Artificial Intelligence (AI) is revolutionizing the loan lending industry, bringing efficiency, accuracy, and enhanced user experiences.

AI in loan lending apps leverages advanced technologies such as machine learning, natural language processing, and predictive analytics to streamline processes, reduce risks, and offer personalized services.

From automated credit scoring to real-time fraud detection, AI is transforming how loans are processed, approved, and managed.

This blog explores the critical role of AI in loan lending apps, highlighting its benefits, challenges, and real-world applications, making it clear why AI is the future of the lending industry.

Therefore, let’s get right into it:

Understanding AI in Loan Lending

AI in loan lending refers to the application of Artificial Intelligence technologies to streamline and enhance various aspects of the loan process.

This includes using machine learning algorithms, predictive analytics, and natural language processing to automate tasks, improve risk assessments, and enhance customer interactions.

AI is revolutionizing the loan lending industry by making processes more efficient, accurate, and customer-friendly.

Traditional loan processes often involve manual data collection, analysis, and decision-making, which can be time-consuming and prone to human error.

AI in loan lending apps automates these tasks, significantly reducing processing time and minimizing errors.

Machine learning algorithms analyze vast amounts of data to assess creditworthiness more accurately, taking into account factors beyond traditional credit scores, such as social media activity and utility payments.

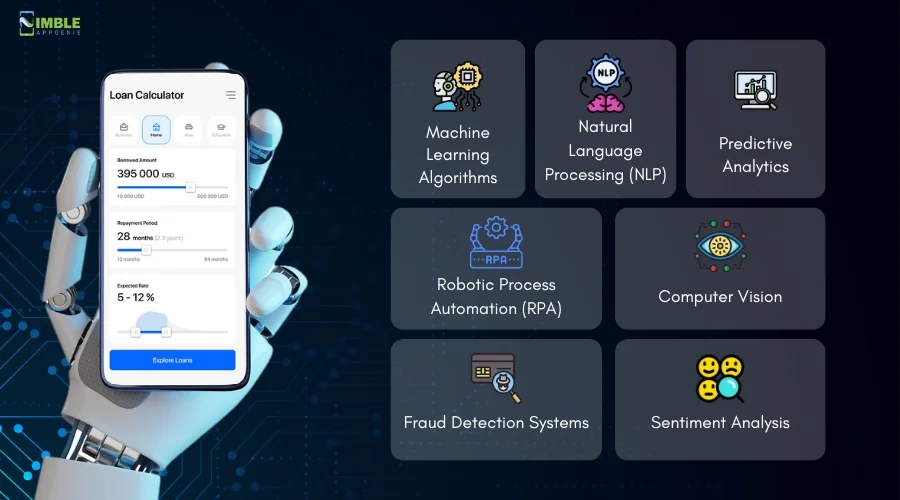

Key AI Technologies in Loan Lending Apps

Artificial Intelligence (AI) technologies are revolutionizing the loan lending industry by enhancing efficiency, accuracy, and customer satisfaction.

Here are some of the key AI technologies driving this transformation:

► Machine Learning Algorithms

Machine learning (ML) algorithms analyze vast amounts of data to identify patterns and make predictions.

In loan lending, ML algorithms assess creditworthiness by examining traditional data (credit scores, income levels) and non-traditional data (social media activity, utility payments).

This comprehensive analysis allows for more accurate risk assessments and credit decisions, reducing default rates and improving loan approval processes.

► Natural Language Processing (NLP)

Natural Language Processing enables computers to understand, interpret, and respond to human language.

In loan lending apps, NLP powers chatbots and virtual assistants that provide instant customer support.

These AI-driven tools can answer queries, guide users through the loan application process, and offer personalized financial advice, enhancing the overall customer experience.

► Predictive Analytics

Predictive analytics uses statistical techniques and machine learning algorithms to forecast future outcomes based on historical data.

