Google Pay stands out as one of the leading platforms in the era of digital payments.

If you’re considering developing an app like Google Pay, understanding the cost involved is crucial. The cost to develop an app like Google Pay can vary significantly based on features, complexity, and development team location.

On average, the cost of building a Google Pay clone ranges from $50,000 to $200,000.

There are various factors that affect Google pay app development cost, like complexity, features, platform, and so on.

This blog will give a comprehensive breakdown of the factors affecting development costs, the features you need to include, and the overall process to create an app like Google Pay.

Whether you aim to develop an app like Google Pay or explore Google Pay clone development, this guide will provide valuable insights.

Google Pay: Google’s Own Payment Solution

Google Pay is Google’s flagship payment solution designed to simplify and secure transactions for users worldwide.

Launched in 2018, Google Pay integrates the functionalities of Google Wallet and Android Pay, offering a unified platform for seamless money transfers, in-store purchases, online payments, and bill payments.

With its intuitive interface and robust security features, Google Pay ensures transactions are quick and secure, utilizing advanced technologies such as tokenization.

The app supports multiple payment methods, including credit and debit cards, bank transfers, and digital wallets.

Thus, making it a versatile solution for various financial needs.

Furthermore, Google Pay’s loyalty and rewards programs add value by offering cashback and discounts, enhancing user engagement and satisfaction.

Given its extensive reach and innovative features, Google Pay has become a preferred choice for digital payments, influencing many businesses to explore Google Pay clone development.

Also Read: Google Pay vs Apple Pay vs Samsung Pay

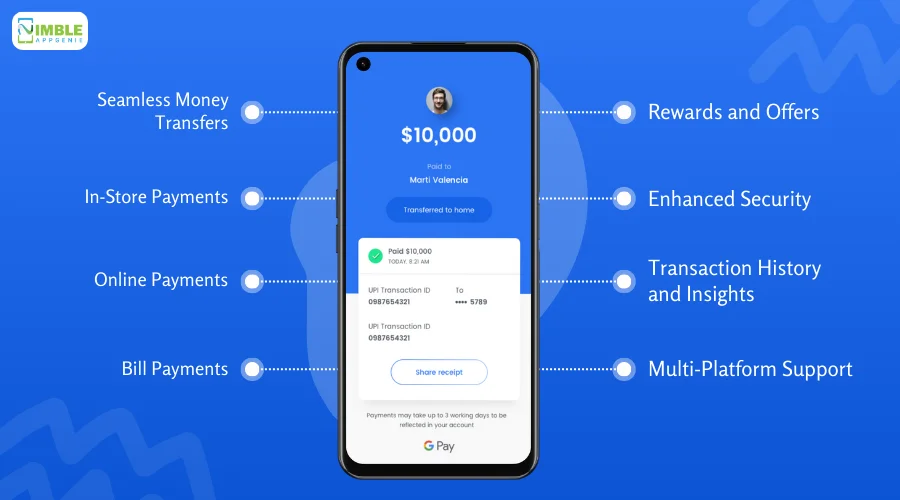

Google Pay’s Top Features

Google Pay offers a wide range of features that make it a versatile and convenient payment solution for users.

Here are some of its top features:

♦ Seamless Money Transfers

Google Pay allows users to send and receive money instantly to friends and family.

Users can transfer funds directly from their bank accounts without any additional charges, making it a cost-effective solution for peer-to-peer transactions.

♦ In-Store Payments

Google Pay supports contactless payments through NFC (Near Field Communication) payment technology.

Users can make purchases at retail stores by simply tapping their mobile devices at compatible point-of-sale terminals. This feature is widely accepted at numerous merchants worldwide.

♦ Online Payments

Google Pay integrates seamlessly with various online platforms, allowing users to make secure payments for online shopping, subscriptions, and services.

The app supports a wide range of payment methods, including credit and debit cards, as well as bank transfers.

♦ Bill Payments

Users can pay utility bills, recharge their mobile phones, and settle other recurring payments directly from the app.

Google Pay provides a consolidated view of all bills and reminders for due payments, ensuring users never miss a deadline.

