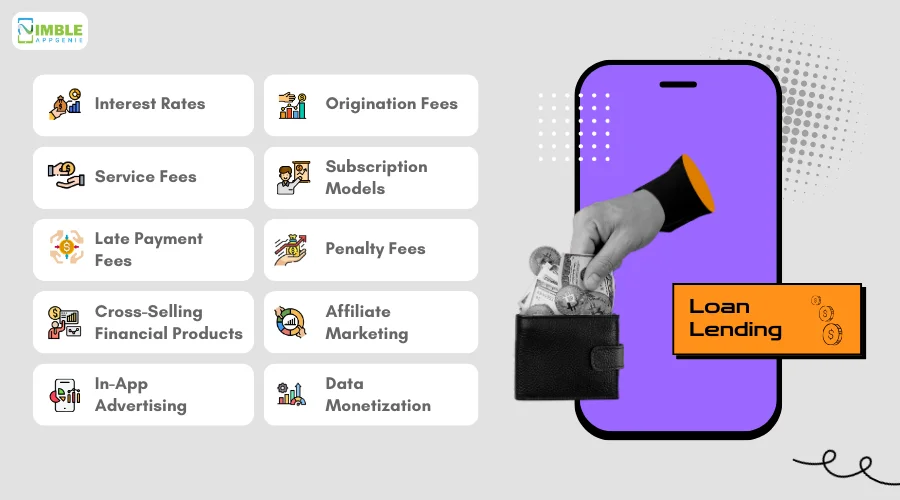

How Do Money Lending Apps Make Money?

One might often wonder, Are loan apps profitable?

Well, they can be. Loan lending apps employ several monetization strategies to generate revenue.

Here’s an overview of “how money lending apps make money”?

1. Interest Rates

Charging interest on the loan amount is the primary revenue source for loan lending apps.

For example, LendingClub offers loans with interest rates tailored to the borrower’s credit profile and loan type.

If an app serves 10,000 users with an average loan amount of $5,000 at a 10% annual interest rate, the potential revenue from interest alone can be substantial, potentially reaching millions annually.

2. Origination Fees

This is a one-time fee charged for processing the loan application, typically deducted from the loan amount before disbursement.

SoFi, for instance, charges origination fees ranging from 1% to 6% of the loan amount.

For a platform disbursing $50 million in loans annually, even a 2% origination fee can generate $1 million.

3. Service Fees

Some loan apps charge service fees for managing the loan, providing customer support, and maintaining the platform.

Earnin, for example, encourages users to tip voluntarily for the service instead of charging mandatory fees.

If each user tips $5 per transaction and the app processes 100,000 transactions a year, this can lead to $500,000 in revenue.

4. Subscription Models

Loan lending platforms can offer premium features and services through subscription models.

Credit Karma, for instance, offers premium subscriptions with enhanced features and financial insights.

With 10,000 subscribers paying $10 per month, the app can generate $1.2 million annually from subscriptions.

5. Late Payment Fees

Loan apps often charge fees for late payments to incentivize timely repayments and compensate for the risk of delayed payments.

Many loan services, including traditional banks, charge a fixed fee or a percentage of the missed payment amount.

For an app with 5,000 late payments a month at $25 per late fee, this could result in $1.5 million annually.

6. Penalty Fees

In addition to late fees, some apps impose penalty fees for other violations of the loan agreement, such as prepayment penalties or fees for insufficient funds.

If an app charges $50 for each prepayment and 1,000 users prepay annually, it can generate $50,000 in penalty fees.

7. Cross-Selling Financial Products

Loan apps can partner with other financial service providers to offer additional products such as insurance, credit cards, or investment services.

For example, Kabbage offers business loans and promotes business insurance and payment processing services.

By earning commissions of $100 per sale and making 500 sales monthly, the app could generate $600,000 annually.

8. Affiliate Marketing

By promoting third-party products and services, loan apps can earn affiliate commissions.

Credit Karma earns affiliate commissions by recommending credit cards and personal loans to users.

With commissions averaging $50 per referral and 2,000 referrals monthly, the app could make $1.2 million annually.

9. In-App Advertising

Some loan lending apps generate revenue through in-app advertising.

By displaying targeted ads to users, these apps can earn revenue from ad impressions, clicks, or conversions.

Freemium loan apps may use in-app advertising as a primary revenue source.

With a CPM (cost per thousand impressions) of $10 and 1 million monthly impressions, the app could earn $120,000 annually.

10. Data Monetization

Loan apps can monetize anonymized user data by selling insights to financial institutions, market researchers, or advertisers.

This data can provide valuable insights into consumer behavior and market trends.

If the app sells data insights at $50,000 per report and sells 10 reports annually, it can generate $500,000.

By leveraging these various monetization strategies, loan lending apps can build a sustainable business model that generates consistent revenue while providing valuable financial services to users.

AI’s Impact: AI and machine learning in loan lending can not only reduce default rates but also predict borrower behavior with up to 95% accuracy.