In the context of loan lending, predictive analytics helps lenders anticipate borrower behavior, such as the likelihood of default or early repayment.

This technology aids in making informed lending decisions and developing strategies to mitigate risks.

► Robotic Process Automation (RPA)

Robotic Process Automation involves using AI to automate repetitive and time-consuming tasks.

In loan lending, RPA can automate document verification, data entry, and compliance checks.

This reduces processing time, minimizes errors, and allows human employees to focus on more complex tasks.

► Computer Vision

Computer vision technology enables AI systems to interpret and analyze visual information from documents.

In loan lending, this technology is used to automate the verification of identity documents, such as passports and driver’s licenses.

By extracting and validating information from these documents, computer vision accelerates the onboarding process and ensures accuracy.

► Fraud Detection Systems

AI-powered fraud detection systems analyze transaction patterns and behaviors to identify and flag suspicious activities.

These systems continuously monitor loan applications and transactions for signs of fraud, such as identity theft or false information.

By detecting potential fraud early, lenders can take preventive measures and protect their financial assets.

► Sentiment Analysis

Sentiment analysis involves analyzing text to determine the sentiment or emotional tone behind it.

In loan lending, this technology can be used to gauge customer satisfaction and identify potential issues from customer feedback.

By understanding customer sentiment, lenders can improve their services and address concerns proactively.

The integration of these AI technologies in loan lending apps is transforming the industry by automating processes, improving risk assessment, enhancing customer interactions, and ensuring security.

By leveraging these technologies, lenders can offer more efficient, accurate, and personalized services, ultimately driving better outcomes for both lenders and borrowers.

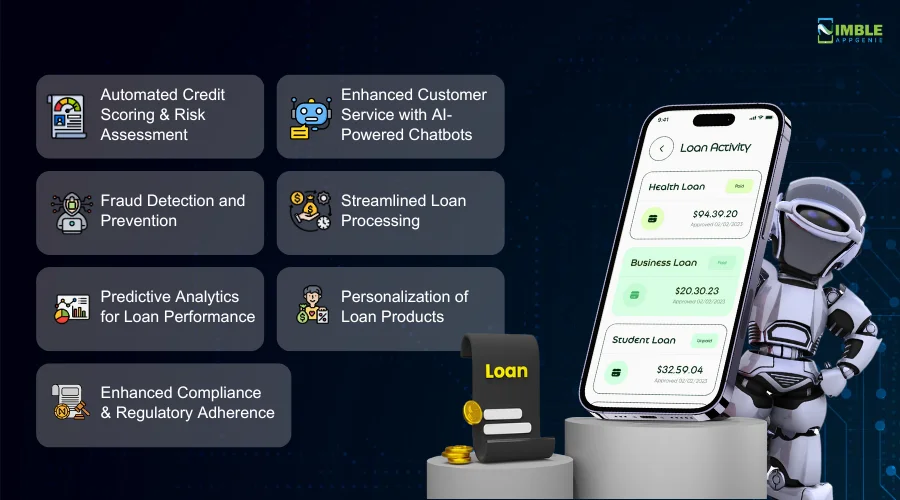

Role of AI in Loan Lending Apps

The integration of Artificial Intelligence (AI) in loan lending apps is significantly transforming the lending industry.

To recognize “how to build a loan lending app?” It’s important to evaluate the role of new and updated technologies as AI in the sector.

By utilizing advanced technologies such as machine learning, natural language processing, and predictive analytics, AI enhances various aspects of the lending process, making it more efficient, accurate, and user-friendly.

Below, we delve into the detailed roles and impacts of AI in loan lending apps.

1. Automated Credit Scoring and Risk Assessment

AI algorithms excel at analyzing vast amounts of data to provide a comprehensive assessment of a borrower’s creditworthiness.

Traditional credit scoring models are often limited to historical credit data, which can exclude many potential borrowers.