♦ Rewards and Offers

Google Pay offers a range of rewards, cashback, and discount offers from various merchants.

Users can earn rewards by making transactions through the app, which enhances user engagement and loyalty.

♦ Enhanced Security

Google Pay prioritizes user security by employing advanced security measures such as tokenization, which replaces card details with a unique code during transactions.

Plus, biometric authentication (fingerprint or face recognition) and PIN protection add extra layers of security.

♦ Transaction History and Insights

The app provides detailed transaction history and insights, allowing users to track their spending habits and manage their finances effectively.

Users can view past transactions, categorize expenses, and monitor their financial activities in real-time.

♦ Multi-Platform Support

Google Pay is available on both Android and iOS devices, ensuring a broad user base.

It also integrates with other Google services and applications, providing a seamless user experience across different platforms.

By incorporating these features, Google Pay has established itself as a comprehensive payment solution, offering convenience, security, and value-added services to its users. This robust feature set serves as a benchmark for businesses looking to develop a Google Pay clone or similar payment application.

Cost To Develop An App Like Google Pay

Developing an app like Google Pay involves significant investment, given its complex features and high-security requirements.

On average, the cost to develop an app like Google Pay ranges from $100,000 to $300,000.

This cost variation depends on several factors, including the development team’s location, the app’s complexity, and the technology stack used.

For a basic version of a Google Pay clone development, which includes essential features such as user registration, peer-to-peer payments, and transaction history, the development cost can start at around $100,000.

However, for a more comprehensive version that includes advanced features like real-time fraud detection, loyalty programs, and integration with multiple payment gateways, the cost can go up to $300,000 or more.

The development process also involves various stages, such as planning, design, development, testing, and deployment, each contributing to the overall cost.

In addition to this, ongoing maintenance and updates are crucial to ensure the app remains secure and up-to-date with the latest technological advancements, further influencing the total expenditure.

Considering these factors, businesses must carefully plan their budget and work with experienced developers to build a secure, feature-rich, and user-friendly payment app similar to Google Pay.

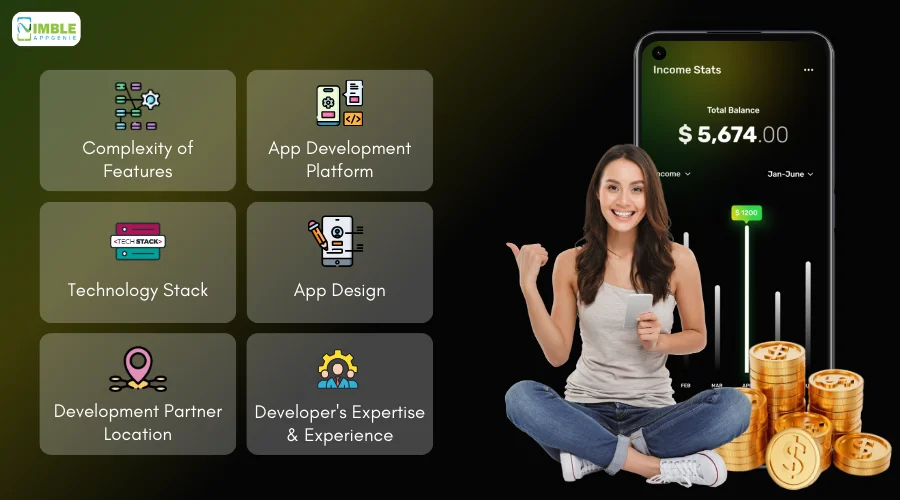

Factors That Affect Google Pay Clone Development Cost

Developing a Google Pay clone involves various factors that significantly impact the overall cost to develop an ewallet app.

Here are the detailed factors broken down to help you understand what influences the development budget:

1. Complexity of Features

The complexity of features is a primary determinant of the development cost.

Simple applications with basic functionalities will cost less compared to advanced applications with sophisticated features.

Basic Features:

- User Registration and Authentication: Secure methods for user sign-up and login.

- Peer-to-Peer Payments: Simple money transfer between users.

- Transaction History: Viewing past transactions.

- Bill Payments: Facilitating payments for utilities and services.