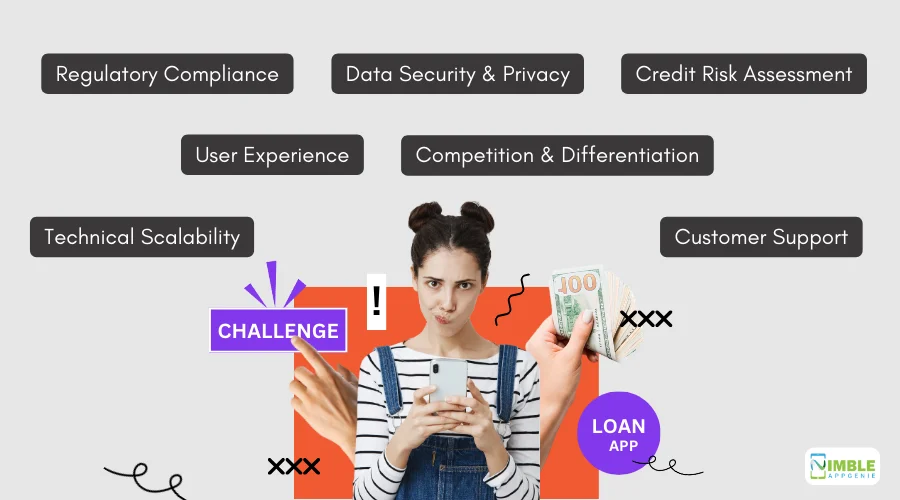

Challenges in Implementing Loan Lending Apps (And Their Solutions)

Implementing loan lending apps comes with various challenges that developers and businesses need to address to ensure success.

Here are some of the common mistakes to avoid while developing a money-lending app:

♦ Regulatory Compliance

Navigating the complex regulatory landscape is one of the biggest challenges. Different regions have varying regulations regarding data protection, lending practices, and consumer rights, making compliance a daunting task.

Solution: Stay updated with the latest fintech regulations and work closely with legal experts to ensure your app complies with all necessary laws.

Implementing a robust compliance framework from the beginning can help mitigate risks and avoid legal issues.

♦ Data Security and Privacy

Ensuring data security and privacy is crucial, especially given the sensitive nature of financial data handled by loan lending apps.

Any breach can lead to severe consequences, including loss of trust and legal penalties.

Solution: Use advanced encryption techniques, implement secure authentication methods like two-factor authentication, and regularly conduct security audits.

Adhering to data protection standards like GDPR and CCPA is also essential.

♦ Credit Risk Assessment

Accurately assessing the credit risk of borrowers is critical to minimizing defaults and ensuring the financial stability of the lending platform.

Traditional credit scoring models may not be sufficient for all types of borrowers, especially those with limited credit history.

Solution: Integrate AI and machine learning models to analyze a broader set of data points, including alternative credit data like social media behavior and transaction history.

This can provide a more comprehensive view of the borrower’s creditworthiness.

♦ User Experience

Providing a seamless and intuitive user experience is vital to attract and retain users. Complex or confusing interfaces can deter potential borrowers and lead to high dropout rates during the application process.

Solution: Focus on UX/UI design to create an intuitive and engaging interface. Conduct user testing to gather feedback and make necessary adjustments.

Ensure that the application process is streamlined and easy to navigate.

♦ Competition and Differentiation

The loan lending market is highly competitive, with many players offering similar services. Differentiating your app from competitors and capturing market share can be challenging.

Solution: Identify unique selling points (USPs) such as lower interest rates, faster approval times, or innovative features like AI-powered insights and gamification. Highlight these USPs in your marketing strategy to attract users.

♦ Technical Scalability

As the user base grows, ensuring that the app can handle increased load and transactions without compromising performance becomes challenging.

Solution: Build a scalable architecture from the start, using cloud services and microservices. Regularly monitor performance and optimize the infrastructure to handle peak loads effectively.

♦ Customer Support

Providing efficient customer support to address user queries and issues is essential for maintaining a positive user experience. Poor support can lead to user dissatisfaction and attrition.

Solution: Implement a robust customer support system that includes live chat, email support, and AI-powered chatbots for 24*7 assistance.

Regularly train support staff to handle complex issues and provide timely resolutions.

By addressing these challenges with the right strategies and solutions, you can ensure the successful implementation and operation of your loan lending app, providing a valuable service to users while maintaining compliance and security.