AI overcomes this limitation by incorporating alternative data sources such as social media activity, transaction history, and even behavioral patterns to generate a more accurate and nuanced credit score.

- Machine Learning Models: AI uses machine learning models to identify patterns and predict a borrower’s likelihood of default. These models continuously improve over time as they are exposed to more data.

- Alternative Data Utilization: By incorporating non-traditional data sources, AI provides a more inclusive assessment of creditworthiness, enabling lenders to extend credit to individuals with limited or no credit history.

2. Enhanced Customer Service With AI-Powered Chatbots

AI-powered chatbots and virtual assistants in loan lending apps offer instant customer support, guiding users through the loan application process, answering queries, and providing personalized financial advice.

These chatbots leverage natural language processing (NLP) to understand and respond to customer inquiries in real-time, significantly enhancing the user experience.

- 24*7 Availability: Chatbots are available around the clock, ensuring that customers can get support whenever they need it.

- Personalized Interaction: AI can tailor interactions based on the user’s profile and previous interactions, providing a more personalized and satisfying experience.

3. Fraud Detection and Prevention

AI enhances the security of loan lending apps by detecting and preventing fraudulent activities.

AI systems continuously monitor transactions and user behavior to identify unusual patterns that may indicate fraud.

This proactive approach helps in mitigating risks and protecting both the lender and the borrower.

- Anomaly Detection: AI algorithms are adept at identifying anomalies in transaction patterns that could signify fraudulent activity. They analyze transaction data in real-time to detect inconsistencies or suspicious behaviors.

- Real-Time Alerts: AI systems can send real-time alerts to relevant stakeholders when suspicious activities are detected, enabling swift action to prevent fraud.

4. Streamlined Loan Processing

AI automates various aspects of the loan processing workflow, significantly reducing the time and effort required to approve and disburse loans.

Tasks such as document verification, data entry, and compliance checks can be handled by AI systems, allowing human employees to focus on more complex tasks.

- Robotic Process Automation (RPA): RPA uses AI to automate repetitive tasks, such as verifying identity documents and processing loan applications. This leads to faster processing times and reduced operational costs.

- Faster Approvals: AI accelerates the loan approval process by quickly analyzing and validating data, enabling borrowers to receive funds more rapidly.

5. Predictive Analytics For Loan Performance

Predictive analytics powered by AI helps lenders forecast loan performance by analyzing historical data and identifying trends.

This allows lenders to anticipate potential issues, such as late payments or defaults, and take preemptive measures to mitigate risks.

- Loan Performance Forecasting: AI models can predict the likelihood of loan repayment based on various factors, helping lenders manage their portfolios more effectively. These models consider a wide range of data points, including economic indicators, borrower behavior, and market trends.

- Risk Mitigation Strategies: By identifying high-risk loans early, lenders can implement strategies to reduce the impact of potential defaults, such as adjusting loan terms or increasing monitoring efforts.

6. Personalization of Loan Products

AI enables lenders to offer personalized loan products tailored to the individual needs of borrowers.

By analyzing a borrower’s financial behavior and preferences, AI can recommend loan products with customized terms and interest rates.

- Customized Offers: AI can create loan offers that are specifically tailored to the financial situation and needs of each borrower, improving customer satisfaction. These personalized offers can lead to higher acceptance rates and better customer retention.

- Dynamic Pricing: AI allows for dynamic pricing models that adjust interest rates based on real-time data and market conditions. This ensures that borrowers receive competitive rates while lenders maintain profitability.

7. Enhanced Compliance and Regulatory Adherence

AI helps ensure that loan lending apps comply with regulatory requirements by automating compliance checks and monitoring changes in regulations.

This reduces the risk of non-compliance and the associated penalties.

- Automated Compliance Checks: AI can automatically verify that loan applications adhere to regulatory standards. This includes checking for necessary documentation, verifying borrower information, and ensuring that all legal requirements are met.