Advanced Features:

- AI Fraud Detection: Using AI to detect and prevent fraudulent activities.

- Real-Time Notifications: Instant alerts for transactions and updates.

- Multi-Language Support: Catering to a global audience with various languages.

- Loyalty Programs: Reward systems to increase user engagement.

| Feature Set | Estimated Cost |

| 1. Basic | $100,000 – $150,000 |

| 2. Advanced | $200,000 – $300,000 |

The more advanced features you incorporate, the higher the development cost due to increased complexity and the need for specialized skills.

2. App Development Platform

The choice of platform plays a significant role in determining the Google Pay development cost.

Developing a native app for a single platform (iOS or Android) costs less than developing for both.

Cross-platform app solutions can offer cost savings but may not always match the performance of native apps.

Platform Costs:

- iOS: higher due to stringent guidelines and standards set by Apple.

- Android: lower but requires extensive testing across multiple devices.

- Cross-Platform: Offers wider reach but may involve trade-offs in performance.

| Platform | Estimated Cost |

| 1. iOS | $50,000 – $100,000 |

| 2. Android | $50,000 – $100,000 |

| 3. Cross-Platform | $120,000 – $200,000 |

Choosing the right platform based on your target audience and business goals can help optimize the budget.

3. Technology Stack

The ewallet app technology stack used for developing the app can significantly impact the cost.

Modern technologies and frameworks might incur higher initial costs but offer better performance, scalability, and future-proofing.

Popular Tech Stacks:

- Frontend: React Native or Flutter for cross-platform; Swift for iOS; Kotlin for Android.

- Backend: Node.js, Django, Ruby on Rails.

- Databases: PostgreSQL, MongoDB.

- Payment Gateway: Stripe, PayPal, Braintree.

Cost Impact:

- Advanced technologies generally require developers with specialized skills, increasing the cost.

- Open-source technologies might reduce initial licensing fees but require expert handling to ensure security and performance.

The choice of tech stack should align with the app’s requirements, future scalability, and the development team’s expertise.

4. App Design

Google pay like ewallet App design is critical in ensuring user engagement and satisfaction.

A well-designed app with a user-friendly interface and engaging experience can attract more users but will increase development costs.

Design Elements:

- User Interface (UI) Design: Visual aspects, layouts, colors, and branding.

- User Experience (UX) Design: How users interact with the app, ease of navigation.

- Animations and Transitions: Enhancements to make the app more interactive.

- Custom Graphics: Unique elements that align with the brand.

| Design Complexity | Estimated Cost |

| 1. Basic | $5,000 – $10,000 |

| 2. Moderate | $10,000 – $20,000 |

| 3. Advanced | $20,000 – $50,000 |

Investing in high-quality design is crucial for user retention and satisfaction.

5. Development Partner Location

The cost to hire app developers isn’t static either.

The geographical location of your development partner significantly influences the cost. Developers’ rates vary widely based on the region due to differences in living costs and market demand.

| Region | Hourly Rate |

| North America | $100 – $200 |

| Western Europe | $80 – $150 |

| Eastern Europe | $40 – $80 |

| Asia (India, China) | $20 – $50 |

Choosing a development partner in regions with lower rates can reduce costs, but it’s important to balance cost with quality and experience.

6. Developer’s Expertise and Experience

The experience and expertise of the development team are critical factors.

Highly experienced developers with specialized skills demand higher rates but offer better quality and efficiency.

Experience Levels:

- Junior Developers: Lower cost, suitable for less complex tasks.

- Mid-Level Developers: Balance of cost and experience, capable of handling most tasks.

- Senior Developers: Higher cost, ideal for complex and critical aspects of development.

| Experience Level | Hourly Rate |

| 1. Junior | $25 – $50 |

| 2. Mid-Level | $50 – $100 |

| 3. Senior | $100 – $150 |

Hiring the right mix of developers based on the project’s complexity can optimize both cost and quality.

By understanding these factors, businesses can better plan and allocate their budget for developing a robust and competitive app like Google Pay.

How Long Does It Take To Develop a Google Pay App?

Developing an app like Google Pay is a complex process that involves various stages, including planning, design, development, testing, and deployment.