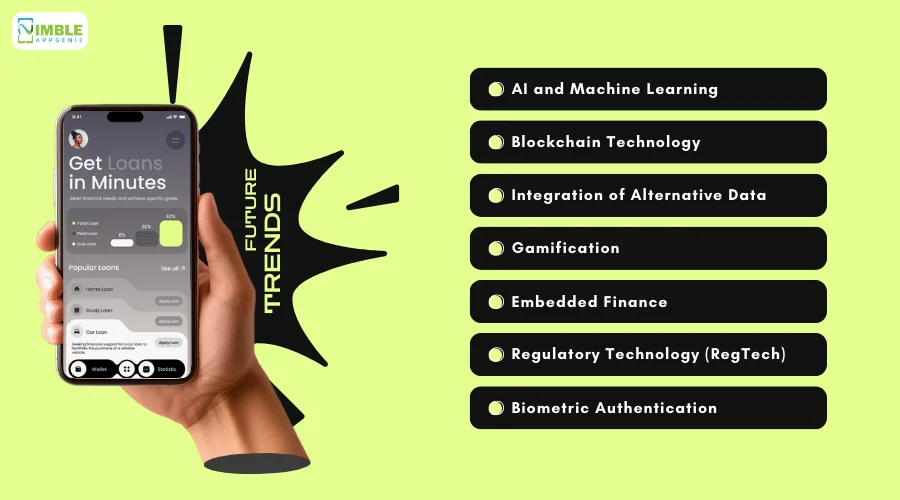

Future Trends to Look Out For in Loan Lending Apps

As the financial technology (fintech) sector evolves, loan lending apps continue to innovate and adapt to new trends.

Here are some key loan lending app trends to watch for in the development and functionality of the platform.

• AI and Machine Learning

The use of AI and machine learning in loan lending apps is becoming increasingly sophisticated.

These technologies help in automating loan approval processes, enhancing credit scoring models, and providing personalized financial advice.

• Blockchain Technology

Blockchain technology is being integrated into lending apps to ensure secure and transparent transactions.

This technology can help in creating immutable records of loan agreements and repayments, thereby increasing trust among users.

• Integration of Alternative Data

Loan lending apps are increasingly using alternative data sources to assess creditworthiness.

This includes social media activity, transaction history, and other non-traditional data points that provide a more comprehensive view of a borrower’s financial behavior.

• Gamification

Gamification elements are being incorporated into loan lending apps to increase user engagement and retention.

This includes rewards, badges, leaderboards, and challenges that make the borrowing and repayment process more interactive and enjoyable.

• Embedded Finance

Embedded finance involves integrating financial services into non-financial platforms.

Loan lending services are being embedded into e-commerce websites, ride-sharing apps, and other platforms, making it easier for users to access credit at the point of need.

• Regulatory Technology (RegTech)

The rise of RegTech solutions helps loan lending apps comply with regulatory requirements more efficiently.

These technologies automate compliance processes, monitor transactions for suspicious activity, and ensure adherence to legal standards.

• Biometric Authentication

The use of biometric authentication, such as facial recognition and fingerprint scanning, is becoming more common in loan lending apps.

This technology enhances security and provides a seamless login experience.

By staying abreast of these trends, loan lending apps can continue to innovate and offer enhanced services to their users.

Adopting these advancements not only improves the user experience but also strengthens the app’s competitive position in the fintech market.

Nimble AppGenie: Empower Great Ideas With Powerful Technology

As a leading loan lending app development company, Nimble AppGenie specializes in creating robust, scalable, and user-friendly loan lending apps tailored to your business needs.

Our expertise in fintech allows us to integrate advanced features like AI-powered credit scoring, blockchain security, and seamless user experience, ensuring your app stands out in a competitive market.

Partner with us to leverage cutting-edge technology and industry best practices and transform your ideas into a successful loan lending platform that meets the needs of modern users.

Our comprehensive approach ensures that your app is not only functional but also secure, scalable, and ready for the future.

Conclusion

In today’s digital age, creating a loan lending app offers an incredible opportunity to meet the growing demand for convenient, accessible, and secure financial services.

By incorporating advanced features such as AI-powered credit scoring, blockchain for secure transactions, and intuitive user interfaces, you can create a competitive and user-friendly app.

Staying ahead of future trends like embedded finance, biometric authentication, and gamification will further enhance your app’s appeal and functionality.

FAQs

Essential features include user registration and profile management, loan application processes, credit scoring, loan approval and disbursement, repayment scheduling, and robust customer support.

Loan lending apps use a combination of traditional credit scores and alternative data sources, such as social media activity and transaction history, often powered by AI and machine learning models.

Regulatory requirements vary by region but typically include data protection laws, lending regulations, and consumer protection standards. Compliance with GDPR, CCPA, and other local regulations is crucial.

Apps ensure data security through advanced encryption, two-factor authentication, regular security audits, and compliance with data protection standards.

They generate revenue through interest rates, origination fees, service fees, subscription models, late payment fees, penalty fees, cross-selling financial products, affiliate marketing, in-app advertising, and data monetization.

Key trends include AI and machine learning, blockchain technology, the integration of alternative data, embedded finance, RegTech, gamification, and biometric authentication.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

![CTA_1 Ready_to_Build_Your_Own_Loan_Lending_App[1]](https://www.nimbleappgenie.com/blogs/wp-content/uploads/2024/08/CTA_1-_Ready_to_Build_Your_Own_Loan_Lending_App1-1.webp)

No Comments

Comments are closed.