- Regulatory Updates: AI systems can stay updated with the latest regulatory changes and ensure that the lending processes are always compliant. This adaptability is crucial in the constantly evolving financial landscape.

The integration of AI in loan lending apps is revolutionizing the lending industry by automating processes, improving risk assessment, enhancing customer service, detecting fraud, and personalizing loan products.

By leveraging AI, lenders can offer better services, reduce operational costs, and manage risks more effectively, ultimately benefiting both lenders and borrowers.

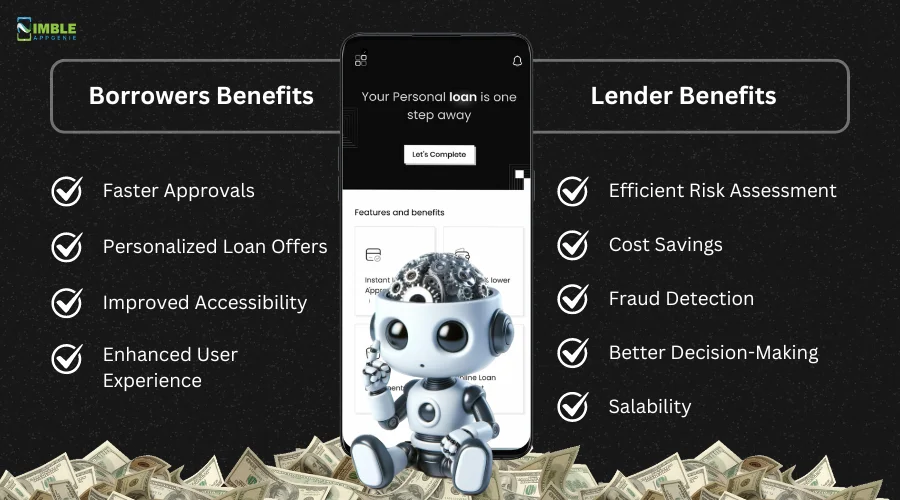

Why AI in Loan Lending Apps is The Future?

The integration of AI in loan lending apps is rapidly transforming the financial sector. By leveraging advanced technologies, these apps are enhancing the efficiency, accuracy, and personalization of lending processes.

Here’s a detailed look at the benefits for both borrowers and lenders, highlighting why AI is the future of loan lending.

♦ Borrowers Benefits

- Faster Approvals: AI-driven loan lending apps significantly speed up the loan approval process. Traditional lending methods can take days or even weeks to process applications, while AI algorithms can analyze data and make decisions within minutes.

- Personalized Loan Offers: AI in loan lending apps uses machine learning to analyze a borrower’s financial behavior and history. This allows for personalized loan offers tailored to an individual’s creditworthiness and financial needs.

- Improved Accessibility: AI technologies can assess creditworthiness based on non-traditional data sources, such as utility payments and social media activity.

- Enhanced User Experience: AI-powered chatbots and virtual assistants in lending apps provide instant support, guiding borrowers through the application process and answering queries in real-time.

♦ Lenders Benefits

- Efficient Risk Assessment: AI in loan lending allows for more accurate and efficient risk assessment. Machine learning algorithms analyze vast amounts of data to predict the likelihood of default, enabling lenders to make informed decisions.

- Cost Savings: Automating the loan processing workflow with AI reduces operational costs for lenders. Tasks such as data entry, document verification, and compliance checks can be handled by AI systems, freeing up human resources for more complex tasks.

- Fraud Detection: AI technologies are highly effective in detecting fraudulent activities. By analyzing transaction patterns and behaviors, AI systems can identify and flag suspicious activities, preventing fraud before it occurs.

- Better Decision-Making: AI-driven analytics provide lenders with deeper insights into borrower behavior and market trends. This enables better decision-making and more strategic planning.

- Scalability: AI systems allow lenders to scale their operations efficiently. With automated processes, lenders can handle a higher volume of loan applications without compromising on quality or speed.