On average, it takes about 6 to 12 months to develop a fully functional and robust Google Pay clone. The timeline can vary based on the complexity of features, the technology stack, and the expertise of the development team.

Here’s a breakdown of the Google Pay development timeline:

| Development Stage | Timeframe |

| 1. Planning and Analysis | 2 – 4 weeks |

| 2. Design (UI/UX) | 4 – 8 weeks |

| 3. Frontend Development | 8 – 12 weeks |

| 4. Backend Development | 10 – 16 weeks |

| 5. Integration & APIs | 4 – 6 weeks |

| 6. Testing & QA | 6 – 8 weeks |

| 7. Deployment | 2 – 4 weeks |

| 8. Total Time | 26 – 52 weeks (6 – 12 months) |

The duration can be shortened or extended based on the project’s complexity and the team’s efficiency. Proper planning, choosing the right technology stack, and working with experienced developers can help streamline the process and ensure timely delivery.

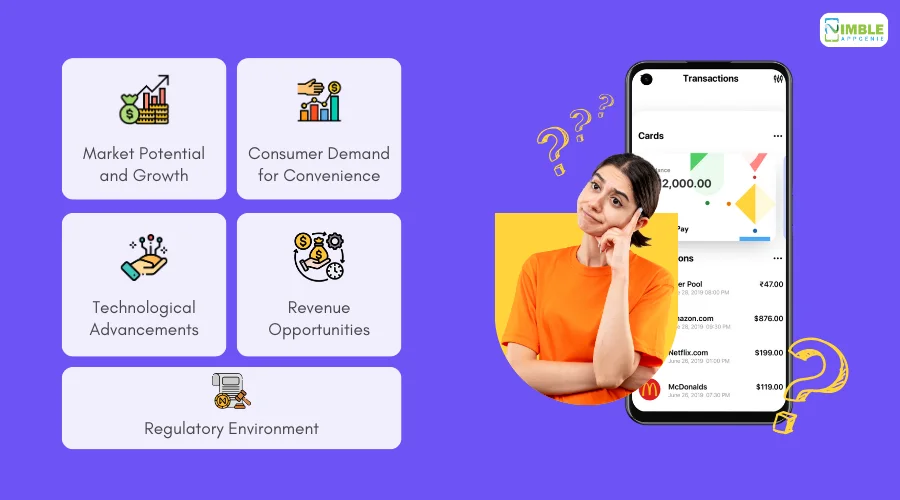

Should You Develop an App Like Google Pay?

Developing an eWallet app like Google Pay can be a highly strategic move, especially in today’s digital-first financial landscape.

With the growing adoption of digital payments, the demand for secure, convenient, and versatile payment solutions is at an all-time high.

► Market Potential and Growth

The digital payments market is experiencing exponential growth.

According to Statista, the total transaction value in the digital payments segment is projected to reach $8.49 trillion in 2022 and is expected to show an annual growth rate (CAGR 2022-2026) of 13.0%, resulting in a projected total amount of $13.91 trillion by 2026.

This indicates robust market potential for new entrants offering innovative payment solutions.

► Consumer Demand for Convenience

Consumers increasingly prefer digital wallets and mobile payment apps for their convenience and ease of use.

Google Pay, for instance, has set a benchmark with its seamless user experience, allowing for quick and secure transactions.

Developing an app with similar functionalities can attract a significant user base, provided it offers intuitive design, fast transactions, and robust security features.

► Technological Advancements

Advancements in technology, such as AI, machine learning, and blockchain, provide a solid foundation for developing sophisticated payment apps.

These technologies enhance security, enable personalized user experiences, and streamline operations.

Leveraging these technologies can position your app as a cutting-edge solution in the competitive fintech market.

► Revenue Opportunities

Payment apps like Google Pay offer multiple revenue streams.

Transaction fees, partnerships with banks and financial institutions, in-app advertisements, and premium features can generate substantial revenue.

Plus, loyalty programs and rewards can increase user engagement and retention, driving long-term profitability.

► Regulatory Environment

It’s crucial to navigate the regulatory landscape carefully.

Compliance with financial regulations, data protection laws, and anti-fraud measures is essential.