By adopting AI, lenders can offer more efficient, accurate, and personalized services, ultimately driving better outcomes for all stakeholders involved.

Case Study: Examples of AI in Loan Lending Apps

AI has been instrumental in transforming the loan lending landscape, offering enhanced efficiency, accuracy, and user experience.

Here are some notable examples of AI in best loan lending apps:

| App | Availability |

| Upstart | iOS |

| ZestFinance | iOS & Android |

| LendingClub | iOS & Android |

| Affirm | iOS & Android |

► Upstart

Upstart is a lending platform that utilizes AI to provide personal loans.

It was founded by ex-Googlers who aimed to improve access to affordable credit while reducing the risk and costs of lending.

Upstart’s AI-driven model evaluates over 1,000 data points, including education, employment history, and credit behavior, to predict creditworthiness more accurately than traditional credit scoring models.

Key Features:

- Alternative Data Analysis: Utilizes non-traditional data to assess risk.

- Faster Approvals: Automated processes allow for quick loan approval and funding.

- Lower Default Rates: AI algorithms help in reducing the likelihood of defaults by providing more accurate risk assessments.

► ZestFinance

ZestFinance uses machine learning to improve the underwriting process for loans.

Their platform, Zest Automated Machine Learning (ZAML), helps lenders assess credit risk with greater accuracy by analyzing vast datasets and identifying patterns that traditional models might miss.

Key Features:

- Risk Assessment: AI models assess risk using a broader range of data.

- Fair Lending: Ensures compliance with fair lending regulations by identifying and mitigating biases.

- Enhanced Predictive Power: Provides more accurate predictions of loan performance.

► LendingClub

LendingClub integrates AI into its lending process to improve loan approval and customer experience.

AI-driven models help in credit risk assessment, fraud detection, and personalized customer interactions.

Key Features:

- Personalized Loan Offers: AI tailors loan offers to individual borrowers’ needs.

- Fraud Detection: AI systems monitor transactions for fraudulent activities.

- Improved Customer Experience: Chatbots and AI assistants enhance customer support.

Explore More: How To Develop An App Like LendingClub

► Affirm

Affirm is a fintech company that provides point-of-sale financing and personal loans.

Affirm uses AI to offer consumers transparent and flexible financing options at the point of sale.

AI models analyze various data points to determine the borrower’s ability to repay without affecting their credit score.

Key Features:

- Transparent Financing: Clear terms with no hidden fees.

- Instant Approval: AI enables quick loan approval decisions.

- Flexible Payment Plans: Offers customizable payment options to fit the borrower’s budget.

These examples highlight the significant role AI plays in modernizing and enhancing the loan lending process.

This transformation not only benefits lenders by improving efficiency and reducing costs but also provides borrowers with better access to credit and a more personalized lending experience.

AI-Driven Features in Loan Lending Apps

The integration of Artificial Intelligence (AI) into loan lending apps is revolutionizing the industry by enhancing efficiency, accuracy, and customer satisfaction.

Here are the key AI-driven loan lending app features:

1. Automated Credit Scoring and Risk Assessment

AI algorithms analyze a wide array of data points, including traditional credit data, social media activity, and payment history, to assess creditworthiness.

This allows for more accurate risk assessments and quicker loan approvals compared to traditional methods.

- Faster decision-making process

- Inclusive credit scoring by considering alternative data sources

- Reduced risk of default due to comprehensive borrower profiling

2. Personalized Loan Offers

AI algorithms analyze individual financial behaviors and preferences to offer personalized loan products.

Borrowers receive customized loan terms, interest rates, and repayment plans that best suit their financial situations.

- Higher customer satisfaction with tailored loan offers

- Increased likelihood of loan acceptance and customer retention

3. Fraud Detection and Prevention

AI monitors transactions and user behavior in real-time to detect and flag suspicious activities. Machine learning models identify patterns that indicate potential fraud.

- Enhanced security and reduced fraud risk

- Immediate alerts and actions to prevent fraudulent transactions

4. AI-Powered Customer Support

AI-powered chatbots provide instant responses to customer queries, guide users through the application process, and offer personalized financial advice.

Natural Language Processing (NLP) enables chatbots to understand and respond to complex customer inquiries.

- 24/7 customer support availability

- Improved user experience through quick and accurate responses

- Reduced workload for human customer service agents

5. Predictive Analytics for Loan Performance

Predictive analytics use historical data to forecast loan performance, including the likelihood of timely repayments and potential defaults.

AI models help lenders develop strategies to mitigate risks and optimize loan portfolios.

- Better risk management and reduced loan defaults

- Informed decision-making based on predictive insights

6. Automated Document Verification

AI automates the verification of identity documents and financial records during the loan application process.

Computer vision technology extracts and validates information from documents such as passports and driver’s licenses.

- Faster document processing and loan approvals

- Reduced errors and enhanced accuracy in verification

7. Dynamic Pricing Models

AI algorithms adjust interest rates and loan terms in real-time based on market conditions and borrower profiles.

This ensures competitive pricing and maximizes profitability for lenders.

- Competitive loan offers that attract more borrowers

- Optimized pricing strategies that balance risk and return

8. Enhanced Compliance and Regulatory Adherence

AI ensures that loan applications comply with regulatory requirements by automating compliance checks.

Continuous monitoring of regulatory changes ensures up-to-date adherence.

- Reduced risk of non-compliance and associated penalties

- Streamlined compliance processes and reduced manual workload

9. Sentiment Analysis for Customer Feedback

AI analyzes customer feedback and reviews to gauge sentiment and identify areas for improvement.

Sentiment analysis helps lenders understand customer satisfaction and address concerns proactively.

- Improved customer satisfaction through proactive service enhancements

- Valuable insights for refining loan products and services

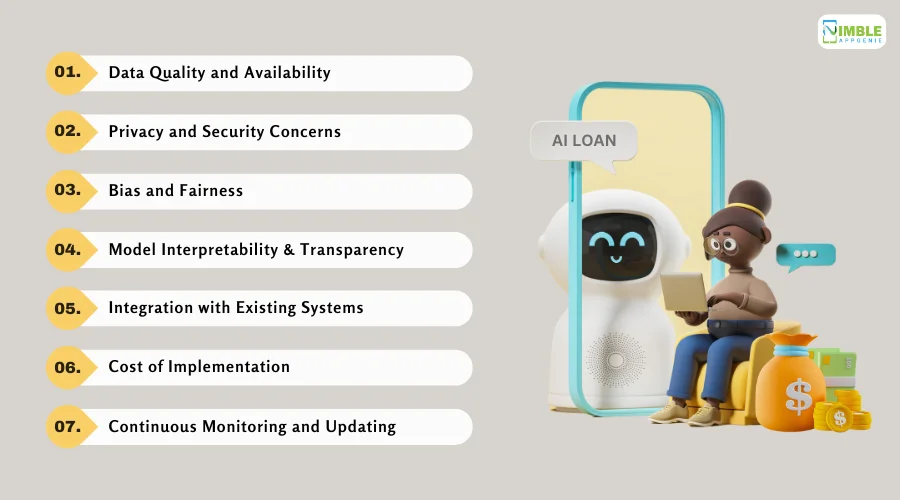

Challenges and Considerations

While AI offers numerous benefits to the loan lending industry, its implementation comes with several challenges and considerations.

Here are the key points to challenges for loan lending apps that you might face:

♦ Data Quality and Availability

AI models require large volumes of high-quality data to function effectively. Poor data quality or insufficient data can lead to inaccurate predictions and unreliable AI performance.

Considerations:

- Data Collection: Ensure robust data collection mechanisms are in place to gather comprehensive and high-quality data.

- Data Cleaning: Implement processes for data cleaning and preprocessing to eliminate noise and inaccuracies.