While this may add to the complexity and cost, it ensures the app’s credibility and trustworthiness, critical factors for user adoption.

Developing an app like Google Pay can be a lucrative venture if approached strategically. The market is ripe with opportunities, driven by consumer demand for convenient and secure digital payment solutions.

Monetization Methods: Here’s How To Get RoI

Creating a successful app like Google Pay involves not just the development process but also planning effective ewallet app monetization strategies to ensure a return on investment (ROI).

Here are some proven methods to monetize your Google Pay clone and achieve a robust ROI:

1. Transaction Fees

Charging a small fee for each transaction processed through the app is a straightforward and effective way to generate revenue. This could include:

- Peer-to-Peer Transfers: A nominal fee for transferring money between users.

- Merchant Payments: Charging businesses a percentage of the transaction amount for payments processed through the app.

Example: PayPal charges merchants a fee of around 2.9% + $0.30 fee per transaction in the US.

2. Premium Services

Offering premium services can attract users who are willing to pay for enhanced features. These services could include:

- Faster Transfers: Expedited money transfers for a fee.

- Higher Transaction Limits: Allows higher amounts of money to be transferred or received.

- Exclusive Rewards and Cashback Offers: Providing better deals and offers to premium users.

Example: Venmo offers a Venmo card with cash-back rewards as part of its premium services.

3. Advertising

Advertising is a powerful tool for monetization. You can integrate various forms of advertising within the app:

- Banner Ads: Displaying ads in non-intrusive areas within the app.

- Video Ads: Offering users rewards or discounts for watching short videos.

- Sponsored Content: Featuring content or promotions from partner companies.

Example: Google Pay partners with businesses to offer exclusive discounts and deals, which are advertised within the app.

4. Affiliate Marketing

Collaborating with other companies to offer products or services through your app can generate additional revenue:

- In-App Purchases: Promoting products from partner merchants and earning a commission on each sale.

- Referral Programs: Earning money by referring users to other financial services or apps.

Example: Cashback offers and referral bonuses for recommending friends to use the app.

5. Data Analytics

Monetizing data can be another revenue stream, provided it is done ethically and in compliance with privacy laws:

- User Insights: Providing anonymized data and insights to businesses to help them understand consumer behavior.

- Market Trends: Selling aggregated market trend data to financial institutions and market research firms.

Example: Many financial apps offer aggregated data analytics to companies, helping them with market insights and consumer behavior analysis.

6. Subscription Model

Implementing a subscription model for regular users who want to access premium features:

- Monthly or Yearly Subscriptions: Charging users a recurring fee for accessing premium services, higher transaction limits, or exclusive deals.

- Freemium Model: Offering basic services for free while charging for advanced features.

Example: Apps like Venmo and CashApp offer premium services for a monthly fee, which include enhanced security features and faster transfer options.

Nimble AppGenie, Your Partner in Payment App Solutions

At Nimble AppGenie, we specialize in creating innovative and secure payment solutions tailored to your business needs.

As a leading eWallet app development company, we bring extensive experience in developing apps like Google Pay that offer seamless transactions, robust security, and user-friendly interfaces.

Our team of skilled developers leverages cutting-edge technologies to deliver customized eWallet applications that cater to the evolving demands of the digital payments landscape.

We ensure a comprehensive development process, from initial consultation and planning to design, development, and deployment.

Our commitment to quality and client satisfaction drives us to create payment solutions that not only meet but exceed expectations.

Whether you aim to develop a new eWallet app or enhance an existing one, Nimble AppGenie is your trusted partner for delivering exceptional results.

Contact us today to turn your vision into a successful reality.

Partner with Nimble AppGenie and revolutionize your payment solutions with our expert development services.

Conclusion

Creating an app like Google Pay involves careful planning, a solid technology stack, and an experienced development team.

an ewBy understanding the costs, factors affecting those costs, and effective monetization strategies, you can ensure a successful launch and robust ROI.

Whether you’re aiming to enter the digital payments market or enhance an existing product, partnering with a skilled app development company l can turn your vision into reality.

With the right approach, your app can offer seamless, secure, and innovative payment solutions to meet the demands of today’s digital-first consumers.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.