- Data Integration: Integrate data from various sources (e.g., credit reports, social media, transaction histories) to provide a holistic view for AI analysis.

♦ Privacy and Security Concerns

Handling sensitive financial and personal data raises significant privacy and security concerns. AI systems must comply with stringent data protection regulations.

Considerations:

- Compliance with Regulations: Ensure AI systems comply with data protection regulations such as GDPR, CCPA, and others relevant to the region.

- Data Encryption: Use advanced encryption techniques to protect data in transit and at rest.

- Access Control: Implement strict access controls to ensure only authorized personnel can access sensitive data.

♦ Bias and Fairness

AI models can inadvertently perpetuate biases present in training data, leading to unfair lending decisions and potential discrimination.

Considerations:

- Bias Detection: Regularly audit AI models to detect and mitigate biases.

- Diverse Data Sets: Use diverse and representative data sets to train AI models, reducing the risk of bias.

- Ethical Guidelines: Develop and adhere to ethical guidelines for AI development and deployment.

♦ Model Interpretability and Transparency

AI models, especially complex ones like deep learning, can act as “black boxes,” making it difficult to understand how decisions are made. This lack of transparency can be problematic for regulatory compliance and user trust.

Considerations:

- Explainable AI: Invest in explainable AI techniques that provide insights into how AI models make decisions.

- Transparency: Ensure transparency in AI decision-making processes and communicate this clearly to stakeholders and users.

- Regulatory Requirements: Adhere to regulatory requirements that mandate the explainability of automated decisions.

♦ Integration with Existing Systems

Integrating AI solutions with existing legacy systems can be complex and costly, requiring significant changes to infrastructure and processes.

Considerations:

- Scalability: Choose AI solutions that are scalable and can be integrated seamlessly with existing systems.

- Phased Implementation: Consider a phased implementation approach to gradually integrate AI into existing workflows.

- Technical Support: Ensure access to technical support and expertise to manage integration challenges effectively.

♦ Cost of Implementation

To evaluate the cost to develop a loan lending app, it’s vital to identify the developing and deploying AI solutions. These can be expensive with the types of costs associated with acquiring technology, hiring skilled personnel, and ongoing maintenance. You can consider the following points here.

Considerations:

- Cost-Benefit Analysis: Conduct a thorough cost-benefit analysis to assess the financial viability of AI implementation.

- Budget Allocation: Allocate sufficient budget for initial implementation and ongoing maintenance of AI systems.

- Partnerships: Consider partnerships with AI vendors or third-party providers to manage costs and gain access to advanced technologies.

♦ Continuous Monitoring and Updating

AI models need continuous monitoring and updating to ensure they remain effective and relevant in changing market conditions.

Considerations:

- Performance Monitoring: Implement robust monitoring systems to track the performance of AI models in real-time.

- Regular Updates: Schedule regular updates and retraining of AI models to incorporate new data and adapt to evolving market trends.

- Feedback Loops: Establish feedback loops to gather insights from users and stakeholders for continuous improvement.

Transform Your Lending Business With Nimble AppGenie

Are you looking to revolutionize your lending services?

Nimble AppGenie, a premier loan lending app development company, is here to help.

Our team of experts specializes in integrating AI technologies to create innovative, efficient, and secure lending solutions.

We provide end-to-end development services, ensuring your app meets the highest standards of performance and user satisfaction.

Partner with us to harness the power of AI and transform your loan lending business today.

Conclusion

The integration of AI in loan lending apps represents a significant leap forward for the financial sector. By automating processes, enhancing risk assessments, and providing personalized customer experiences, AI-driven solutions are setting new standards in efficiency and reliability.

As AI technologies continue to evolve, their role in loan lending will only grow, offering even more innovative ways to serve borrowers and lenders alike.

Embracing AI is not just about staying competitive; it’s about leading the way in a rapidly transforming industry.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.